Ground up shot of 2 apartment blocks with trees coming off the balconies and a blue cloudy sky.

'Two decades of analysing the state in the green transition: Where are we now?' Mathias Larsen, James Jackson & Environment and Climate Politics Working Group "suggesting that the debate surrounding the conceptus of the state has become overly conflated." 🌳

Full article 👉 https://ow.ly/JYmB50XvChB

22.11.2025 11:00 — 👍 2 🔁 2 💬 0 📌 0

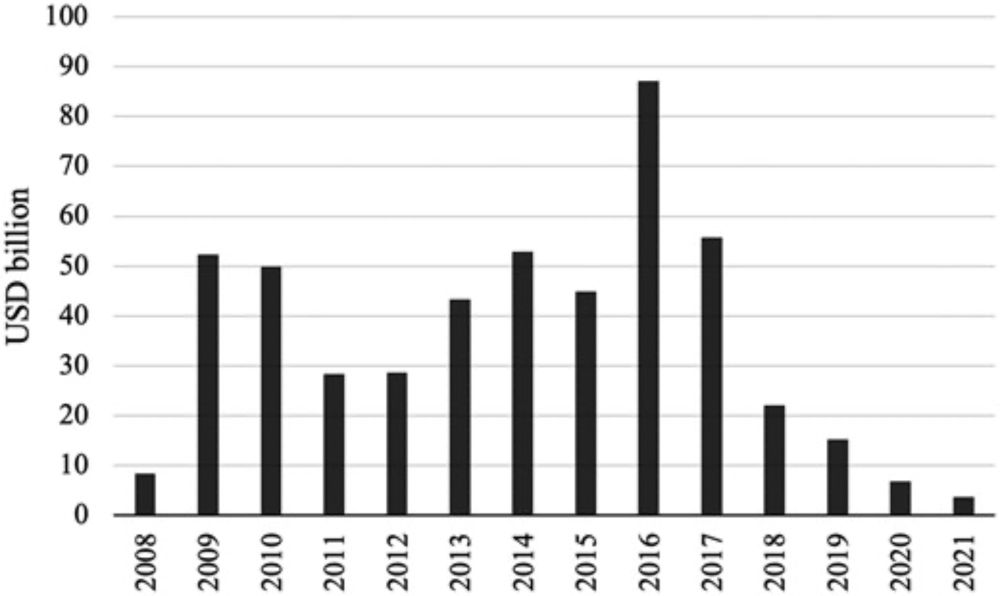

Great to see our data used by the @iea.org in their new World Energy Outlook. The outlook uses our data to show the massive increase in Chinese outward investments in clean tech manufacturing.

15.11.2025 10:33 — 👍 13 🔁 4 💬 0 📌 0

A Flood of Green Tech From China Is Upending Global Climate Politics

Pleased to have my research featured in @nytimes.com reporting on China's role in a global green transition

www.nytimes.com/2025/11/10/c...

11.11.2025 13:58 — 👍 20 🔁 7 💬 1 📌 0

New article out in @lsebr.bsky.social:

10.10.2025 07:49 — 👍 2 🔁 0 💬 0 📌 0

“Chinese overseas FDI is nearing $100 billion per year. The Marshall Plan was $200b—and locked Europe into US tech and standards. When we see sums of this size, we can ask whether it will have a similar effect on the globe.”

NEW: @70sbachchan.bsky.social & @mathiaslarsen.bsky.social on the BRI 2.0

20.09.2025 17:48 — 👍 20 🔁 9 💬 1 📌 2

I’m excited to have started a job at the LSE as a Senior Policy Fellow, leading the China work at the Grantham Research Institute on Climate Change & the Environment @granthamlse.bsky.social

17.09.2025 08:18 — 👍 10 🔁 0 💬 0 📌 0

A pleasure to contribute to the blog!

15.09.2025 09:42 — 👍 0 🔁 0 💬 0 📌 0

New op-ed published in @carnegieendowment.org's China blog, edited by @michaelpettis.bsky.social: “How China’s Growth Model Determines Its Climate Performance: Rather than climate ambitions, compatibility with investment and exports is why China supports both green and high-emission technologies.”

15.09.2025 09:20 — 👍 4 🔁 4 💬 0 📌 0

China Green Leap Outward — Net Zero Industrial Policy Lab

A new China Low Carbon Technology FDI Database

New policy report just published with groundbreaking data showing that China's new global role in the green transition is investing in manufacturing, not financing infrastructure: "China’s Green Leap Outward"

www.netzeropolicylab.com/china-green-...

