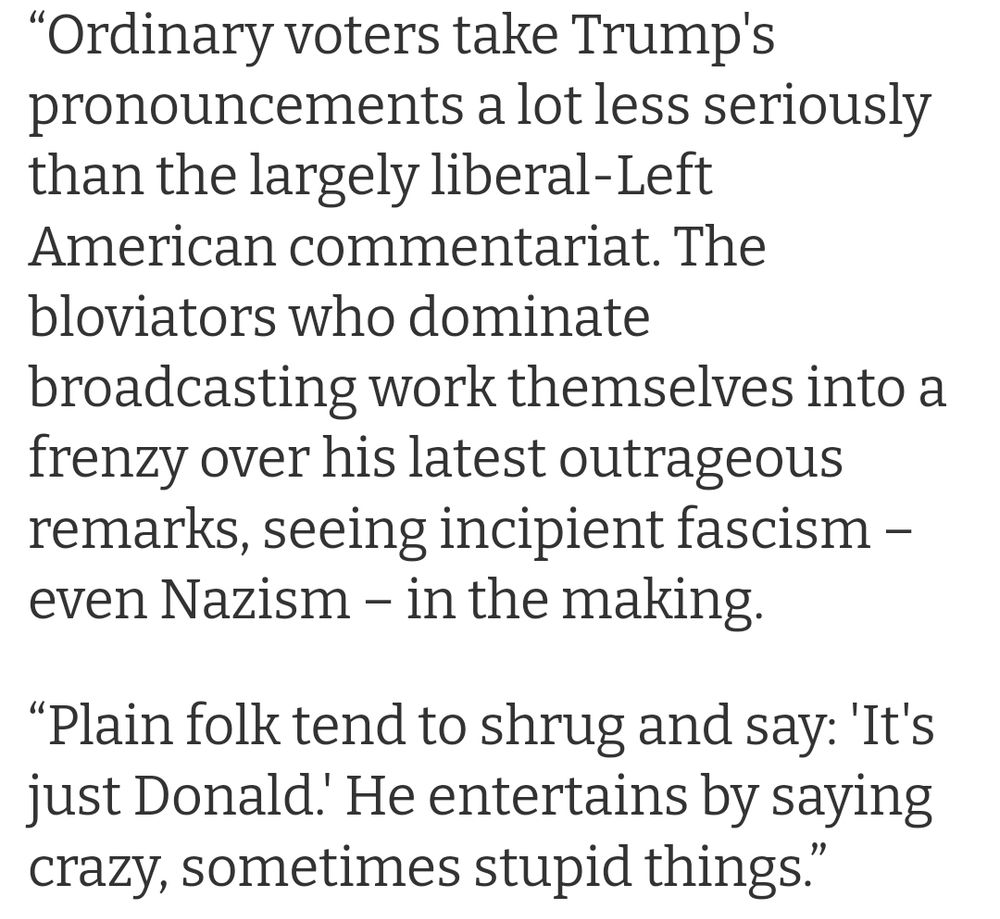

Andrew Neil now.... and exactly four months ago.

A great example of the British Right finally catching up. Their primary objective of 'owning the libs' has hit brutal reality.

@robert19pearson.bsky.social

Andrew Neil now.... and exactly four months ago.

A great example of the British Right finally catching up. Their primary objective of 'owning the libs' has hit brutal reality.

Times article from 2018 with a headline from Jacob Rees-Mogg "President Trump will be our greatest ally after Brexit"

Well this aged well.....

05.03.2025 23:13 — 👍 480 🔁 114 💬 31 📌 7if Gilts were perpetual variable rate instruments, then haircuts could be zero. Mind you, there wouldn't be much need for a repo market, or leveraged investors....or a bond market, or bond traders.

They might have to go and find something more productive to do

the key measure when selling govt bonds is to ensure that those banks that have to buy them (GEMMs in the UK) have sufficient balances in their reserve accounts to be able to buy whatever the govt wants to sell.

Fortunately, this is exactly what happens

Box 1 from Pension's Partnership report on private market investing.

Economists and Markets people - divided by a common language?

