Hurdle Rate has published a new research piece on the LSE listed MHA Plc, a new IPO on the AIM segment of the LSE.

Please find the research at our website below:

www.hurdlerate.com.au

@hurdlerateut.bsky.social

Australian Fixed Unit Trust available for Global Wholesale Investors. Strictly focused on investing in globally listed professional and financial services. https://www.hurdlerate.com.au/

Hurdle Rate has published a new research piece on the LSE listed MHA Plc, a new IPO on the AIM segment of the LSE.

Please find the research at our website below:

www.hurdlerate.com.au

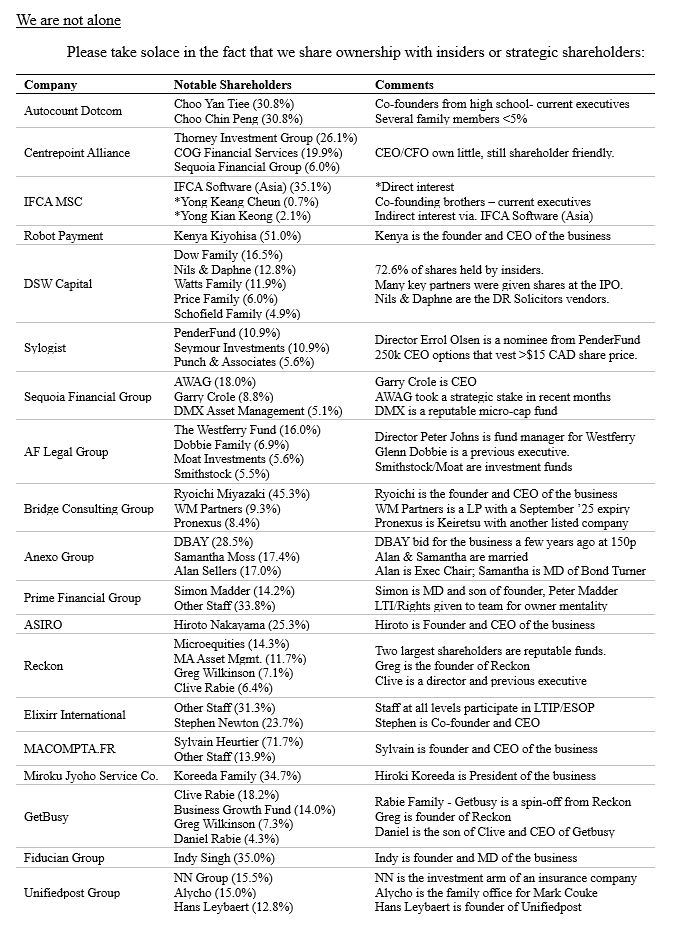

Key to our investments is a high degree of shared ownership with notable inside or substantial shareholders.

These shareholders have the ultimate incentive to act in our best interest.

Hurdle Rate held a short call on state of mind given recent market turbulence.