10.09.2025 09:16 — 👍 59 🔁 22 💬 0 📌 6

Sage Journals: Discover world-class research

Subscription and open access journals from Sage, the world's leading independent academic publisher.

New article with @james7jackson.bsky.social out in Competition & Change: The green versus environmental state: Reviewing two decades of conceptualizing state-led approaches

journals.sagepub.com/doi/10.1177/...

03.09.2025 19:14 — 👍 6 🔁 2 💬 0 📌 1

China’s Political System Makes Consumption-led Growth Impossible

Beijing’s prioritization of political security necessitates a reliance on investment and exports – not consumption – to power the economy.

New op-ed out in The Diplomat @thediplomat.com: 'China’s Political System Makes Consumption-led Growth Impossible: Beijing’s prioritization of political security necessitates a reliance on investment and exports – not consumption – to power the economy.'

thediplomat.com/2025/08/chin...

24.08.2025 06:50 — 👍 4 🔁 0 💬 0 📌 0

I only got involved in the topic after reading your article.

31.05.2025 04:01 — 👍 1 🔁 0 💬 1 📌 0

I'll be in Beijing all of May and June as a visiting scholar at Peking University's Carbon Neutrality Institute. Let me know if you're in town or if you know someone I should meet.

02.05.2025 12:12 — 👍 1 🔁 0 💬 0 📌 0

Sage Journals: Discover world-class research

Subscription and open access journals from Sage, the world's leading independent academic publisher.

NEW ARTICLE out in Capital & Class revisiting the debate on whether China is capitalist or socialist: ‘Reconsidering the ‘China model’ through structure and agency: The hybrid realities of Chinese capitalism and ‘socialism with Chinese characteristics’

journals.sagepub.com/doi/10.1177/...

