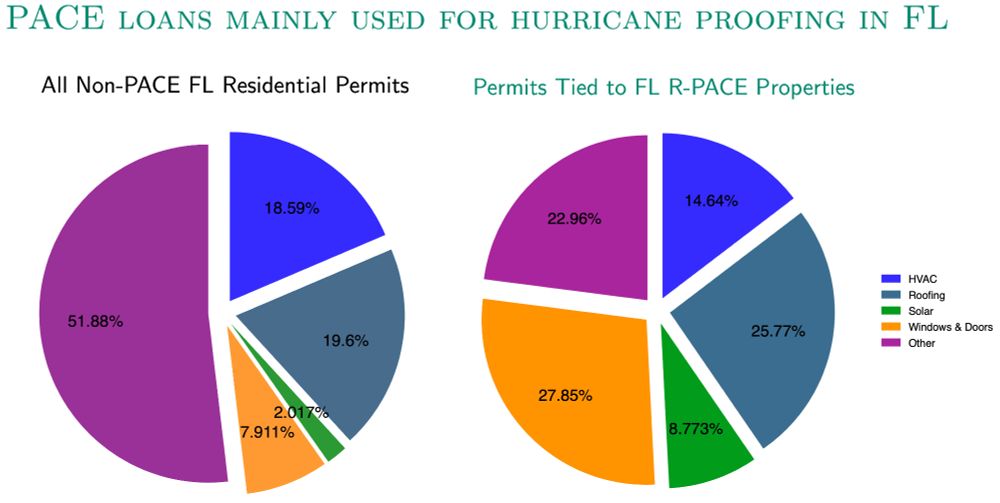

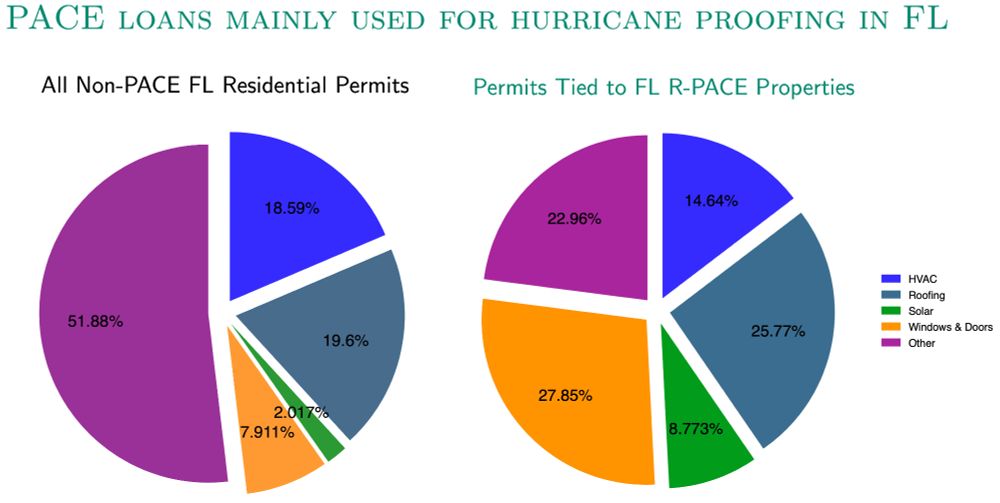

Thanks @martinschmalz.bsky.social for the invitation to talk about how government-backed lending to homeowners in the form of PACE can help improve climate resilience of the housing stock.

Full paper here 👇

papers.ssrn.com/sol3/papers....

