We just launched Season 3 with an accompanying blog, a new feature of the podcast!

@adamposen.bsky.social

@piie.com

18.11.2025 15:42 — 👍 8 🔁 2 💬 0 📌 0

Listen to PIIE Insider LIVE wherever you get podcasts!

10.11.2025 14:40 — 👍 1 🔁 1 💬 0 📌 0

Definitely worth a listen to @mdebolle.com on @npr.org On point discussing the Argentina bailout by the US government @wbur.org @piie.com

www.wbur.org/onpoint/2025...

14.11.2025 17:28 — 👍 16 🔁 6 💬 0 📌 0

YouTube video by Peterson Institute for International Economics

Adam Posen on Trump policies: Lagged inflation, possible financial instability

@adamposen.bsky.social explains why some effects from Trump’s policies, like tariffs & deportations, are lagged & why he worries erosion of Fed independence plus the admin’s crypto policies could lead to financial instability.

Watch:

14.11.2025 17:15 — 👍 3 🔁 1 💬 0 📌 0

Adam Posen on the economy one year after the US election (Episode 11)

Podcast Episode · PIIE Insider LIVE · 11/07/2025 · 32m

I appreciate @chinadailyusa.bsky.social 's accuracy and fairness in presenting my views in this article. Thanks to

Anjali Bhatt for the discussion leading to this on #piieinsiderlive from @piie.com

podcasts.apple.com/us/podcast/a...

14.11.2025 17:25 — 👍 1 🔁 0 💬 0 📌 0

Scholar warns of 'weaponizing uncertainty'

A year since his election victory, United States President Donald Trump's economic policies are fulfilling his campaign promises but are weaponizing uncertainty, exacerbating global economic divisions...

This is a good summary of my assessment of the Trump economic policies after one year, and what is to come.

There is a consistent thru line to the Trump program which was evident by Nov '24,but that does not make it a coherent policy nor reduces uncertainty.

global.chinadaily.com.cn/a/202511/14/...

14.11.2025 17:23 — 👍 9 🔁 3 💬 1 📌 0

Adam Posen on the economy one year after the US election (Episode 11)

Podcast Episode · PIIE Insider LIVE · 11/07/2025 · 32m

New podcast: me reflecting on US economic policies since the election, what we foresaw, what surprised, what the impact has been and will be.

Includes a warning about the seeds being sown for the next financial crisis by Trump's crypto and Fed policy combo.

podcasts.apple.com/us/podcast/a...

08.11.2025 16:25 — 👍 24 🔁 7 💬 0 📌 1

Adam Posen on the economy one year after the US election

It's been one year since the 2024 US presidential election—and since the launch of PIIE Insider LIVE. Anjali V. Bhatt, PIIE communications manager and research fellow welcomes back Adam Posen, PIIE pr...

NOVEMBER 7: It's been a year this week since the US presidential election...& one year of PIIE Insider LIVE!

@adamposen.bsky.social is coming back onto the podcast to discuss what's changed in the US & global economy.

Tune in live or subscribe wherever you get podcasts: www.piie.com/events/2025/...

05.11.2025 20:13 — 👍 3 🔁 1 💬 0 📌 0

Sorry, I have been away (in general and from BlueSky).

Please email me at posena@piie.com

29.10.2025 18:53 — 👍 2 🔁 0 💬 0 📌 0

Surveying the new economic geography with Peterson Institute's Adam Posen

YouTube video by AtlanticCouncil

Live webcast today 10:45 ET Surveying the new economic geography with @AdamPosen and @joshualipsky

Live at @IMFNews

Watch here!

www.youtube.com/live/kNiZYVd... via @YouTube

15.10.2025 13:48 — 👍 5 🔁 2 💬 0 📌 0

Can climate efforts create jobs? (Episode 20)

Is it possible to pursue climate efforts, create jobs, and achieve social justice at the same time? That was the challenge that the Inflation Reduction Act of 2022 was designed to meet. Ben Beachy (Gl...

If you'd like a break from doomerism, @mdebolle.com & I had a good time recording this new @piie.com podcast to explore potential paths forward for clean energy industrial policy.

We touched on IRA lessons learned, abundance, bottom-up policy design, & yes...bagels.

www.piie.com/experts/podc...

