“'We as consumers are quite vulnerable right now,' says Christine Hines, senior policy director at the National Association of Consumer Advocates.

'We all need to be much more diligent about the products and services that we sign up for.'"

@consumeradvocates.bsky.social

The National Association of Consumer Advocates (NACA) is a nonprofit association of attorneys and advocates committed to representing customers’ interests.

“'We as consumers are quite vulnerable right now,' says Christine Hines, senior policy director at the National Association of Consumer Advocates.

'We all need to be much more diligent about the products and services that we sign up for.'"

The CFPB was set to return $360 million to consumers harmed by lenders, student loan servicers, money transfer companies, and more. But now those consumers may never see a dime.

29.07.2025 13:24 — 👍 0 🔁 0 💬 0 📌 0

Today is the CFPB's 14th birthday! From regulating financial products to advocating against predatory practices, the CFPB has helped millions of Americans and returned billions to them since 2011.

That fact makes the ongoing attacks on the Bureau that much more egregious.

"Ordinary people are more at the mercy of the companies they do business with, said Christine Hines, senior policy director at the National Association of Consumer Advocates...'Consumers generally are in a very precarious place because some of these fundamental protections have been removed.'"

18.07.2025 15:21 — 👍 0 🔁 0 💬 0 📌 0

The CFPB has said the agency is pivoting from other enforcement to focus on protecting servicemembers, veterans, and their families.

Yet, actions like dropping an action against Navy Federal Credit Union with no explanation and kneecapping the Office of Servicemember Affairs undercuts that claim.

“Banks aren’t paying hundreds of millions out of generosity. They’re paying because they broke the law.”

That’s what happens when the CFPB does its job.

And now Congressional Republicans want to slash its funding?

🗣️: @velazquez.house.gov

The Trump administration and Russ Vought are "reverse-engineering" CFPB settlements, including one that would have forced Navy Federal Credit Union to return $80 million to veterans and Navy servicemen/women, and $48 million to harmed Toyota customers. apnews.com/article/cfpb...

15.07.2025 15:40 — 👍 147 🔁 43 💬 7 📌 5

The House Financial Services Subcommittee is pushing to undo critical protections in Dodd Frank, and is currently discussing DOZENS of bad bills that play fast & loose with consumer protections & the stability of our financial system. Do they *want* another financial crisis? buff.ly/nmXw3eC

15.07.2025 14:45 — 👍 1 🔁 1 💬 0 📌 0

CFPB employees have been barred from working for nearly six months, enforcement actions are being dropped left and right without explanation, the budget has been slashed in half...

And Congress is still considering more bills to attack the CFPB. This assault must end! #HandsOffCFPB

Today, the House Financial Services Committee is once again holding a hearing discussing DOZENS of bad bills aimed at gutting the CFPB.

Earlier this year, we took a closer look at some of those bills on our blog and the enormous harm they could wind up inflicting. #HandsOffCFPB

CFPB employees have been blocked from working, but that doesn't mean there was no work to be done. Consumer complaints have been soaring and no one is addressing them.

The situation is only going to get worse for consumers as attacks on the CFPB and consumer protection continue.

Millions of people recently saw their credit scores drop into “subprime” borrower status. Why? The Trump administration starting reporting student loan delinquencies to credit bureaus, writes @chichiwu.bsky.social in @chicagotribune.com

www.chicagotribune.com/2025/07/03/o...

Servicemembers risk their lives to protect us. They deserve a strong CFPB that protects them from scams, fraud, and other predatory conduct.

08.07.2025 14:16 — 👍 0 🔁 0 💬 0 📌 0

. @benwinters.bsky.social, director of #AI and #DataPrivacy at the Consumer Federation of America, said #Congress could take up the idea of pre-empting state laws again in separate legislation. "Fundamentally, it's just a bad idea."

www.cnet.com/tech/service...

Need a quick read with some good news? Take a minute to virtually meet three more of our NACA Summer Fellows: www.linkedin.com/feed/update/...

01.07.2025 12:26 — 👍 1 🔁 1 💬 0 📌 0A great reminder that the CFPB was created in the aftermath of the 2008 financial crisis after millions lost their jobs and savings.

