According to Bloomberg, Nigerian princes now represent safer investment opportunities than diminished European empires.

11.04.2025 23:26 — 👍 2 🔁 0 💬 0 📌 0@lucidvoyager.bsky.social

Entrepreneur and builder Tech, olive oil, economics

According to Bloomberg, Nigerian princes now represent safer investment opportunities than diminished European empires.

11.04.2025 23:26 — 👍 2 🔁 0 💬 0 📌 0

"Ironically, just as the “China shock” pushed the US out of low-end manufacturing, the “Trump shock” is propelling China to reallocate resources into higher value, advanced technologies that compete directly with the US."

www.ft.com/content/2583...

"Economically, the net effect is negative. Costs rise for US consumers and US manufacturers reliant on imported inputs. Retaliatory measures reduce export opportunities. Overall trade volume shrinks. Growth slows, and no fundamental improvement in the US external balance occurs."

10.04.2025 17:48 — 👍 0 🔁 0 💬 0 📌 0AI judges tariffs and finds them wanting:

marginalrevolution.com/marginalrevo...

Matt Levine is going on vacation from his finance newsletter next week.

Given his vacation track record, we can expect weird market events to increase +20% during his absence.

Strap in.

09.04.2025 17:02 — 👍 0 🔁 0 💬 0 📌 0

09.04.2025 17:02 — 👍 0 🔁 0 💬 0 📌 0

09.04.2025 16:53 — 👍 0 🔁 0 💬 1 📌 0

09.04.2025 16:53 — 👍 0 🔁 0 💬 1 📌 0

This is crazy. Markets now rate Greek bonds as safer investments than US Treasuries.

x.com/DrewPavlou/s...

Ever since Brexit, the American right seems determined to take England's mistakes and "do it bigger".

This is Trump's Liz Truss moment.

marketmonetarist.com/2025/04/09/t...

FYI, the Treasury market is currently extremely leveraged. What could possibly go wrong?

www.ft.com/content/1df2...

"Trump has described the Smoot-Hawley tariff as a belated attempt to save the U.S. economy from the Depression, which could have worked had it been rolled out earlier."

We are so F'd.

www.washingtonpost.com/history/2025...

Strong words from Tracy in today's Bloomberg Odd Lots:

www.bloomberg.com/news/newslet...

This is not my preferred scenario, but it's the only viable outcome I can see from this whole mess.

The only way the US can salvage this is for Trump to wind everything back with tail tucked between his legs (good luck) or Congress stripping him of power (also good luck).

"China is 'ready to compete with the US in redefining the new global trade system' and cannot afford to 'tolerate US bullying.'" 3/

arstechnica.com/tech-policy/...

"If the US loses too much business, while China potentially gains, then China could potentially emerge as the global leader, possibly thwarting Trump's efforts to use tariffs as a weapon driving investment into the US." 2/

arstechnica.com/tech-policy/...

"For China, the bet seems to be that by imposing tariffs broadly, the US will drive other countries to deepen their investments in China." 1/

arstechnica.com/tech-policy/...

So much winning!

www.ft.com/content/b418...

Did you know? April was declared "Financial Literacy Month" 😂

www.whitehouse.gov/briefings-st...

06.04.2025 16:17 — 👍 0 🔁 0 💬 0 📌 0

06.04.2025 16:17 — 👍 0 🔁 0 💬 0 📌 0

💲📈 Why Do Domestic Prices Rise With Tarriffs?

"The fundamental reason domestic prices rise with tariffs is that expanding production must displace other high-value uses."

"The result is a net loss of wealth."

marginalrevolution.com/marginalrevo...

Admitting in court (aka, telling the truth) that your department broke the law?

Now that's a fireable offense: www.washingtonpost.com/national-sec...

“I see no soft landing to this,” Hsu says. “I see this as becoming an explosion of global supply chain disorder and chaos. The ramifications are going to be very long and painful.”

www.wired.com/story/trump-...

This is remarkably close to what we had six days ago. The average tariff rate of most European nations was about 1%.

05.04.2025 17:59 — 👍 1040 🔁 235 💬 46 📌 8

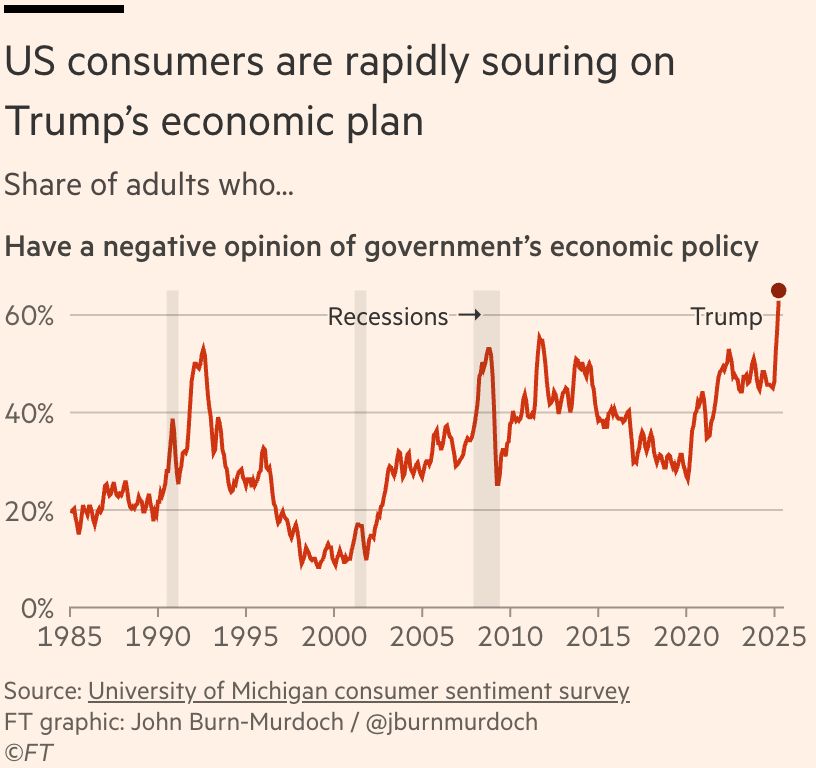

6) Just 25% of US adults say they expect their finances to look better in five years than today.

That’s lower even than at the nadir of the Great Recession.

NEW 🧵

A quick thread of charts showing how Trump’s economic agenda is going so far:

1) US consumers are reacting very very negatively.

These are the worst ratings for any US government’s economic policy since records began.

This is looking awfully like a replay of Smoot-Hawley and the devastation that followed (the stock market didn't regain its June 1930 high until 1955). Even Rand Paul has said those tariffs lost Congress for Republicans for 60 years.

scottsumner.substack.com/p/learning-f...

MUST READ for people looking for historical context.

Scott Sumner is on fire with this one.

He quotes at length from his book The Midas Paradox (written in 2015) and it NAILS the current moment.

scottsumner.substack.com/p/learning-f...

“China now has a golden opportunity to beat America at its own game.”

www.bloomberg.com/news/article...

The new Gotham economy.

03.04.2025 14:56 — 👍 0 🔁 0 💬 0 📌 0