Today's the day: the Land Trap is now OUT in the US! Just two days to wait until the UK release. Pre-orders landing imminently.

If you're interested in why land is so vital in finance everywhere, the rise and fall of Georgism, and how land shaped Japan, China and Singapore, this is the book for you

04.11.2025 14:51 —

👍 28

🔁 5

💬 4

📌 2

Very excited to see the first major review of my book, which now comes out in less than three weeks, by @martinsandbu.ft.com in the Financial Times! www.ft.com/content/cb90...

16.10.2025 18:23 —

👍 29

🔁 3

💬 2

📌 1

PS, if you would like to review the book, if you'd like me to talk about it for an event, if you'd like me to come on a podcast or anything else, now is very much the time to get in touch and ask!

11.10.2025 17:57 —

👍 6

🔁 1

💬 0

📌 0

Just finished the final touches on the audiobook.Less than three weeks to go now, getting very exciting!

If you're interested, the best thing you can possibly do now is pre-order! Available all over the place - Amazon, Barnes & Noble, Guardian Bookshop and many other bookshops.

11.10.2025 17:56 —

👍 9

🔁 3

💬 1

📌 0

Thank you! That's great to hear

08.10.2025 17:29 —

👍 0

🔁 0

💬 1

📌 0

Audiobook recording is WRAPPED!

You can preorder here, or get yourself a print copy! Or ideally, both! Available at a bunch of other places too.

www.amazon.com/Land-Trap-Hi...

27.09.2025 22:00 —

👍 12

🔁 1

💬 0

📌 0

BIG NEWS: My book, The Land Trap, is coming out on Nov 4! I've been fascinated by this topic for years. The book tells the story of why land still occupies such a huge role in finance, economics and politics globally, and why that's a source of huge risk. You can preorder NOW!

