Also, the German car industry’s woes have sucked up most of the attention.

But another storm is brewing in machinery - the other core engine of Germany’s growth model.

Also, the German car industry’s woes have sucked up most of the attention.

But another storm is brewing in machinery - the other core engine of Germany’s growth model.

Brutal chart from @noahbarkin.bsky.social and Gregor Williams. German exports to China grew for nearly two decades - and are now in free fall.

10.02.2026 10:06 — 👍 56 🔁 31 💬 4 📌 2

Applications to the LIS Introductory Workshop 2026 are now open!

www.lisdatacenter.org/news-and-eve...

"Behind Closed Doors: Intra-Couple Pension and Wealth Gaps in Germany and Beyond" 🚪👩🦳👴

@lisdata.bsky.social / @liser.lu policy brief by @nicolekapelle.bsky.social and me out now!

Read more here 👉

www.lisdatacenter.org/newsletter/n...

Looks like LinkedIn is the place to be? At least for me, right now, see you there & happy to connect 👋

(tried X, BlueSky, and Mastodon)

"Who Thrives and Who Falls Behind? Household Income Differences in Luxembourg and its Neighbouring Countries"

... and why we need more research on Luxembourg✍️☺️

www.lisdatacenter.org/newsletter/n...

New Capitalism II:

Compositional vs income inequality

Are all class-based societies unequal?

branko2f7.substack.com/p/new-capita...

My today's Substack:

New Capitalism in America

Richest capitalists and richest workers are increasingly the same people

branko2f7.substack.com/p/new-capita...

seems like a built in feature to keep AI human like.

23.07.2025 22:03 — 👍 0 🔁 0 💬 0 📌 0

How does housing affect living standards in the UK?

Our new interactive charts allow you to explore the status of affordability, supply and quality of British housing ⤵️ buff.ly/X5xMmnF

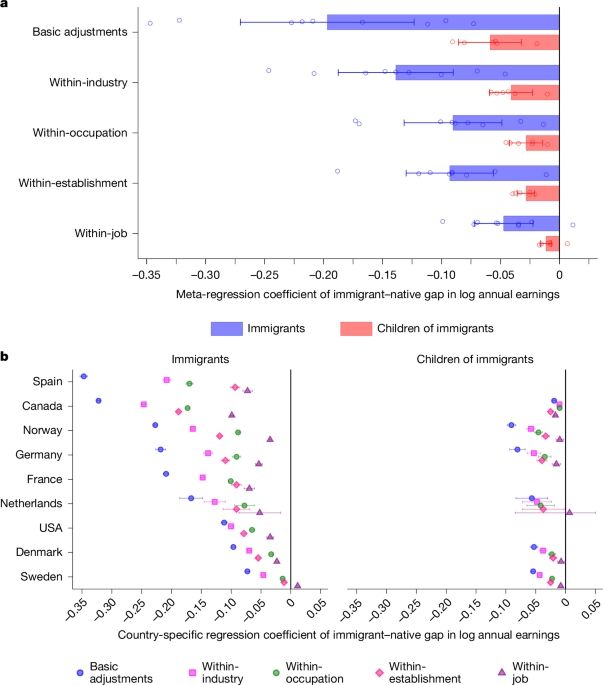

IN OTHER NEWS: check out our new COIN paper on immigrant--native pay gaps in advanced economies published in @nature.com this afternoon! Specifically, we study the relative contribution of within-job unequal pay vs between-job segregation to earnings disparities across immigrant generations. 1/9

