🚨New article🚨 Why has the promise of universal ownership been broken, as @benbraun.bsky.social has suggested?

Our argument: because the Big Three are hardly universal. They mainly invest in those that can insulate themselves from environmental harm - big tech & financials in the Global North.

🧵

24.09.2025 12:14 — 👍 42 🔁 18 💬 2 📌 5

As the revision of the #SFDR comes to an end, I am joining @reclaimfinance.org and +120 experts in calling on the @ec.europa.eu exclude companies developing new fossil fuel projects a minimum criterion across all #SFDR product categories.

There's no room for new fossil fuels in sustainable funds!

30.09.2025 13:50 — 👍 2 🔁 1 💬 1 📌 0

There is no room for fossil fuel developers in any sustainable finance categories - Reclaim Finance

The review of the SFDR is coming to an end with the publication of the proposal for a revised regulation by the European Commission announced for Q4 2025.

📣 Avec plus de 120 organisations, experts, chercheurs et entreprises, nous appelons la Commission européenne à garantir l'exclusion des entreprises développant de nouveaux projets d'énergies fossiles des futures catégories du SFDR afin de lutter efficacement contre le greenwashing.

Lire la lettre ⤵️

30.09.2025 08:48 — 👍 21 🔁 13 💬 0 📌 3

Once again a cery interesting, thought provoking and inspiring Finance and Society conference @finandsoc.bsky.social - looking forward to next year (whereever it's going to be)!

Thanks to numerous colleagues for intense discussions and critical questions!

12.09.2025 14:01 — 👍 4 🔁 2 💬 0 📌 0

What Salvador Allende Feared

On September 11, 1973, Chile’s socialist president Salvador Allende was overthrown in a CIA-backed military coup. In this 1971 interview, published in English for the first time, Allende expressed his fears of internal destabilization and US interference.

On September 11, 1973, Chile’s socialist president Salvador Allende was overthrown in a CIA-backed coup.

In this 1971 interview, published in English for the first time in Jacobin, Allende expressed his fears of destabilization and US interference.

11.09.2025 11:59 — 👍 47 🔁 29 💬 1 📌 0

13/ “Beijing is offering cheap, clean power, employment, trade and a route to prosperity. Washington is offering tariffs, policy chaos, White nationalist memes and South Korean workers in shackles after a raid on an EV battery factory.” ht

@davidfickling.bsky.social

bloomberg.com/opinion/arti...

12.09.2025 04:23 — 👍 63 🔁 26 💬 3 📌 2

The paper is part of a special issue on sustainable finance entitled "Puzzling, powering, profiting: The politics of sustainable finance in Europe". We are grateful for the kind guidance and support from the guest editors @danmertens.bsky.social and @nataschavanderzwan.bsky.social!

22.07.2025 10:49 — 👍 0 🔁 0 💬 0 📌 0

📌 Examining these articulation strategies helps reveal the political dimension of the relationship between financial capital and sustainability, highlighting efforts to engage various stakeholders, privileging some and sidelining others.

22.07.2025 10:49 — 👍 0 🔁 0 💬 1 📌 0

📌 By proposing the political strategy of ‘playing the capital market’, the paper emphasizes the strategic malleability of market-related ideas by EU institutions, but also the necessity to relegitimise them in the name of a common good.

22.07.2025 10:49 — 👍 0 🔁 0 💬 1 📌 0

📌 In addition, they attempted to reconcile the tension between the goal of redirecting financial flows to meet environmental targets and the need to enhance the competitiveness of the European financial and industrial system.

22.07.2025 10:49 — 👍 0 🔁 0 💬 1 📌 0

📌 By introducing sustainable finance into the EU agenda 'as part of' the CMU project in 2016, their strategy sought to ease the tension between the short-termism and volatility of market-based finance, in order to mobilize for investment purposes, and the long-term nature of green investments.

22.07.2025 10:49 — 👍 0 🔁 0 💬 1 📌 0

📌 The paper explores how the European Commission and the ECB have simultaneously sought to relegitimise the Capital Markets Union (CMU) and mobilise market-based finance for green investments.

22.07.2025 10:49 — 👍 0 🔁 0 💬 1 📌 0

[tra:ce] Policy Report

Financing the green transition: Increasing bankability, phasing out carbon investments and funding ‘never bankable’ activities

Our #policy #paper has just been published: "Financing the #green #transition: Increasing #bankability, phasing out carbon investments and funding 'never bankable' activities". We ask: Why does a large green financing gap persist? What policies do we need to change it: www.uni-wh.de/en/your-camp...

