S&P500 Dec24 Rebalance: APO and WDAY IN; QRVO and AMTM Demoted - Travis Lundy

S&P500/400/600 Index rebal names were announced Friday. APO + WDAY are the big S&P500 adds. QRVO and AMTM get demoted to 600. 17x/13x ADV for the ADDs, 3+x ADV for the sells. $10bn of funding trades.

The big flows for S&P500/400/600/Completion rebalance.

17x ADV (estimated) to buy on APO.

13x ADV (estimated) to buy on WDAY.

3-4x ADV to sell on QRVO and AMTM

$11bn of funding trade on S&P498

$11bn of reverse funding on S&P Completion -2

$5bn a side for $RSP.

The piece: skr.ma/UgLmN

09.12.2024 12:26 — 👍 1 🔁 0 💬 0 📌 0

I think he’s done. This is an effort to delay the inevitable lame duck status.

He’s done.

03.12.2024 15:11 — 👍 2 🔁 0 💬 0 📌 0

Koreanists

Join the conversation

In light of the martial war declaration in South Korea, here are some people you should follow for informed analyses & news about the developing situation.

Koreanists: go.bsky.app/U3Nm5FX

Korea watchers: go.bsky.app/9SrguSU

Korean studies scholars: go.bsky.app/8nRZ5tp

+ @koreajoongangdaily.com

03.12.2024 14:40 — 👍 1425 🔁 779 💬 79 📌 86

Though if someone asks me… this is a political fight not a natsec issue and it was A Bad Idea by a politician who feels he is cornered and thinks resorting to old style ‘politics’ has value (it doesn’t).

03.12.2024 15:08 — 👍 3 🔁 0 💬 1 📌 0

S Korea has seen martial law before but it doesn’t always end the same.

The big picture issues will be all over the geopol pundit timelines.

The nuances of how this works out are going to be domestically understood rather than Twitter/bsky experts.

Find the right expert.

(it ain’t me).

