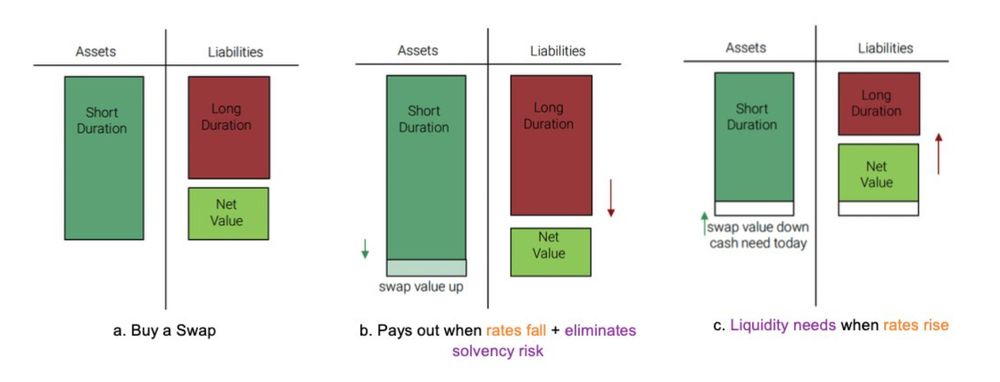

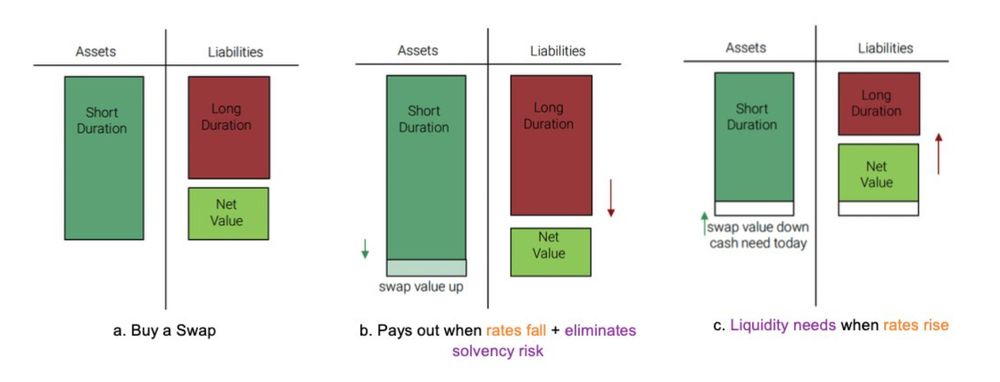

But consistent with our framework, the solvency of the pension fund sector improved during the liquidity crisis.

Here’s a link to the paper. Comments welcome!

jadhazell.github.io/website/LASH...

(11/11)

16.12.2024 12:02 — 👍 1 🔁 0 💬 0 📌 0

We show that institutions with ex- ante larger LASH risk sold substantially more bonds during the crisis. Bond sales exacerbated the crisis further by contributing to interest rates. (10/11)

16.12.2024 12:02 — 👍 0 🔁 0 💬 1 📌 0

3) When rates rise sharply, LASH risk leads to liquidity crises—i.e. the UK bond market crisis of September and October 2022. The crisis involved rising interest rates, margin calls, and bond sales by pension funds. (9/11)

16.12.2024 12:02 — 👍 1 🔁 0 💬 1 📌 0

2) Low interest rates cause LASH risk. In the time series, low interest rates associate with high LASH risk. In the cross section, institutions that are more exposed to falling rates take on more LASH risk. (8/11)

16.12.2024 12:02 — 👍 1 🔁 0 💬 1 📌 0

LASH risk is big: at the peak, a 100bps rise in interest rates would have generated liquidity needs close to the liquid asset holdings of the entire UK pension fund and insurance sector. (7/11)

16.12.2024 11:57 — 👍 1 🔁 0 💬 1 📌 0

We make three main contributions.

1) We show that non-banks take on LASH risk to hedge solvency risk. We measure LASH risk for pound sterling interest rate contracts held by UK non-banks, using amazing supervisory data. (6/11)

16.12.2024 11:57 — 👍 1 🔁 0 💬 1 📌 0

But when rates rise, the value of the swap falls, and the fund must pay liquid assets (“margin”) to their counterparty. The margin requirement is LASH risk, which materializes even as the solvency of the fund improves with rising rates. (5/11)

16.12.2024 11:57 — 👍 1 🔁 0 💬 1 📌 0

Imagine a pension fund with long-duration liabilities and shorter duration assets. Falling rates lowers solvency since liabilities rise more than assets. The fund can hedge this solvency risk using an interest rate swap, whose value rises when rates fall. (4/11)