08.10.2025 15:46 — 👍 9 🔁 3 💬 0 📌 0

Robust investment in the US in AI-related categories has more than compensated for softer investment elsewhere.

Find these charts & so many more, & watch the presentation here: www.piie.com/events/2025/...

09.10.2025 17:31 — 👍 3 🔁 1 💬 1 📌 0

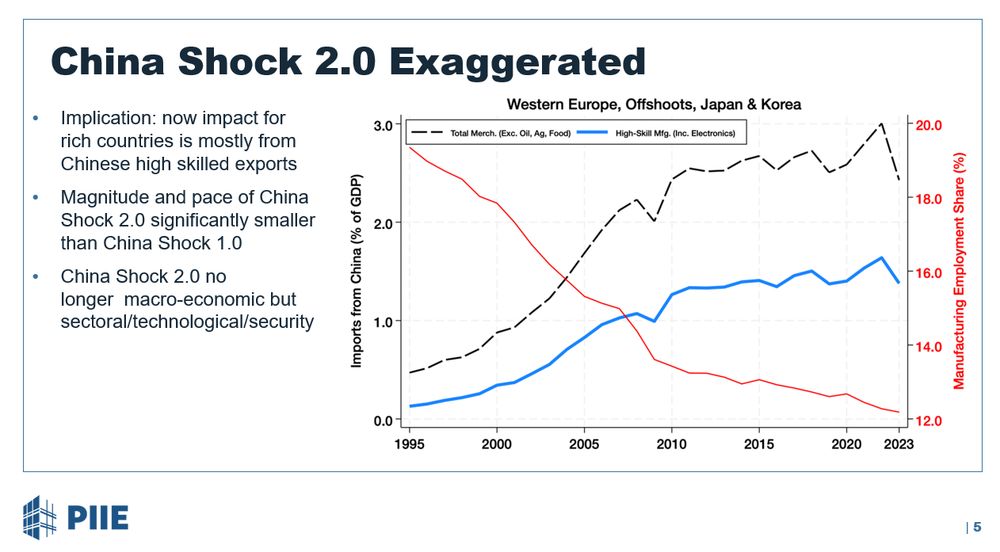

The New China Shock is on Low and Middle Income Countries (LMICs)

High and rising imports of low-skilled products from China

Magnitude and pace of China shock much greater than for rich countries

China Shock 2.0 Exaggerated

Implication: now impact for rich countries is mostly from Chinese high skilled esports

Magnitude and pace of China Shock 2.0 significantly smaller than China Shock 1.0

China SHock 2.0 no longer macro-economic but sectoral/technological/security

Rather than worrying about the China Shock 2.0 in developed economies, we should be much more worried about the China Shock 1.0 in low- & middle-income countries, Arvind Subramanian says.

Find slides & watch the Global Economic Prospects event here: www.piie.com/events/2025/...

09.10.2025 17:38 — 👍 14 🔁 5 💬 0 📌 0

Most large, advanced economies face slower GDP growth next year, while China and India withstand tariff drag

Our Fall 2025 Global Economic Prospects shows that real global GDP is projected to rise 3.1% in 2025 & 2.9% in 2026. #PIIECharts

14.10.2025 15:25 — 👍 5 🔁 2 💬 1 📌 0

PIIE Fall Meetings

Coming up in October 2025 | Watching at piie.com/events

--

October 8 | 1:00 PM EDT

China’s economic outlook: Challenges and opportunities

Martin Chorzempa (PIIE), Tianlei Huang (PIIE), Mary E. Lovely (PIIE), Yeling Tan (PIIE)

--

October 9 | 1:00 PM EDT

Global Economic Prospects: Fall 2025

Karen Dynan (PIIE), Arvind Subramanian (PIIE), Adam S. Posen (PIIE)

--

October 14 | 3:00 PM EDT

PIIE Insider LIVE: Maurice Obstfeld on trade and the international financial system

Anjali V. Bhatt (PIIE), Maurice Obstfeld (PIIE)

--

October 15 | 9:00 AM EDT

Trade Winds: How is the world adjusting to a new trading landscape?