03.12.2024 15:04 — 👍 2 🔁 0 💬 1 📌 0

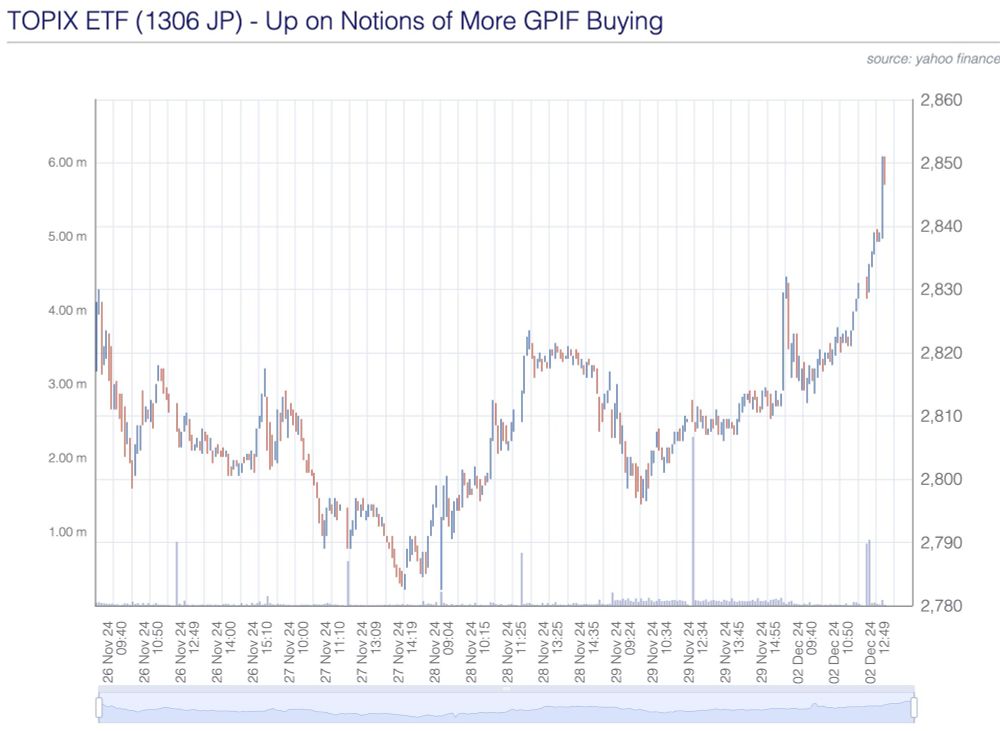

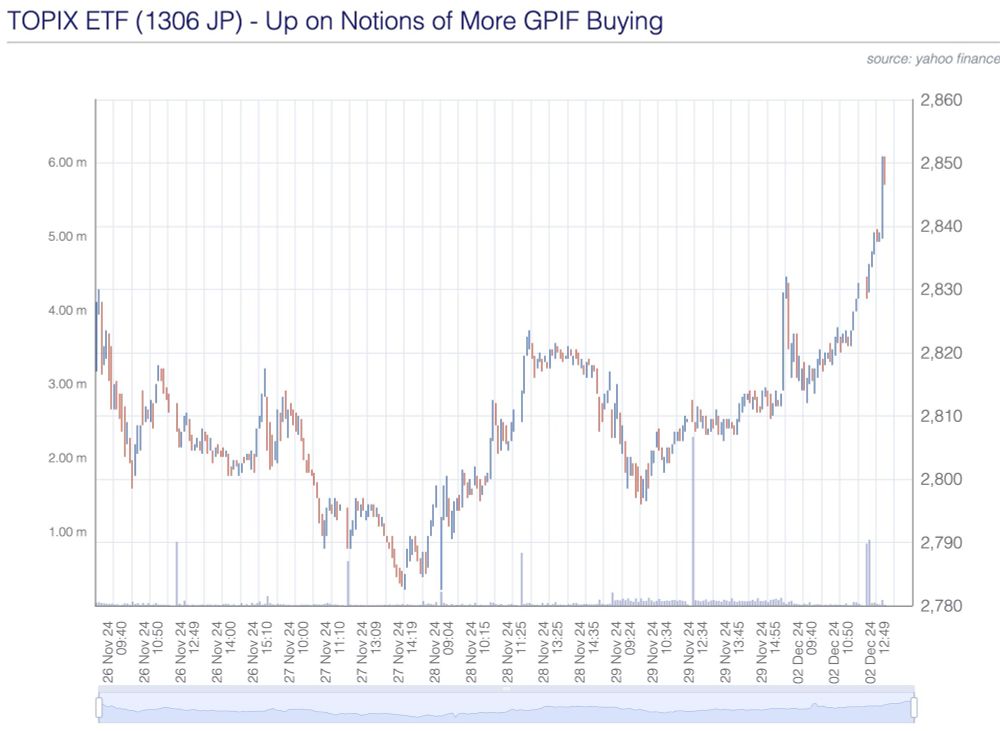

solvent against future liabilities (which Brad Setzer noted are not explicit) for longer.

It is a reasonable "political goal", but it works, in return terms, with a stable USDJPY not a strong USDJPY.

02.12.2024 07:36 — 👍 0 🔁 0 💬 1 📌 0

*JAPAN WANTS TO LIFT GPIF REAL INVESTMENT RETURN TARGET TO 1.9%

This means less domestic bonds, more Japan and foreign equities.

The "political angle" here is to 'force' a higher target return, more risk, with the 'political goal' being to keep the GPIF

02.12.2024 07:32 — 👍 3 🔁 0 💬 1 📌 0

And you thought the used car premium got silly last time…

26.11.2024 00:11 — 👍 3 🔁 0 💬 0 📌 0

Keisei Elec (9009 JP) is bouncing hard today on a Toyo Keizai report that noted Japanese activist Murakami-san has bought a stake (under 1%).

Keisei is getting the boot from MSCI today. A bunch of HFs who had been short are getting a nice lesson in shareholder structure risk.

25.11.2024 08:04 — 👍 2 🔁 0 💬 0 📌 0

And as far as I can tell, Barron seems to have done a rug pull. Or tried to.

