New working paper “Immigration and credit in America” with Ben Guttman-Kenney and Will Mullins.

Abstract screenshot attached and download link available here: papers.ssrn.com/sol3/papers....

If you have thoughts, we would appreciate hearing them.

29.03.2025 07:42 — 👍 2 🔁 0 💬 0 📌 0

YouTube video by Rick Astley

Rick Astley - Never Gonna Give You Up (Official Music Video)

I could never give it up.

youtu.be/dQw4w9WgXcQ?...

01.01.2025 01:13 — 👍 6 🔁 0 💬 0 📌 0

20.12.2024 19:49 — 👍 1 🔁 1 💬 0 📌 0

20.12.2024 19:49 — 👍 1 🔁 1 💬 0 📌 0

Check out Tony's thread summarizing our new paper, which evaluates the drivers of underinsurance for total loss events like wildfires.

19.12.2024 19:39 — 👍 5 🔁 1 💬 0 📌 0

2024 Online Boulder Summer Conference-Abstract Submission

2024 Online Boulder Summer Conference-Abstract Submission

3 days until the submission deadline

🌟 The 2025 Boulder Summer Conference on Consumer Financial Decision Making!🌟

📅 May 28–30, 2025 | 📍 Boulder, CO

cuboulder.qualtrics.com/jfe/form/SV_...

If you haven't gone before, this is a **top tier** interdisciplinary conference in household finance.

17.12.2024 16:53 — 👍 2 🔁 0 💬 0 📌 0

The discrete choice model allows us to perform a counterfactual without coverage neglect -- i.e., what if consumers efficiently shopped by $/coverage?

We estimate this would improve welfare by $290, on average, per year (or about 10% of annual premiums).

16.12.2024 20:42 — 👍 0 🔁 0 💬 1 📌 0

Why do consumers neglect coverage?

1) it is tough to know what total loss limit is "full" coverage (rebuild cost isn't home price).

2) even with dueling insurance quotes, it is tough to compare policies w different total loss limits.

We think information provision could help.

16.12.2024 20:42 — 👍 0 🔁 0 💬 1 📌 0

And, that's what we find (see column 3):

* Consumers respond significantly to lower headline premiums in their insurance choice.

* They are less responsive (and in the opposite direction) to the $/coverage price schedule.

16.12.2024 20:42 — 👍 1 🔁 0 💬 1 📌 0

In the last part of the paper, we test for and quantify the coverage neglect mechanism using a discrete choice model.

The idea is that a rational consumer would compare cost per coverage, but a coverage neglected one would only respond to headline premium.

16.12.2024 20:42 — 👍 0 🔁 0 💬 1 📌 0

Does underinsurance matter?

Yes! For about 1000 total losses, we find that being more underinsured makes it less likely the household rebuilds and more likely they sell.

Here, we're instrumenting for coverage choice using insurer average coverage ratio (leave one out).

16.12.2024 20:42 — 👍 0 🔁 0 💬 1 📌 0

What it is not 3: We find evidence against adverse selection on Wood Frame houses, which are *wayy* more likely to be a total loss, but are somehow not priced more expensively.

Homeowners do not buy more coverage for such houses.