03.07.2025 06:01 — 👍 6 🔁 5 💬 1 📌 1

🚨 Do check out this very timely Policy Report on "Financing the green transition" 👇

30.06.2025 13:22 — 👍 8 🔁 6 💬 1 📌 0

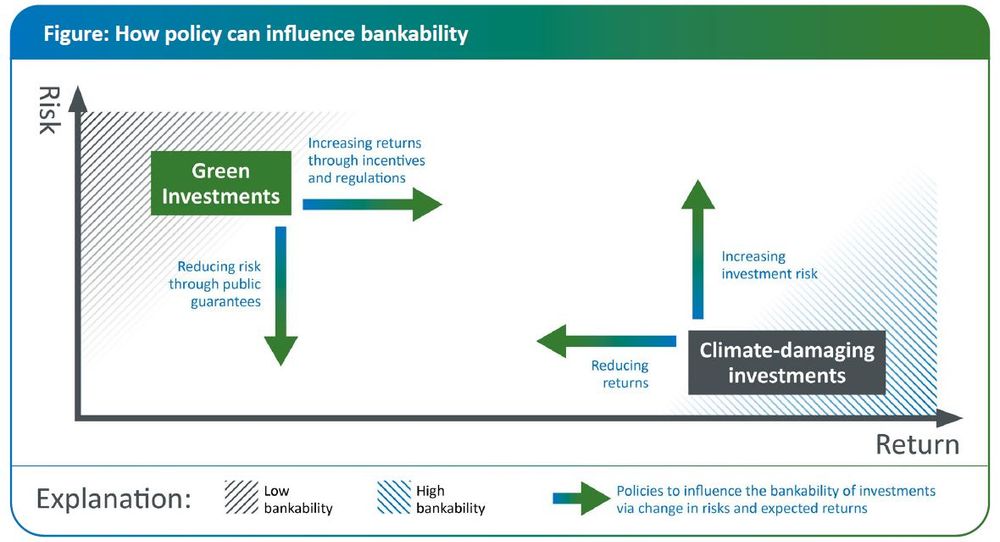

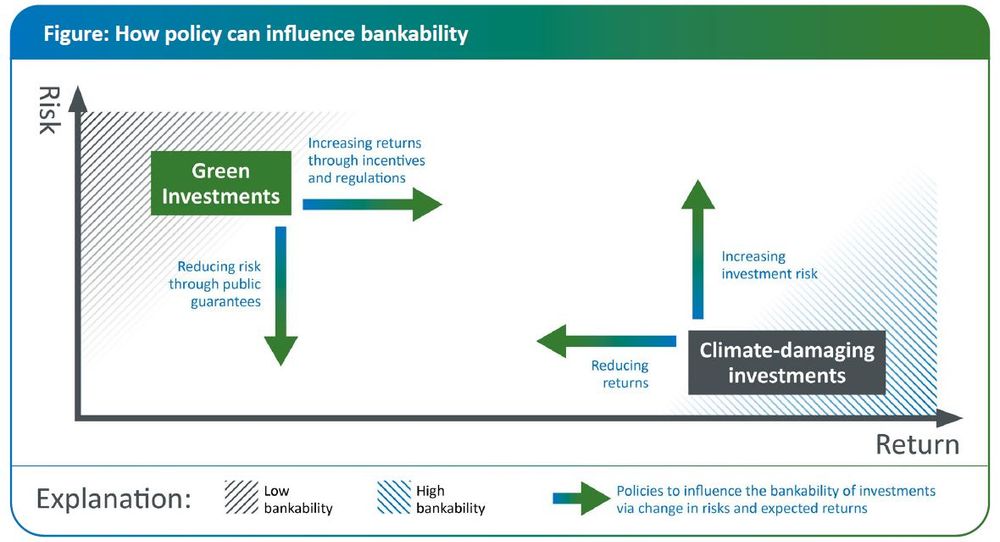

Figure from our #policy #report: 1. The main barrier to #financing the necessary activities for the sustainable transition is their lack of #bankability

2. High GHG-emitting activities remain #bankable and thus continue to attract financing from banks and shadow banks

www.uni-wh.de/en/your-camp...

