Huge executive pay packages are a prime driver of income inequality.

Shareholders and the public deserve to know about how CEOs are compensated, but new SEC leadership seems to think otherwise.

itep.org/excessive-ce...

@itep.org.bsky.social

Informing the debate on tax policy nationwide with research and data-driven solutions. Visit www.itep.org to find our work. More info: linktr.ee/_itep

Huge executive pay packages are a prime driver of income inequality.

Shareholders and the public deserve to know about how CEOs are compensated, but new SEC leadership seems to think otherwise.

itep.org/excessive-ce...

Several states have sales tax holidays this weekend.

They look like relief for low- and middle-income families, but they're poorly targeted, easy to exploit, and offer little lasting benefit.

Direct File saved users an average of $160 in filing fees and made it easier for families to claim tax credits like the EITC and CTC.

Despite strong results from its pilot year, the IRS says it's "gone."

Good tax policy means supporting the families who need it most.

This year, 9 states boosted their Child Tax Credits or EITCs, continuing the momentum we’ve seen around these credits in recent years.

Tariffs are driving up costs for working families.

They function like a consumption tax, with middle- and lower-income households paying more as a share of their income.

The Financial Accounting Standards Board now requires corporations to disclose detailed info about their U.S. & foreign taxes.

Most Americans support this, but House Republicans don't.

They want to withhold funding for this oversight board because of this new requirement. itep.org/corporate-ta...

Single filers can exclude up to $250,000 in capital gains on home sales, and that amount is doubled for married filers.

Eliminating the federal capital gains tax on home sales would be another move that primarily benefits wealthier Americans. www.forbes.com/sites/tylerr...

CBO says Trump's megabill will add $3.4 trillion to the deficit while stripping health care from 10 million people.

And for what? Massive tax cuts that will mostly flow to the richest Americans and foreign investors.

Sales tax holidays don’t fix regressive tax codes, they just offer a short break that anyone can benefit from – especially rich people.

Low- and middle-income families deserve real relief, not gimmicks.

When the IRS uses tax data to target immigrants, it makes many taxpaying undocumented immigrants fearful and suspicious of the tax collection agency. That reduces public revenues.

21.07.2025 16:57 — 👍 1 🔁 1 💬 0 📌 0

Property tax limits (like CA’s Prop 13)

🏡don’t make housing less expensive

😱sometimes make new housing MORE expensive

💲tend to favor wealthier ppl and harm less wealthy ppl

🔨take a hammer to local services

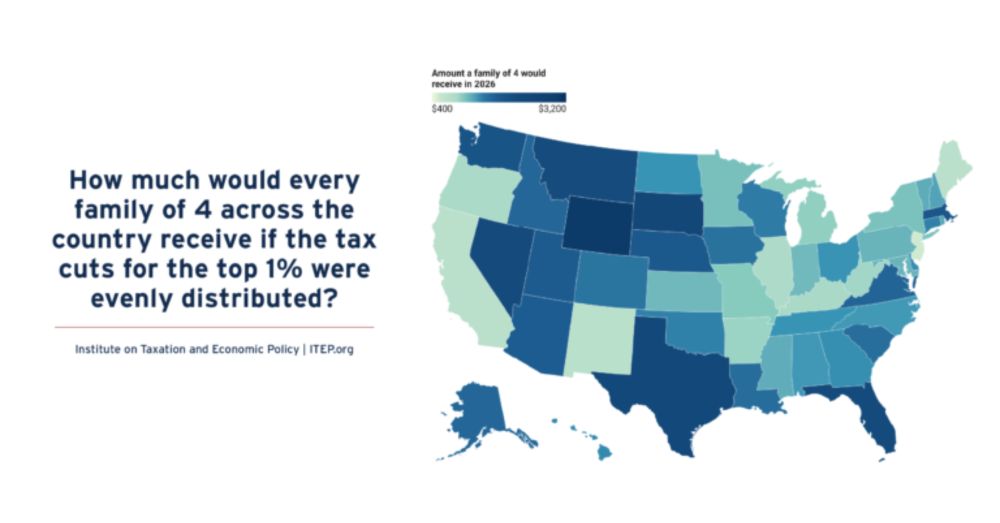

The megabill gives $117 billion in tax cuts to the wealthiest 1% in 2026.