16.07.2025 15:16 — 👍 64 🔁 28 💬 4 📌 2

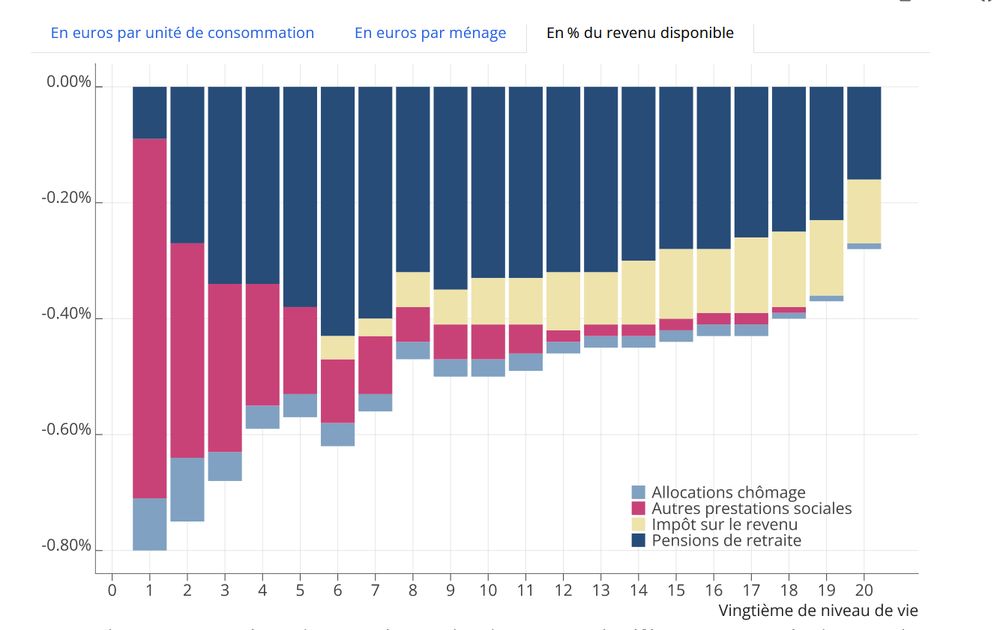

Effet du gel des prestations sociales, des pensions de retraite et de l'IR par 20e de niveau de vie. Le niveau de vie est diminuée d'environ 0,8% au 1er vingtième, 0,6% au 6e vingtième et 0,4% au delà de la médiane

Impôts et prestations: quels effets attendre d’une « année blanche »? Par @pmadec.bsky.social

% au revenu, l'effet d'un gel est bien évidemment plus fort sur les ménages modestes (via les prestations) que sur un ménage médian (via l'IR)

www.ofce.sciences-po.fr/blog2024/fr/...

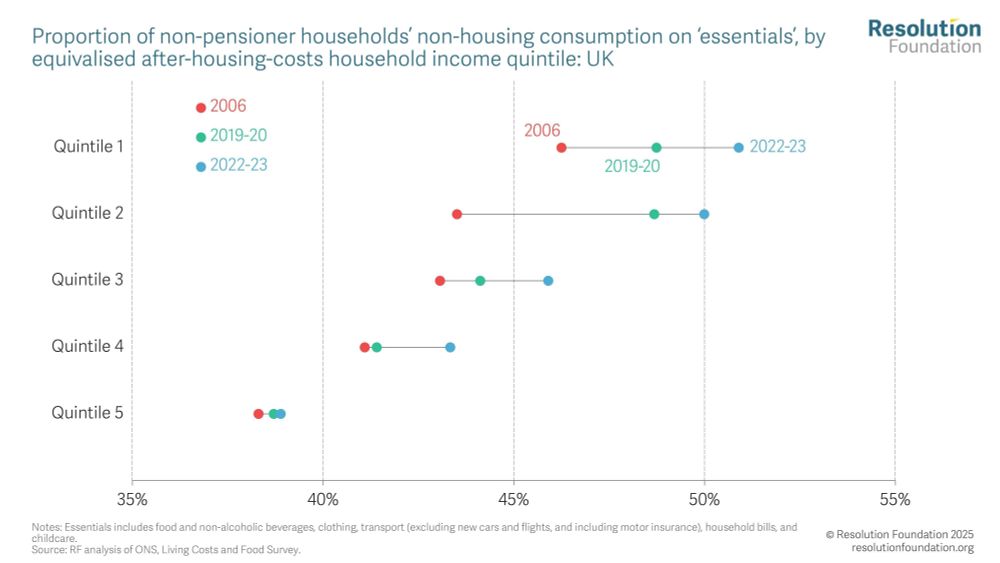

Chart showing Proportion of non-pensioner households’ non-housing consumption on ‘essentials’, by equivalised after-housing-costs household income quintile: UK

The bottom two-fifths of the income distribution saw the biggest rise in essentials spending between the financial crisis and the pandemic

Rising energy prices in particular have led to a ‘comfort crunch’ as families spend more of their budgets on essentials.