youtu.be/ZJVqa5gzSxg

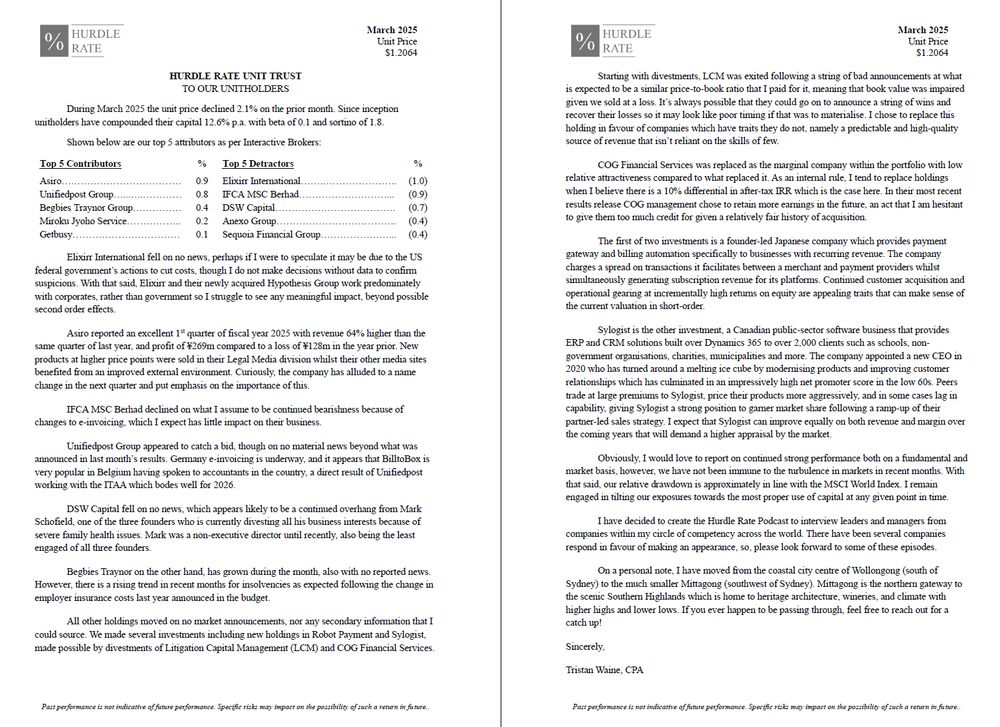

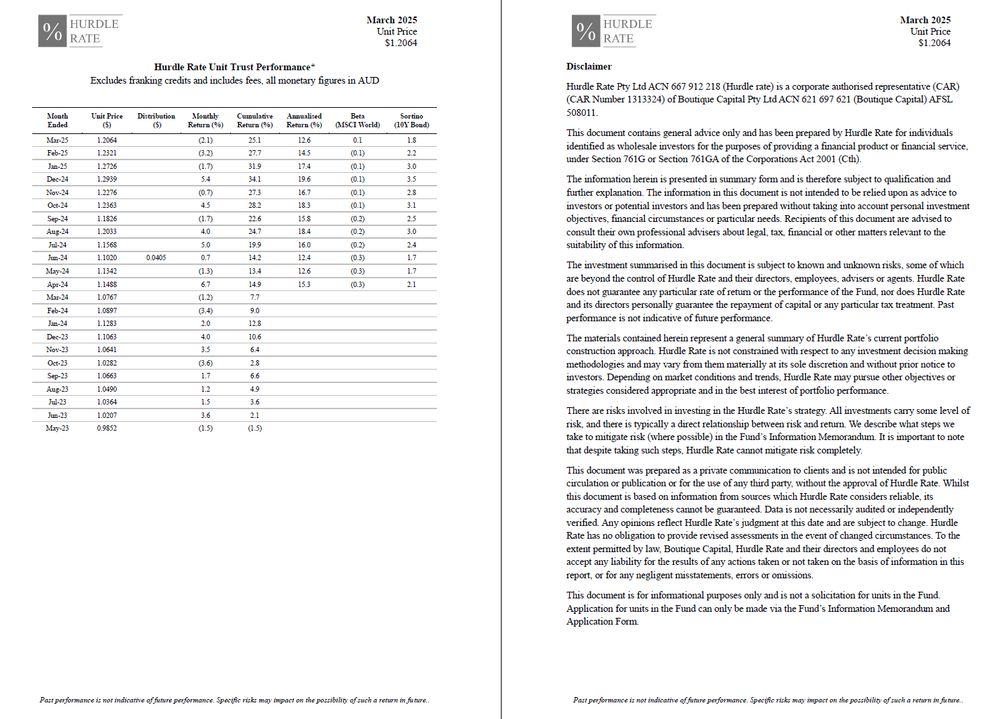

March 2025 Letter to Unitholders

If you are interested in making an investment into the Hurdle Rate Unit Trust please visit www.hurdlerate.com.au for more information

We have combined our website and blog into one to simplify our communications.

