On the first of those, I find it bizarre that the ONS and particularly the OBR still focus all of their commentary on PSNB and PSND when the fiscal rules switched to PSCB and PSNFL almost a year ago. It's creating unnecessary confusion for some

21.08.2025 10:25 — 👍 2 🔁 1 💬 1 📌 0

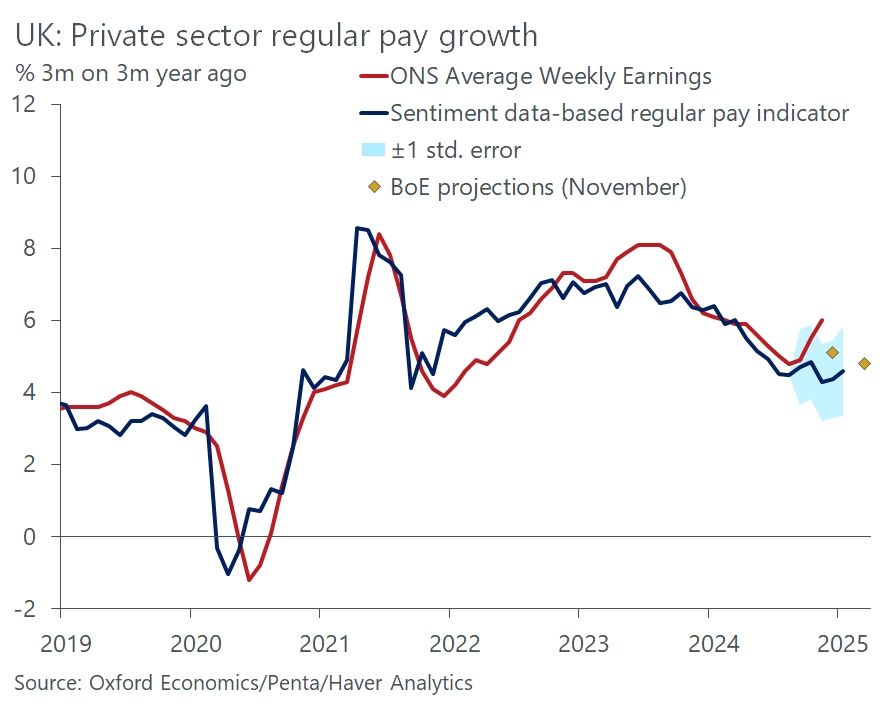

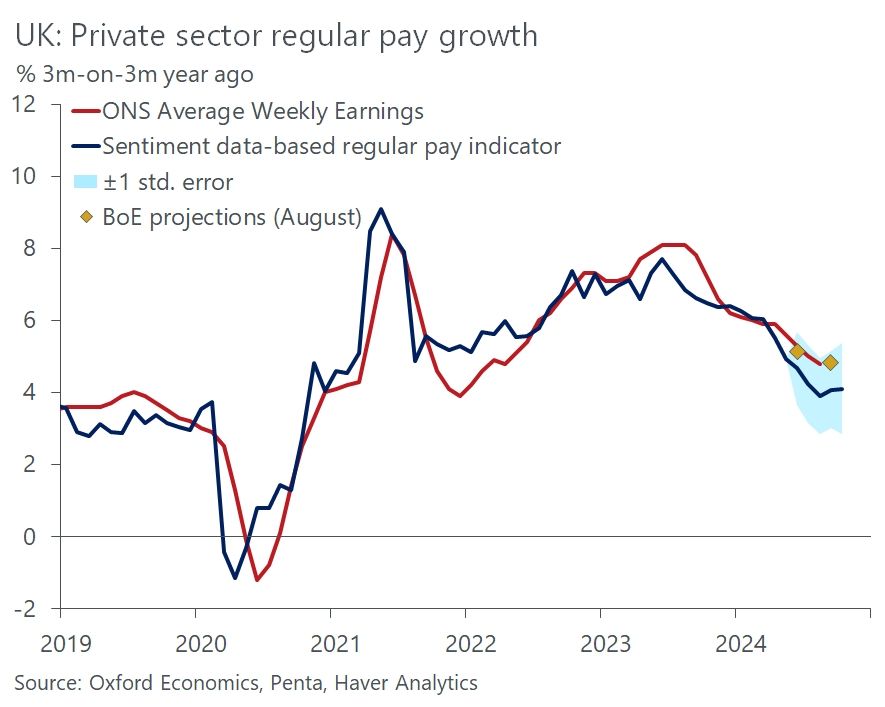

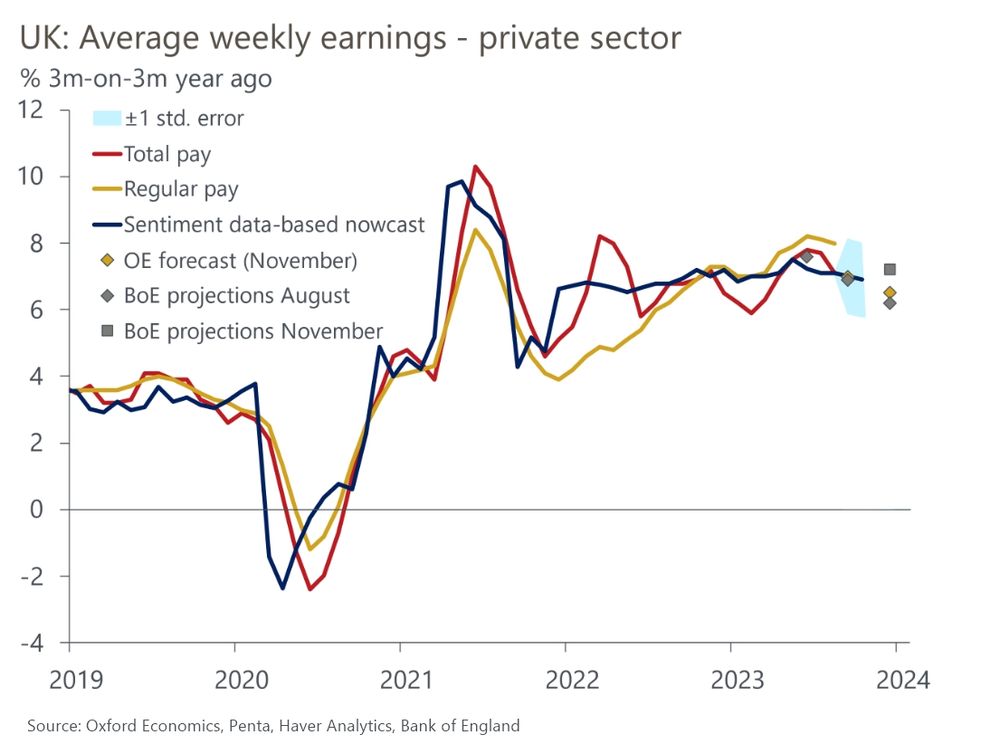

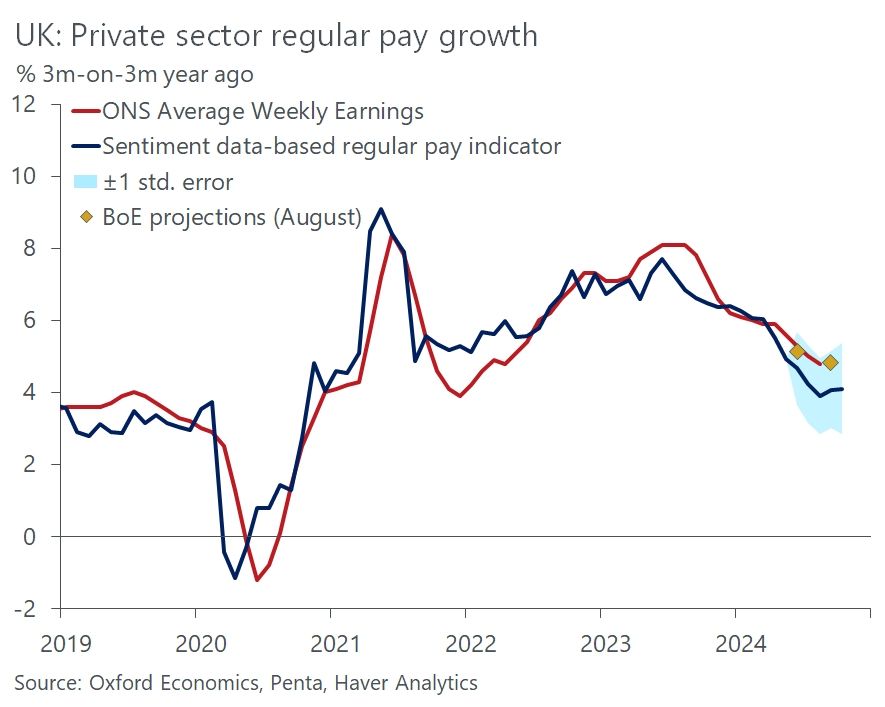

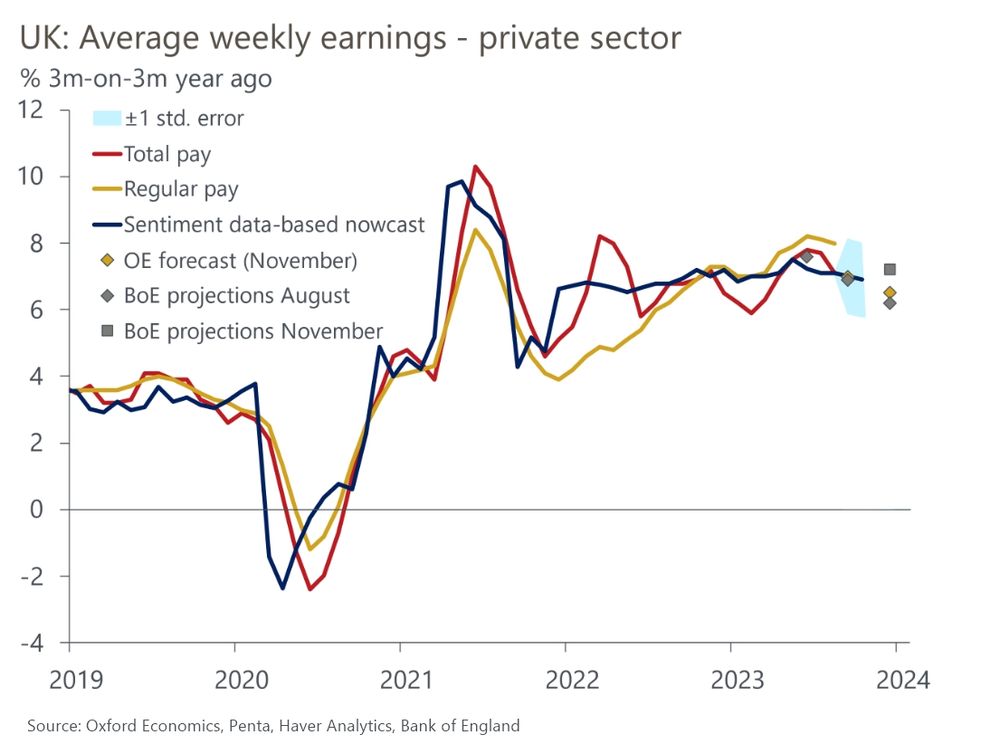

The MPC is trying to gauge where inflation will be in 2 years. As the past few years have shown, pay growth gives a good indication of where services inflation will go. Pay growth is high now, but most of the MPC think it will soften if the jobs market cools. So how that story plays out will be key

21.01.2025 20:15 — 👍 1 🔁 0 💬 0 📌 0

Excellent 🧵 on UK labour market data

21.01.2025 13:19 — 👍 5 🔁 1 💬 0 📌 0

Some more information about our latest note that Andy kindly mentioned: bsky.app/profile/andr...