15.08.2025 15:06 —

👍 83

🔁 15

💬 8

📌 2

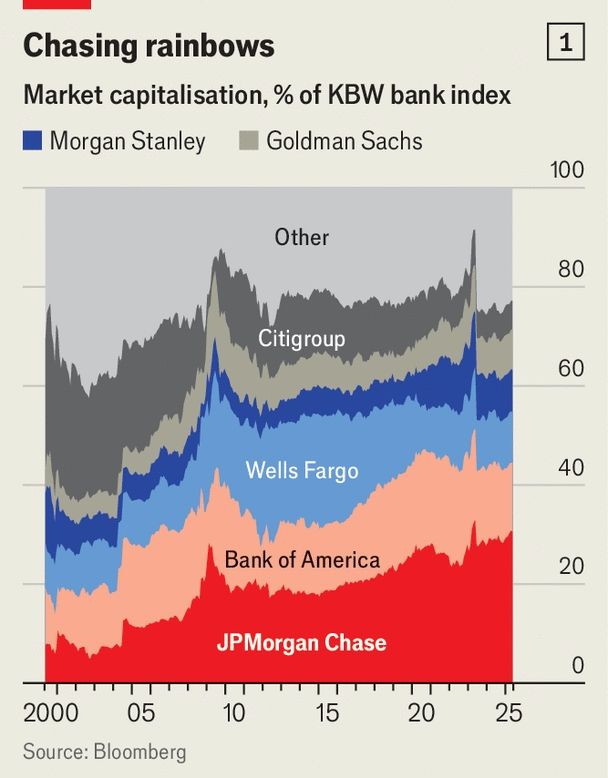

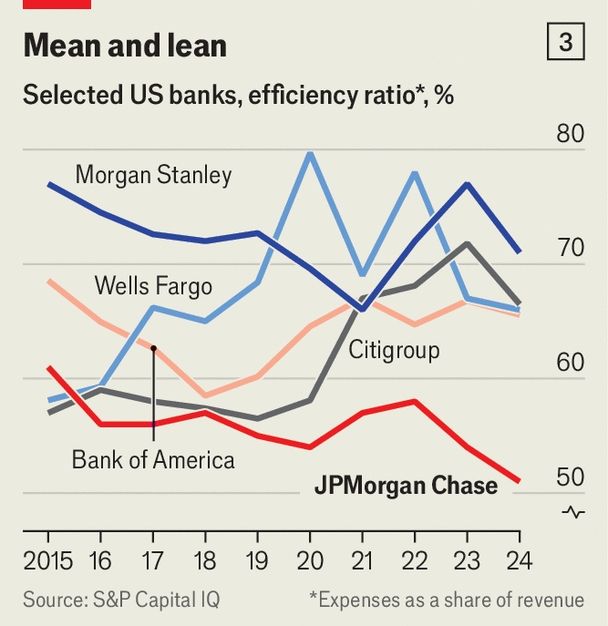

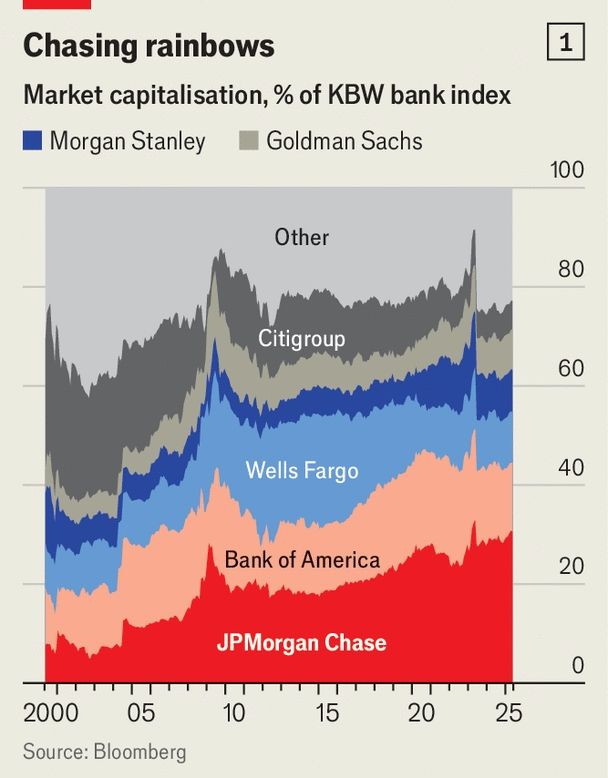

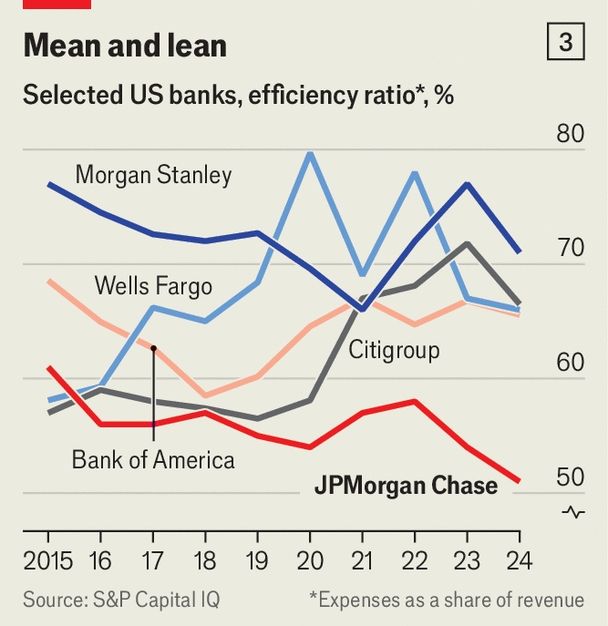

JP Morgan now accounts for about 30% of the market cap of large American banks, from 12% when Dimon started. Mike Mayo, the Wells Fargo banks analyst, thinks itsm's heading to $1tn. It already had a lead over competitors on efficiency pre-pandemic, but the gap is huge now.

22.05.2025 12:11 —

👍 7

🔁 1

💬 1

📌 1

Will Jamie Dimon build the first trillion-dollar bank?

We interview JPMorgan Chase’s boss, and his lieutenants

Fun story this week. I interviewed Jamie Dimon and the each of the heads of the bank's major businesses (his potential successors) about JP Morgan's astonishing expansion, what could threaten the biggest bank in American history, and what's coming next.

www.economist.com/finance-and-...

