GitHub - echolab-stanford/heat: R package heat: Harmonized Environmental Exposure Aggregation Tools

R package heat: Harmonized Environmental Exposure Aggregation Tools - echolab-stanford/heat

Excited to share a new R package: 𝗵𝗲𝗮𝘁 🌡️

`heat` makes it easier to work with climate or other gridded data in applied research, providing a comprehensive + optimized set of tools to compute environmental exposures for admin boundaries or points from gridded/point data.

github.com/echolab-stan...

05.01.2026 23:19 — 👍 36 🔁 20 💬 3 📌 0

KM_UCCP_Nov25.pdf

Max has a great portfolio and lots of interesting stuff in the pipeline.

For instance, he has this very cool paper on the economic and political effects of carbon pricing in Europe: drive.google.com/file/d/1NvVV...

26.11.2025 18:57 — 👍 1 🔁 0 💬 0 📌 0

My co-author 𝗠𝗮𝘅 𝗞𝗼𝗻𝗿𝗮𝗱𝘁 is on the academic job market! Max is a fantastic empirical macroeconomist working on the interrelations between the economy, financial markets and climate change. If you are hiring in macro or macro-finance, take a close look at him!

26.11.2025 18:57 — 👍 1 🔁 0 💬 1 📌 0

👋I'm on the #EconJobMarket!

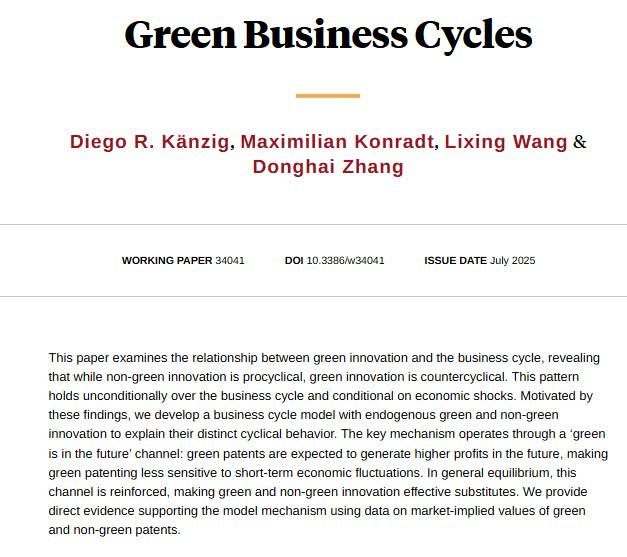

❓My JMP, together with @dkaenzig.bsky.social, Lixing Wang and Donghai Zhang studies how green innovation varies over the business cycle.

💡We find that green innovation is countercyclical, while non-green innovation is procyclical.

🔗https://tinyurl.com/4b45h979

🧵👇

20.11.2025 17:01 — 👍 8 🔁 4 💬 1 📌 1

Thanks to @equitablegrowth.bsky.social for the generous support! Excited to study how global supply chain shocks affect markets and the broader economy. #EGgrantee #EconSky

27.08.2025 13:41 — 👍 4 🔁 1 💬 0 📌 0

Equitable Growth awards funding to early career scholars studying the effects of economic inequality

Equitable Growth has awarded funding to seven early career scholars seeking to better understand the effects of economic inequality in the United States.

🚨Meet the 2025 Early Career #EGgrantee(s)!

Seven scholars will get funding to study economic inequality. Projects range in topic, from the housing crisis to child care to supply chain resilience. Stay tuned this week to learn about each grantee and their research.

equitablegrowth.org/equitable-gr...

20.08.2025 14:14 — 👍 3 🔁 1 💬 0 📌 1

War jeden Cent Wert!:-)

02.08.2025 10:10 — 👍 1 🔁 0 💬 0 📌 0

I've been working on a new tool, Refine, to make scholars more productive. If you're interested in being among the very first to try the beta, please read on.

Refine leverages the best current AI models to draw your attention to potential errors and clarity issues in research paper drafts.

1/

24.07.2025 03:24 — 👍 320 🔁 88 💬 28 📌 22

Showing empirically that green innovation is countercyclical and explaining it with a model where backloaded profits make green research and development less sensitive to downturns, from Diego R. Känzig, @maxkonradt.bsky.social, Lixing Wang, and Donghai Zhang https://www.nber.org/papers/w34041

22.07.2025 13:00 — 👍 9 🔁 2 💬 0 📌 0

I will be presenting some new work on climate policy uncertainty, joint with my amazing co-authors Costas Gavriilidis, Ramya Raghavan and Jim Stock

17.07.2025 11:14 — 👍 0 🔁 0 💬 0 📌 0

Very much looking forward to today's workshop on Macro Public Finance at the @nber.org SI. Honored to be among a fantastic group of speakers and discussants. If you are in Cambridge, drop by! www.nber.org/conferences/...