07.11.2025 14:35 — 👍 1 🔁 0 💬 0 📌 0

It really makes the raccoon pop out haha

04.04.2025 01:45 — 👍 3 🔁 0 💬 1 📌 0

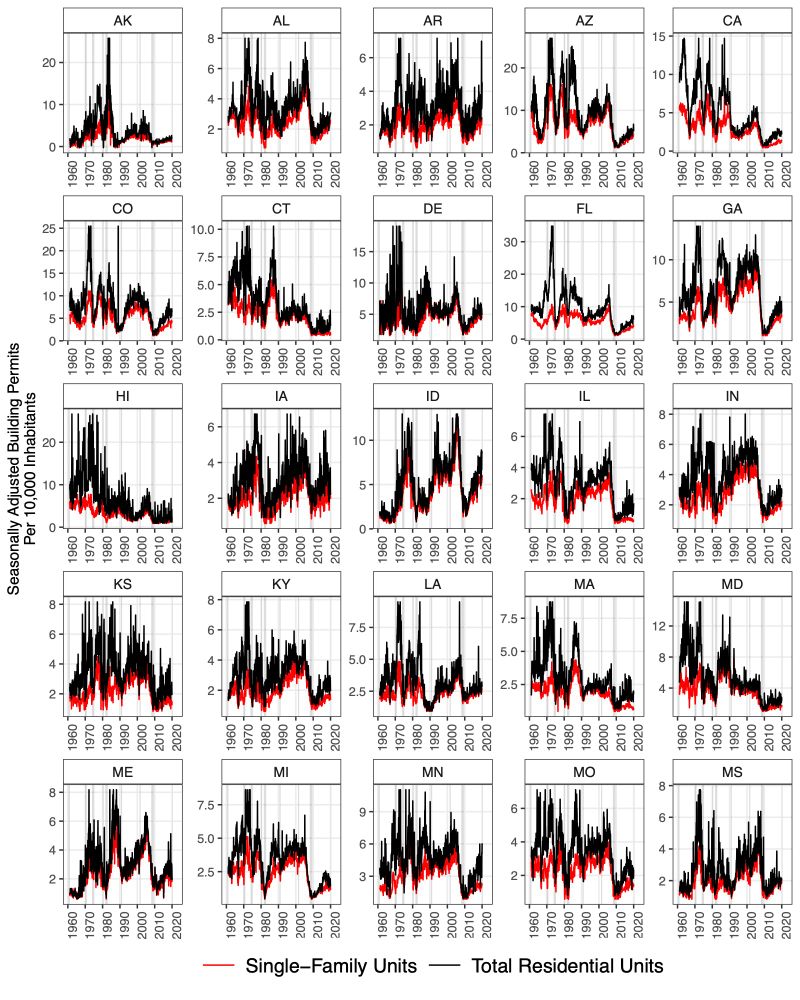

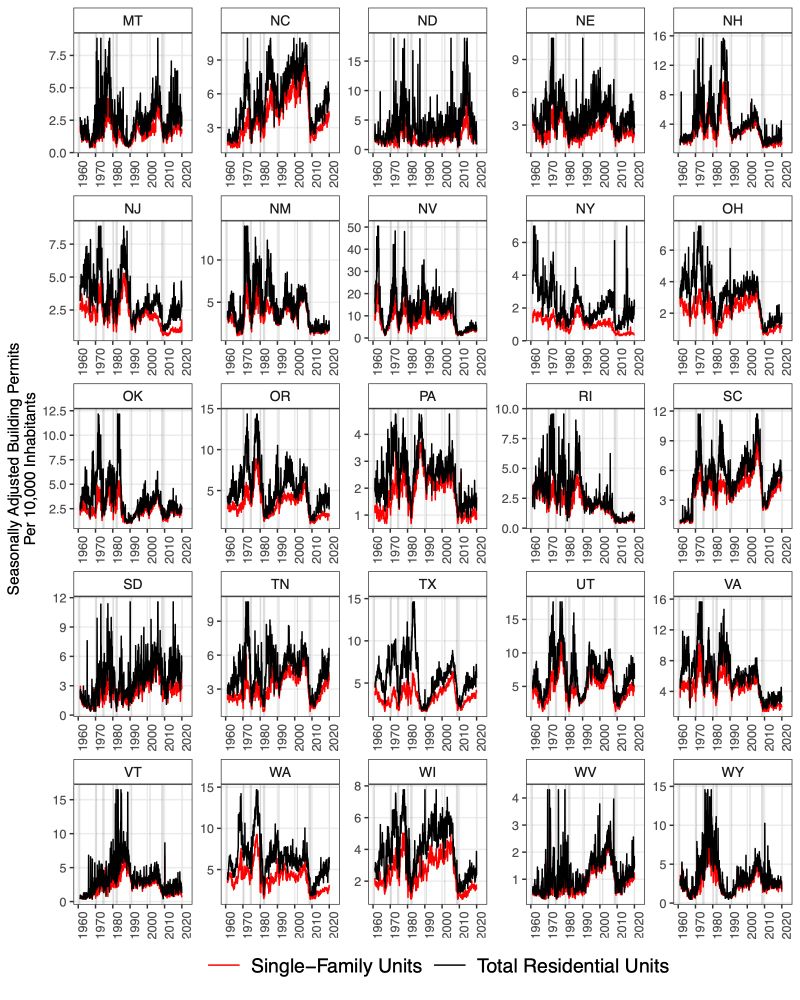

