New NBER WP on algorithmic "coercion."

Unlike collusion, coercion can be achieved by a single firm's pricing algorithm.

It can be worse for consumers than collusion.

@nber.org

@amackay.bsky.social

Economist and professor at the University of Virginia. www.alexandermackay.org

New NBER WP on algorithmic "coercion."

Unlike collusion, coercion can be achieved by a single firm's pricing algorithm.

It can be worse for consumers than collusion.

@nber.org

Several observations related to pricing, current technology, and consumer welfare, in this New York Times article.

10.12.2025 16:39 — 👍 1 🔁 0 💬 0 📌 0

Same product. Same store. Same time. But on Instacart, different customers may see different prices.

My story on a fascinating new experiment from @groundwork.bsky.social & @consumerreports.org and how the idea of a single price is breaking down in the digital age:

www.nytimes.com/2025/12/09/b...

New evidence from a field experiment finds that Amazon brands generate positive benefits to consumers, despite having similar substitutes and receiving priority in search rankings, from Chiara Farronato, Andrey Fradkin, and @amackay.bsky.social https://www.nber.org/papers/w34135

21.08.2025 17:00 — 👍 4 🔁 1 💬 0 📌 0The paper, joint with Chiara Farronato and

@andreyfradkin.bsky.social , is now available as an NBER working paper.

@nber.org link: nber.org/papers/w34135

@ssrn.bsky.social link: ssrn.com/abstract=538...

#EconSky

Our findings suggest that policymakers and regulators should exercise caution when the assessing the role of vertically integrated products and services on platforms.

Even corrections for self-preferencing can reduce consumer welfare, as we show in the paper.

A big reason why is that tastes vary, and some consumers have a preference for Amazon products. Amazon brands add about 5% to consumer surplus in the short run.

This effect varies a lot across categories. We found the largest benefits in acid reducers and batteries.

We found:

1. Consumers select similar products when Amazon brands are not available

2. No evidence for changes in search behavior

3. No evidence for shifts to other retailers

Despite these findings, we still found that consumers valued Amazon brands!

We also used structural modeling to quantify the benefits to consumers of Amazon products and simulate the potential price effects of having low-cost Amazon brands.

19.08.2025 17:43 — 👍 0 🔁 0 💬 1 📌 0Using a custom browser extension we designed, we hid Amazon brands from a random subset of shoppers.

We then looked at:

- What products were selected in their absence

- If consumer search behavior changed

- If consumers went to other retail websites more often

Using a field experiment, we studied how consumers valued Amazon brands and the extent of self-preferencing by Amazon.

We found that Amazon brands bring benefits to consumers, even though they receive a modest prioritization in search rankings.

There is more in the paper, including how dynamics in bargaining translate to dynamic in pass-through.

@nberpubs

link here: nber.org/papers/w34110

Also available on SSRN: dx.doi.org/10.2139/ssrn...

Joint with Santiago Alvarez-Blaser, Alberto Cavallo, and Paolo Mengano

#econsky

The model helps explain the observed patterns. It allows us to interpret manufacturer-retailer profit shifts as changes in bargaining leverage.

We evaluate the drivers of this leverage. The manufacturer gets a higher split with (e.g.) lower costs and greater market penetration.

Given the heterogeneity in product-level markups and the stability over time, we model pricing as occurring in two stages:

1. The manufacturer proposes downstream retail prices.

2. The manufacturer and retailers bargain over the wholesale price (and/or lump sum transfers).

We document supply chain markups in the US, the UK, Canada, and Mexico. We find several similarities, though the split of markups between manufacturers and retailers varies across countries.

