("GENinCode" or the "Company")

GENinCode up over 41% so far this morning on RNS that New York State has approved clinical test of CARDIO-inCode-score.

I last bought #GENI.L at 2.3p but am still down 50%.

Hoping for FDA approval of De Novo assessment in Q1. 2026 and for no more dilutive fundraises.

⚠️SPECULATIVE ⚠️

03.12.2025 08:41 — 👍 1 🔁 0 💬 0 📌 0

I like #BIG.L but Sara Murray seems very bitter so I'm expecting a depressed share price until issues resolved. Timing will be everything!

25.11.2025 11:40 — 👍 1 🔁 0 💬 0 📌 0

A venture capital fund on a tantalising discount

Simon Thompson: Sum-of-the-parts valuation is only three times the share price

Made heavy losses on Destiny Pharma when it delisted in 2024 and fell into administration.

Ever the optimist, I have taken a small holding in EMV Capital following it's deal to acquire Destiny's IP.

Now 52.5p, #EMVC.L featured in Simon Thompson's 2023 Bargain Shares at 64p.

Interesting company IMHO

25.11.2025 07:48 — 👍 2 🔁 0 💬 0 📌 0

⬆️14%. No Shield Therapeutics news but this published yesterday:

#STX.L “...demonstrates the hallmarks of a potential millionaire-maker penny stock: strong revenue acceleration, expanding market opportunities, and a path to profitability...

Shield Therapeutics is compelling."

⚠️Speculative⚠️

I hold.

24.11.2025 17:33 — 👍 2 🔁 0 💬 0 📌 0

Shield Therapeutics up 9.6% this morning on no news but many small transactions.

#STX.L now demonstrating healthy revenue growth each quarter.

There may be minor hiccups along the way but serious backward steps unlikely now, IMHO.

I hold.

24.11.2025 09:30 — 👍 0 🔁 0 💬 0 📌 1

GENinCode did raise funds in February with directors adding.

£8m raised in 14 months.

Downward trend as Y/E cash forecast low but #GENI.L CEO working hard to avoid another dilutive raise.

Continued growth, albeit not as fast as CEO would like.

Cavendish TP 11.5p.

⚠️ Speculative! ⚠️

I hold.

24.11.2025 08:06 — 👍 2 🔁 0 💬 0 📌 0

YouTube video by Investor Meet Company

SHIELD THERAPEUTICS PLC - Q3 Trading Update

Interesting to note in their recent Investormeet presentation Shield Therapeutics (#STX.L) CEO Anders Lundstrom had no concerns about potential USA tariffs as if / when they were implemented, they would be based on Accrufer's very low manufacturing costs.

26.10.2025 12:34 — 👍 1 🔁 0 💬 0 📌 0

I've held Shield Therapeutics since buying at 59p in June 2021, last buying at 2.7p in December 2024.

Still underwater but #STX.L now making good headway and the recent 15% quarter revenue increase is impressive - just not the 20% investors anticipated.

On track to be cash flow positive by year-end.

26.10.2025 11:48 — 👍 1 🔁 0 💬 1 📌 1

YouTube video by Vox Markets

The Exchange with Richard Staveley of Rockwood Strategic

Added more Kooth after Richard Staveley's recent interview.

SP low on contract loss speculation but #KOO.L is sticky.

RS sees California being renewed and enhanced.

Any new contracts could revive SP.

Beat 400 (inc Google) for California deal so could become bid target.

MCap £46m with £15m cash.