21.01.2025 12:41 — 👍 0 🔁 0 💬 0 📌 0

These results highlight the trade-off recently identified by the Bank of England's Monetary Policy Committee between persisting inflation and weak growth and employment prospects. (6/6)

21.01.2025 12:39 — 👍 3 🔁 0 💬 2 📌 0

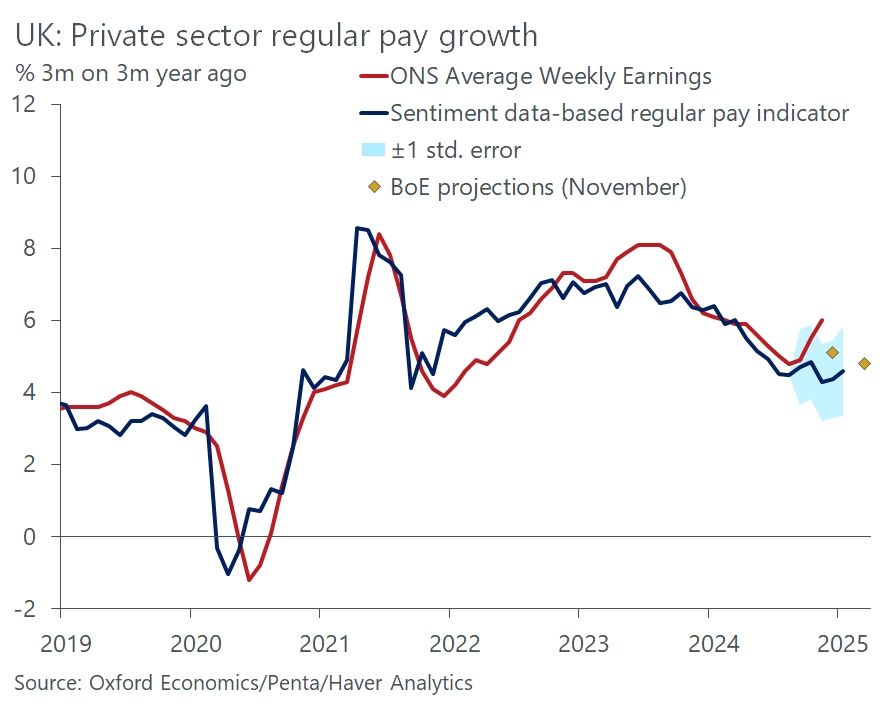

Our nowcast suggests pay growth has stabilised at around 4.5%

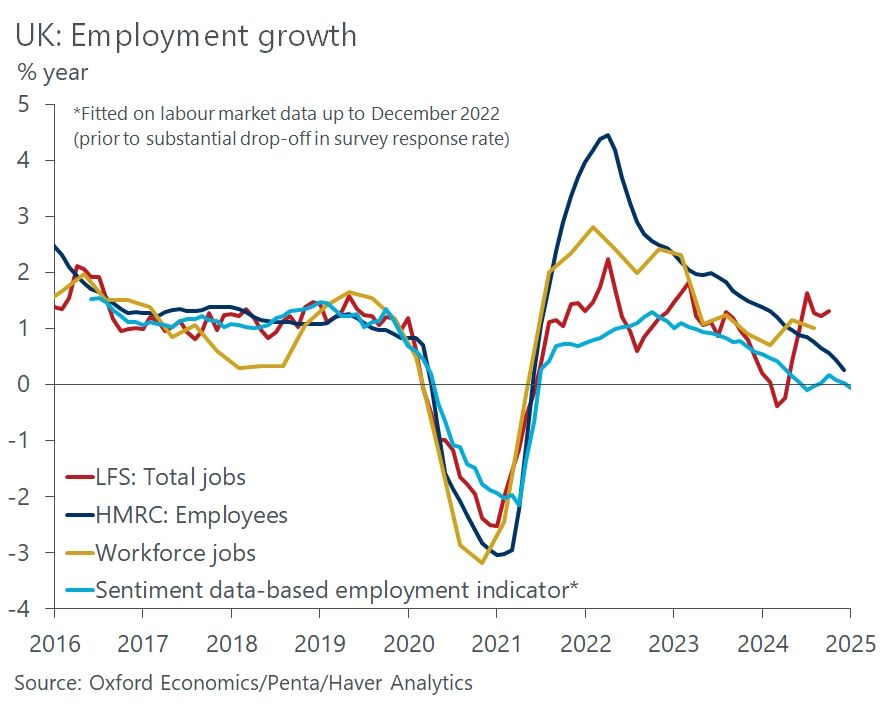

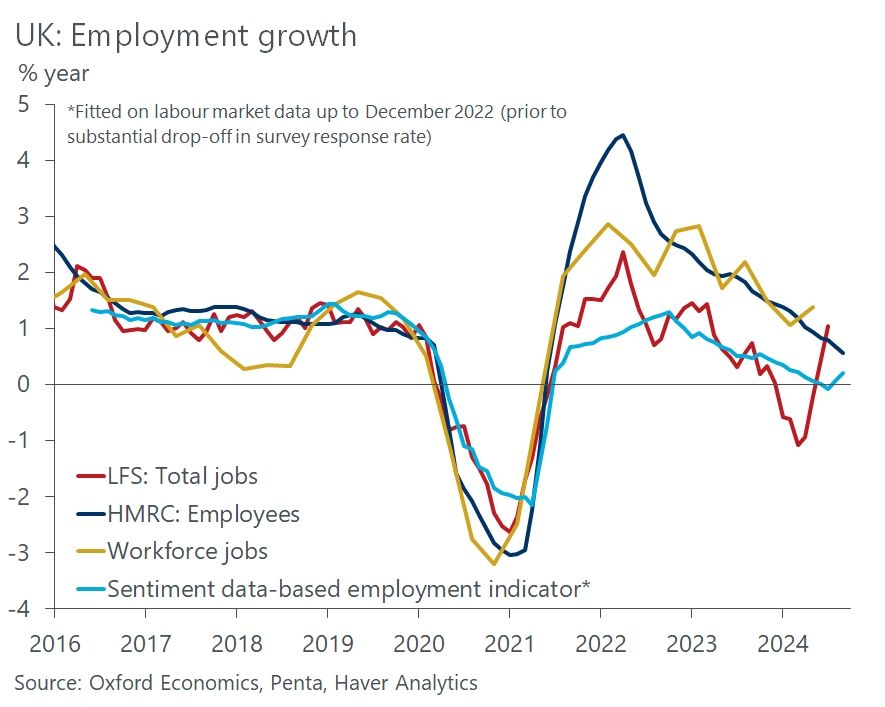

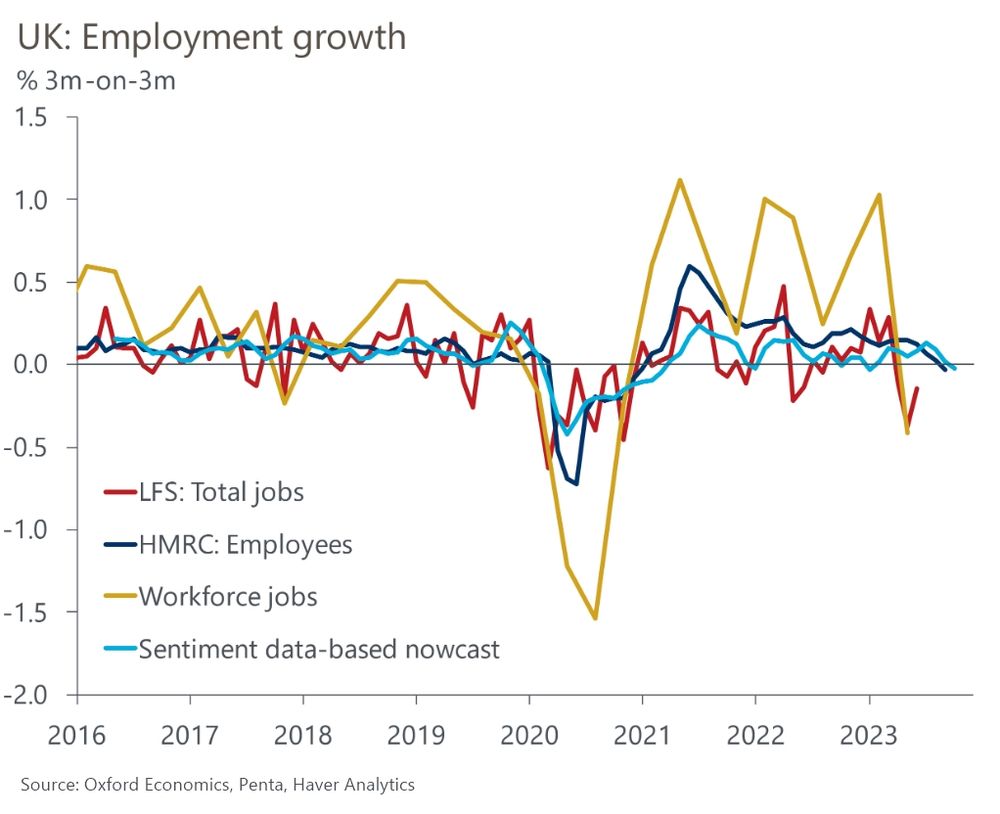

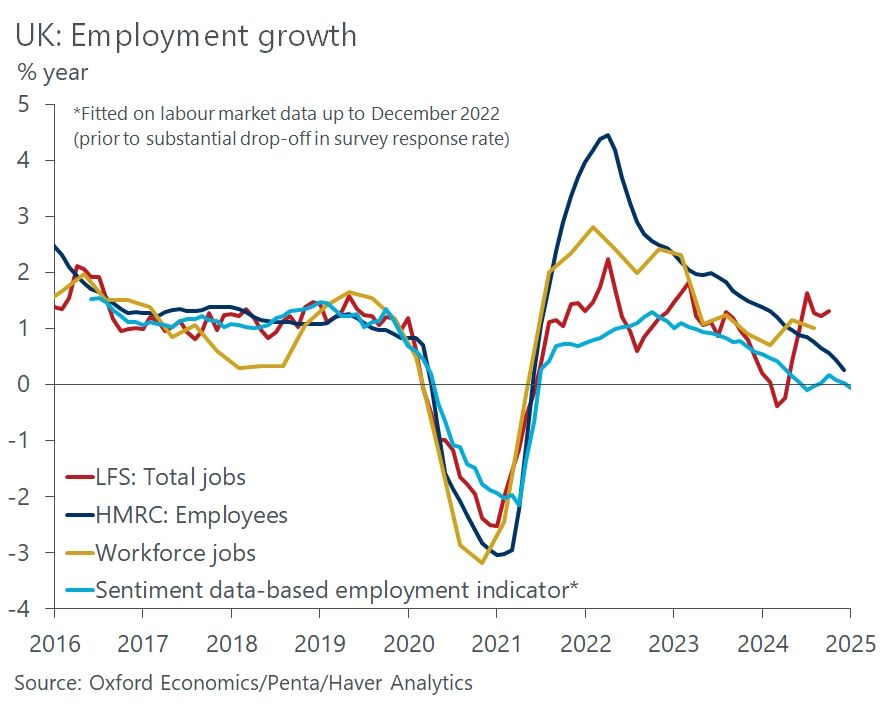

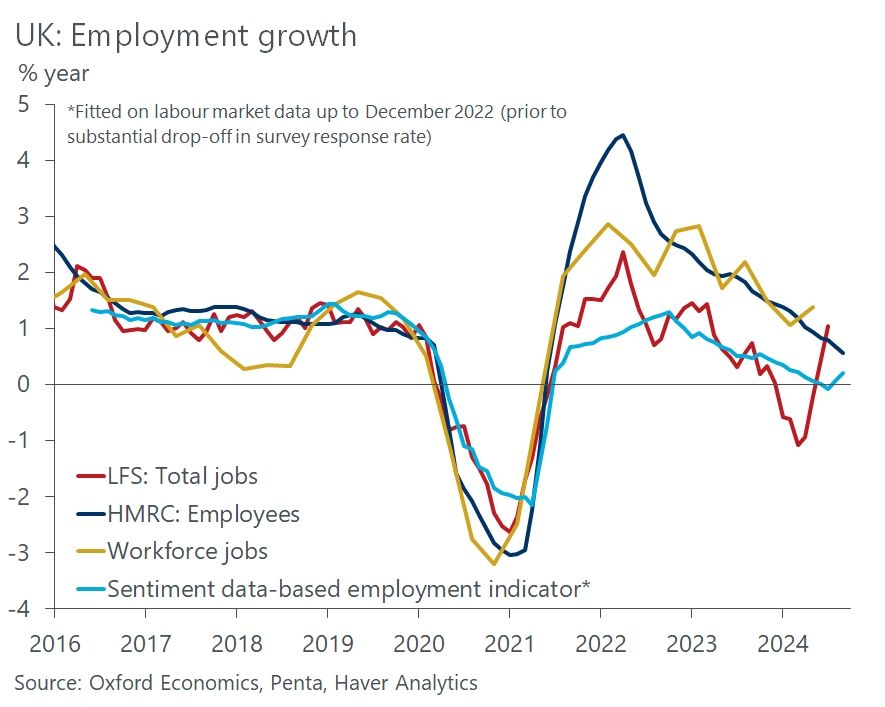

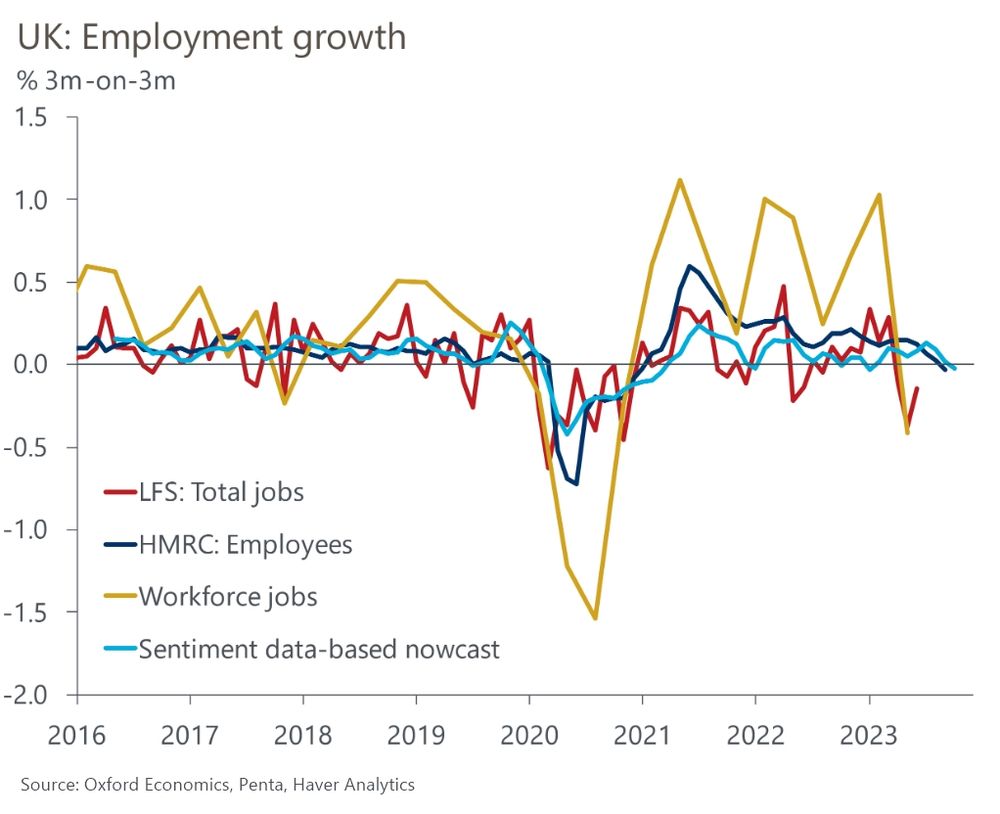

Our nowcasts using this sentiment data suggest employment growth is slowing to zero, and private sector regular pay growth stabilising at around 4.5% at the turn of the year. (5/6)