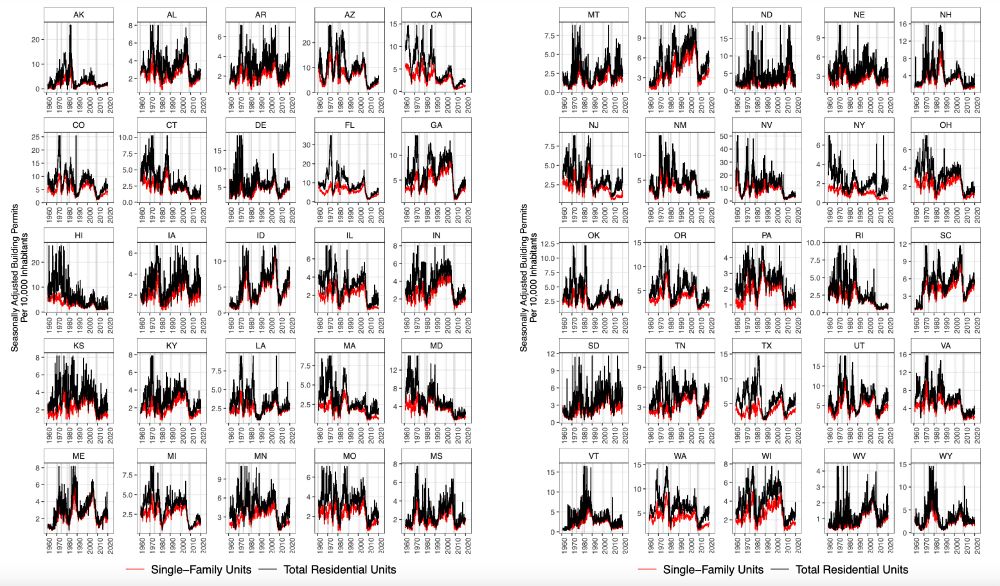

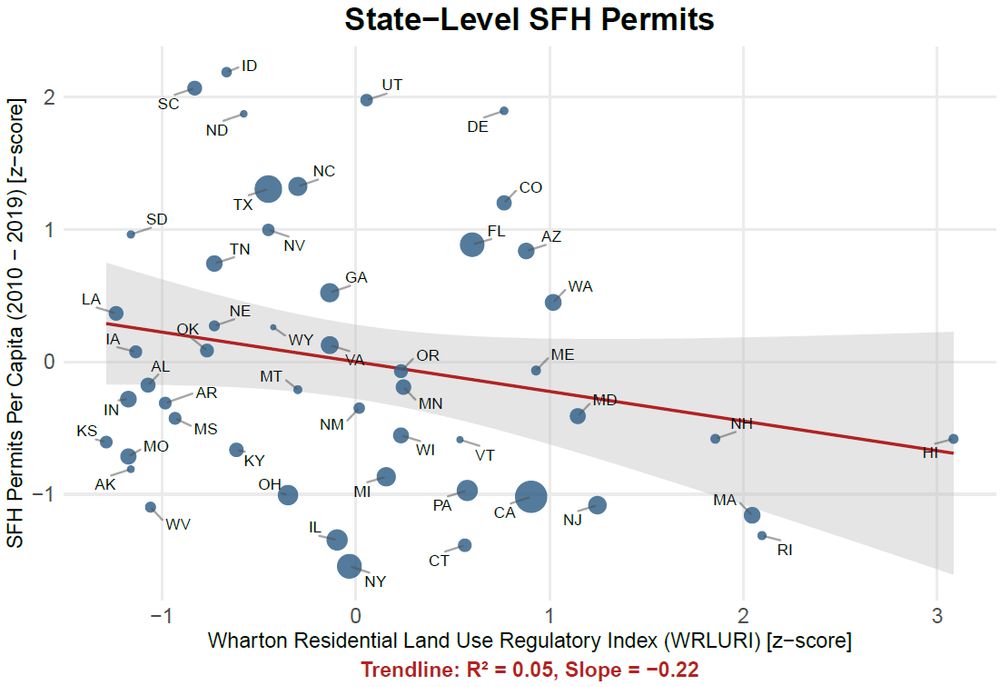

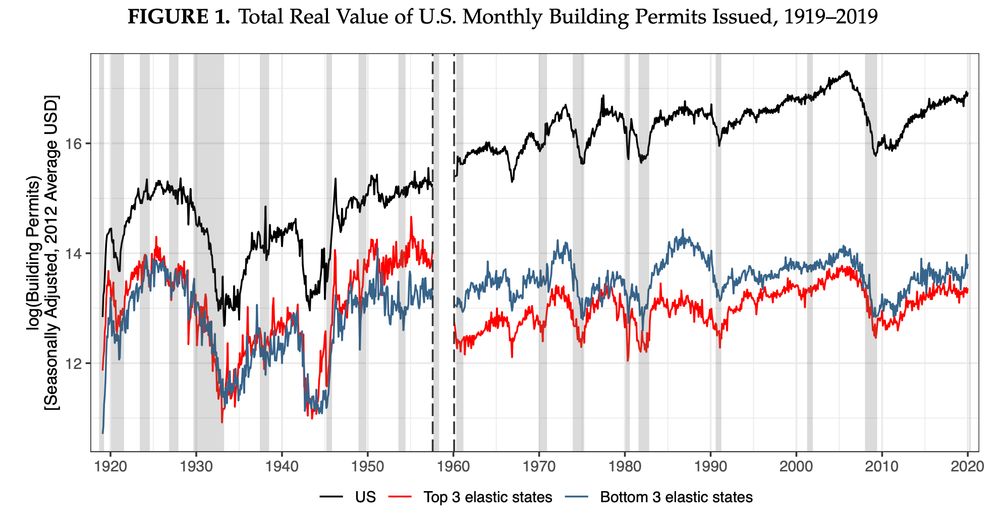