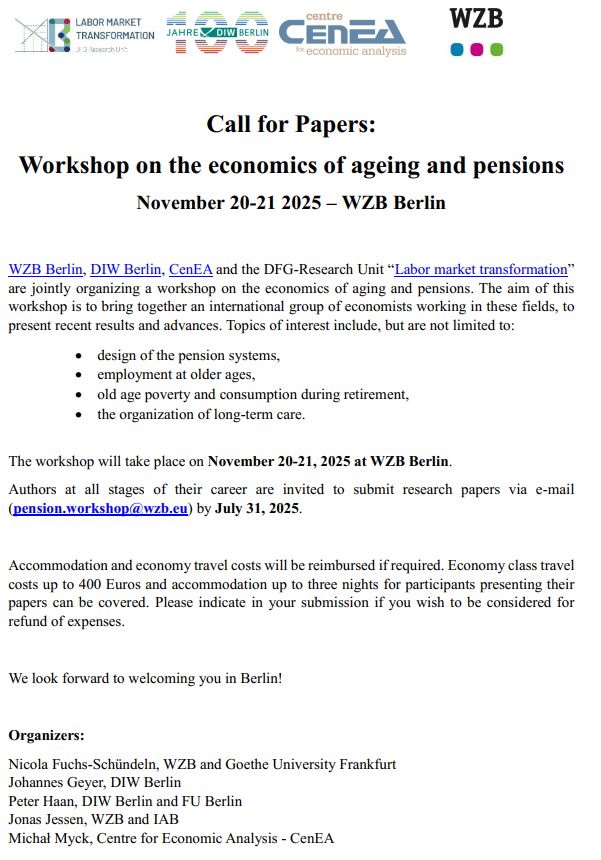

📣CALL FOR PAPERS 📣

Workshop on the economics of ageing and pensions

tinyurl.com/2wez4wp7

Where? Berlin @wzb.bsky.social 🐻

When? November 20-21 November 🍂

For whom? Researchers at all stages in their career

Anything else? Accomodation & travel cost will be covered 🚅🏨

Please circulate!

The divergence in child versus pensioner income trends over both halves of the 2020s is also not new. In 2002-03 pensioners and children had very similar typical equivalised household incomes, but between then and 2023-24 the median pensioner income grew by 32 per cent and the child figure by 7 per cent (with the typical working-age income growing by 8 per cent). In cash terms, the equivalised household income gap between pensioners and children has grown from roughly zero in the early 2000s to over £5,000 by 2023-24 and potentially over £7,000 by 2029-30. As we explore below, this is also reflected in poverty figures.

The typical pensioner and typical child’s household income were once very similar, but have diverged.

In cash terms, the equivalised household income gap between pensioners and children has grown from roughly zero in the early 2000s to over £5,000 by 2023-24 and potentially over £7,000 by 2029-30.

1/10 🚨Why do women accumulate less wealth than men across countries and time?

I had the privilege of co-directing the latest Special Issue of #SER @sasemeeting.bsky.social with @celinebessiere.bsky.social on gender and wealth accumulation. 🧵 ⤵️

academic.oup.com/ser/article/...

Comparable, well, so so... yes, the Americans can in principle buy more, but in fact they may need to spend more for private healthcare, education, and childcare, which is typically integrated in public services in Denmark.

