@isaacbaley.bsky.social @matthiasmeier.bsky.social @joachimjungherr.bsky.social

15.07.2025 05:44 — 👍 0 🔁 0 💬 0 📌 0

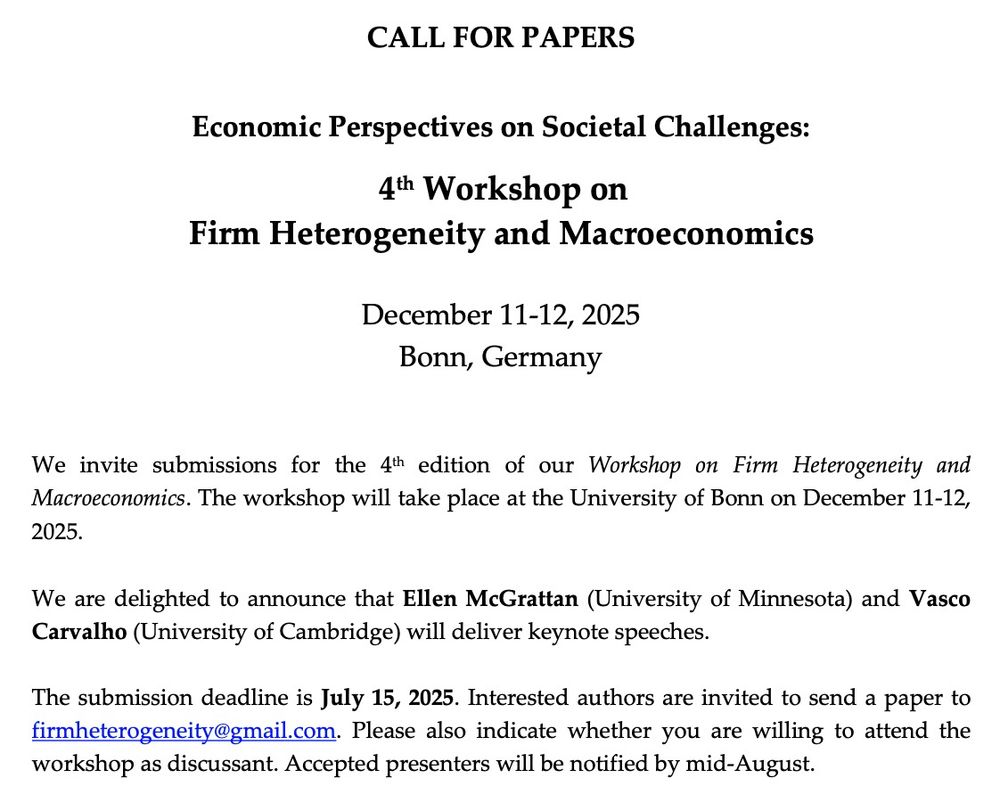

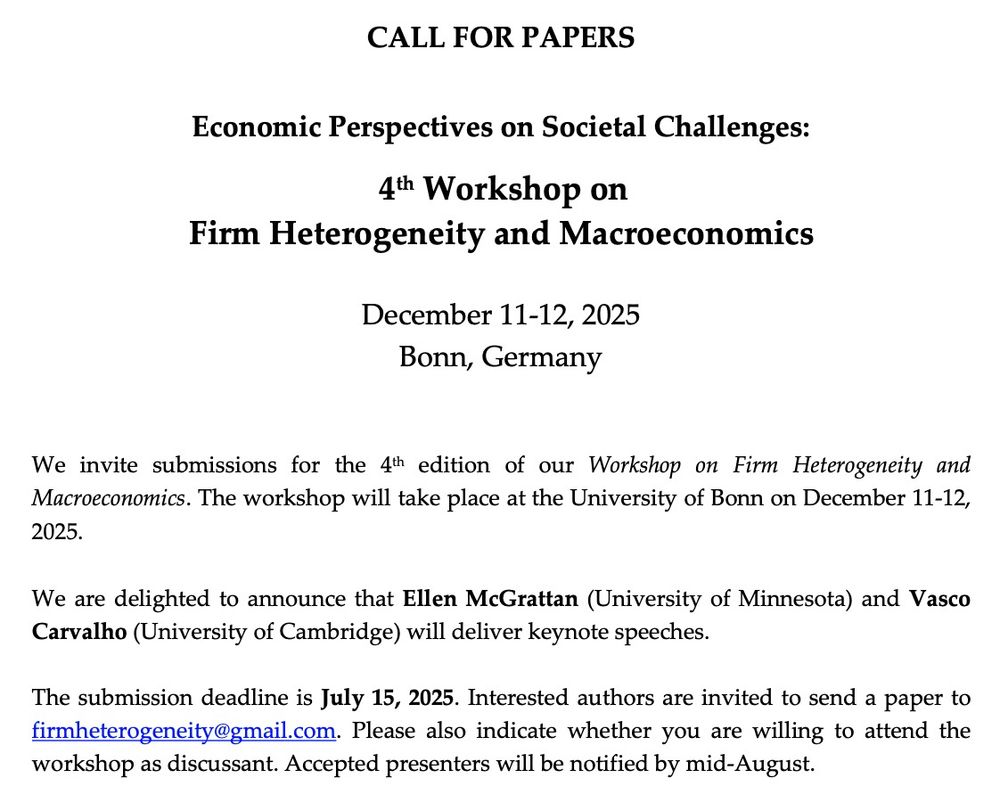

📢Last day to submit!

"Firm Heterogeneity and Macro," Dec 11/12 in Bonn.

