I have been thinking this year will be a particularly rough year for economists seeking employment, and this new data tool from the AEA definitely shows that is the case with 1/3 less listings than the same time last year, basically matching COVID lows.

09.10.2025 19:35 — 👍 3 🔁 3 💬 0 📌 0

Just a reminder to submit your papers to SoLE!!! It will be a great conference, with not-to-be-missed keynotes by Janet Currie, Kerwin Charles, and Jeff Smith! Avoid FOMO and submit!

🥳

07.10.2025 14:57 — 👍 7 🔁 6 💬 0 📌 0

Happy Caturday from Big Gus and Archie who like to politely join me at the kitchen counter for an afternoon snack.

27.09.2025 19:43 — 👍 2 🔁 0 💬 0 📌 0

"What are you working on?" seems the most natural thing I would want to be asked. It's perfectly fine to say you're in between projects or caught up teaching. Another option is "What are you thinking about these days?" or "What sessions are you excited for?" without getting existential about fields

21.09.2025 21:31 — 👍 2 🔁 0 💬 0 📌 0

Hi Bluesky!

I'm excited to share my job market paper (for the 2025-26 market)!

It introduces a new extension of RDD where outcomes are entire distributions: Regression Discontinuity Design with Distributions (R3D).

Thread below 👇 (1/)

09.04.2025 15:17 — 👍 36 🔁 14 💬 2 📌 4

This has also been my experience with econ research and professionally related posts in particular. LinkedIn is surprisingly effective for getting likes, but conditional on a reply I do think the discussion is better here instead of the series of exact "Congratulations, [name]!" replies on LinkedIn

28.08.2025 19:16 — 👍 2 🔁 0 💬 0 📌 0

The letter is ready, thanks to all those who helped out! Starting to gather signature now, please consider signing (link at top of letter) & spread the word.

docs.google.com/document/d/1...

27.08.2025 16:29 — 👍 124 🔁 85 💬 7 📌 28

Graeter's is a really great brand out of Cincinnati (in my personal opinion, bested only by Skyline if you're in the area). Black Raspberry is probably my favorite of their flavors.

06.08.2025 22:28 — 👍 4 🔁 0 💬 2 📌 0

I do. It's part of "participation" which is 20% of the grade (doubled after Gen-AI ruined other assignments). If it's obvious a student is unprepared, I make sure I call on them the next class and take off points only for (1) multiple unexcused absences or (2) consistent unpreparedness.

06.08.2025 13:52 — 👍 4 🔁 0 💬 0 📌 0

I switched to cold calls as my approach to encouraging interaction with readings back in 2022 and it's been going surprisingly well. Since it happens is in-class, cold calls are quite AI-proof and the students, advanced undergrads and MBAs, actually seem to like it when I thought they'd hate it

06.08.2025 13:15 — 👍 3 🔁 0 💬 1 📌 0

PhD students working on projects in the crime & criminal justice space (empirical w/ a causal focus) - see below for a fun workshop in October! Will be a great opportunity for feedback and networking with other scholars.

05.08.2025 16:45 — 👍 4 🔁 1 💬 0 📌 0

There is some great discussion by one of my dissertation committee members, Jimmy Roberts who happens to be an excellent industrial organization economist, around claim #4.

Market concentration and market power, while sometimes correlated, are not the same thing.

31.07.2025 18:42 — 👍 2 🔁 0 💬 0 📌 0

Lexington, KY

Excited to announce the call for papers for the inaugural MidSouth Education Policy Workshop, October 16-17, in Lexington, KY!

Send us your abstracts on all things econ of ed & ed policy by 8/27. Grad students & early career folks especially welcome!

Info & link to submit here: bit.ly/44TdiGf

29.07.2025 20:09 — 👍 28 🔁 25 💬 1 📌 5

38 states have legalized sports betting, but little is known about the financial, social, and behavioral impacts.

@arnoldventures.bsky.social is committed to building the evidence base with our newest RFP.

LOIs due 9/15 and details here: www.arnoldventures.org/causal-resea...