17.07.2025 11:14 — 👍 2 🔁 0 💬 1 📌 0

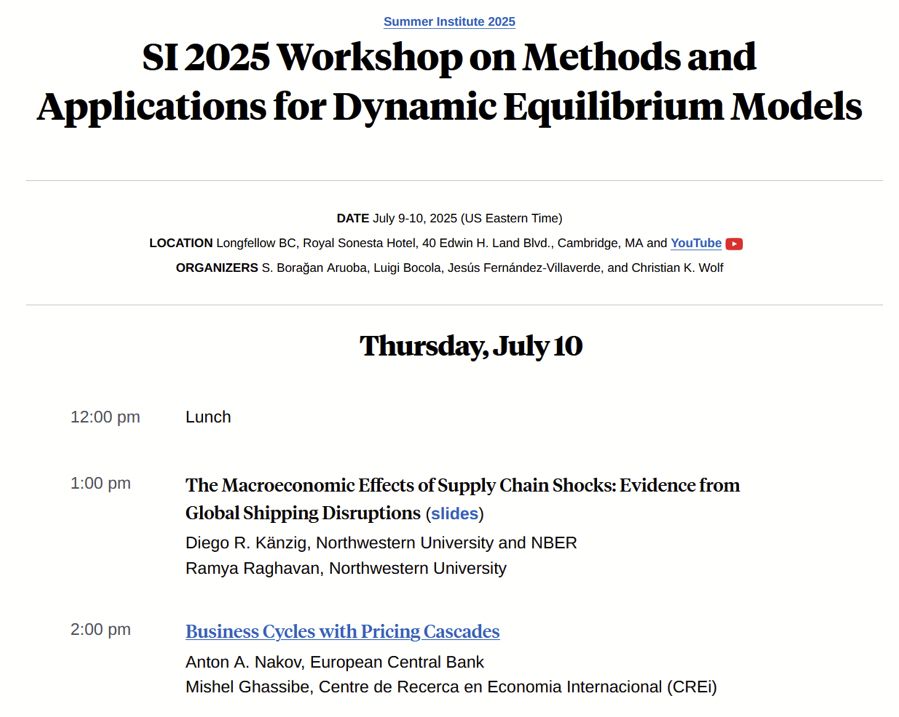

If you are in Cambridge, don't miss out on this session including fascinating papers by @mickeygb.bsky.social