Wrote this box in new private market investing report after Bsky exchange on topic with @gilesyb.bsky.social

peoplespartnership.co.uk/wp-content/u...

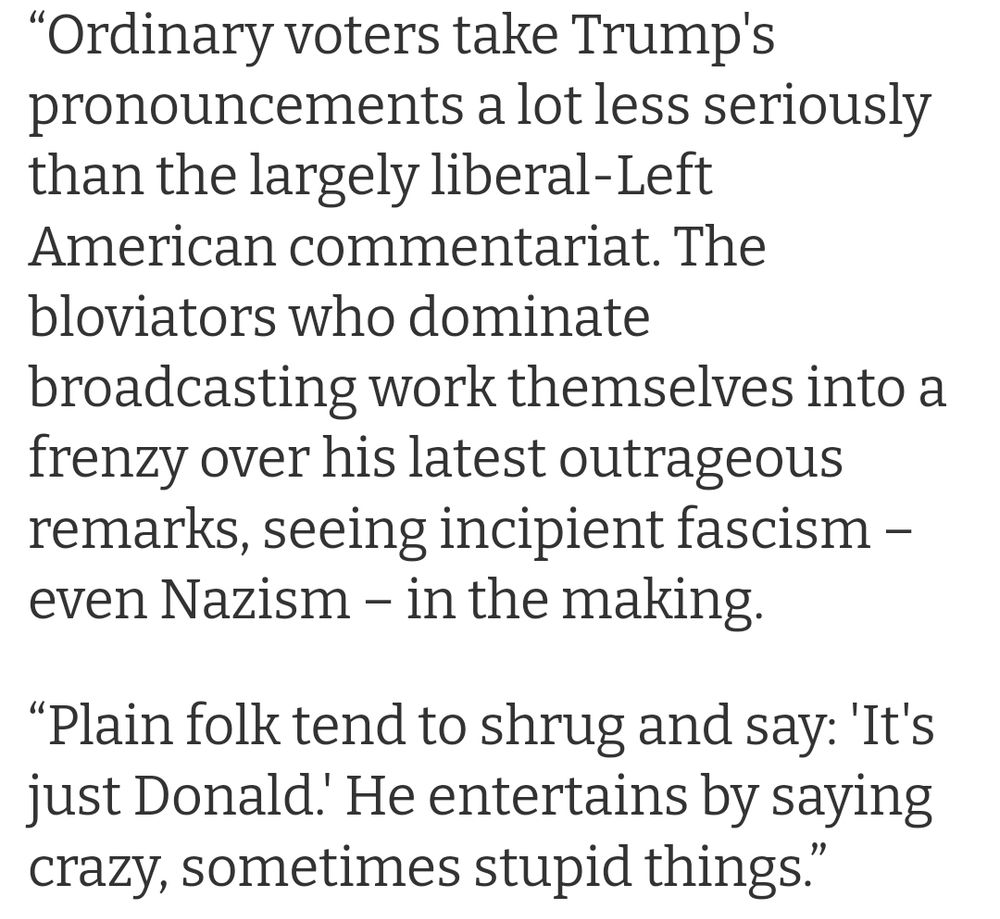

Another entry for my niche collection of "didn't read to the end of the story being referenced" posts.

02.02.2025 17:34 — 👍 705 🔁 115 💬 22 📌 4deposits are created by credit extension....an expansion of the banking and BS balance sheet. Saying that BS have to fund with deposits doesn't mean what you think it means.

If a BS extends credit, it creates a deposit just like a bank.

Neither banks nor BS 'lend out' deposits

Here's the speech if you haven't heard it. 13 minutes of your time. Share it with your American friends and neighbours, because they won't see it otherwise. Circulate it in Mexico and Denmark, France and the UK, Panama and Germany, Poland and Estonia, and especially -- especially -- Ukraine.

02.02.2025 04:38 — 👍 7296 🔁 4306 💬 189 📌 462all 'bank lending' whether by a bank or BS creates a new customer deposit.