If that money had been evenly divided among all Americans, every person would get $343 – or nearly $1,400 for a family of four.

Here’s what each state would receive:

itep.org/map-family-s...

18 states currently offer a "sales tax holiday," a brief tax break on select items like firearms or school supplies.

Costing nearly $1.3 billion in lost revenue, these tax breaks do little to address the bigger problems with regressive sales taxes.

itep.org/sales-tax-ho...

Gas taxes are used in every state to help fund transportation infrastructure.

But a traditional fixed rate loses value due to inflation and fuel efficiency.

That's why more states are modernizing this tax to keep pace with rising infrastructure costs.

itep.org/state-gas-ta...

The megabill gives $117 billion in tax cuts to the wealthiest 1% in 2026.

That amount is more than the cost of:

- Every MLB team

- Tuition, room and board for every college senior

- Every wedding in the U.S for an entire year

itep.org/10-crazy-com...

The White House is touting last month’s Treasury statement showing a budget surplus as a fiscal victory.

Are we on track to closing the budget gap?

The short answer: not even close.

itep.org/june-budget-...

50 years of property tax limits have done nothing to reduce the cost of housing.

Instead, they’ve favored wealthier homeowners and businesses over average Americans while reducing funds for local services.

There are better solutions available.

itep.org/effects-of-p...

“They’ve been claiming this for a long time, and there’s just very scant evidence to support it."

Our Local Policy Director Kamolika Das debunks the millionaire tax flight myth as more New Yorkers want to tax their rich.

www.usatoday.com/story/money/...

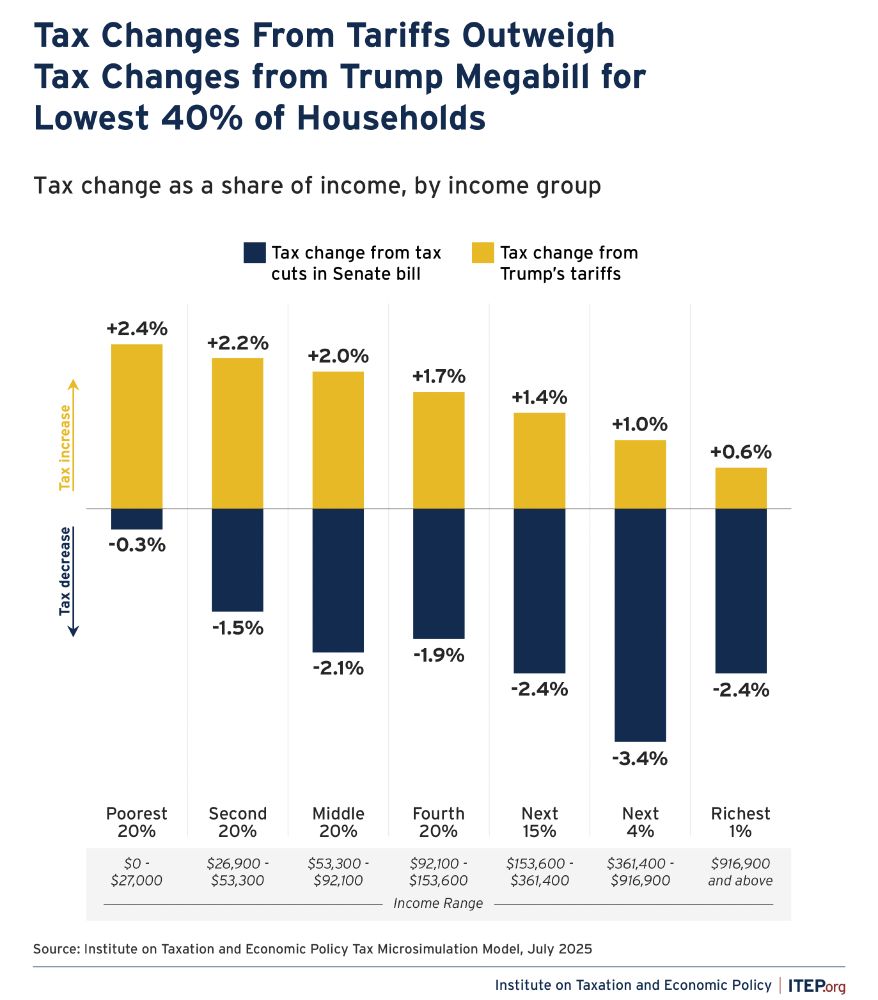

Trump’s tariffs could offset most of the megabill’s tax cuts for the bottom 80% of Americans.