16.12.2024 20:42 — 👍 1 🔁 0 💬 1 📌 0

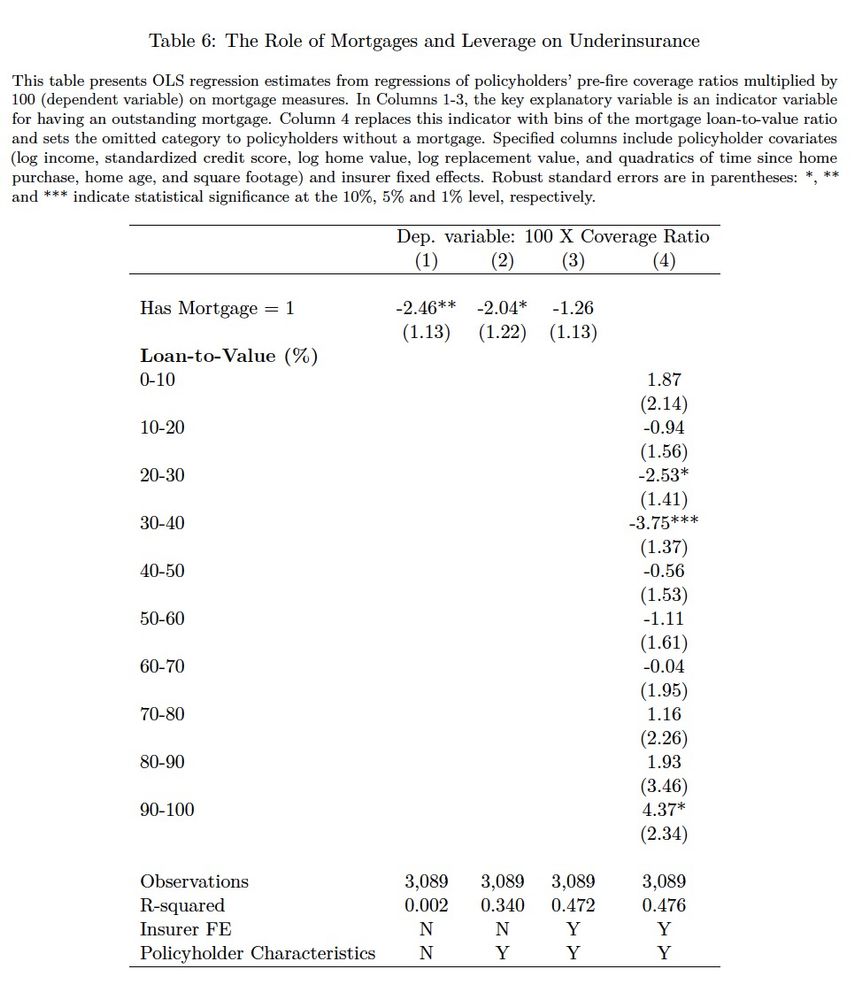

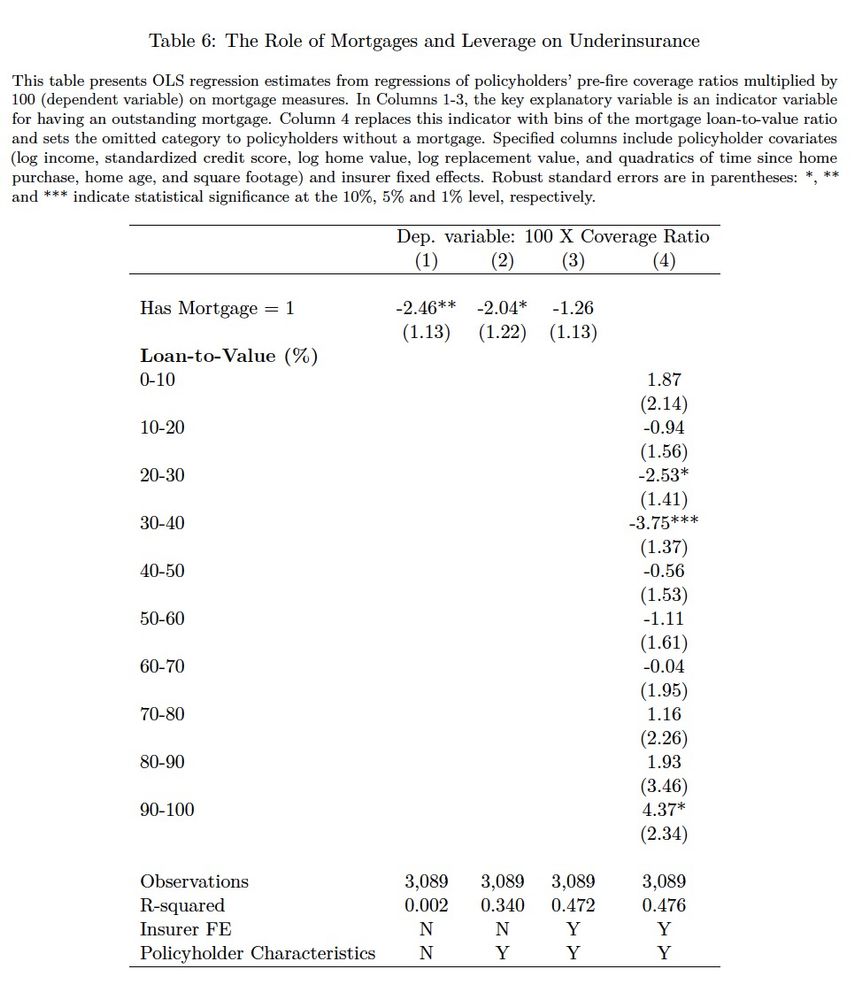

What it is not 2: Underinsurance is only weakly connected to having a mortgage or the mortgage's loan-to-value at the time of the fire.

16.12.2024 20:42 — 👍 0 🔁 0 💬 1 📌 0

What it is not 1: Underinsurance is *not* because policies get out of date. If anything, older policies are better insured.

We can see this because we observe contracts at inception and as of the date of the Marshall Fire (Dec 31, 2021).

16.12.2024 20:42 — 👍 0 🔁 0 💬 1 📌 0

Finding 3: Underinsurance varies *a lot* across insurers operating in the same market, and policyholder characteristics do not explain this variation very much.

The flip of this? Underinsured households could have gone with an insurer who would have provided fuller insurance.

16.12.2024 20:42 — 👍 0 🔁 0 💬 1 📌 0

So, what do we find?

Finding 1: Underinsurance is *severe and common*... 75% of households are underinsured, and 37% are what we call *severely underinsured* -- i.e., only insured for 75% or less of their home's rebuild cost.

16.12.2024 20:42 — 👍 0 🔁 0 💬 1 📌 0

Our detailed data give a complete picture of underinsurance and recovery in the Colorado market. This allows us to:

1) measure extent of underinsurance,

2) understand how underinsurance ~ insurers versus household characteristics,

3) evaluate impact of underinsurance on recovery

16.12.2024 20:42 — 👍 1 🔁 0 💬 1 📌 0

Our paper relies on detailed insurance contract data, matched to household-level information from a major credit bureau, housing characteristics, and after a major wildfire, recovery outcomes.