21.11.2024 14:16 — 👍 1 🔁 0 💬 0 📌 0

So… 7&i…

19.11.2024 13:21 — 👍 0 🔁 0 💬 0 📌 0

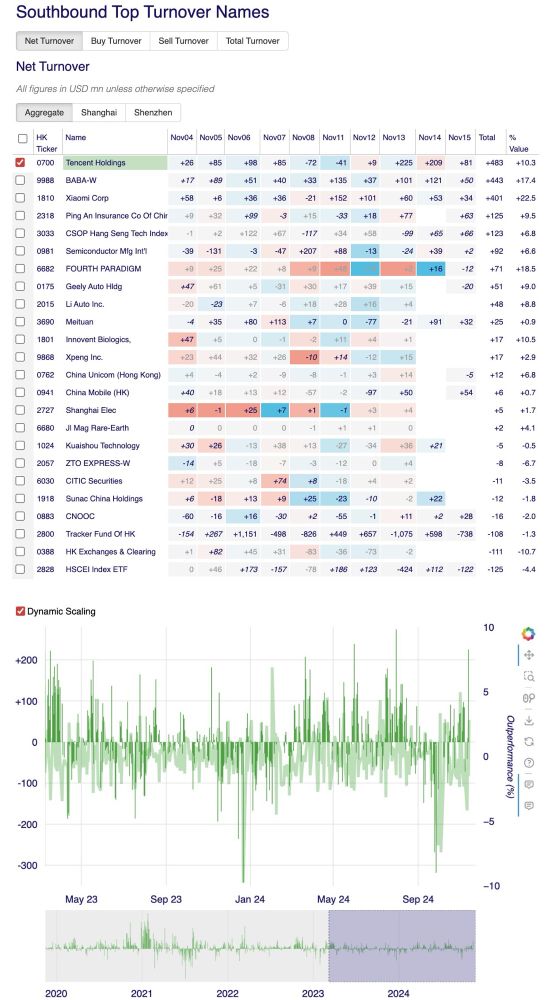

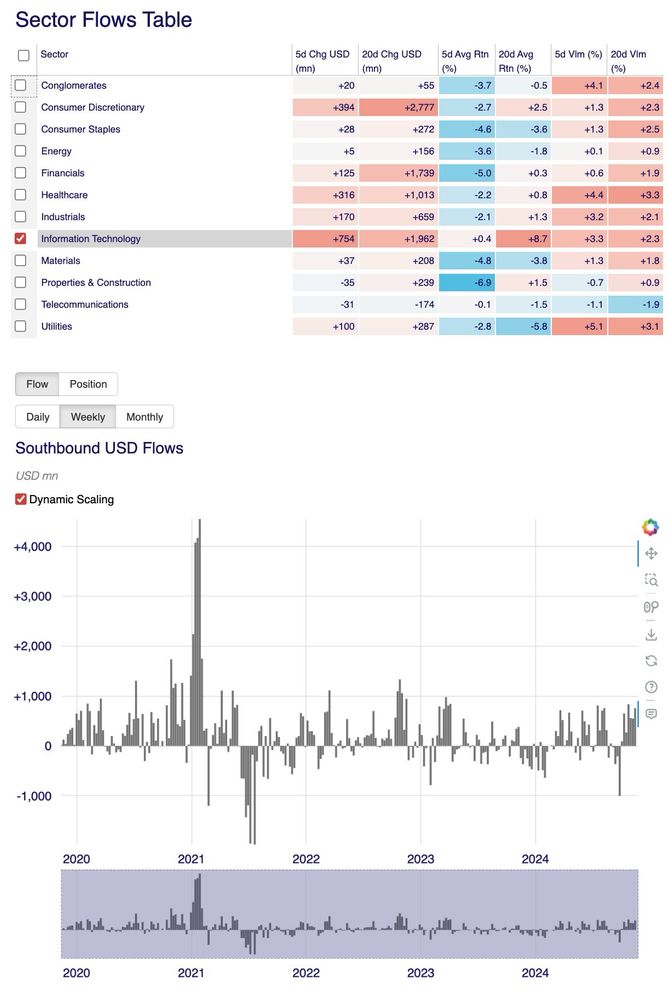

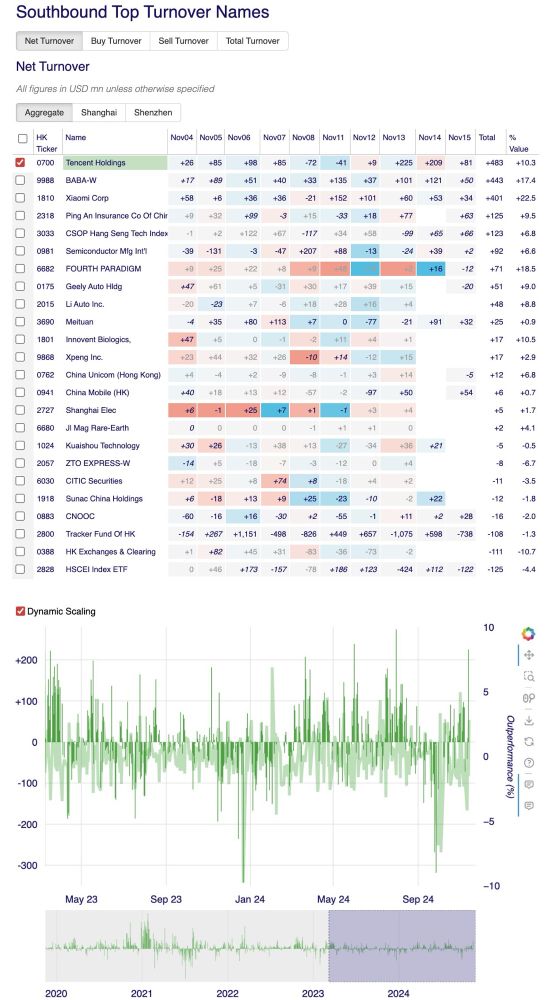

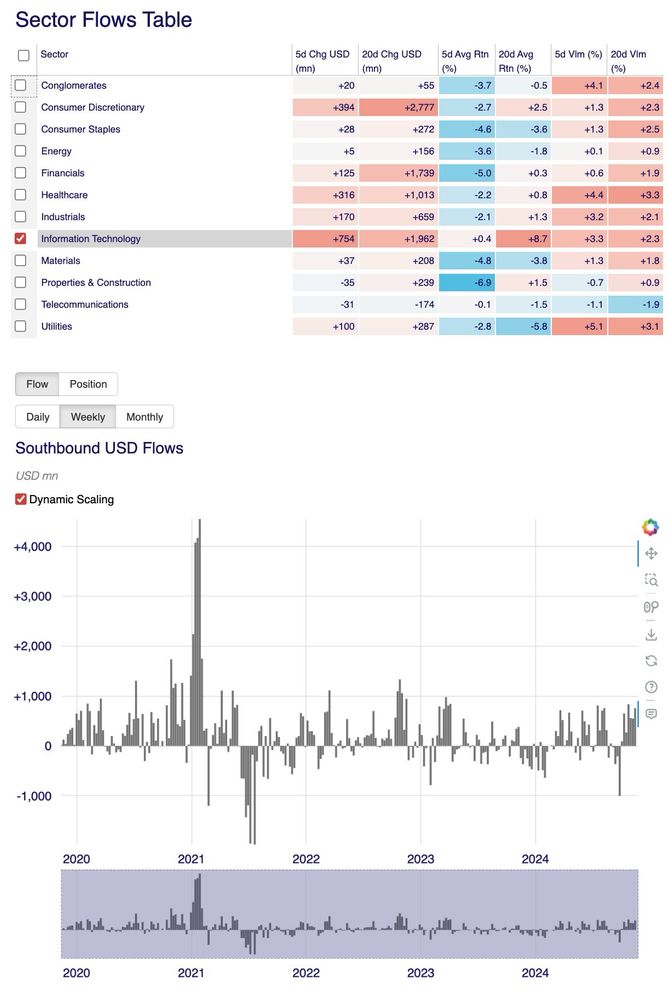

Tencent was the big net buy on the week for SOUTHBOUND. Alibaba and Xiaomi were #2 and #3.

Net buying by SOUTHBOUND in Info/Tech is decent recently, but still nothing like the froth of early 2021.

16.11.2024 16:09 — 👍 1 🔁 0 💬 1 📌 0

HK Connect SOUTHBOUND saw BIG buying this past week (previous week was big too) as HK stocks got shellacked on the week (HSI -6.3%, HSCEI -6.45%) and mainland blue chip indices were also hurt (CSI300, SSE50, SSE180 were -3.3%, -3.4%, -3.64%) and CSI 500 worse (-4.8%)