Soon, users will be redirected to our blog when they click on www.hurdlerate.com.au

For the time being our blog can be viewed at hurdlerate.substack.com

The Hurdle Rate website has been simplified to what is shown below.

We remain open to partner with wholesale investors, domestically and internationally.

Please reach out if you have any questions or would like to chat.

Due to greater than expected volume in our mailing list, I have decided to move our mailing list back to Substack.

Here I will update subscribers of our performance, letters, and blog posts about specific companies or process.

It is a shame right, such a good setup in the core business through to 2053 yet feel the need to do M&A.

22.03.2025 10:39 — 👍 1 🔁 0 💬 2 📌 0

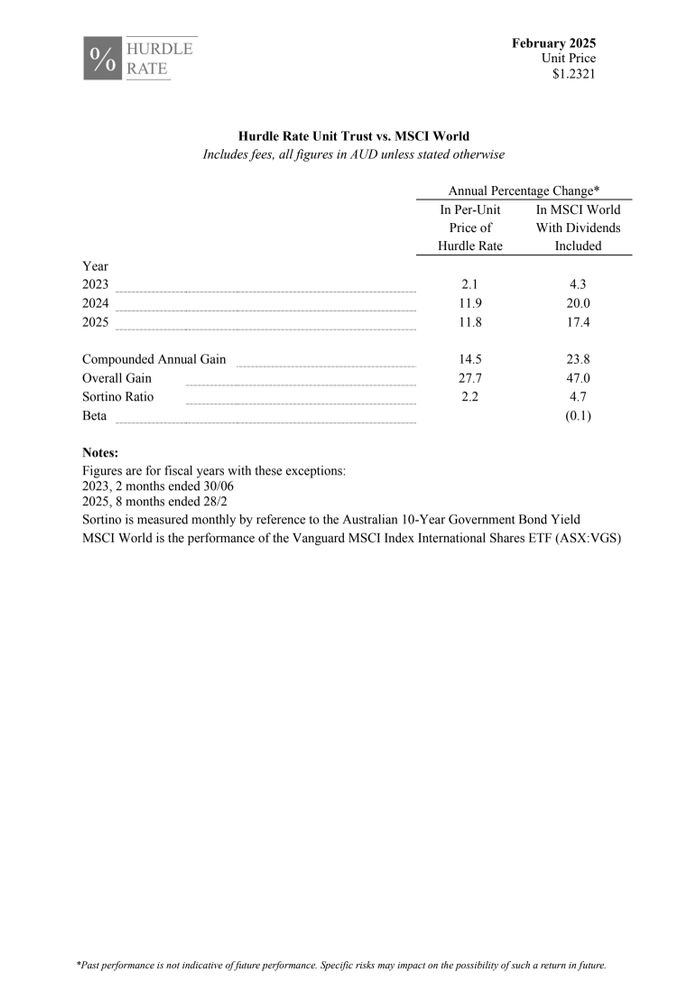

Below is our tear sheet for February 2025

18.03.2025 06:49 — 👍 0 🔁 0 💬 0 📌 0Subscribers to the Hurdle Rate Unit Trust mailing list just received a new investment pitch. For now this has also been posted on the Hurdle Rate blog, but future ad-hoc pitches will only be available if you are subscribed to the list below.

14.03.2025 07:25 — 👍 0 🔁 0 💬 0 📌 0

To understand the frequency of corrections and bear markets, I would recommend listening to the great Peter Lynch below:

www.youtube.com/watch?v=XRFf...

What am I doing? The same as always, hunting for deals.

I remain laser focused on maximising absolute returns over the long term (5+ year periods). Volatile periods and drawdowns create a greater pool of opportunities for us!

