Well, that’s the sort of thing that will help $DXS.AX, alongside the story of possible corporate interest.

10.02.2025 03:55 — 👍 2 🔁 0 💬 0 📌 0@davidberthon-jones.bsky.social

Co-CIO, Aequitas Investment Partners. Information is general advice and prepared without taking into account your objectives, financial situation or needs.

Well, that’s the sort of thing that will help $DXS.AX, alongside the story of possible corporate interest.

10.02.2025 03:55 — 👍 2 🔁 0 💬 0 📌 0When a stock drops on a good result, it's usually a marker that the top is in. That's a heuristic only, but it's not a bad one.

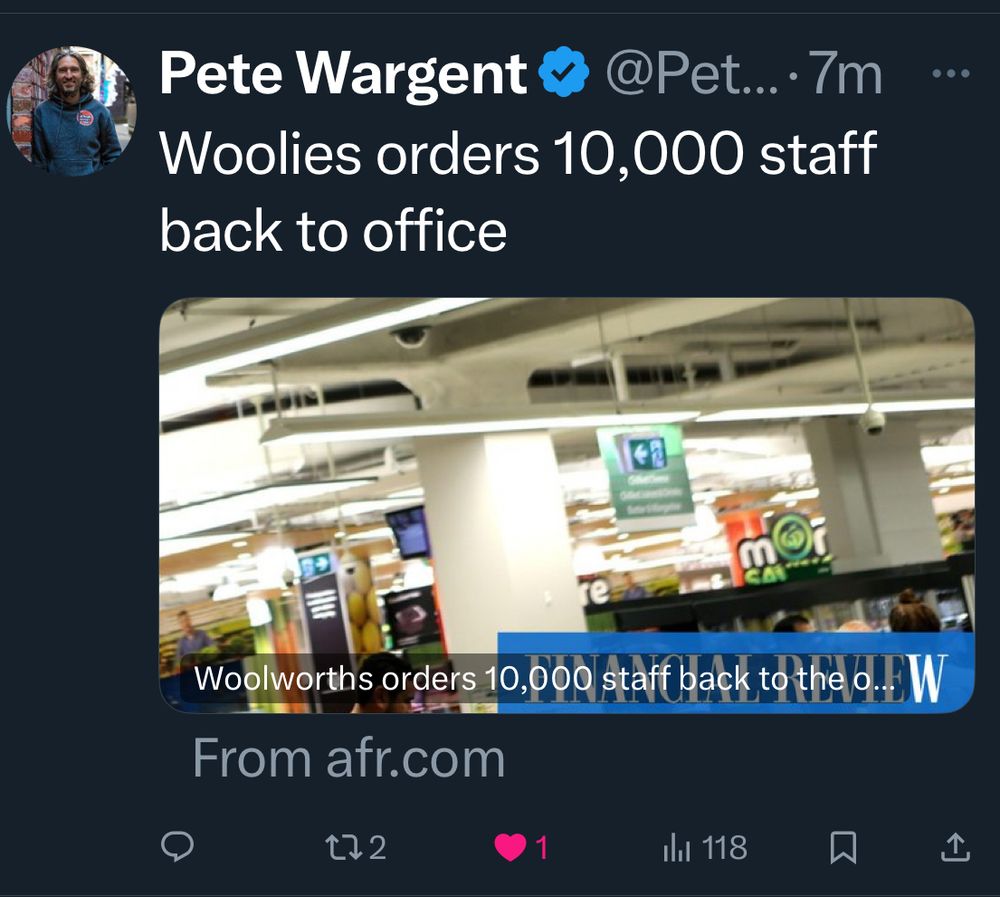

10.02.2025 02:50 — 👍 0 🔁 0 💬 0 📌 0If you are wondering how $JBH.AX managed to open up and wind up down, the multiple expansion is a good place to start. Share price has massively overshot the earnings growth, as such, the forward PE is around the same as $CSL.AX. Both great businesses, but pretty hefty increase.

10.02.2025 02:50 — 👍 1 🔁 0 💬 1 📌 0

With $CAR.AX, $CAR, to me, the bigger issue, beyond the earnings quality questions of this result, is the price. 12x forward sales boggles my mind.

