Direct link to the updated version of my paper: opfaeuti.github.io/website/IAT....

15.08.2025 14:56 — 👍 3 🔁 1 💬 0 📌 0Direct link to the updated version of my paper: opfaeuti.github.io/website/IAT....

15.08.2025 14:56 — 👍 3 🔁 1 💬 0 📌 0

How News about the US Economy Drives Global Financial Conditions

New blog post by Chris Boehm and @kronerniklas.bsky.social (UT graduate @utaustinecon.bsky.social 🤟) based on paper recently published in @reveconstudies.bsky.social.

Short summary below ⬇️

How French Firms Navigated the Inflation Surge: Lessons for Expectations and Decision-Making

New blog post by Oli Coibion, @erwan-gautier.bsky.social and Frédérique Savignac.

Short summary follows ⬇️

Now also out as a EMPCT working paper!

Link: sites.utexas.edu/macro/resear...

Inflation, Expectations and Monetary Policy: What Have We Learned and to What End?

New paper by Oli Coibion and @ygorodnichenko.bsky.social sheds new light on the recent inflation period and looks ahead.

It took a while, but we finally have a new (heavily revised) version out:

nber.org/papers/w32305

Want to know more about firms' inflation expectations during the recent inflation surge? And how do their expectations correlate w/ wage expectations and firms' price setting?

Check out the new EMPCT working paper by @erwan-gautier.bsky.social, Savignac & Coibion: sites.utexas.edu/macro/resear...

New working paper on French firms' inflation and wage expectations by Oli Coibion and coauthors!

22.05.2025 04:27 — 👍 1 🔁 2 💬 0 📌 1

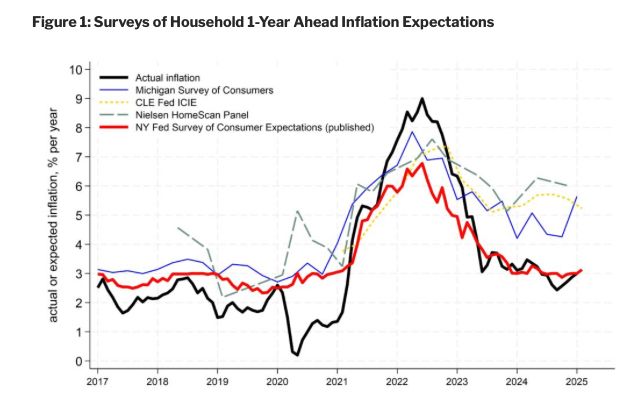

The blog post's documented patterns of inflation expectations & its conclusion below are consistent with the implications of attention changes documented in my paper on the inflation attention threshold (see Figure).

Good to know, that the two Oli's at @utaustinecon.bsky.social agree 😅

What's happening with inflation expectations?

Two often used household surveys disagree:

- the Michigan MSC says inflation expectations are up

- the NY Fed SCE says they're not...

Which one is it?

New blog by Oli Coibion and @ygorodnichenko.bsky.social says: MSC is right!

Find out why ⬇️

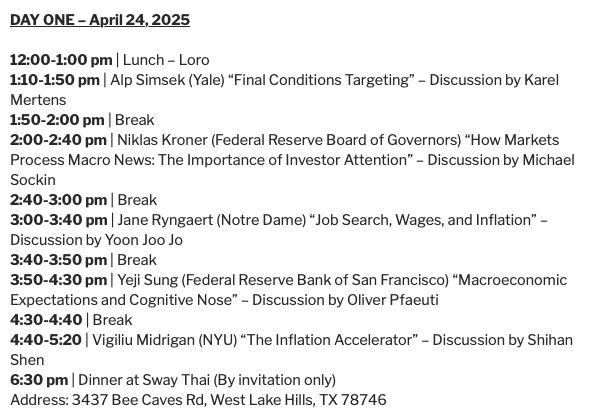

After a great first day of our conference yesterday, we look forward to an exciting second day!

