Congrats to all the EU patriots for posting this flag today. Quick reminder that the EU remains deadlocked on Russia's frozen FX reserves, ignores rampant transshipments and allows Greece to keep selling oil tankers to Putin's shadow fleet. Easier to post a flag than actually fix stuff I guess...

08.12.2025 00:46 — 👍 53 🔁 17 💬 2 📌 0

It's fashionable to post the EU flag today. That worries me. Better to reflect on what led us here and have a sober debate on how Europe can again become relevant on the global stage. Because we are NOT relevant. No amount of flag posting changes that...

robinjbrooks.substack.com/p/the-politi...

07.12.2025 18:46 — 👍 12 🔁 4 💬 1 📌 1

I'm a proud European. It must be clear to everyone at this point that Europe isn't working. We should openly debate what's holding us back and fix it. We should NOT hush up what isn't working. That only perpetuates what makes us weak on the global stage...

robinjbrooks.substack.com/p/why-euro-b...

07.12.2025 17:04 — 👍 18 🔁 3 💬 4 📌 0

EU enlargement is a disaster. You can't become a geopolitical force if you admit Russian satellite states like Hungary. This mistake now gets compounded by admitting Bulgaria to the Euro. Bulgaria has well-known erosion of democracy and corruption. Do we learn nothing? Is anyone paying attention?

07.12.2025 16:38 — 👍 38 🔁 10 💬 3 📌 0

We're in a global war for AI dominance. China doesn't have the edge in chips, but - as a ruthless dictatorship that doesn't care about the environment - it can build lots and lots of coal-fired powerplants (blue) to make electricity as cheap as possible...

robinjbrooks.substack.com/p/chinas-ele...

07.12.2025 15:59 — 👍 11 🔁 6 💬 2 📌 0

Price cuts, not tariff triumph. #finsky

07.12.2025 13:31 — 👍 6 🔁 2 💬 0 📌 0

Reality

07.12.2025 13:52 — 👍 6 🔁 3 💬 0 📌 0

Beijing's bots want you to think that China won the tariff war. That's nonsense. The way China kept its exports going in the face of US tariffs is by cutting the prices on the goods it exports. That's bad for exporters and a deflationary shock for China...

robinjbrooks.substack.com/p/how-us-tar...

07.12.2025 13:08 — 👍 38 🔁 14 💬 7 📌 1

That isn't what China's own data say. Electricity generation has risen sharply in recent months, but that rise is powered by thermal power plants that are burning fossil fuels (blue). There's nothing renewable about what's going on. China is just ruthlessly burning coal to win the AI race...

07.12.2025 12:56 — 👍 2 🔁 2 💬 1 📌 0

Germany and EU hold ‘constructive’ talks with Belgium on Russian assets

Merz jetted to Brussels for dinner with Belgian premier on Friday to try to win approval for a reparations loan for Kyiv

Russia’s frozen reserves expose an EU governance crisis. Just recall how tiny Greece totally undermined the G7 price cap on behalf of its shipping oligarchs. Belgium’s veto now is more of the same. The EU can’t be a geopolitical power if it’s constantly busy herding cats.

www.ft.com/content/4283...

07.12.2025 12:51 — 👍 32 🔁 9 💬 1 📌 0

Lots of people are going on about cheap electricity in China and how this will allow it to win the AI race with the US. Here's the thing about that electricity: it's from burning fossil fuels like coal with huge CO2 emissions. There is no "green" China...

robinjbrooks.substack.com/p/chinas-ele...

07.12.2025 12:29 — 👍 47 🔁 13 💬 6 📌 1

If you live in EU ask your friends, colleague and MPs why do you want ruzzian boots on EU soil.

06.12.2025 15:16 — 👍 8 🔁 2 💬 0 📌 0

Can someone on here please explain to me all the excitement over China's electrification? China set up a lot of power lines, but 65% of electricity generation is still from fossil fuels (blue). What matters is how electricity gets generated and whether you're self-sufficient. Not power lines...