Because of that wildfire, we also have accurate rebuild cost estimates.

16.12.2024 20:42 — 👍 0 🔁 0 💬 1 📌 0

🚨 New working paper! 🦶

"Coverage neglect in homeowners insurance" with

Emily Gallagher and Phil Mulder

Link: papers.ssrn.com/sol3/papers....

We study the problem of why people underinsure against total losses, a pressing issue as climate events make these more common.

#EconSky

16.12.2024 20:42 — 👍 10 🔁 3 💬 1 📌 1

2024 Online Boulder Summer Conference-Abstract Submission

2024 Online Boulder Summer Conference-Abstract Submission

Have some cool financial decision-making research that you'd like to share with an awesome interdisciplinary audience of academics, practitioners, and policy-makers?

Don't wait: Submission portal for the 2025 Boulder Summer Conference is now open! cuboulder.qualtrics.com/jfe/form/SV_...

11.12.2024 04:32 — 👍 8 🔁 4 💬 0 📌 2

Happy 20th Birthday, FRA!

2004-2024

09.12.2024 07:58 — 👍 6 🔁 0 💬 0 📌 1

Current Program – FRA

I am super excited for the FRA this weekend (and honored to help put it together):

fraconference.com/current-prog...

One of my most favorite features is the early ideas session on Sunday afternoon. Always interesting & great interaction between authors and audience.

04.12.2024 03:57 — 👍 12 🔁 0 💬 1 📌 2

Super helpful.

22.11.2024 05:51 — 👍 1 🔁 0 💬 0 📌 0

Happy to see my review paper, "Social Media and Finance" (with Will Mullins and Marina Niessner) published today at the Oxford Research Encyclopedia of Economics and Finance (oxfordre.com/economics/pa...).