25.04.2025 13:06 — 👍 2 🔁 1 💬 0 📌 0

Starting tomorrow: 𝐓𝐄𝐗𝐀𝐒 𝐌𝐎𝐍𝐄𝐓𝐀𝐑𝐘 𝐂𝐎𝐍𝐅𝐄𝐑𝐄𝐍𝐂𝐄

We have a great line-up of speakers & discussants (program below)

including @alpsimsek.bsky.social, @kronerniklas.bsky.social, @pfaeutiecon.bsky.social, @mathpedemonte.bsky.social, @hugolhuillier.com, @elpuntoderocio.bsky.social

(+ some not on here)

Thank you!

29.03.2025 13:20 — 👍 1 🔁 0 💬 0 📌 0

Highly recommended!

"Attention to the Macroeconomy" by Link, Peichl, Pfäuti, Roth, and Wohlfart

"...attention to the macroeconomy responds strongly to shocks; more attentive respondents adjust their inflation expectations more frequently during the shock"

opfaeuti.github.io/website/Atte...

New working paper by @pfaeutiecon.bsky.social and coauthors

28.03.2025 13:51 — 👍 2 🔁 1 💬 1 📌 0

Much more in the paper, including memory interference of other variables (e.g., energy), co-movement of attention to different variables, etc.

Thanks for reading!

Comments & questions always welcome

Link to the working paper: opfaeuti.github.io/website/Atte...

Consistent with this theory, we show

- agents with inflation experiences pay more attention to inflation as inflation increases

- and they increase their expectations more strongly, deviating more from expert benchmarks

We then present a model of selective memory, in which experiences interfere with agents' expectation formation & attention allocation:

- agents that experienced past inflation, recall memories of these episodes in times of high inflation

➡️ increase their expectations too much

However, at odds with these theories, we find:

- attentive agents increase their (inflation) expectations too strongly: they deviate more from expert benchmarks than inattentive agents during a high-inflation period

- they disagree more about forecasts than about nowcasts

And attention and beliefs are linked to decisions:

- firms that pay more attention to inflation tend to increase (or plan to increase) their prices more during that period of high inflation

We find evidence for theories of goal-optimal attention (e.g. rational inatt):

- attention is related to exposure & info costs

- attention is state dependent

- attentive agents update expectations more frequently

- are more confident in their beliefs

- have more accurate nowcasts

We collect measures of German households' and firms' attention to the economy during the recent inflation surge, using a new survey approach based on open-ended questions, and we test theories of attention

28.03.2025 12:09 — 👍 0 🔁 0 💬 1 📌 0

We have a new working paper:

𝐀𝐭𝐭𝐞𝐧𝐭𝐢𝐨𝐧 𝐭𝐨 𝐭𝐡𝐞 𝐌𝐚𝐜𝐫𝐨𝐞𝐜𝐨𝐧𝐨𝐦𝐲

with Sebastian Link, @apeichl.bsky.social, Chris Roth and @johanneswohlfart.bsky.social