and @benmoll.bsky.social

10.07.2025 14:53 — 👍 2 🔁 2 💬 1 📌 0

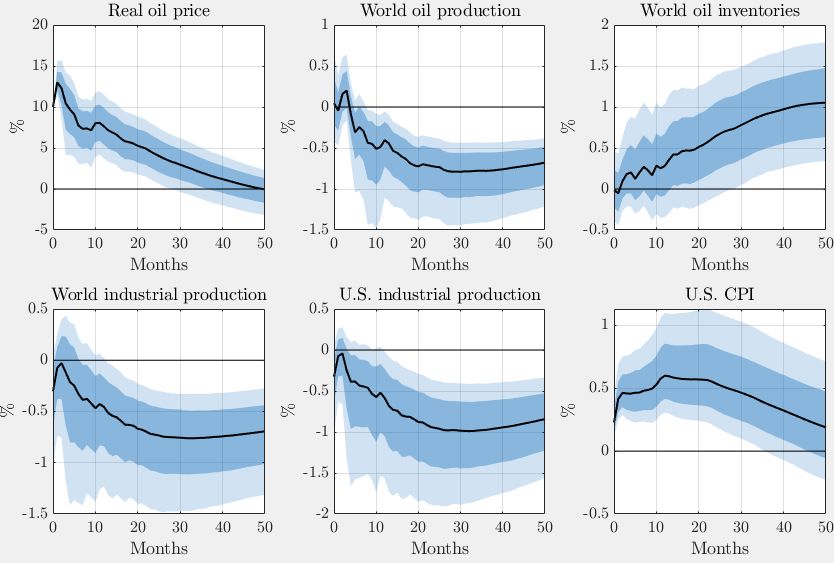

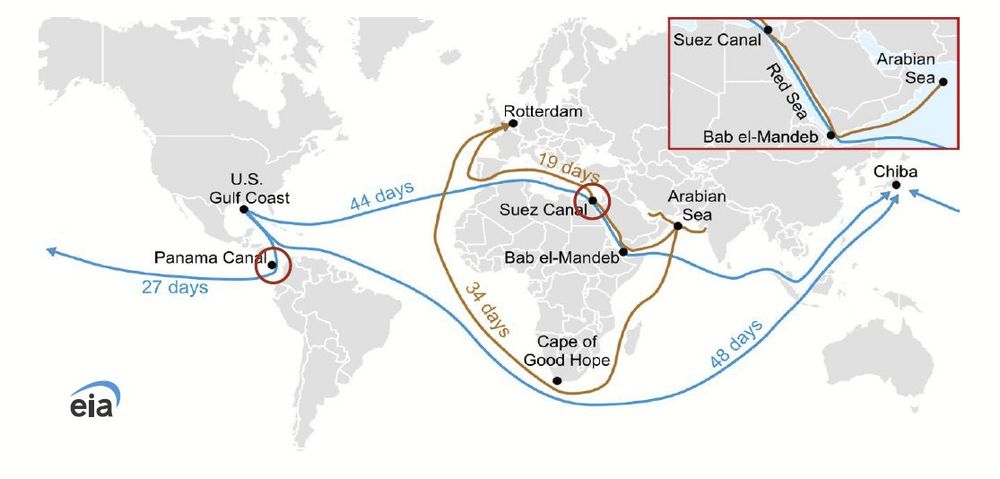

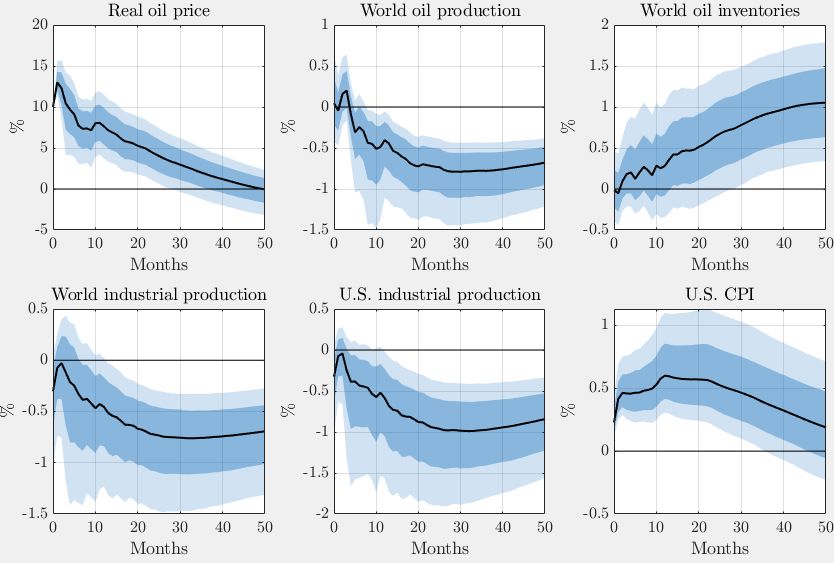

We also study how important these shocks were in the recent inflationary episode, the role of monetary policy in the transmission of these shocks, as well as the sectoral impacts.

