Vil si at Hemnet, og kanskje de siste årene Norbit også, har vært blant de aller beste på operasjonell leverage. #HEM er i en egen liga though.

22.08.2025 11:03 — 👍 1 🔁 0 💬 0 📌 0

Sorry for å poke opp en gammel tråd, men har du noen kilder eller noe lignende på dette? Om det var tilfellet virker det vanskelig å forstå selskapets inntjening og vekst, så hadde vært spennende å lest litt om et negativt moment med Hemnet. 😊

25.04.2025 20:21 — 👍 0 🔁 0 💬 1 📌 0

Hey Bluesky. I'm just jumping in to say that I've bought shares of #Hemnet.

Wild business, wild price.

15.04.2025 11:01 — 👍 2 🔁 0 💬 0 📌 0

The first book that is being read is Machiavellis classic: The Prince.

In the time of pauper princes ruling behind the boom box of demagaugery that is Trump it's a fitting book to read.

The learnings from this book is vast, and seeped in pragmatism. Highly enjoyable.

23.03.2025 21:27 — 👍 0 🔁 0 💬 0 📌 0

I've launched a book club: The Club of the Eminent Dead!

Inspired by great investors who tout reading beyond the scope of investing, I'm going to be disciplined in reading classics. A great excuse to get this going is putting myself out there. Hope you'll join me!

🔗 in prof

23.03.2025 21:27 — 👍 0 🔁 0 💬 1 📌 0

Bought some Berner Industrier - potentially great company. Bought still a lot of uncertainty: What will they buy? Can they buy stuff well? Do they find good stuff? 🤷♂️ Cheap at least.

20.03.2025 19:38 — 👍 0 🔁 0 💬 0 📌 0

HARVIA

CSU

TOI

FFH

RACE

ROKO

MMGR

V

NORBT

NU (🤞)

15.03.2025 22:22 — 👍 2 🔁 0 💬 0 📌 0

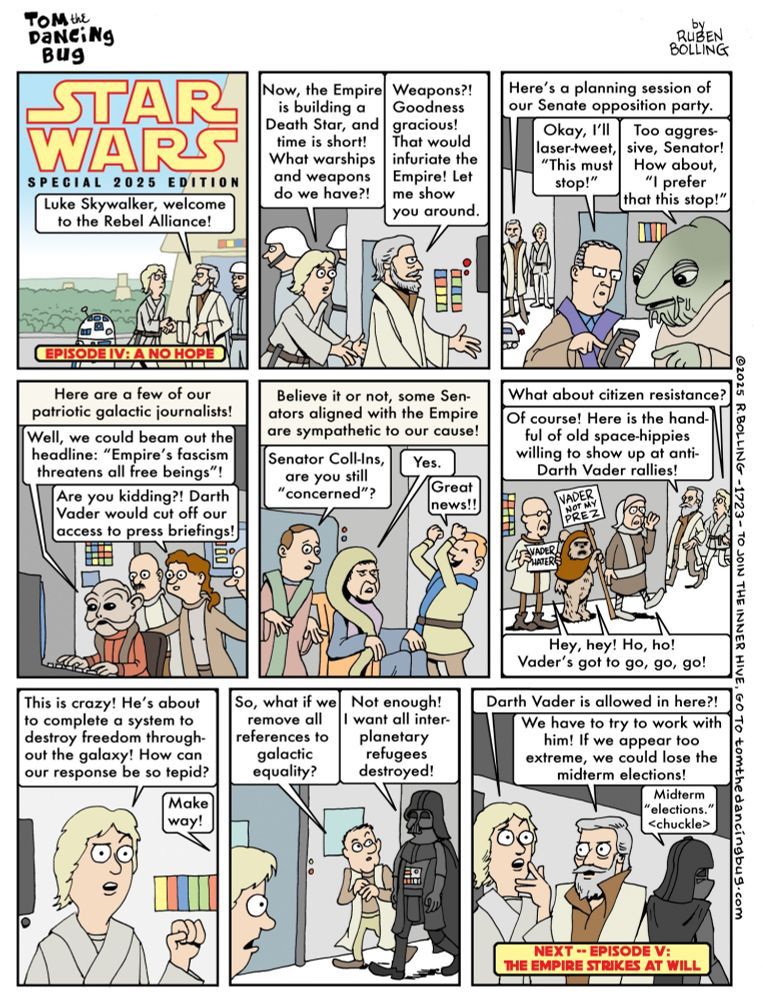

Seeing China adding to their global investments and donations, opening up to visa free travel, building their military strength and quite frankly using Russia to sow dissent and strife seems like textbook Machiavelli.

So Xi is basically Ferdinand of Aragon?

15.03.2025 21:16 — 👍 0 🔁 0 💬 0 📌 0

"From this a general rule is drawn which never or rarely fails: that he who is the cause of another becoming powerful is ruined; because that predominancy has been brought about either by astuteness or else by force, and both are distrusted by him who has been raised to power."

15.03.2025 21:16 — 👍 0 🔁 0 💬 1 📌 0

Feels like a good time to be reading "The Prince".

Trump is basically King Louis XII.

Lays the grounds for several strong adversaries to expand (🇷🇺, but mostly 🇨🇳)

Weakens allies due to fear of other strong powers

Aggrandisement of powers he idolises

15.03.2025 21:16 — 👍 0 🔁 0 💬 1 📌 0

Helt byttet ut Google med Perplexity de siste 2 månedene.