Keynotes by Ellen McGrattan (University of Minnesota) and Vasco Carvalho (University of Cambridge)

#econsky

15.07.2025 05:43 — 👍 4 🔁 0 💬 1 📌 0

⚠️Call for papers for the 4th Macro & firm heterogeneity conference in December in Bonn. Keynotes by Ellen McGrattan & Vasco Carvalho. Submit your paper by July 15th. More info here: tinyurl.com/5n8nyy2u #EconTwitter

12.05.2025 14:36 — 👍 1 🔁 0 💬 0 📌 0

I put together a starter pack of all the academic macroeconomists I could find on the platform.

It's short. Please message me if you would like to be added.

go.bsky.app/RYnjd8k

#econsky etc.

16.11.2024 17:11 — 👍 84 🔁 34 💬 16 📌 6

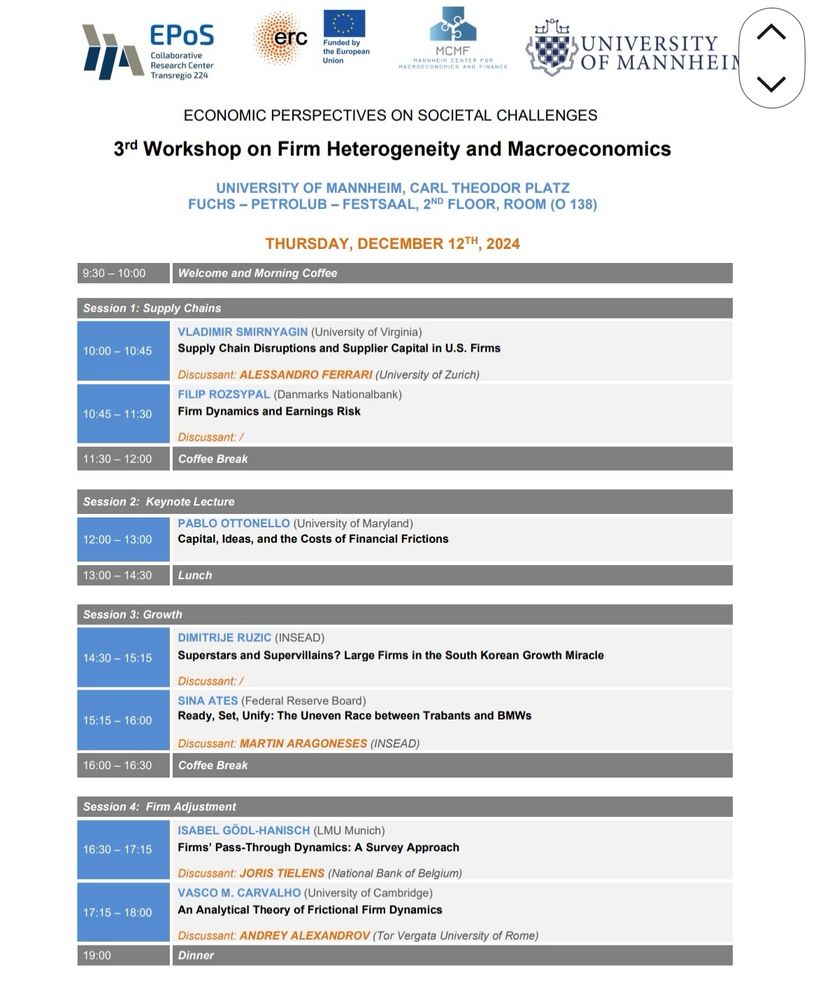

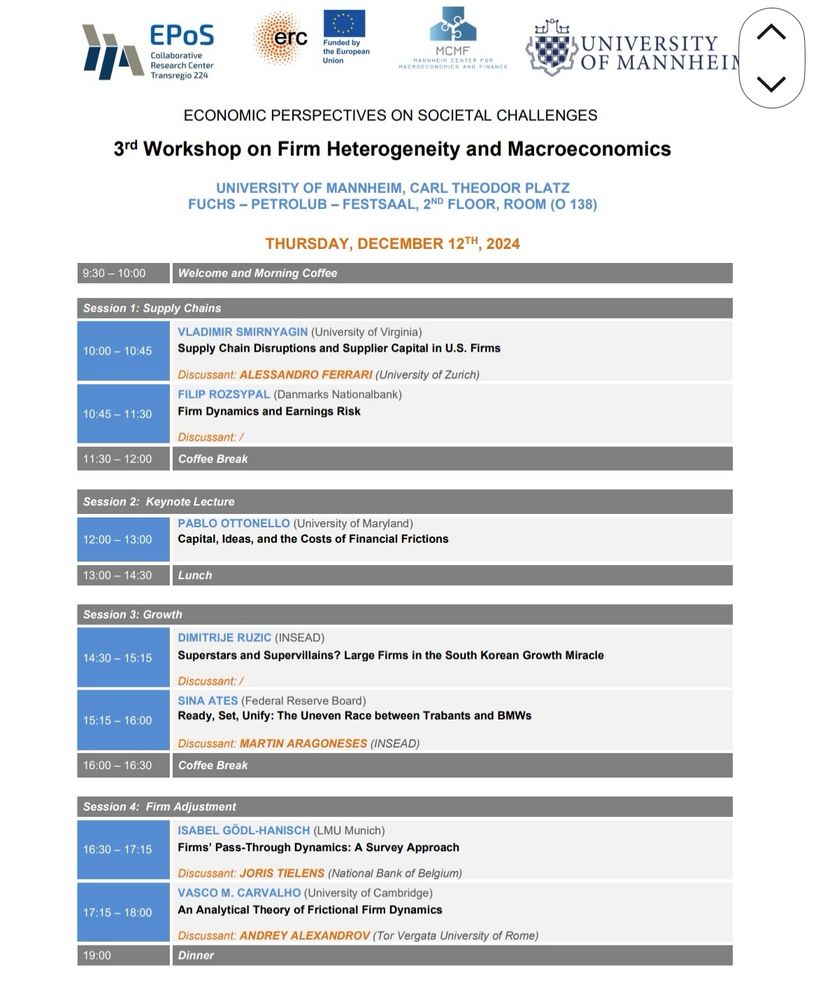

3rd Workshop on Firm Heterogeneity and Macroeconomics in on!

