As a reminder, there is a contingency fund available for paying SNAP benefits. Trump's "Government lawyers" thought he could use it during the first term shutdown and as recently as September.

31.10.2025 22:43 — 👍 6 🔁 2 💬 0 📌 0@tylerevilsizer.bsky.social

Numbers wizard for the Senate Budget Committee Democrats; tax nerd, budget wonk. Formerly at @BudgetHawks

As a reminder, there is a contingency fund available for paying SNAP benefits. Trump's "Government lawyers" thought he could use it during the first term shutdown and as recently as September.

31.10.2025 22:43 — 👍 6 🔁 2 💬 0 📌 0When I worked at Senate Budget, every single year, I would go through the copious errors in Rand Paul's budget. Tyler was my replacement when I left (follow him).

What's so amazing about the Paul budget is both that he has some of the same errors each year & that there are new ones every year too.

Finally, the budget accidentally sets spending levels for the year *3031* instead of 2031. Maybe it's a typo, but it's one they made 32 separate times!

18.09.2025 00:03 — 👍 13 🔁 2 💬 0 📌 0The budget is supposedly balanced in 5 years and in surplus after that, but it still has the U.S. paying the same amount in interest payments: over $1.8 trillion (35% of the new budget) by the tenth year.

18.09.2025 00:03 — 👍 9 🔁 1 💬 1 📌 0It's also full of typos.

The budget includes all the tax cuts from the recently passed reconciliation bill, but is silent on the spending. Are these cuts on top of reconciliation? Who knows.

So Paul can simultaneously say he's not cutting anything but also that he's cutting enough to balance the budget. It's a secret plan that could be anything.

18.09.2025 00:03 — 👍 13 🔁 2 💬 1 📌 0But then it invents a new category of spending called "Efficiencies, Consolidations, and Other Savings" and cuts that by $22 trillion.

That's a huge amount of cuts! As an example, abolishing Social Security would come close. Abolishing Medicare or defense is only halfway there.

The budget is here: congress.gov/bill/119th-c...

The budget calls out all the categories of spending to keep the same.

Defense = undo the reconciliation bill and make no cuts

Health, education = make no cuts

Vets = make no cuts

And so on for all the other categories of spending

Yesterday, Rand Paul proposed a budget that is full of gimmicks AND full of typos. It calls for a massive 38% cut to federal spending, but doesn't tell you where.

18.09.2025 00:03 — 👍 38 🔁 13 💬 2 📌 1

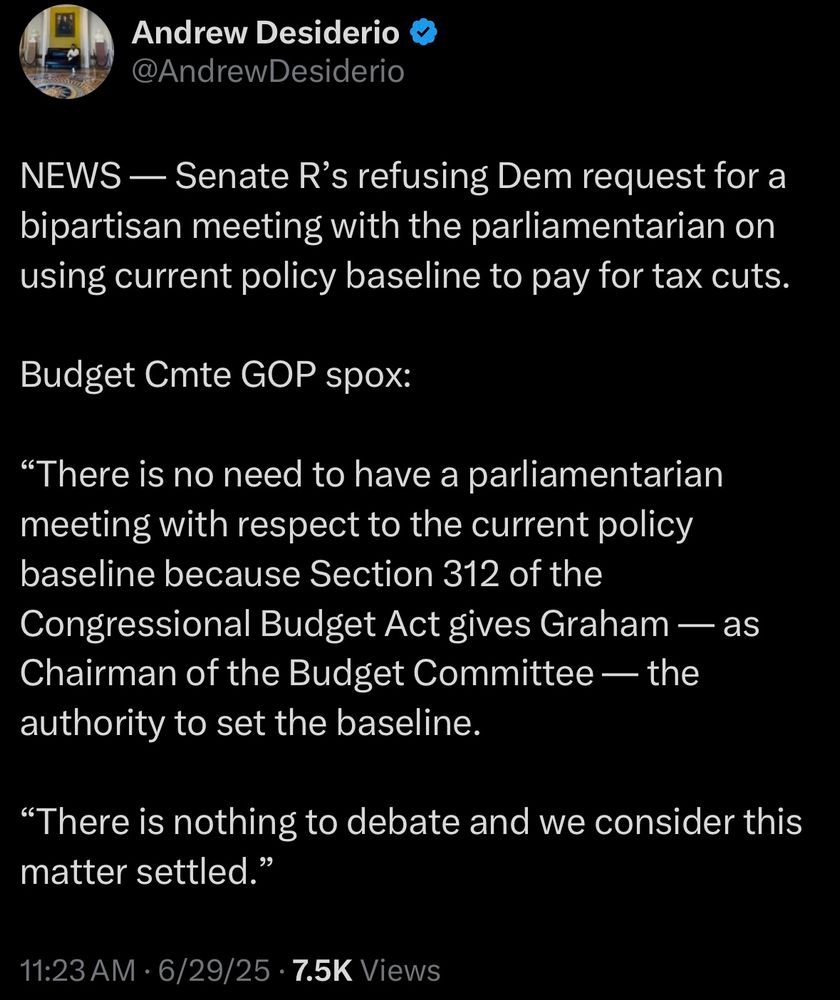

NEWS — Senate R's refusing Dem request for a bipartisan meeting with the parliamentarian on using current policy baseline to pay for tax cuts. Budget Cmte GOP spox: "There is no need to have a parliamentarian meeting with respect to the current policy baseline because Section 312 of the Congressional Budget Act gives Graham — as Chairman of the Budget Committee — the authority to set the baseline. "There is nothing to debate and we consider this matter settled."