09.03.2025 12:35 — 👍 4 🔁 0 💬 2 📌 0

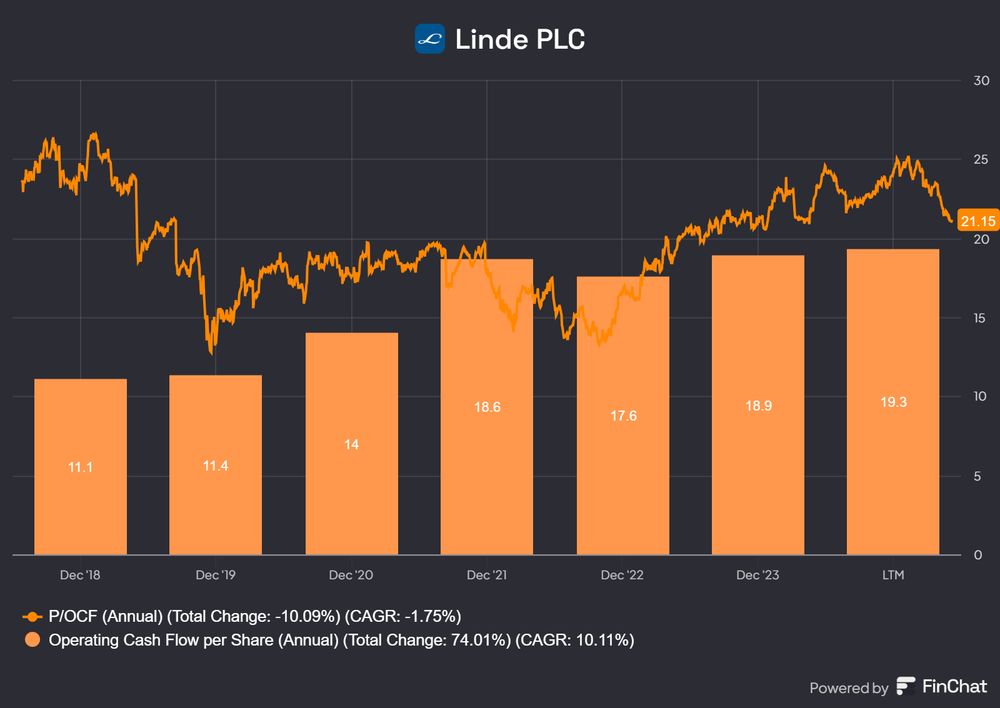

That's not longer the case. A lot of steady long term growers have started prioritising share buybacks due to the tax benefits. See Ferrari, Linde, ORLY, Autozone, Murphy USA, and so on and so on. A lot has changed since 1999.

07.03.2025 09:32 — 👍 0 🔁 0 💬 0 📌 0

I'm buying quite a lot of NU currently. Great opportunity in a name I'm bullish on for many years. World class leadership that seems a privilege to team up with via shares

But not looking forward to the volatility of LATAM and credit exposure 🧙♂️

04.03.2025 15:49 — 👍 0 🔁 0 💬 0 📌 0

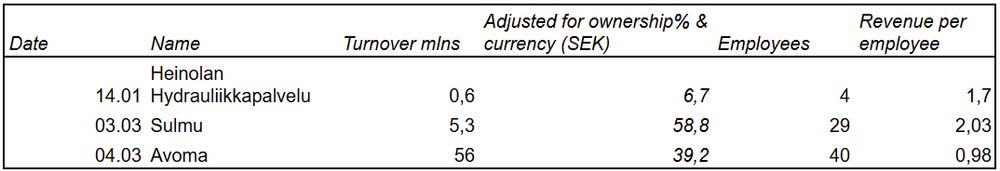

The year looks like this so far:

04.03.2025 11:12 — 👍 0 🔁 0 💬 0 📌 0

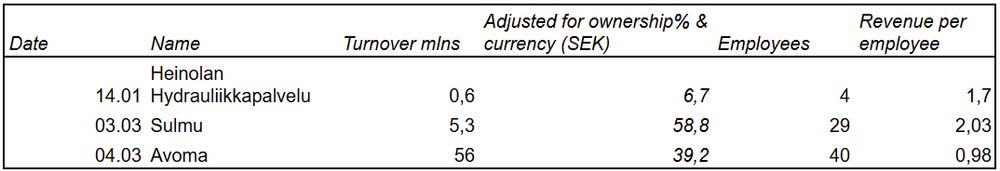

Two acquisitions in two days for Momentum Group:

Avoma, industrial services acquisition, with SEK 56mln in turnover and 40 employees

Sulmu, industrial acquisition, with SEK 59.2mln in turnover and 29 employees

Good to see things ramp up, they typically pay between 5-7x EBITA and 1.3-1.7x revenue.