10.07.2025 14:53 — 👍 0 🔁 0 💬 1 📌 0

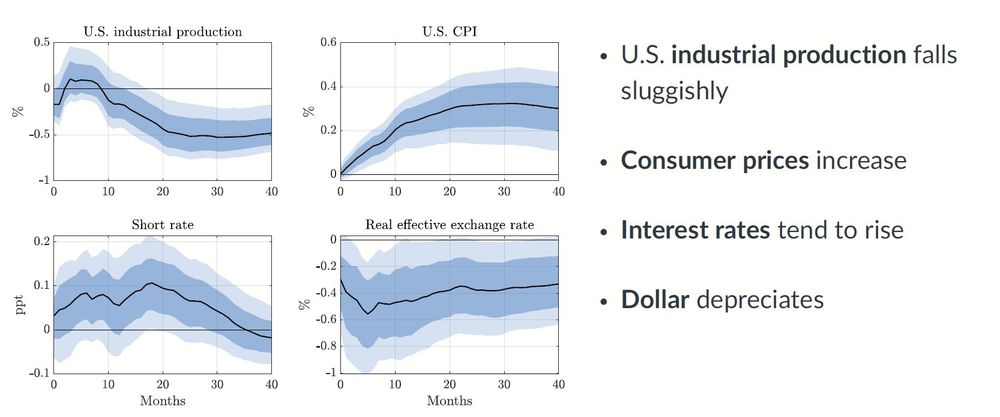

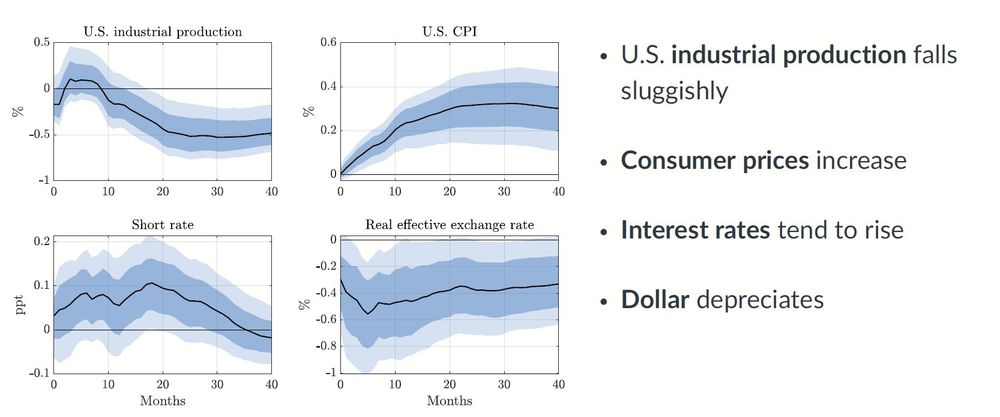

This has also substantial effects on the U.S. economy

10.07.2025 14:53 — 👍 0 🔁 0 💬 1 📌 0

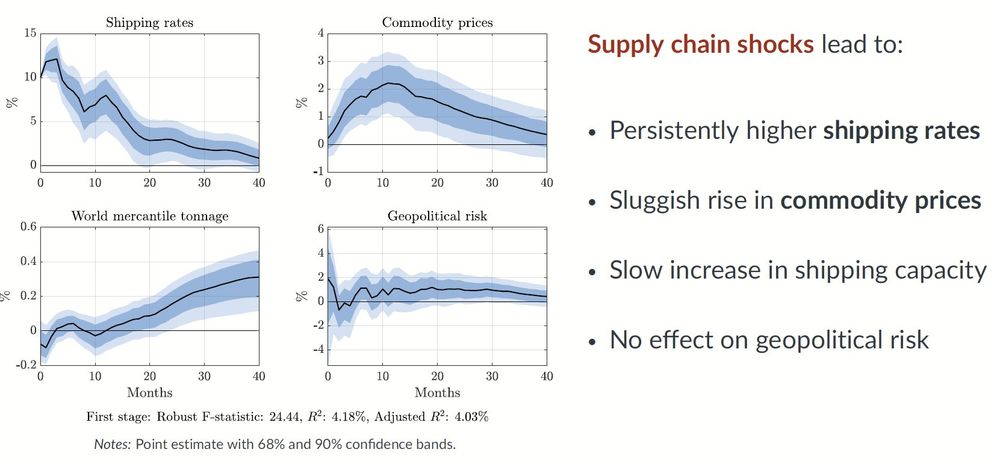

Using this as an instrument in a semi-structural model of global shipping markets, we document pervasive macroeconomic effects:

