My @alphaville.ft.com post below.

BTW, if you haven’t seen the @financialtimes.com film narrated by @katie0martin.ft.com on $MSTR from last May, it is well worth a watch as (so far) a remarkably prescient work of video journalism

02.12.2025 13:28 — 👍 7 🔁 5 💬 1 📌 0

The MD moment in an investment banking career

It’s a fraught and familiar time as banks select their new managing directors

It’s that time of year again: investment banks are announcing their latest slate of managing directors. Here is @thekrazykobra.bsky.social on how that unfolds and what the MD title means www.ft.com/content/e8eb...

28.11.2025 18:37 — 👍 4 🔁 1 💬 0 📌 0

Around this time of year, investment banks announce who has been promoted to the ranks of managing director.

My @financialtimes.com column looks at the committees, politics, rankings, and the occasional tears of joy and asks what this milestone really means

www.ft.com/content/e8eb...

28.11.2025 18:17 — 👍 4 🔁 2 💬 0 📌 0

‘Infinite money glitch’; meet arithmetic

[FREE TO READ] Micro Strategy, major strife

A Strategy update from the finite money grinch, @thekrazykobra.bsky.social

on.ft.com/48kKIxY

26.11.2025 11:30 — 👍 15 🔁 5 💬 1 📌 3

Strategy (formerly MicroStrategy) was knocking on the door of the S&P 500 barely two months ago. Now the conversation has flipped to whether it can survive. My take in $MSTR in @alphaville.ft.com www.ft.com/content/1f63...

26.11.2025 12:23 — 👍 3 🔁 0 💬 0 📌 1

Column I wrote in today’s @financialtimes.com - have financiers been captured by an industry whose greatest strength is the financial freedom that working in it purports to offer?

17.11.2025 08:23 — 👍 3 🔁 0 💬 0 📌 0

another nice piece on MSTR from @thekrazykobra.bsky.social

10.11.2025 13:29 — 👍 5 🔁 3 💬 0 📌 0

My take on the largest London IPO since 2021 — the flotation of Princes Group. Free to read at @alphaville.ft.com : www.ft.com/content/4141...

03.11.2025 16:03 — 👍 7 🔁 3 💬 0 📌 0

Saylor’s Strategy (née MicroStrategy) is hailing a “historic” credit rating from S&P.

It’s B-minus — deep in junk.

My latest for @alphaville.ft.com on a “bitcoin treasury company” craving TradFi approval while its stock badly trails the asset it worships. $MSTR

www.ft.com/content/f087...

31.10.2025 12:34 — 👍 5 🔁 1 💬 0 📌 0

Revenge against the banking nerds is near - @thekrazykobra.bsky.social's column on AI replacing a lot of the modelling grunt work is drawing a lot of debate... www.ft.com/content/0b7f...

29.10.2025 10:38 — 👍 3 🔁 2 💬 1 📌 0

Revenge against the banking nerds is near

With progress in AI, the showhorses may yet eclipse the more technically skilled workhorses

Column I wrote today in @financialtimes.com about OpenAI hiring over a hundred investment bankers under “Project Mercury” to program AI to build financial models and automate junior banker grunt work.

on.ft.com/4ohgEu3

29.10.2025 09:08 — 👍 2 🔁 0 💬 0 📌 0

Article I published today in @financialtimes.com on reunion I attended last month for my old investment bank. www.ft.com/content/5504...

20.10.2025 10:47 — 👍 5 🔁 1 💬 1 📌 0

I’m mentioned briefly in this Daily Telegraph article on my brother Harlan!

Paywalled: www.telegraph.co.uk/tv/2025/10/1...

Archived version: archive.is/ImXPa

19.10.2025 00:23 — 👍 2 🔁 0 💬 0 📌 0

(Micro)Strategy raised $128 million last week but only bought $22 million of bitcoin. What’s going on? My take and what it says about $MSTR business model

29.09.2025 22:18 — 👍 12 🔁 3 💬 1 📌 0

Robert De Niro in “Heat” had a rule: be ready to walk away in 30 seconds. Is that the ultimate career goal?