11.08.2025 14:11 — 👍 0 🔁 0 💬 1 📌 0

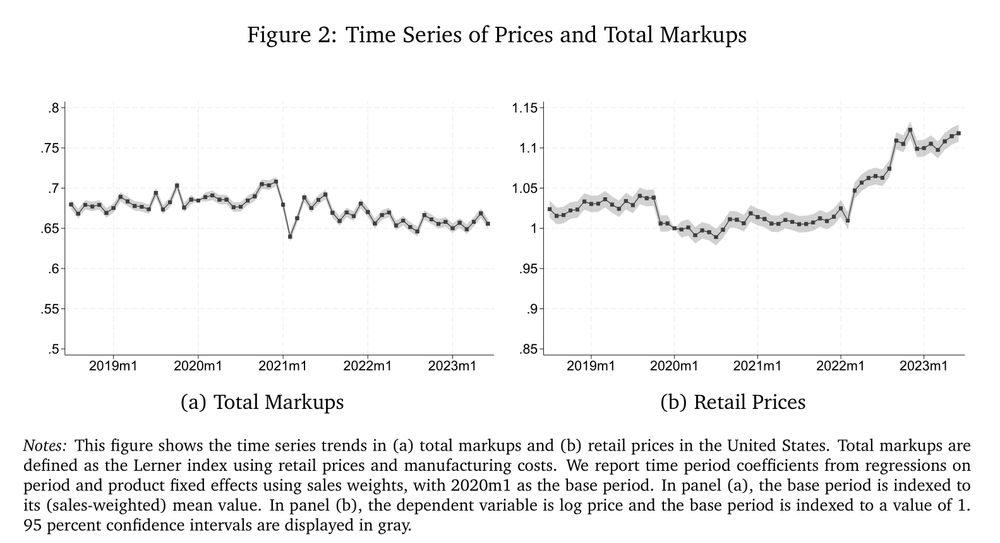

But: manufacturer and retailer markups move up and down quite a bit. Retail markups fell at the end of 2020 and increased starting in 2022. Manufacturer markups did the opposite.

The movements offset each other, leading to stable total markups.

In the US, total product markups are around 0.67 and relatively flat from July 2018 through June 2023.

Retail prices increase starting in 2022, coinciding with general inflation.

But there is no increase in total markups, i.e., no evidence for "greedflation."

With unique data from a large global manufacturer, we were able to study how product markups vary along the supply chain and over time.

One thing that surprised us: though manufacturer and retail markups bounce up and down, total (manufacturer + retail) markups are stable.

Pricing algorithms that provide a speed advantage and commitment can be worse for consumers than full collusion, from Zach Y. Brown and Alexander MacKay https://www.nber.org/papers/w34070

31.07.2025 16:00 — 👍 3 🔁 2 💬 0 📌 0

Link here: www.nber.org/papers/w34070

28.07.2025 17:18 — 👍 0 🔁 0 💬 0 📌 0

New NBER WP on algorithmic "coercion."

Unlike collusion, coercion can be achieved by a single firm's pricing algorithm.

It can be worse for consumers than collusion.

@nber.org

Rivals' prices, and the ability to monitor them, play a special role in pricing algorithms. Zach Brown and I discuss the research and the implications in the latest CPI Antitrust Chronicle on Surveillance Pricing.

Read the article here:

tinyurl.com/2pj93aat

Thank you!

28.05.2025 20:37 — 👍 0 🔁 0 💬 0 📌 0Link here: alexandermackay.org/files/Algori...

This is joint work with Zach Brown. Comments welcome.

I'll wrap up this thread with a question:

What are some examples where you think pricing speed matters?

This has implications for the pricing technology that platforms make available to sellers on the platform. Platforms that prioritize profits might allow some sellers faster pricing algorithms, as this softens competition without explicit coordination.

