End of Term Web Archive – Preserving the Transition of a Nation | Internet Archive Blogs

The Internet Archive has to date downloaded 500 terabytes of US government websites, which it crawls at the end of every presidential term. The whole archive is fully searchable. This effort's housed by a donation-funded nonprofit, not a branch of the US government. blog.archive.org/2024/05/08/e...

01.02.2025 00:58 — 👍 33102 🔁 12238 💬 486 📌 582

Lina Khan is the GOAT. 💯💯💯 agree

07.12.2024 14:06 — 👍 15 🔁 6 💬 0 📌 0

This NEEDS to happen.

07.12.2024 14:27 — 👍 9 🔁 8 💬 0 📌 1

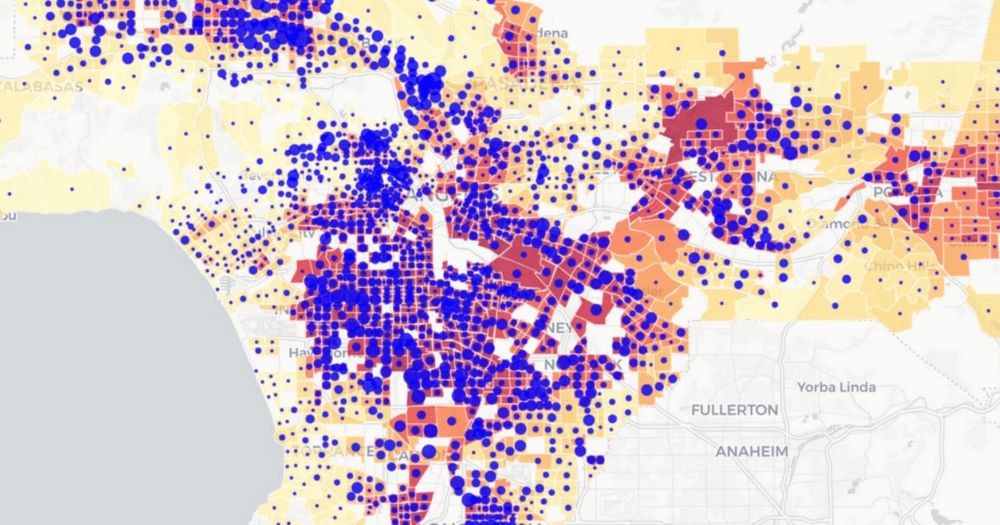

a box with the following text: "Californians living in zip codes where 67% or more of the population identifies as Hispanic have among the lowest number of collection accounts on their credit reports on average and yet are sued in debt collection cases at rates that are more than twice as high as their White counterparts."

The report is descriptive and exploratory, as there is little information connecting debt lawsuits and credit report data. One of the most interesting findings is a disconnect between collection accounts on credit reports and lawsuit rates in a zip code, by race.

03.12.2024 14:58 — 👍 0 🔁 0 💬 1 📌 0

A figure representing the three data sources used in the report (debt collection lawsuit records, University of California Consumer Credit panel, and the American Community Survey) that have been combined in two datasets: (1) a “case- level” dataset which has one row per person sued in our study counties and time period and aggregates the credit reporting and demographic information to zip code and (2) a “zip-level dataset” that combines lawsuit, credit reporting, and ACS demographic information at the level of zip code and year.

The report examined a sample of debt collection lawsuits in 4 large California counties and combines three different datasets at both lawsuit- and zip-levels.

03.12.2024 14:58 — 👍 0 🔁 0 💬 1 📌 0

Would love to be considered to be part of this group! Thanks for putting it together.

27.11.2024 11:55 — 👍 3 🔁 0 💬 0 📌 0

Happening in ~40 mins. You can still register to watch our film screening and discussion!

campusgroups.uci.edu/law/rsvp_boo...

21.11.2024 19:20 — 👍 1 🔁 1 💬 0 📌 0

Watch the trailer of our award-winning documentary short, Shame on You! about the debt collection industry and then RSVP to a screening and discussion next Thursday at 12pm PT in person at UCI Law or online - campusgroups.uci.edu/law/rsvp_boo...

13.11.2024 19:52 — 👍 5 🔁 2 💬 0 📌 3

#consumerlaw #debtcollection #academicsky

16.11.2024 20:09 — 👍 0 🔁 0 💬 0 📌 0

Interested in empirical studies of low-income people and debt with big sets of state court record data? Follow me and my co-researchers @debtcollectionlab.bsky.social! Lots of new research reports up this summer.

16.11.2024 13:40 — 👍 2 🔁 1 💬 0 📌 1

Debt Collection Lab

We are changing the narrative about debt collection by building a public facing resource for debtors and their advocates.

@claireraba.bsky.social and @dalie.bsky.social have also coauthored several reports on various aspects of California debt collection, including how lawsuits map onto credit access and race/ethnicity. debtcollectionlab.org/research?loc...