21.01.2025 12:39 — 👍 1 🔁 0 💬 1 📌 0

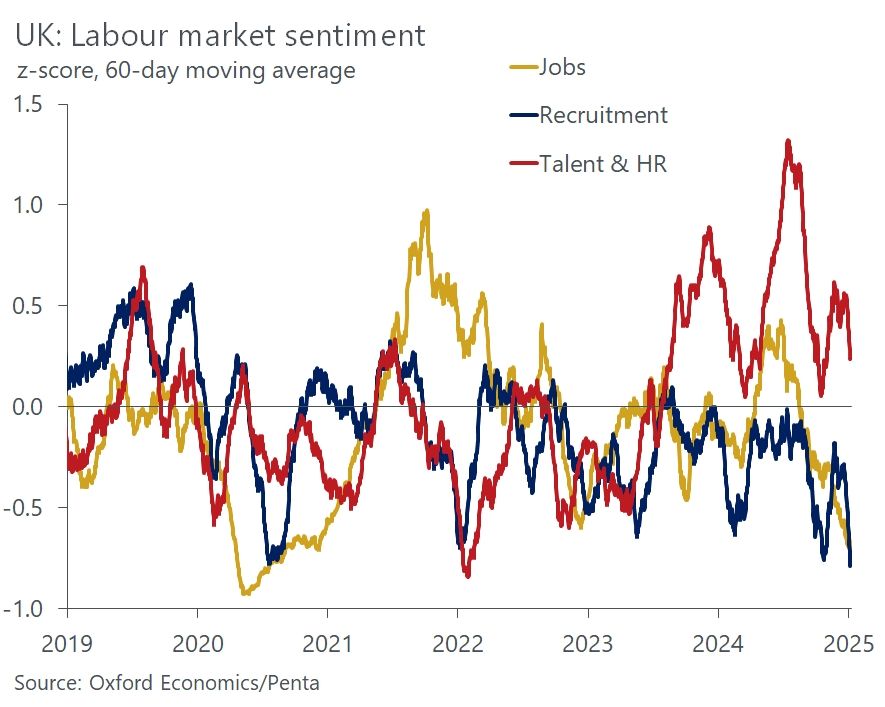

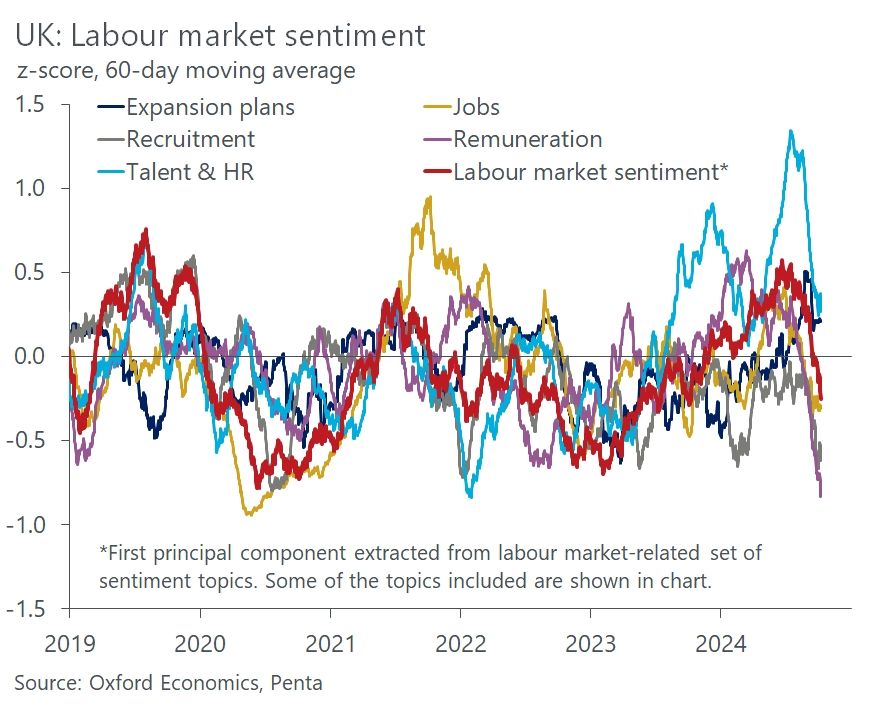

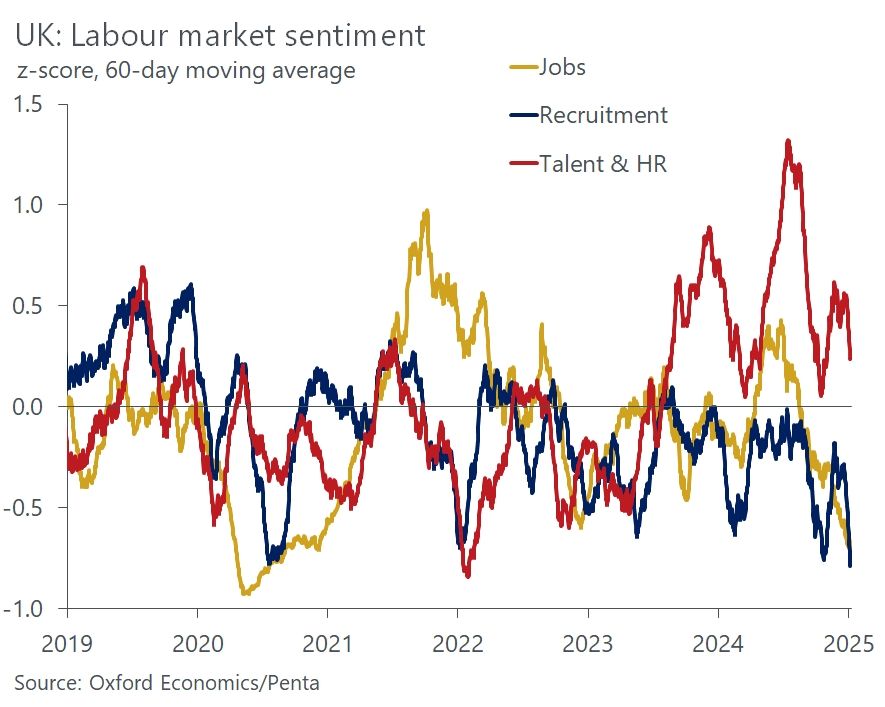

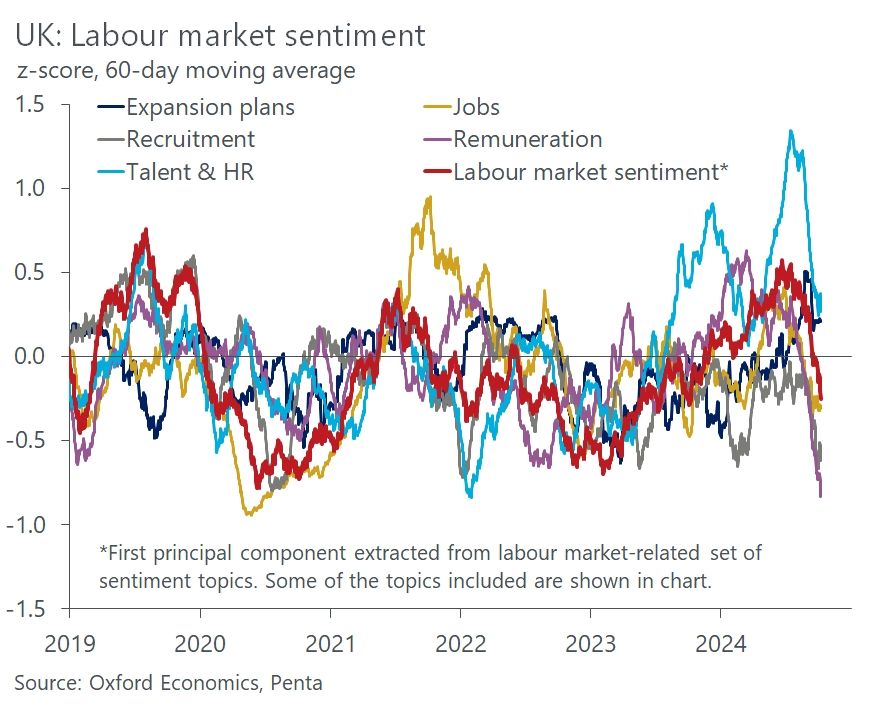

Sentiment scores suggests firms are prioritising retention over job creation

Our proprietary sentiment data, developed with Penta, fills part of the information void, acting as a check on official data as well as being timelier. The latest results for early January suggest that firms are keen to retain existing workers but not to create new roles. (4/6)

