As we approach the Fall semester, some ancient wisdom on learning...

The student obtains:

one quarter from the teacher,

one quarter by one's own intellect,

one quarter from fellow students,

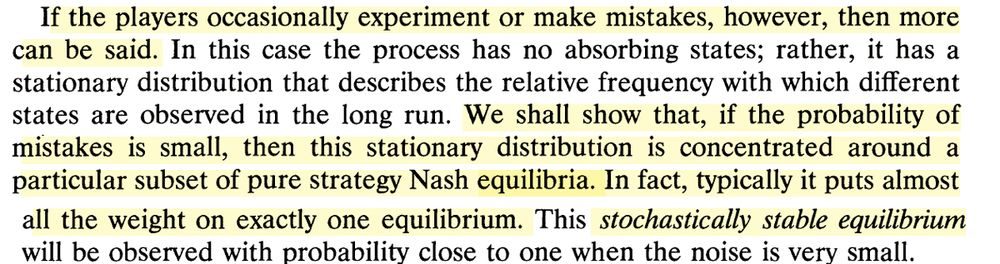

and one quarter through the passage of time.

@rohitlamba.bsky.social

Economist, Himalayan boy, poetry enthusiast, foodie. Amor fati :) www.rohitlamba.com

As we approach the Fall semester, some ancient wisdom on learning...

The student obtains:

one quarter from the teacher,

one quarter by one's own intellect,

one quarter from fellow students,

and one quarter through the passage of time.

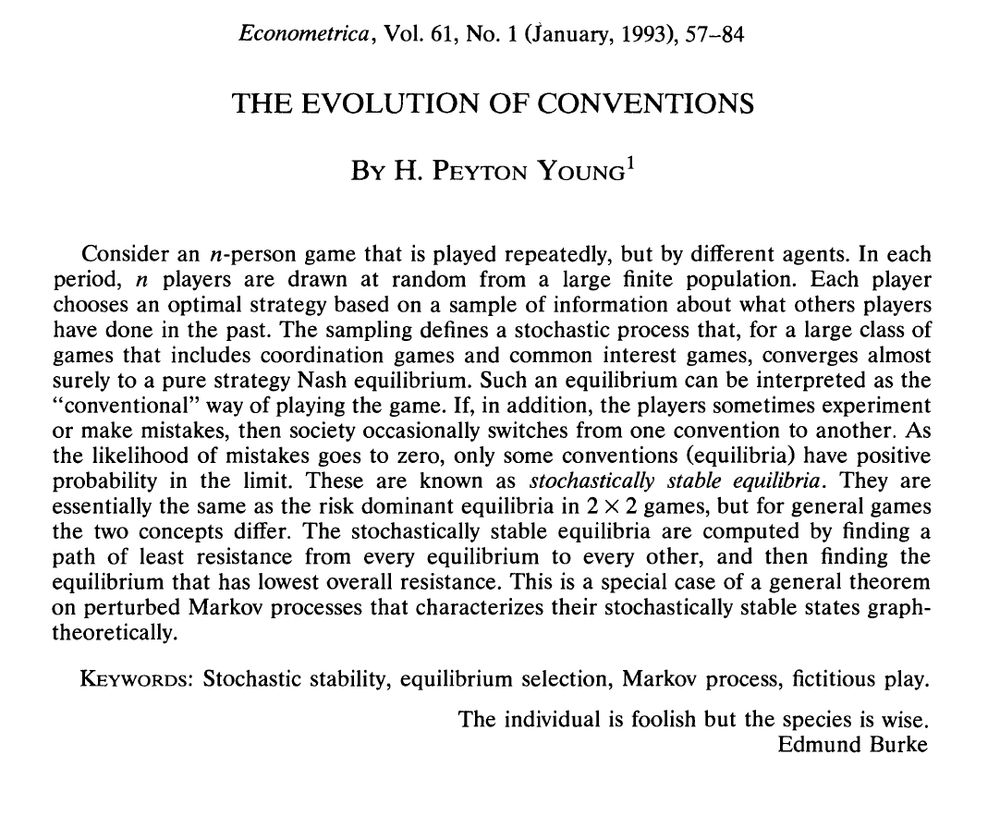

18/ TL;DR: Adding a dash of noise (random experimentation) to learning dynamics, evolutionary reasoning can resolve (in many static games) equilibrium indeterminacy. The one with larger basin of attraction – the risk-dominant convention – tends to reign supreme in the long run.

