This past Friday, the Trump Administration made a choice to cut support for vital services people depend on like education funding for children with special needs, financial services in underserved communities, and public health readiness.

🧵

14.10.2025 17:03 — 👍 20 🔁 13 💬 1 📌 1

Must read thread on new study showing school vouchers are spurring enrollment in small Christian private schools--the same schools that research suggests produce some of the poorest academic outcomes for students:

12.09.2025 15:20 — 👍 10 🔁 7 💬 0 📌 1

School districts can anticipate funding chaos in the coming months stemming from an unprecedented lack of enrollment data as students switch between private and public schools. As Sen. Don Gaetz (R-Pensacola) told @politico.com:

11.09.2025 18:21 — 👍 0 🔁 0 💬 0 📌 0

Once again, Florida shows what’s waiting for other states that careen toward universal school vouchers: public schools that can’t pay teachers, school closures that dislocate communities, & budget woes from trying to fund two separate education systems. subscriber.politicopro.com/article/2025...

11.09.2025 18:21 — 👍 2 🔁 1 💬 1 📌 0

Delaware Explained: Property reassessment

Property reassessment notices have been scaring residents across Delaware, but the impact on tax rates has yet to be determined.

State legislators in 2023 also passed legislation mandating that reassessments occur every five years, helping to make sure this situation doesn’t happen again. However, ideally, reassessments should occur every 1 to 2 years. spotlightdelaware.org/2024/11/25/e...

09.09.2025 18:18 — 👍 1 🔁 0 💬 1 📌 0

Since the last assessment in the ‘80s, taxable values in New Castle Cty quadrupled on average. But frequent assessments result in gradual changes in values & tax bills that reflect the true property value, making budgeting easier & fairer for homeowners. www.delawareonline.com/story/news/2...

09.09.2025 18:18 — 👍 1 🔁 0 💬 1 📌 0

The session was responding to New Castle County’s (DE’s largest county & home to Wilmington) first full reassessment in decades, where homeowners’ property tax bills increased dramatically due to home values increasing more rapidly than commercial property values.

09.09.2025 18:18 — 👍 1 🔁 0 💬 1 📌 0

The state legislature passed laws last month that allow cities, counties, and school districts to set separate property tax rates for residential & commercial properties, helping them rebalance the scales and ensure that businesses are paying their fair share to support schools.

09.09.2025 18:18 — 👍 1 🔁 0 💬 1 📌 0

Delaware is protecting critical funding for services like public schools while more equitably distributing property tax responsibility among homeowners & businesses. Here’s what other states can learn from DE’s thoughtful approach to #PropertyTax reform from last month's special session. 🧵

09.09.2025 18:18 — 👍 2 🔁 1 💬 1 📌 0

States are increasingly calling for special sessions this year, and it’s not just routine business. From addressing the impact of federal policy, to state tax debates, to shoring up disaster aid and political power plays, 2025 is shaping up to be a year of legislative overtime.🧵

25.07.2025 16:34 — 👍 6 🔁 7 💬 1 📌 0

🚨 BREAKING: A shocking $440M in unused ESA voucher funds are sitting in bank accounts — while AZ's public schools are left under-resourced and struggling.

This hoarding of taxpayer dollars by mostly wealthy families hurts public school students who go without needed supports 😠

10.07.2025 01:08 — 👍 9 🔁 9 💬 1 📌 0

See How Much Federal Money Trump Is Holding Back From Your District

Hundreds of districts will lose more than $1 million each, according to a new analysis.

Yesterday, I shared my @educationwork.newamerica.org team's district impact analysis of the $6+ billion that the Trump admin is refusing to disburse to schools (link in 2nd post). Now, @edweek.org has published our funding figures for ALL districts in the US for which we have data. Search for yours↓

09.07.2025 13:51 — 👍 13 🔁 14 💬 2 📌 2

"Eight states—AL, AZ, FL, GA, ID, IN, NE and NC—saw their real per-pupil education expenditures decline even while their per capita GDP went up. These eight states had the capacity to expand educational opportunities for their state’s children but have gone in the opposite direction instead."

07.07.2025 14:46 — 👍 78 🔁 32 💬 1 📌 5

Make no mistake-- today’s Supreme Court ruling does not end constitutionally guaranteed birthright citizenship. However, the SCOTUS has ruled against the injunctions that have been blocking The Trump Administration’s birthright citizenship EO from being implemented nationwide.