Banks and building societies create customer deposits, they don't 'lend out' customer deposits, whether for mortgages or any other purpose

Once created, if a deposit is designated a 'cash ISA', nothing changes.

Account and credit his cash ISA account. This doesn’t give the bank anything that it can ‘lend out’ or invest. The deposit is its liability, not its asset

02.02.2025 07:46 — 👍 0 🔁 0 💬 0 📌 0Your first point is wrong

If a bank wants to extend credit to a corporate, it can.

That ‘loan’ creates a customer deposit. If the holder of that balance, which will initially be created in a current account, wishes the balance to be in a cash ISA account, the bank will debit his current

The bank earns interest on its reserve deposits, just as it earns interest on virtually all of its other assets (apart from the small amount of vault cash it holds)

02.02.2025 07:38 — 👍 0 🔁 0 💬 0 📌 0The word cash in cash ISA refers to what the customer holds, which is a bank deposit, commonly referred to as ‘cash’. It has nothing to do with the assets the bank holds. But if the bank holds some cash, that will mainly be a call deposit the bank holds at the central bank

02.02.2025 07:36 — 👍 0 🔁 0 💬 2 📌 0OK. ……

I really have no idea what point you are trying to make here

No

02.02.2025 07:13 — 👍 0 🔁 0 💬 1 📌 0balance doesn't actually go anywhere. It's created when a loan is granted, or when the Treasury spends, and the loan that is extended, or the reserves created by govt deficit spending is an asset of the bank and the deposit is a liability of the bank. The bank cannot do anything with that deposit.

02.02.2025 00:00 — 👍 0 🔁 0 💬 1 📌 0most cash ISAs are deposits at banks and building socs. Such deposits are mainly created by banks and building socs extending credit or by the govt deficit spending. Once created as a balance in a current account, the account holder might choose to move the balance into a cash ISA account. The

01.02.2025 23:57 — 👍 0 🔁 0 💬 1 📌 0the word cash in cash ISA is a description off your asset - a deposit at your bank, which, to you, is 'cash'.

It doesn't refer to the assets your bank holds

As a deposit holder, you don't have a claim on any specific assets of the bank, just a claim on the bank

the 'cash' part of a cash ISA is a perfectly reasonable description of such a deposit from the point of view of the deposit holder. It tells you nothing about the assets the bank has

01.02.2025 23:50 — 👍 0 🔁 0 💬 0 📌 0building docs have assets, which are mainly customer loans and reserve balances (created when the govt deficit spends) and on the other side of the balance sheet they have mainly customer deposits and equity. The customer deposits can be current accts, savings accts or cash ISA accts.

01.02.2025 23:48 — 👍 0 🔁 0 💬 1 📌 0bank and building social deposits are created when banks and building docs extend credit, or when the govt deficit spends. The holders of the deposits thus created might choose to exchange the balance in the current account for a balance in a cash ISA account. Nothing goes anywhere.

Banks and

credit extended by banks and building societies (including mortgage lending) creates bank and building society deposits. Not the other way around

01.02.2025 20:46 — 👍 0 🔁 0 💬 1 📌 0for one person to save by spending less than his or her income, somebody (or something) else has to be spending more than theirs.

Who (or what) should that be?