Cecilia Malmström (PIIE), Mari Elka Pangestu (National Economic Council; PIIE), Hector Torres (Centre for International Governance Innovation)

--

October 16

9:00 AM EDT

The changing dollar regime: An update

Joseph E. Gagnon (PIIE), Maurice Obstfeld (PIIE), Moritz Schularick (Kiel Institute for the World Economy), Adam S. Posen (PIIE)

1:30 PM EDT

Canada’s economic outlook and global trade: A conversation with Governor Tiff Macklem

Tiff Macklem (Bank of Canada), Adam S. Posen (PIIE)

--

October 17 | 1:00 PM EDT

Europe in a changing international monetary system

Agnès Bénassy-Quéré (Banque de France), Jacob Funk Kirkegaard (PIIE), Klaas Knot (De Nederlandsche Bank; Financial Stability Board), Signe Krogstrup (Danmarks Nationalbank), Olli Rehn (Bank of Finland), Ángel Ubide (Citadel LLC)

🍂 It's fall meetings szn 🍂

We hope you can join us this week & next! Find all event pages, info, & registration here: www.piie.com/event-series...

06.10.2025 13:50 — 👍 2 🔁 1 💬 2 📌 1

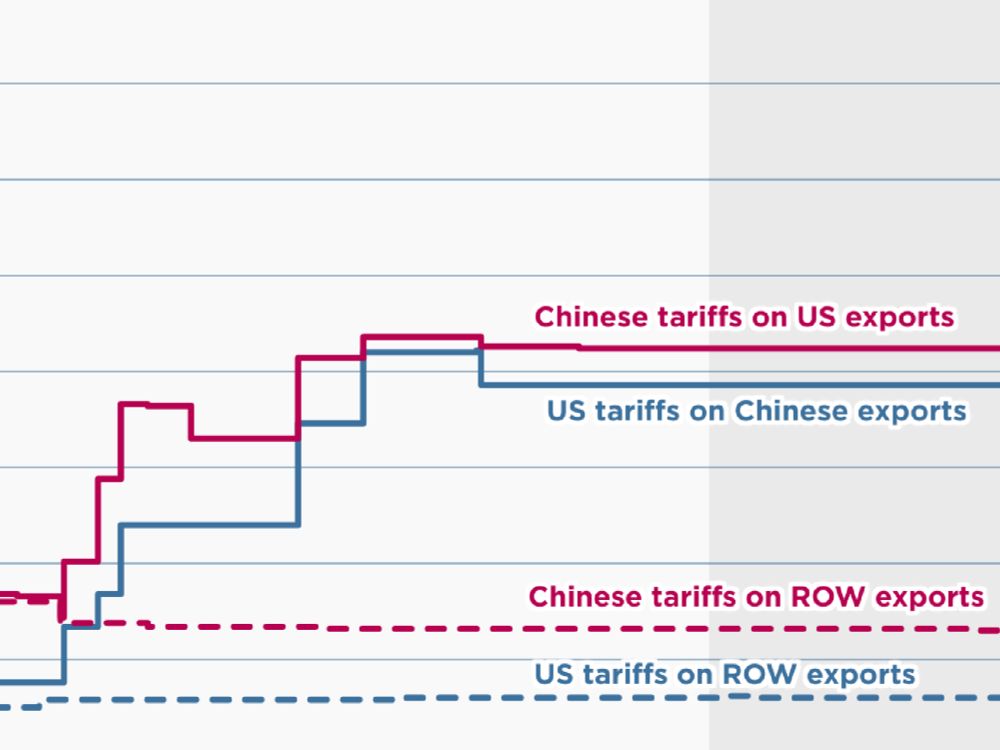

Trade Wars Are Easy to Lose

Beijing has escalation dominance in the U.S.-Chinese tariff fight.

In a large-scale trade war with China, the U.S. economy will suffer more than the Chinese economy, argued

@adamposen.bsky.social

:“The Trump administration may think it’s acting tough,but it’s in fact putting the US economy at the mercy of Chinese escalation"

www.foreignaffairs.com/united-state...

10.10.2025 18:02 — 👍 26 🔁 6 💬 2 📌 0

10.10.2025 16:20 — 👍 128 🔁 28 💬 2 📌 3

10.10.2025 16:20 — 👍 128 🔁 28 💬 2 📌 3

YouTube video by Peterson Institute for International Economics

Adam S. Posen on why inflation impact from tariffs and deportations has been lagged

WATCH: @adamposen.bsky.social explains why the substantial inflationary impact from tariffs & deportations has been lagged but is coming.