First day: supply chains, firm-worker risks, ideas, growth, financial frictions and firm adjustments

12.12.2024 11:35 — 👍 5 🔁 3 💬 0 📌 0

@joachimjungherr.bsky.social #Econsky @treinelt.bsky.social

09.12.2024 21:42 — 👍 0 🔁 0 💬 0 📌 0

This is a joint paper with Joachim, Matthias, and Timo. This version of the paper is part of the IFDP series, where IFDP stands for "International Finance Discussion Paper" and "International Finance" is the name of the division that I work for at the Federal Reserve Board.

09.12.2024 21:42 — 👍 0 🔁 0 💬 1 📌 0

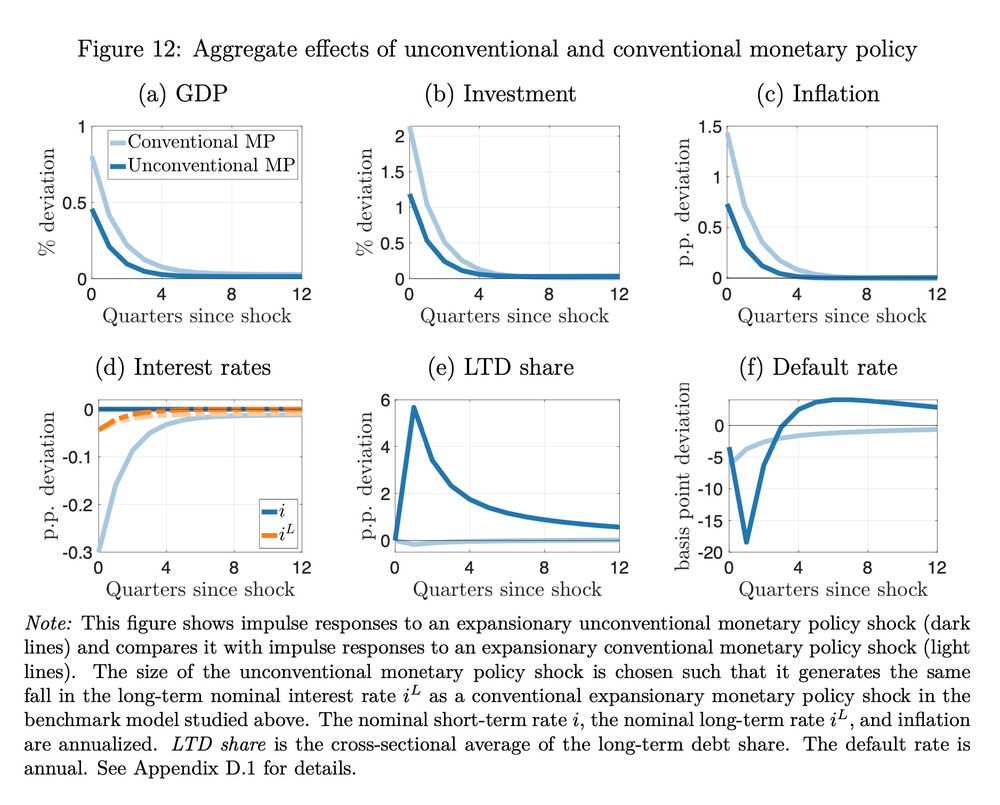

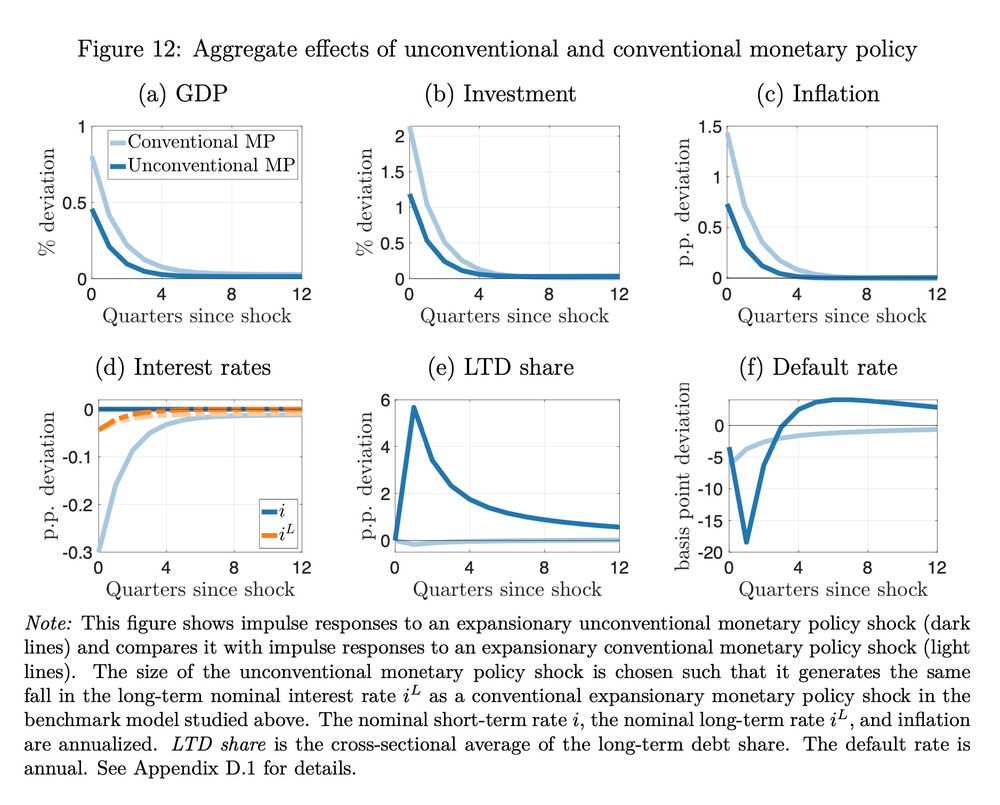

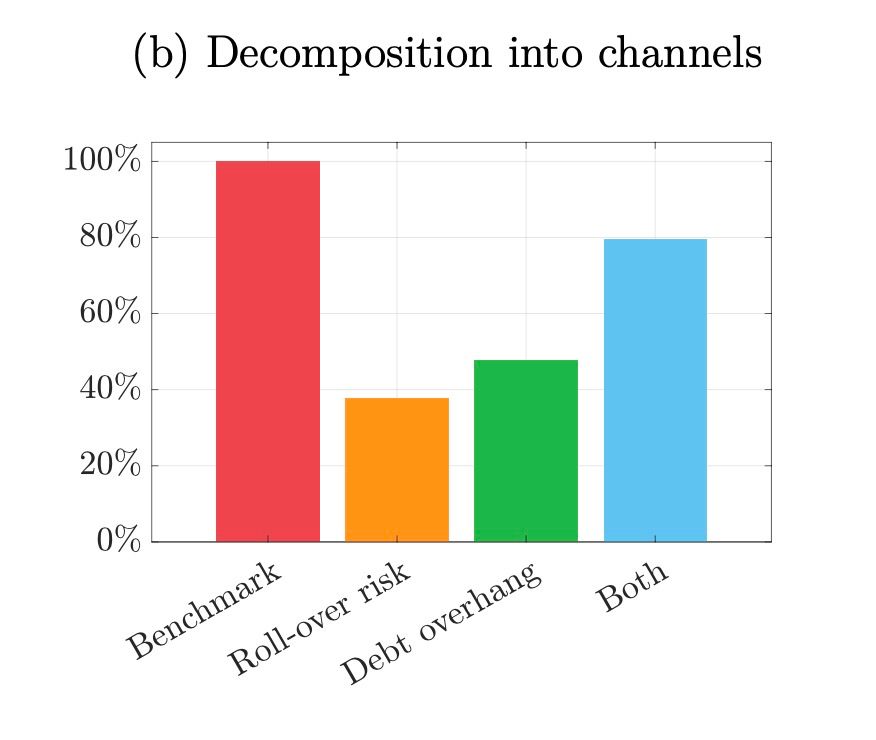

