The briefing includes an overview of the bill’s three substantive clauses, background information, reaction, and analysis of the potential impact of the bill

29.11.2024 12:44 — 👍 0 🔁 0 💬 0 📌 0

The front page of the Library briefing. It reads ‘National Insurance Contributions (Secondary Class 1 Contributions) Bill 2024-25, and a photo of the Treasury building in London

Yesterday we published a briefing on the upcoming employer National Insurance contributions Bill - second reading is next week ⬇️

commonslibrary.parliament.uk/research-bri...

29.11.2024 12:44 — 👍 0 🔁 1 💬 1 📌 0

Order Paper for 27 November 2024

Clauses + schedules that will be debate in committee of the whole house relate to:

- Capital gains tax and reliefs

- Energy profits levy

- VAT on private schools

- changes to stamp duty land tax (particularly the increase in the SDLT rate on purchases of additional dwellings)

See link below ⬇️

27.11.2024 15:34 — 👍 0 🔁 0 💬 0 📌 0

The government has also announced clauses that will be debated in committee of the whole house (essentially, clauses that parties want to discuss with enhanced scrutiny, where the Commons sits as a committee where all MPs are members of the committee

27.11.2024 15:34 — 👍 0 🔁 0 💬 1 📌 0

https://commonslibrary.parliament.uk/research-briefings/cbp-9384/

Since he’s not here my colleague David Torrance has just published a paper that’s the result of a year long exercise of trying to ‘map’ or rather identify and summarise all the various sources of the UK constitution.

He’s asked for feedback on any omissions/errors etc

t.co/dl1BC68Pc0

26.11.2024 14:55 — 👍 31 🔁 22 💬 2 📌 1

☀️

22.11.2024 12:47 — 👍 0 🔁 0 💬 0 📌 0

In the old days, it was traditional for the Leader of the Opposition to host a Christmas party for Commons Library staff, to show appreciation for our work. My first one, was also Tony Blair's first one, so I guess 1994. I remember Tony Blair seeming quite nervous at being introduced to us all...

21.11.2024 08:58 — 👍 0 🔁 1 💬 1 📌 0

GPs and care homes fear impact of National Insurance rise after Budget

The NHS is exempt from the rise in employer National Insurance contributions, but private providers are not.

Writing about national insurance and the changes announced in the Budget at the moment.

Worth noting that the NHS and the public sector are *not* exempted from the rise in employer NICs (like the article says) - instead the govt compensates them back for the extra cost

19.11.2024 09:33 — 👍 0 🔁 0 💬 0 📌 0

Reminder to check @metoffice.bsky.social’s forecast before cycling to work 👎

18.11.2024 23:24 — 👍 0 🔁 0 💬 0 📌 0

Just published an update to my briefing on stamp duty land tax (SDLT), outlining the changes announced at the Budget and implemented on 31 October ⬇️

commonslibrary.parliament.uk/research-bri...

18.11.2024 21:13 — 👍 2 🔁 0 💬 0 📌 0

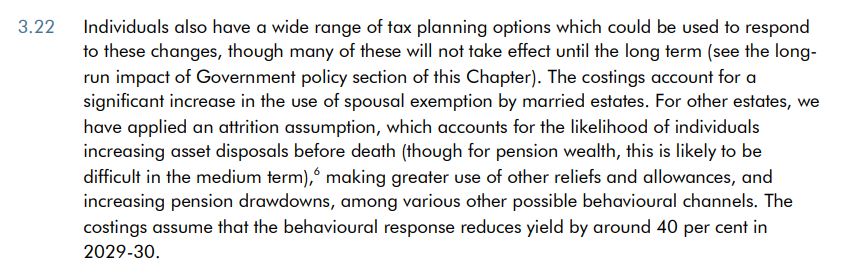

The OBR estimates the total yield of the reform will be reduced by 40% in 2029/30 because of behavioural responses (but this also includes responses to the change of the IHT treatment of pensions)

See obr.uk/docs/dlm_upl... [8/8]

18.11.2024 14:31 — 👍 0 🔁 0 💬 0 📌 0

- an increase in asset disposal before death

- an increase in the use of other reliefs [7/8]

18.11.2024 14:31 — 👍 0 🔁 0 💬 1 📌 0

is because behavioural responses are not taken into account here. The OBR outlined its estimated behavioural response on para 3.22, p58 of the Oct 2024 Economic and Fiscal Outlook. The OBR accounted for:

- a significant increase of the use of the spousal exemption

- ... [6/8]