10.02.2025 00:21 — 👍 2 🔁 0 💬 0 📌 0

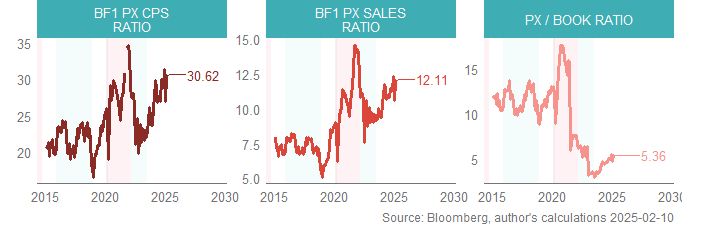

Weather and other odds and sodds perhaps muddying the US jobs numbers. Still, a 4 handle on the unemployment rate is an enviable number.

09.02.2025 23:51 — 👍 1 🔁 1 💬 0 📌 0

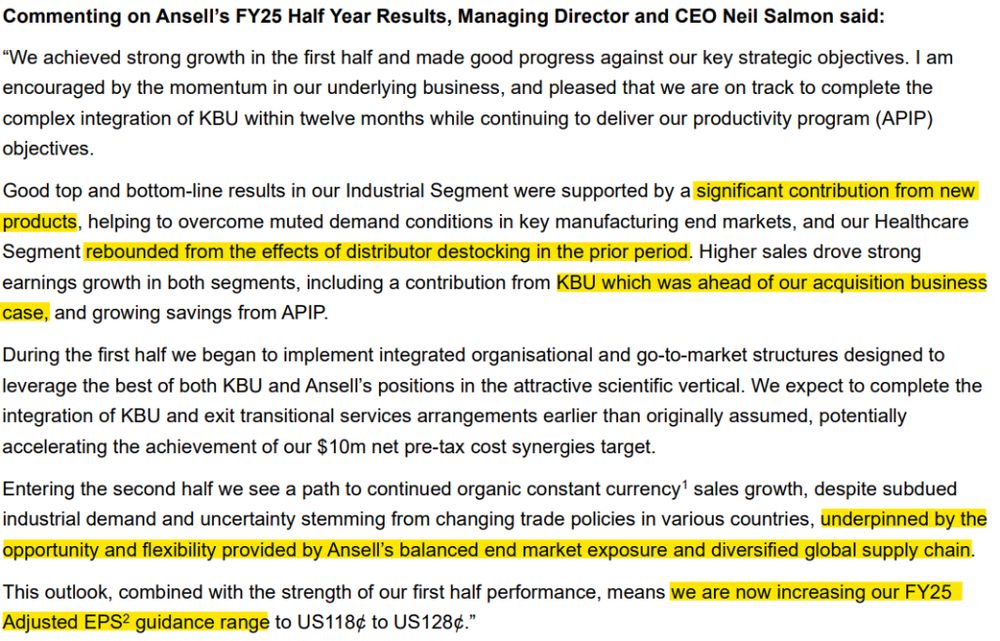

About as good as you could ask, really. KBU integration tracking ahead, cost out program delivering, gearing down eps guide up. $ANN.AX $ANN

09.02.2025 21:03 — 👍 0 🔁 0 💬 0 📌 0Seems somewhat bullish for select REITs. I have a reasonable DAA allocation to them, and often worry because the very clever X account Ptuomov argues against them.