10.10.2025 15:00 — 👍 12 🔁 4 💬 1 📌 0

This was short and informative. Definitely worth a listen.

10.10.2025 15:58 — 👍 5 🔁 1 💬 0 📌 0

Trade Wars Are Easy to Lose

Beijing has escalation dominance in the U.S.-Chinese tariff fight.

Trump and Xi are both posturing ahead of their upcoming summit, but PRC/Xi is escalating - as noted by @rushdoshi.bsky.social and Lingling Wei this is because they think (rightly) Trump will back off.

*Taps the sign* (I warned y'all @foreignaffairs.com )

www.foreignaffairs.com/united-state...

10.10.2025 15:07 — 👍 9 🔁 1 💬 0 📌 0

Tariffs, deportations: inflation’s delayed hit. #econsky

10.10.2025 13:02 — 👍 4 🔁 2 💬 0 📌 0

FT, E17, Unhedged podcast, gardening, making bread, plazzy Scouser, crap at charts, 6 Music Mum. I don't deserve my bad Uber rating and I never give investment advice - if it looks like I am, it's a scam.

Professor, Political Science | Syracuse University, Maxwell School | American politics, political psychology | Co-author of Anxious Politics and Pandemic Politics

I'm a political scientist in @mccourtschool.bsky.social. I study trust in institutions and media effects on the public.

Web page: https://www.jonathanmladd.com/

Google Scholar: https://scholar.google.com/citations?user=J6tt69QAAAAJ&hl

Apologies for typos.

Dad. Marine. Massachusetts Congressman. Build an economy that works like Legos, not Monopoly. My only Bluesky account.

The events of exactly 250 years ago today (1775). A project in conjunction with America’s semiquincentennial. By Jon Blackwell, an editor at the Wall Street Journal. Also follow me @100yearsagonews.bsky.social

International Trade and Macroeconomics at the Saint Louis Fed. Views are my own. https://www.anamariasantacreu.com/ 🇪🇸🇺🇸

Chicago diehard. President & CEO of the Chicago Fed, econ prof Chicago Booth School, former Chairman of the Council of Economic Advisers.

I do not speak for the Fed or others on the FOMC

Economist. Professor at UPF Barcelona. Work on market power, macro, labor. Author of “The Profit Paradox” TheProfitParadox.com

Macroeconomist @sffed and @UCDavisEcon. RT's ≠ endorsements

http://ssingh.ucdavis.edu

MIT Robert M. Solow Professor of Economics | Macro, International, Public, Monetary, Taxes, Finance | v = u + β v | Beatles | Boston | Argentina | Patagonia

Remembering WWI through interesting events that happened OTD during WWI.

Fan account of John Singer Sargent (1856-1925), an American artist, considered the "leading portrait painter of his generation" #artbot by @andreitr.bsky.social and @botfrens.bsky.social

Sports lady on WEEI. Patriots & Celtics coverage for WEEI.com & Celtics Weekly host.

Facts and stats for fans of Pats

Same as Twitter @PatriotsCLNS account. Official CLNS Media BlueSky account for the 6X World Champion New England #Patriots

@sportsillustrated.bsky.social 📝 // @patriotsclns.bsky.social 🏈// optimistic pessimist about the city of champions 🏆

New England Patriots reporter for @AtoZSportsNFL @AtoZSports | past @masslivesports | UMass | business inquiries: sophieewellerr@gmail.com

Bringing you the latest news & video on the Celtics, Patriots, Red Sox, Bruins & CT Sun

NBCSportsBoston.com | ☘ Celtics coverage @nbcsceltics.bsky.social

Insiders: @tomecurran.bsky.social | @PhilAPerry.bsky.social | @ChrisForsberg.bsky.social

Senior Reporter and host of Patriots Catch-22 at Patriots.com. Thanks to @guertin11 for putting up with football season. Thoughts are my own.

10.10.2025 16:20 — 👍 128 🔁 28 💬 2 📌 3

10.10.2025 16:20 — 👍 128 🔁 28 💬 2 📌 3