We use the model to study unconventional monetary policy (UMP). UMP lowers long-term rates when the short-term rate is at the ZLB. This has the effect that firms borrow at longer durations. The increase in debt overhang makes UMP less effective than conventional monetary policy.

09.12.2024 21:42 — 👍 0 🔁 0 💬 1 📌 0

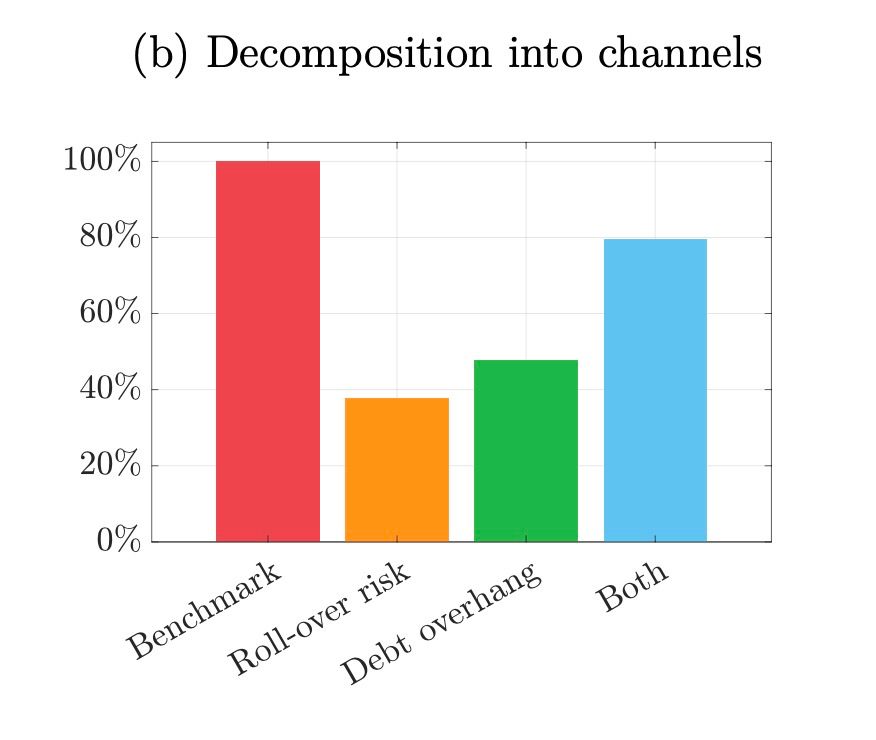

2) Debt overhang means that firms lower their investment if a part of the benefit goes to its long-term creditors. A contractionary monetary policy shock worsens debt overhang, because tighter monetary policy is deflationary, increasing the real burden of outstanding debt.

09.12.2024 21:42 — 👍 0 🔁 0 💬 1 📌 0

Two channels explain our result: 1) Rollover-risk implies that if a lot of debt matures at the time when interest rates have gone up, this increases firms' cost of capital, lowering investment.