28.07.2025 15:49 — 👍 8 🔁 3 💬 0 📌 0

As an amateur appreciator of urban amenities, I just arrived in Vancouver and the Canada Line train into the city is so nice. Easy to use, clean, and right on time.

24.07.2025 23:51 — 👍 2 🔁 0 💬 0 📌 0

👇👇👇

23.07.2025 17:29 — 👍 6 🔁 2 💬 0 📌 0

Who Labels and What's Priced? Evidence from Third-Party ESG Assessments in the Municipal Bond Market

We study the supply and pricing dynamics for ESG labels using a novel and unexpected third-party assessment of environmental, social, and governance (ESG) chara

Next up, I’ll be presenting “Who Labels and What's Priced? Evidence from Third-Party ESG Assessments in the Municipal Bond Market” where we explore environmental, social, and sustainability labels using an unexpected information release in 2023 through Bloomberg

(papers.ssrn.com/sol3/papers....)

23.07.2025 13:05 — 👍 1 🔁 0 💬 0 📌 0

Discussant @ivantivanov.bsky.social (Chicago Fed) focuses on the growth of “alternative trading systems” (ATS) that dealers have increasingly used since about 2010. Some questions remain about how ATS interacts with reciprocity

23.07.2025 13:01 — 👍 1 🔁 0 💬 1 📌 0

Dealer Quid Pro Quo in the Municipal Bond Market

Dealers intermediate trades in OTC markets by forming trading networks. We find greater network complexity in the municipal bond market than the typical core-pe

First paper: Casey Dougal (FSU) tells us about muni dealer networks in “Dealer Quid Pro Quo in the Municipal Bond Market.” The paper finds, on average, dealers that trade back and forth (reciprocal trades) have low execution costs, but effect flips on the periphery

papers.ssrn.com/sol3/papers....

23.07.2025 12:59 — 👍 1 🔁 0 💬 1 📌 0

14th annual Municipal Finance Conference | Brookings

It’s Day 2 of the Brookings Muni Finance Conference (livestream: www.brookings.edu/events/14th-...)! I will be live tweeting a lot less today but the papers—including my own paper on green muni bonds—will hopefully be just as good as yesterday

23.07.2025 12:33 — 👍 3 🔁 1 💬 1 📌 0

Melissa Winkler (Crosswalk Labs) discusses the paper and starts by noting that it looks like markets are doing what they are supposed to. Coal’s decline led to decreased fiscal stability and markets priced that risk. She also brings up a lot of forward looking questions on future energy transitions

22.07.2025 20:28 — 👍 1 🔁 0 💬 1 📌 0

Last paper: “Navigating Structural Change: Evidence from Municipal Finances and Bond Market Pricing During the Coal Transition” presented by Marcelo Ochoa. The large decline in coal production following from the fracking boom in the US was priced in munis and led to local fiscal distress

22.07.2025 20:21 — 👍 1 🔁 0 💬 1 📌 0

Discussant Francesco Ruggieri (UChicago) zooms in on nonlinearities in the NYC property tax system: assessment growth caps interact interestingly with property tax relief. Dynamic welfare implications not obvious.

22.07.2025 19:50 — 👍 0 🔁 0 💬 1 📌 0

The basic idea: hurricane Sandy had a massive deleterious effect on property values in NYC for damaged properties, but property tax assessments adjust these values down for property taxes less, leading to increases in the taxable ratio (especially damaged properties ineligible for tax relief)

22.07.2025 19:40 — 👍 0 🔁 0 💬 1 📌 0

The final paper session of the day is also on climate risk and the energy transition. First up is “Rising Waters, Falling Taxes: The Impact of Hurricane Sandy on Property Tax Assessments in New York City” presented by Yilin Hou

22.07.2025 19:29 — 👍 0 🔁 0 💬 1 📌 0

Discussant Brian McCartan (Ceres) zeros in on *operational changes* that can be functions of climate events/disasters, and called this research filling in specific causal chains between climate risks and fiscal impacts underexplored. With limited resources, important work. How to inform adaptation?