We learned a lot doing this review.

Ungated version here: papers.ssrn.com/sol3/papers....

21.11.2024 15:12 — 👍 10 🔁 0 💬 0 📌 0

I had a great time at the OU-RFS Climate and Energy conference.

www.ou.edu/content/dam/...

I might be biased, but I think the paper I discussed on climate risks and underinsurance was the most interesting.

Related, I’m eager to but cannot yet post my own underinsurance paper. Update soon.

17.11.2024 14:41 — 👍 3 🔁 0 💬 0 📌 0

Journal of Corporate Finance Special Issue Conference 2025

🚨Call for papers: JCF/Bocconi/@cepr.org Conference on 'Info, Contracts, and Firms'

*Keynote: Mike Ewens

*Featured Panel: 'The Changing Info Environment' w/ @profcookson.bsky.social, @israelsen.bsky.social, & Laurent Fresard

*More to come!

Deadline: Nov 18

www.neeley.tcu.edu/jcf-conferen...

07.11.2024 19:39 — 👍 5 🔁 4 💬 0 📌 1

Not that it doesn’t matter, but I’ve found students aren’t particularly attentive to the issue of which assignments generate the most variance.

I also find that very different assessments have high correlations across sections, so as long as that’s true, it might not matter *as much* to scale.

24.12.2023 18:30 — 👍 1 🔁 0 💬 1 📌 0

Research Economist at Deutsche Bundesbank - Head of Research Focus Group “Monetary Policy Implementation”

President of IBEFA (International Banking, Economics and Finance Association)

only my views

Associate Professor

Illinois Gies College of Business

Coeditor, American J. of Health Economics

www.julianreif.com

Polling editor at CNN, keeping (cross)tabs on public opinion and the news. I like puns.

Associate Professor of Finance

University of Wisconsin-Madison

anthonydefusco.com

I am an Economist leveraging the assignment mechanism in the field to test theory and help non-profits, govts, and anyone who will listen! My goal is to (hopefully!) change the world for the better. My picture is with my oldest son!

Bridging finance & tech @ Lehigh. Research: 💡innovation, 🤖 AI lending, ⚖️ algorithmic bias, & 🚀 startups. Data and papers at https://bowen.finance

economist

@nyfedresearch

(my views, not fed views); interested in macroeconomics, finance, economic history, jazz, Bayer 04 Leverkusen, and New Yorker cartoons

🌱Plant based Bodybuilding💪🏻🔥, Health Coach, love my 3 boys, ☀️lives in Vegas, 🌲Oregon is home. Exploring and hiking the outdoors. 🌊Democrat💙love my Dog Mo🩷🐾

Economist at Stanford GSB and @siepr.bsky.social | Avid Racer

Website: www.timdesilva.me

Financial economist at NUS Business School interested in banking & household finance. NYU Stern & PKU GSM alumna

Assistant Professor of Finance, University of Florida, Warrington College of Business

Research: Macro-Finance, Banking, Monetary Policy, Financial & Economic History

🇧🇷 in 🇺🇸

https://sites.google.com/site/cortesgustavos/

Finance Professor/Climate Researcher/Firefighter

economist thinking about taxes and public debt | co-organizer for the virtual municipal finance workshop | ap in finance at the wharton school

www.danggarrett.com

www.muni-workshop.com

Financial economist at MIT Sloan working on finance, macro, international, economic history, and other fun stuff

emilverner.com

Menswear writer. Editor at Put This On. Words at The New York Times, The Washington Post, The Financial Times, Esquire, and Mr. Porter.

If you have a style question, search:

https://dieworkwear.com/ | https://putthison.com/start-here/

Economics | Barnard | Columbia | Santa Fe Institute | http://www.columbia.edu/~rs328/ | https://rajivsethi.substack.com/ | https://tinyurl.com/shadowsofdoubt

20.12.2024 19:49 — 👍 1 🔁 1 💬 0 📌 0

20.12.2024 19:49 — 👍 1 🔁 1 💬 0 📌 0