I want to be very clear about what’s happening: Senate Republicans know the parliamentarian will say they can’t use 312 to pretend tax cuts are free (because two have two Byrd rule problems).

So they are refusing to meet with her so they can pretend they never ignored her when they do it anyway.

Parliamentarian's guidance for the Finance tax portion.

No school vouchers, can't relax gun control, can't require millions of people to pre-certify their taxes, and Hillsdale College still doesn't get a special tax break.

The sixth set of Byrd droppings is out and WOW - huge and COSTLY loss for Republicans.

Loan repayment changes can only be for new borrowers, and they lost on CSRs, can’t add new Hyde language, plus other stuff.

By my rough calculations, this just cost Republicans $150 billion or more of their cuts

More guidance from the Parliamentarian about what cannot be in the reconciliation bill, this time in the Judiciary Committee.

Injunctions against the federal government can't be banned.

We're still waiting for the immigration portions of Judiciary.

www.budget.senate.gov/ranking-memb...

NEW: Nonpartisan analysis confirms that the benefits of Trump's "Big, Beautiful" Bill are dramatically skewed toward the wealthy while leaving struggling families WORSE off.

In short: families lose, billionaires win.

Tax cuts do not juice economic growth or come close to paying for themselves.

JCT examined the tax cuts in the reconciliation bill. Economic growth reduces the cost of $3.8 trillion of tax cuts to...$3.7 trillion. GDP growth would increase from 1.83% to 1.86%

The House reconciliation bill is not fiscally responsible. When Republicans say "it has the most savings of any reconciliation bill ever," they are ignoring all the new spending and tax cuts.

16.05.2025 14:07 — 👍 11 🔁 2 💬 0 📌 1

Full article has more examples across government:

www.washingtonpost.com/nation/2025/...

Another example of the inefficiencies and red tape caused by DOGE. Rather than giving federal employees credit cards to buy pens and printer paper, DOGE wants another level of approvals. Then they sit on the request so the agency must sit idle

12.05.2025 14:43 — 👍 5 🔁 0 💬 1 📌 0Link:

17.04.2025 14:02 — 👍 2 🔁 0 💬 0 📌 0

Punchbowl has a schedule for planned House reconciliation markups. Mark your calendars!

17.04.2025 14:02 — 👍 2 🔁 1 💬 1 📌 02 data points to watch at 4pm today for gov't finances

Daily Treasury statement - how much was tax day revenue? In 2024, 1/4 of all the electronic tax payments made over the last 6 months came on 4/15.

Major Foreign Holders of Debt - Did the countries holding U.S. debt change from Jan to Feb?

Meme from High School Musical. Text: "T as in Troy?" "No Gabriella, T as in $52 TRILLION in debt."

ICYMI: CBO’s latest estimate is that the disastrous Republican budget plan will put us $52 TRILLION in debt over the next 30 years.

15.04.2025 13:56 — 👍 18 🔁 10 💬 3 📌 1

CBO: If the Trump tax cuts are renewed with an additional $1.5 trillion in tax cuts, as in the Senate budget, debt will climb, interest rates will rise, and the economy will shrink.

11.04.2025 01:56 — 👍 8 🔁 3 💬 0 📌 0There’s been a lot of talk recently about cutting funding and staffing at the IRS. New work from the Budget Lab shows that if the IRS shrinks by 50% we estimate that this would result in 350 billion net forgone revenue over the 10-year budget window. 1/ @budgetlab.bsky.social

13.03.2025 12:51 — 👍 171 🔁 82 💬 3 📌 9

This Admin is considering shrinking the IRS by 50% to levels not seen since 1960.

@budgetlab.bsky.social estimates this costs at least $400B ($350 net) in uncollected taxes over a decade.

Could be closer to $2.4T if taxpayers comply less when they realize no tax police on the beat.

Trump said the best way to juice the economy was to pass his tax cuts, but that's dead wrong.

The Congressional Budget Office found that extending Trump's tax cuts would make the economy worse, not better.

But what they definitely would do is give households in the top 0.1% a $278,000 tax cut.

There's no reason to think that Republicans won't amend the budget and add reconciliation instructions in the Senate.

But you're right. If the House budget passes the Senate unchanged and there's no Senate instructions, the "big beautiful bill" could be filibustered.

There's nothing unusual about that. The budget in 2017 that teed up the Trump tax tax cuts only included reconciliation instructions for the House, and the Senate added it's own.

27.02.2025 14:24 — 👍 1 🔁 0 💬 1 📌 0The House and Senate often defer to the other chamber. The House wrote the provisions that apply to the House, and after it passes, they expect the Senate will add in the provisions that apply to the Senate. It just means the Senate must make changes, if only to add in their part

27.02.2025 14:24 — 👍 1 🔁 0 💬 1 📌 0