16.11.2024 16:09 — 👍 0 🔁 0 💬 1 📌 0

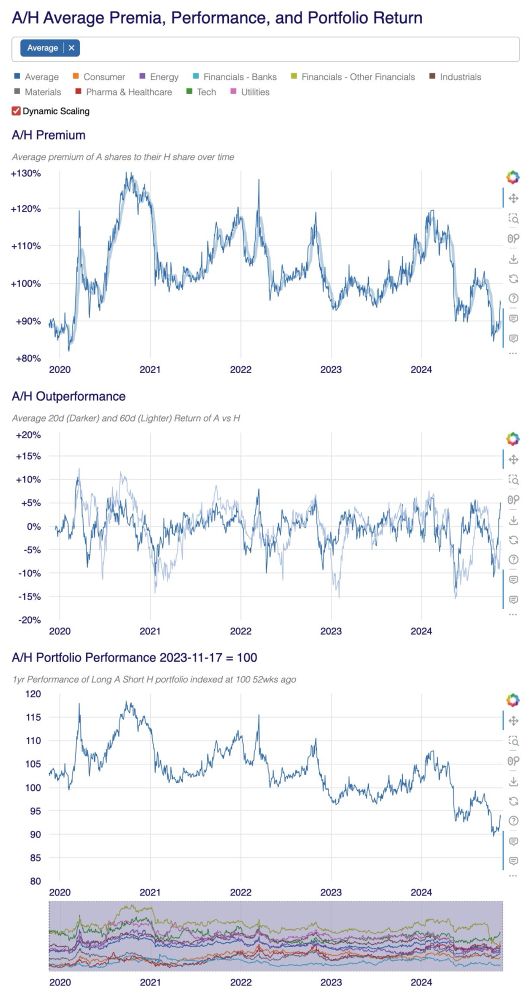

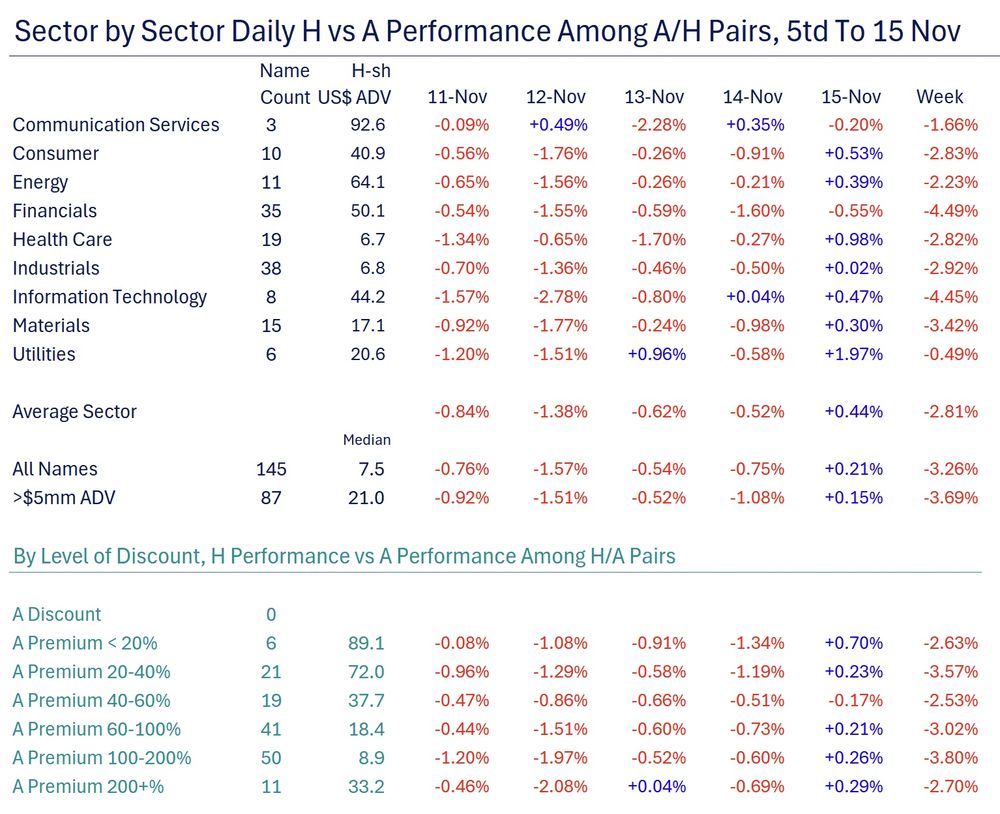

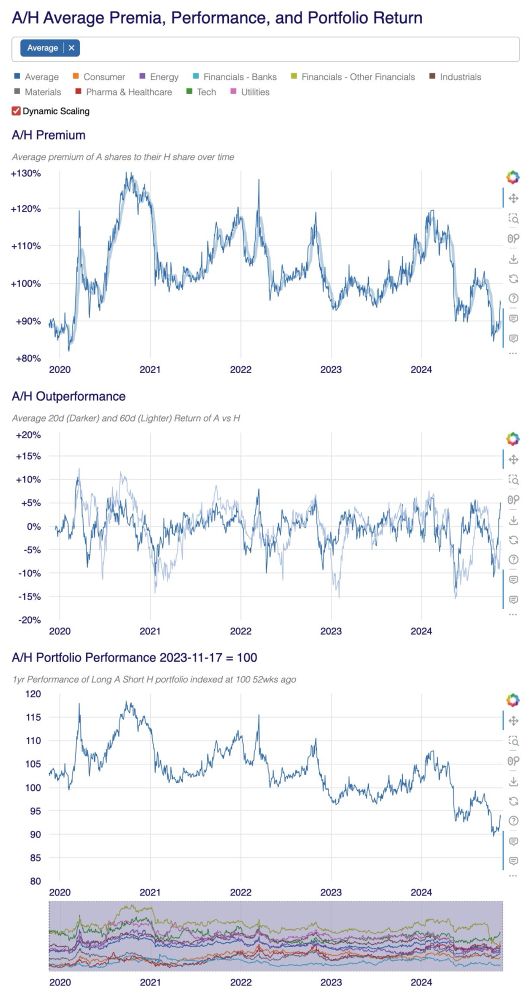

One can see Sinopec (386 HK) is at its cheapest in 52 weeks (the yellow dot in the premium range section in the first table) and also at its widest in 5yrs in terms of H vs A (A premium to H highest in 5yrs)

