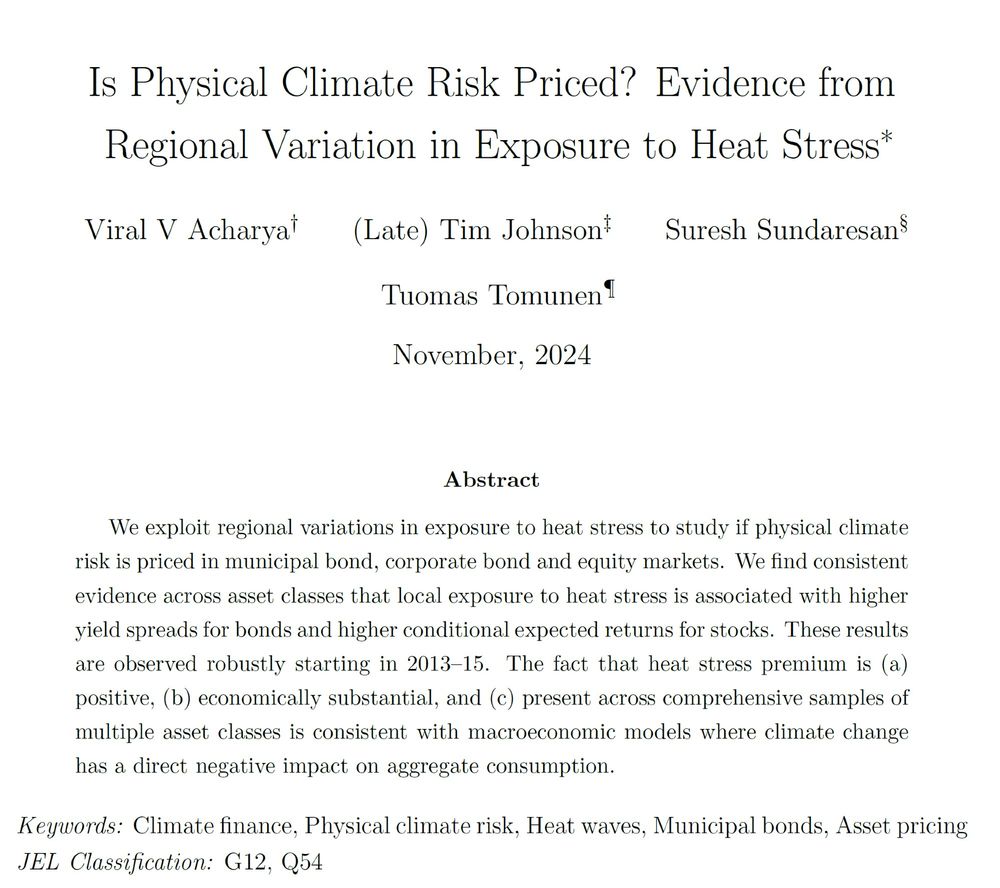

The Virtual Municipal Finance Workshop meets TOMORROW, 4/16, at 11am EDT!

Our presentations will be by Viral Acharya (NYU) and Tuomas Tomunen (Boston College) covering topics in municipal finance and the environment.

Papers and Zoom link: www.muni-workshop.com

15.04.2025 14:08 —

👍 3

🔁 1

💬 0

📌 0

🚨New Working Paper 🚨

How does Federal Reserve policy impact the real economy? With Igor Cunha, we reveal a key but overlooked player in this transmission: municipal bond issuers. Our findings show how financial flexibility in public finance amplifies monetary policy's local effects. (1/N)

05.12.2024 19:42 —

👍 3

🔁 1

💬 1

📌 1

Websites: Igor (sites.google.com/site/igorfcc...)