21.01.2025 12:39 — 👍 2 🔁 0 💬 1 📌 0

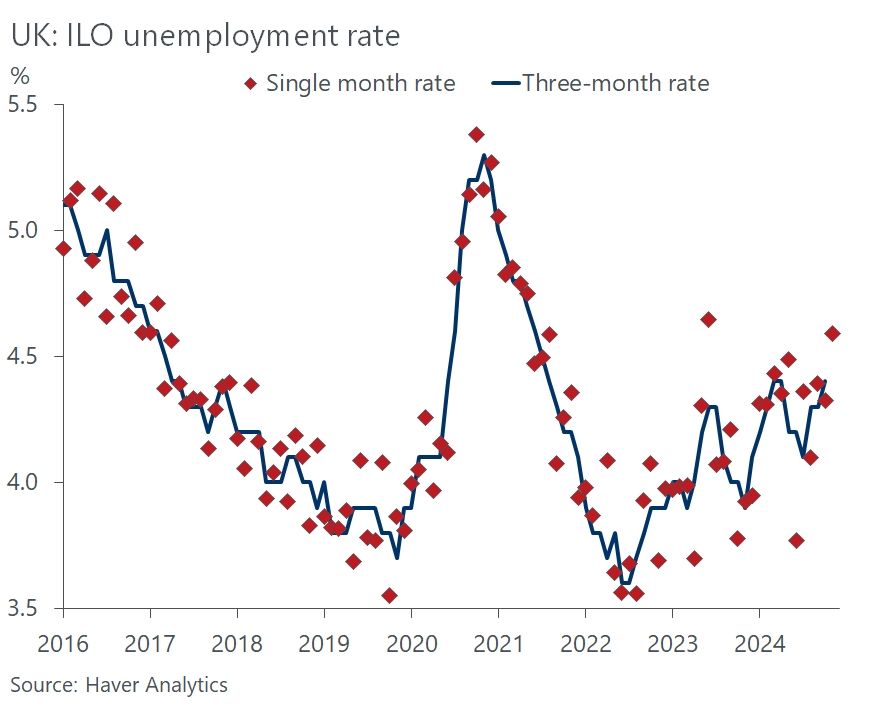

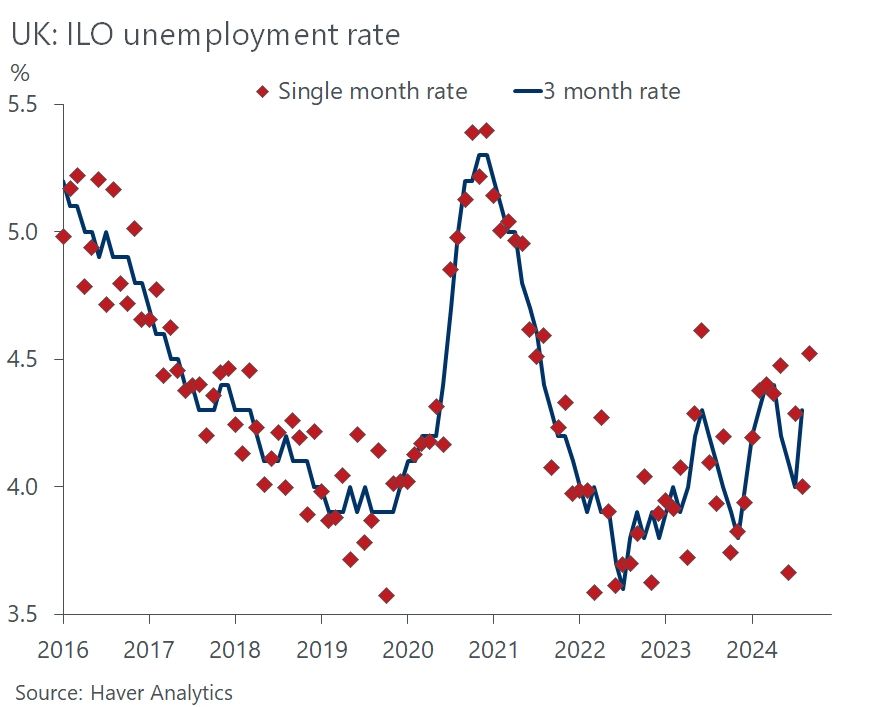

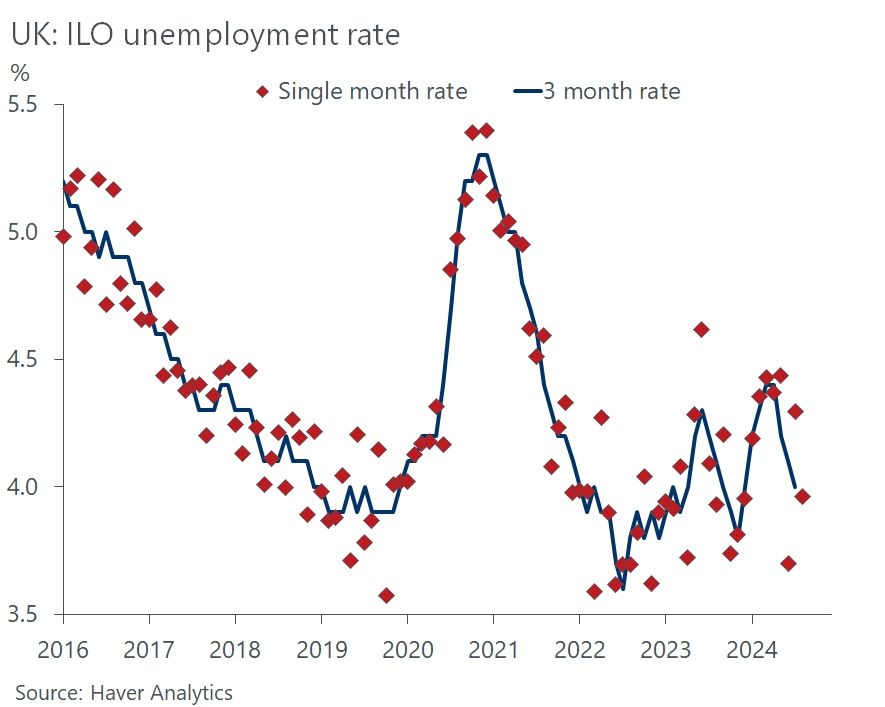

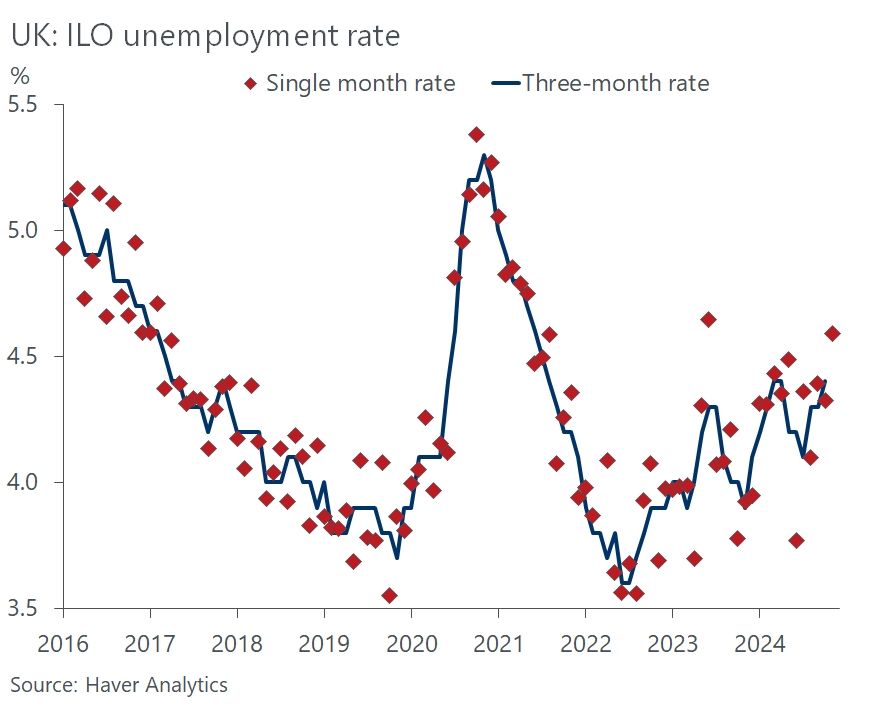

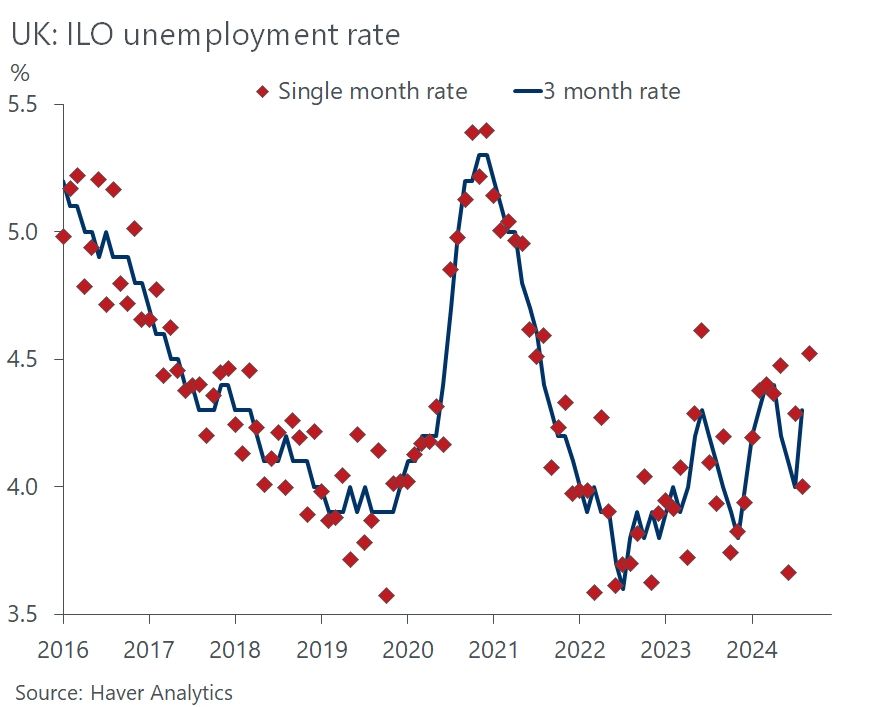

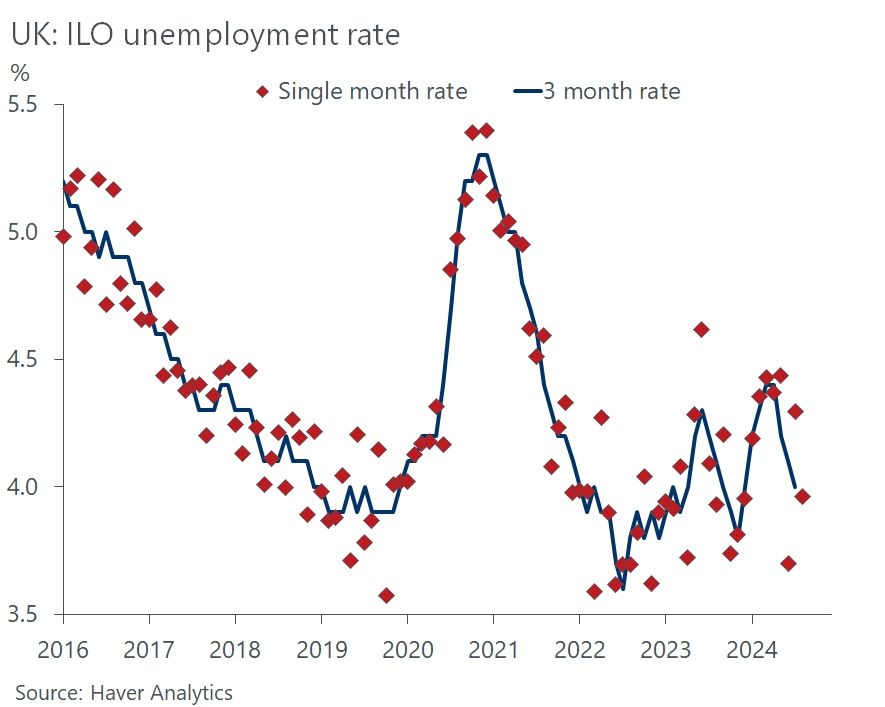