22.07.2025 18:57 — 👍 0 🔁 0 💬 1 📌 0

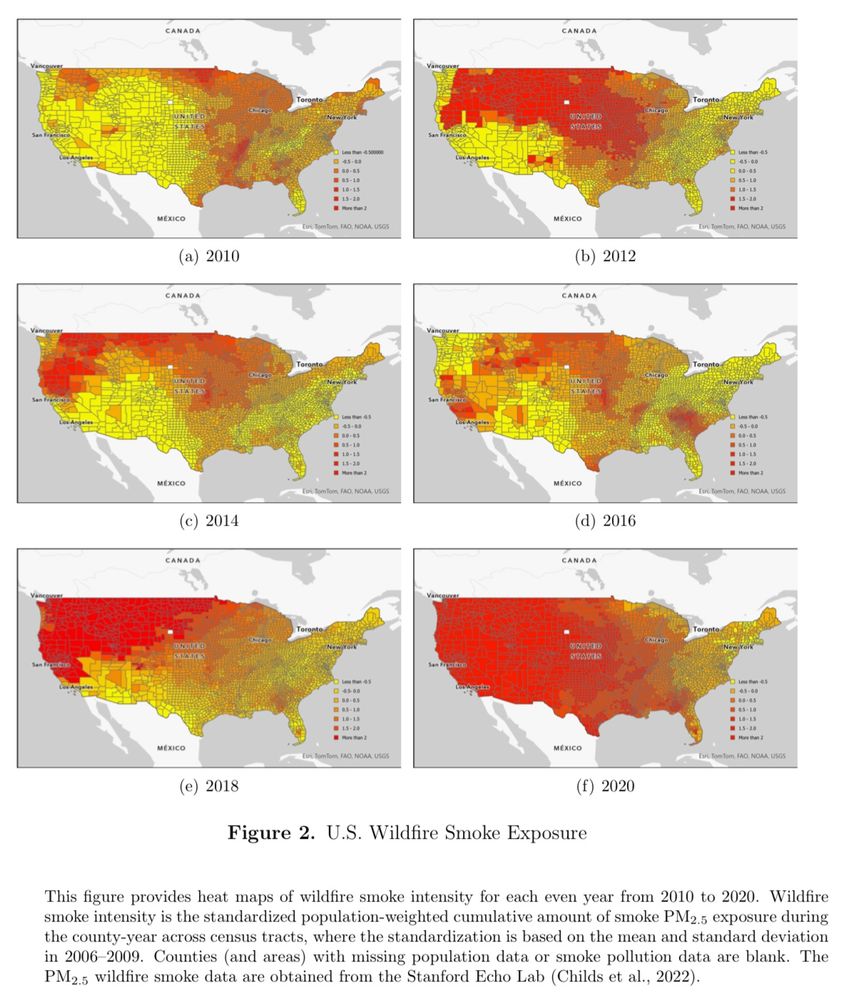

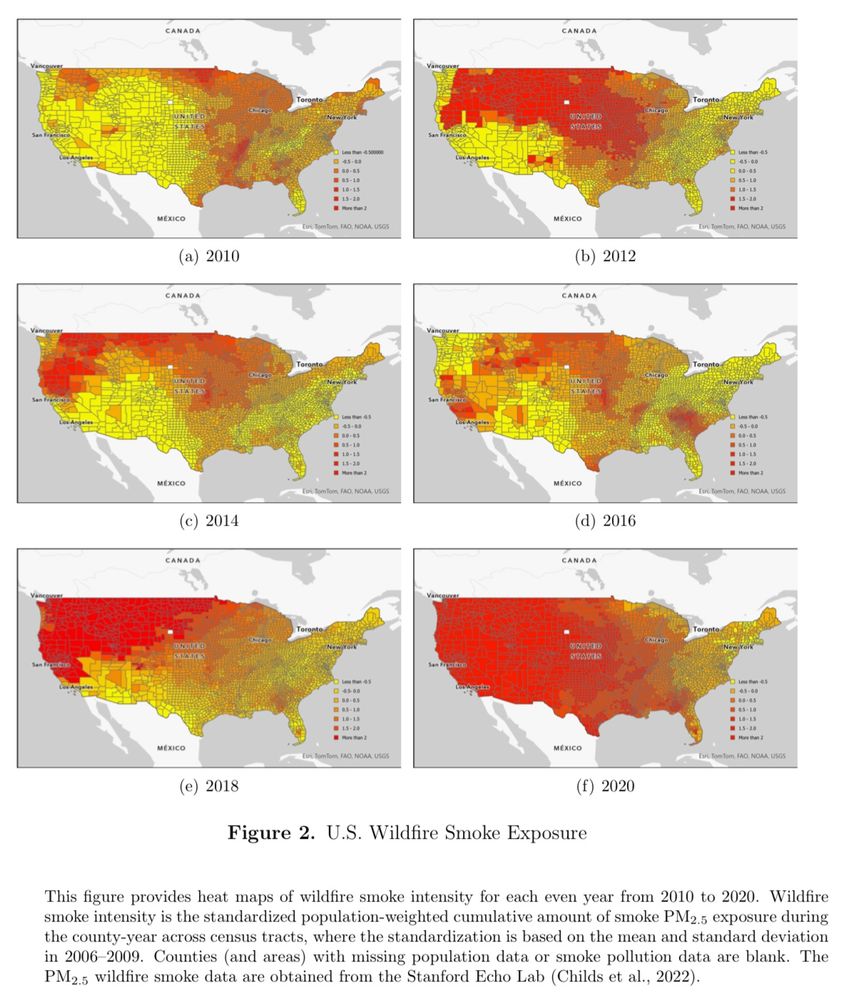

But wildfires cause more than just direct damage! Luis Lopez (UIC) presents “Up in Smoke: The Impact of Wildfire Pollution on Healthcare Municipal Finance” documenting that the smoke from wildfires is priced in the bonds of hospitals and nursing homes (more negative profitability services)