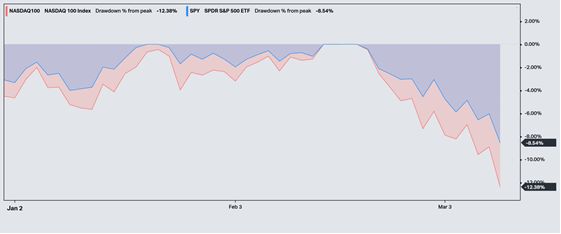

The Hurdle Rate Unit Trust is in the process of having it's February accounting done, but, I can say that we are also in a drawdown, though not quite as much as either at the time of writing.

Does this change things? No.

As I write this, the S&P500 is edging on the verge of a "correction" (a 10% decline in the index) and the Nasdaq has already passed into it.

11.03.2025 23:38 — 👍 1 🔁 0 💬 1 📌 0

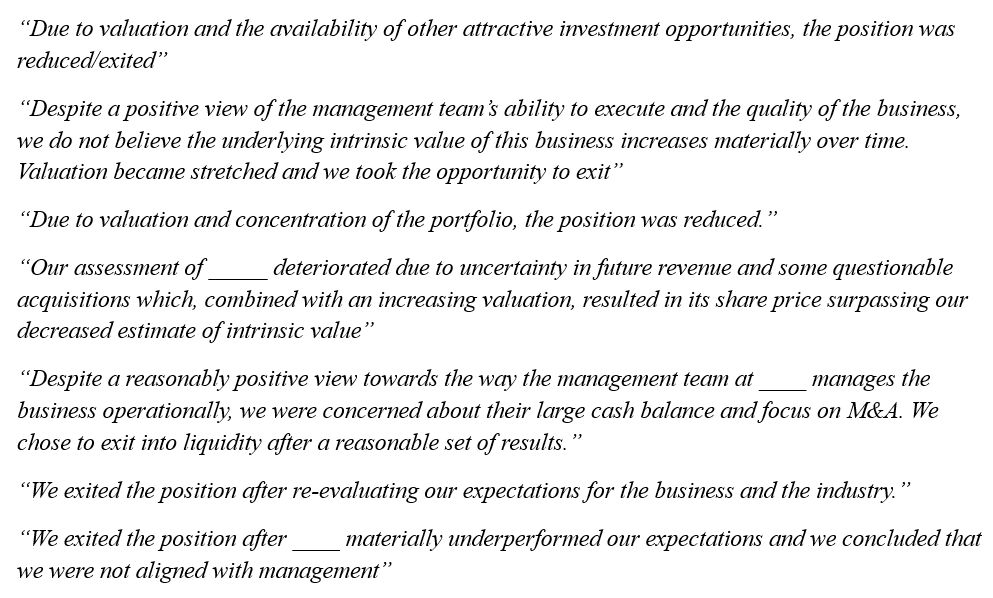

In our 2024 Letter you will find discussion of various divestments.

1 investment ( $DVR.AX ) was acquired

2 were on valuation ( $PBEE.L $BVS.AX )

3 were adverse thinking ( $PPE.AX $ORCH.L $FNX.AX )

www.hurdlerate.com.au/home/founder...

Divestments seem to be often the result of being acquired, just like Constellation, but, in cases where that is not the case it is adverse changes in expectations, concentration of their portfolio, or the combined presence of overvaluation, alternatives, and liquidity.