24.10.2025 12:09 — 👍 1 🔁 0 💬 0 📌 0

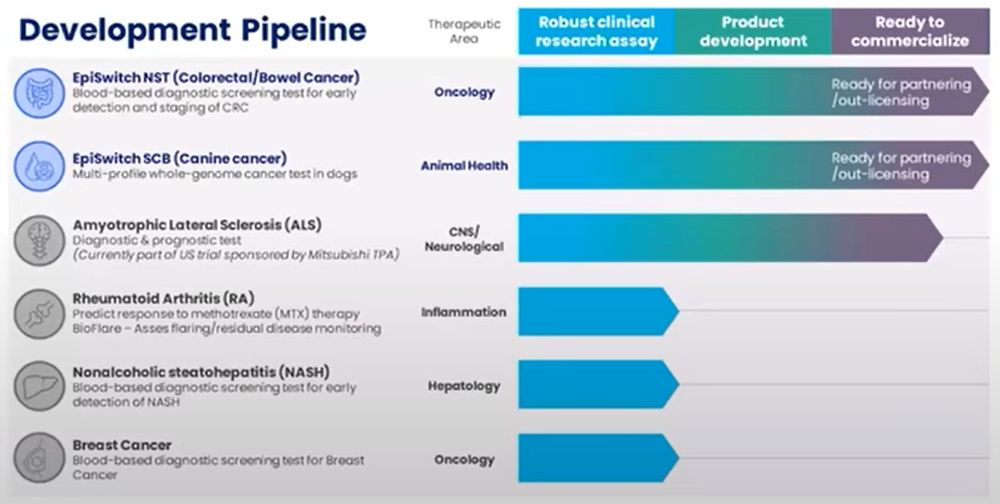

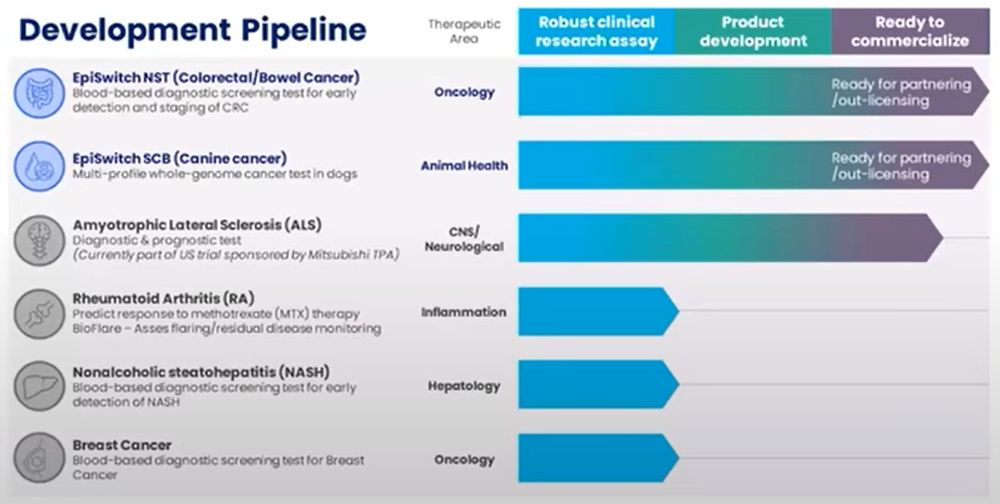

Oxford Biodynamics (#OBD.L) has now announced dilutive discounted fundraise.

Still has insufficient sales to self-finance, so expect further fundraises.

22.10.2025 12:23 — 👍 0 🔁 0 💬 0 📌 0

Oxford BioDynamics are up 121% today after Pfizer published news of successful use of EpiSwitch.

We always knew that it worked - what it doesn't do yet is sell well!

Recommend extreme caution here as #OBD.L needs cash so a dilutive discounted fundraise could well quickly follow.

I no longer hold.

15.07.2025 11:44 — 👍 3 🔁 0 💬 0 📌 1

London Stock Exchange | London Stock Exchange

null

This mornings RNS from GENinCode (#GENI.L) lifted the share price over 150% at one point - I was almost 10% up on my investment!

Share price has since drifted back and is now just over 90% up.

Be aware that the company needs funds and may well use a improved share price to raise.

I continue to hold.

23.01.2025 13:31 — 👍 1 🔁 0 💬 0 📌 1

Paul Hill discusses / pumps (!) his new IXICO purchase with Paul Scott.

#IXI.L share price now 8.75p - below last month's fundraise at 9.5p.

New significant shareholders are encouraging.

2024 accounts due early December.

Increased losses forecast so could drop further.

I hold and am waiting to add.

