Fiscal Policy Institute Announces Leadership Transition - Fiscal Policy Institute

Executive Director Nathan Gusdorf departs to join New York City Mayor’s Office of Management and Budget. Dr. Emily Eisner appointed Acting Executive Director.

Announcement: Executive Director Nathan Gusdorf will depart FPI to pursue a new opportunity as Deputy Director of Policy, Planning, and Delivery at @nycbudget.bsky.social. Dr. Eisner, currently FPI’s Chief Economist, has been appointed Acting Executive Director while the board plans a transition.

04.03.2026 18:06 —

👍 2

🔁 1

💬 0

📌 0

New York Focus

New York's only statewide newsroom dedicated to holding Albany accountable.

Panelists are talking about Mamdani's promise to build 200,000 units of affordable housing over the next decade.

Emily Eisner of @nyfiscalpolicy.bsky.social: 200,000 is the minimum # of units we need to build in the city. The city would need to take on a lot more debt to do this.

nysfocus.com

13.02.2026 00:49 —

👍 1

🔁 2

💬 0

📌 0

Curious about the state budget? Join FPI's virtual briefing tomorrow at noon. We'll dive into NY's fiscal & economic outlooks, federal cuts, universal childcare, foundation aid, Medicaid & SNAP after the OBBBA, and the NYC budget. us06web.zoom.us/webinar/regi...

18.02.2026 20:14 —

👍 1

🔁 0

💬 0

📌 0

The rent is too damn high! Tomorrow night FPI chief economist @emmurpheis.bsky.social joins @aarmlovi.bsky.social and Sam Mellins at Judson Memorial Church to discuss housing under Mamdani

11.02.2026 16:48 —

👍 4

🔁 2

💬 0

📌 0

How to Get to Universal Childcare

A conversation with Josh Wallack on Universal Pre-K, the Mamdani-Hochul childcare announcement, and early childhood policy in NYC

Don't miss @ngusdorf.bsky.social in conversation with Josh Wallack, who helped deliver Pre-K for All to New York--covering the de Blasio Pre-K experience, voucherization, universal provision, private providers, & the Hochul-Mamdani childcare announcement.

nycpolicyforum.substack.com/p/how-to-get...

31.01.2026 15:46 —

👍 5

🔁 5

💬 0

📌 0

FPI Statement on City Budget Crisis: It's Time to Raise City Taxes - Fiscal Policy Institute

New York, NY | Fiscal Policy Institute Executive Director Nathan Gusdorf released the following statement on behalf of FPI: Today, Mayor Zohran Mamdani announced that New York City is facing a $12…

Today, Mayor Mamdani announced a $12B fiscal deficit facing NYC.

This challenge can be solved w/o slashing services—if NYS authorizes NYC to raise taxes on the highest earners & most profitable corporations.

There are compelling tax policy reasons for an increase, as well.

28.01.2026 20:12 —

👍 2

🔁 0

💬 0

📌 1

Tomorrow at noon FPI's analysts are taking a first look at the New York's FY27 Executive Budget.

Join us on Zoom to discuss the Governor’s financial plan, the proposed budget, and the State’s updated fiscal projections.: us06web.zoom.us/webinar/regi...

21.01.2026 21:26 —

👍 0

🔁 0

💬 0

📌 0

Trump's OBBBA gives millionaire New Yorkers a $12B tax cut through

1) Reductions on most individual income tax brackets

2) A 20% federal income tax deduction for owners of eligible pass-through businesses

3) Reducing the federal corporate income tax rate from 35% to 21%

20.01.2026 20:28 —

👍 2

🔁 0

💬 0

📌 0

Join the Fiscal Policy Institute for a briefing about Governor Hochul's 2026 State of the State this Wednesday at noon.

Attend on Zoom: us06web.zoom.us/webinar/regi...

Or in-person in Lower Manhattan: secure.givelively.org/event/fiscal...

13.01.2026 23:42 —

👍 2

🔁 0

💬 0

📌 0

Correction:

3. $500 million for “2-Care” in New York City over two years.

A phase in of universal daycare for two-year-olds in New York City: $75 million in the first year and $425 million in the second year.

08.01.2026 21:42 —

👍 0

🔁 0

💬 0

📌 0

Read FPI's full statement here: fiscalpolicy.org/fpi-applauds...

08.01.2026 18:49 —

👍 0

🔁 0

💬 1

📌 0

4. $1.2B for Child Care Assistance Program

NYS's voucher program subsidizing childcare for low- & moderate-income families is inadequately funded, forcing districts to put eligible families on waitlists. Gov. Hochul committed to adding $1.2B in funding to shore up the program.