10.07.2025 14:53 — 👍 0 🔁 0 💬 1 📌 0

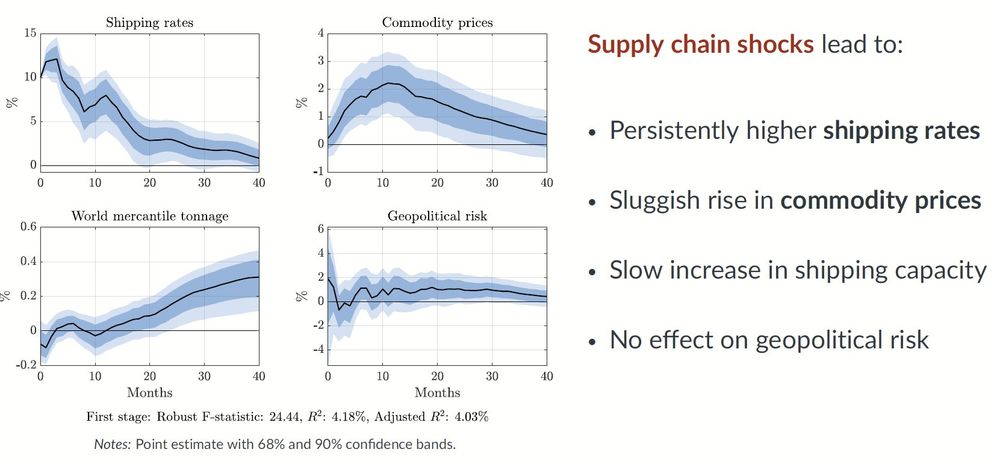

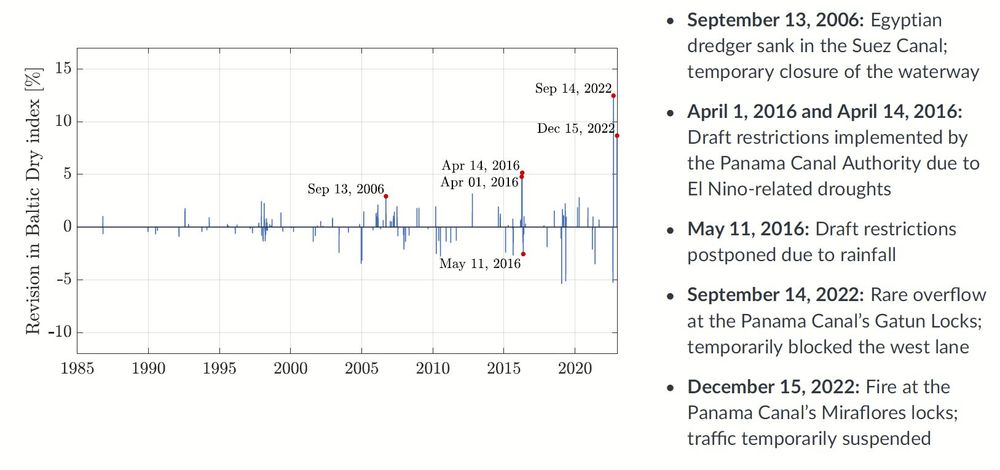

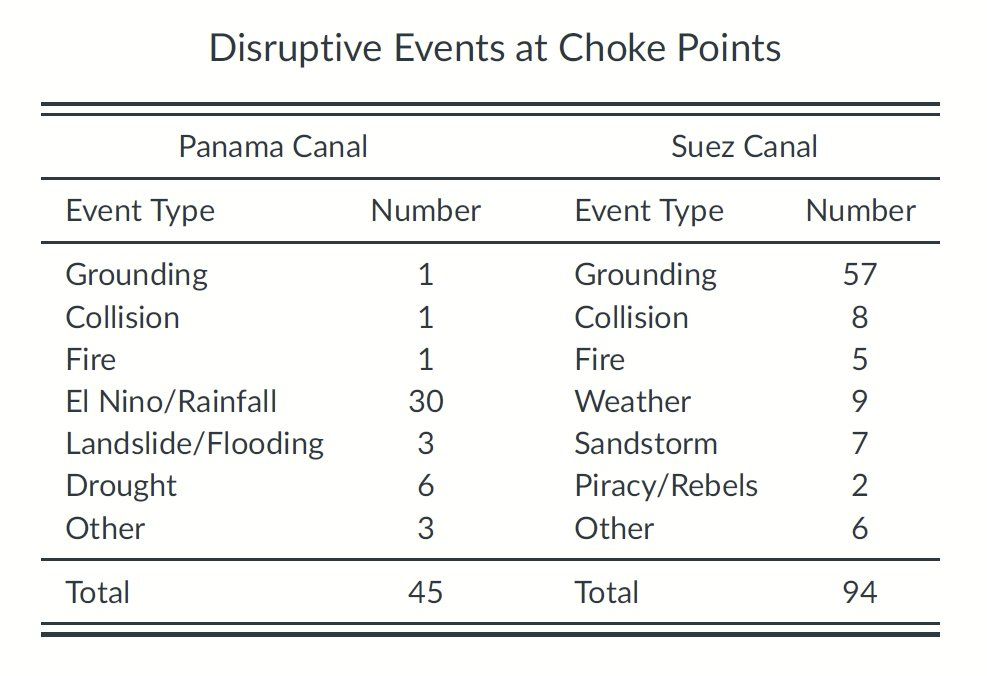

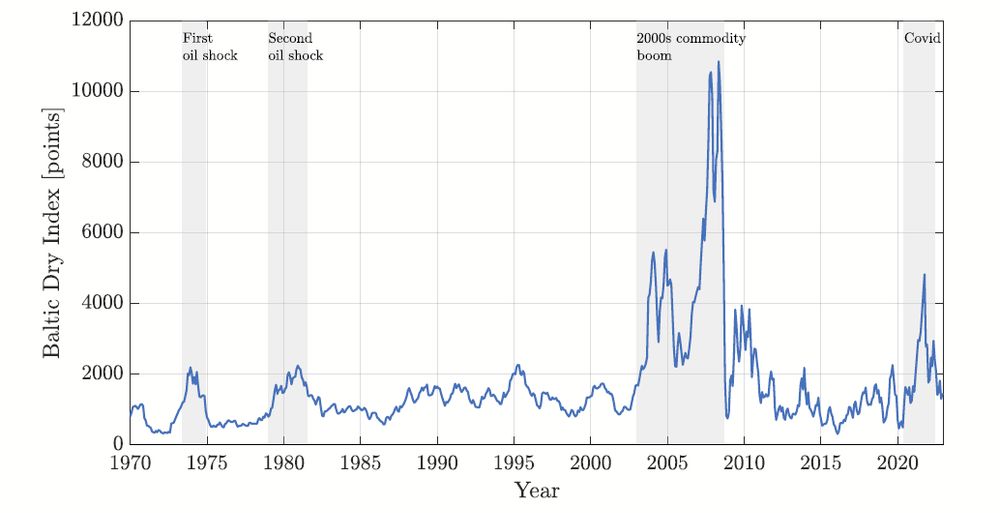

We quantify the market impact of these disruptions by measuring how shipping rates change in a narrow window around the events. In this way, we obtain some plausibly exogenous variation in shipping rates