reserve deposits that pay the bank 4.75%

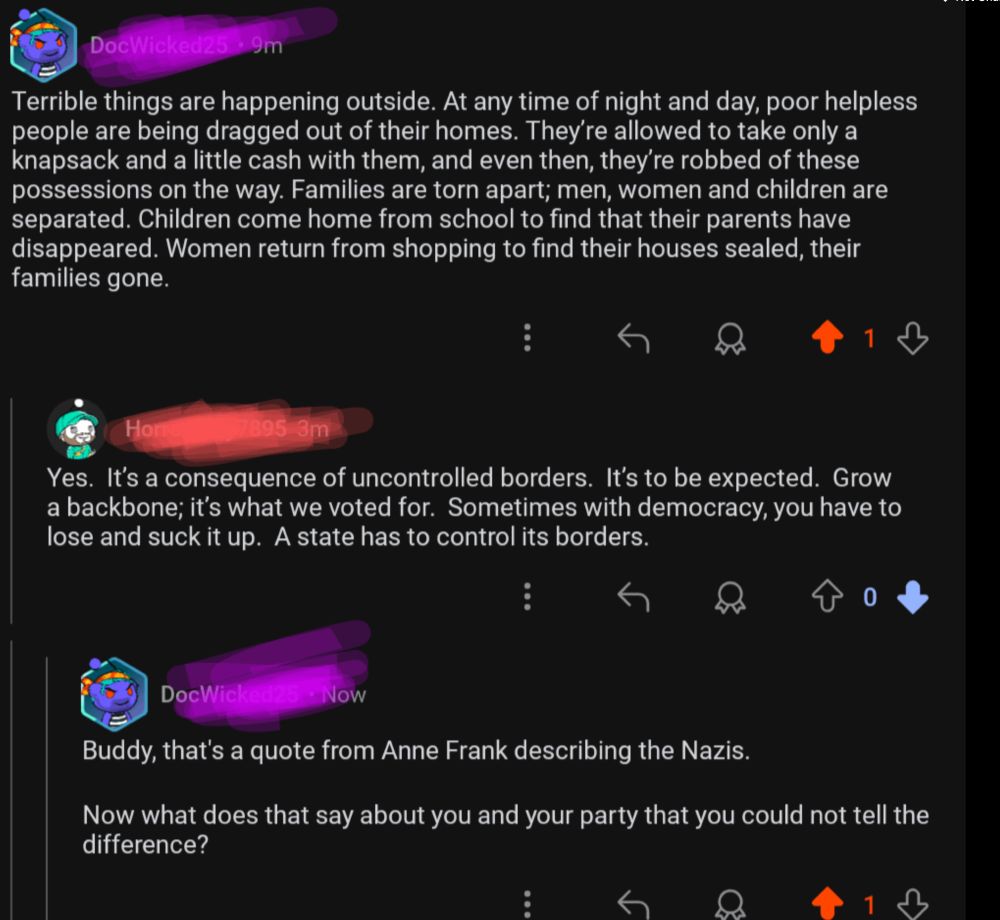

01.02.2025 20:42 — 👍 0 🔁 0 💬 2 📌 0Trump is a One-Dimensional Negotiator

I'm going to get a little wonky and write about Donald Trump and negotiations. For those who don't know, I'm an adjunct professor at Indiana University - Robert H. McKinney School of Law and I teach negotiations. Okay, here goes.

IMO, govt should offer a single account via NS&I that pays 2% tax free (to match its inflation target), with no limit on how much anyone can hold and no restriction on who can have an account

The central bank should pay the same on reserves.

And the Treasury should stop selling gilts

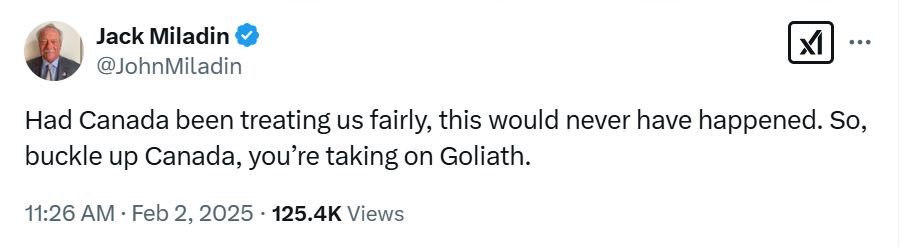

Maga Unmasked

31.01.2025 17:37 — 👍 352 🔁 126 💬 10 📌 12he gets that, but is also concerned that the US could run out of money........

31.01.2025 09:38 — 👍 1 🔁 0 💬 0 📌 0it's always about the availability of real resources, never about 'finding the money'.

If the resources needed to build runways, houses, transmission grid etc are currently employed, they will need o be made unemployed. That's what tax is really for.

and to think that just over a decade ago they were demolishing half finished 'ghost housing estates'. because there was not enough demand for those houses.

28.01.2025 10:59 — 👍 1 🔁 0 💬 0 📌 0