16.11.2024 10:16 — 👍 0 🔁 0 💬 0 📌 0

Absolutely agree.

#DUKE.L had a bit of a nightmare during COVID when a tourist boat company investee went under.

When #TIME.L stopped paying dividends in order to reinvestment funds, their share price shot up.

15.11.2024 13:11 — 👍 1 🔁 0 💬 1 📌 0

No idea!

The high dividend attracts investors who are than tapped for more funds. And then repeat.

Crazy.

But with the share price drop I would suggest that investors are becoming wary / disillusioned and that #DUKE.L may need to review.

Investors Champion are also dubious of its business model.

15.11.2024 13:04 — 👍 1 🔁 0 💬 0 📌 0

Another fundraise by Duke Capital.

Perhaps if #DUKE.L cut it's dividend it might be able to use it's own cash.

Seems mad to pay a high dividend and then ask the investors for it back again.

Share price has now fallen to a three year low.

Used to hold but not tempted back.

Just doesn't work for me.

15.11.2024 12:35 — 👍 5 🔁 0 💬 1 📌 0

Well done!

11.11.2024 15:57 — 👍 1 🔁 0 💬 0 📌 0

Thought I'd dodged a bullet when I sold Aquis in June for 17% profit and the share price tumbled.

I sold because I was unsure that market volumes would recover and I have market exposure through my holding of Jarvis Securities #JIM.L.

Today #AQX.L recommended offer at 727p.

Congratulations holders!

11.11.2024 10:20 — 👍 4 🔁 0 💬 1 📌 0

YouTube video by Oxford Metrics

Capital Markets Day 2024 presentation

Oxford Metrics' acquisitions seem to be shrewd add-ons at fair prices.

#OMG.L seems to be on track to achieve their five year growth plan targets.

I see this as a temporary set-back and have recently bought in.

Worth watching their Capital Markets day here:

www.youtube.com/watch?v=wClU...

07.11.2024 17:02 — 👍 2 🔁 0 💬 1 📌 0

I used to hold Argentex #AGFX.L and still follow with interest.

I find their move to "alternative banking" worrying as it is a notoriously expensive space to enter and just as difficult to make money in.

Far too early for me to buy in again as would need to see solid proof this is successful first.

12.10.2024 07:32 — 👍 0 🔁 0 💬 0 📌 0

London Stock Exchange | London Stock Exchange

null

Yet another hot air RNS from OptiBiotix #OPTI.L

Yes, we know that it works, what we want is to see that it SELLS!

And, at the moment, I can't see that it does.

[A still frustrated ex-shareholder!]

www.londonstockexchange.com/news-article...

10.10.2024 09:44 — 👍 2 🔁 0 💬 0 📌 0

I find that the share price will tend to drop below raise price soon afterwards for the majority of companies - within my portfolio anyway!

10.10.2024 07:15 — 👍 0 🔁 0 💬 0 📌 0

Good to see Ixico's share price up 10% yesterday after the successful fundraise.

I'm not adding just yet though as I suspect the #IXI.L 2024 results will bring the share price down below fundraise.

10.10.2024 06:41 — 👍 0 🔁 0 💬 1 📌 1

Bought back into Oxford BioDynamics in April and have added further.

The #OBD.L June HY presentation illustrated an impressive product pipeline with the CEO "very bullish" that a non-dilutive partnering deal would be forthcoming by the end of the year.

Sales slow but novel IP attractive.

Speculative

10.10.2024 06:35 — 👍 3 🔁 0 💬 0 📌 0

I'm nursing a chunky loss too.

A raise price above previous closing is quite an achievement, particularly in this market.

The raise was anticipated so this may trigger an upward move but, really, I'd like to see some new deals coming through and potential for a significant contract before adding.

09.10.2024 06:04 — 👍 2 🔁 0 💬 0 📌 0

Pleased to see that Ixico's fundraise is above yesterday's closing price and that #IXI directors are taking part.

Will add in time but content to wait for the moment as I find often shares will drop below the raise price.

I hold.