09.07.2025 15:44 — 👍 2 🔁 0 💬 0 📌 0

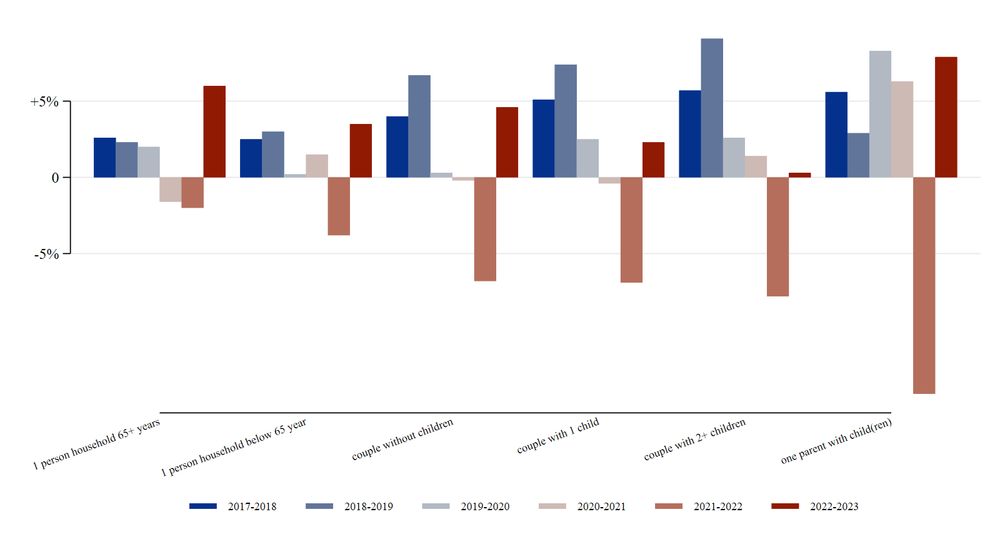

It remains remarkable to look at PPP-adjusted amounts. The Danish look less well off, and the distance between lone parent and couple households in the U.S. is much higher.

09.07.2025 15:44 — 👍 1 🔁 0 💬 1 📌 0

The similar pattern can be observed in the U.S. However, there, particularly single parent households lose after receiving additional support during the COVID years.

09.07.2025 15:44 — 👍 1 🔁 0 💬 1 📌 0

Interesting insights in the inflation crisis with latest #LISdata

Danish incomes in real terms decreased massively in 2022 for all household types.

Chart showing Proportion of non-pensioner households’ non-housing consumption on ‘essentials’, by equivalised after-housing-costs household income quintile: UK

The bottom two-fifths of the income distribution saw the biggest rise in essentials spending between the financial crisis and the pandemic

Rising energy prices in particular have led to a ‘comfort crunch’ as families spend more of their budgets on essentials.

Poorer families in Britain are spending more of their income on essentials The poorest half of working-age households now spend 49% of their non-housing budgets on essentials like food, utility bills, clothing, childcare, and transport, up from 42% in 2002. Meanwhile richer households now spend 41% of their budgets on essentials, up from 37% in 2002.

This cost increase comes despite many essentials falling in price. The cost of clothes has fallen by 37% in real terms since before the financial crisis. Fuel is cheaper in real terms today than it was in 2002. While the recent surge in ‘cheapflation’ on low-cost groceries increased rates of food insecurity, food prices are still 11% lower than the OECD average.

But energy costs have skyrocketed. Between 2000 and 2019, the cost of gas and electricity doubled in real terms. These costs shot up further between 2019 and 2023, with annual bills rising from £1,200 to £2,051. While energy prices have come down from the 2023 peak, total household energy debt has more than doubled, from £1.6 billion in Q4 2019 to £3.9 billion in Q4 2024.

A social tariff could help struggling families with energy bills. Offering a 10% tariff discount to the poorest two-fifths of households in England and Wales would cost £1.6 billion. This the same as the expected cost of the re-introduce Winter Fuel Payments, but better targeted at those who need help the most.

Low-to-middle income families have been experiencing a 'comfort crunch', as they now spend more of their budgets on essentials, especially energy and food.