06.12.2025 17:04 — 👍 15 🔁 3 💬 8 📌 2

Truely

06.12.2025 13:06 — 👍 7 🔁 3 💬 1 📌 0

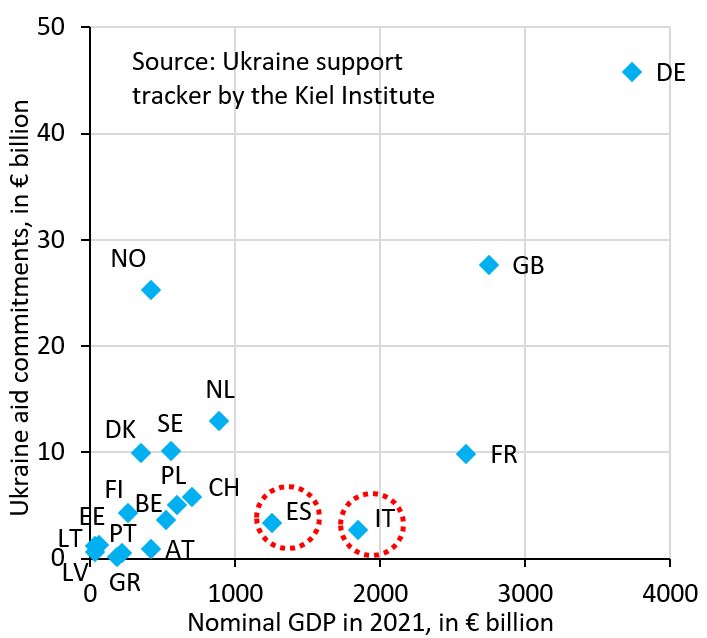

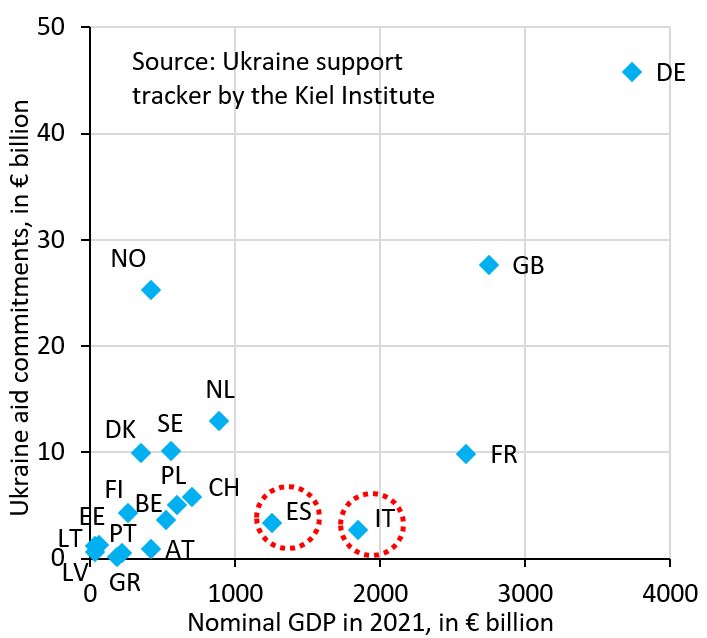

Greece's shipping oligarchs continue to sell oil tankers to Putin's shadow fleet every day. It's this shadow fleet (gray) that funds Russia's war in Ukraine. How can the EU expect to be taken seriously if it turns a blind eye to this? A massive failure...

robinjbrooks.substack.com/p/how-does-t...

06.12.2025 12:58 — 👍 104 🔁 43 💬 1 📌 4

Sometimes the sum of the parts isn't worth much. That's true for the Euro. The Euro zone desperately needs fiscal space to counter threats like Russia and China. Without the Euro, the EU will be stronger and have more fiscal space. Time to stop pretending...

robinjbrooks.substack.com/p/why-euro-b...

06.12.2025 12:49 — 👍 16 🔁 4 💬 3 📌 0

Earlier this year, there were lots of forecasts that the Dollar is going into a multi-year decline. That hasn't happened and it's worth thinking about why. The fact that the Dollar isn't falling is about a lack of alternatives. The Euro in particular is falling short. There is no alternative (TINA).

