Our @bundesbank.de research paper dives into the methodology. www.bundesbank.de/resource/blo...

09.04.2025 21:22 — 👍 0 🔁 0 💬 1 📌 0

MILA’s granular approach outperforms typical full-document analyses in replicability and consistency. Despite the stochastic nature of language models, it delivers consistent results - so no need to lower the temperature to ensure replicability 3/

09.04.2025 21:22 — 👍 0 🔁 0 💬 1 📌 0

MILA combines text mining, a large language model (LLama 3.1 70B), mathematical formulas and topic modeling 2/

09.04.2025 21:22 — 👍 0 🔁 0 💬 1 📌 0

𝗡𝗲𝘄 𝗥𝗲𝘀𝗲𝗮𝗿𝗰𝗵: 𝗠𝗜𝗟𝗔 (𝗠𝗼𝗻𝗲𝘁𝗮𝗿𝘆-𝗜𝗻𝘁𝗲𝗹𝗹𝗶𝗴𝗲𝗻𝘁 𝗟𝗮𝗻𝗴𝘂𝗮𝗴𝗲 𝗔𝗴𝗲𝗻𝘁)

We introduce MILA—a new AI-driven solution for analyzing central bank communication.

MILA operates on individual sentences by using the macro and in-document context. 1/n

09.04.2025 21:22 — 👍 4 🔁 3 💬 1 📌 0

(c) Nadine Jakobs

Guten Morgen aus #Frankfurt!

Wir begrüßen Sie auf unserem offiziellen Bluesky-Kanal!👋

Ab heute halten wir Sie hier über alles Wissenswerte rund um die #Geldpolitik, #Bankenaufsicht und #Finanzstabilität sowie über viele weitere Aufgaben der #Bundesbank auf dem Laufenden.

#HerzlichWillkommen

09.04.2025 08:14 — 👍 65 🔁 4 💬 3 📌 0

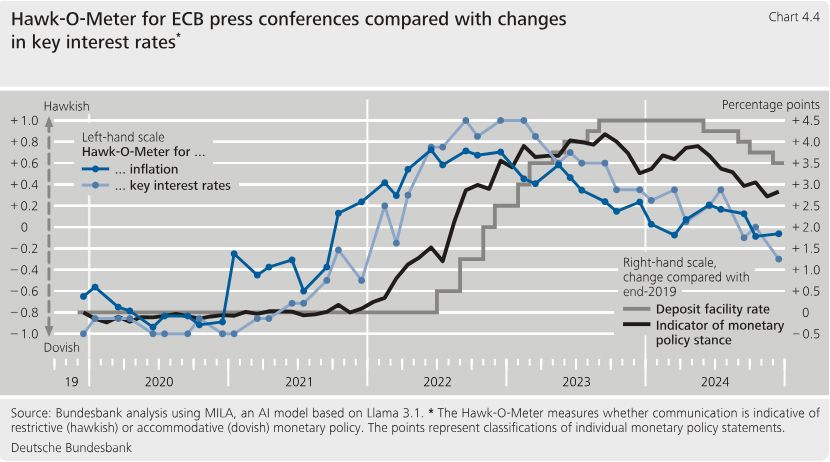

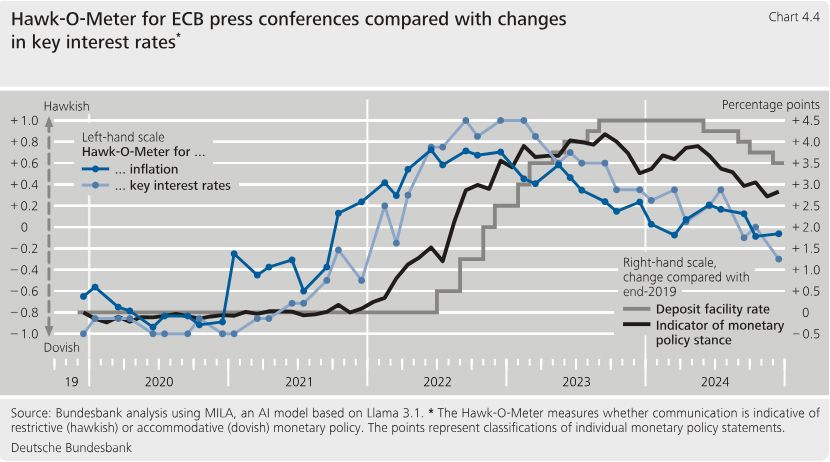

➡️ Recently, the stance has been more accommodative than policy rates suggest. This reflects lower longer-term rates and narrower spreads on sovereign and corporate bonds by historical standards, i.e. given the policy rate level, long-term rates and risk spreads historically tended to be higher. \5