04.03.2025 10:39 — 👍 0 🔁 0 💬 1 📌 0

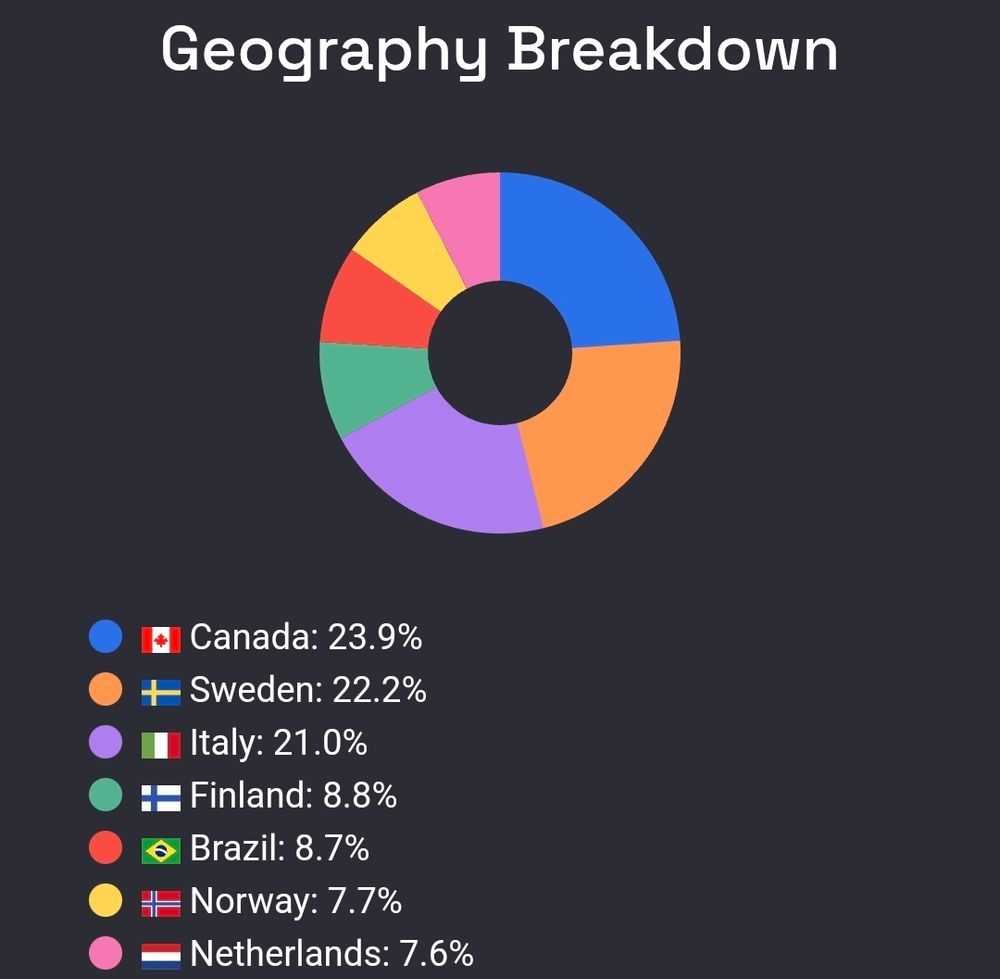

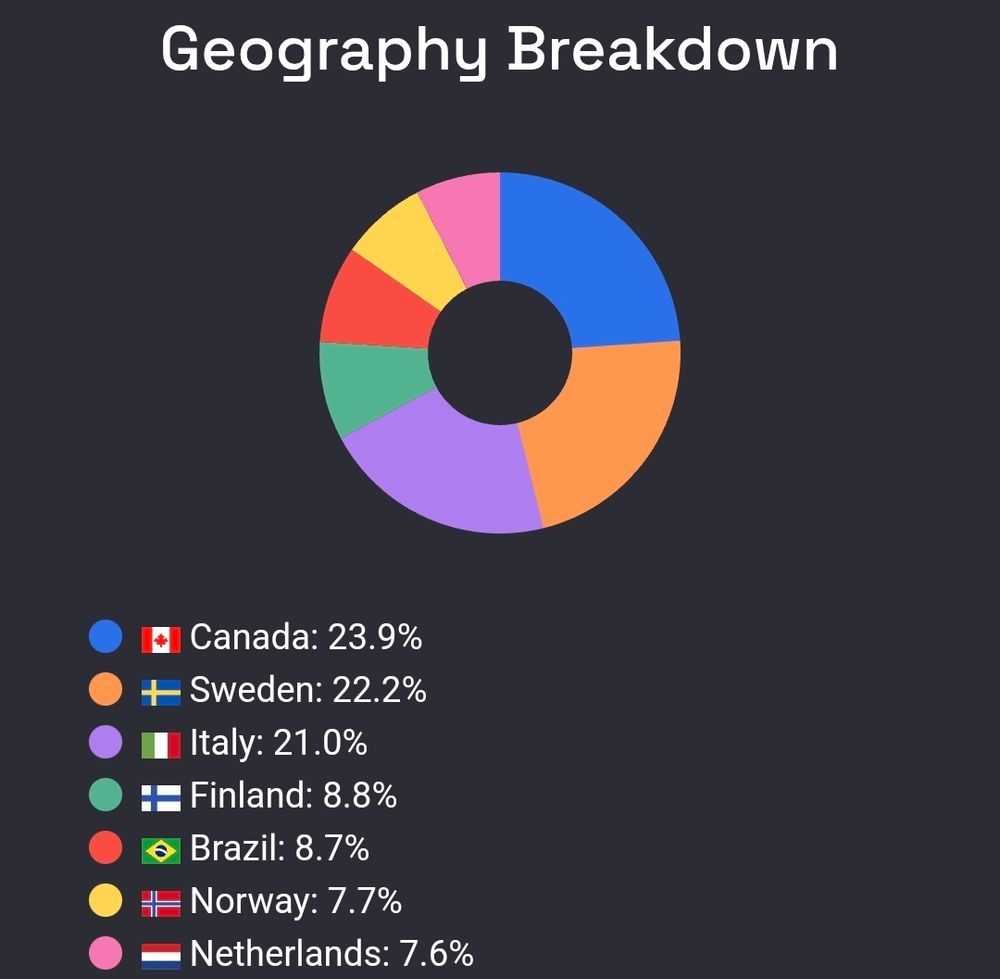

Unintentionally I've ended up with no US-headquartered companies in my portfolio.

Could've said its due to concerns about the slide away from democracy, but it's due to valuations.

Still no value investor, but I want higher fwd IRRs than 4-7% which is what I "found" in my (former) US holdings.

03.03.2025 18:27 — 👍 0 🔁 0 💬 0 📌 0

Interesting insights - February 2025

You don't need a weatherman to know which way the wind blows.

Every month I share summarize changes to my portfolio and watchlist as well as general ramblings on things going on relevant (and some times not so relevant) to my investing journey.

Also: A bunch of tips for podcasts, newsletters and more!

February post below 👇

open.substack.com/pub/growthby...

03.03.2025 11:39 — 👍 0 🔁 0 💬 0 📌 0

What an absolute twat. Nothing constructive to add other than that.

01.03.2025 07:38 — 👍 3 🔁 0 💬 0 📌 0

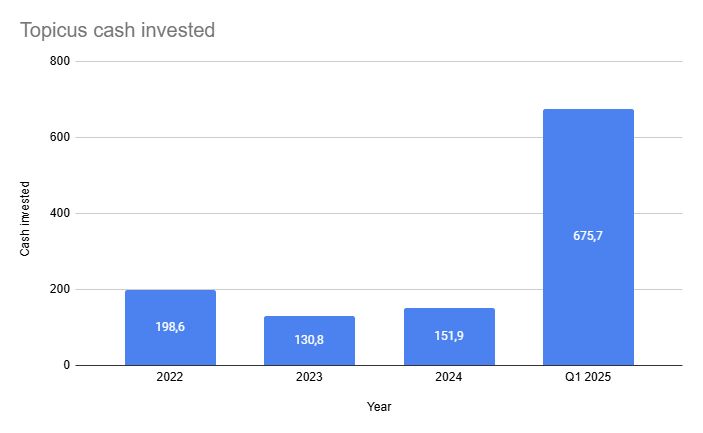