29.07.2025 04:19 — 👍 1 🔁 0 💬 0 📌 0

17/ A truly remarkable scholar of the field and whose book you must read is the late William H. Sandholm.

29.07.2025 04:19 — 👍 0 🔁 0 💬 1 📌 0

16/ Intellectual history: Evolutionary game theory is inspired from biology’s idea of natural selection. John Maynard Smith (w/ G.R. Price) introduced the concept of Evolutionarily Stable Strategy (ESS) in 1973, showing how certain behaviors become stable in animal conflicts.

29.07.2025 04:19 — 👍 0 🔁 0 💬 1 📌 015/ Significance: KMR and Young bridged ideas from biology and bounded rationality to explain which social convention “wins” when everyone occasionally makes mistakes. The concept of stochastically stable equilibrium introduced here has become a key tool in economic theory.

29.07.2025 04:19 — 👍 0 🔁 0 💬 1 📌 0

14/ Beyond 2×2 games: Young showed the selected convention need not be the risk-dominant or Pareto-best. Nonetheless, his general algorithm can identify the stochastically stable convention in such cases. And more work has generalized the KMR techniques to general games as well.

29.07.2025 04:19 — 👍 0 🔁 0 💬 1 📌 0

13/ The two papers--- KMR and Young have somewhat different setups, but they both eventually use Markov chain methods and results from perturbation theory (Freidlin–Wentzell).

29.07.2025 04:19 — 👍 0 🔁 0 💬 1 📌 012/ Young's method involves finding the minimum “cost” (fewest simultaneous mutations) needed to escape each equilibrium; the equilibrium with the highest escape cost is selected in the long run.

29.07.2025 04:19 — 👍 0 🔁 0 💬 1 📌 0

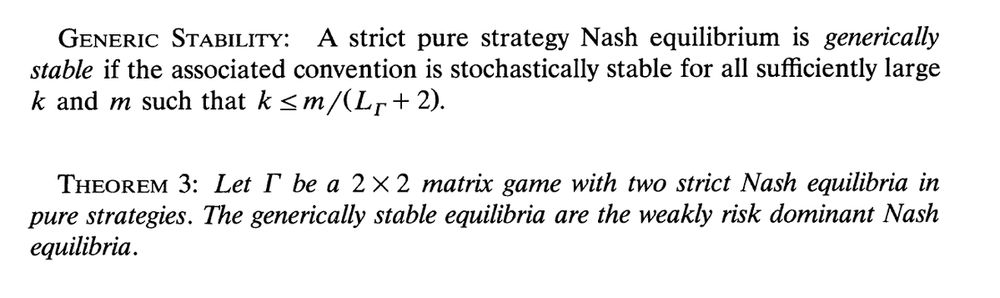

11/ Young’s result: By analyzing the “graph” of state transitions, he finds a unique stochastically stable equilibrium in many games. In 2×2 coordination games, it coincides with the risk-dominant convention – exactly as in KMR.

29.07.2025 04:19 — 👍 0 🔁 0 💬 1 📌 0

10/ Even under adaptive play, multiple equilibria can persist (each is an absorbing convention if no one deviates). Young adds a small chance that players choose a non-best-response at random. Just as in KMR, these “mistakes” let some conventions prove more enduring than others.