09.12.2024 21:42 — 👍 0 🔁 0 💬 1 📌 0

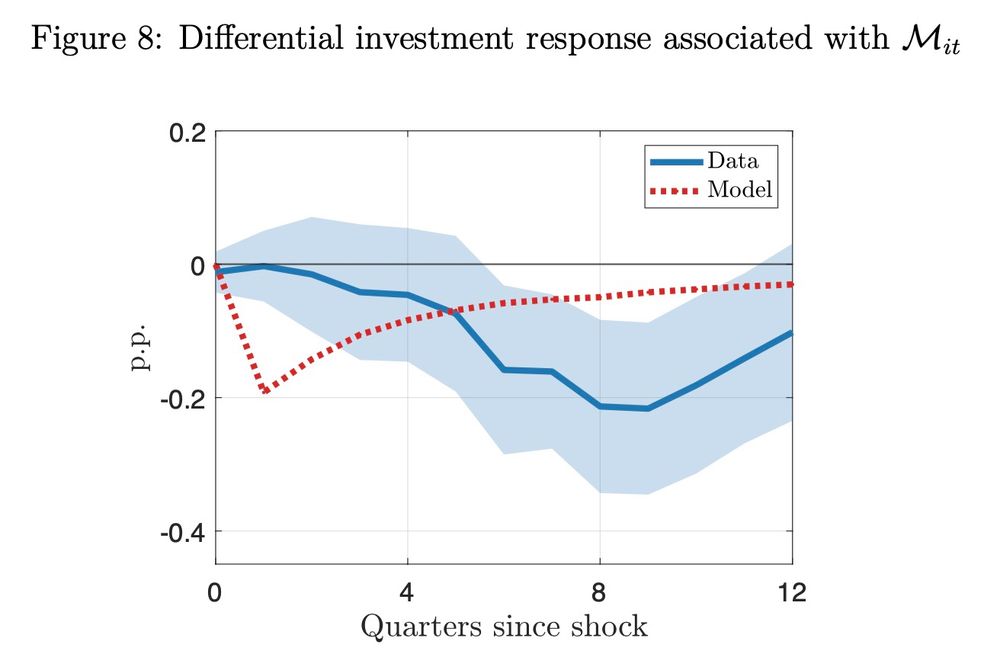

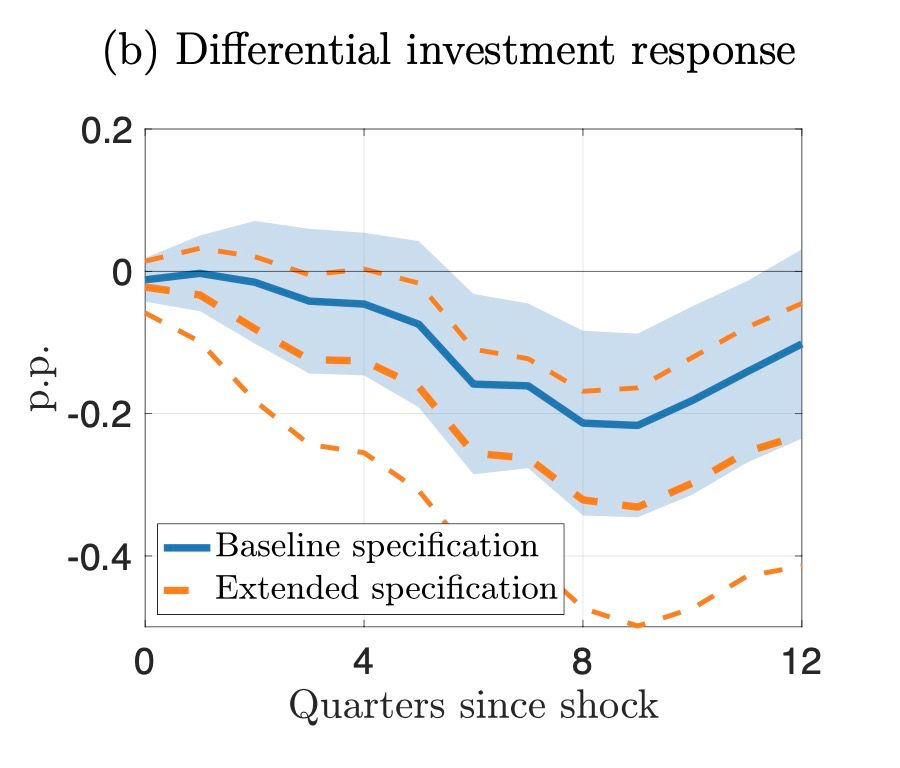

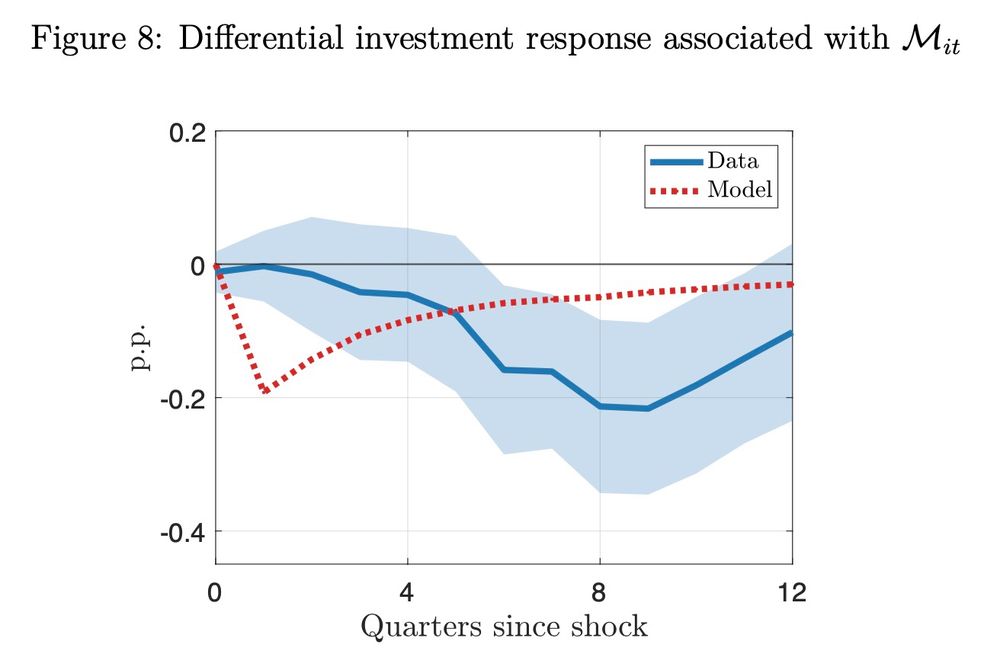

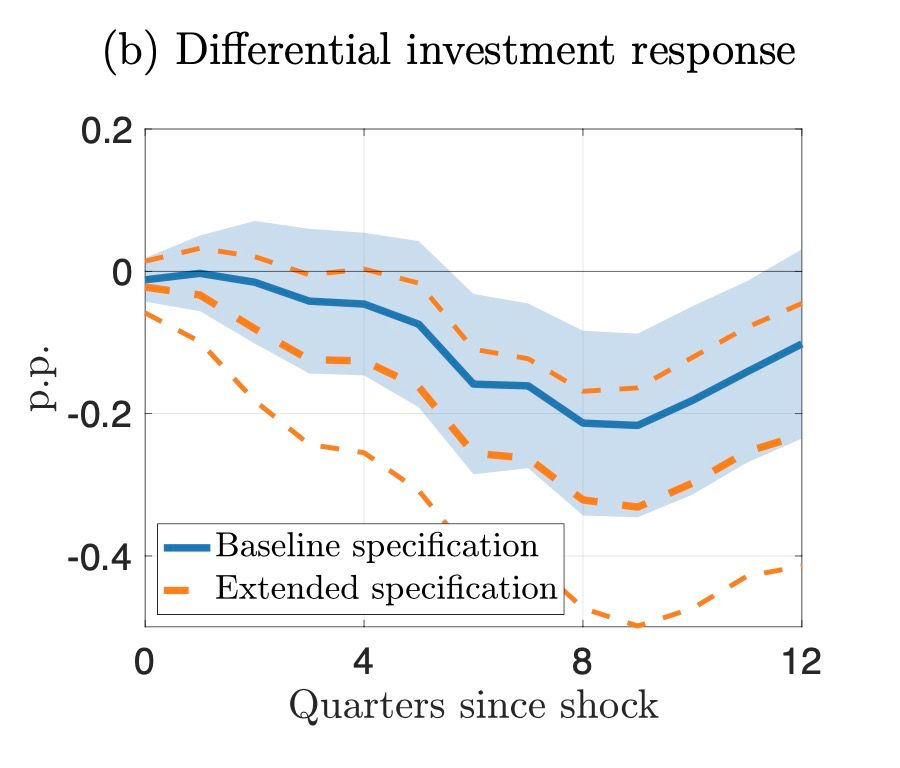

The model replicates the empirical observation that after a contractionary monetary policy shock, firms with shorter remaining debt maturity react more strongly, meaning that they reduce investment by more and that they see larger increases in credit spreads.