Unemployment estimates have become very noisy since the start of the pandemic

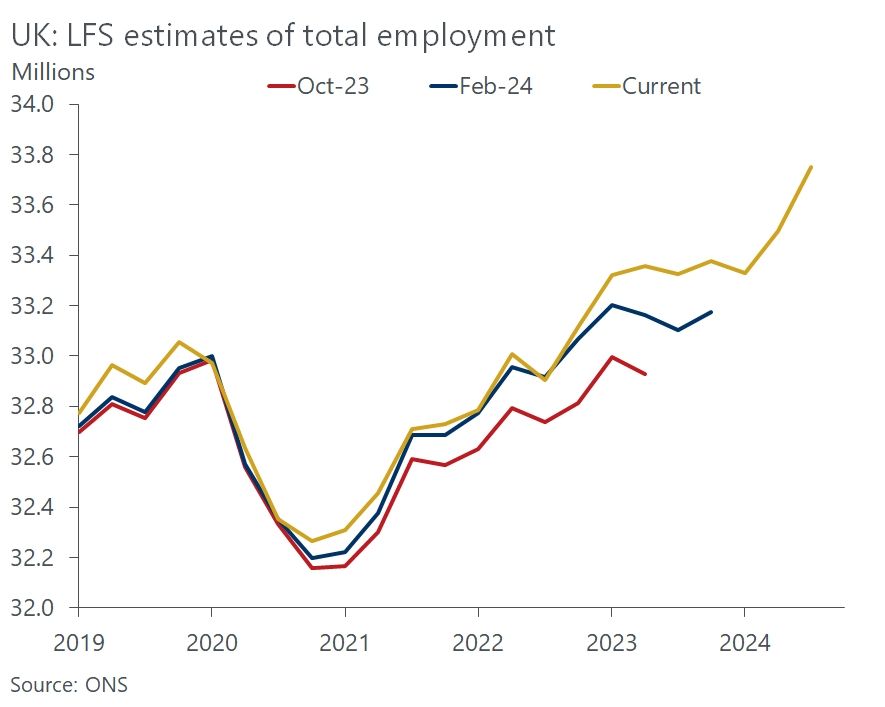

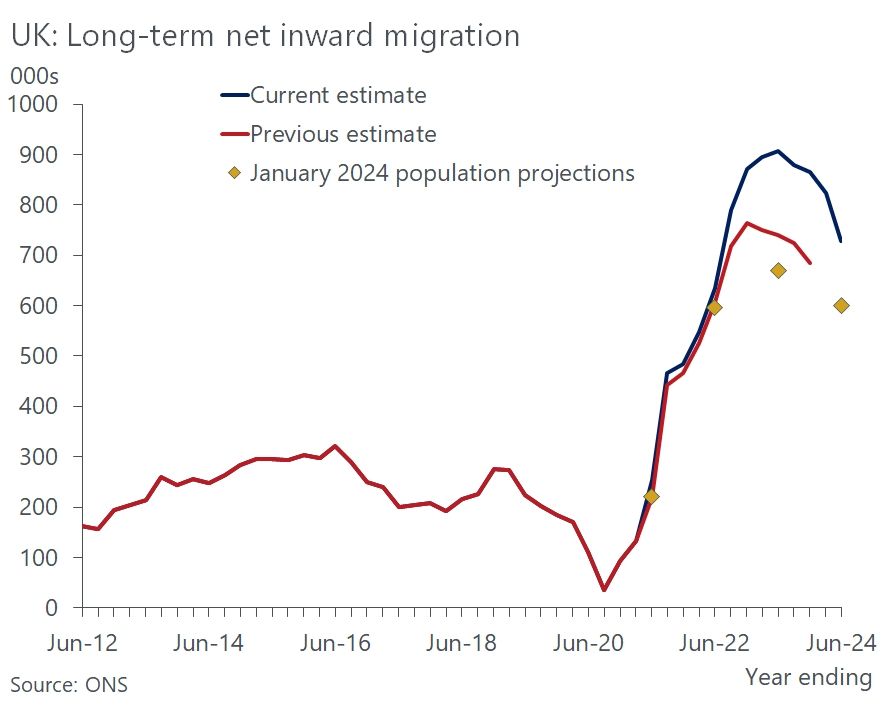

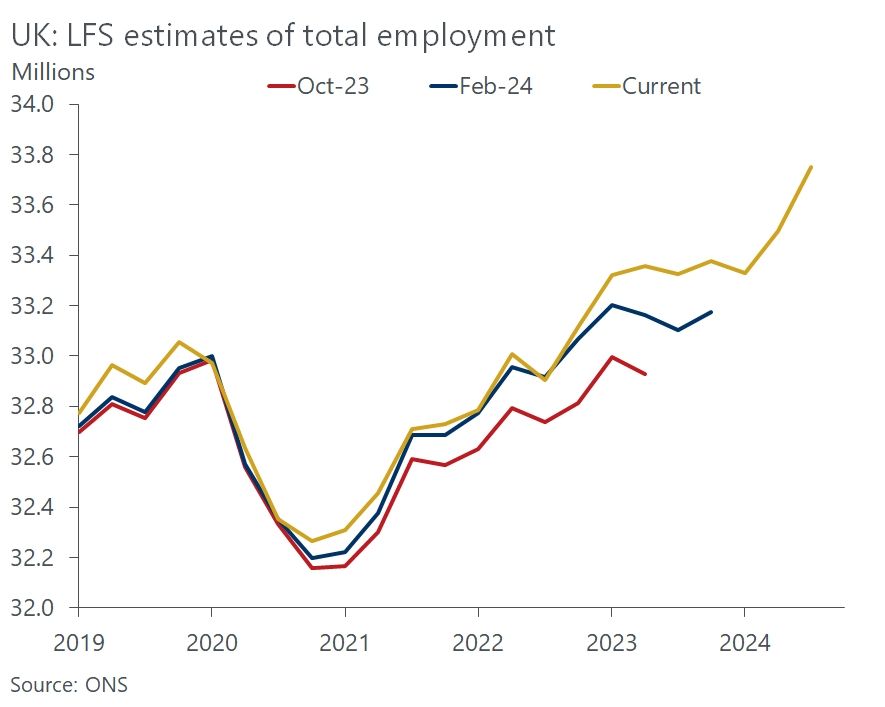

Higher population estimates have caused LFS employment to be revised up significantly