16.11.2024 16:05 — 👍 0 🔁 0 💬 1 📌 0

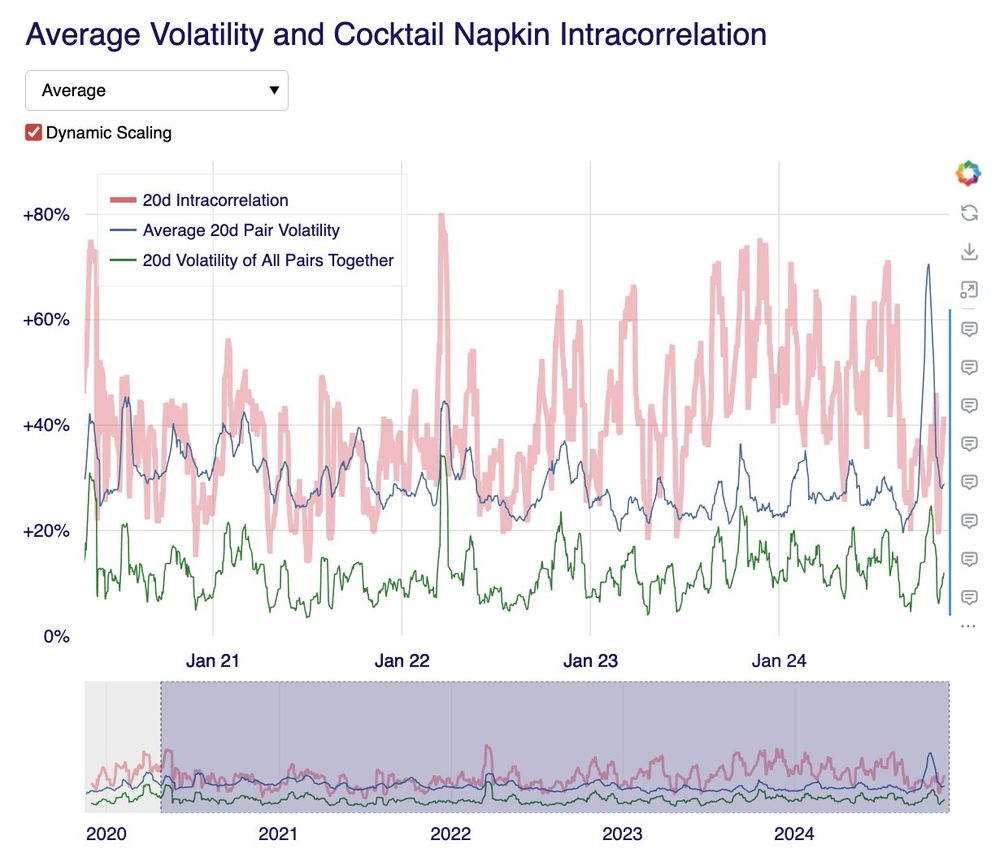

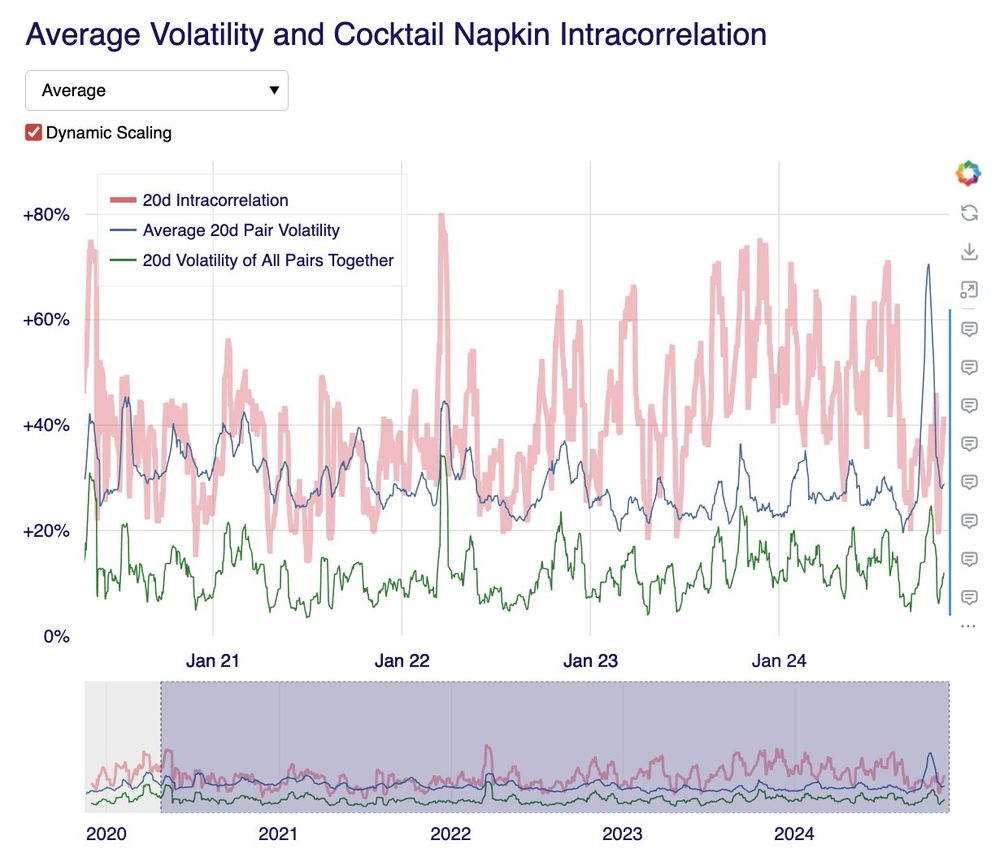

Somewhat strangely, intracorrelation of pairs is low recently (after spiking through the Sep hols) and pairwise volatility is also low (until this week).