29.07.2025 04:19 — 👍 0 🔁 0 💬 1 📌 0

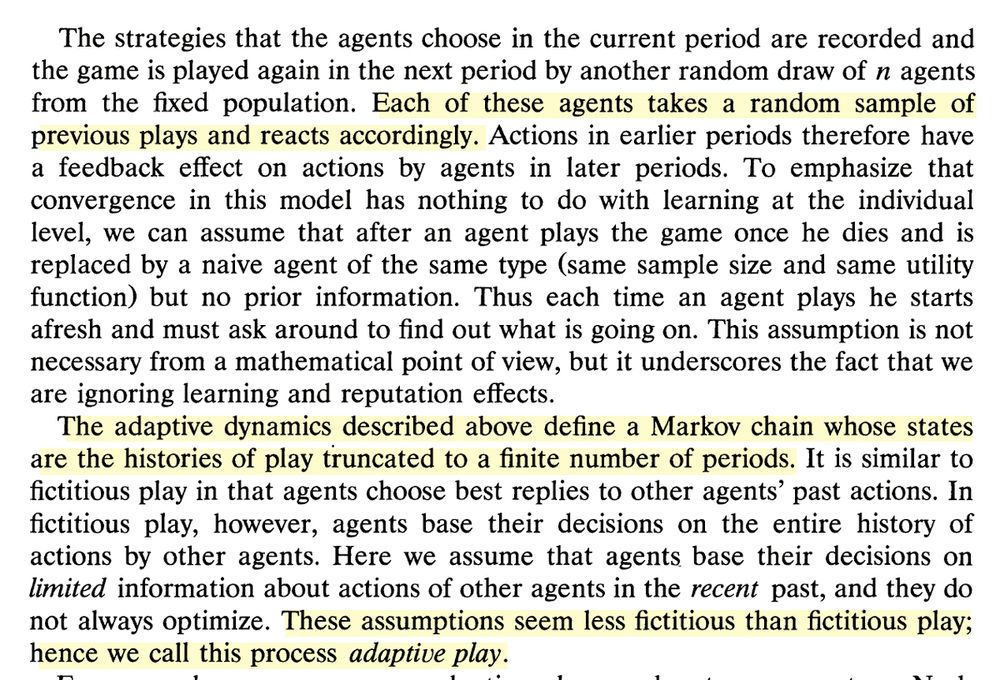

9/ Young introduces a boundedly rational learning rule: adaptive play. Population of players randomly matched to play a game; only remember a small sample of recent rounds; choose a best response to that. This limited memory (different for each player) prevents cyclic behavior.

29.07.2025 04:19 — 👍 0 🔁 0 💬 1 📌 0

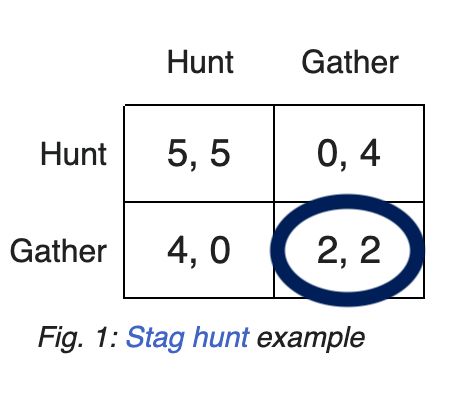

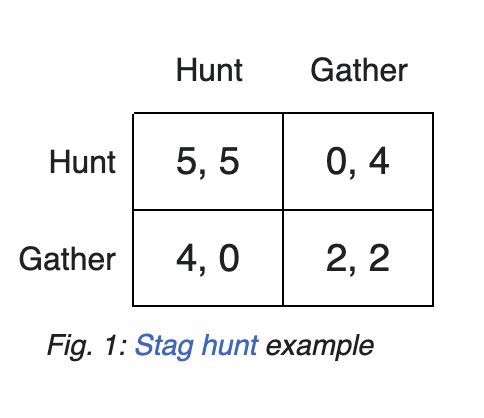

8/ Risk dominance was introduced by Harsayni and Selten (1988): (G,G) here risk dominates (H,H) because the expected payoff from playing G is higher than H when you assume the other player is playing 50-50:

1/2* 4 + 1/2* 2 > 1/2* 5 + 1/2* 0.