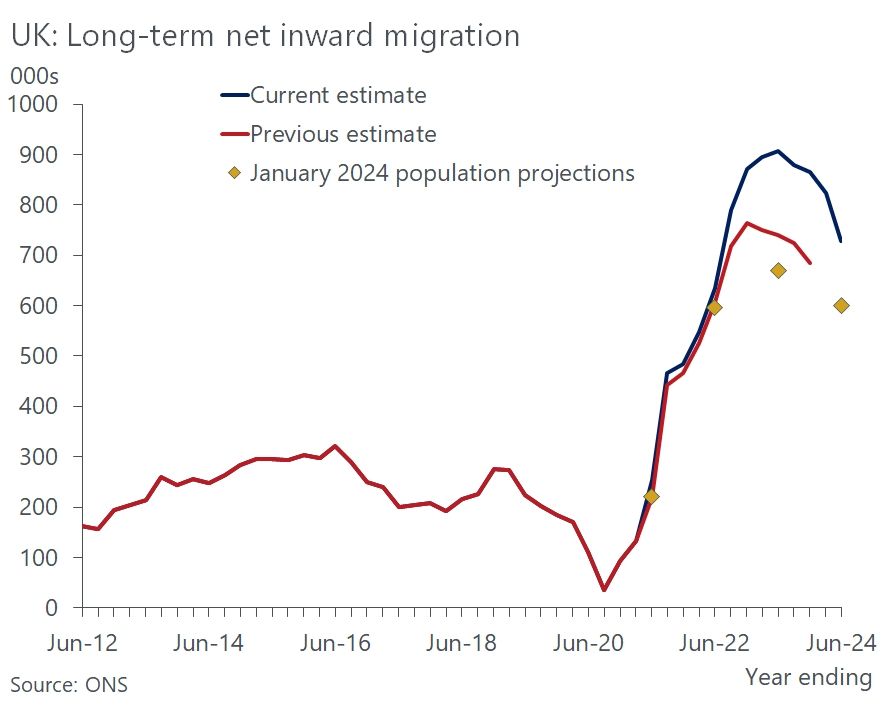

The latest, much higher, immigration data is yet to be incorporated into the LFS

Response rates to the LFS remain very low, resulting in significant data volatility. Problems measuring population compound the problems, resulting in a series of upward revisions to the level of employment, with more revisions to come once the latest migration estimates are incorporated. (3/6)

21.01.2025 12:39 — 👍 1 🔁 0 💬 1 📌 1

We think that concerns about the quality of data from the UK's Labour Force Survey (LFS) make it virtually unusable at present. Considering it will likely take another two years to fix the problems, this poses a major headache for policymakers and economists alike. (2/6)

21.01.2025 12:39 — 👍 0 🔁 1 💬 1 📌 0

Our sentiment-based nowcast suggests employment growth stalled in H2 2024

A short 🧵 on our latest note which looks at shortcomings in official labour market data and where our proprietary high-frequency sentiment dataset can fill in the gaps (1/6) www.oxfordeconomics.com/resource/uk-...

21.01.2025 12:39 — 👍 9 🔁 4 💬 1 📌 2

Interesting note from Oxford Economics' @andrewgoodwin.bsky.social.

He says the Labour Force survey is "virtually unusable".

Oxford Economics' proprietary nowcast model shows a weaker picture for employment and wage growth, which seems to have stabilised at around 4.5%.

21.01.2025 09:28 — 👍 10 🔁 6 💬 1 📌 1

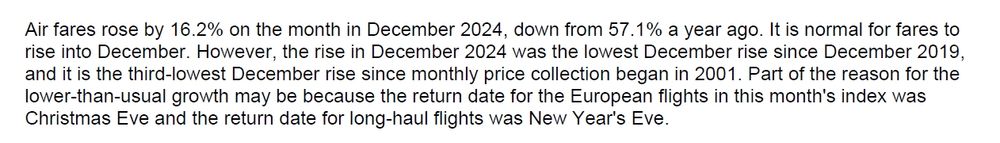

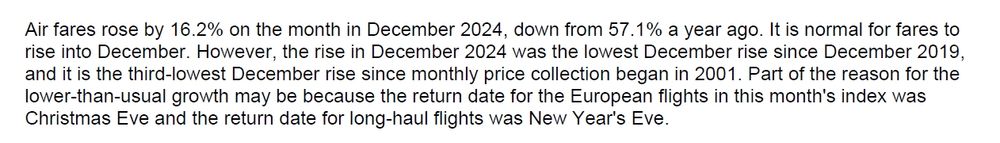

Not sure this morning's inflation data is quite as good as many are suggesting. The downside surprise was mainly due to the volatile air fares component (almost 0.1ppt off of CPI) and that seems to be mainly due to a quirk of the dates that prices were taken (screenshot from ONS release)

15.01.2025 07:44 — 👍 1 🔁 0 💬 0 📌 0

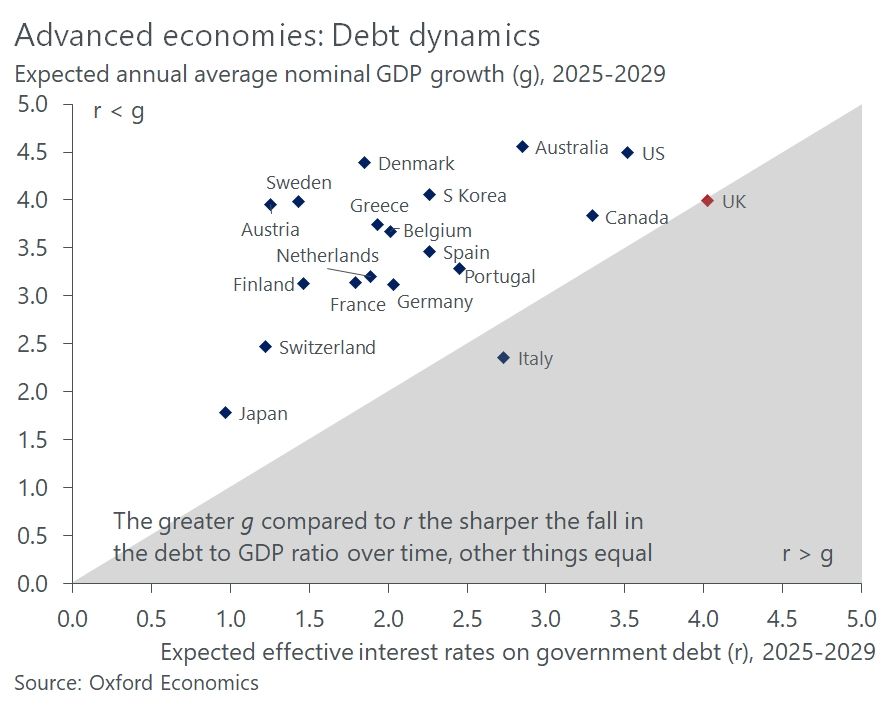

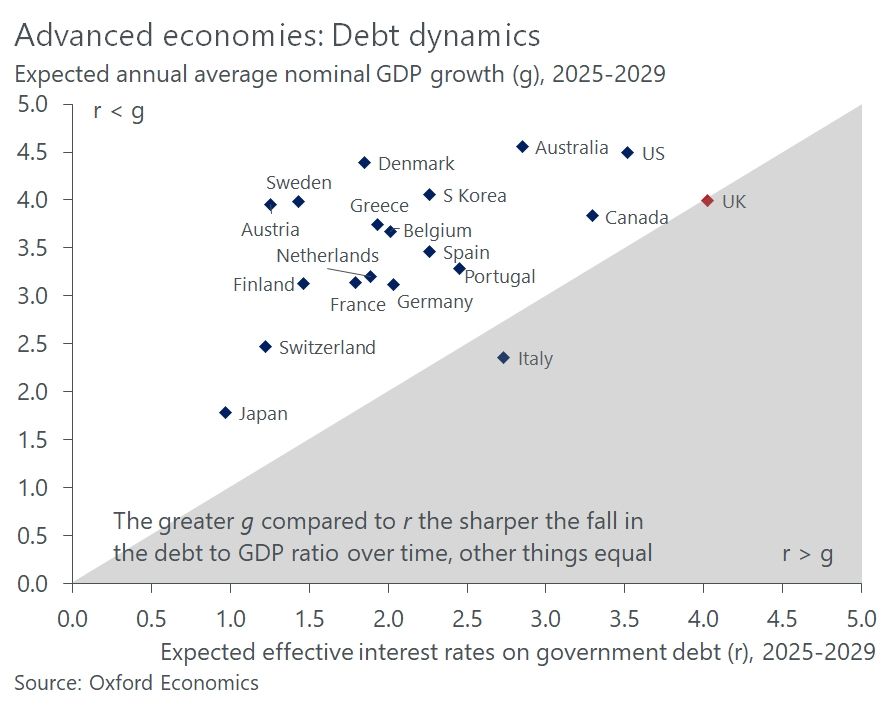

My concern is more that if yields on safe assets are high in a low growth world then it makes investing in riskier assets look much less attractive

26.11.2024 17:14 — 👍 1 🔁 0 💬 1 📌 0

This chart makes for pretty depressing reading. If I substituted in the OBR's forecasts, the UK would be similarly placed relative to other countries

26.11.2024 16:56 — 👍 3 🔁 3 💬 1 📌 1

Eye-catching note from Oxford Economics just out:

"Some forecasters are more optimistic about UK growth prospects following the Budget, but we take the opposite view," says @andrewgoodwin.bsky.social.

He says UK debt dynamics "are among the worst of the

advanced economies".

26.11.2024 16:51 — 👍 14 🔁 10 💬 2 📌 1

The latest output from the ONS's random number generator. Surely its time to suspend the LFS again...publishing such poor quality data is counter-productive and encouraging bad takes