20.03.2025 13:36 — 👍 0 🔁 0 💬 1 📌 0

➡️ Between 2022 and 2023, the extent of monetary policy tightening was comparable to the actual rise in key interest rates, but tightening began six months earlier given anticipation effects already reflected in financial market prices. \4

20.03.2025 13:36 — 👍 0 🔁 0 💬 1 📌 0

➡️ The rate suggests that the monetary policy stance between 2012 and 2021 was considerably more accommodative than signalled by policy rates. This comes not as a surprise, given that the proxy rate picks up impact of asset purchases and forward guidance during the effective lower bound regime. \3

20.03.2025 13:36 — 👍 0 🔁 0 💬 1 📌 0

➡️ The proxy rate maps common movements of a set of financial market variables to the actual DFR policy rate level following Doh and Choi (2016). 2\

20.03.2025 13:36 — 👍 0 🔁 0 💬 1 📌 0

How to measure the broader monetary policy stance in the euro area?

In our latest @bundesbank.de report, we present the proxy monetary policy rate, which combines information from the risk-free yield curve and risk assets. 1\ #EconSky @plieberk.bsky.social

20.03.2025 13:36 — 👍 4 🔁 3 💬 1 📌 0

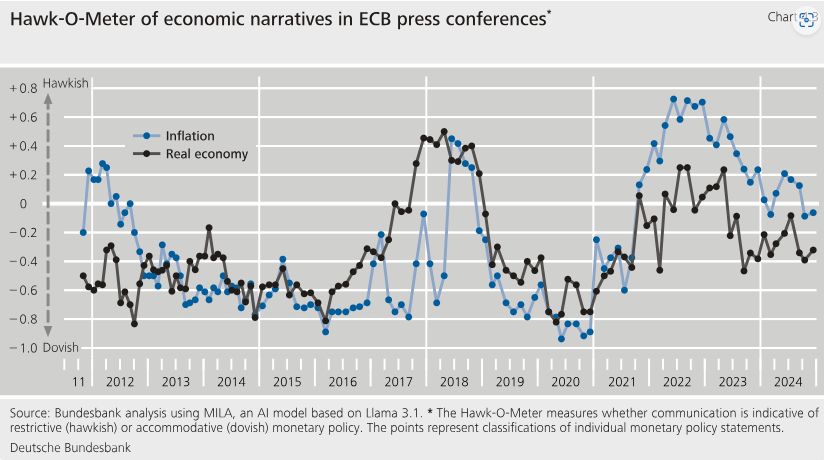

Since 2011, the tone of the ECB Executive Board’s monetary policy speeches has evolved in line with the ECB press conferences and the macroeconomic environment in the euro area. Some dispersion of speeches visible during the recent tightening and easing phase. \4

18.03.2025 20:55 — 👍 0 🔁 0 💬 1 📌 0

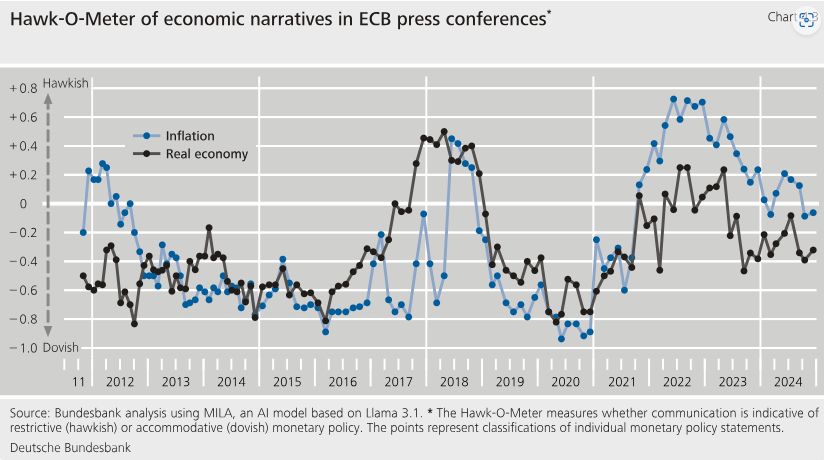

𝗦𝗵𝗶𝗳𝘁𝗶𝗻𝗴 𝗽𝗼𝗹𝗶𝗰𝘆 𝘀𝗶𝗴𝗻𝗮𝗹𝘀: MILA detects a dovish stance in 2020; a balanced inflation narrative in 2021, but still a dovish rate outlook; then a hawkish shift in 2022-23. By 2024, communication became more balanced. \3