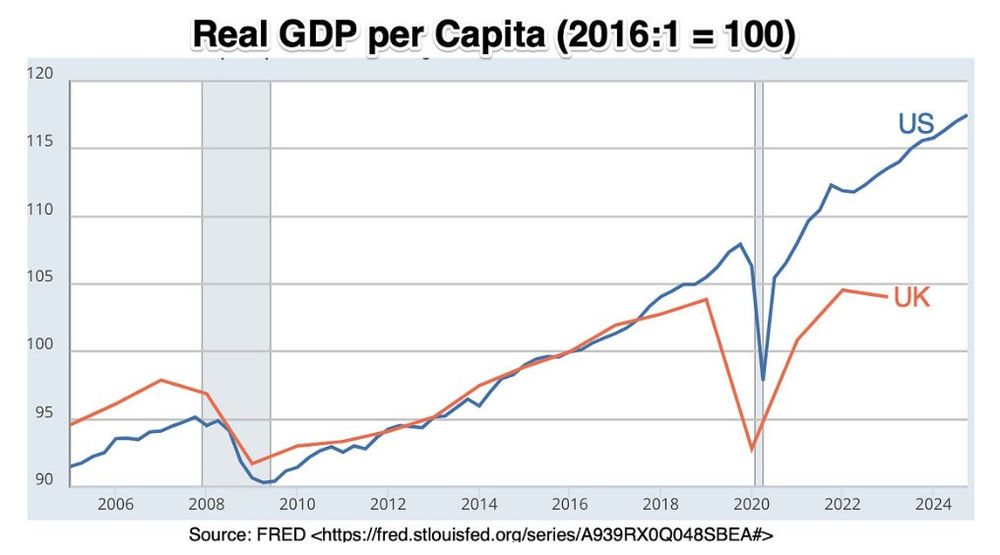

08.02.2025 22:46 — 👍 1 🔁 0 💬 0 📌 0Conor’s point on homebuilders seems very relevant for $JHX.AX, which is still quite elevated. Similar for $RWC.AX. These are local fund manager favourites

08.02.2025 22:38 — 👍 2 🔁 1 💬 0 📌 0

Pondering the @delong.social BREXIT article, I wonder how people are meant to know what's really at stake. You rely on institutions, those institutions fail. Anything you do for a living, that isn't econ policy, you aren't going to be able to DYOR. And yet the consequences are huge.

08.02.2025 05:01 — 👍 3 🔁 2 💬 0 📌 0Maybe restated. I worry the cheap versions, lower tier levels of product that "sorta kinda" work, but leaves you unaware that two more meters forward on the technological frontier on which your treading will 10x the experience, and I just don’t know what I don’t know.

08.02.2025 04:48 — 👍 0 🔁 0 💬 0 📌 0But it does seem inevitable that I'll have to fork out for these (only slightly) more expensive versions to have a play, and see if they've solved the problem of "often people back down on a topic when you challenge them (even if right) and thus so too does the all too human AI".

08.02.2025 04:48 — 👍 0 🔁 0 💬 1 📌 0..on its answers at the slightest of pushbacks, leaving me to be unsure of whether I was right and the software wrong, or I was wrong but the software was “guessing that the next logical expected step was an apology” based on how I was responding to its answers.

08.02.2025 04:48 — 👍 1 🔁 0 💬 1 📌 0I've heard (read) rave reviews about some of the latest top tier paid for AI's (thinking about @tylercowen.bsky.social blogging at MR). And I was thinking about how (the very useful) entry level ($20 per month) Claude would "fluff" some relatively basic economic questions. It would fold...

08.02.2025 04:47 — 👍 0 🔁 0 💬 1 📌 0...as is ever increasing competition from alternatives (Taco Bell, new burrito stores, whatever it might be).

07.02.2025 05:20 — 👍 0 🔁 0 💬 0 📌 0..."unambiguously cheap" which is generally where you want to be buying turnarounds (ideally, at any rate, sometimes you get stuck in them). In the very long run, I also see the GLP-1s as something of an overhang to long run demand...

07.02.2025 05:20 — 👍 0 🔁 0 💬 1 📌 0interesting, never really ditched it's "growth multiple" in our view (similar framing from @bowtiedstocks). Prior to today, it was still trading above 22-23x forward earnings. Now maybe that really was trough earnings, but I don't you could say it had gotten...

07.02.2025 05:19 — 👍 0 🔁 0 💬 1 📌 0

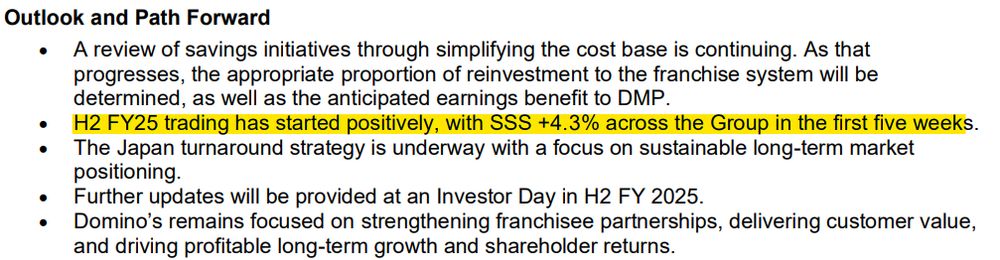

$DMP.AX $DMP certainly has all the hallmarks of a turnaround. Old CEO is out, the old growth strategy has changed (hence closing the underperforming stores) and maybe the rebased earnings has fallen enough that growth can begin again. However I'd say that DMP, whilst certainly very...