22.07.2025 18:51 — 👍 2 🔁 0 💬 1 📌 0

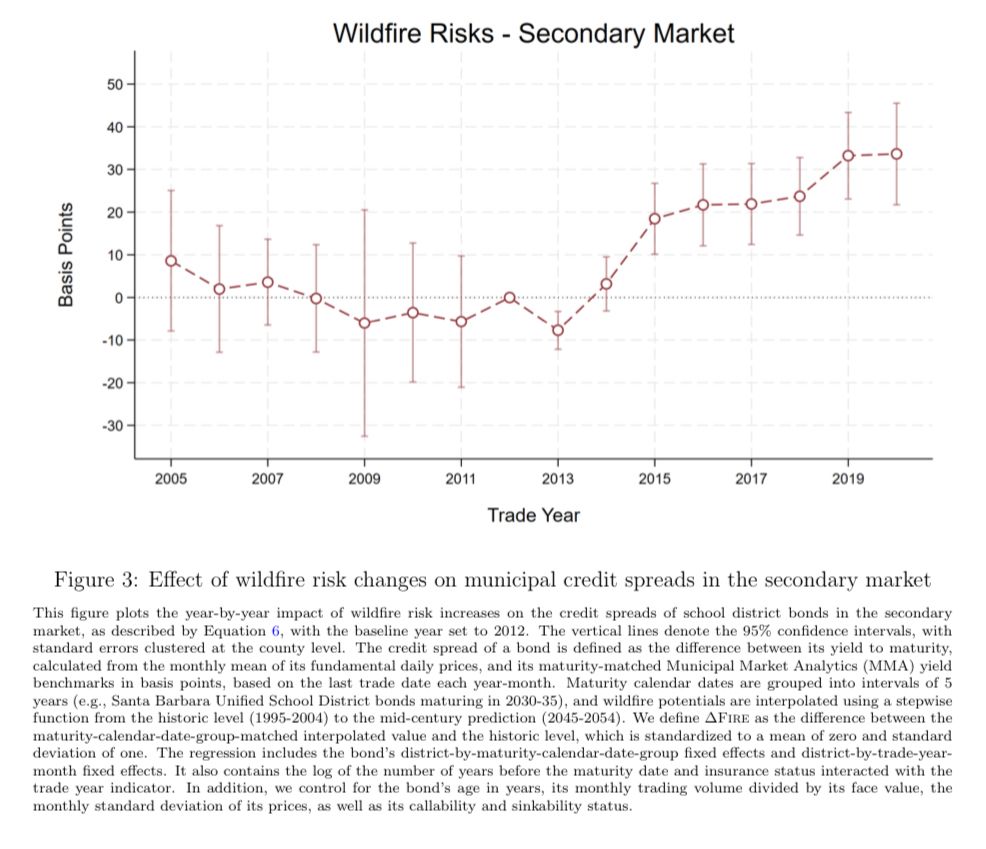

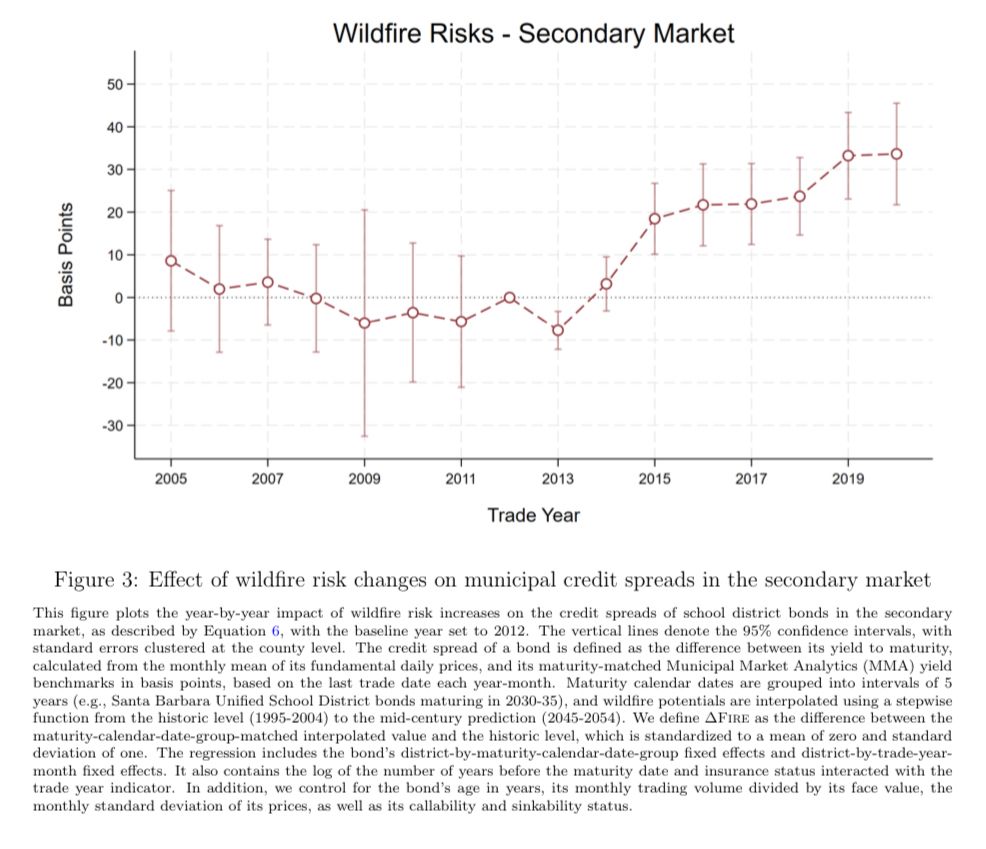

This also inspired a good discussion among the crowd (and another great discussion from Erika Smull of Breckenridge). Lots of suggestions of other things that could be going on. Some surprise at lack of term structure adjustment or adaptation given very large price effects.