09.10.2024 05:31 — 👍 3 🔁 0 💬 1 📌 1

IC036 So Many Bonkers Bargains Right Now – How Do We Keep Up

Investor's Champion Podcast · Episode

I do enjoy Investor's Champion podcasts.

This week two favourites are noted as Bonkers Bargains:

Time Finance (#TIME.L) which I pitched on StockSlam in January 2022 at 26p (now 59.5p) now sold.

Alumasc (#ALU.L) which I bought in June - up 46% - which still looks great value, IMHO (and IC agrees!)

07.10.2024 06:04 — 👍 3 🔁 0 💬 1 📌 0

Investors Champion on James Halstead (#JHD.L):

"The forecast dividend of 8.8 pence for 2025 is a dividend yield of 4.8% and, with cash building [£74.3m], management might also be contemplating a special dividend, as they have paid previously."

www.investorschampion.com/channel/blog...

02.10.2024 09:40 — 👍 0 🔁 0 💬 0 📌 0

Record pre-tax profit on slightly reduced revenue shows how on top of things #JHD are.

If it wasn't for the tax rate going from 20.5% to 25% and adding £2.6m to their tax bill, net profit would be a record too.

And close to 5% annual dividend.

01.10.2024 08:50 — 👍 0 🔁 0 💬 0 📌 0

UK based Investor. Primarily invests in UK small/midcaps. Life long learning ! Don’t follow anyone into buying/selling a stock, Do your own research.

Investing for 14+ years. Mistakes teach you more than successes, have fun along the way.

I am a Technology investment analyst and recovering Tech industry analyst. 35 years experience with investors, government and enterprise IT (but who is counting). Visit my Substack: The long and the short of IT

Private investor and a director of ShareSoc. My tweets and RTs are merely opinions, not investment advice. They are my personal opinions and NOT ShareSoc's.

• Intelligent Market News.

• The fully customisable, free-to-access information aggregation platform.

• Check it out FOR FREE → app.PiQSuite.com

• Proudly Partnered with Pepperstone

Financial economist musing on behavioural finance, behavioral economics, emotion, markets, risk, pensions, humans, & animals.

Professor of Finance, University of Toronto

Joint Sponsors, UPP

Board of Directors, UTAM & We Animals

http://www.lisakramer.com

City Editor, The Guardian - aka poking about in the money/power mix

Get in touch with tips: trucker3@pm.me

Writer, investor etc. Mostly lurking for now.

beddard.net

Small/Mid Caps investor/commentator

Private investor. Investment views, strategies, stocks held and actions taken based on personal financial goals for retirement. It should NOT be taken as advice. Long time twitter user https://x.com/SandyMidd ..... dipping my toe in BlueSky.

Small business owner & stock trader, I share set ups & other trading info. Plan the trade, trade the plan. Info & Education, not financial advice DYOR

Interested in investing and improving!

#BILN#IPF#ZTF#MTRO#MEGP#PAY#COST#GTLY#CPI#RFX#PTAL

CVO (Chief Visionary officer) behind mojostrat™ a new global incoherence recognition and interpretation advisory CFA. Mainly UK stocks and some global themes.

V occasional blogs here: https://medium.com/@mojomogoz

Financial journalist, broadcaster, and speaker. Seek the truth, find the truth, tell the truth. Unequivocally for free speech & press. Wilkie Collins expert too

Private investor in UK growth stocks:

#MGNS #MHA #SNX #ELIX #KLR #MKS #NXR #NCC #SOS #SGLN (iShares Gold ETF). Tweets and RTs are not investment advice.

A global leader in neuroscience imaging and biomarker analytics, using its proprietary AI-driven platform to help advance the treatment of neurological disorders and reduce the uncertainties associated with drug discovery, development and monitoring.

Private investor, UK small cap focus. Largest current holdings : #GAMA, #PZC, #CAV, #GCP, #RCH, #CHH, #AVG, #PMI, #TUNE, #CAU

Analysing financial stuff in the UK. Sometimes for Moneyweek, Sharepad or others.

Active all cap equity investor. High quality write-ups at SweetStocks.substack.com