10.07.2025 14:53 — 👍 0 🔁 0 💬 1 📌 0

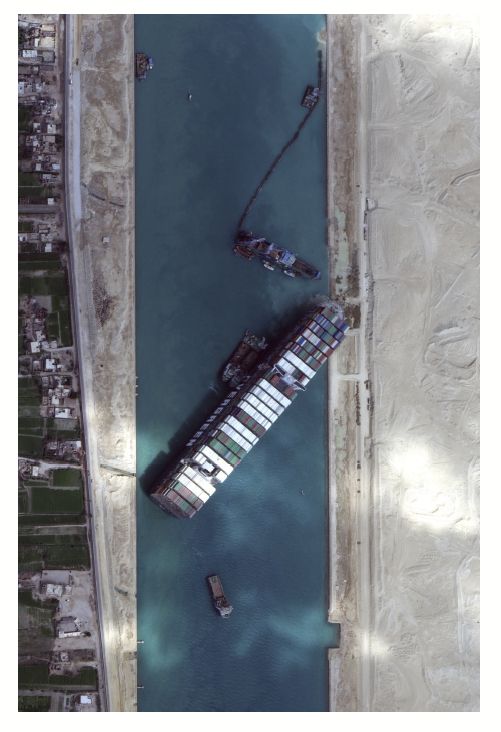

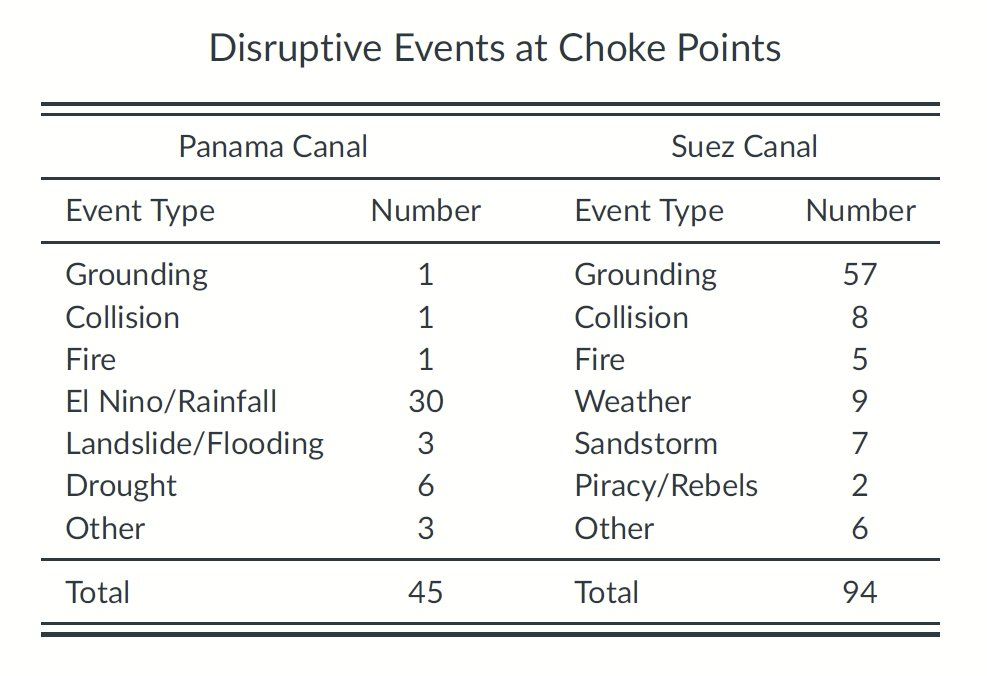

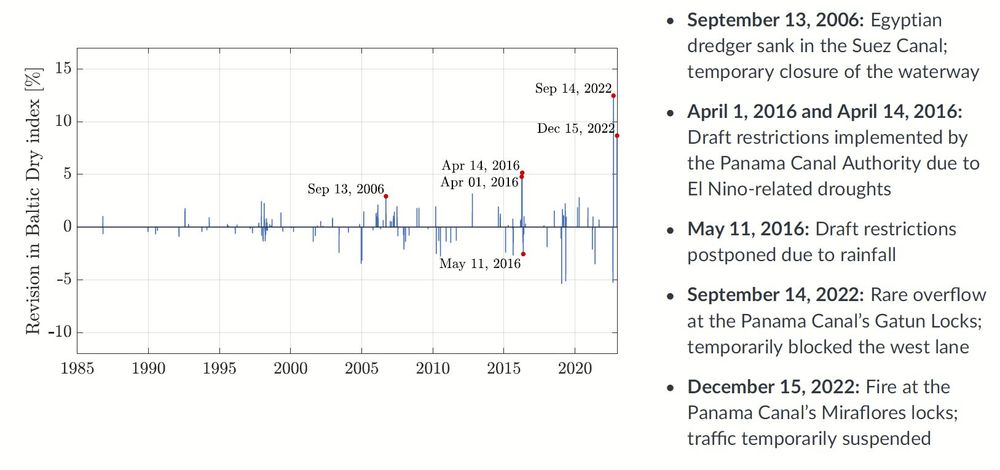

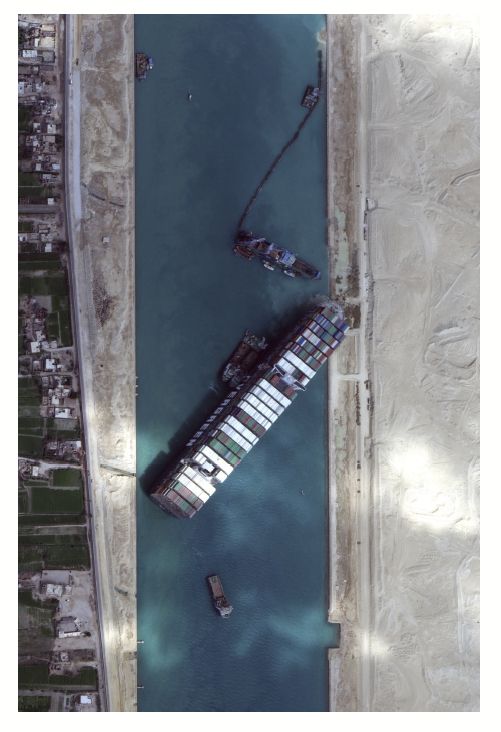

We perform a detailed narrative account of disruptive events at these choke points, including collisions, groundings or extreme weather events. I am sure you remember Ever Given, but there are many more:

10.07.2025 14:53 — 👍 0 🔁 0 💬 1 📌 0

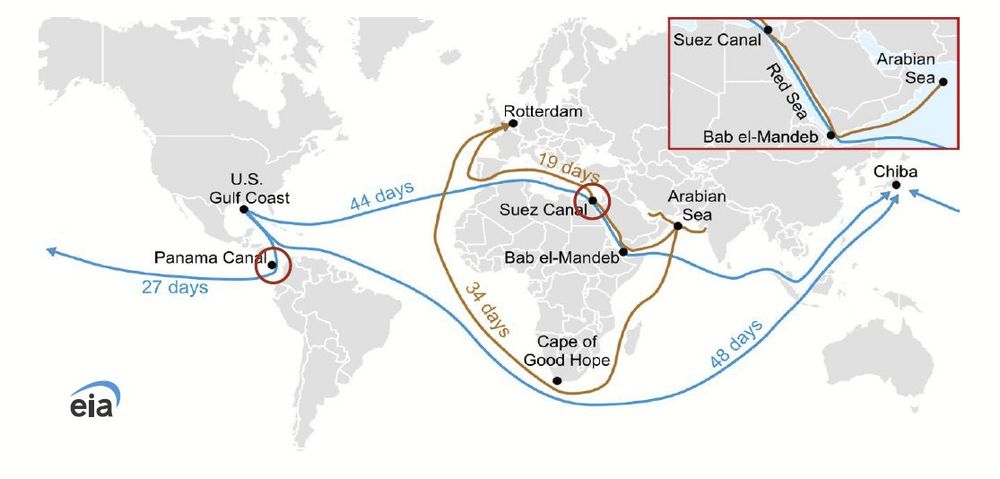

Our idea: Global trade is heavily reliant on maritime trade, which in turn relies on a few key choke points: the Panama and the Suez canal

10.07.2025 14:53 — 👍 0 🔁 0 💬 1 📌 0

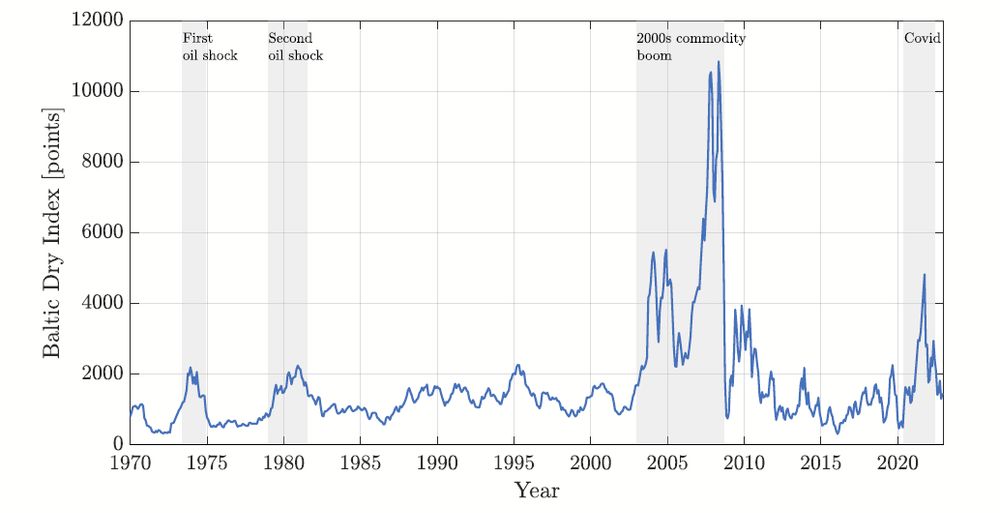

Shipping costs are a key barometer for supply chain pressures. However, they are influenced by both demand and supply. How can we isolate the effects of an exogenous supply chain disruption?

10.07.2025 14:53 — 👍 0 🔁 0 💬 1 📌 0

Very excited to present some new work on the macroeconomic effects of supply chain disruptions at the @nber.org SI, joint with my brilliant student Ramya Raghavan!

10.07.2025 14:53 — 👍 4 🔁 0 💬 1 📌 0

Florin Bilbiie 🇪🇺 🇺🇦 on X: "SED-ing in København, looking forward to the session on inflation this Friday, sharing it with an amazing group of economists. Presenting our paper with Diego @drkaenzig on Profits, Inflation, and AD (and "Greed?"). Sometimes misunderstood, hopefully increasingly less so :) https://t.co/w1hS1uB5Tt" / X

SED-ing in København, looking forward to the session on inflation this Friday, sharing it with an amazing group of economists. Presenting our paper with Diego @drkaenzig on Profits, Inflation, and AD (and "Greed?"). Sometimes misunderstood, hopefully increasingly less so :) https://t.co/w1hS1uB5Tt

And the one and only @florinbilbiie.bsky.social is presenting our work on profits, inflation and aggregate demand: x.com/FlorinBilbii...