12.11.2024 09:10 — 👍 2 🔁 1 💬 0 📌 0

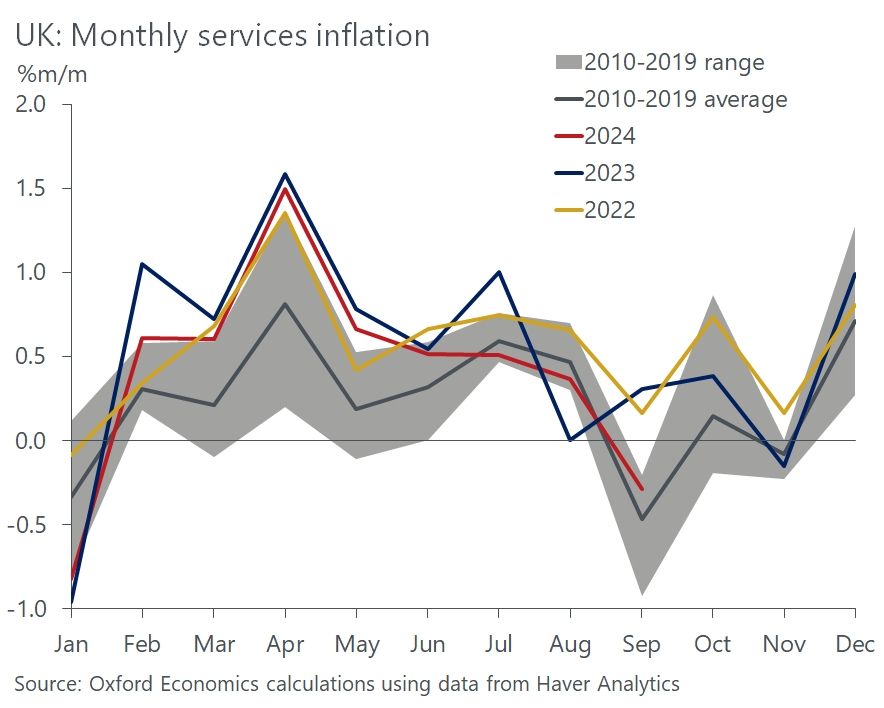

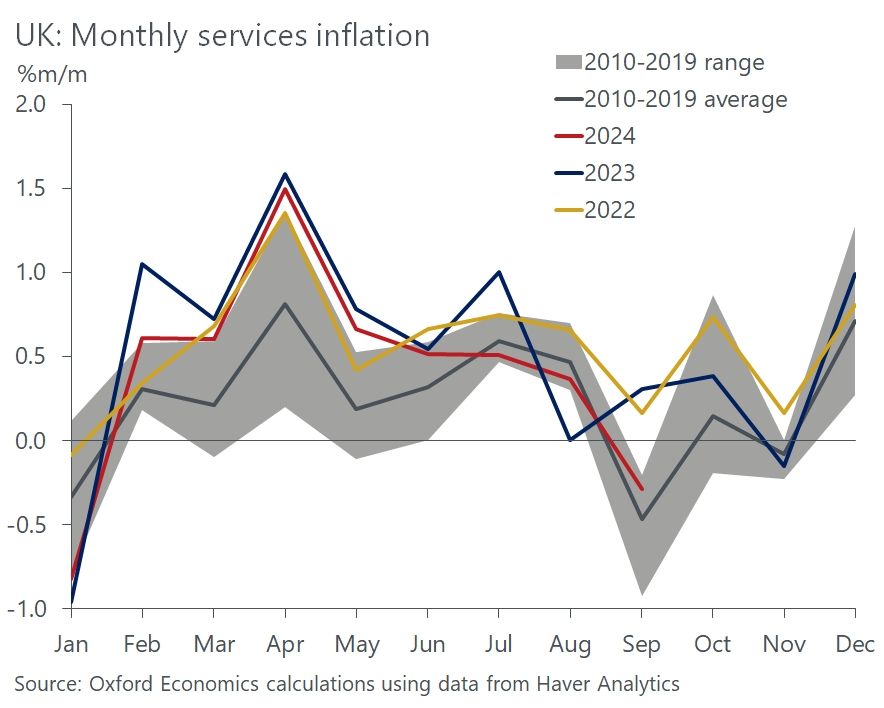

Surprised by the surprise about today's low inflation reading . The September 2023 services inflation reading was a big outlier to the upside so there was always going to be a big base effect. Recent m/m changes in services prices are roughly in line with the pre-pandemic average

16.10.2024 08:50 — 👍 2 🔁 1 💬 0 📌 0

Our model also shows an abrupt slowdown in pay growth. If this trend is reflected in official data, it could motivate some MPC members to join Swati Dhingra in voting for rate cuts at successive meetings

15.10.2024 10:27 — 👍 0 🔁 1 💬 0 📌 0

Our nowcasting model suggests labour market conditions have loosened through the summer. We think this is a more accurate depiction of what's happening than the LFS data

15.10.2024 10:27 — 👍 0 🔁 1 💬 1 📌 0

We've developed a sentiment dataset in collaboration with Penta. Data for September shows sharp falls in most of our individual indicators. Talent & HR is the one exception, suggesting firms continue to place a high value on retaining staff

15.10.2024 10:26 — 👍 0 🔁 0 💬 1 📌 0

A short 🧵 on today's labour market data and where our our proprietary high-frequency sentiment dataset can fill in the gaps.

First up - don't use the LFS data....it's complete rubbish. Just a collection of random dots with no pattern

15.10.2024 10:26 — 👍 2 🔁 2 💬 1 📌 0

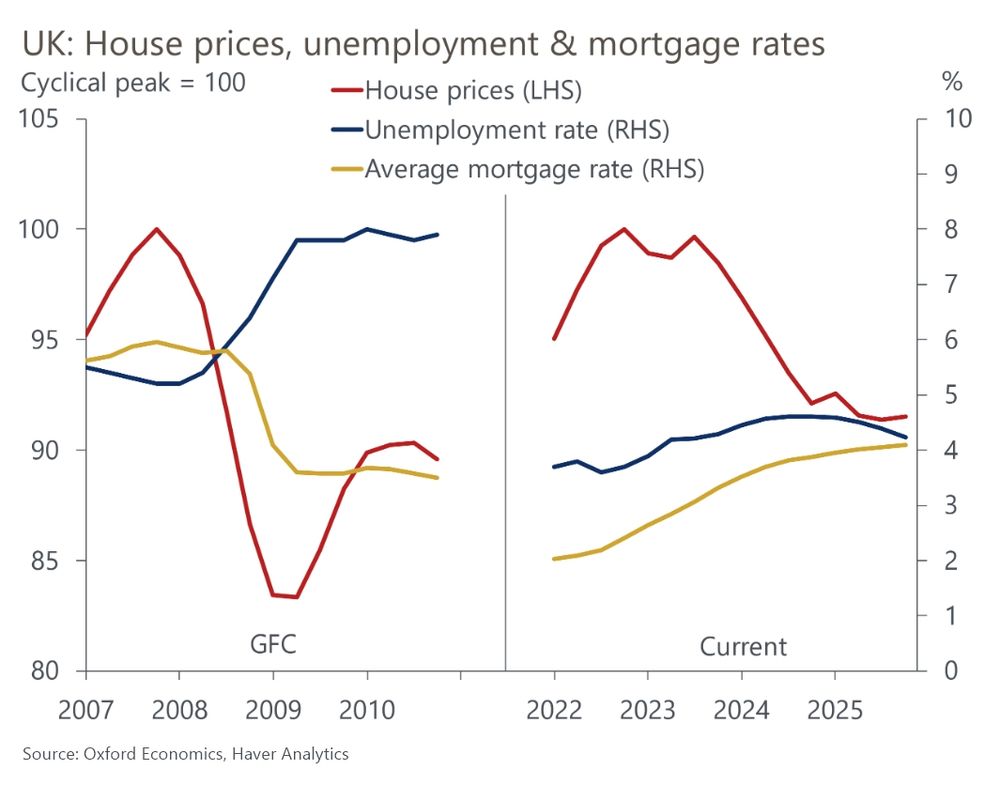

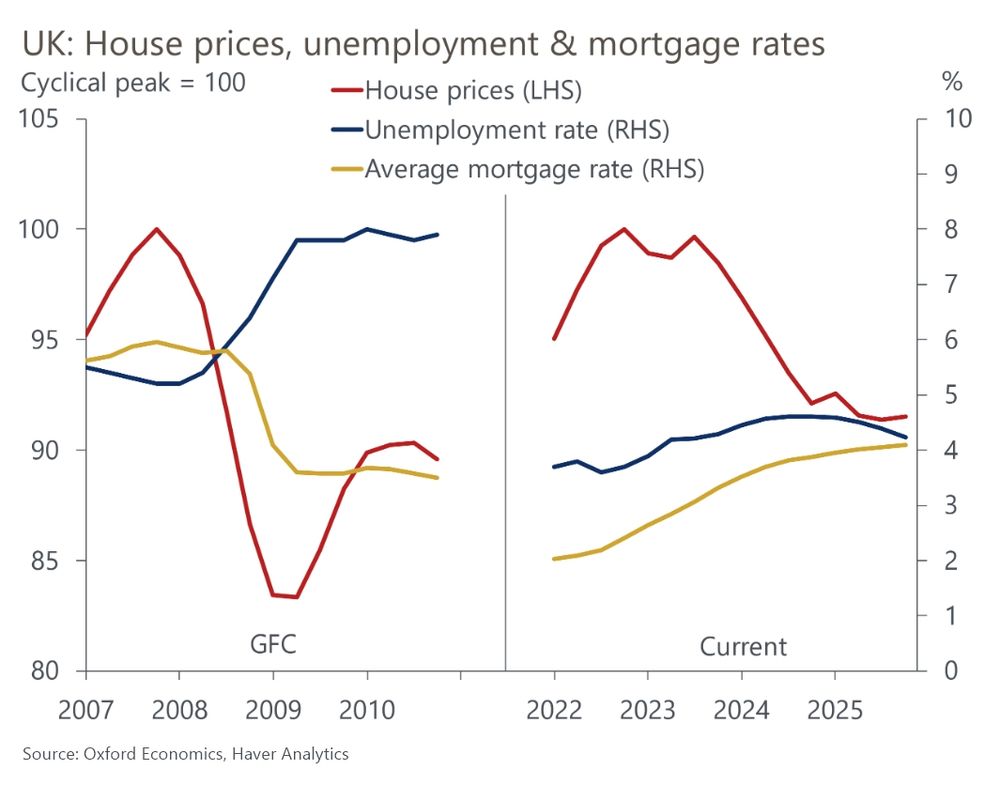

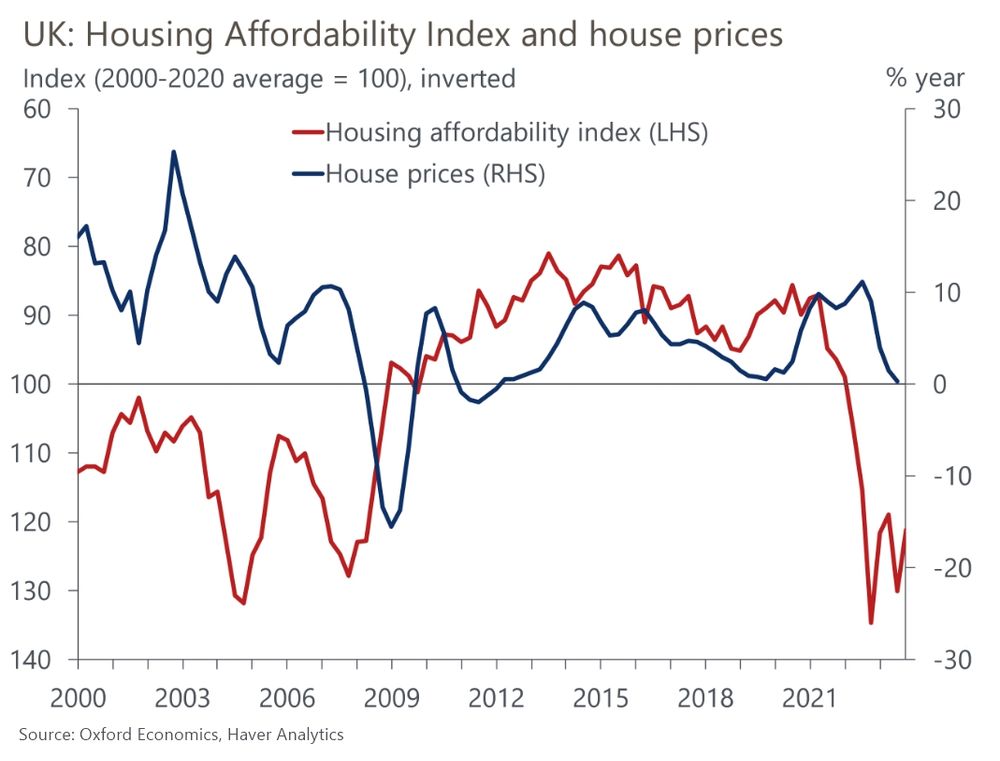

But we forecast only just over half the drop in prices seen in the global financial crisis due to the much lower unemployment rate and slow rise in average mortgage rates www.oxfordeconomics.com/resource/too... (2/2)