09.03.2025 08:31 — 👍 0 🔁 0 💬 1 📌 0

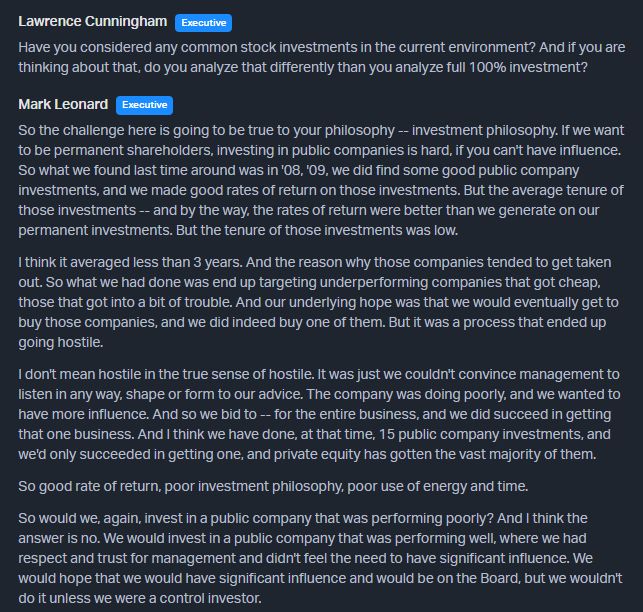

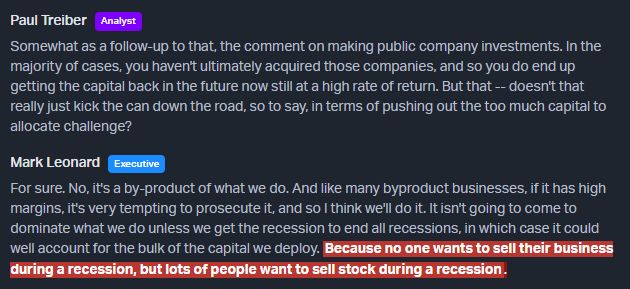

How would an exclusive focus on publicly listed investments look like for Constellation Software?

A proxy for me is his sons' investment vehicle, Pinetree Capital.

Here are some quotes about divestments they have made in the past:

The buyout was Gladstone Plc, a cornerstone of their education business within the Jonas subsidiary

09.03.2025 06:51 — 👍 1 🔁 0 💬 0 📌 0 09.03.2025 06:40 — 👍 0 🔁 0 💬 1 📌 0

09.03.2025 06:40 — 👍 0 🔁 0 💬 1 📌 0

I have been re-reading the Constellation Software material including the letters, but also their press releases and transcripts.

This response to a question about public investments is quite interesting

"If you feel the need to pitch a stock you probably don't understand it well enough"

"Stocks don't move because you are new to the business, they move because there is incremental knowledge, the best pitches take that into account"

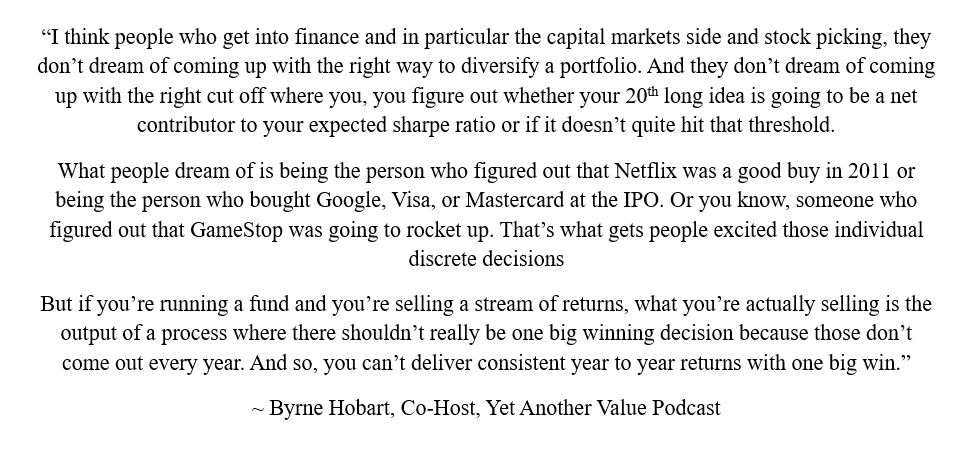

I really enjoyed this podcast from the gentlemen at the Yet Another Value Podcast.

At Hurdle Rate it is important that we differentiate the forest from the trees and focus on the performance of the team, rather than play hero and swing for the fences.