16.11.2024 16:05 — 👍 0 🔁 0 💬 1 📌 0

The top chart below shows As have sharply outperformed Hs within their pairs recently. The second shows just how much it is on a rolling basis.

16.11.2024 16:05 — 👍 0 🔁 0 💬 1 📌 0

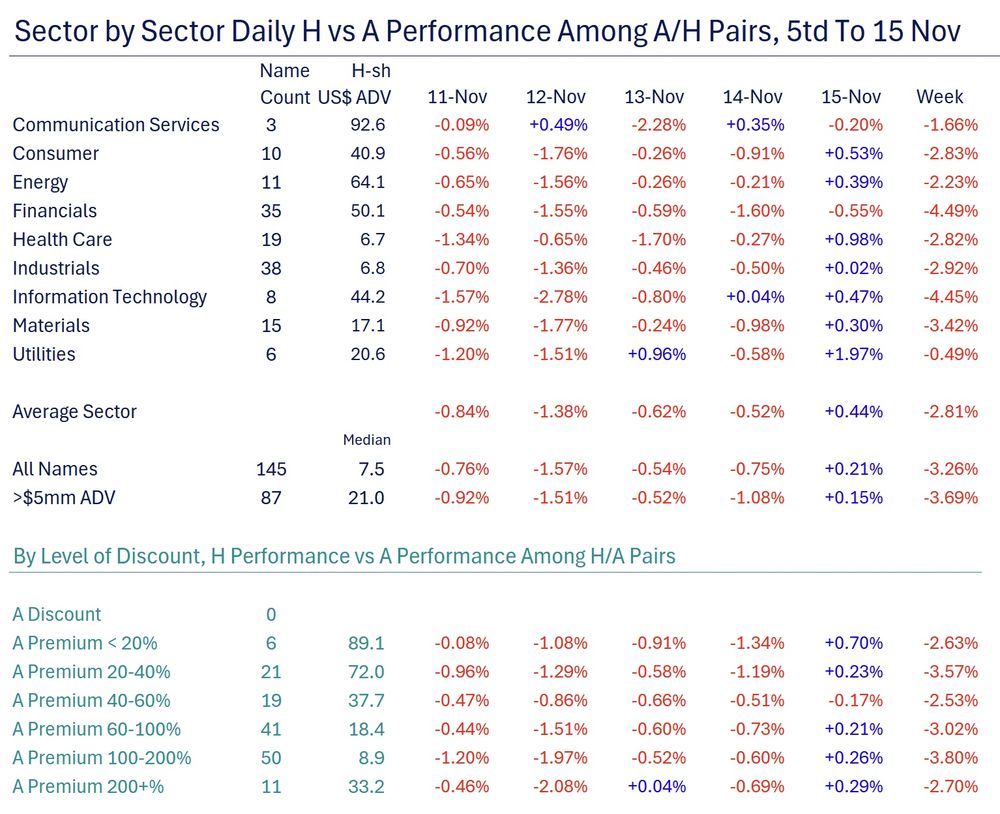

This past week in H-share/A-share pairs was something of a disaster.

Within the HK/mainland universe, H/A pairs saw H underperformance of 3.7% for the average liquid pair. Tech and Financials were especially hurt.

16.11.2024 16:05 — 👍 1 🔁 0 💬 1 📌 0

So… 7&i.

13.11.2024 04:50 — 👍 0 🔁 0 💬 0 📌 1

¥900bn of buybacks after the next 12mos over the following 24mos.

And that tells you where EPS will trend to in a few years’ time.

31.10.2024 13:28 — 👍 0 🔁 0 💬 0 📌 0

So after the first 12mos, Denso probably has another ¥540bn (at current price) to buy just from UnListedCo and TIC.

But… if they buy say ¥350-400bn a year, that puts Toyota Motors closer to a legal voting rights border problem. So they’d sell some too.

This buyback is ¥450bn. I expect there is

31.10.2024 13:27 — 👍 0 🔁 0 💬 1 📌 0

12mos. So ¥160bn would come from the public. That’s about 4% of ADV every day on a net basis.

But Toyota Group shareholders are selling crossholdings and that will likely include big holdings in a large unlisted Toyota Group member. And that member will have to sell its ¥300bn of Denso to fund it.

31.10.2024 13:23 — 👍 0 🔁 0 💬 1 📌 0

They also said financial crossholders had approached wanting to sell. That’s the P&C insurers. 1.2% or ~¥80bn.

