Would take only one or two large state tax disputes like that get to $160M for high-net-worth/business owner types?

31.10.2025 14:51 — 👍 0 🔁 0 💬 1 📌 0

Could those be refunds related to pre-2018 years? Like you paid state tax, challenged the state tax calculation and then in 2019 or 2022 you received the money?

31.10.2025 14:48 — 👍 0 🔁 0 💬 1 📌 0

It's not quite like pop quiz level who-did-what polling, but @s-stantcheva.bsky.social does interesting survey research work in this area.

29.10.2025 18:04 — 👍 0 🔁 0 💬 0 📌 0

How to Squeeze the Most From the New SALT Cap

Taxpayers can act now to make the most of an increase in state and local tax deductions when they file 2025 taxes in the spring.

The SALT cap is now $40,000, but it shrinks very quickly once income exceeds $500k. All-in marginal tax rates are over 50% in that range in some states.

We go through some key tax-planning ideas:

www.wsj.com/personal-fin...

27.10.2025 14:09 — 👍 0 🔁 0 💬 0 📌 0

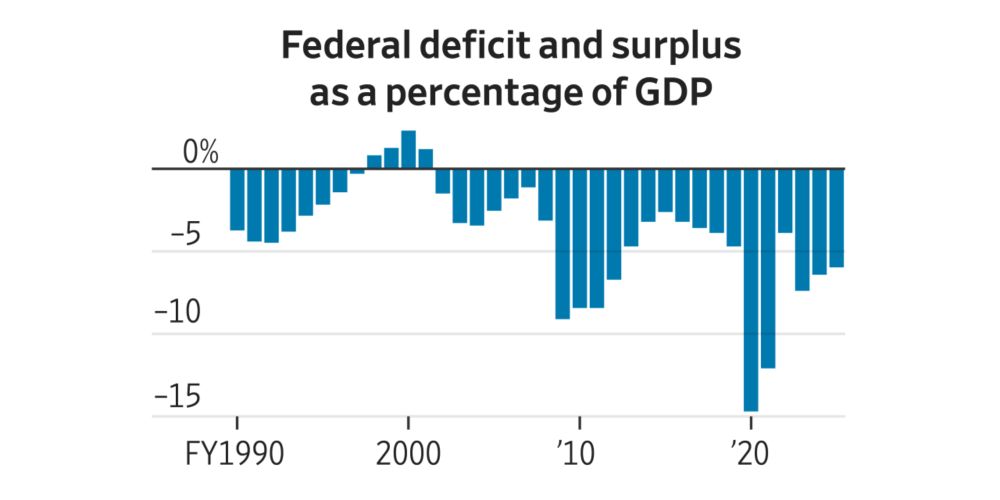

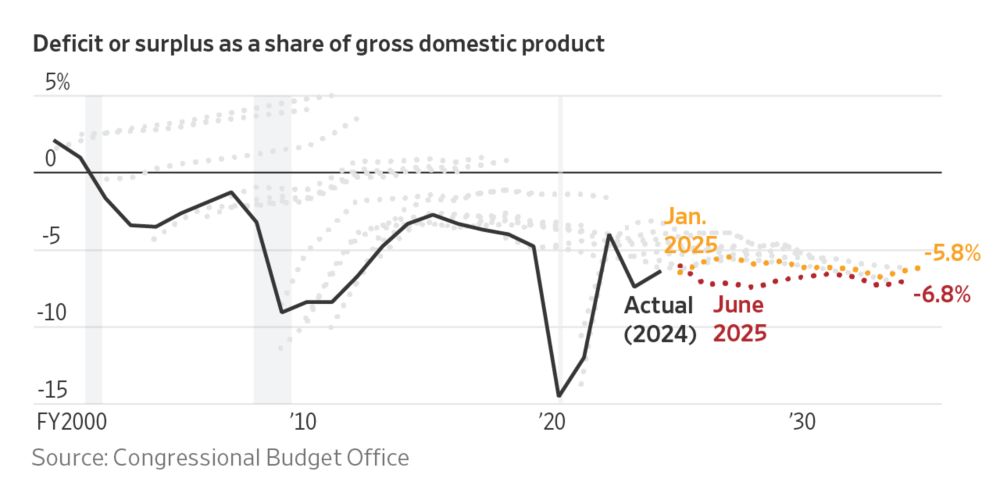

Tariffs Are Way Up. Interest on Debt Tops $1 Trillion. And DOGE Didn’t Do Much.