09.12.2024 21:42 — 👍 0 🔁 0 💬 1 📌 0

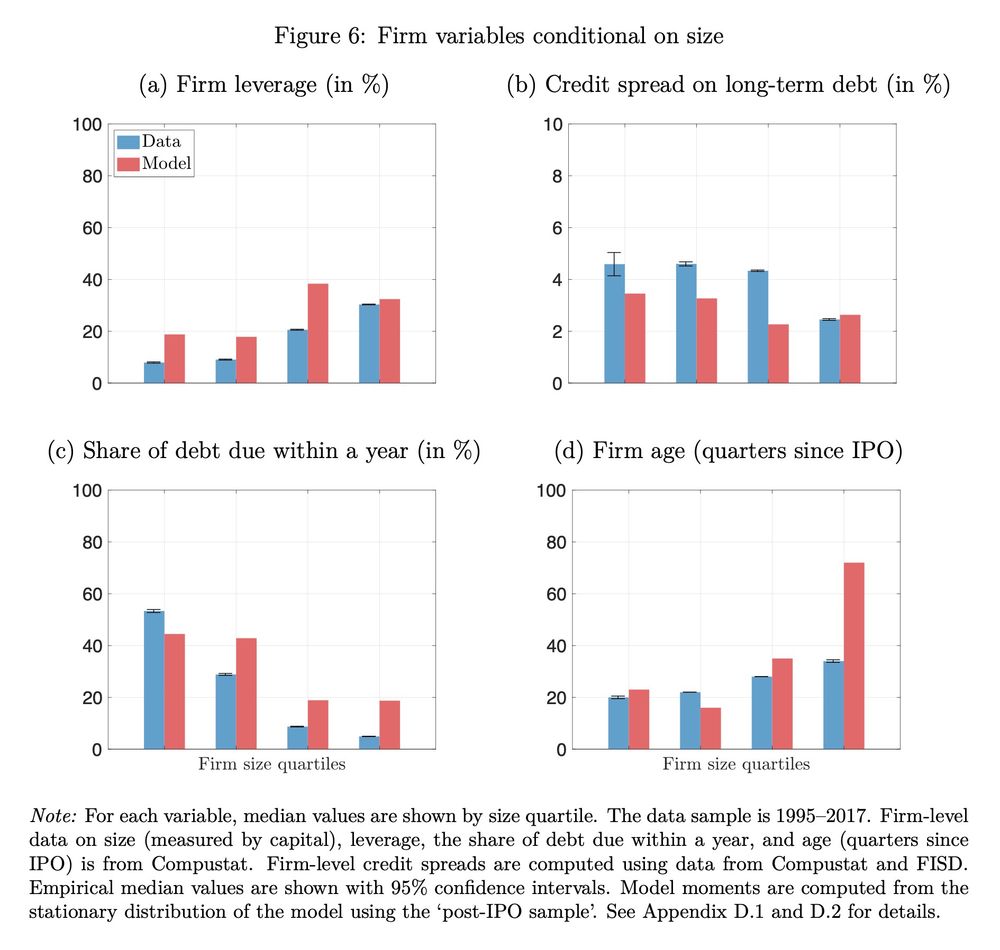

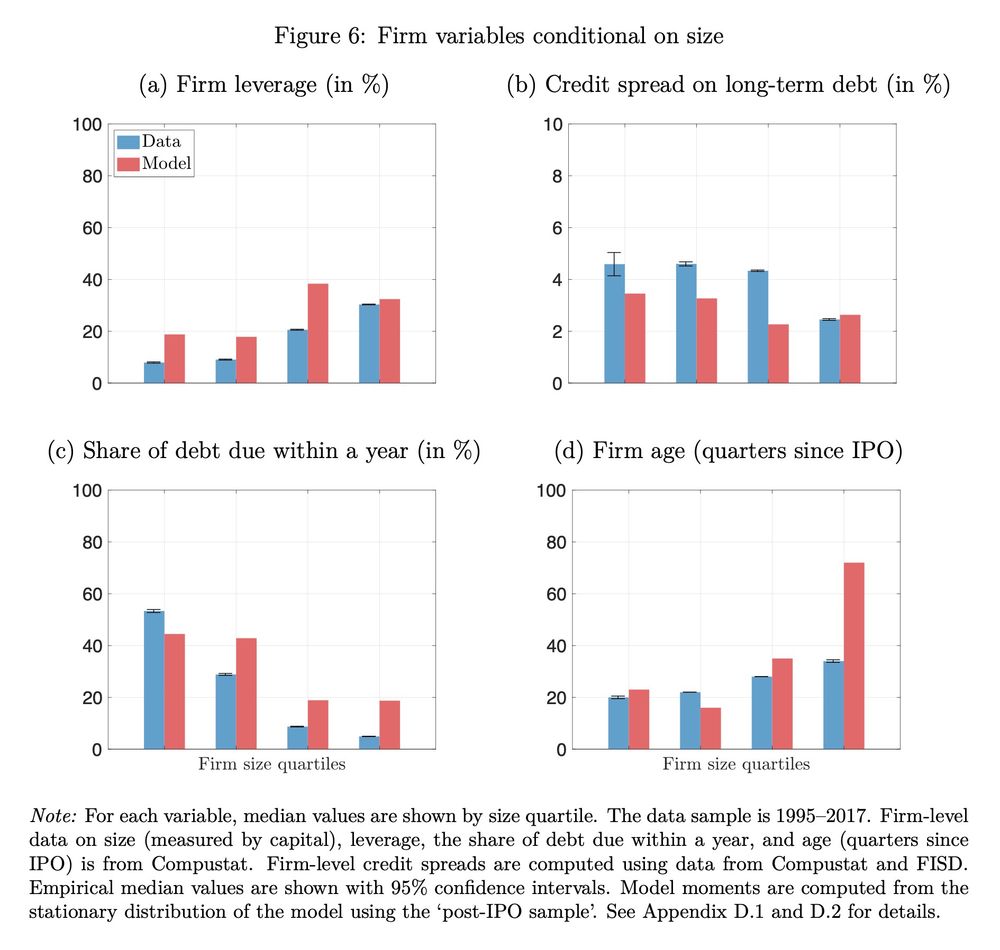

We construct a general equilibrium model with heterogeneous firms, long-term debt, and costly default. Firms raise capital, consisting of equity, long-term debt, and short-term debt. Safer firms endogenously have higher leverage, lower credit spreads, and more long-maturity debt.

09.12.2024 21:42 — 👍 0 🔁 0 💬 1 📌 0

This heterogeneity across firms is important if we want to understand which firms are most affected by monetary policy. It is also a crucial for assessing the macroeconomic effects of rate changes, which depends on the distribution of firms across remaining maturities.

09.12.2024 21:42 — 👍 0 🔁 0 💬 1 📌 0

We combine balance sheet & bond-level data to construct a measure of the share of a firm's debt which matures at any given point in time. Using panel local projections, we show that investment & credit spreads react more strongly to MP when firms have higher maturing bond shares.

09.12.2024 21:42 — 👍 0 🔁 0 💬 1 📌 0

"Corporate Debt Maturity Matters for Monetary Policy" is now available as an IFDP. We show that empirically and in a model, firms react more strongly to monetary policy (MP) when a larger fraction of their debt matures. This has important implications for the effectiveness of MP.

09.12.2024 21:42 — 👍 6 🔁 2 💬 1 📌 0

Greek fiscal humour is just the best.

Greek minister suggests that Germany should sell some islands to plug its fiscal hole.