18.03.2025 20:55 — 👍 0 🔁 0 💬 1 📌 0

𝗔𝗜-𝗽𝗼𝘄𝗲𝗿𝗲𝗱 𝗮𝗻𝗮𝗹𝘆𝘀𝗶𝘀: MILA provides structured assessments of ECB communication from 2011 to 2024, analyzing around 50,000 sentences on an individual basis. \2

18.03.2025 20:55 — 👍 0 🔁 0 💬 1 📌 0

At @bundesbank.de, we have developed 𝗠𝗜𝗟𝗔 (𝗠𝗼𝗻𝗲𝘁𝗮𝗿𝘆-𝗜𝗻𝘁𝗲𝗹𝗹𝗶𝗴𝗲𝗻𝘁 𝗟𝗮𝗻𝗴𝘂𝗮𝗴𝗲 𝗔𝗴𝗲𝗻𝘁) - an AI tool designed to evaluate ECB communication, assessing individual sentences from monetary policy statements and speeches given in-document as well as the macro context. \1 #EconSky

18.03.2025 20:55 — 👍 7 🔁 1 💬 1 📌 0

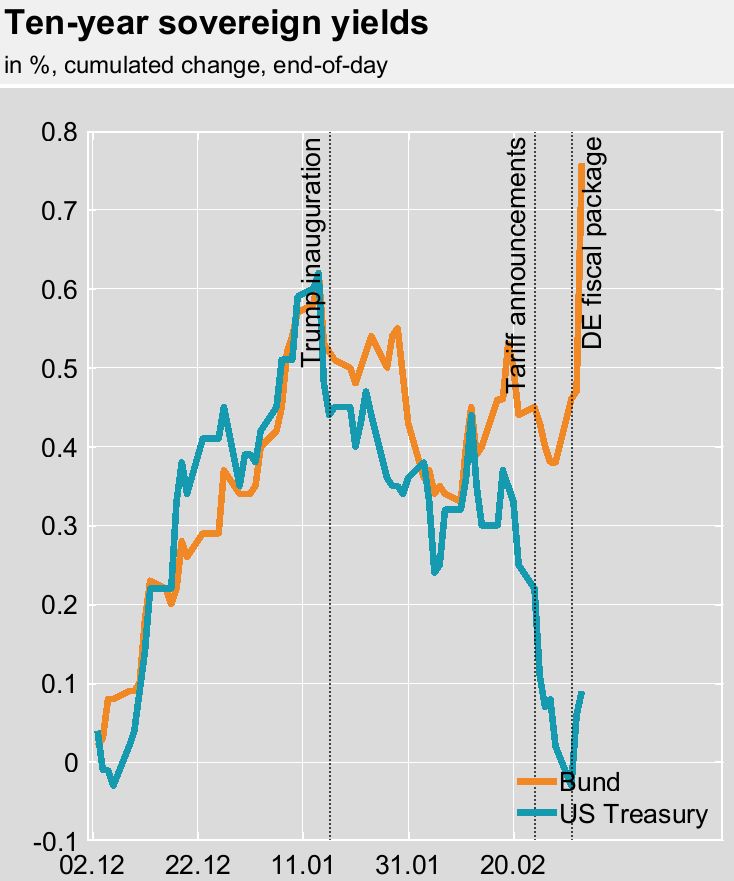

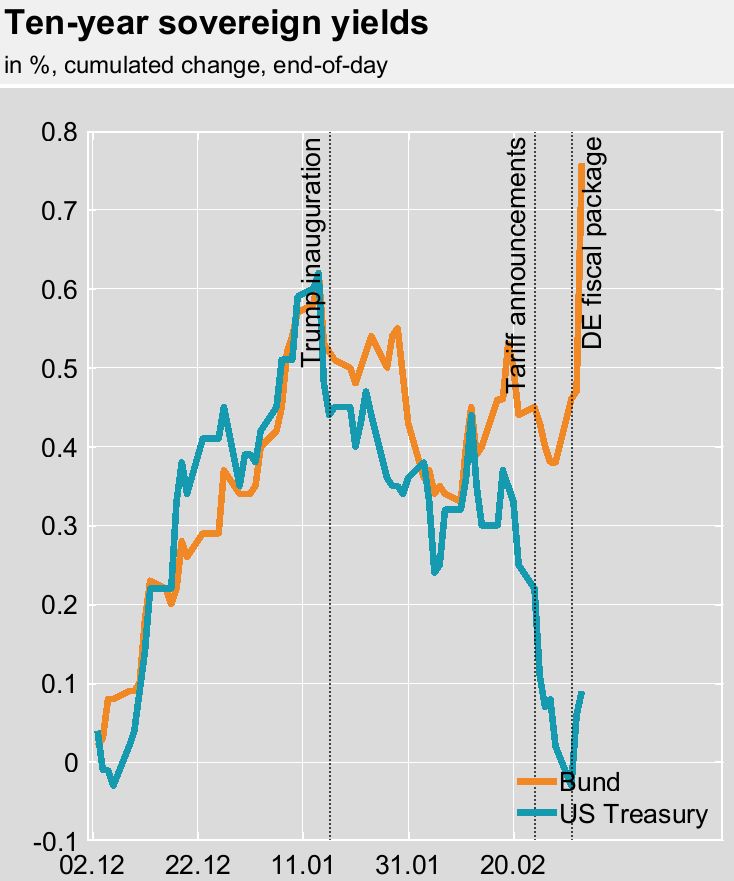

The script has flipped 🌎

- Euro area macro drives euro yields aka Bunds up

- US macro drives these yields down.

06.03.2025 17:41 — 👍 4 🔁 0 💬 0 📌 0

US Treasuries: slide. 🛝

Bunds: hold my beer. 🍺

06.03.2025 12:41 — 👍 1 🔁 2 💬 0 📌 0

Yesterday I delivered a speech with the title “No longer convenient? Safe asset abundance and r*” at the @bankofengland.bsky.social's #2025BEARconference. Let me summarise the main messages in a 🧵. 1/16

26.02.2025 09:38 — 👍 16 🔁 9 💬 2 📌 0

This is an important observation by @isabelschnabel.bsky.social:

Typically, tight monetary policy transmits also by increasing risk premia on financial markets. Without it, transmission is notably weaker.

During the recent hiking cycle, we did not observe this feature.

bsky.app/profile/flxg...

19.02.2025 18:29 — 👍 3 🔁 1 💬 0 📌 0