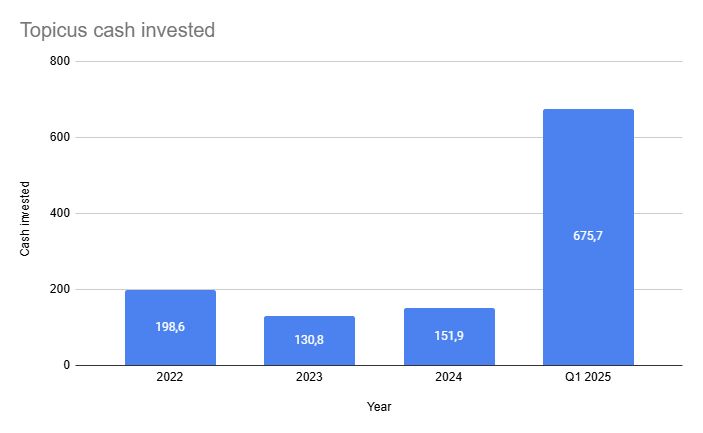

#TOI reported excellent results yesterday:

+32% net income (even absorbing a more than doubling in taxes in Q4)

FCFA2S +27%

EBITA margins: 28,5%

This is before the insane Q1 of cash deployment is added to the company. Despite the recent share price jump it's still an attractive opportunity.

27.02.2025 12:36 — 👍 0 🔁 0 💬 0 📌 0

Thanks! I was actually just ranting about Robertet to a friend about how it's one of the best companies I've researched lately. I'm happy to see you share the sentiment.

26.02.2025 12:10 — 👍 1 🔁 0 💬 0 📌 0

Whats the French company you rank highest in terms of quality that too few people talk about? And what company would you love to own shares in, but don't at the moment?

26.02.2025 11:51 — 👍 1 🔁 0 💬 1 📌 0

Worst. Episode. EVER.

22.02.2025 04:00 — 👍 31314 🔁 8710 💬 859 📌 512

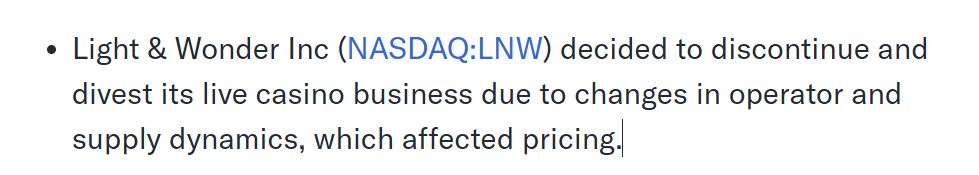

Another one bites the dust: Light and Wonder to divest it's Live Casino busiess. But as people continue to point out: Live casino is just streaming a casino table.