29.11.2023 22:28 — 👍 56 🔁 17 💬 1 📌 0

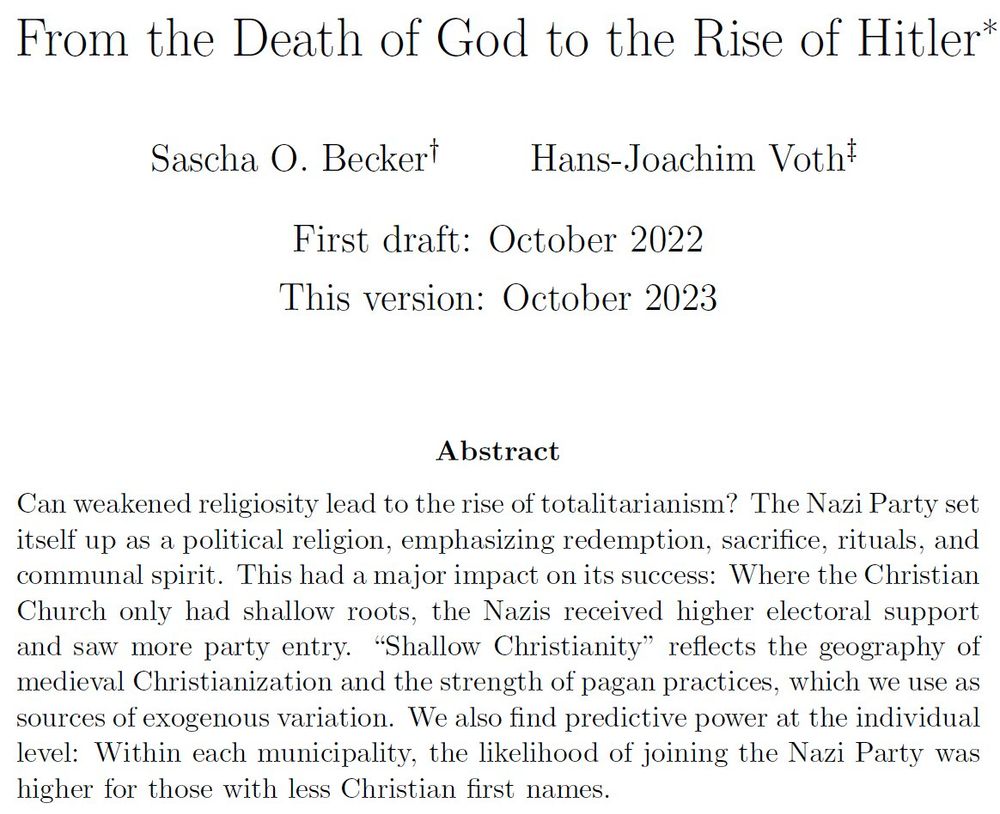

New paper with @jvoth.bsky.social

"From the Death of God to the Rise of Hitler"

Click (pdf) 👉 lnkd.in/g2wtSvUm

20.10.2023 21:58 — 👍 94 🔁 35 💬 6 📌 7

We're hiring an assistant prof in macroeconomics @ Hertie in Berlin, together with the IfW Kiel 👉 apply.interfolio.com/133002

06.10.2023 10:00 — 👍 21 🔁 22 💬 0 📌 1

Economics graduate working in the technology sector.

Posts on the themes of Economics, Tech, Politics, and Finance.

All views expressed are my own.

Liberal Democrat🔸

PhD student in Economics at @upf.edu. Financial stability and inequality. Ghisleriano.

PhD student at @ndecon.bsky.social

Working on sovereign debt and international finance.

Professor Emeritus, Department of Economics, University of Copenhagen. Also tennis and guitars. Everything is own opinions.

Assistant Professor of Business Economics & International Business, Alberta School of Business, University of Alberta | Former AP of HEC Montreal | PhD in Economics, Columbia University | International Economics/Finance/Business

The official account for the Federal Reserve Bank of Kansas City. We serve the public as we work to support a healthy, stable economy for all. https://www.kansascityfed.org/

Research economist at the Bank of England. My personal views only.

Economist working on topics in Macro-labor and behavioral macro, currently at the Federal Reserve Board. @utaustinecon.bsky.social, Delhi School of Economics alum.

#dftba #entrepreneurship #startups #events #tech #politics #education #innovation & #cocreation

📍Helsinki, Finland

DM me: https://ger.mx/AzXcep8R8N49oqWYAIjPoX6Pd9XtD96eyauRX9WvQTny#did:plc:7ld54xhibs7pb4o5emrrlhnc

Economist Federal Reserve Board | International Macro | 🇯🇵🇳🇱 | View are my own | mkomatsu.com

Researcher at @bundesbank.de Research Center. Working on Housing, Macro & Family.

Formerly at @umichECON, @cerge-ei-found.bsky.social and as a forecaster at #RSQE@umich.

Assistant Professor, Department of Economics @unibocconi, @IGIER, Research Fellow @cepr.org, Associated Researcher @ofceparis. #macroeconomics #IO #network

Associate professor at Tufts University working in macro-labor, macro-climate, and international macroeconomics. Views are my own.

https://sites.google.com/view/alanfinkelsteinshapiro

Senior economist at the European Central Bank, Monetary Policy directorate

On leave from Banque de France

WiMi Finanzpolitik Bundestag | Economics | WWU/HSE

S&P Global Market Intelligence

Senior Reporter, Global Markets

Visiting Fellow @ San Francisco Fed; International economics, market power, macro-labor, firm dynamics.

https://sites.google.com/view/hamidfirooz

Economic Historian, University of Oxford | History of economic governance and financial stability. Views are my own.

Website: https://glocobank.web.ox.ac.uk/people/dr-sabine-schneider

AP macroeconomics @Berlin School of Economics

website: https://sites.google.com/view/nicolas-syrichas/home