Mine: (www.michaelvarley.com) (10/9)

05.12.2024 19:42 —

👍 1

🔁 0

💬 0

📌 0

We also find our effects are ⬆️ in local gov'ts and areas with healthy gov't balance sheets. With ⬇️ balance sheets in municipalities getting more attention recently, our paper shows another unfortunate side effect of poor public finance: muted monetary policy passthrough to the real economy. (8/N)

05.12.2024 19:42 —

👍 1

🔁 0

💬 1

📌 0

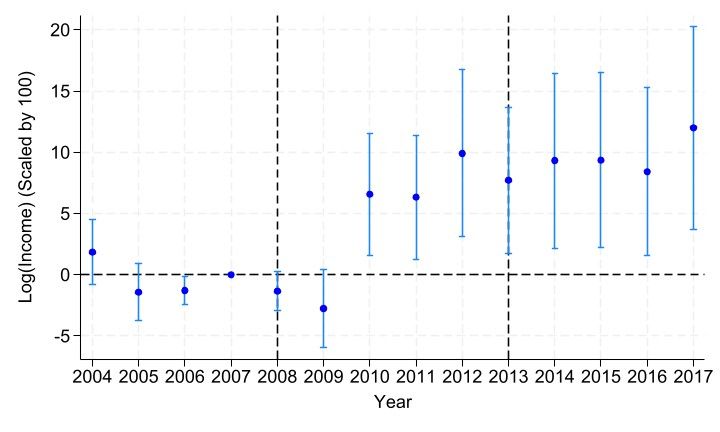

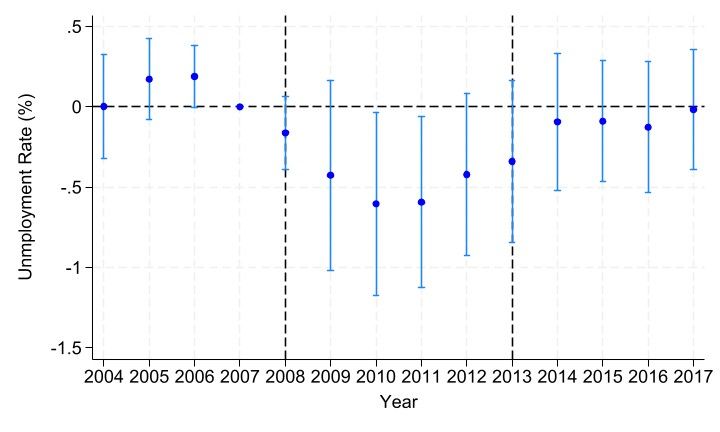

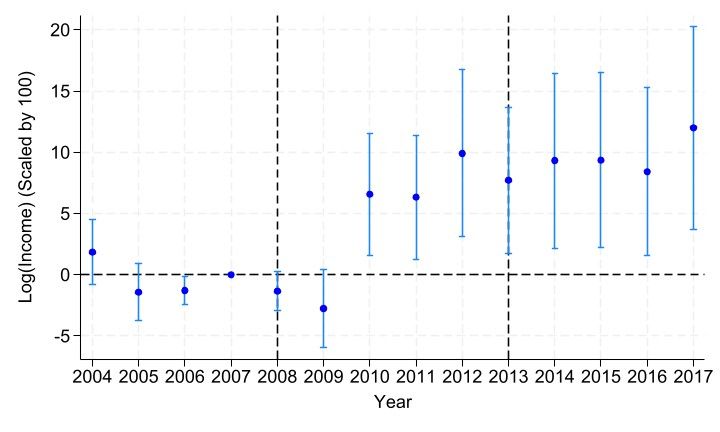

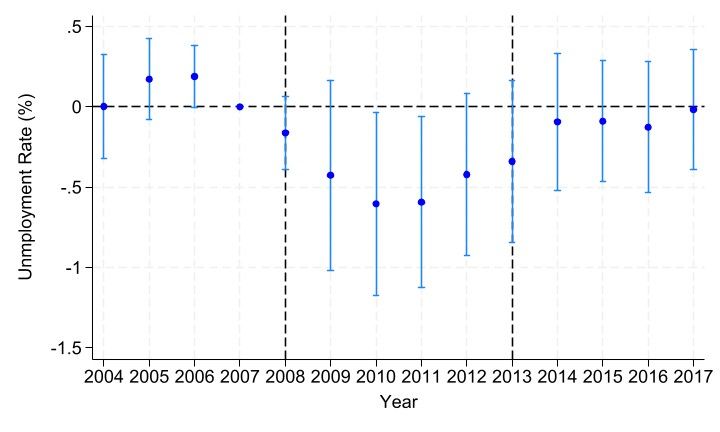

3. High callability ratios lead to lower unemployment rates and higher incomes. These variables are particularly important because they are close local analogs to the Fed’s dual mandate to promote maximum employment and stable prices. (7/N)