Evolution AB is looking better and better each day imo. Keep focused on the fundamentals and the business.

26.02.2025 11:19 — 👍 0 🔁 0 💬 0 📌 0

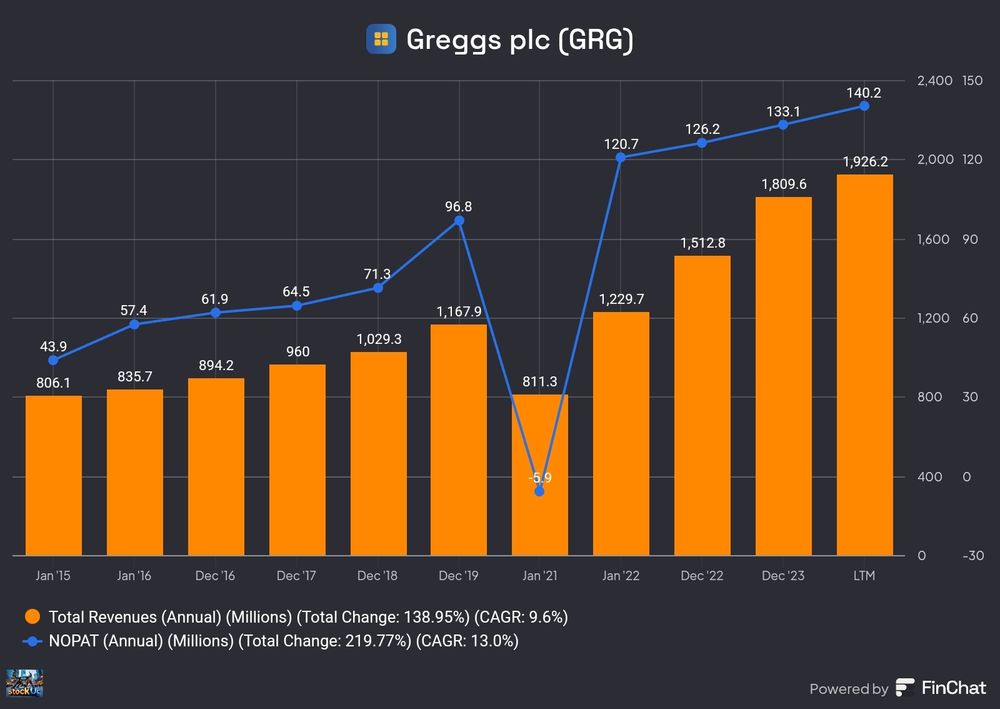

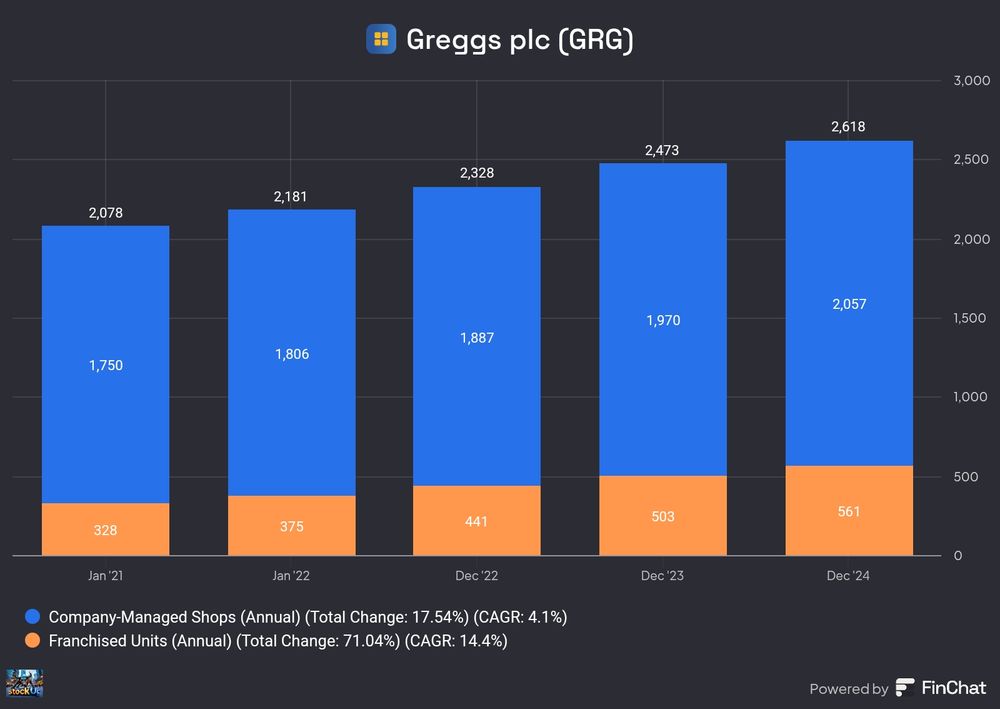

They got hit by a triple whammy:

1. Substantial analyst downgrade

2. Product recall

3. Soft earnings

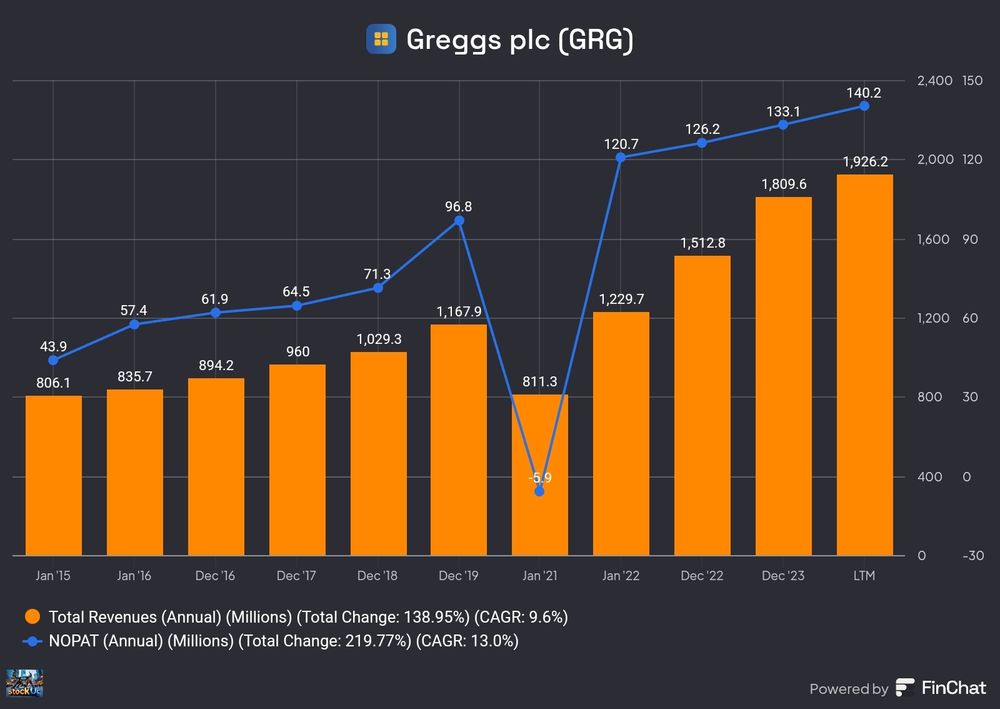

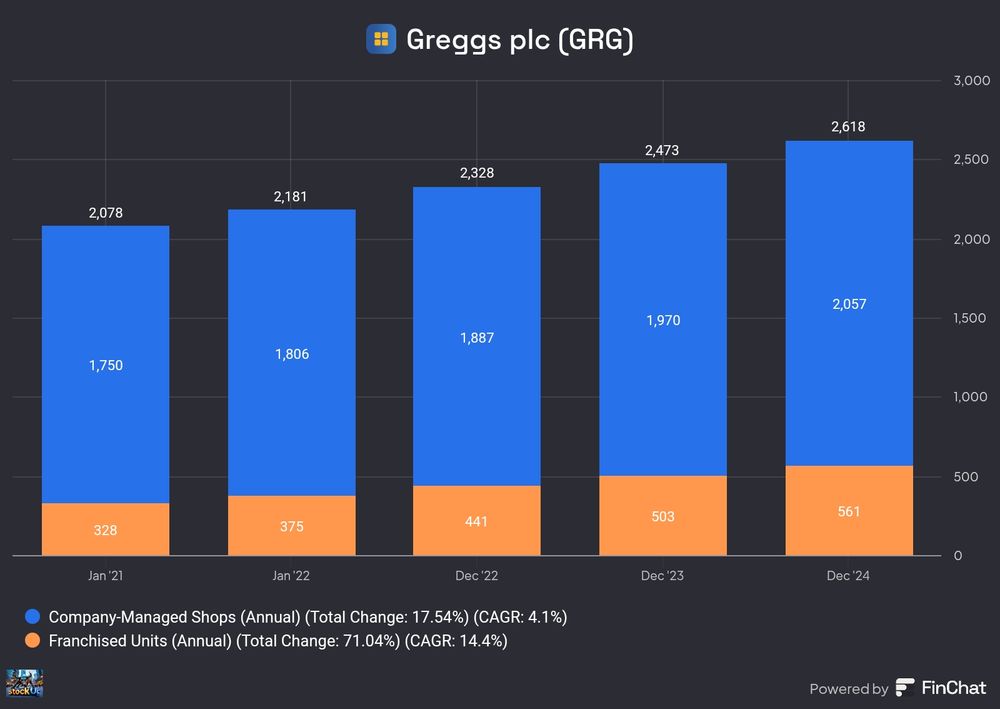

Imo, the shareprice drop seems very overdone for a company with Greggs track record. Gonna have to dig into this a bit. 🌭

24.02.2025 17:53 — 👍 0 🔁 0 💬 0 📌 0

$GRG looks to be a bit of an opportunity right now. Well ran bakery/fast-food company that is hugely popular in its home markedet with great growth in app users, expanding store offering, and well: Sausage rolls.

24.02.2025 17:53 — 👍 0 🔁 0 💬 1 📌 0

Cheers to a less noisy pub Andy 🍻

24.02.2025 13:33 — 👍 1 🔁 0 💬 1 📌 0

I'm amazed that Teqnion (TEQ.ST) only loses 11% on that report. Overstated results as well, as EBITA is helped by positive earn-outs. $EVOs report adjust for positive earns out to provide honest (and worse) adjusted earnings numbers, imo the right way. Teqnions flags getting redder by each report.