I wrote in today’s @financialtimes.com on the trade-offs of a "portfolio career" vs. a singular role. It's not all freedom and laptops on the beach.

22.09.2025 07:10 — 👍 3 🔁 0 💬 0 📌 0

The jury is still out on S&P’s rejection of Strategy

Beyond its small software division, the company’s entire model relies on constantly selling new shares

The jury is still out on S&P’s rejection of Strategy - column here @thekrazykobra.bsky.social here on the bitcoin investor that is now one of the largest companies outside the S&P 500 with a market cap of $93bn www.ft.com/content/57c4...

12.09.2025 06:16 — 👍 9 🔁 3 💬 1 📌 0

The S&P 500 just left Strategy (fka MicroStrategy) outside the index after most recent rebalancing. My latest for the @financialtimes.com on why it wasn't invited: it acts like a bitcoin fund, not an operating company. The rejection is a blow to its business model. www.ft.com/content/57c4...

12.09.2025 06:01 — 👍 8 🔁 2 💬 2 📌 0

Man U’s fall after Fergie is the perfect parable for Britain after Brexit.

28.08.2025 09:40 — 👍 1 🔁 0 💬 0 📌 0

Strategy’s sagging bitcoin strategy

[FREE TO READ] Ahoi Saylor

"The previously successful treasury strategy seems now to be preventing stockholders from fully participating in the very bitcoin rally they are funding."

on.ft.com/3JR070i

27.08.2025 14:35 — 👍 10 🔁 2 💬 1 📌 0

“The previously successful treasury strategy seems now to be preventing stockholders from fully participating in the very bitcoin rally they are funding. In fact, the rush of stock sales by Strategy insiders in November 2024 appears to have been well-timed.” My take in @alphaville.ft.com

27.08.2025 13:58 — 👍 4 🔁 1 💬 0 📌 0

Reuniting the old crew at a new bank is tough

Hiring star bankers and letting them bring their own posse has had mixed results

Reuniting the old crew at a new bank is tough - @thekrazykobra.bsky.social here on Citi’s hiring spree and why such move rarely deliver sustainable gains. A great look at what goes on inside a bank - and it cites The Blues Brothers www.ft.com/content/0719...

22.08.2025 18:26 — 👍 4 🔁 1 💬 2 📌 0

In this “On Wall Street” column in @financialtimes.com, I look at Citigroup’s bid to “get the band back together” under Viswas Raghavan — and why star hires alone rarely change an investment bank’s trajectory. www.ft.com/content/0719...

22.08.2025 18:19 — 👍 9 🔁 1 💬 0 📌 0

Fantastic essay. Really learned a lot - thank you

22.08.2025 09:56 — 👍 1 🔁 1 💬 0 📌 0

Ex-bankers often think angel investing is the natural next step. It can be stimulating, but it’s no road to quick riches. My column in the @financialtimes.com on the seductions & realities of backing start-ups

18.08.2025 08:11 — 👍 3 🔁 0 💬 0 📌 0

Figma’s IPO soared 250% — cue outrage. $3bn left on the table? A rigged game? Not so fast. In @alphaville.ft.com, I argue that the “broken” IPO process may just be the least-worst option. $FIG

Free to read: www.ft.com/content/9fa9...