27.06.2025 15:50 — 👍 0 🔁 1 💬 0 📌 0#WATCH: Ranking Member Waters' opening statement at today's Subcommittee on Oversight & Investigations hearing:

"For consumers who broadly support having a strong Federal watchdog protecting them from financial rip offs, this Republican-led Congress is not providing it." | tinyurl.com/yc847afk

Under CFPB Director Chopra, the agency’s work saved consumers $1 billion each year from overdraft charges alone. 79% of voters approve of the CFPB's mission & work. It is because of the efficacy of Chopra's work at the CFPB that the billionaires are now gunning for its demise.

26.06.2025 14:40 — 👍 2 🔁 1 💬 0 📌 0

This summer, a dozen law students are working with NACA members to learn about practicing consumer law. We're introducing them on our LinkedIn page and would like you to meet our first two Fellows: www.linkedin.com/feed/update/...

24.06.2025 17:34 — 👍 0 🔁 1 💬 0 📌 0

President #Trump's rapid pullback of the U.S. Consumer Financial Protection Bureau has cost Americans at least $18 billion in higher #fees and lost #compensation according to the @thesbpc.bsky.social and CFA. #CFPB

@reuters.com

Dropping enforcement actions means that not only will ripped-off consumers never receive any compensation, but that known corporate bad actors will be emboldened to continue their predatory practices.

23.06.2025 15:40 — 👍 2 🔁 1 💬 1 📌 0

“The #stablecoin bill creates a transmission channel from the extremely volatile #crypto ecosystem to the traditional #financial sector, and that’s incredibly dangerous,” @csfrayer.bsky.social said. #GENIUSACT

23.06.2025 12:54 — 👍 3 🔁 1 💬 0 📌 0

Another shameful proposal by the CFPB's current leadership. The CFPB's consumer education and financial literacy programs have long been a tool to prevent consumer harm before it happens.

18.06.2025 18:49 — 👍 1 🔁 0 💬 0 📌 0AI is already developing and being adopted at a rate regulators can barely keep up with. A 10-year blanket preemption of all state and local protections is likely to lead to disaster for consumers.

17.06.2025 14:25 — 👍 0 🔁 0 💬 0 📌 0

New from our blog: A closer look at the CFPB's withdrawn guidance on unfair fine print in consumer contracts.

State and federal lawmakers should be stepping up to make sure consumers aren't being ripped off by boilerplate terms and conditions.

Notably, the Motion, as observed by Amici, is unprecedented. The Parties in this case—a government agency and private parties—voluntarily entered into a settlement and consent decree to resolve the dispute. As previously noted, the consent decree, among other things, enjoined Townstone from engaging in any acts that violate the ECOA in connection with offering or providing mortgage loans. The voluntary nature of the resolution of this case cannot be overemphasized. It was only after a change at the leadership at CFPB that CFPB now seeks—along with Defendants—to unwind the very settlement and consent decree that it negotiated.

Recall that the investigation and initiation of the lawsuit occurred during President Trump’s first term, not under some previous administration. Presumably, CFPB launched the lawsuit after it determined that there was a legal and factual basis for the suit. Apparently, that was not the case. Now, current CFPB leadership under the second Trump administration, in an act of legal hara-kiri that would make a samurai blush, falls on the proverbial sword and attests that the lawsuit lacked a legal or factual basis.7 That’s not all, as current CFPB leadership lambasts CFPB leadership under the first administration for trampling Defendants’ First Amendment rights.

![Moreover, the Court agrees with Amici that granting the Motion would erode

public confidence in the finality of judgments. It would set a precedent suggesting

that a new administration could seek to vacate or otherwise nullify the voluntary

resolution of a case between a prior administration (or the same administration ,but

under different agency leadership) and a private party merely because its leadership

thought the original litigation unwise or improperly motivated. That is a Pandora’s

box the Court refuses to open.

All in all, balancing the benefits vacatur against the public interest in the

finality of judgment, the Court finds that the latter outweighs the former.