The books have closed on the U.S. government’s fiscal 2025. Here’s what has changed about the federal budget—and what hasn’t.

Tariffs brought in record revenue in fiscal year 2025 for the U.S. government. But how much did that change the overall picture? Five takeaways from @richardrubindc.bsky.social and me today on what has changed about the federal budget—and what hasn’t. www.wsj.com/economy/tari...

09.10.2025 13:46 — 👍 1 🔁 1 💬 0 📌 0

except this time it's the blue jays instead of the expos.

09.10.2025 13:04 — 👍 1 🔁 0 💬 0 📌 0

Some Democrats Want to Upsize Trump’s New Tax Cuts

Bills try to tap into economic populism and expand breaks for tipped employees, overtime and seniors.

New from me today: Democratic-backed tax bills introduced since OBBBA enactment have called for expanding some of Trump's "no tax on" policies.

It's a nod to their popularity -- and an attempt to highlight the new law's limits.

www.wsj.com/politics/pol...

01.10.2025 13:30 — 👍 0 🔁 0 💬 0 📌 0

How the New Tax Law Can Drive Your Bill to $0

It’s easier for some middle-income Americans to eliminate their tax bills without arcane strategies.

If you fall into one of the new law's preferred groups, you can go quite a way up the income scale before you have to pay federal income tax.

We visualized a few examples:

www.wsj.com/personal-fin...

29.09.2025 19:22 — 👍 1 🔁 0 💬 0 📌 0

That is a very House Guy use of "other office" instead of "higher office."

11.09.2025 16:52 — 👍 5 🔁 1 💬 1 📌 0

The Tax That Billionaires Actually Pay

Nearly 40% of taxes at the very top come through the corporate income levy, study says.

New from me today: What tax do billionaires pay?

The corporate tax, which is a crucial component of the US revenue system at the very top of the income distribution, according to a new study.

www.wsj.com/personal-fin...

25.08.2025 14:16 — 👍 5 🔁 3 💬 0 📌 2

Who Gets ‘No Tax on Overtime’? It’s Messy.

Employers and workers start grappling with limited scope of new tax deduction

New from me:

The "no tax on overtime" deduction is big, popular -- and a little messy.

Employers and workers are starting to grapple with the rules for who qualifies and who doesn't.

www.wsj.com/politics/pol...

31.07.2025 13:19 — 👍 4 🔁 1 💬 0 📌 0

Trump Tax Megalaw Upends Charitable Giving

Nonprofits, already under strain, face “mixed bag” from the law’s changes to giving incentives.

New from us today: The tax law made five separate changes that will affect incentives for charitable giving.

How will that all shake out?

www.wsj.com/politics/pol...

30.07.2025 12:50 — 👍 1 🔁 0 💬 0 📌 0

IG update: As of May, IRS workforce was down 25% from this year's 103,000 starting point.

Pretty even spread over job types, including a 26% decline in revenue agents (auditors).

Here are all the details:

www.tigta.gov/sites/defaul...

22.07.2025 13:48 — 👍 2 🔁 2 💬 0 📌 1

CBO current policy (CP) score is useful for the pattern. You see expanded tax cuts happen first (deficits up against CP by $597B in 26-29). Those expire and spending cuts come ($936B deficit reduction against CP in 30-34).

Unless Congress extends "no tax on" & cancels spending cuts.

21.07.2025 18:52 — 👍 0 🔁 0 💬 0 📌 0

but for a lot of these, it's a state choice about whether to conform. Arizona starts with federal AGI so the legislature can decide whether to allow state-level tips/overtime deductions.

weird that SALT would have that effect given that you can't deduct state taxes from state taxes?

17.07.2025 17:19 — 👍 0 🔁 0 💬 1 📌 0

GOP Reshapes Opportunity Zones to Target Trump Country

New tax-and-spending law expands benefits for investments in sparsely populated regions.

New from us: The tax law retools Opportunity Zones, trying to push more money into rural areas largely left behind by a program for left-behind areas.

www.wsj.com/politics/pol...