08.01.2026 18:49 —

👍 0

🔁 0

💬 1

📌 0

2. $470 million for Statewide Universal Pre-Kindergarten

New York State currently provides pre-kindergarten for three-quarters of its four-year-olds. This plan would add $470 million to expand pre-kindergarten to the remaining districts that do not yet provide the program. 8/

08.01.2026 18:49 —

👍 0

🔁 0

💬 0

📌 0

How the Hochul-Mamdani Childcare Deal Works:

1. No new taxes or other revenue sources; new investments come from “existing state revenues.” 7/

08.01.2026 18:49 —

👍 0

🔁 0

💬 1

📌 0

The obstacle has always been securing adequate funding, and all New Yorkers should feel heartened by today’s commitment from the State to fund this initiative. 6/

08.01.2026 18:49 —

👍 0

🔁 0

💬 1

📌 0

The high cost of childcare has made it impossible for many families to remain in New York: our research shows that families with young children are 40% more likely to leave the state. 4/ fiscalpolicy.org/new-families...

08.01.2026 18:49 —

👍 0

🔁 0

💬 1

📌 0

Though it will be necessary to enact a stable, long-term revenue source to ensure the permanence of these commitments along the lines of our tax plan for statewide childcare. 3/ fiscalpolicy.org/a-tax-plan-f...

08.01.2026 18:49 —

👍 0

🔁 0

💬 1

📌 0

We applaud this shared commitment to expanding the public sector in order to lower the cost of living and ensure that all families with children have access to high-quality care and education starting in infancy. 2/