16.12.2024 11:56 — 👍 1 🔁 0 💬 1 📌 0

Institutions take LASH risk when they hedge against losses, using strategies that require liquidity as solvency improves. LASH is different from most other forms of liquidity risk, which materialize when solvency gets worse. (3/11)

16.12.2024 11:56 — 👍 1 🔁 0 💬 1 📌 0

We’re motivated by recent liquidity crises, such as the pandemic crisis of Spring 2020 or the 2022 UK bond market crisis. We link these crises to Liquidity After Solvency Hedging or “LASH” risk. (2/11)

16.12.2024 11:56 — 👍 0 🔁 0 💬 1 📌 0

🚨 New paper🚨

Liquidity crises have become common in the non-bank financial sector. One reason is LASH risk.

With awesome coauthors Laura Alfaro, Saleem Bahaj, Robert Czech and Ioana Neamtu

#econsky

(1/11)

16.12.2024 11:56 — 👍 4 🔁 2 💬 1 📌 0

One more week to apply for our predoc program!

#econsky #econ_ra

12.12.2024 02:54 — 👍 4 🔁 2 💬 0 📌 0

Hi #econsky!

Macro at LSE is hiring pre docs for September 2025.

Come and work in the best city in the world, on cutting edge macro with me, Ethan Ilzetzki, Ricardo Reis, Matthias Doepke and Ben Moll.

jobs.lse.ac.uk/Vacancies/W/...

#econ_ra

20.11.2024 03:12 — 👍 12 🔁 6 💬 0 📌 1

Pediatric infectious disease doc | global health researcher | modelling disease burden and intervention coverage from local to global scales | #vaccines, #VPDs, #NTDs, #malaria, #anemia, #hemoglobinopathies, #geospatial analysis | he/him | opinions my own

Infectious disease modeller. Lecturer in stats at University of Bristol.

Assistant Professor NUS. Infectious diseases, virus evolution, AI for Public Good, Human Behaviour and Bayesian Inference

Fritz Family Postdoctoral fellow in Epidemiology at Georgetown University | infectious disease modeling.

My website: https://giuliapullano.weebly.com/

Lecturer and Eric and Wendy Schmidt AI in Science Fellow @mrc-outbreak.bsky.social @ Imperial College London. Mathematical modelling of malaria, COVID-19 & humanitarian response.

Phylo, dynamics, epidemiology, data sci, computational biology

University of Auckland

PhD candidate at Wageningen University and Research | Viral modeler 🦠🖥️ | Interested in anticipating future outbreaks of infectious diseases 🔮

Associate Professor at University of Washington, Seattle.

Demographer who studies Pop Health, Pop Environment, and Infectious disease dynamics. Data Visualization Enthusiast. 🇭🇹

Infectious disease modeller

Main interest in aborvirures

Public Health Analytics and Modeling fellow at CDC

Working at the dengue branch, San Juan, Puerto Rico

The network based at the University of Edinburgh for infectious disease researchers.

https://edinburgh-infectious-diseases.ed.ac.uk/

Infectious disease modeler. Interested in: social drivers of infectious disease, evolution of abx resistance, math models. He/him.

Postdoc @Cambridge_Uni doing infectious disease modelling | Interested in arboviral dynamics, immunity, climate & forecasting | Previously @LSHTM

R&D Scientist and epidemiologist

PhD student @ CMMID LSHTM | Field Epidemiologist FETP/EPIET c2016 | mathematical modelling, vaccines, electronic health records, outbreaks

Professor of Infectious Disease Dynamics at @lshtm.bsky.social. Developing methods for making sense of outbreak data. Outside of work trying to make sense of the rest of the world.

Disease ecologist, Cary Institute of Ecosystem Studies. Zoonotic disease, predictive analytics, machine learning, AI. www.hanlab.science.

Infectious disease modeller (MD PhD). Asst Prof at Saw Swee Hock School of Public Health, National University of Singapore / School of Tropical Medicine and Global Health, Nagasaki University

Twitter: @_akiraendo

Epidemiology, biophysics, data science & modelling. Working at Mahidol University, Thailand. Views are my own.

More info: https://www.modchang.me

PhD student in infectious disease epidemiology - Max Planck Institute for Infection Biology & Charité Berlin. Interested in vaccine-preventable diseases and mathematical modeling.

A research group at @mpiib.bsky.social, led by Matthieu Domenech de Cellès, focused on vaccines, interactions, and the seasonality of infectious diseases.

Website: https://www.mpiib-berlin.mpg.de/1953092/Infectious-Disease-Epidemiology