04.08.2025 06:16 — 👍 9 🔁 2 💬 0 📌 1

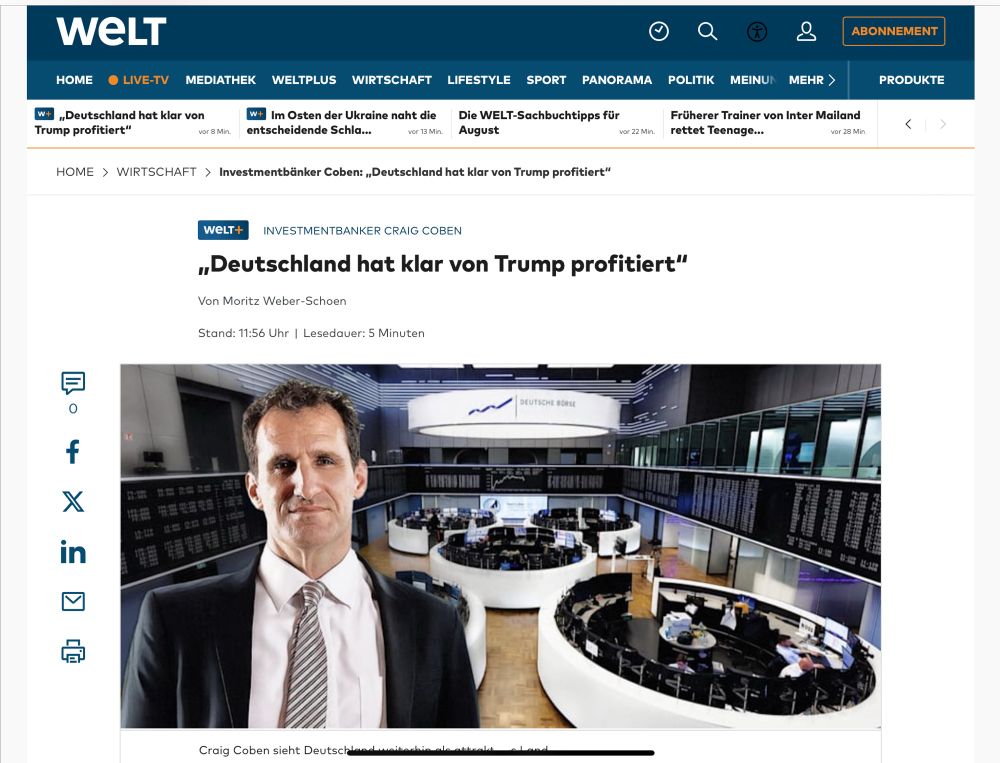

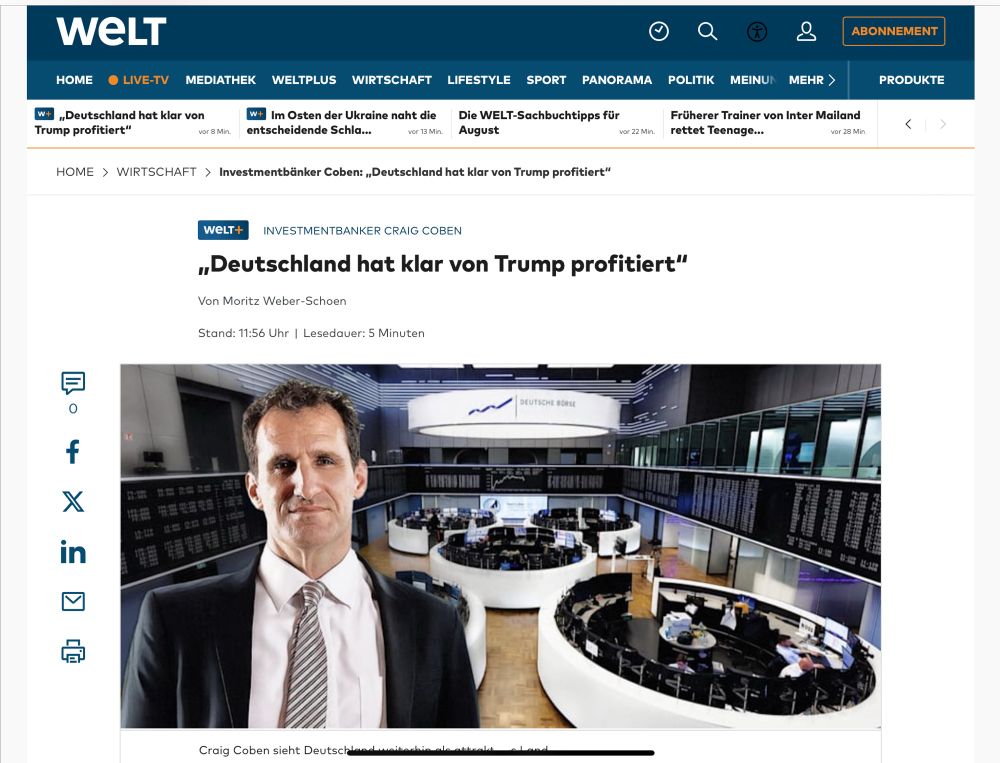

Interviewed in Die Welt newspaper about financial markets, investment banking, and leadership. When I was asked who was my role model leader in Europe, I was unequivocal: Marco Silva, the Portuguese manager of Fulham FC www.welt.de/wirtschaft/p...

01.08.2025 18:58 — 👍 0 🔁 0 💬 0 📌 0

Many late-career pros return to university to seek intellectual nirvana and campus highs, only to find the transition much harder than expected. My “After the Bell” column in @financialtimes.com : www.ft.com/content/3762...

28.07.2025 07:24 — 👍 8 🔁 2 💬 1 📌 2

Senior Economist at the Resolution Foundation, focusing on employment, young people and health | views my own

Finance, investing, history, art, literature | Runner, Gardener | French | https://alphabetablogfr.substack.com/

I post cool charts about markets and investing. Scottish and into running. Head of Strategic Research @Schroders. Not investment advice

PhD candidate in the history of finance at Princeton. Working on early-modern Atlantic currencies. Writing a trade-press history of the dollar and a dissertation about the guinea. I used to be a journalist. I used to be a lot of things.

Editor of IFR. Man v Fat five-a-side incompetent, ale-supper, cyclist, Derby County sufferer, man of the hills, undercover Welshman

Archive - https://x.com/nosunkcosts

Professor, Wharton School, and Senior Fellow, Lauder Inst (both at UPenn). Allianz Chief Economic Advisor. Chair, UnderArmour Board of Directors. Board member, NBER. CFR. Former co-CIO/CEO PIMCO and President, Queens' College, Cambridge University.