05.12.2024 19:42 —

👍 1

🔁 0

💬 1

📌 0

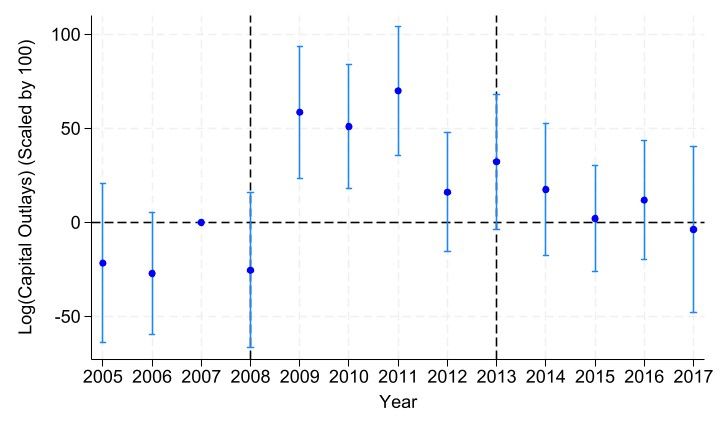

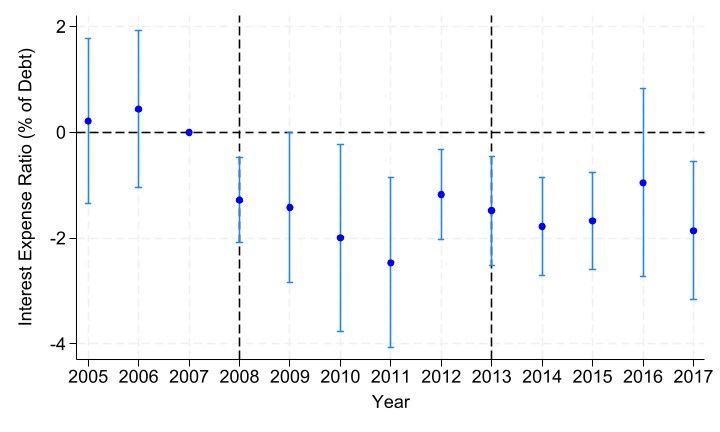

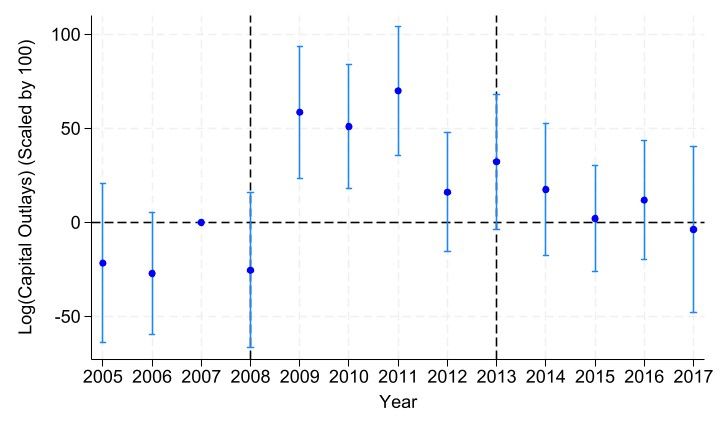

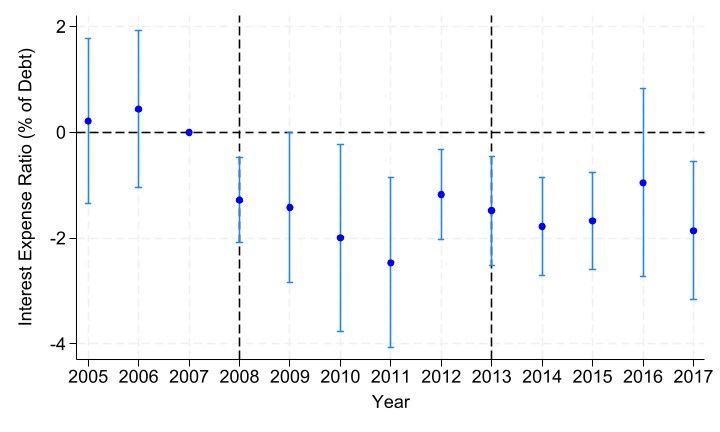

2. High callability ratios lead to more spending, particularly in capital outlays, and less interest expenses. (6/N)

05.12.2024 19:42 —

👍 1

🔁 0

💬 1

📌 0

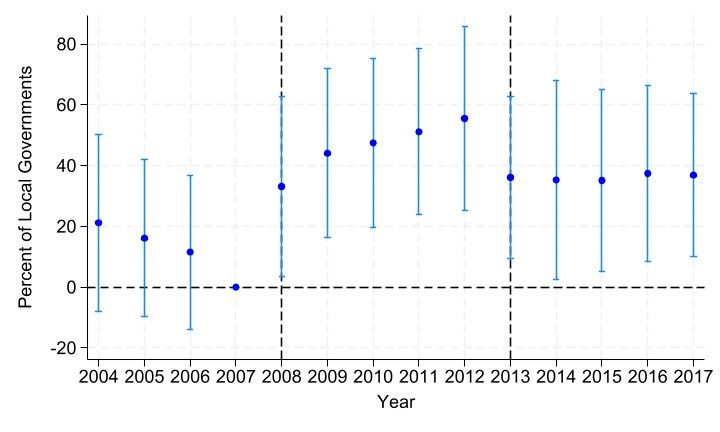

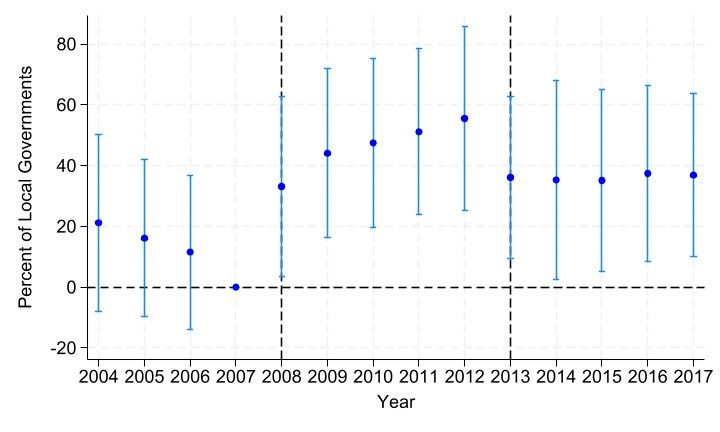

So, what do we find? Using an event study of local governments around 2008-2013 that vary in the dollar fraction of their debt becoming callable (callability ratio), our three main findings are:

1. High callability ratios lead to more bond issuance! (5/N)

05.12.2024 19:42 —

👍 1

🔁 0

💬 1

📌 0

Our ID relies on the assumption that the amount of bonds becoming callable is effectively random. Municipalities with more bonds becoming callable during rate cuts can benefit more by calling their debt to refinance to ⬇️ interest rates, unlocking fiscal space to ⬆️spending/investment. (4/N)

05.12.2024 19:42 —

👍 1

🔁 0

💬 1

📌 0

Basic identification: Typical municipal bond has a 10-year call provision. So, the call date of municipal bonds was set a decade before policy changes, making it unlikely local governments predicted the Fed rate cuts or that the callability was related to other chars. of the local gov't. (3/N)

05.12.2024 19:42 —

👍 1

🔁 0

💬 1

📌 0

Our paper examines how municipal financing shapes monetary policy transmission to the real economy. We leverage variation in the timing of municipal bonds outstanding becoming callable around the largest easing cycle in the 21st century: the Fed's zero interest rate policy starting in 2008. (2/N)

05.12.2024 19:42 —

👍 1

🔁 0

💬 1

📌 0

🚨New Working Paper 🚨

How does Federal Reserve policy impact the real economy? With Igor Cunha, we reveal a key but overlooked player in this transmission: municipal bond issuers. Our findings show how financial flexibility in public finance amplifies monetary policy's local effects. (1/N)

05.12.2024 19:42 —

👍 3

🔁 1

💬 1

📌 1

🤝

11.11.2024 19:11 —

👍 0

🔁 0

💬 0

📌 0