11.07.2025 13:10 — 👍 6 🔁 5 💬 1 📌 0

[tra:ce] Policy Report

Financing the green transition: Increasing bankability, phasing out carbon investments and funding ‘never bankable’ activities

How can political decision-makers strengthen sustainable and climate-friendly investments - and at the same time effectively prevent climate-damaging financial flows? The latest [tra:ce] Policy Report takes a closer look at this question.

Further information:

www.uni-wh.de/en/your-camp...

30.06.2025 12:07 — 👍 3 🔁 2 💬 0 📌 1

We are thrilled to announce the public launch of our policy paper: "Financing the green transition: Increasing bankability, phasing out carbon investments and funding 'never bankable' activities" Monday 30.06.2025, 11:00 (CET) via Zoom.

Please register here:

www.uni-wh.de/die-finanzie...

12.06.2025 11:04 — 👍 0 🔁 0 💬 0 📌 0

Jugend-Kreativpreis Nachhaltigkeit 2025

Ratschläge aus der Zukunft gesucht!

Wir suchen inspirierende, innovative & kreative Antworten auf die Frage „Was rät die Zukunft dem Heute?”

Stell dir vor: Es ist das Jahr 2070 und du lebst in einer nachhaltigen und gerechten Welt.

Spread the word! :)

www.uni-wh.de/euer-campus/...

26.05.2025 16:09 — 👍 0 🔁 0 💬 0 📌 0

Check out our second [tra:ce] working paper!

This time, we zoom in on the role of banks in sustainable finance: "The green banking gap: how bankability, business models, and regulations challenge banks' decarbonisation". *Join our public paper launch on Monday, 26 May, 11h (CET)*!

19.05.2025 10:44 — 👍 0 🔁 0 💬 0 📌 0

Interesting read.

15.05.2025 07:19 — 👍 4 🔁 1 💬 0 📌 0

Stellenausschreibung

📢 Job announcement – 1 PhD researcher in my "Global Sustainability Governance" research group

Please share this opportunity within your networks and encourage suitable candidates to apply (or consider applying yourself)! Happy to answer questions!

Deadline: 4 June 👇

www.uni-due.de/karriere/ste...

17.05.2025 07:59 — 👍 3 🔁 3 💬 0 📌 1

Thanks a lot for the valuable feedback, @sebastianmack.bsky.social ! :)

07.04.2025 09:01 — 👍 0 🔁 0 💬 0 📌 0

+ also @jryancollins.bsky.social and @jvtk.bsky.social

01.04.2025 11:05 — 👍 0 🔁 0 💬 0 📌 0

Thanks a lot for the colab, @riccardobaioni.bsky.social !

01.04.2025 11:03 — 👍 1 🔁 0 💬 0 📌 0

Relevant for @danielagabor.bsky.social gabor.bsky.social @adamtooze.bsky.social oze.bsky.social @bencaldecott.bsky.social ott.bsky.social @emacampiglio.bsky.social ky.social @steffenmurau.bsky.social @vgalaz.bsky.social @taxjustice.net e.net @sebastianmack.bsky.social