Senior Fellow at Carnegie China. For speaking engagements, please write to chinfinpettis@yahoo.com

Trade wonk, Brexit bore, globalisation defender, music lover, cricketer, gardener, supporter of mediocre football teams, who knows where the time goes?

Data Editor, @thetimes.com

I write a weekly data column called Go Figure

🔗 https://www.thetimes.com/profile/tom-calver

📧 thomas.calver@the-times.co.uk

shadow hedgie, your favourite reply guy's favourite reply guy

Migrant in London, citizen of nowhere, marked safe from the transphobe mind virus

geriatric millennial, like everyone else here

still looking for the Édouard Drumont of the left

Editor, FT Weekend Magazine

cordelia.jenkins@ft.com

Editor of Weekend FT • sinkhole tracker • Do not buy crypto from me or anyone who appears to be me

A modern news outlet for London, covering the city in the old-fashioned way. Edited by @jim.londoncentric.media. Subscribe now for a 25% discount: www.londoncentric.media

Informed crypto news — protos.com

Protos Live 🔴 — protos.com/live

📈📉 US markets/macro/Fed/housing (everything here = own). 🗣️ Learning French with very modest success (Intermediate/B1). 📍Chicago, formerly UWS/Boston/Nashville/LA, always very Californian.

Professor of Economics and Public Policy, King's College London; Senior Fellow, UK in a Changing Europe. Immigration, economics, public policy. Personal views only; usual disclaimers apply.

Books: Immigration (Sage), Capitalism (Quercus)

Founder of think tank New Financial. Bigger & better capital markets in Europe. ‘Top City wonk’ - CityAM. Expert on the decline of ties - Daily Mail