22.05.2025 12:01 —

👍 28

🔁 6

💬 4

📌 3

My piece this week: for a long time, private markets firms have dreamed of "democratising" their asset class. They're not dreaming anymore - the moment of truth has arrived www.economist.com/finance-and-....

01.05.2025 13:04 —

👍 8

🔁 3

💬 1

📌 0

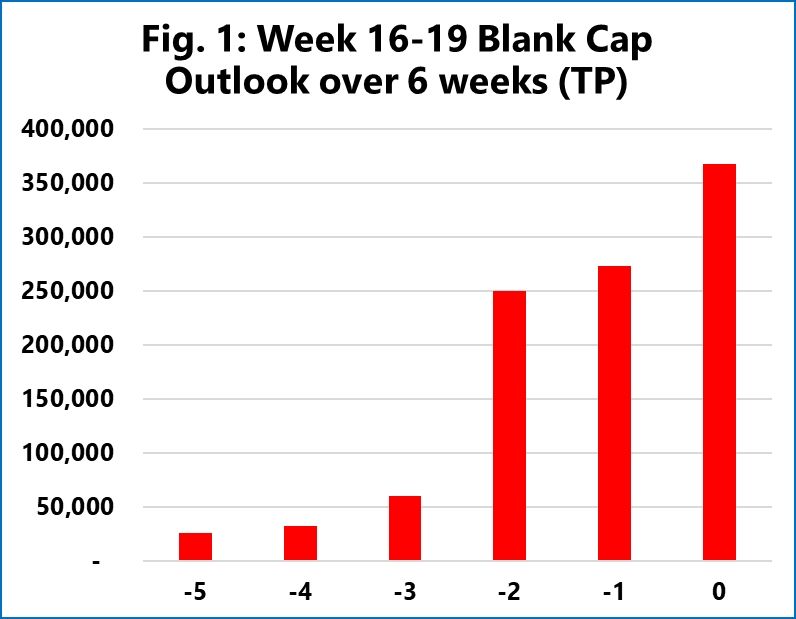

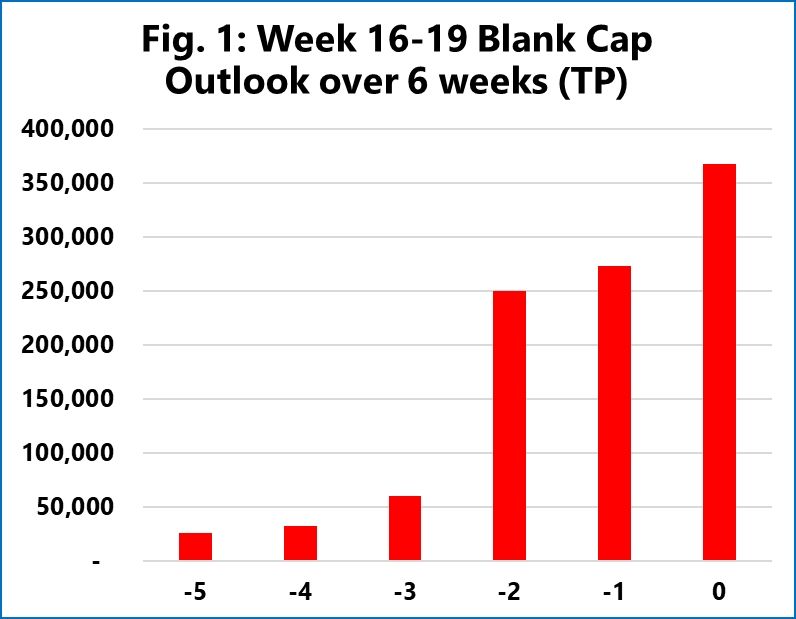

Transpacific trade is already seizing up because of the tariffs.

Three weeks ago, about 60,000 TEU (a measure of container volume) were scheduled to be "blanked" from April 16-May 10 (cancelled voyages/stops at a port). Now the figure is *367,800*

www.sea-intelligence.com/press-room/3...