01.04.2025 11:02 — 👍 0 🔁 0 💬 1 📌 0

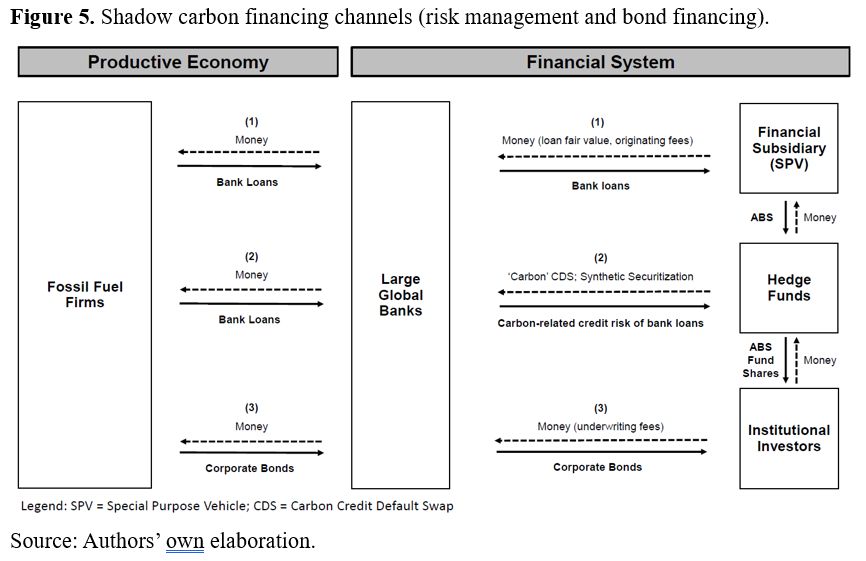

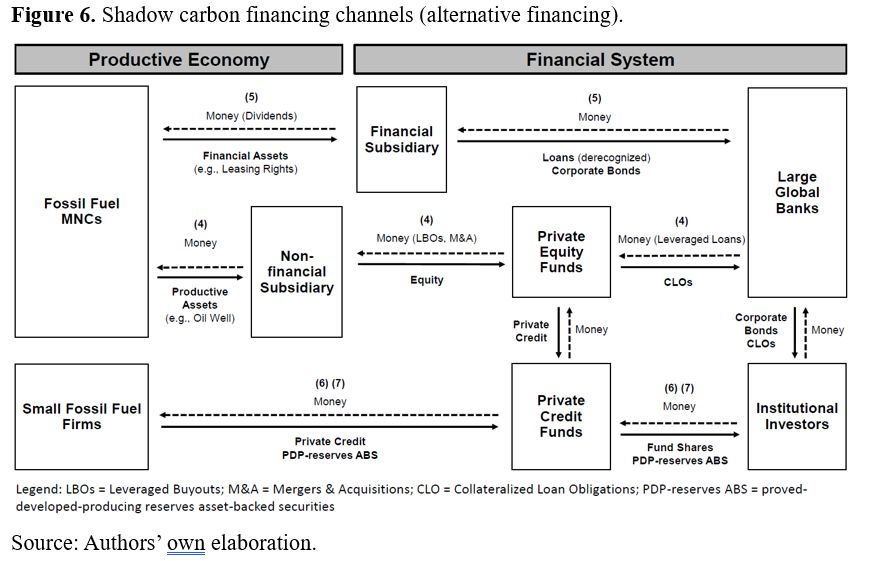

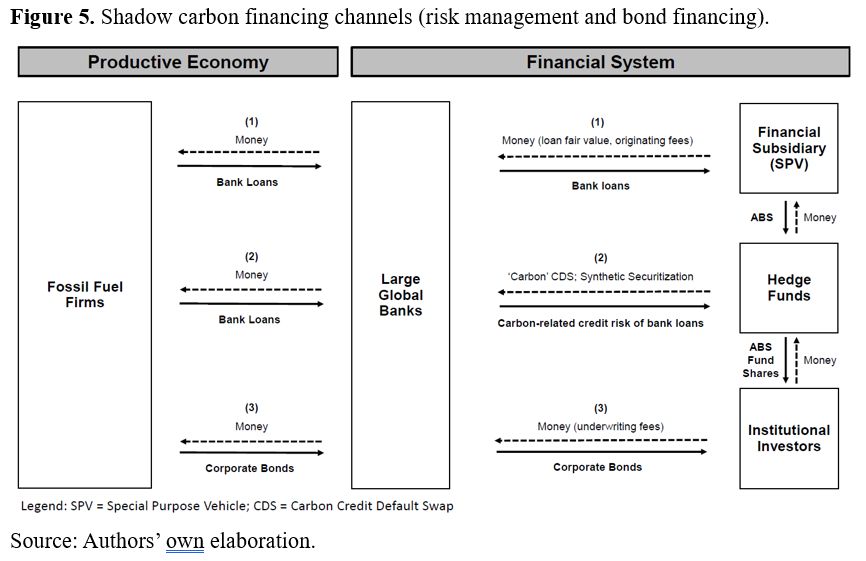

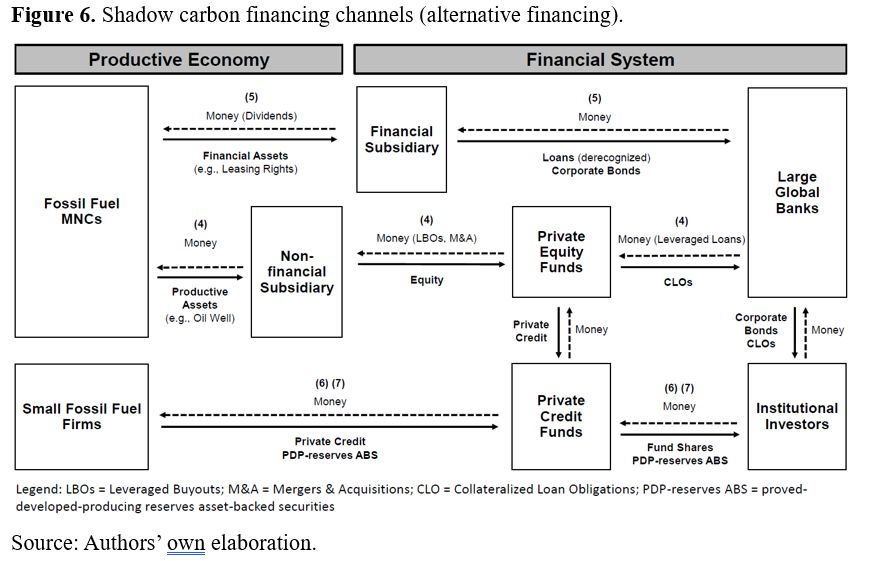

We argue that shadow carbon financing may increase climate-related systemic risks in various ways (see Figures). Consequently, financial regulation must address shadow carbon financing to avoid a "climate Minsky moment"

01.04.2025 10:57 — 👍 0 🔁 0 💬 0 📌 0

All forms of shadow carbon financing have in common that they enable the continuance of carbon financing ‘by other means’, respectively the circumvention of regulatory attempts to steer financial flows away from carbon-intensive activities.

01.04.2025 10:56 — 👍 0 🔁 0 💬 0 📌 0

Cross-disciplinary journal dedicated to interrogating the central role of finance in contemporary life. cambridge.org/core/journals/finance-and-society

Leading international journal dedicated to the systematic exploration of IPE from a plurality of perspectives.

Alternately Defiant, Dispirited, and Despondent. Without illusions but not disillusioned. Focus on Climate, Inequality and Development.

I co-edit the Polycrisis project and newsletter https://www.phenomenalworld.org/series/the-polycrisis/

Political Economist at Institute of Public Administration, Leiden University | Sustainable Finance | Financialization | Politics of Investment | Pensions | http://nataschavanderzwan.com

Professor of International Political Economy | Osnabrück University | Personal website: https://danielmertens.info

Policy @BloombergNEF - US and Canadian industrial strategy, trade, regulations, etc. UNC and @harvardkennedy.bsky.social

alum. Category-5 brainstormer. Views are my own, likes & reposts are not endorsements, etc.

SSRN’s mission is to rapidly share early-stage research and empower global scholarship to help shape a better future. You can submit your research to SSRN online at www.ssrn.com.