17.07.2025 13:28 — 👍 0 🔁 0 💬 0 📌 0

So post-enactment, the current policy baseline is no longer current policy.

Are we calling it:

--Baseline formerly known as current policy

--The then-current policy baseline

--Prior policy baseline

None of those are particularly fun and/or clear.

15.07.2025 15:50 — 👍 2 🔁 1 💬 0 📌 1

FWIW, Sen. Mullin said this week that he didn't view the PTET issue as tied to the SALT discussions with House members that he's been having.

25.06.2025 13:27 — 👍 1 🔁 0 💬 1 📌 0

GOP Senators’ Demands Push Megabill Price Tag Up

Stances on Medicaid, clean energy and tax cuts complicate passage of President Trump’s agenda.

There's noise about trying to do more spending cuts in the Senate bill. But addressing many of the senators' concerns--Medicaid cuts, IRA phaseouts, tax-cut permanence--require more money to avoid even bigger deficit increases.

My latest on the $$ squeeze in the Senate:

www.wsj.com/politics/pol...

04.06.2025 13:28 — 👍 2 🔁 0 💬 0 📌 0

Editor-in-chief, Votebeat. Always following the money. https://www.votebeat.org/

Co-Founder & CEO of Artemis Ward, a strategy-driven creative agency.

www.artemisward.com

Visiting Fellow, @brookings.edu & @hamiltonproject.org; founder and president @centeronbudget.bsky.social 1981-2020

Wrangler of words and people.

Boulder > Mikkeli > Berkeley > Göttingen > Berkeley > London > NYC > DC > San Mateo > Tokyo > Belmont > Boulder

christinechen.com

I work for readers as the New York Times money scribe. Author of "The Price You Pay for College," teacher of a course about merit scholarships (meritaidcourse.com), Brooklyn now but forever Chicago. He/We/Abba. Gratitude and rage.

Economist at Joint Committee on Taxation

Kopple Family Professor, NYU Law. Faculty Director @taxlawcenter.org. Former Assistant Secretary for Tax Policy at Treasury; Deputy Director, National Economic Council; Chief Tax Counsel, Senate Finance Committee.

Established in 1905, The Chronicle is the independent source for Duke news run by students.

Sr. Fellow @ManhattanInst. Past: Sen. Portman chief economist (2011-17), DC think tanker (2001-11), budget policy @ 4 prez campaigns. Independent. Formerly Brian Riedl. Views mine.🏳️🌈

Professor, Yale Law School & Yale School of Management; President @budgetlab.bsky.social; Contributing columnist @postopinions.bsky.social

Former Counselor at Treasury, Professor Penn Law & Wharton

https://www.natashasarin.com/

Senior legal affairs reporter at POLITICO with a focus on democracy, the balance of power and the clash between the Trump administration and courts.

Tax lawyer, sports fan, podcasting @howtaxworks.bsky.social. I accept bobbleheads as payment. Not legal advice; views are mine, not my employer's. He/him.

Director of the Economic Program at Third Way. Former Senate Budget Committee Staffer. Budget process nerd. How can I help?

Economist working on topics in public finance, labor, corporate finance, household finance, and adjacent areas. Views are my own, not my employer's. My hands and feet are mangoes.

https://www.andrewwhitten.com

ProPublica reporter. Email tips/comments/complaints: justin@propublica.org

Signal: https://www.propublica.org/people/justin-elliott/

More: justinelliott.co

Professor of Econ and Intl affairs at GW

Former: Under Secretary of Intl Affairs at Treasury, Director of the Hamilton Project at Brookings, Member at WH CEA, Senior /chief economist at CEA.

Former head of Obama Auto Task Force. Wall Street financier. Contributing Writer to NY Times Op-Ed. Morning Joe Economic Analyst. 🌐

Political scientist by day (and night). GWU and Brookings. Co-editor, https://goodauthority.org/

sarahbinder.weebly.com

White House + econ policy @washingtonpost.com. Bad golfer. jacob.bogage@washpost.com. Signal: jacobbogage.87.

Investigative journalist, NOTUS contributing editor, fake arctic explorer, free agent placekicker, #BillsMafia. DaveLevinthal.com