18.04.2025 02:13 —

👍 127

🔁 48

💬 2

📌 13

The media monoculture breaking down is so fun. This guy is visiting China, I had never previously heard of him, but as far as I can tell it's perhaps the third biggest global news story happening in the last week.

05.04.2025 22:57 —

👍 11

🔁 1

💬 3

📌 0

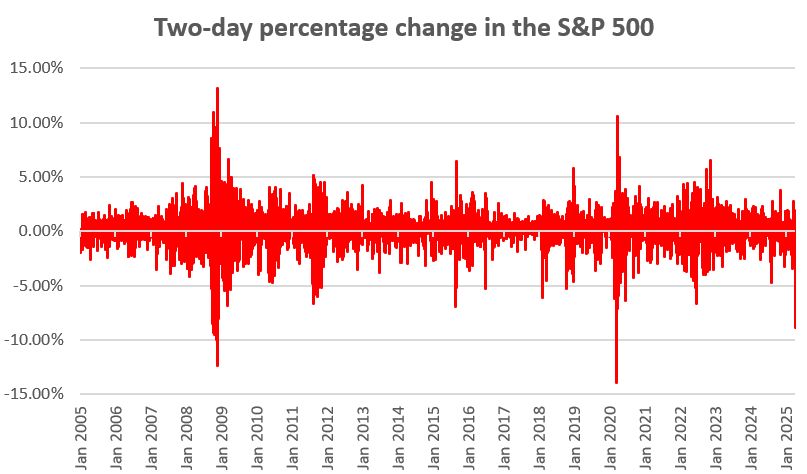

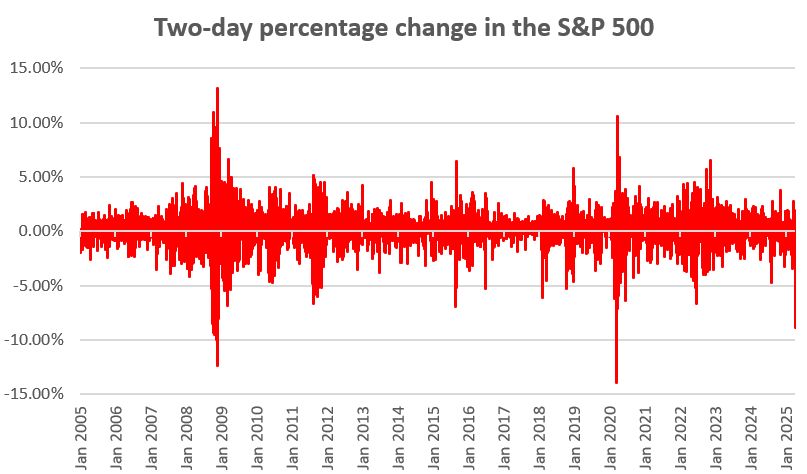

Actually can take it back further: only 3 occasions since 1964 with larger 2-day sellouts in S&P 500

04.04.2025 17:16 —

👍 6

🔁 3

💬 2

📌 0

It's important to remember that for younger investors, a selloff can represent a great entry opportunity! Unless it represents a change in the value of discounted future cash flows.

04.04.2025 16:21 —

👍 41

🔁 4

💬 2

📌 0

Fact check true

04.04.2025 15:25 —

👍 25

🔁 1

💬 1

📌 0

What was that all priced in, guilders? Spanish dollars?

04.04.2025 15:11 —

👍 2

🔁 0

💬 1

📌 0

There are now only two occasions in recent financial history where the S&P 500 sold off more sharply in two days than it has since the US tariff announcements - the peak of Covid panic in March 2020, and a cluster of occasions during the very worst moments of the global financial crisis in 2008

04.04.2025 15:05 —

👍 35

🔁 12

💬 3

📌 1

What America’s stockmarket plunge means

Farewell to 15 years of exceptionalism?

My piece today: Trump's tariff bazooka is the biggest threat yet to 15yrs of US equity exceptionalism.