So, (G,G) is the SSE.

7/ KMR’s insight: In any 2×2 coordination game with 2 Nash equilibria, the risk-dominant equilibrium will prevail in the long run: it’s the equilib hardest to upset. If it takes a larger rare shock to leave Equilib A than to leave B, the system will spend most of its time at A.

29.07.2025 04:19 — 👍 0 🔁 0 💬 1 📌 0

6/ KMR analyze a finite population repeatedly playing a symmetric game. Successful strategies spread (Darwinian) and each player occasionally mutates (chooses a random action) instead of the best response. This ongoing noise “drastically reduces” the set of long-run equilibria.

29.07.2025 04:19 — 👍 0 🔁 0 💬 1 📌 05/ Long-run equilib: Game never truly “freezes” at a NE, a tiny chance someone experiments. So process has a stationary distribution over states (what is played). As mutation probability → 0, distribution puts ~100% weight on a single stochastically stable equilibrium (SSE).

29.07.2025 04:19 — 👍 0 🔁 0 💬 1 📌 04/ A dynamic approach: Instead of assuming players magically coordinate on an equilibrium, KMR/Young model how conventions emerge via a dynamic learning process with occasional random perturbations (small “mutations”). Players mostly adjust to success, but sometimes experiment.

29.07.2025 04:19 — 👍 0 🔁 0 💬 1 📌 0

3/ Consider the Stag Hunt: In this coordination game, two pure Nash equilibria (NE) exist: (Hunt,Hunt) and (Gather,Gather). (Hunt,Hunt) is Pareto-best for both, but (Gather,Gather) is risk-dominant – it’s safer if you’re unsure what the other will do.

29.07.2025 04:19 — 👍 0 🔁 0 💬 1 📌 0

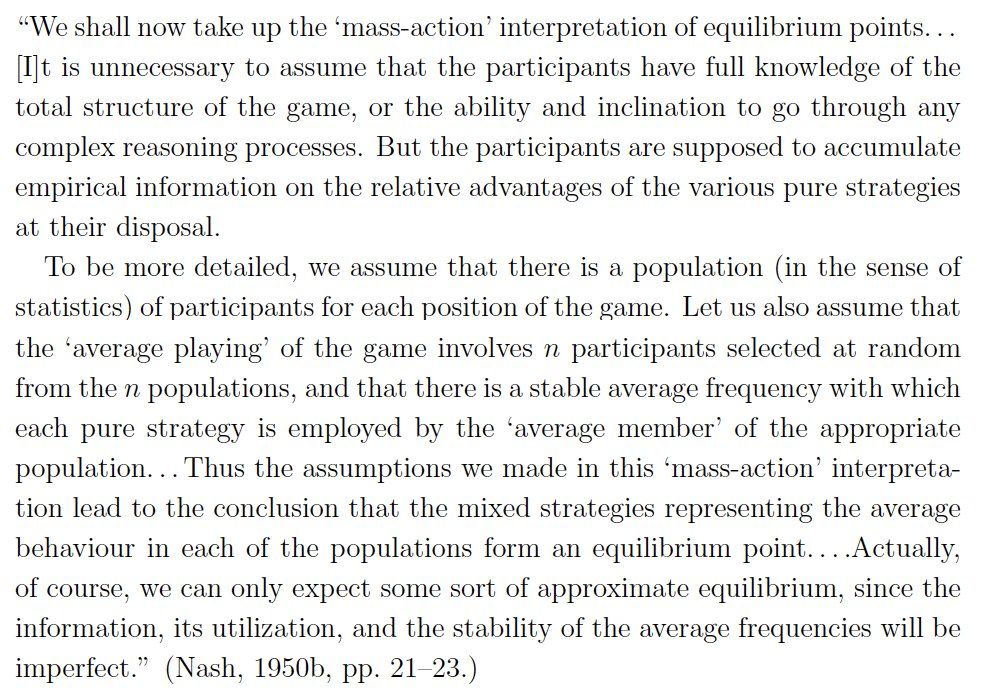

2/ Just when you think you've understood all that Nash brought to game theory, he surprises you. This from his PhD thesis (1950), where he conceptualizes early on, how players could arrive at playing the (well, Nash) equilibrium: a population and an empirical perspective!