In my interview with @financialtimes.com published today I explained my current thinking about the @ecb.europa.eu ’s monetary policy and gave some personal reflections on the upcoming update of our monetary policy strategy. Let me briefly summarise the main points in a 🧵. 1/16

19.02.2025 16:14 — 👍 26 🔁 8 💬 1 📌 2

As we can no longer be confident that our monetary policy is restrictive, the direction of travel is less clear, Executive Board member @isabelschnabel.bsky.social tells @financialtimes.com. We are nearing the point where we may need to pause or halt our rate cuts.

www.ecb.europa.eu/press/inter/...

19.02.2025 11:02 — 👍 13 🔁 6 💬 2 📌 2

Many #ECB watchers have waited for this article. Chart A shows the huge model uncertainty surrounding the estimates. Adding parameter and filter uncertainty, data revisions and considering all models (not just those available for Q4 2024), you can see what we know about r* ... very little.

07.02.2025 18:05 — 👍 26 🔁 8 💬 1 📌 0

Moritz Kuhn

Moritz Kuhn

Professor

Department of Economics

University of Mannheim

L 7, 3-5, 68161 Mannheim, Germany

mokuhn@uni-mannheim.de

+49 621 181 1929

Office hours: please send an email (judith.price@uni-ma...

To all econ students on the market and advisors: I am thinking about filling an additional postdoc position at the University of Mannheim working on portfolio choice, wealth inequality, and labor markets. Interested? If yes, please let me know!

sites.google.com/site/kuhneco...

06.02.2025 17:34 — 👍 12 🔁 9 💬 0 📌 0

It's high time to have another look at interesting papers like this one!