It's not just the mindless economic hit. Amateurish execution undermines the widespread belief in pro-market US governance

www.economist.com/finance-and-...

03.04.2025 21:14 —

👍 28

🔁 10

💬 2

📌 0

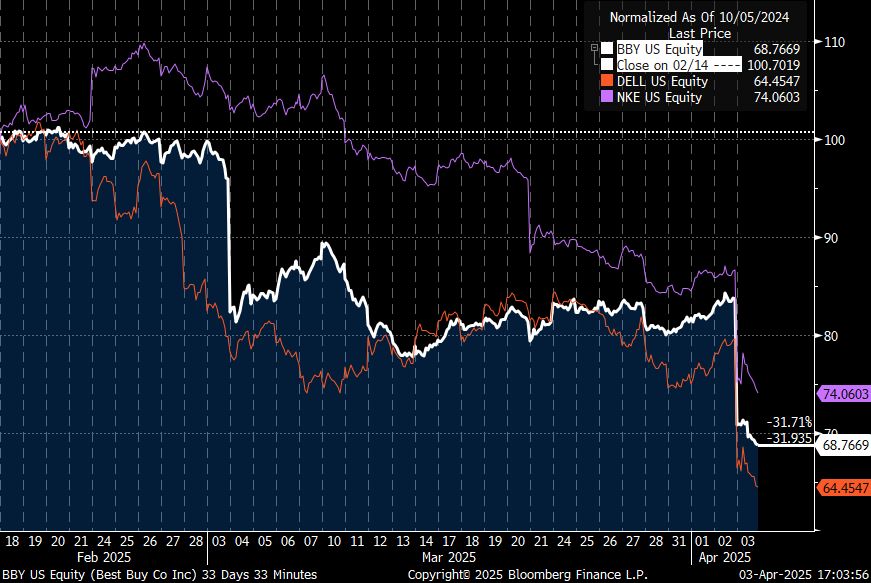

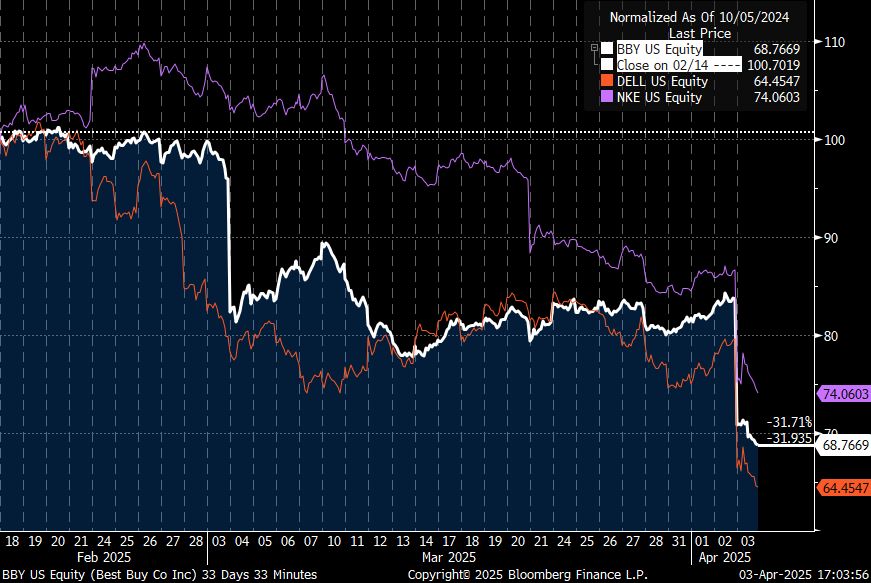

Some of the US stocks with the biggest international trade/production exposures have just been absolutely battered since mid-February. Best Buy, Dell and Nike down between 26% and 36%.