27.06.2025 20:46 — 👍 109 🔁 36 💬 10 📌 6

Instead of using a tax shelter for the wealthy to weaken the public schools that serve 90% of kids, lawmakers should invest in students and take us one step closer to the promise of an excellent public education for every child.

26.06.2025 14:58 — 👍 7 🔁 4 💬 0 📌 0

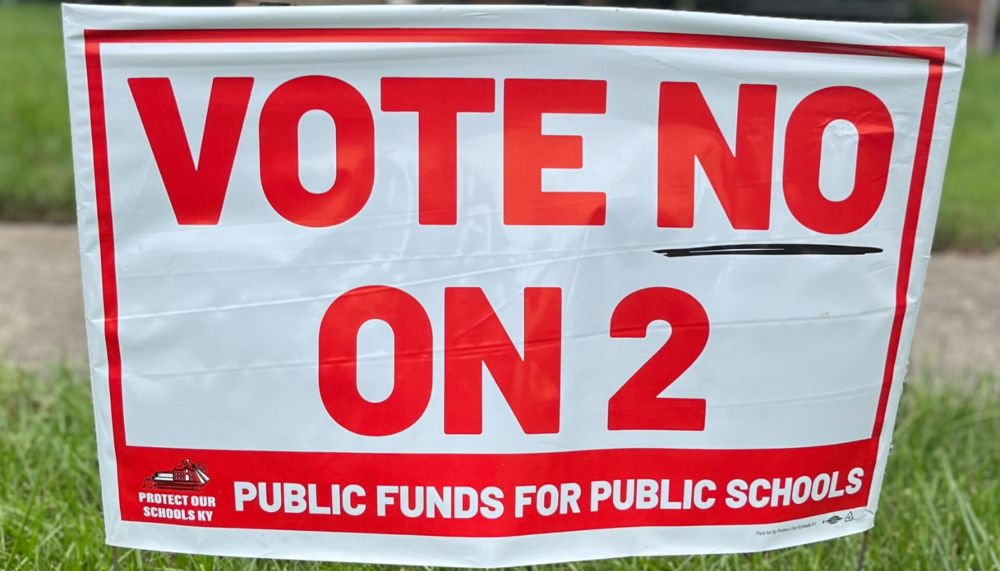

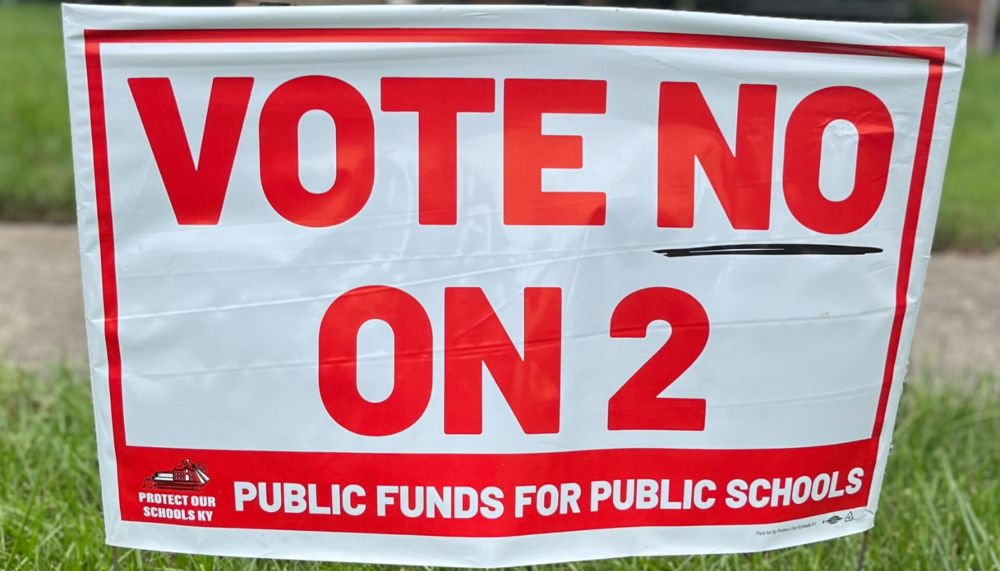

Kentucky Voters Buried Private School Vouchers. One More Idea Must Die to Truly Reinvest in Our Public Schools - Kentucky Center for Economic Policy

Kentucky can't truly reinvest in our public schools unless lawmakers abandon the goal of eliminating the state's income tax.