07.02.2025 05:19 — 👍 0 🔁 0 💬 1 📌 0

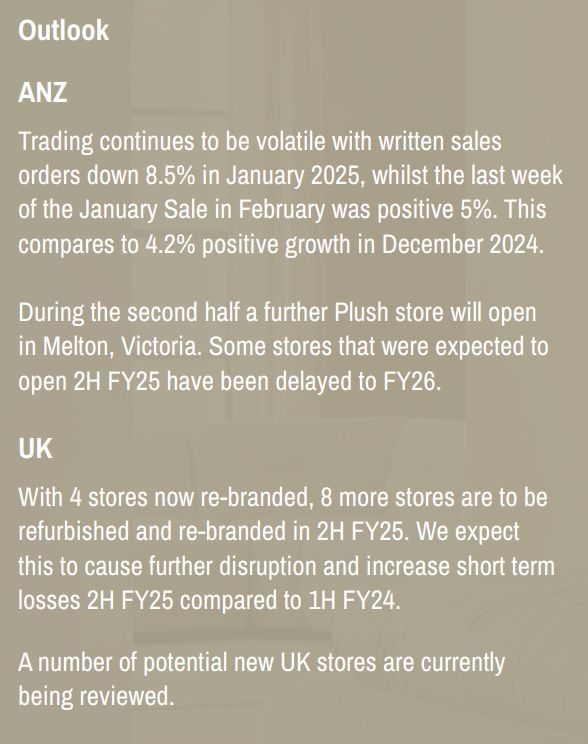

UK losses to increase given build out, ANZ store rollout slows/pushed out, and some very difficult to read sales volatility in local trading (-8.5%, then +5%). $NCK.AX Freight costs not getting much airplay this time around.

06.02.2025 22:14 — 👍 1 🔁 0 💬 0 📌 0

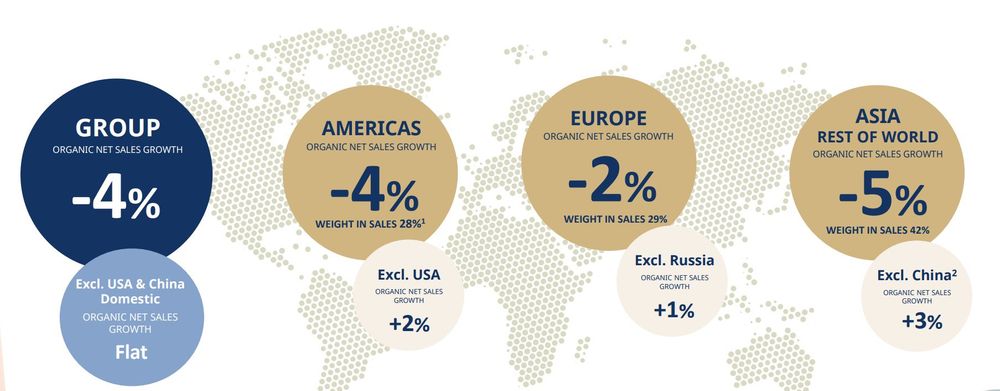

$RI.FP putting an understandable but near comical positive spin on geographic breadth. "Ex USA and China, our sales were flat!". Spirits in the doldrums.

06.02.2025 20:15 — 👍 1 🔁 0 💬 0 📌 0

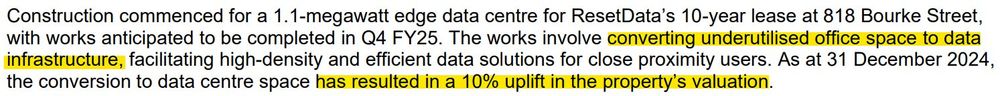

Interesting from $COF.AX $COF. Data centre-esq pivot to monetise underutilised space. There's loads of examples about office-to-resi conversions, this one is a bit novel (at least to my ears) but a good example of adaptation.