03.04.2025 21:05 —

👍 15

🔁 4

💬 1

📌 0

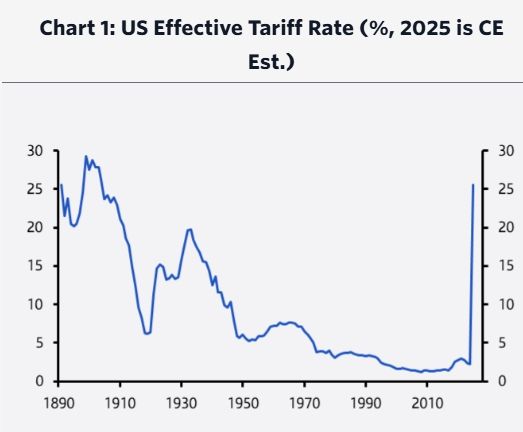

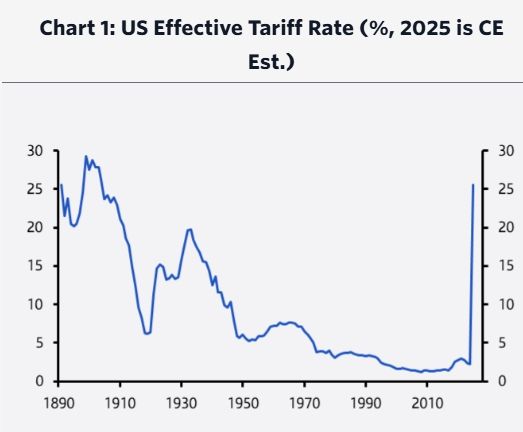

Capital Economics: if today's announcements are implemented, the effective US tariff rate will shoot straight past the Smoot-Hawley levels of the 1930s.

"The effective tariff rate on all imports will rise from 2.3% last year to around 26%, leaving it at a 131-year high"

02.04.2025 23:06 —

👍 919

🔁 350

💬 32

📌 68

I dunno, because there was quite a drumbeat for that which didn't come from Churchill. Was it also more binary than this? I don't know if there was any discussion about the precise level to peg at

01.04.2025 20:08 —

👍 1

🔁 0

💬 2

📌 0

Yeah it may be that - although at least the US was at that time perceptibly in crisis

01.04.2025 20:01 —

👍 2

🔁 0

💬 1

📌 0

I'm trying to think of something as clearly discretionary as this, where there's no immediate or meaningful consequence to just not doing it.

01.04.2025 20:00 —

👍 9

🔁 1

💬 4

📌 0

What's a historical example of an economic policy as significant as the tariffs being discussed, where we knew similarly little about the scale of the announcement right beforehand? The Covid + 2008 crisis responses seem different because they were triggered by exogenous events.