18.11.2024 14:31 — 👍 0 🔁 0 💬 1 📌 0

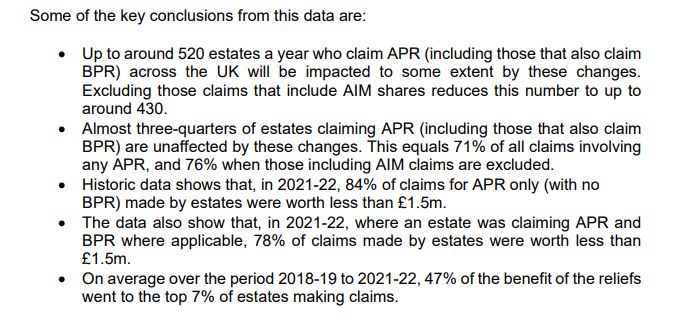

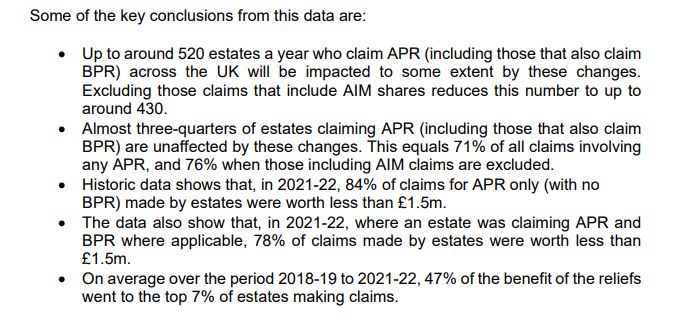

Looking at the reforms (changes to APR, BPR, and AIM shares), compared to a 'do-nothing' scenario, 2,000 more estates are expected to pay more tax. 520 of these are expected to contain APR claims.

CHX was clear the difference between this and the official costing certified by the OBR ... [5/8]

18.11.2024 14:31 — 👍 0 🔁 0 💬 1 📌 0

The letter adds that an expected 520 estates (claiming APR, including those that claim both APR and BPR) would be impacted by the reform per year. 71% of estates claiming APR (including BPR where both are claimed) would be unaffected (76% if estates claiming AIM shares are excluded) [4/8]

18.11.2024 14:31 — 👍 0 🔁 0 💬 1 📌 0

Reeves added that from existing data, around 25% of estates claiming for APR and BPR include a claim for AIM shares. She added that it's likely these estates are at least partly investment portfolios aiming to reduce IHT liabilities, rather than entire farming businesses [3/8]

18.11.2024 14:31 — 👍 0 🔁 0 💬 1 📌 0

The Chancellor explained the apparent discrepancy between HMRC and Defra data. Broadly, it is hard to estimate inheritance tax liabilities from data on the asset value of farms.

CHX said data on APR claims from previous years "is the correct way to understand an inheritance tax liability" [2/8]

18.11.2024 14:31 — 👍 0 🔁 0 💬 1 📌 0

The Chancellor has written to the Treasury Committee detailing the impact of the proposed changes to Agricultural Property Relief (APR) and Business Property Relief (BPR) [1/8] ⬇️

committees.parliament.uk/publications...

18.11.2024 14:31 — 👍 0 🔁 1 💬 1 📌 0

Second reading of the finance bill has been provisionally scheduled for 27 November ⬇️

15.11.2024 09:04 — 👍 1 🔁 0 💬 0 📌 0

The new alcohol duty system https://commonslibrary.parliament.uk/research-briefings/cbp-9765/

07.11.2024 23:20 — 👍 1 🔁 1 💬 0 📌 0

VAT on private school fees https://commonslibrary.parliament.uk/research-briefings/cbp-10125/

11.11.2024 13:40 — 👍 0 🔁 2 💬 0 📌 0

Children’s author, mediocre footballer, internet transgender || he/him #COYG

Where elected MPs represent the public, legislate, and scrutinise the Government. Find out more about their work and how Parliament happens.

The Library is my refuge from Fascism.

Daniel Nichanian. Editor in chief of @boltsmag.org (follow us!). Elections, (local) politics, voting rights, criminal justice, and drag race.

Democracy is like exercise. You can't do it once every four years and complain when you don't see results.

Pro-edit button. "Soros-backed." He/him.

Linktree.com/joekatz45.

visual investigations @nytimes / sanjana.varghese@nytimes.com

The Journal of Tax Administration is a peer-reviewed, open access journal about tax administration around the world. A joint venture between the University of Exeter Business School and the Chartered Institute of Taxation. www.jota.website

Oh god not again (📺🎬: ITG, 📚: Curtis Brown)

Just to let you know, there are many, many recipes waiting for you on www.nigella.com

Black Sky Thinking since 2008.

Help support independent cultural journalism & get perks by becoming a tQ subscriber here: https://steadyhq.com/thequietus

UK political historian, lecturer and writer;

Co-founder of the Centre for Opposition Studies.

Cake, campery & historical/constitutional trivia. 🍰🏳️🌈 📖 🇬🇧

Website: www.nigelfletcher.org

Subscribe to my newsletter:

https://nigelfletcher.substack.com

Senior Lecturer in Politics, teaching and writing about politics, ideology and pro-wrestling, with a bit of Wales 🏴 when I can. https://www.davidsmoon.co.uk

House of Commons Library researcher: poverty, incomes, and labour market statistics

Head of Advocacy at Patriotic Millionaires UK. These views and tweets are all mine.

🌹Staffer for a Labour MP

🌹Former UK Labour Organiser

🌎 Fellow RGS_IBG

🇩🇪🇬🇧 2023 Young Königswinter Alumni

*Views My Own | UTC 🔴🔵

Former research assistant @instituteforgov

Senior researcher/ Learning and development manager at Institute for Government.

All things parliament and government.

PhD in modern US/UK history.

Sport fan.

Parliament's magazine, published bi-weekly when Parliament is in session. Learn more: https://www.politicshome.com/house-magazine.htm

The United Kingdom

Constitutional Law Association.

The UK's leading research centre on constitutional change, covering parliament, government, democracy, elections and more.

Sign up to hear about our blog posts, events and publications 👉 https://www.ucl.ac.uk/constitution-unit/mailing-list.