29.07.2025 04:19 — 👍 0 🔁 0 💬 1 📌 0

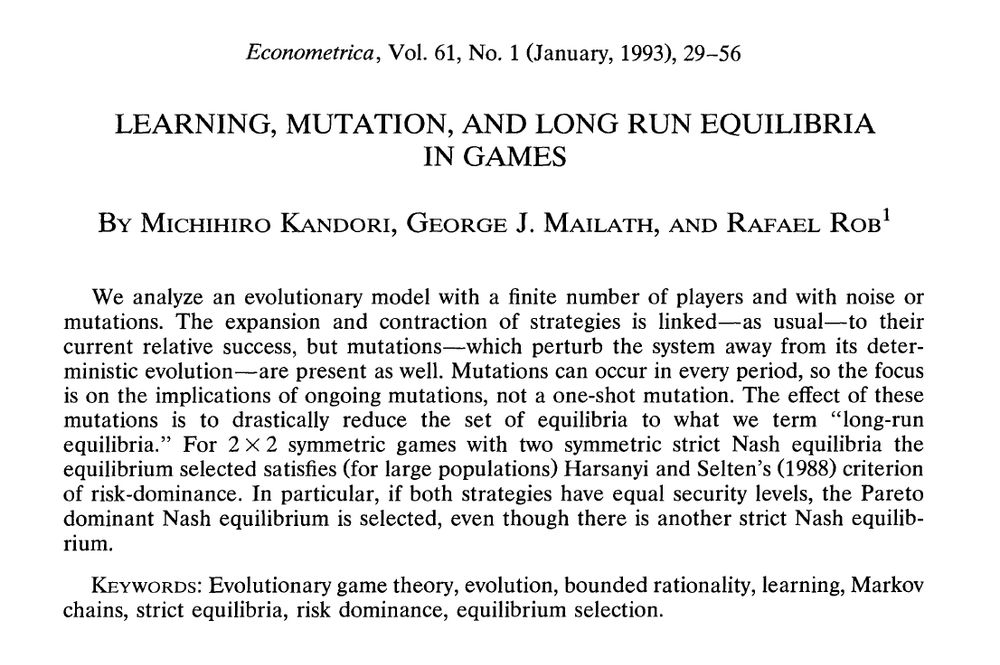

1/ Week 30: The theory paper(s) in focus this week are KMR 93 & Young 93, which provided a remarkably elegant evolutionary perspective to equilibrium selection in games. If games have multiple equilibria, which is more "reasonable", if at all? A deep problem in game theory.