15.11.2024 16:09 — 👍 2 🔁 1 💬 1 📌 0

Debt Collection Lab

We are changing the narrative about debt collection by building a public facing resource for debtors and their advocates.

Some highlights: we have 3 different papers on the effect of debt documentation laws on court outcomes, and a fourth on the effect of these laws on access to credit written by a team led by @dalie.bsky.social and @claireraba.bsky.social, co-PIs of the Lab.

debtcollectionlab.org/research?iss...

15.11.2024 16:09 — 👍 1 🔁 1 💬 1 📌 0

Debt Collection Lab

We are changing the narrative about debt collection by building a public facing resource for debtors and their advocates.

One of our main goals at the Debt Collection Lab is to produce original research papers and briefs studying the impact of debt collection lawsuits on consumers and the courts. We have 9 reports on our site right now, take a look here!

debtcollectionlab.org/research

15.11.2024 15:59 — 👍 4 🔁 0 💬 1 📌 1

Watch the trailer of our award-winning documentary short, Shame on You! about the debt collection industry and then RSVP to a screening and discussion next Thursday at 12pm PT in person at UCI Law or online - campusgroups.uci.edu/law/rsvp_boo...

13.11.2024 19:52 — 👍 5 🔁 2 💬 0 📌 3

I look forward to reading this very soon. Curious what they've found and how it matches what my team has reported for #PSLF borrowers.

You can read my latest three releases (qualitative work) here!

protectborrowers.org/scholars-dis...

13.11.2024 16:20 — 👍 3 🔁 2 💬 0 📌 0

Working to change public policy, rollback corporate power, rebuild local communities. Co-Executive Director at the Institute for Local Self-Reliance. Portland, Maine.

Advancing social equity via research, education, and policy.

https://samuelduboiscookcenter.org/

The International Inequalities Institute drives integrated research and teaching on inequality at LSE. Home of @afsee-lse.bsky.social.

Illuminating the debate through data-driven research #inequalitydata✨

Hosting the World Inequality Database🌐 https://wid.world/

https://inequalitylab.world/en/

IRP is a national center for interdisciplinary research into the causes and consequences of poverty and social inequality in the United States. We are part of the University of Wisconsin-Madison.

The Stone Center for Research on Wealth Inequality and Mobility advances interdisciplinary research on the origins and nature of contemporary inequalities.

The Stone Center conducts and promotes quantitative research using inequality as a lens on society and the economy. Home to the US Office of LIS.

stonecenter.gc.cuny.edu

We produce cutting-edge research on social inequality, train the next generation of scholars, build data infrastructure, and increase data accessibility at the Institute for Social Research, University of Michigan. Learn more at inequality.umich.edu.

We are a digital agency focused on creating innovative data viz in the public interest. Clients include @evictionlab.bsky.social and more.

Law prof at U Colorado, business and securities. Blogging at https://www.businesslawprofessors.com/

Scholarship at https://papers.ssrn.com/sol3/cf_dev/AbsByAuth.cfm?per_id=2365170

No longer welcome in the State of Nevada.

Consumer advocate skeeting about #finjustice, AAPI issues, Brookline & random stuff. Loud Asian Woman (so all posts my own) Reposts =/= endorsements

Candidate for MA State Senate in Norfolk & Suffolk district

www.electpersis.com

Deputy ED @thesbpc.bsky.social; proud Boston Public School mom; consumer advocate; #mapoli #bospoli

debt, development, infrastructure, the economics of racial inequality, and the myth of racial progress. I express my own views

Professor at Duke Law. US & global taxation, transnational sociology, data & tech. Dance Enthusiast (tap, jazz, Lindy hop, balboa). Type A-minus. 🌈🎶👞

data and people at January Advisors

https://www.januaryadvisors.com

My name is Roman. Interests: Traveling, History, Economy, Languages (🇩🇪🇬🇧🇺🇲🇳🇱🇵🇱🇨🇳) and I make free map based geography learning games.

📍Frankfurt, Dortmund, Enschede, Cheltenham, Katowice, Jingdezhen

🗺️😎: https://geographyquiz.app/

Directed by @dalie.bsky.social at UCILaw & Jonathan Glater at BerkeleyLaw, driving cutting-edge research into one of the most pressing challenges facing America.

www.slli.org

Supreme Court & appellate advocate for plaintiffs and the public interest. Access to justice, consumer and workers rights, class actions. Founder of Gupta Wessler LLP, Washington, DC. Lecturer at Harvard Law School. Formerly of CFPB and Public Citizen.

Economist interested in all things mortgage/consumer finance, #rstats, data visualization, and Econsky.

Law prof, mom of 4, & very concerned citizen.

My scholarship centers on housing, consumer finance, and property law.