Vouchers are often unpopular, incl. in red states, b/c voters prefer to spend public $ on public schools: Kentucky voters rejected a ballot measure last fall in all 120 counties that would have amended the KY constitution to allow school vouchers. @kypolicy.bsky.social kypolicy.org/kentucky-vot...

26.06.2025 14:58 — 👍 6 🔁 7 💬 1 📌 0

Federal Voucher System — Like Florida’s — Would Divert Funding to Private Schools and Home-Schoolers

Florida has lessons to offer about vouchers.

Experts at @floridapolicy.bsky.social warn a federal voucher cld explode in cost over time if expanded, as happened in Florida. FL’s vouchers now eat up more than 25% of the state’s K-12 budget, w/ most $$ subsidizing students who already attended private school www.floridapolicy.org/posts/federa...

26.06.2025 14:58 — 👍 9 🔁 3 💬 2 📌 0

The national school voucher proposal in the Senate GOP reconciliation plan would threaten students’ access to quality public schools, give tax breaks to the wealthy, & override states that have rejected these harmful policies. Lawmakers who care about our kids’ futures should reject it.

26.06.2025 14:58 — 👍 23 🔁 23 💬 2 📌 6

Public education would be at especially high risk, given that it makes up the largest share of state budgets. For context: just the potential cost of the proposed 5% minimum SNAP match is the equivalent of average salary costs for about 65K public school teachers nationwide.

03.06.2025 19:19 — 👍 12 🔁 3 💬 1 📌 0

NEW REPORT: House Republicans’ budget reconciliation bill, now in the Senate, would shift major new costs to the state- & local-level, paving the way for harmful cuts to food assistance, health care, & other services like education. Here’s the 3 top things to know:🧵

03.06.2025 19:19 — 👍 107 🔁 48 💬 7 📌 9

A network of mayors, county officials and state legislators advocating for direct cash policies that create economic stability for all Americans. Founded by Michael Tubbs.

We seek to build political power for hardworking Arizonans by advocating for housing & healthcare affordability and a dignified living.

opportunityarizona.org

linktr.ee/opportunityarizona

Proud Member of the @nonprofitunion.bsky.social family! Representing the employees of the Center on Budget and Policy Priorities

Progressive tax policy advocate. #taxtherich

“this short hair quiet slightly angry woman from the middle of the country with a don’t mess with me attitude.” Herds cats at OK Policy. Opinions are mine.

Nobody knows politics and policy like we do.

www.politico.com

Director of Federal Tax Policy @centeronbudget.bsky.social

Tax, budget, policy, racial and economic justice | Views are my own

she/her

associate prof of education policy. former high school teacher. education, ideology, policy, finance, climate, socialism. he/him. https://linktr.ee/davidibacker

Policy Director, @budget.senate.gov / @merkley.senate.gov

Analysis and advocacy to advance our vision for the future: greater opportunity and economic well-being for all Minnesotans

Award-winning author of "The Trial of Donald H. Rumsfeld" and "How America Works ... And Why It Doesn't." Host of "Books and More" podcast.

will-cooper.com

US educational policy | political economies | community organizing | labor

Policy and Research at the Public School Forum of NC | Cat Mom

Less estranged from Elon than most of his kids

10.18.2025

WE SAY NO KINGS

https://www.nokings.org/

It's going to take all of us

https://www.nokings.org/rise

We will win

https://www.thefarce.org/

Jort fiction

https://medium.com/@jasonsattler

Avuncular unionist, uxorious husband, labor historian, cat guy. "Who's Got the Power?: The Resurgence of American Unions" coming in 2025 from New Press. Lives in Minnesota. Posts are personal. The cat in the profile pic is Laverne, aka Peanut.

Next generation, multi-racial civil rights organization inspiring and supporting national and local movements toward a just democracy.

advancementproject.org

Executive Director, Wisconsin Public Education Network. Here for education justice, thriving public schools, and craft cocktails. Not that I'm bitters or anything.

Former journalist, hate corruption, MArch, AIA Assoc, LEED AP BD+C, Climate change is real, y'all

Mom to 2 border collies 🐑🐑🐑🐑🐕🐕