29.07.2025 04:19 — 👍 3 🔁 0 💬 1 📌 0

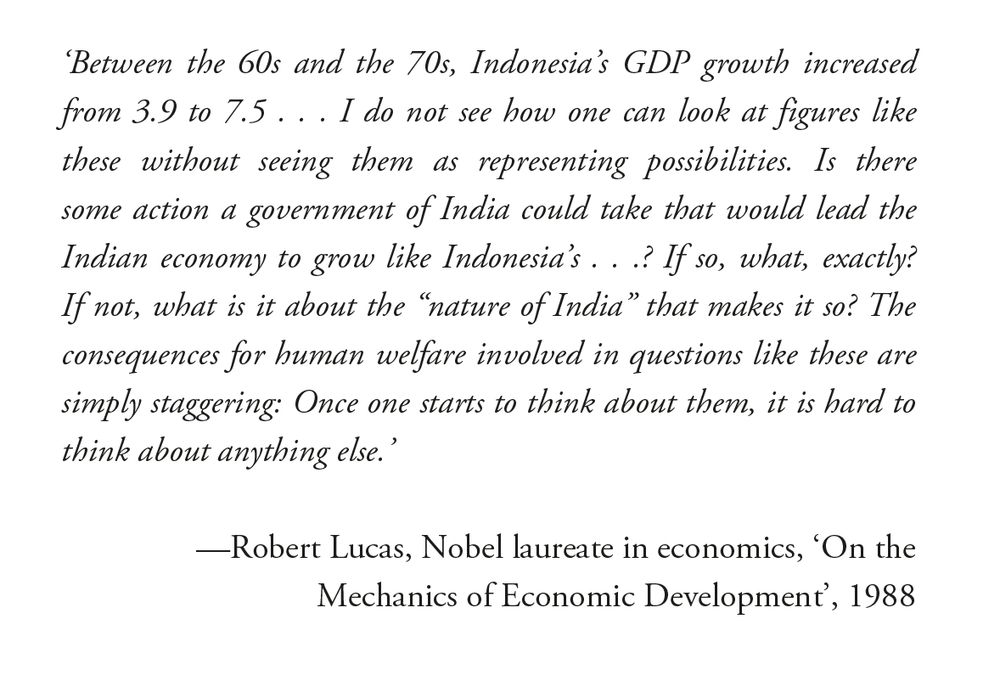

The consequences for human welfare involved in questions like these are simply staggering: Once one starts to think about them, it is hard to think about anything else. --- Bob Lucas (1988).

20.07.2025 04:47 — 👍 1 🔁 0 💬 0 📌 024/ On a personal note, I've learnt a lot about optimal taxation and particularly about the Atkinson-Stiglitz Theorem, its stark implications and its obvious practical limitations from @jacobsgoldin.bsky.social.

11.07.2025 23:23 — 👍 0 🔁 0 💬 0 📌 023/ In practice: Atkinson-Stiglitz is a remarkable theoretical benchmark, not a blanket rule. Real-world tax systems do tax consumption (VAT, excises) and capital, because the theorem's assumptions often fail (preferences not separable, multiple sources of inequality, etc.).