06.02.2025 05:05 — 👍 2 🔁 0 💬 0 📌 0

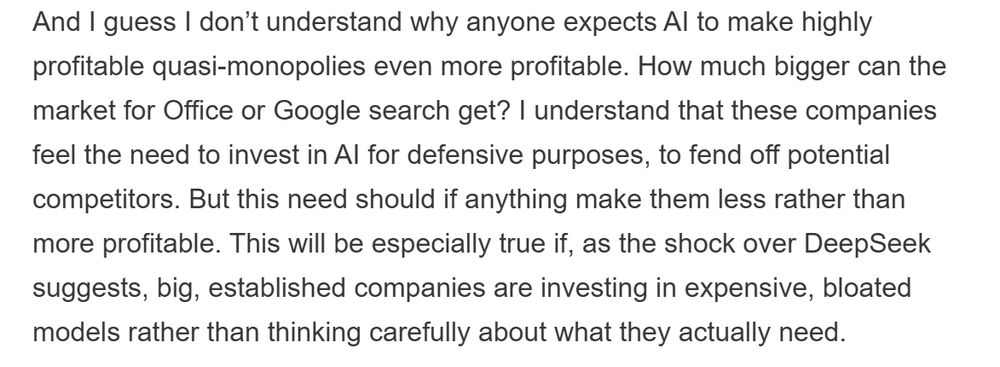

Krugman with interesting thoughts on tech. Imv, Mag 7 are over-cooked, the capex won't generate the returns they are hoping for, and whilst maybe not akin to lighting money on fire is closer to that than the nibbana they see it as.

06.02.2025 00:09 — 👍 31 🔁 1 💬 3 📌 0

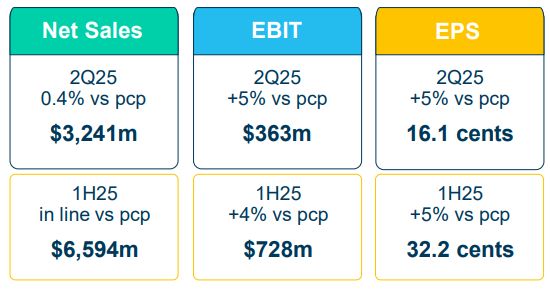

Solid operating leverage evident. Sales +0.4%, EBIT +5%. The main driver has been "AMC really suffered during the COVID-recovery period, as AMC customers drew down bloated inventories, and as such had to go and find a whole bunch of ways to take cost out".

04.02.2025 20:57 — 👍 0 🔁 0 💬 0 📌 0

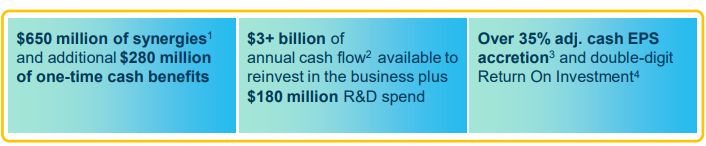

The Berry acquisition continues to look a) compelling b) underappreciated in our view. $AMC.AX $AMCR.US. The expected EPS accretion is quite large, if they get anywhere near this, it would be a strong outcome.

04.02.2025 20:56 — 👍 0 🔁 0 💬 1 📌 0In short, whilst these are the kind of markets where DAA trades are more target rich, we still need to see some more oommph behind the changes for now.

03.02.2025 23:26 — 👍 0 🔁 0 💬 0 📌 0After all, intra year drawdowns of 10% are the norm in equity markets. They just happen a little slower, and with less newsflow, drifting somewhat randomly on the back of millions of decisions made at the margin by market participants for reasons you can often only guess at...

03.02.2025 23:26 — 👍 0 🔁 0 💬 1 📌 0Easier to just wait for a more material dislocation. 5% moves in the market over a handful of days, that sort of thing.

03.02.2025 23:26 — 👍 0 🔁 0 💬 1 📌 0These aren't the kind of headlines you can (the vast majority anyway) make money on. You'll just get whipsawed.

03.02.2025 23:25 — 👍 2 🔁 0 💬 2 📌 0

A whole bunch of punting would appear neccessary, given industry profitability has been decimated, and even before COVID eps growth has been scant. $RHC.AX $RHC. CEO clearing the decks, and accountability for a share price in the low 30s that's followed the earnings.

30.01.2025 23:09 — 👍 0 🔁 0 💬 1 📌 0....like retail sales, unemployment rates etc to improve.

30.01.2025 03:18 — 👍 0 🔁 0 💬 0 📌 0...all else is recoverable in good time. Anyway, I'd thought the NZ housing bubble popping would be very bad, and if housing is ground zero for negative spill overs, then it would seem the recovery sets the stage for all those other downstream things...

30.01.2025 03:17 — 👍 0 🔁 0 💬 1 📌 0