22.07.2025 18:30 — 👍 0 🔁 0 💬 1 📌 0

After congestion pricing, back to muni bonds. Woongchan Jeon presented “Pricing Climate Risks: Evidence from Wildfires and Municipal Bonds” arguing that wildfire risks are being increasingly price over time (following the Goldsmith-Pinkham et al. sea level rise paper)

22.07.2025 18:26 — 👍 3 🔁 2 💬 1 📌 0

Social Scientist, Harvard University

https://www.ryandenos.com/

https://ryandenos.substack.com/

Daniel Patrick Moynihan Chair in Public Policy, @maxwellsu.bsky.social. Also @cprmaxwell.bsky.social @nber.org, @uniofgalway.bsky.social, AEA Committee on the Job Market. Studying health economics and policy, economics of risky behaviors.

Economist; professor; health policy and decision science. Advocate for high quality, affordable #HigherEd. Georgetown and UW-Madison alum. Personal views only. #AcademicSky #EconSky #Bayesian

https://orcid.org/0000-0002-9790-2988

Political Science Prof at University of Southampton. I study misperceptions, fact-checking, and foreign policy attitudes. American in the UK. he/his (y'all whenever possible). Spurs #COYS.

Economist. Economic Historian. Lego Nerd. Sharing thoughts.

https://bettercities.substack.com/

Better cities and transit are possible 🚇

#1 Congestion pricing stan

#1 RFK Jr. hater

Economics Commentator, Financial Times; Honorary Professor of Practice, UCL Policy Lab

Sign up to my central banks newsletter here https://ep.ft.com/newsletters/subscribe?newsletterIds=6501cc9ec6e3c91c18b0b9e6

Assistant professor at Georgia State University, formerly at BYU. 6 kids. Study NGOs, human rights, #PublicPolicy, #Nonprofits, #Dataviz, #CausalInference.

#rstats forever.

andrewheiss.com

Signal: andrewheiss.01

Author of Bea Wolf, A City on Mars, and the comic SMBC

Website: www.smbc-comics.com

Patreon: https://www.patreon.com/ZachWeinersmith?ty=h

New book: http://www.acityonmars.com/

clown of a person!

sports | economics | third thing

university faculty in RI

very much not a professional work account -> views are my own

Evolutionary anthropologist & behavioral scientist. Leadership, punishment, conflict resolution, & cultural transitions.

Asst. Prof at UM6P in FGSES & AIRESS. Co-Director of @omovalleyresearchproject.org.

📍 Rabat 🇲🇦

🌐 https://zhgarfield.github.io

PhD Candidate in economics at the University of Michigan. Metrics & big data. 🇧🇪. Views mine.

https://www.davidvandijcke.com/

Educational researcher focused on EdTech x AI,student engagement and motivation. Associate professor at USC Rossier. Associate Director of USC Center for Generative AI and Society

i run a data-driven website about politics called Strength In Numbers: gelliottmorris.com/subscribe

wrote a book by the same name: wwnorton.com/books/Strength-in-Numbers

polling averages at @fiftyplusone.news

formerly @ 538 & The Economist. gardener

Development economist, demographer & social scientist.

Currently - Senior Evaluator @3ieImpact.org

[x-Mathematica, UW-Madison, IFPRI, FAO, AU, AmeriCorps NCCC & Tufts].

Anti-fascist + anti-racist in Chicagoland, 🇺🇸🇪🇨 & he/el.

http://www.ejquinones.com/

Political scientist at the University of Pennsylvania. Prof: http://goo.gl/qAOlH9 538: http://goo.gl/1iwZJs

Professor of Political Science at Stanford | Exploring money in politics, campaigns and elections, ideology, the courts, and inequality | Author of The Judicial Tug of War cup.org/2LEoMrs | https://data4democracy.substack.com

Helping put social science to use for society at Stanford Impact Labs

Twitter: @michaeleddy 🏳️🌈

Staunch liberal, hopeful Georgist, moderate intuitionist. Hoping to one day pass on an even better world than the one I inherited. Retweet =/= Endorsement