Also today, TIC said it would sell its 185mm shares from Dec24 through Mar27. No method decided but as it is ¥400bn, it’ll probably be a 28mo VWAP trade. That’s about ¥160bn in the next

31.10.2024 13:21 — 👍 0 🔁 0 💬 1 📌 0

buybacks. Aisin did too. Toyota sold shares in insurers. The insurers sood shares in Toyota. Toyota sold KDDI.

Today, Denso announced a ¥450bn buyback over the next year. That’s 13% of ADV. Every day. And they suggested “If a major shareholder wants to sell, we’d accommodate” (up buyback size).

31.10.2024 13:18 — 👍 0 🔁 0 💬 1 📌 0

¥460bn selldown of its TIC (6201) stake. Basically a 30-month VWAP trade. Also in Q1, the FSA told P&C insurers they had to sell crossholdings. They own Toyota Group cos too. Then Denso sold a block of Renesas (6723) (more to go). Then there was an Aisin offering. TIC and Toyota Motors announced big

31.10.2024 13:12 — 👍 0 🔁 0 💬 1 📌 0

Aisin, Toyota Industries (TIC), and Toyota Motors did a multi-billion dollar secondary offering on fourth group musketeer, Denso (6902).

Denso initiated a ¥200bn buyback, and promised to sell down its Aisin and TIC holdings. It bought back the stock in 3mos, then in March it announced a 10-quarter

31.10.2024 13:08 — 👍 0 🔁 0 💬 1 📌 0

When Aisin (7259) announced a year ago September that it would sell all its cross-holdings eventually, it meant Toyota Group would go from capital governance recidivist to leader.

In November, a bunch of small sell downs occurred across the group. Then in late Nov23, the first big name selldown as

31.10.2024 13:02 — 👍 0 🔁 0 💬 1 📌 0

Lurking as the migration continues

Deputy Director & Fellow @korea.csis.org

- China's Weaponization of Trade: https://shorturl.at/X3yPG

- Koreanists starter pack: https://go.bsky.app/U3Nm5FX

- Personal website: andysaulim.com

- Moonlighting at @citylightsofchina.bsky.social

Washington Post Tokyo/Seoul Bureau Chief, covering Japan, the two Koreas and beyond. Mom to two needy cats & a rambunctious golden retriever. michelle.lee@washpost.com

New York State Author Laureate 2025-2027. Writer. New Yorker. Late Bloomer.

www.minjinlee.com

Assistant Professor at William & Mary.

www.eunajo.com

Georgetown Professor, author, former USG, CSIS Geopolitics President, long-suffering Giants and hopeful Knicks aficionado.

Assistant Professor in Media Law and Ethics, UMass-Amherst

Proud UNC J-school PhD alumna

heesoojang.com

Korea Studies Fellow in the Asia Program @carnegieendowment.org Researches Korean Peninsula politics, economy, and security. https://www.darciedraudt.com

Assistant Professor @Yale || Studying International Relations with a focus on territorial conflicts, rivalries, and nationalism

https://www.soyoungleeresearch.com

Stanton Senior Fellow, Carnegie Endowment for International Peace; Author of ‘THE NEW NUCLEAR AGE’ (Polity) & ‘KIM JONG UN AND THE BOMB’ (Hurst/Oxford)

Subscribe to my newsletter (Nukesletter): https://panda.substack.com/

Director, Nuclear Information Project, Federation of American Scientists. Tracking nuclear arsenals, co-author of Nuclear Notebook, SIPRI Yearbook. Opinions my own.

Website: https://fas.org/initiative/nuclear-information-project/

PRC and DPRK strategic forces analyst with CNA. BA Reed College, MA Middlebury Institute. NSF GRFP.

Open Source Analysis of ballistic missiles, nuclear weapons, BMD, DPRK, & PRC.

Vice President of Nuclear and Technology Security Programs, Exiger.

Making podcasts over at https://www.armscontrolwonk.com/

All opinions my own.

Media scholar | Assistant Professor of Political Science @Columbia | Author of The American Mirage (PUP 2025) | Host of Media Effects Empricial Workshop (MEEW)

Economist | Assistant Professor and Director of LSU Global Value Chains Research Program at Louisiana State University | 2025 FarmFoundation Fellow

Website: https://sites.google.com/view/limsunghun

International relations-diplomacy-international security.

🐿️ watcher striving to be a whisperer

Philosophy professor, Univ of Arizona 🌵 executive team at SEP 👩💻 thinking about fiction, poetry, music, movies, time, VR, AI & East Asian thought 🇰🇷🇰🇵 freelancer for philosophy, arts & culture ✌️

www.hannahkimphilosophy.com

North Korea-focused journalist/researcher at www.38North.org and NorthKoreaTech. Senior Fellow, Stimson Center. On air as KJ6SDF. UK to US via Japan.

Sociologist at Loyola University Chicago