"Anticipation effects of protectionist U.S. trade policies" by Norbert Metiu.

Article in the Journal of International Economics:

www.sciencedirect.com/science/arti...

Working paper:

papers.ssrn.com/sol3/papers....

03.02.2025 14:21 — 👍 2 🔁 1 💬 0 📌 0

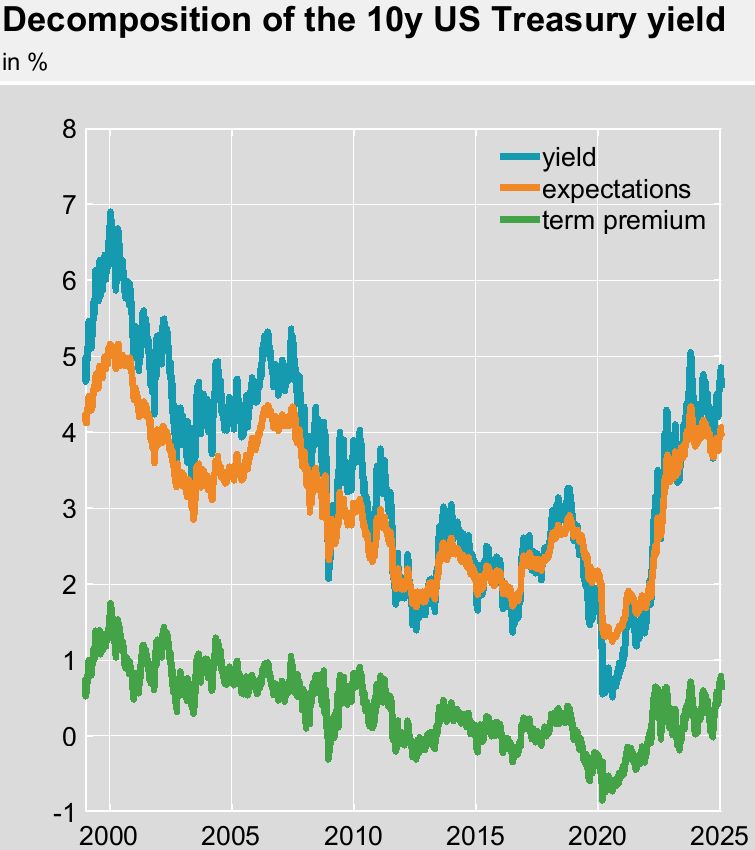

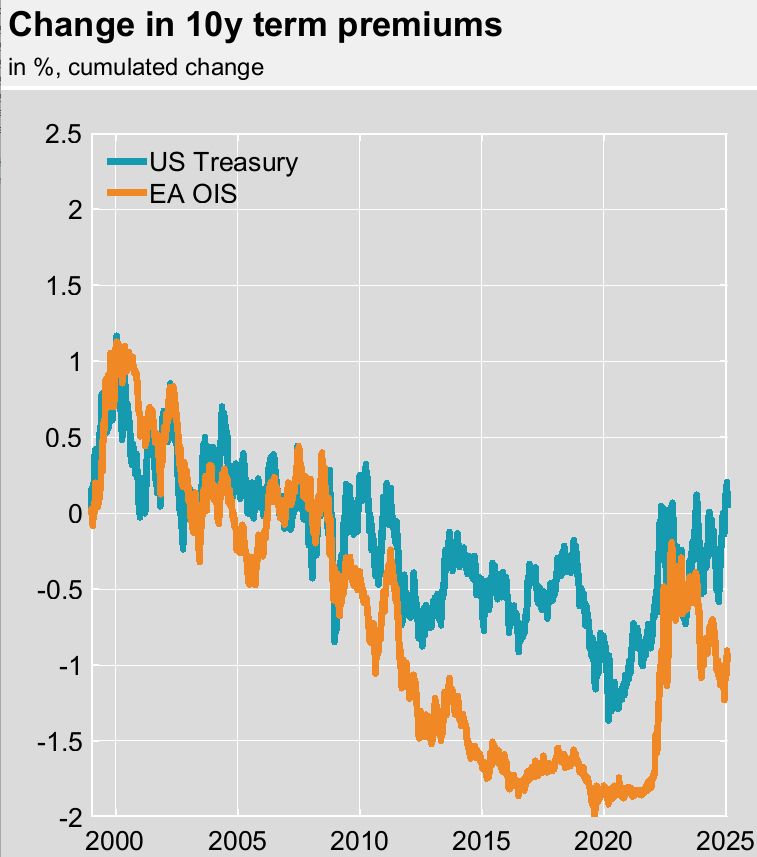

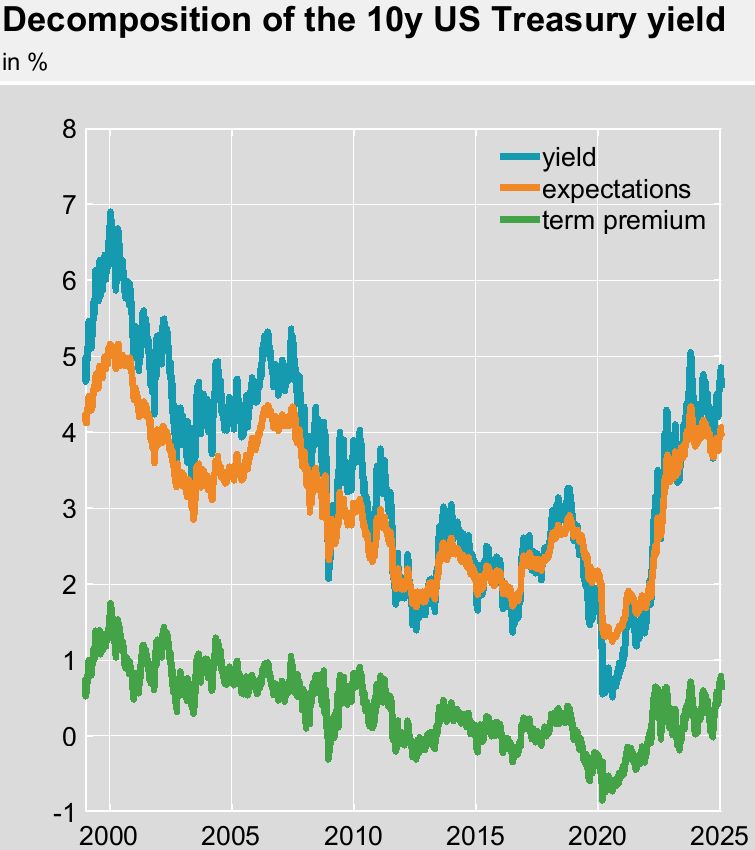

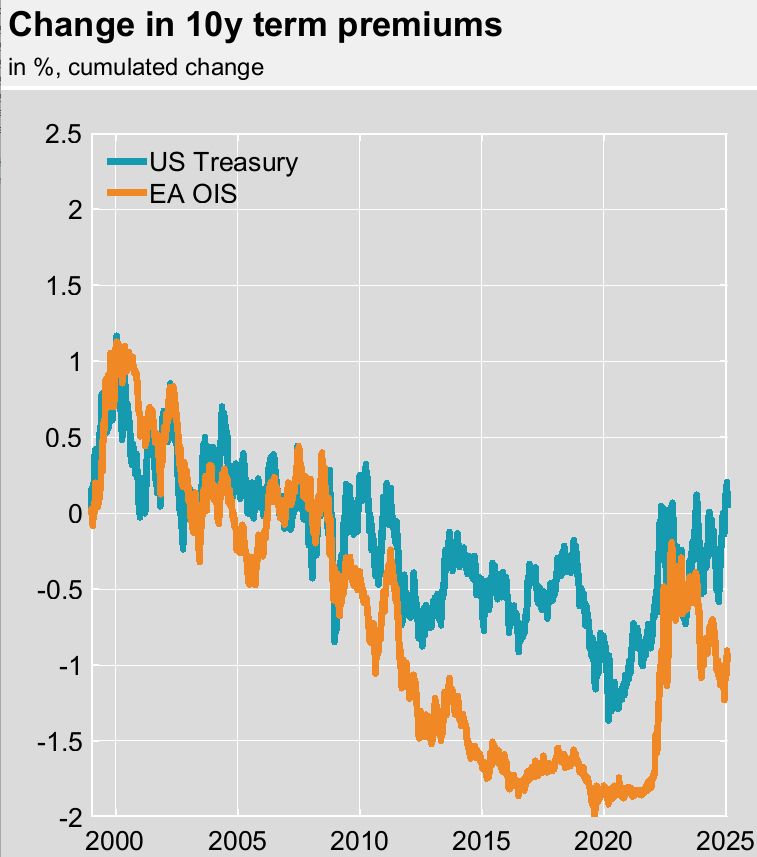

Estimates are based on affine / lower-bound term structure models augmented by survey information.