For the bottom 40% of Americans, the tariffs would be greater than the tax cuts.

Higher prices will impact low- to middle-income households more than the wealthy.

Tax and social policies in the 20th century helped open doors for many working Americans, our director @amyhanauer.bsky.social explains.

But with their megabill, Republicans have retreated from many achievements in ways that will slam doors for the next generation.

itep.org/gop-megabill...

President Trump's megabill will reduce revenue by around $570 billion in 2026 and mainly help the rich.

But Congress and Trump could have spent less than half that on a tax bill that does far more for working- and middle-class households.

itep.org/there-were-f...

The car loan interest deduction in Trump's tax bill? A mirage.

For most buyers, it won't even offset a small price increase from his own tariffs.

edition.cnn.com/2025/07/09/b...

“SALT cap or no SALT cap, the mega bill overall is a bonanza for the rich in every state."

Even with the SALT cap, the wealthy still receive the biggest tax cuts from this bill, as our Steve Wamhoff explains.

www.washingtonpost.com/business/202...

Who benefits from the tax cuts in Trump's megabill?

More than 70% of these tax cuts will go to the richest 20% of Americans.

The richest 1% will receive a total of $117 billion in tax cuts in 2026 alone.

See our national and state estimates here:

itep.org/federal-tax-...

Trump signed into law an unprecedented 100% tax credit on donations to private school vouchers.

Here's what Congress ultimately settled on:

- Permanent

- No budget cap

- States must opt in

It remains triple the value of donating to any other charity.

www.nytimes.com/2025/07/03/u...