01.04.2025 19:57 —

👍 34

🔁 5

💬 11

📌 2

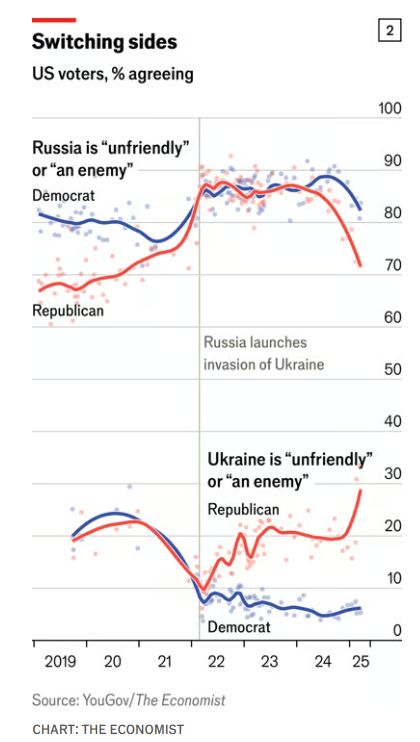

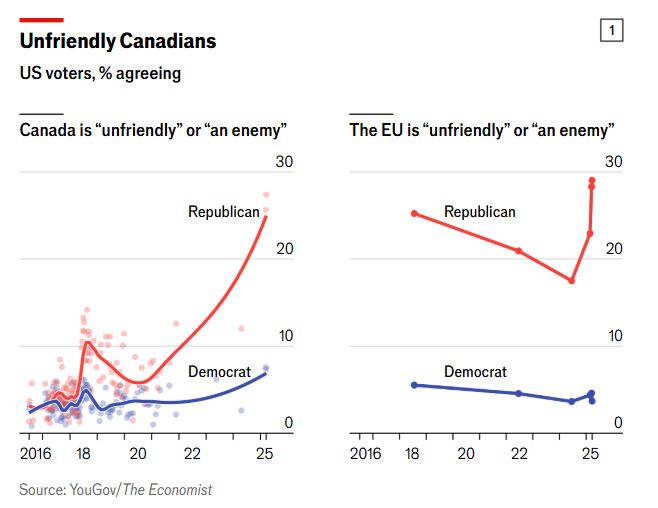

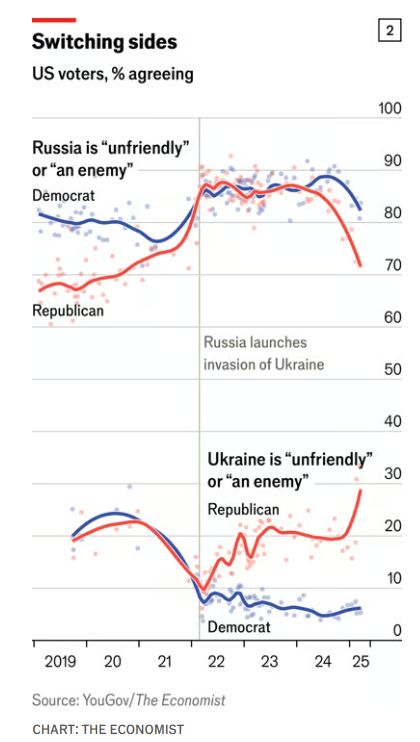

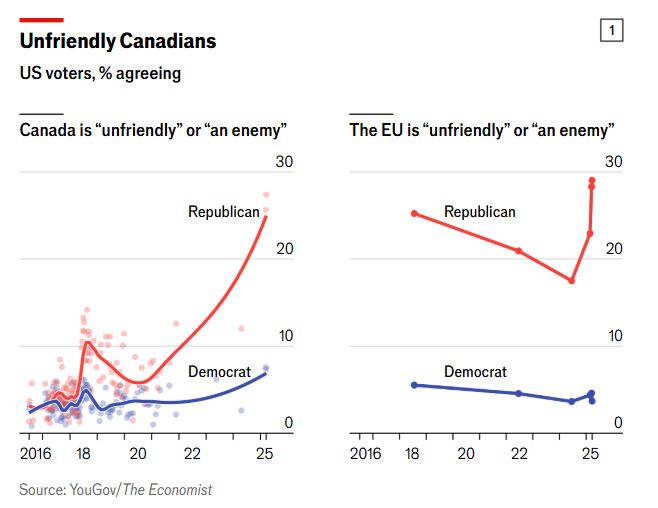

There's something darkly funny in looking at these trends and remembering the RW mockery of the shifting "current thing" and NPCs who can't think for themselves