Read more 👉 buff.ly/gXWlEGQ

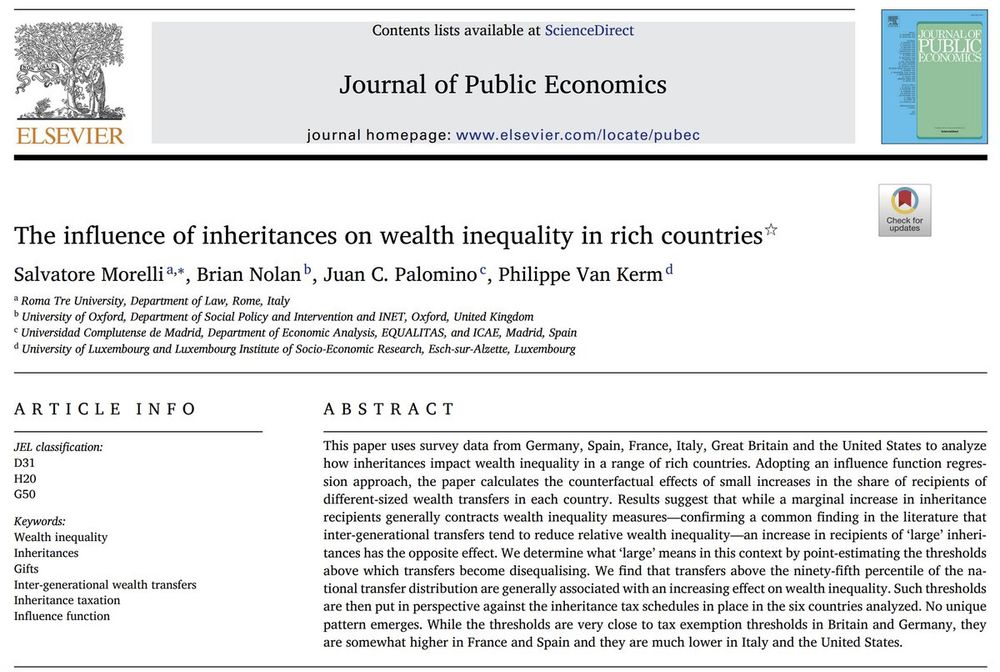

Just published in @jpube.bsky.social:

"The Influence of Inheritances on Wealth Inequality in Rich Countries"

By @morellisal.bsky.social, Brian Nolan, @juancpal.bsky.social, & Philippe Van Kerm

www.sciencedirect.com/science/arti...

#econsky #publiceconomics #publicfinance

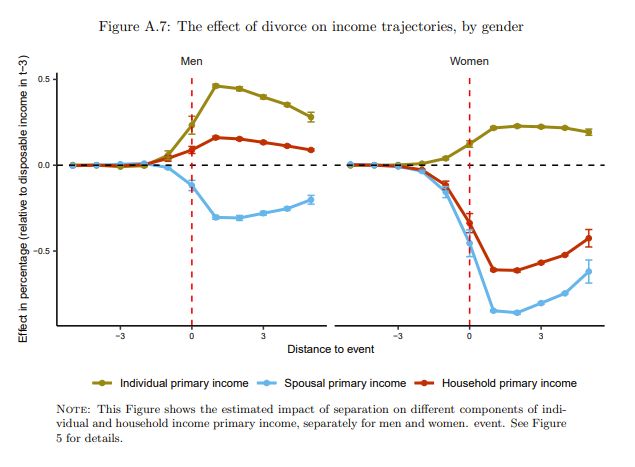

Very striking findings on the effect of divorce for men vs. women from a recent study, underlying data are administrative data from the Netherlands

www.cpb.nl/sites/defaul...

It's a wrap! The 2025 meeting of LIS' governing body, where representatives from many countries assess past work, review current projects, and plan LIS' future. These meetings demonstrate the extraordinary power and potential of international cooperation. #42years @lisdata.bsky.social

01.07.2025 12:20 — 👍 8 🔁 2 💬 1 📌 0

Recently, we updated the World Bank’s global poverty measures – three big changes:

(1) New survey data (especially for India)

(2) Change to 2021 PPPs

(3) New global poverty lines

Blog: blogs.worldbank.org/en/opendata/...

Details: documents1.worldbank.org/curated/en/0...

[1/5]

Second, private pensions became more equally distributed among the retired in most countries." [3/3]

19.06.2025 06:19 — 👍 0 🔁 0 💬 0 📌 0First, more equally distributed public pensions in emergent multi-pillar systems and declining shares of capital income in mature multi-pillar systems either fully or partially compensated for increased inequality due to larger shares of private pensions. [2/3]

19.06.2025 06:19 — 👍 0 🔁 0 💬 1 📌 0