11.07.2025 23:23 — 👍 0 🔁 0 💬 1 📌 0

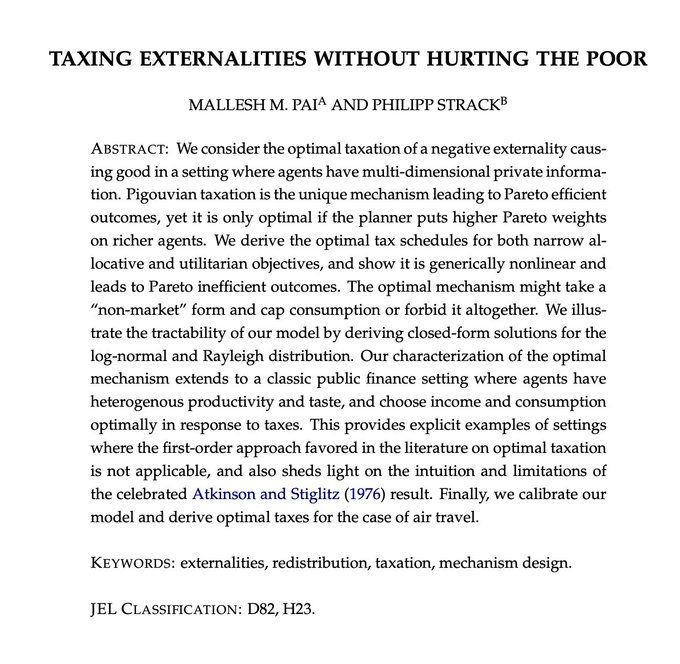

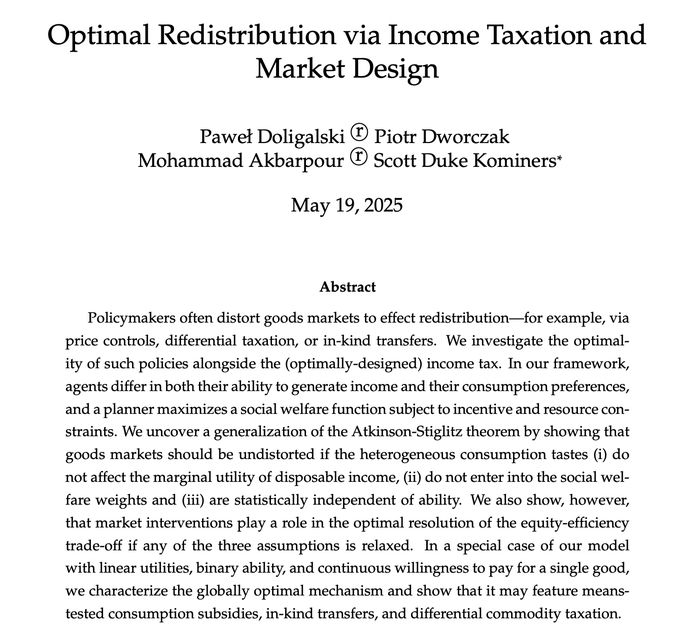

22/ Excellent recent work by Pai-@philippstrack.bsky.social, and Doligalski-Dworczak-Akbarpour- @skominers.bsky.social brings fresh perspectives on the Atkinson-Stiglitz theorem.

11.07.2025 23:23 — 👍 3 🔁 1 💬 1 📌 0

21/ A-S remains a benchmark, but knowing when it fails is key for real-world tax design. These lectures by @s-stantcheva.bsky.social provide a great overview of how relaxing A-S assumptions shows when commodity or capital taxes become warranted. stantcheva.scholars.harvard.edu/sites/g/file...

11.07.2025 23:23 — 👍 5 🔁 1 💬 1 📌 0

20/ @josephestiglitz.bsky.social critiques 0-capital-tax view. Notes A-S separability assump is implausible. In more realistic settings (imperfect info, inheritance, etc.), taxing capital can improve equity w/ acceptable efficiency costs.

[Though implementing inheritance taxes well has been hard.]

19/ In a lovely paper, @ludwigstraub.bsky.social & @ivanwerning.bsky.social revisit Chamley-Judd & overturn the zero-capital-tax result. If people are not very willing to substitute consumption over time (low intertemporal elasticity), the optimal policy has a positive long-run capital tax!

11.07.2025 23:23 — 👍 0 🔁 0 💬 1 📌 0

18/ If inequality has multiple sources, the A-S result can fail. Their model assumed only ability differences. In reality, people also differ in inherited wealth. With such inequality, taxing only labor income may not suffice—some capital taxation can be part of the optimum.

11.07.2025 23:23 — 👍 0 🔁 0 💬 1 📌 0

17/ Another assumption was identical preferences. If people's tastes differ, A-S can fail. For example, if high-ability people spend more on certain luxuries, taxing those goods effectively targets them. Different preferences can thus justify commodity taxes.

11.07.2025 23:23 — 👍 0 🔁 0 💬 1 📌 0

16/ If separability fails, the optimal tax mix changes. For example, if a certain good is consumed mostly during leisure, taxing it effectively taxes leisure (which otherwise escapes taxation). In such cases, differential commodity taxes can improve outcomes.

11.07.2025 23:23 — 👍 0 🔁 0 💬 1 📌 015/ This powerful result hinges on particular assumptions. If those fail, optimal policy might require commodity or capital taxes after all. The crucial assumption was separability of consumption and labor (no good is especially a "leisure luxury"). What if that's not true?

11.07.2025 23:23 — 👍 0 🔁 0 💬 1 📌 0