01.04.2025 15:33 —

👍 175

🔁 39

💬 6

📌 8

Bit embarrassing to admit they missed this one

31.03.2025 16:33 —

👍 24

🔁 4

💬 1

📌 0

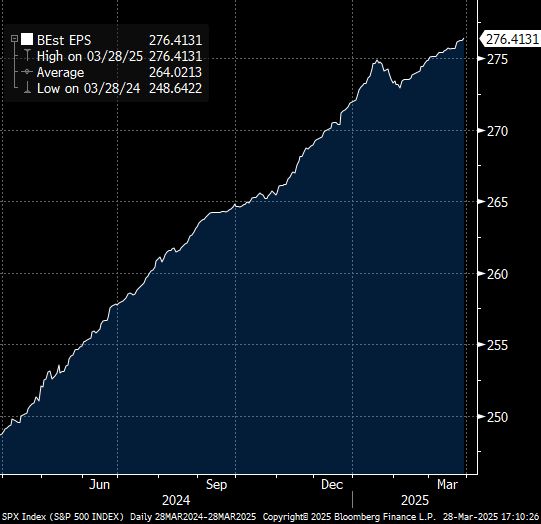

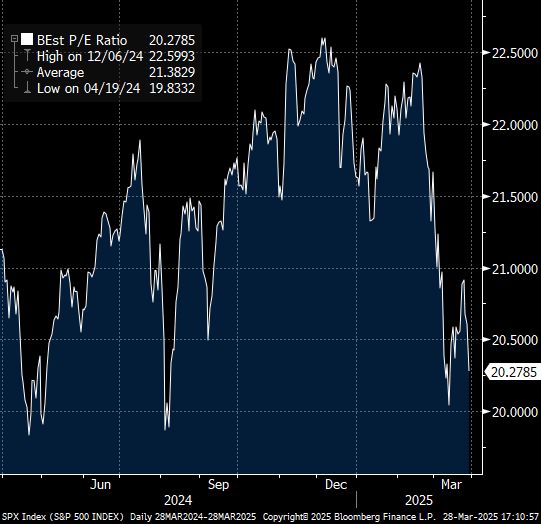

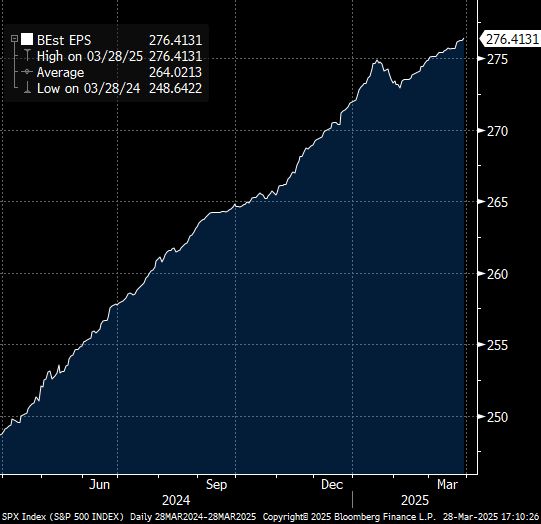

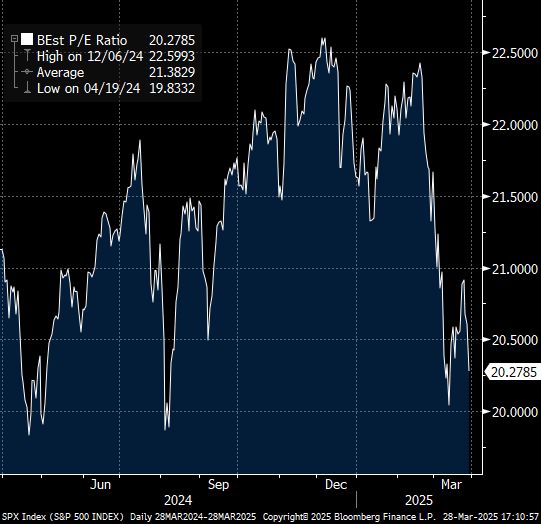

It is fascinating that the entirety of the recent US stock selloff is accounted for by valuation re-rating. For all the reduced confidence, tariff threats etc, earnings estimates are still at an all-time-high.

28.03.2025 21:14 —

👍 38

🔁 12

💬 10

📌 7

Can foreign investors learn to love China again?

Wall Street still needs more to coax it back. But non-American firms may be ready to return

Even if the Chinese economy rebounds (a big if), and its tech crackdown comes to a clear end, politics now makes it hard for Wall Street to turn really bullish.

Investors in Dubai, Singapore and Zurich will not feel the same compunctions. My column this week.

www.economist.com/finance-and-...

28.03.2025 01:39 —

👍 7

🔁 2

💬 2

📌 0

26.03.2025 16:57 —

👍 16

🔁 2

💬 0

📌 0

26.03.2025 16:57 —

👍 16

🔁 2

💬 0

📌 0

26.03.2025 16:57 —

👍 16

🔁 2

💬 0

📌 0

26.03.2025 16:57 —

👍 16

🔁 2

💬 0

📌 0