06.12.2025 12:35 — 👍 13 🔁 2 💬 1 📌 0

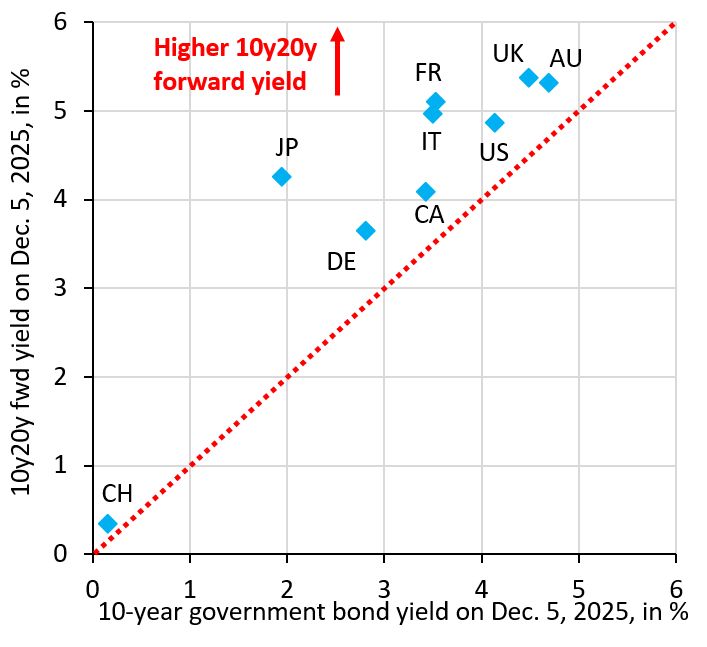

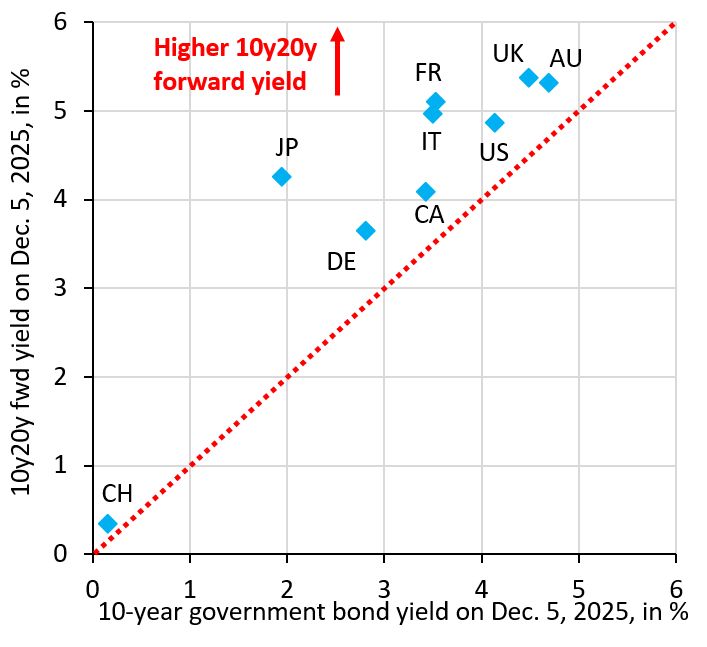

Where is fiscal distress greatest? Chart shows 10-year yield on the horizontal axis and 10y20y forward on the vertical. If the latter is way higher than the former, that's bad. If the latter is high in general, that's also bad. Japan, France, Italy, UK...

robinjbrooks.substack.com/p/where-is-f...

06.12.2025 12:24 — 👍 9 🔁 1 💬 0 📌 0

What's the best bond market measure of fiscal distress? In my view, it's the difference between 10-year yield (blue) and 10y20y forward (red) yield. If the latter is way higher, markets are pricing big risk premia. That's true for Japan, France and Italy...

robinjbrooks.substack.com/p/bond-marke...

05.12.2025 17:00 — 👍 11 🔁 4 💬 2 📌 0

10-year yields are a vanity project for governments. A lot of effort goes into keeping those low. So - if you want to get a sense of fiscal stress - it's better to look at the long end of the curve. That looks most distressed for Japan, France and Italy...

robinjbrooks.substack.com/p/the-global...

05.12.2025 13:43 — 👍 10 🔁 2 💬 0 📌 0

The German verb "entgleiten" means "to slip out of control." That's what Germany feels like currently. This isn't about Trump, China or anything external. It's about a political center that turned on itself and is busy name calling instead of fixing stuff...

robinjbrooks.substack.com/p/the-politi...

05.12.2025 13:15 — 👍 8 🔁 0 💬 3 📌 0

Germany is no longer a safe haven. Best way to see that is chart below, which shows central bank rate cuts (-) on the horizontal axis and rise in 30-year yield (+) on the vertical. Switzerland (CH) gets safe haven inflows that Germany (DE) no longer gets...

robinjbrooks.substack.com/p/germanys-l...