22.03.2025 13:39 — 👍 4 🔁 0 💬 0 📌 0

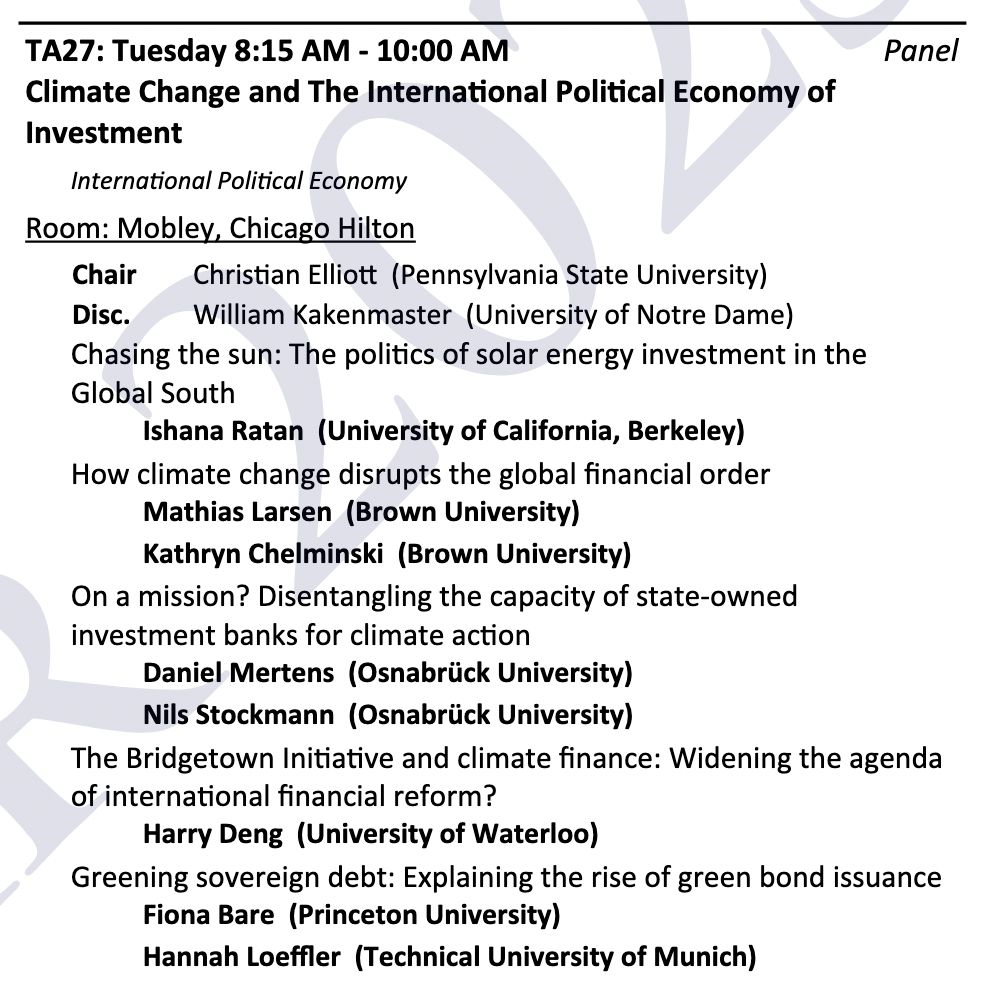

We have another phenomenal panel on green finance tomorrow morning at #ISA2025! We're bringing the energy with papers on solar investment, state-owned investment banks, the Bridgetown Initiative, sovereign green bonds, and more!

8:15 am in the Mobley Room!

03.03.2025 23:24 — 👍 8 🔁 3 💬 1 📌 0

Sustainable Finance at WRI Finance.

Interested in Climate Change, Politics, Economics, Finance, Foreign Policy. Still learning. Views my own. 🇺🇸🇧🇷🇰🇷

researching economy/ecology/finance at @positivemoneyuk.bsky.social • editorial team degrowth.info • member @iwgbcharityworkers.bsky.social 🍉

PhD candidate, The Fletcher School, Tufts University | Fellow, Climate Policy Lab | Green Economic Development, Industrial Policy, and Innovation

Critical Minerals & Materials in Canada

Shining 💡 on phosphorus 🧪

⚗️ Ph.D. @ C.-J. Li lab 🎓

@Transition Accelerator

@McGill University Chemistry

@Fudan University

@ENSCM Chimie Montpellier

Opinions expressed are my own

sostheneung.com

capital markets & energy finance @ Center for Public Enterprise ☀️🏗️ • bay area / dc • advaitcore.substack.com. on twitter at @advaitarun_

Political ecology of asset manager capitalism | Biodiversity metric contestations in green finance | Performativity of nature-related financial risk modelling by central banks

papers: https://scholar.google.com/citations?user=S6mUi94AAAAJ&hl=en

Political philosophy/ethics, climate ethics, political economy (esp. finance).

Associate Professor of International Political Economy at Ghent University

phd @uwsoc.bsky.social @cso-sciencespo.bsky.social | green industrial policy, democratic finance, post-scarcity futures | https://gabrielkahan.com/

associate professor of global affairs @ Univ. of Notre Dame

studying international organizations & law & climate finance

views my own

Columbia Sociology & Sustainable Development…

Fan of math, science, evidence based practice & nuance…

Pragmatic realist & autodidact…

R/ts are NOT endorsements, all standard disclaimers apply.

PhD at LSE / Politcal Economy, Index Investing, Sustainable Finance, North-South relations

Immigrant. Poli sci prof at U of Toronto. Politics of climate change, carbon markets, oceans, NGOs, enviro politics. Author of Existential Politics, out now: tinyurl.com/ybephkfb. Occasional ranter. greenprofgreen.com

Professor of International Relations at LSE & Academic Dean of TRIUM Global EMBA. Global environmental politics, international political economy & global business.

https://www.robertfalkner.org

Teach and research international relations at the University of Sheffield. Working on security politics, China, & energy/climate issues. Gradually shifting over from Twitter/X.

https://jknyman.com/

Political Science major at Georgia State University | interested in China-Global South IPE, Development, Green Industrial Policy, State Capitalism, Regional Integration & BRI

Energy systems modeling & policy analysis - Associate Research Professor at Center for Global Sustainability, CGS @ctrglobsust.bsky.social at UMD @univofmaryland.bsky.social

German living and biking in DC, and with odd interest in basketball

Views my own

Economist and professor at LSE. “Posting through it."

Clean energy transitions, energy and environmental politics, clean tech and complex global governance. New book on Gov Energy Transitions with CUP is out now ⚡️🔌💡 @Brown CSL Fellow; Personal account, views are my own

A modern news outlet for London, covering the city in the old-fashioned way. Edited by @jim.londoncentric.media. Subscribe now for a 25% discount: www.londoncentric.media