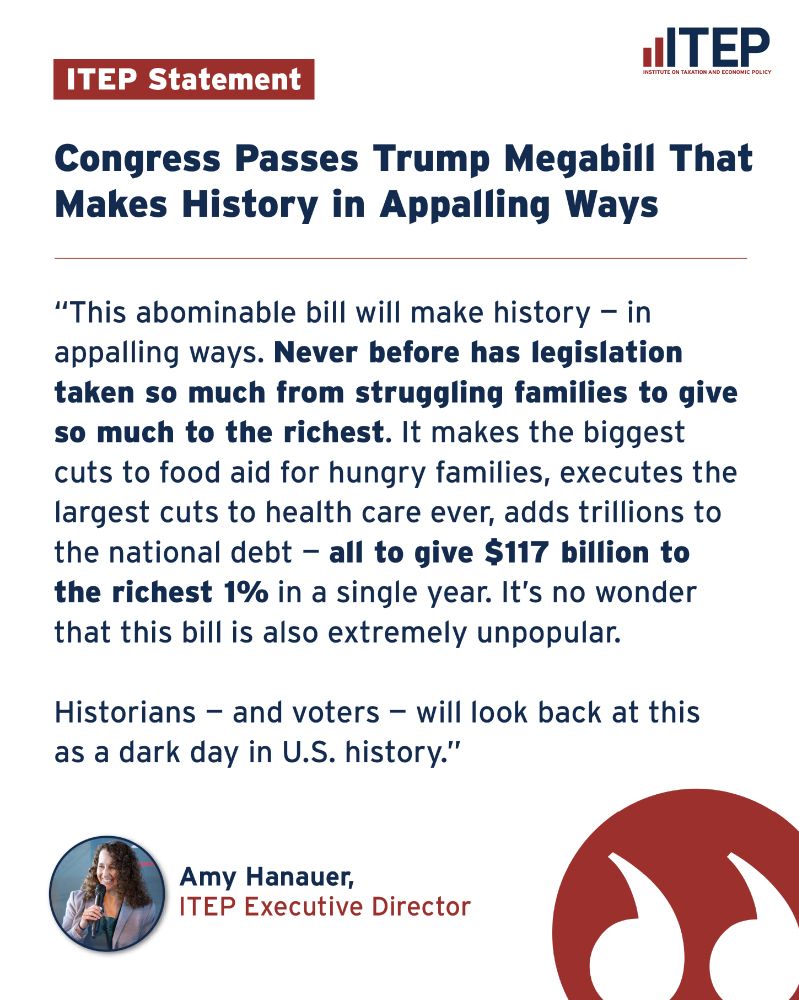

Congress has passed Trump's megabill. It will provide enormous tax cuts to the wealthiest people in this country while taking away health care and food assistance from millions of families.

This bill will only widen the already-huge chasm between the rich and the rest of America.

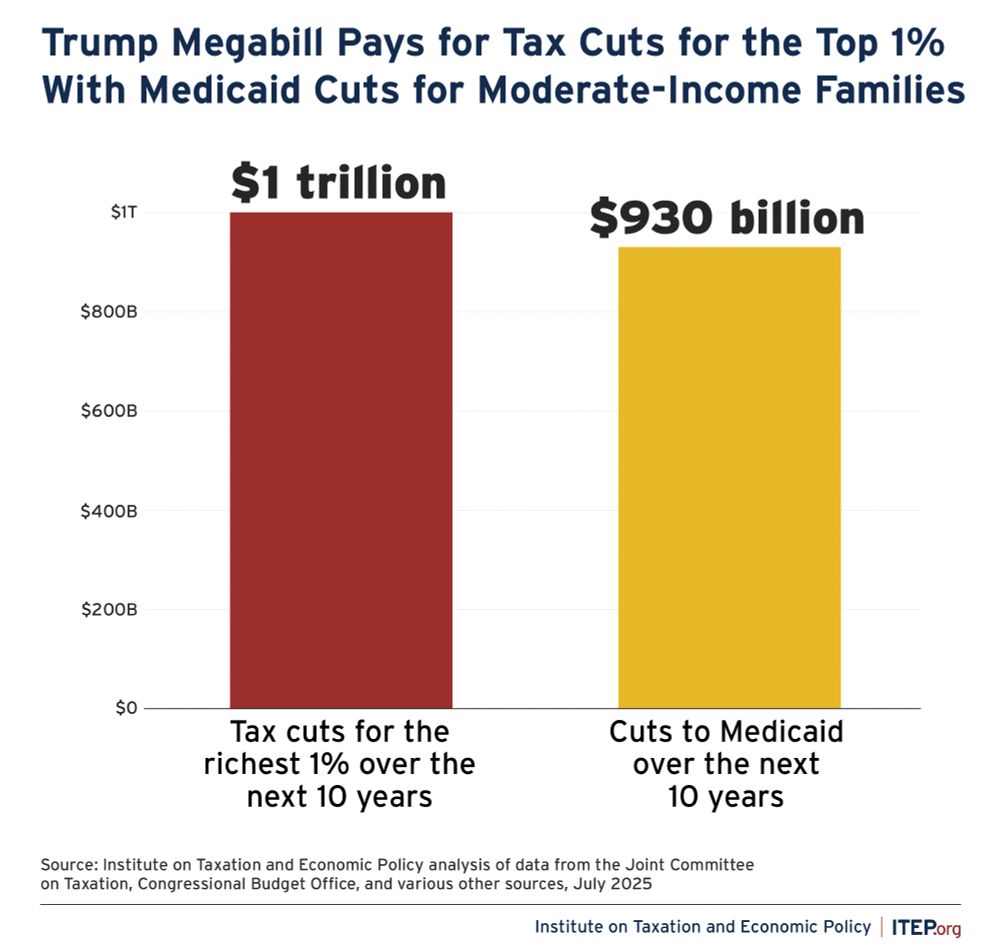

The centerpiece of Trump's megabill is a trillion-dollar tax cut to the wealthy, paid for by increasing the national debt and cutting public services.

03.07.2025 17:12 — 👍 9 🔁 5 💬 1 📌 1