05.12.2025 12:22 — 👍 7 🔁 1 💬 2 📌 0

Where is G10 fiscal distress the most acute? Chart shows 10-year yield on the horizontal axis and 10y20y forward yield on the vertical axis, i.e. what markets price for 10-year yield in 20 years' time. The bigger the vertical gap, the bigger is distress. In descending order: Japan, France, Italy...

04.12.2025 17:38 — 👍 9 🔁 0 💬 0 📌 0

Japan's long-term yields are rising, but here's the thing: they're still much too low and need to rise a lot more. Easiest way to see that is in the chart below, which shows that Japan's 30-year yield is at the same as Germany, which has way lower debt...

robinjbrooks.substack.com/p/japanese-d...

04.12.2025 16:46 — 👍 12 🔁 2 💬 0 📌 0

#EconSky

04.12.2025 14:11 — 👍 7 🔁 1 💬 0 📌 0

I started flagging a scary rise in yields on long-term gov't debt back in September. Since then, this issue has only gotten worse, since Fed rate cuts have driven short-term yields down but long-term yields haven't fallen. The bond vigilantes are here...

robinjbrooks.substack.com/p/the-global...

04.12.2025 14:08 — 👍 24 🔁 7 💬 0 📌 2

Seems quite a few countries managed to stop this re-export. Belgium hasn't but is certainly doing much better than The Netherlands.

bsky.app/profile/robi...

04.12.2025 11:52 — 👍 6 🔁 2 💬 3 📌 0

Germany is facing a political apocalypse. This past weekend saw violent protests against the AfD in Gießen, which will only feed the view among many Germans that the country is descending into lawlessness. The AfD will likely get another bump in the polls...

robinjbrooks.substack.com/p/the-politi...

03.12.2025 19:52 — 👍 12 🔁 3 💬 6 📌 0

Russia's tax revenues from oil fell 10% in Nov '25 as US sanctions on Rosneft and Lukoil scared away Western buyers, pushing down Urals oil price versus Brent. Oil is Putin's Achilles heel and is the way to bring Russia to the negotiating table in good faith. @econharris.bsky.social @brookings.edu

03.12.2025 15:53 — 👍 28 🔁 6 💬 2 📌 2

One puzzle this year is that US Treasury yields have fallen despite out-of-control fiscal policy and erratic policies. One theory is that this is because the private sector is deleveraging. I don't think that's why. The US is still the best of a bad bunch...

robinjbrooks.substack.com/p/how-bad-is...

03.12.2025 12:35 — 👍 8 🔁 0 💬 0 📌 0

I have the world’s best job. I review plane and train trips and make YouTube videos for you to watch. Represented by Dialogue MGMT. @paul_winginit on Twitter.

Associate Fellow @chathamhouse.org | @cepa.org Fellow | Senior Fellow Frivärld | Defence Editor @eurcorrespond.bsky.social. Plot twist: not from Åland. 📸 Stas Kartashov

✍️ Northern Flank Notes: https://open.substack.com/pub/minnalander

Fed and economy reporter with @reuters.com, ex-Wall Street Journal. Failed musician, guitar holdout, I really like pedals.

Author, reenactor, film photographer, military historian specializing in 1930s and 1940s armoured warfare.

Watching webcams & social media for views of combat ships - happy to share photos with full credit given.

### NO POLITICS PLEASE ###

European economics editor @TheEconomist. London via Berlin, Stockholm and Cologne. Have no plans to write a book.

Former head of Obama Auto Task Force. Wall Street financier. Contributing Writer to NY Times Op-Ed. Morning Joe Economic Analyst. 🌐

26+ years at @CNBC and @NBCNews / @WSJ alum / Peabody winner

Ex NY Times, now author of Substack Paul Krugman. Nobel laureate and, according to Donald Trump, "Deranged BUM"

Professor at Harvard. Teaches Ec 10, some posts might be educational. Also Senior Fellow @PIIE.com & contributor

@nytopinion.nytimes.com. Was Chair of President Obama's CEA.

Economics Professor at UC Berkeley; from #Ukraine

President, Kiel Institute for the World Economy and Professor of Economics, Sciences Po

Chief economist @ Centre for European Reform. Eurozone macroeconomic policies | Role of 🇩🇪 🇳🇱 in EU. Formerly @ECB, @IMF, @Worldbank.

Full-time economist & full-time dad // Professor @ University of Bonn.

official Bluesky account (check username👆)

Bugs, feature requests, feedback: support@bsky.app