08.01.2026 18:49 —

👍 0

🔁 0

💬 1

📌 0

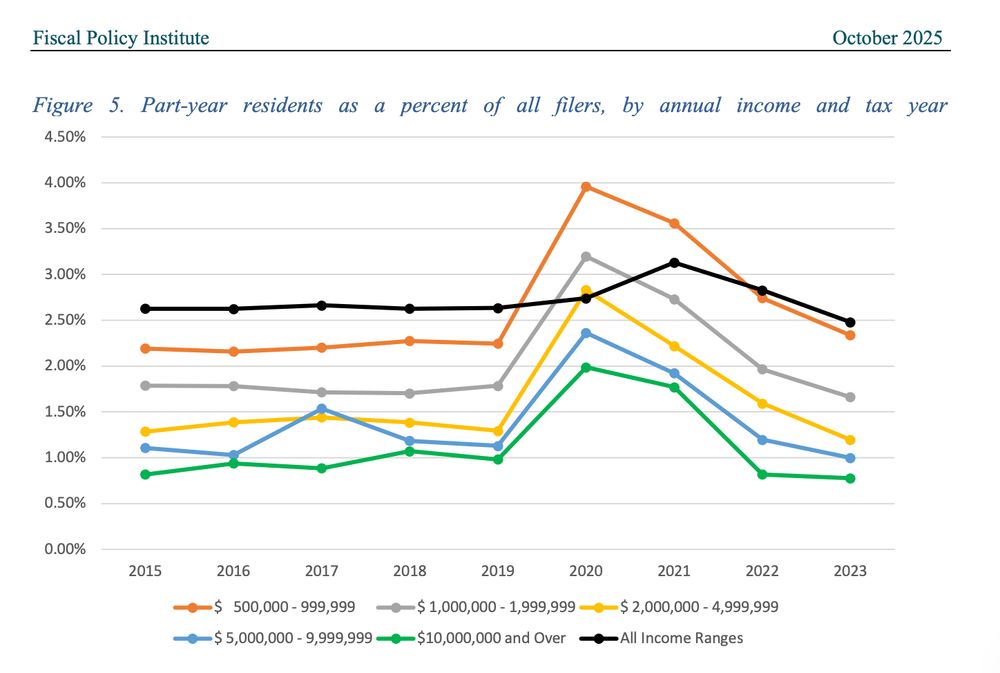

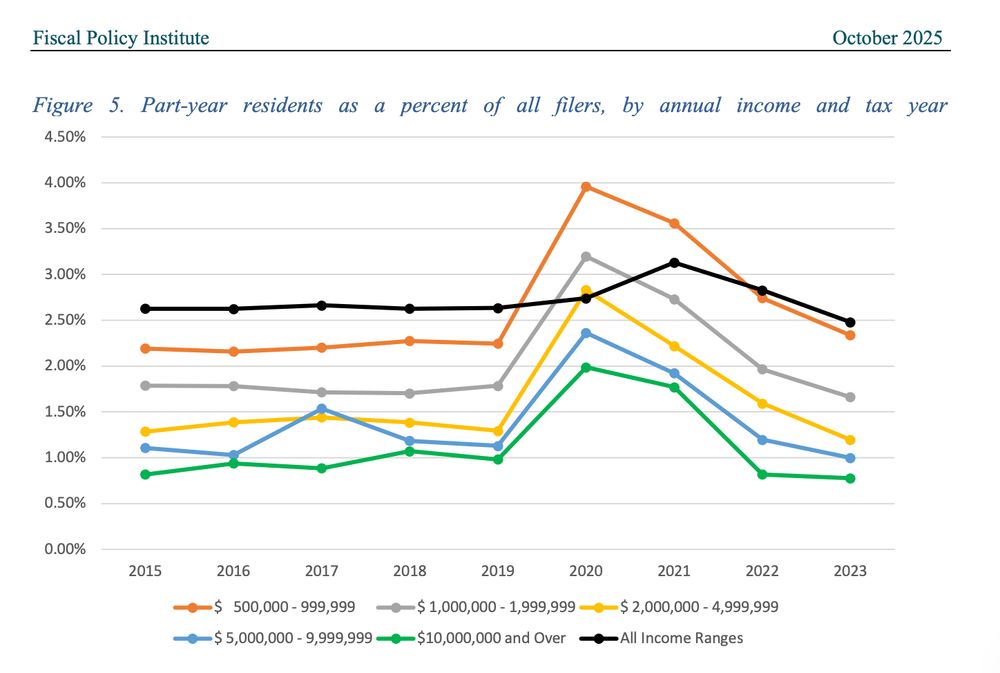

New York’s wealthy warn of a tax exodus after Mamdani’s win – but the data says otherwise

Research on millionaire migration reveals that social and professional ties matter far more than marginal tax rates.

"Many policymakers think that tax cuts will lure [high-income earners] in, but this is mostly a fool’s errand. In normal times, the rich are deeply rooted and not movable."

16.12.2025 23:27 —

👍 0

🔁 0

💬 0

📌 0

Bills being debated by NYC Council would slow the building of affordable housing & make construction more expensive & less targeted to the city's needs—putting major obstacles in the way of the mayor-elect's affordable housing agenda

@emmurpheis.bsky.social speaks w/ @spectrumnewsny1.bsky.social

15.12.2025 18:38 —

👍 2

🔁 1

💬 0

📌 0

A Tax Plan for Universal Childcare in New York City - Fiscal Policy Institute

A combination of progressive and broad-based taxes can finance universal childcare for New York City, ensuring stable and fair funding.

By combining broad-based measure such as a payroll tax with sharply progressive taxes on NYC's highest earners, the incoming administration can ensure both the stability and public legitimacy of its universal childcare system.

See our full report: fiscalpolicy.org/a-tax-plan-f...

12.12.2025 22:05 —

👍 0

🔁 0

💬 0

📌 0

$3.5B will be necessary to finance universal childcare in NYC. It can be supplied by 4 practical taxes on payroll, investment income, corporate profits, and NYC income over $1M. 3/

12.12.2025 22:05 —

👍 0

🔁 0

💬 1

📌 0

The new admin should adopt a mix of progressive and broad-based taxes to finance universal childcare, following the model that funds the MTA.

Spreading costs across multiple, large tax bases, will ensure the needed revenue while staying within the bounds of feasibility 2/

12.12.2025 22:05 —

👍 0

🔁 0

💬 1

📌 0

It's true: "no child care system can survive without sustained attention & investment."

The deciding factor in whether New York achieves truly universal childcare will be whether that system is supported by sustainable, recurring revenue that grows with the program over time 🧵

12.12.2025 22:05 —

👍 0

🔁 0

💬 1

📌 0

Mamdani's First Budget | Andrew Perry

Image and reality of New York City’s finances

Wow so NYC admins systematically underestimate revenues during the budget process, sometimes by big margins, and uses this “structural pessimism” to govern. Andrew Perry of @nyfiscalpolicy.bsky.social says this will determine how Mamdani governs. www.phenomenalworld.org/analysis/mam...

01.12.2025 00:50 —

👍 4

🔁 2

💬 0

📌 0

NYC Mayor-elect Zohran Mamdani announces transition committees

New York City Mayor-elect Zohran Mamdani announced Monday the creation of 17 transition advisory committees made up of more than 400 people.

Today, three of our staff members joined the

@zohrankmamdani.bsky.social admin's transition committee:

🏢 Executive Director Nathan Gusdorf on Government Operations

🏘️ Chief Economist Emily Eisner on Housing

🏥 Director of Health Policy Michael Kinnucan

on Health www.cbsnews.com/newyork/news...

25.11.2025 00:33 —

👍 5

🔁 1

💬 0

📌 0

Will taxing the rich spur them to flee New York?

No.

"There was no notable increase in out-migration among high earners following the State’s 2021 increases to the top Personal Income Tax rates. These higher tax rates raise approximately $3.6 billion annually"—

@nyfiscalpolicy.bsky.social

19.11.2025 16:14 —

👍 13

🔁 3

💬 1

📌 1

Table 2. Average OBBBA tax advantages for top earners

That comes to $12 billion in federal tax cuts for New York's millionaires—at the cost of up to one million New Yorkers losing health insurance and hundreds of thousands facing hunger due to SNAP and Medicaid cuts.

20.11.2025 20:59 —

👍 1

🔁 0

💬 0

📌 0