Decade long researcher on the financial industry & its impacts on planet and society: “private finance” issues, focus on non-banking sector & asset managers; (EU) laws/policies, int. standard & treaties on financial industry vs. needed reforms/alternatives

Doctoral Researcher @UniWH

Earth Insight builds critical transparency tools and momentum for restricting fossil fuel, mining, and other industrial expansion threats to key ecosystems and Indigenous and local communities. Project of Resource Legacy Fund. Visit www.earth-insight.org

MSCA PhD @sorbonneparis1 & @ulbruxelles with @gemdiamondphd. Central bank nerd, interested in (networks of) macroeconomic expertise. Views own.

Associate fellow @ New Economics Foundation - Eurozone, central banking, sustainable finance, EU democracy. Former Director @ Positive Money EU

https://stanislasjourdan.fr/en

Research group leader OBFA-TRANSFORM project (https://obfa-transform.eu) | Global Climate Forum, Berlin. Freie Universität Berlin. Boston University.

Junior Professor of Global Sustainability Governance @College for Social Sciences and Humanities (UA Ruhr) & UDE (IFSO) | IR/IPE scholar | Interested in global governance, IOs, sustainability, (post-)growth & more (he/him)

Lead researcher ING climate lawsuit @milieudefensie and lecturer @uva.nl. IPE of global financial governance by day, Anthropocene politics by night. Views are my own.

Politischer Content aus Deutschland und der Welt. Analysen, Meinungen und Diskussionen zu politischen Themen. Politik ist Kunst.

Political content from Germany and around the world. Analyses, opinions and discussions on political issues. Politics is art.

Associate Professor of Criminology, Law, and Society, Department of Sociology, University of Illinois | personal account

Economic geographer 🗺 💰 Central banking, risk management & climate finance. Co-author (Mis)managing Macroprudential Expectations

Former Senior Policy Fellow @delorsberlin.bsky.social