27.05.2025 17:41 — 👍 0 🔁 0 💬 1 📌 0

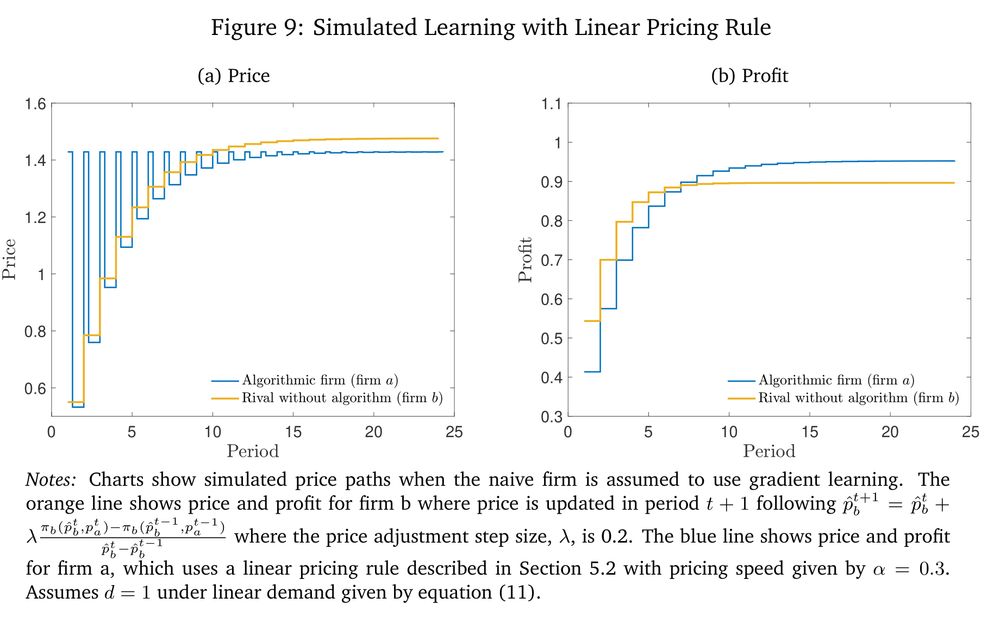

Coercion can happen even with naive rivals that use simple learning rules. An algorithm that is linear in the rival’s price can lead the rival to set prices well above the competitive level - even when the rival isn’t aware of the algorithm.

27.05.2025 17:41 — 👍 1 🔁 0 💬 1 📌 0In a few ways, coercive equilibrium is more robust than traditional collusion. It doesn't require all firms to be forward-looking or understand dynamic strategies. This suggests a broad scope for high-speed algorithms to strategically raise prices in practice.

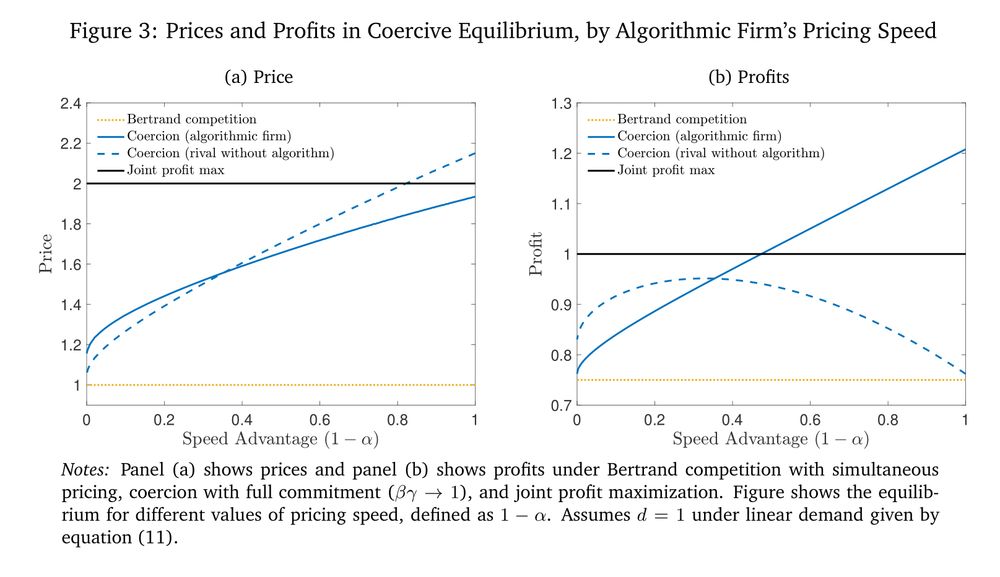

27.05.2025 17:41 — 👍 1 🔁 0 💬 1 📌 0The intuition: faster pricing provides the algorithmic firm with a “stick” to punish rivals, while commitment across periods enables the algorithmic firm to lead with a high price: the “carrot.”

27.05.2025 17:41 — 👍 1 🔁 0 💬 1 📌 0

The coercive equilibrium can be worse for consumers than the collusive or multi-product monopoly outcome. This is because the algorithmic firm can push a rival’s price above the joint profit maximizing level.

27.05.2025 17:41 — 👍 1 🔁 0 💬 1 📌 0In our model, this firm uses a pricing algorithm that enables faster pricing and multi-period commitment. This yields a "coercive equilibrium" where the algorithmic firm maximizes profits subject to its rival's incentive compatibility constraint.

27.05.2025 17:41 — 👍 2 🔁 0 💬 1 📌 0