17.02.2025 09:04 — 👍 1 🔁 0 💬 0 📌 0

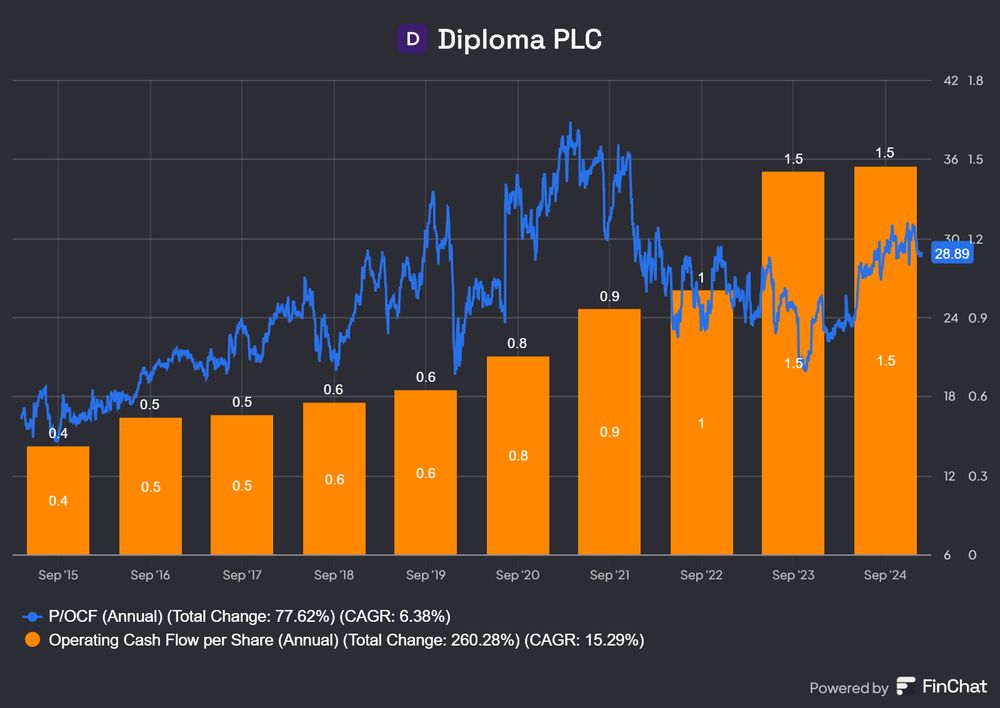

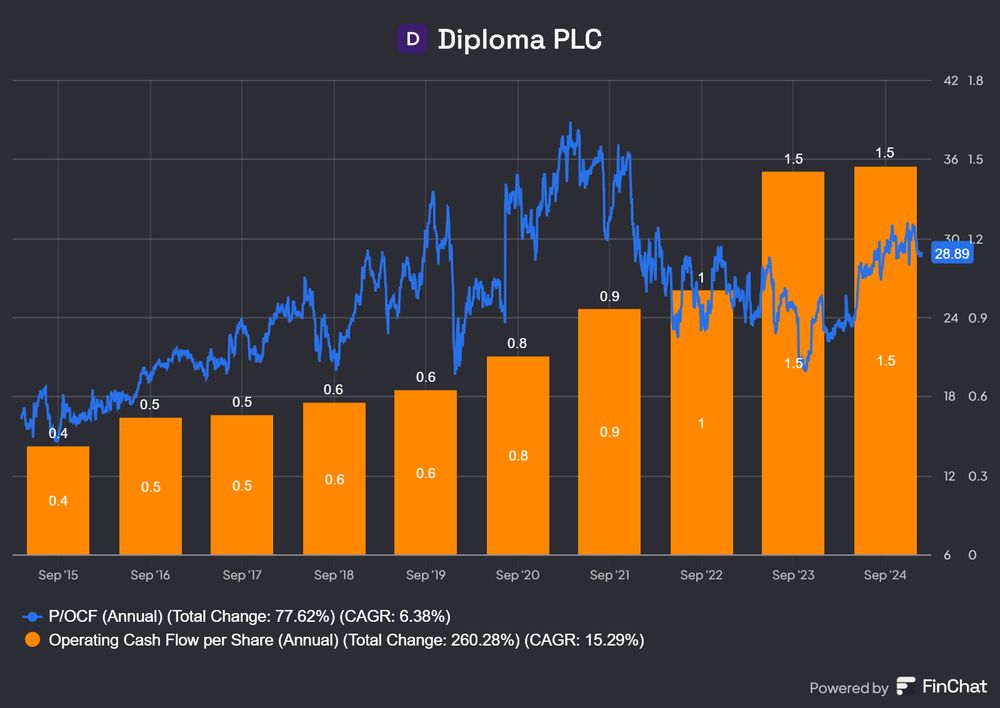

Diploma is an industrial distributor and serial acquirer positioned in sticky niches (ROATCE: 19.4%).

They operate within controls, seals and life sciences. $DPLM have a disciplined M&A approach that allows them to compound at a high rate alongside pretty good organic growth.

