And, Trump has just dug the hole deeper across-the-board which was evident yesterday morning with reports from the Conference Board of the collapse of consumer confidence in January. We’ll see what happens.

apnews.com/article/cons...

@chuckcbpp.bsky.social

And, Trump has just dug the hole deeper across-the-board which was evident yesterday morning with reports from the Conference Board of the collapse of consumer confidence in January. We’ll see what happens.

apnews.com/article/cons...

Moreover, the Trump megabill is already deeply unpopular with the public. This piece from last summer when the bill passed summed up the public’s early take: www.forbes.com/sites/taxnot...

28.01.2026 20:12 — 👍 2 🔁 1 💬 1 📌 0

Plus, this time around people also have to deal with economy-wide Trump tariffs which – yikes – are twice as big in the wrong direction than the tax changes compared to last year:

28.01.2026 20:11 — 👍 2 🔁 0 💬 1 📌 0

The original 2017 Trump tax cut – tilted to the rich like this one – was not popular and subsequent tax filing seasons did nothing to change that. Now consider that the new tax changes people are going to see on average are less than half of 2017 changes:

28.01.2026 20:10 — 👍 2 🔁 0 💬 1 📌 0Peoples’ excitement regarding their tax refunds might be less positive than some Republicans expect or hope, and for good reason. The tax change will be smaller than the 2017 Trump tax cuts and will only make up for about half the tariff hit for many.

28.01.2026 20:10 — 👍 3 🔁 2 💬 1 📌 0These IRS cuts are unfair to honest taxpayers - making it harder for them to file their returns and easier for dishonest people to cheat.

12.01.2026 15:45 — 👍 2 🔁 0 💬 1 📌 0Making the debate over how much to cut is exactly the opposite of what needs to happen -- the debate needs to be about how much to increase the IRS's budget as part of a much needed rebuild.

12.01.2026 15:45 — 👍 1 🔁 0 💬 1 📌 0Now, House Republicans, in particular, are targeting the base budget of IRS with Senate Democrats - and Senate Republicans to a degree seemingly - trying to blunt the damage

12.01.2026 15:44 — 👍 0 🔁 0 💬 1 📌 0

Republicans first targeted the mandatory funding -- going after enforcement in particular, despite the deep cuts in audits they had caused

12.01.2026 15:44 — 👍 0 🔁 0 💬 2 📌 0The Republicans spent a decade gutting the IRS. During the Biden Admin., a rebuild plan was enacted which envisioned two key pillars: robust base funding combined with supplemental mandatory funding

12.01.2026 15:43 — 👍 0 🔁 0 💬 1 📌 0

Congress agreed over the weekend to cut the IRS's base budget by a reported $1 billion. This would be a serious policy mistake at a time when the IRS remains severely depleted. Honest taxpayers deserve better.

12.01.2026 15:43 — 👍 24 🔁 19 💬 4 📌 1

The Trump Administration is doing the exact opposite, instead proposing deep cuts in nondefense R & – it’s hard to overstate how important it is for the Congress to reject this effort

www.cbpp.org/research/fed...

An underlying theme of the research is that the US should be investing more in nondefense R & D to boost future living standards.

10.10.2025 14:30 — 👍 1 🔁 1 💬 1 📌 0

CBO has now weighed in with a stunning analysis that highlights the economic power of investments in non-defense R & D:

www.cbo.gov/system/files...

While this connection has long been recognized, it has been difficult to quantify. Recent exciting research from @A_Fieldhouse, Karel Mertens, @ArnaudDyèvre, & others take a key step forward in connecting the investments to productivity growth, eg:

www.dallasfed.org/~/media/docu...

Investments in non-defense R & D have long been a critical component of the govt-university-private sector US innovation machine

stacker.com/stories/busi...

New Paper:

CBO finds $1 invested in federal non-defense R & D yields $11.50 over 30 yrs, i.e. wow

Meanwhile, the Trump Admin proposes a 21% cut in non-defense R & D funding– while targeting top universities– posing a threat to future living standards

www.cbpp.org/research/fed...

Alarming news this morning that Social Security head Frank Bisignano has been named “CEO” of IRS, a move that raises 3 major concerns:

www.wsj.com/politics/pol...

The Administration acknowledged that it will stop the survey that measures food insecurity, just as tariffs push up food prices and the deep cuts to food assistance enacted in July start to take effect. Congress must intervene to save these vital data. www.wsj.com/economy/trum...

20.09.2025 23:00 — 👍 62 🔁 45 💬 2 📌 7

Via @jeffstein.bsky.social @washingtonpost.com anti-tax interests want the Trump IRS to give an unlawful tax cut to wealthy people by executive fiat.

Just the tip of one of two big icebergs of tax cuts for special interests coming for the tax system. www.washingtonpost.com/business/202...

This suggests that Republicans may add yet another deeply harmful health care cut to the Senate bill – a cut that would take health coverage away from even more people, shift massive, unaffordable costs to states, & could even lead some states to end their #Medicaid expansion.

23.06.2025 17:52 — 👍 30 🔁 36 💬 3 📌 2Meanwhile, House Republicans are doing nothing about the Trump tariffs & going out of their way to deny any of their Child Tax Credit increase to 17 million kids, many of whose parents likely shop at Walmart- families they voted to help last year, but not now when it counts- why?