26.06.2025 04:43 — 👍 2 🔁 0 💬 0 📌 0

I also have wonderful co-authors presenting some new joint work. @adrienbilal.bsky.social is presenting a new project on climate change and monetary policy

26.06.2025 04:43 — 👍 1 🔁 0 💬 1 📌 0

Really looking forward to this year's #SEDmeeting

in Copenhagen. If you are around, check out this cool session on shipping trends and disruptions, happening this Saturday from 13:30 to 15:00:

26.06.2025 04:43 — 👍 2 🔁 0 💬 1 📌 0

SI 2025 Macro Public Finance

We just finalized the program for this year's @nber.org Summer Institute session on Macro Public Finance:

www.nber.org/conferences/...

Join us on July 17!

@s-stantcheva.bsky.social @dirkkruegerier.bsky.social

02.06.2025 09:09 — 👍 8 🔁 4 💬 0 📌 0

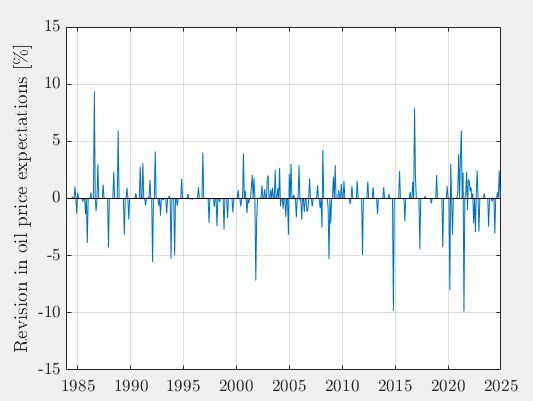

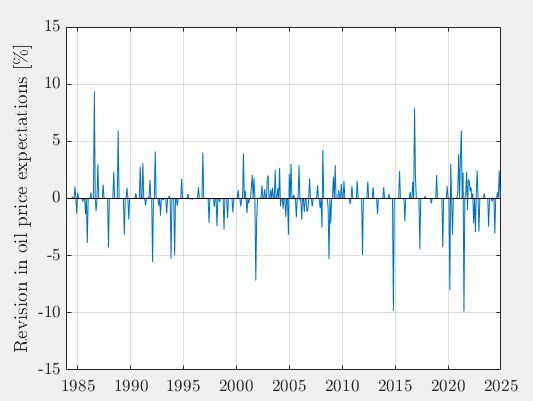

These shocks have meaningful effects on oil prices and the macroeconomy:

22.05.2025 16:24 — 👍 0 🔁 0 💬 1 📌 0

In recent years, there have been some large OPEC surprises in oil markets:

22.05.2025 16:24 — 👍 0 🔁 0 💬 1 📌 0

Non-profit research & grantmaking organization dedicated to advancing evidence-backed ideas & policies that promote strong, stable & broad-based economic growth

equitablegrowth.org

Postdoc at Imperial College London. Research: Macro, Finance, Climate.

More: https://sites.google.com/view/maximiliankonradt

Assistant professor @ Free University of Bozen-Bolzano

Macroeconomics with micro data

andreasdibiasi.com

Research economist at the Bank of England. My personal views only.

Professor of economics at George Mason University, fellow at the Peterson Institute of International Economics, IZA, CReAM/UCL, CEPR, CGD. Associate Editor JEP. USAID 2021–2024. Personal views exclusively.

Web: http://mclem.org

ORCID: 0000-0003-1354-0965

Stanford economist:

Professor of Political Economy; Business & Sustainability.

GSB, Doerr, NBER, CEPR, UiO, TSE, 3ERC.

https://www.gsb.stanford.edu/faculty-research/faculty/bard-harstad

Climate & environmental economics; micro; theory; institutions; trade

Dad, husband, President, citizen. barackobama.com

Professor for Sustainability Economics at University of Hamburg, soon —> ETH Zürich. #climate #biodiversity #pollution #health #inequality

https://sites.google.com/a/fulbrightmail.org/moritzdrupp

Associate professor at U Copenhagen. Resource and environmental economics, welfare economics, game theory. http://frikknesje.com/

Economist. Opinions are my own. RT/likes - not endorsement | PhD @UofR | Research Advisor | Research Fellow @HooverInst @CEPR @iza

Advancing research and teaching at Northwestern University to generate new knowledge about pressing global challenges and promising solutions for addressing them.

Associate Professor in Business and Public Policy at @BerkeleyHaas | Political Economy, Econ History, Organizations

www.guoxu.org

Climate economist, Columbia

https://gwagner.com

It’s pronounced juggernaut without the jug.

Ich werde von etwas als Behausung benutzt!

https://chaos.social/@holgi

Podcast: wrint.network.podigee.io. Mehr: https://wochendaemmerung.de - https://erdeumwelt.podigee.io - https://awo.org/service/podcast/ - https://uebermedien.de/category/podcast/

Economics Prof. @HEC Lausanne. Interests in Deep Learning, Machine Learning, Macroeconomics, Climate Change Economics, Finance, Comp. Science, Skiing and Hiking.

https://sites.google.com/site/simonscheidegger

President CEPR

André Hoffmann Chair and Professor of Economics @ Geneva Graduate Institute