08.01.2025 14:58 — 👍 0 🔁 0 💬 0 📌 0

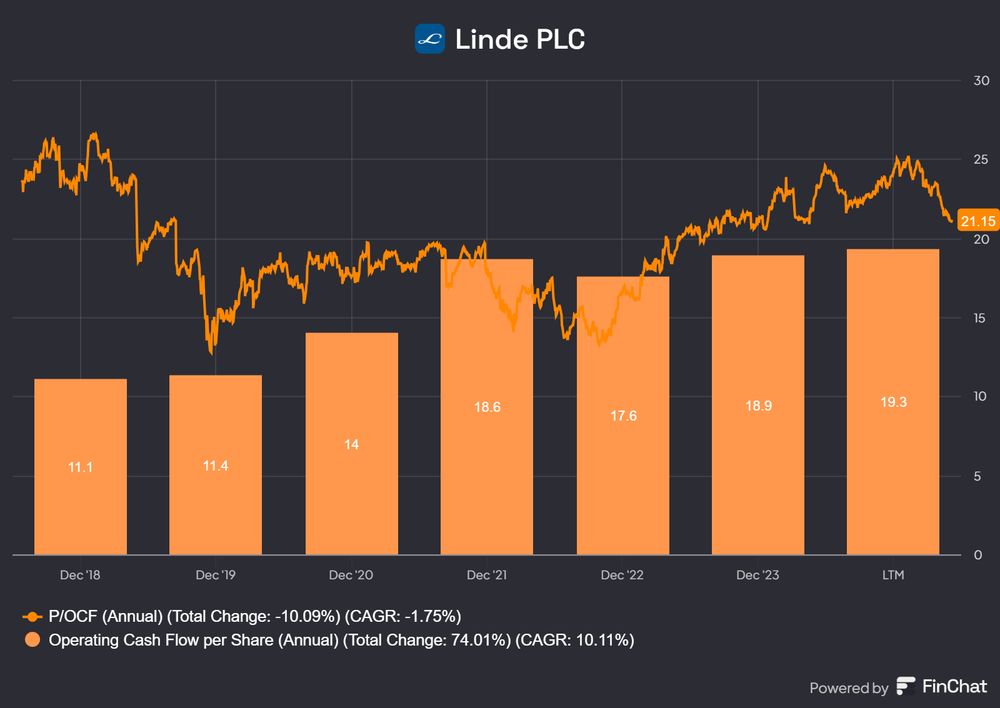

Linde PLC is a global producer and distributor of industrial gasses (ROC: ~25%)

$LIN cater to every gas need their customers have. Their integrated distribution model, where they become an integral part of their customers production chain creates a very defensive business.

08.01.2025 14:58 — 👍 0 🔁 0 💬 1 📌 0

Har fortsatt konto på Det Andre Stedet, men etter hvert som mer og mer av aktiviteten overflytter seg hit, kommer antagelig denne kontoen til å bli ca. samme nivå av frustrasjoner over samfunn og media som den gamle.

🔍 Data Specialist på Modular Finance | Arbetar med @borsdata.bsky.social 📊 | Bygger bolagsspecifik data för Analys Pro+ | 🏌️♂️Golfproffs & Aktienörd 📈

Börsbevakare, ekonomijournalist, aktieanalytiker o dyl. På EFN Finansmagasinet.

🇸🇪 PM @ REQ.

https://req.no/investments-listed-equities/

Letar efter Nordens bästa kapitalallokerare och företag som genererar starka kassaflöden och uthålligt kan compounda kapitalet genom att återinvestera en hög andel av FCF till attraktiv avkastning

Fokus på tillväxtbolag, som har stigande EBIT-marginal och som är prisvärda (GARP).

Microcaps made easy. A sector coverage of quality Nordic microcaps. Analysts: @martinwahlstrom.bsky.social and @benonjacob.bsky.social

✉️microcap@redeye.se

Full time private investor focused on smaller companies. Trying to be consistently not stupid. BSc., Eco&Adm.

Husband. Dad. Local volunteer. Penny stocks: www.nonamestocks.com. Old car tinkerer. Engineer.

Vd @ Avensia, ordförande & kunglig hovleverantör @ Svenska Medalj, ledamot @ CoolStuff, valberedningen @ Cheffelo. Länge Lund, nu Malmö.

Man måste föreställa sig Sisyfos lycklig.

www.proteanfunds.com

Banker by day. Private investor, focus on high quality businesses. In the market since 2008. MSc in Finance.

Privatinvesterare, försöker balansera 50% Ingenjörskonsult med 50% aktiehandel.

Någon i Västra Götaland som är intresserad av fysiska möten där vi diskuterar aktier nära Kvalitetsaktiepoddens filosofi?

@Corkscrew_Hazel på X

På korståg för avkastningens bevarande.

Skriver på www.snaljapen.se.

Equity Analyst at Redeye. Passionate about microcaps.

https://jakten.blogspot.com/

https://x.com/89Olle

Investeringar & spel. Strategi "buy and verify" och att låta vinnare springa. Mål slå OMXSGI 5% per år. CAGR från 2019 20.5% vs. OMXSGI 11.5%.

Private investor. Likes family run companies. SFAF member.

Newsletter: http://frenchhiddenchampions.substack.com