Conclusion

For the foregoing reasons, the Court denies the Parties’ Joint Rule 60(b)(6)

Motion for Relief and Vacatur of the Stipulated Final Judgment and Order [145]. The](https://cdn.bsky.app/img/feed_thumbnail/plain/did:plc:nztbvvo2gl4227zuxjf7gog3/bafkreiajiidpjcym4guhvrvugtdsdogsftm37obeimxcdnylwm6przyfjy@jpeg)

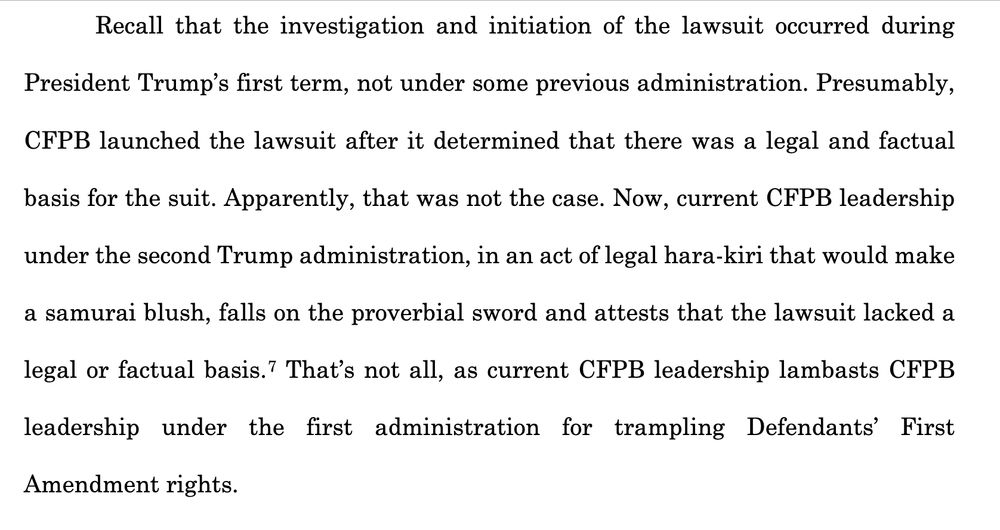

Moreover, the Court agrees with Amici that granting the Motion would erode public confidence in the finality of judgments. It would set a precedent suggesting that a new administration could seek to vacate or otherwise nullify the voluntary resolution of a case between a prior administration (or the same administration ,but under different agency leadership) and a private party merely because its leadership thought the original litigation unwise or improperly motivated. That is a Pandora’s box the Court refuses to open. All in all, balancing the benefits vacatur against the public interest in the finality of judgment, the Court finds that the latter outweighs the former. Conclusion For the foregoing reasons, the Court denies the Parties’ Joint Rule 60(b)(6) Motion for Relief and Vacatur of the Stipulated Final Judgment and Order [145]. The

Russ Vought's CFPB tried to do a corporate pardon with a mortgage broker who had already entered a final judgment and paid a fine for egregious lending discrimination.

The judge looked at it and said, "No."

storage.courtlistener.com/recap/gov.us...

"A lot of people don’t necessarily know about the #CFPB and may not understand how it’s being attacked, but they will be affected." @adamrust.bsky.social

13.06.2025 12:34 — 👍 2 🔁 3 💬 0 📌 0

Students who have been scammed by predatory for-profit colleges shouldn't have their right to go before a judge and jury stripped from them by contractual fine print. That's why NACA is proud to support the CLASS Act. #endforcedarbitration

12.06.2025 15:36 — 👍 0 🔁 0 💬 0 📌 0

Since 2011, the CFPB has defended Americans’ economic security, yet the Trump administration has recently taken steps to severely weaken the agency. Learn more:

11.06.2025 16:05 — 👍 11 🔁 6 💬 1 📌 0

🎉 The Tenth Circuit just affirmed a district court's order denying arbitration in a class action against a bait & switch scam by Renewal By Andersen & GreenSky

The decision is a reminder that 🗣️ arbitration is not a guaranteed free pass to swindle consumers 🎤

www.publicjustice.net/case_brief/p...