15.05.2025 12:54 — 👍 5 🔁 2 💬 0 📌 0The IRS has the fewest auditors who have expertise to audit sophisticated tax returns — since the 1950s

15.05.2025 12:53 — 👍 4 🔁 1 💬 0 📌 0For those who care about the Child Tax Credit - this from my colleague Kris Cox is a must read:

12.05.2025 23:54 — 👍 4 🔁 3 💬 0 📌 1This is an upside-down plan that walks away from campaign promises to serve those at the margins of the economy.

12.05.2025 23:47 — 👍 10 🔁 5 💬 0 📌 0The tax cuts will be partly offset by taking away/cutting food assistance, health coverage, income assistance, & college aid, making it harder for people to afford their basic needs and limiting opportunity.

12.05.2025 23:46 — 👍 5 🔁 3 💬 1 📌 0Meanwhile, the Ways and Means bill does nothing about the elephant that is going to be in their hearing room on Tuesday: the Trump tariffs --- which would erase much of the small working-class gains from their skewed tax bill while risking recession.

12.05.2025 23:46 — 👍 5 🔁 3 💬 1 📌 0And for all of the feigned concern about budget deficits, the House bill likely costs hundreds of billions more than a full extension of the already bloated 2017 tax law. (More to come when JCT scores are released.) The ultimate cost would be much higher without budget gimmicks.

12.05.2025 23:46 — 👍 8 🔁 4 💬 1 📌 0

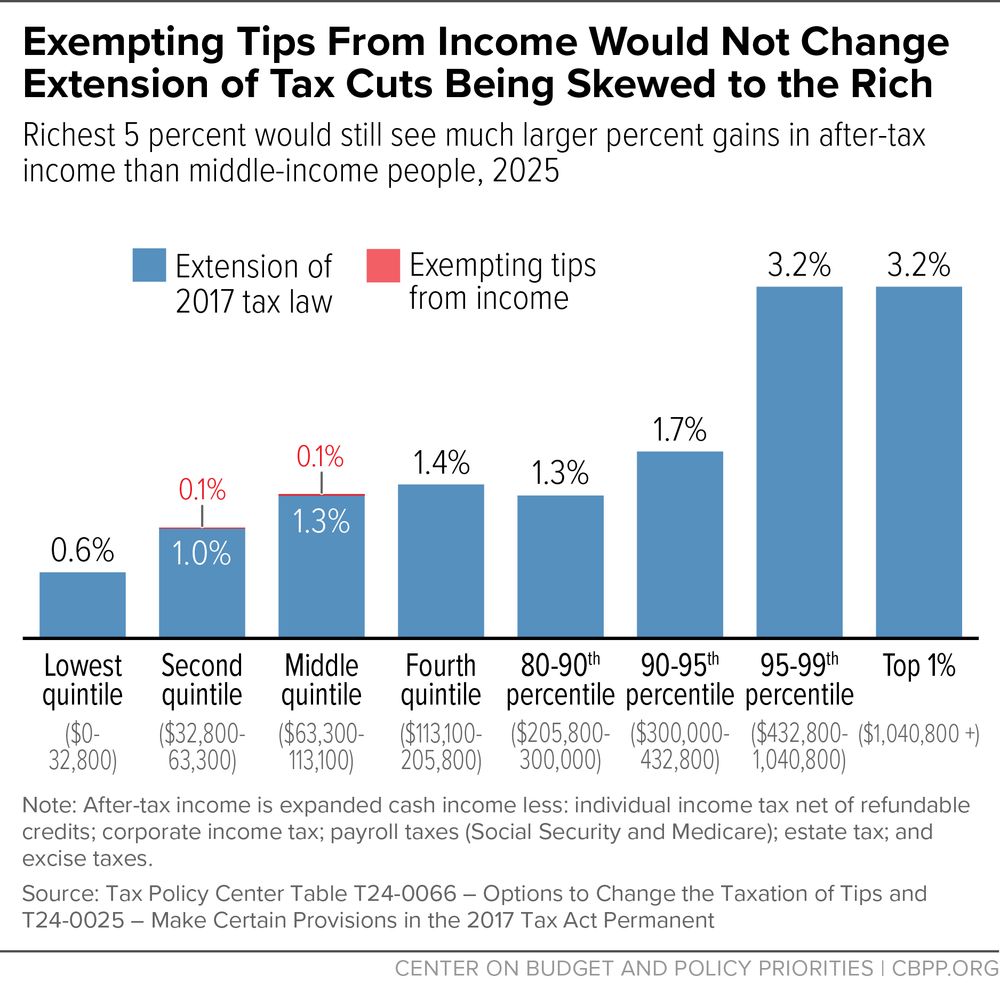

No tax on tips barely registers b/c it affects a tiny share of workers. (Chart is from an older bill but same story here.) And deductions for overtime & seniors add to the cost but don’t fundamentally change the story either (& leave out lower income filers).

12.05.2025 23:45 — 👍 6 🔁 5 💬 1 📌 1And none of the much-touted new tax exemptions change the picture.

12.05.2025 23:45 — 👍 10 🔁 5 💬 1 📌 0