Short thread below ⬇️

@empctmacrotx.bsky.social @utaustinecon.bsky.social

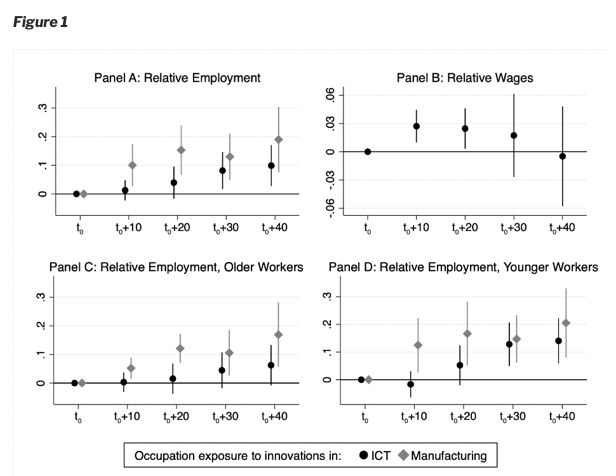

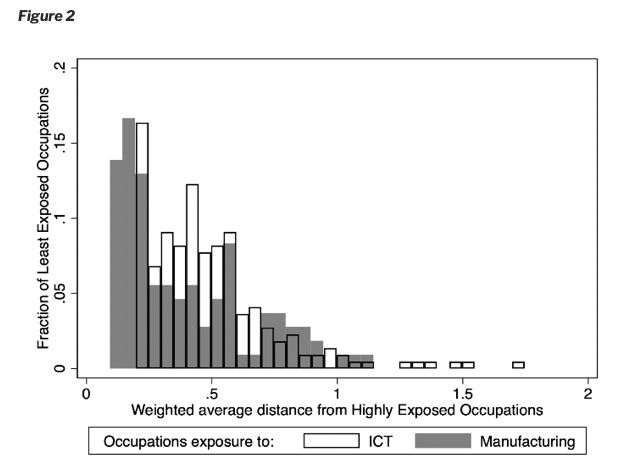

How quickly will workers adapt to AI-driven changes?

New blog post:

𝐒𝐤𝐢𝐥𝐥 𝐒𝐩𝐞𝐜𝐢𝐟𝐢𝐜𝐢𝐭𝐲 𝐚𝐧𝐝 𝐭𝐡𝐞 𝐏𝐚𝐜𝐞 𝐨𝐟 𝐓𝐞𝐜𝐡𝐧𝐨𝐥𝐨𝐠𝐢𝐜𝐚𝐥 𝐂𝐡𝐚𝐧𝐠𝐞: 𝐋𝐞𝐬𝐬𝐨𝐧𝐬 𝐟𝐫𝐨𝐦 𝐇𝐢𝐬𝐭𝐨𝐫𝐲

by @nityanayar.bsky.social, Beraja & Adao

Link: sites.utexas.edu/macro/2025/0...

New blog post on summarizing the key findings from the paper

"𝐇𝐨𝐰 𝐂𝐨𝐬𝐭𝐥𝐲 𝐀𝐫𝐞 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬 𝐂𝐲𝐜𝐥𝐞 𝐕𝐨𝐥𝐚𝐭𝐢𝐥𝐢𝐭𝐲 𝐚𝐧𝐝 𝐈𝐧fl𝐚𝐭𝐢𝐨𝐧? 𝐀 𝐕𝐨𝐱 𝐏𝐨𝐩𝐮𝐥𝐢 𝐀𝐩𝐩𝐫𝐨𝐚𝐜𝐡"

by Coibion and coauthors:

tinyurl.com/blogcoibion

New working paper by our co-director Oli Coibion and co-authors ⬇️

They find that households would sacrifice around 5% of lifetime consumption to eliminate business cycles or inflation. However, these numbers differ across households: exposure, uncertainty, etc., matter!

microfoundations

15.02.2025 13:45 — 👍 0 🔁 0 💬 0 📌 0

A quantitative HANK model estimated with linear methods where aggregate uncertainty interacts with the illiquidity friction to drive business cycles and asset returns, from Cosmin L. Ilut, Ralph Luetticke, and Martin Schneider https://www.nber.org/papers/w33331

03.02.2025 16:00 — 👍 4 🔁 2 💬 0 📌 0

Oli Cobion, Yuriy Gorodnichenko and Michael Weber wrote a new blog post on what Americans expect from the Trump tariffs:

sites.utexas.edu/macro/2025/0...

Key results: they expect to bear a share of tariffs, firm managers expect to raise prices. Disagreement b/n Dems & Reps, and many more in blog

Congratulations @nityanayar.bsky.social , Andrei Levchenko and Zhen Huo on your publication of "International Comovement in the Global Production Network" in @reveconstudies.bsky.social 🥳

Link to the paper: academic.oup.com/restud/artic...