21.11.2023 11:43 — 👍 2 🔁 1 💬 0 📌 0

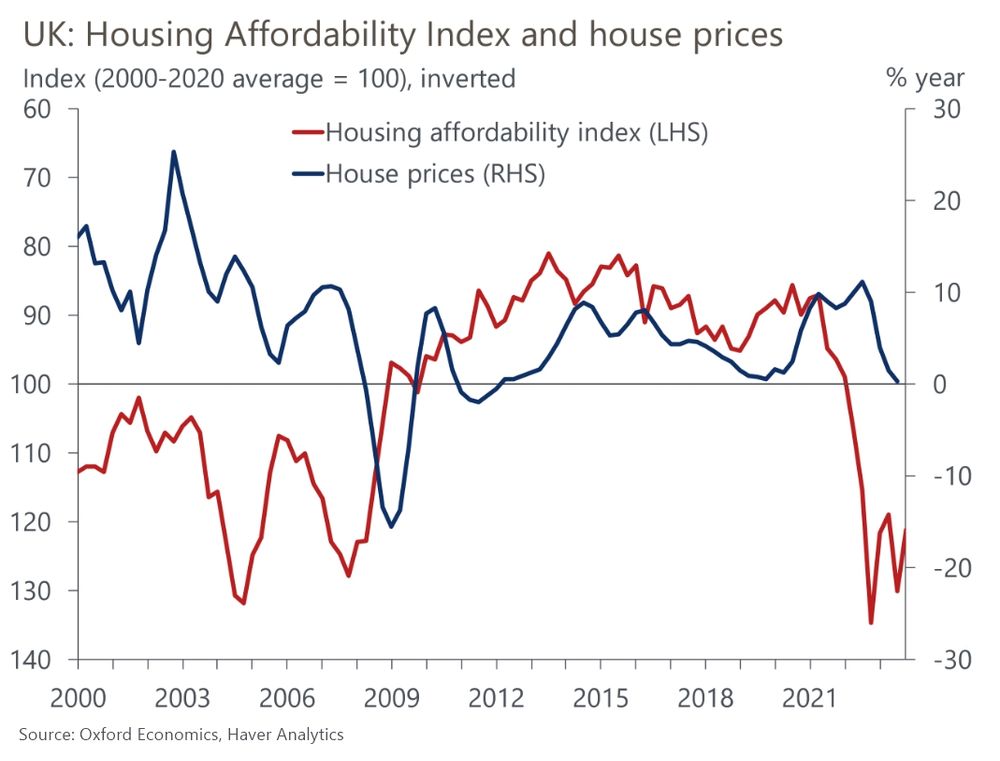

We estimate that UK house prices are still more than 20% overvalued based on the affordability of mortgage payments. This is likely to mean transactions and lending remain very low, and that the house price correction has further to run: www.oxfordeconomics.com/resource/too... (1/2)

21.11.2023 11:42 — 👍 1 🔁 1 💬 1 📌 0

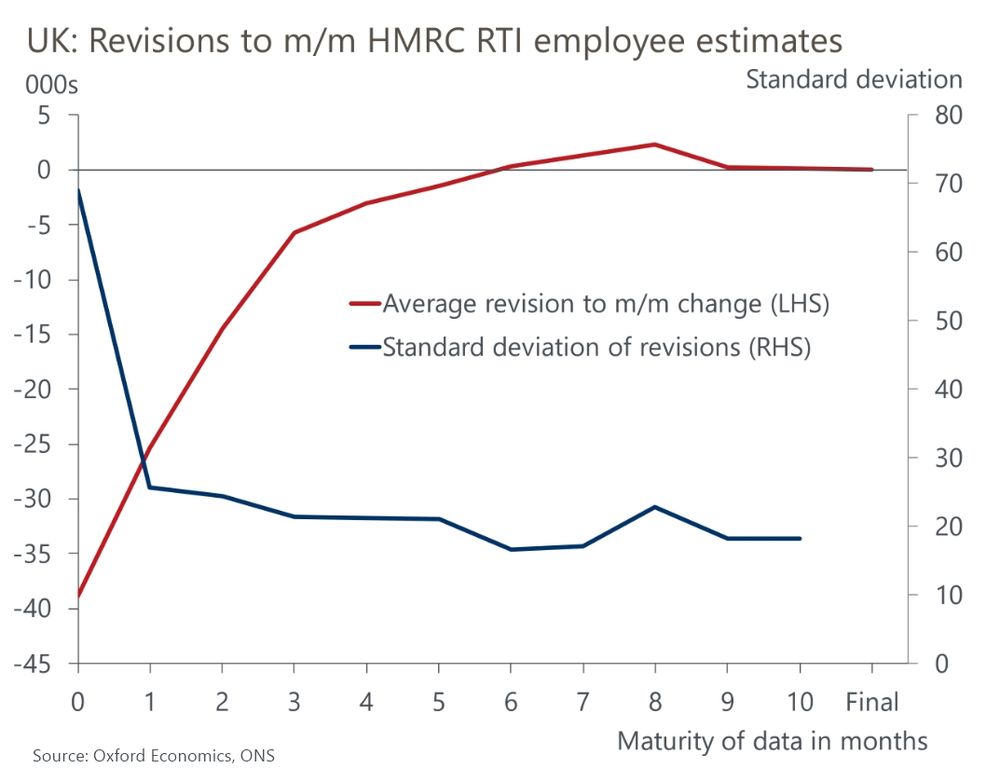

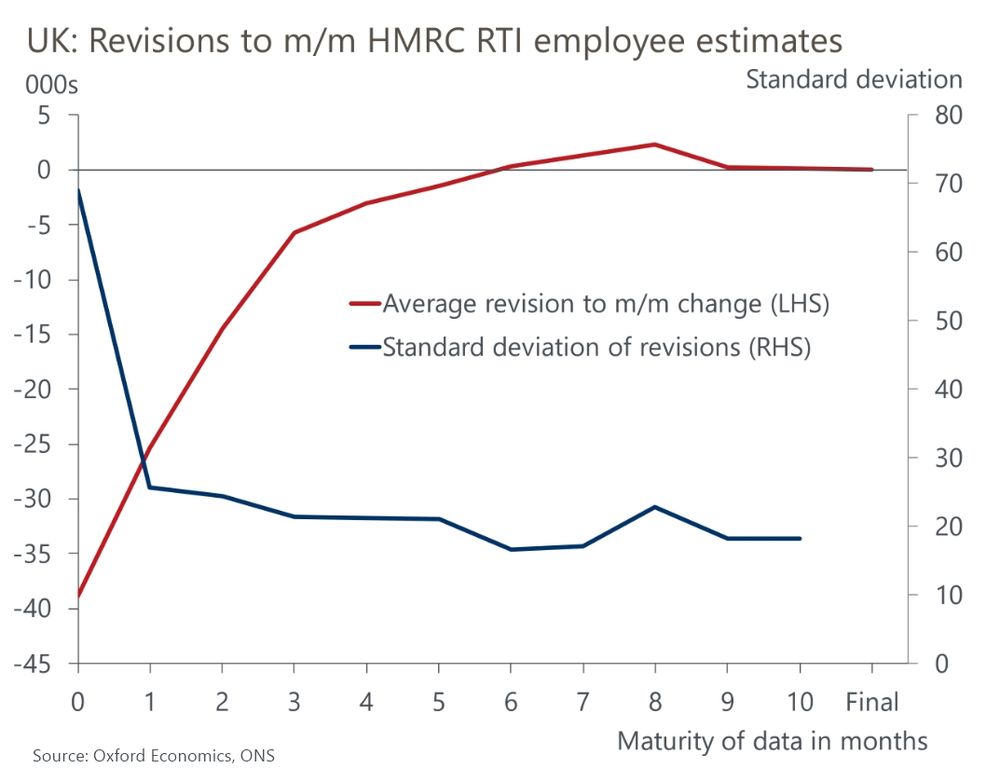

We don't think the ONS's temporary solution adds much value. The flaws in the claimant count are well known. And early HMRC RTI estimates have an upward bias, only settling down after two revision cycles (3/3)

10.11.2023 13:24 — 👍 0 🔁 1 💬 0 📌 0

The latest sentiment data also suggest that while wage growth is gradually moderating, it is still much faster than would be consistent with achieving the inflation target. So near-term interest rate cuts look unlikely (2/3)

10.11.2023 13:24 — 👍 0 🔁 1 💬 1 📌 0

Our proprietary sentiment data, developed with Penta, can help fill the gap left by the suspension of the LFS. It suggests the labour market was more resilient than the unadjusted LFS data implied in the summer, but that labour demand has cooled recently (1/3) www.oxfordeconomics.com/resource/alt...

10.11.2023 13:23 — 👍 2 🔁 1 💬 1 📌 0

Founder, StatsBomb, Variance Incorporated.

@thetransferflow

Daily Rumours newsletter https://www.thetransferflow.com/subscribe

Frmr: Brentford FC, Pinnacle, SB

Devotee of the religion of football

Freelance Journalist/Analyst/Consultant covering the game around the globe. Featured on Al Jazeera, Forbes.com, FourFourTwo, Analytics FC, FotMob, World Soccer, The Blizzard, SCOUTED, The Transfer Flow, Gløry & more

⚽️ Analytics 📊 Altijd Ajacied ✖️✖️✖️

🗣️ @thetransferflow.bsky.social

FREE transfer newsletter with rumours + smart analysis from @mixedknuts.bsky.social. We'll tell you when your Director of Football should be fired. https://www.thetransferflow.com

Data-driven storytelling for sport. 📈

U.S. sports @optaanalystus.optajoe.com

https://www.theanalyst.com

Sign up for our Stat, Viz, Quiz football newsletter: http://theanalyst.com/sign-up

living by the sword @alphaville.ft.com

Research papers, #bankunderground posts, publications and news from Bank of England researchers. Staff opinion and analysis, not necessarily official BoE views. https://linktr.ee/boeresearch

1 - The official BlueSky page for Stats Perform’s English football coverage, brought to you by OptaJoe. Illuminating.

Chief Executive, Resolution Foundation

Erstwhile economist, Stoke City supporter. #madeinstoke

BBC News Analysis Editor, The Media Show, 'The Art of Explanation', 'Communicating...' podcast, squash enthusiast, occasional DJ. Agent:

annie@miradormanagement.co.uk

Trusted Independent Experts in the Energy Industry.

Our research, consulting & training builds capacity for the delivery of net zero: https://www.cornwall-insight.com/

Economics reporter, Bloomberg

Slightly rippled, with a flat underside