US: Kim and Wright (2005, 2011)

EA: Geiger and Schupp (2019)

31.01.2025 13:20 — 👍 0 🔁 0 💬 0 📌 0

Still, there are signficant level differences between US and EA yield curve components. 3/n

31.01.2025 13:20 — 👍 0 🔁 0 💬 1 📌 0

Corresponding change in average short-term rate expectations shows close co-movement since 1999 with EA expectations typically lagging its US peers (if at all). 2/n

31.01.2025 13:20 — 👍 0 🔁 0 💬 1 📌 0

🧵As 𝘁𝗲𝗿𝗺 𝗽𝗿𝗲𝗺𝗶𝘂𝗺𝘀 took center stage these days - Chart depicts dynamics for US and EA 1/n

➡️99-12: strong co-movement

➡️12-20: EA term premium collapses relative to US

➡️22-24: de-compression more pronounced in EA

➡️since mid-24: degree of US term premium rise is only partly matched by EA

#EconSky

31.01.2025 13:20 — 👍 1 🔁 1 💬 1 📌 0

Mit verantwortungsvoller und zukunftsorientierter Finanzpolitik ein Klima für Innovation und Investition schaffen.

Impressum, Datenschutz:

https://bundesfinanzministerium.de/Web/DE/Service/Instagram/links.html

Sustainable Architecture for Finance in Europe • Research & policy advice on finance • Legal Note http://safe-frankfurt.de/impressum

Welkom op het officieel kanaal van de Nationale Bank van België. Een moderne, centrale bank ten dienste van de maatschappij, in het hart van het eurosysteem.

Latvijas Banka ir Latvijas Republikas centrālā banka.

Mēs strādājam Latvijas labā. Mūsu mērķis ir uzticama finanšu sistēma, attīstīta valsts un pārtikusi sabiedrība.

🔗 bank.lv 🔗 makroekonomika.lv 🔗 naudasskola.lv 🔗 fintechlatvia.eu 🔗 e-monetas.lv

Die Oesterreichische Nationalbank (OeNB) ist die Zentralbank der Republik #Österreich und integraler Bestandteil des Eurosystems. Impressum auf https://www.oenb.at/Service/impressum-und-haftung.html

Nationalbanken er Danmarks centralbank. Nationalbankens tre overordnede formål er at bidrage til stabile priser, sikre betalinger og stabilitet i det finansielle system.

Riksbanken är Sveriges centralbank och en myndighet under riksdagen.

Bienvenue sur le canal officiel de la Banque nationale de Belgique. Une banque ecntrale moderne, au service de la société, au coeur de l'eurosystème.

La #BanqueDeFrance est une institution indépendante. Ses 3 grandes missions sont : la stratégie monétaire, la stabilité financière, les services à l’#économie.

Le compte officiel de la Banque centrale du Canada. Promouvoir votre bien-être économique. Maintenir l'inflation à un bas niveau.

Conditions: https://bit.ly/3M3yQH1 | EN: @bankofcanada.ca

Doctoral Candidate in Economics, University of Giessen

https://sites.google.com/view/moritz-grebe

Money and politics, monetary integration in the EU, with a focus on France and Italy, at the SWP think tank in Berlin.

PhD in economics, College of Europe (Natolin) Alumnus

Views expressed are my own

Economist, Eurosystem Centre head BIS Innovation Hub; founder of CEBRA.org (own views) - research site: https://sites.google.com/site/raphaelauer/home

❤️📊 | 🗣️DE|EN|FR | #rstats | #econsky

Independent journalist focusing on economics and global economy

Our website: en.econreporter.com

European, Economist, Communicator, head of Comms and Public Affairs SCHUFAHoldingAG. Tweets are my own, re-tweets aren't endorsements. Neu hier seit 1/25

Associate professor of political communication @ddc-sdu.bsky.social, University of Southern Denmark.

Focus on digital & right-wing media + parties.

Associate Editor @ International Journal of Press/Politics

Journalist at Bloomberg. Author of The Everything Risk newsletter.

S&P Global Market Intelligence

Senior Reporter, Global Markets