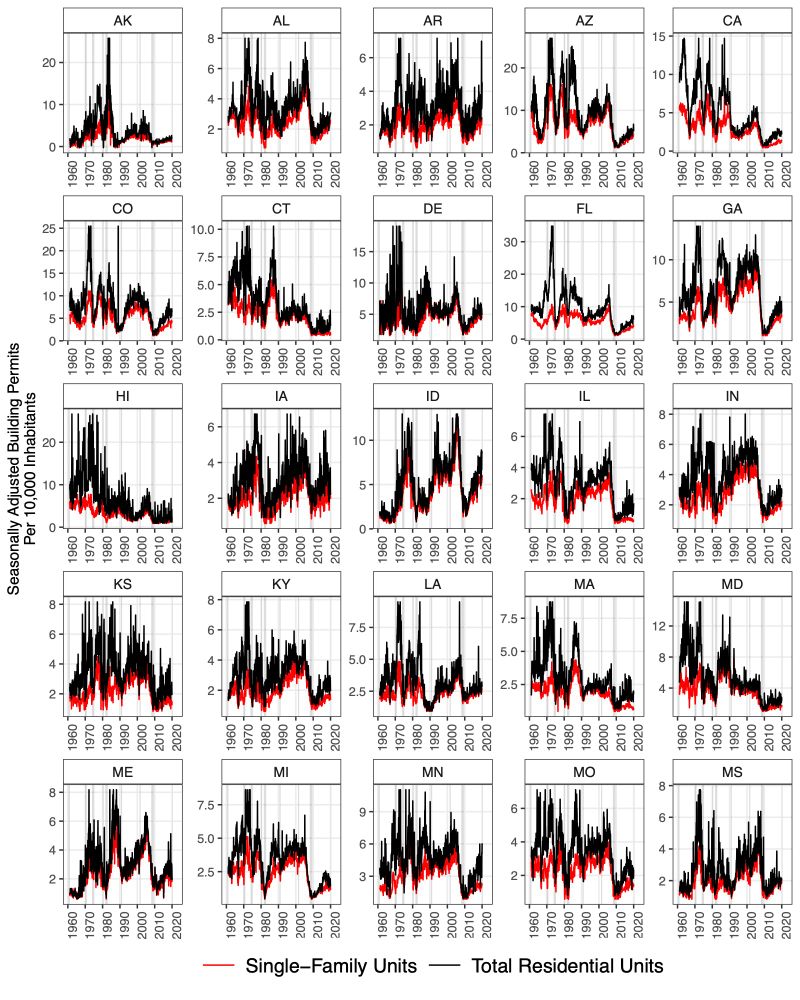

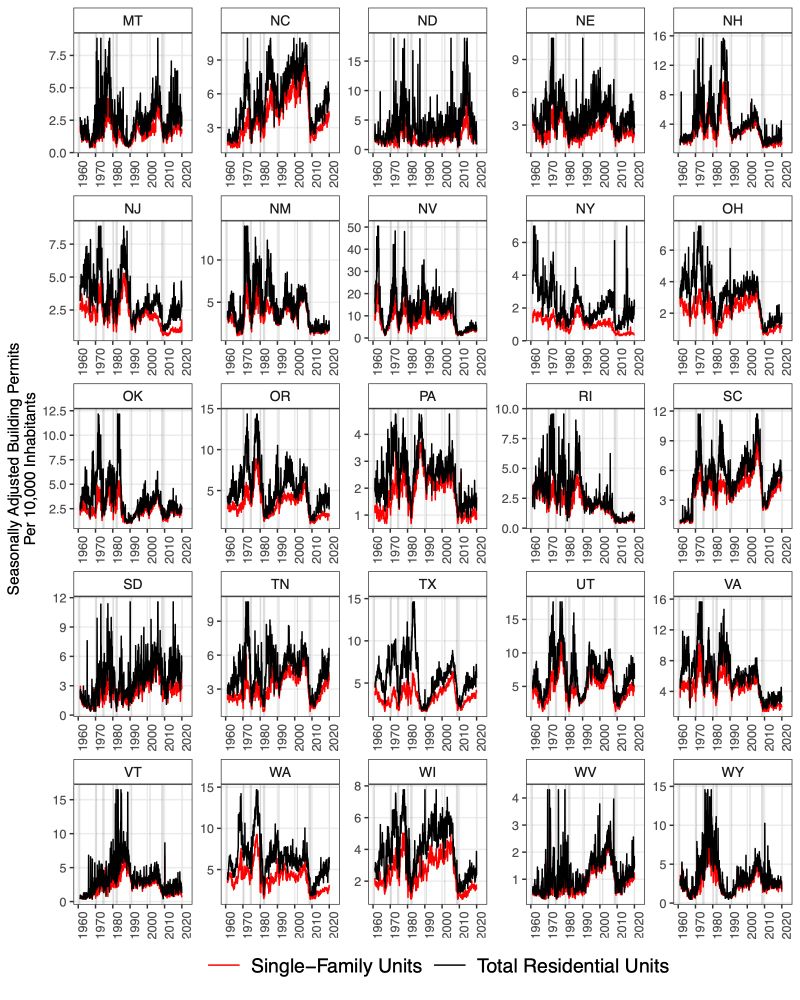

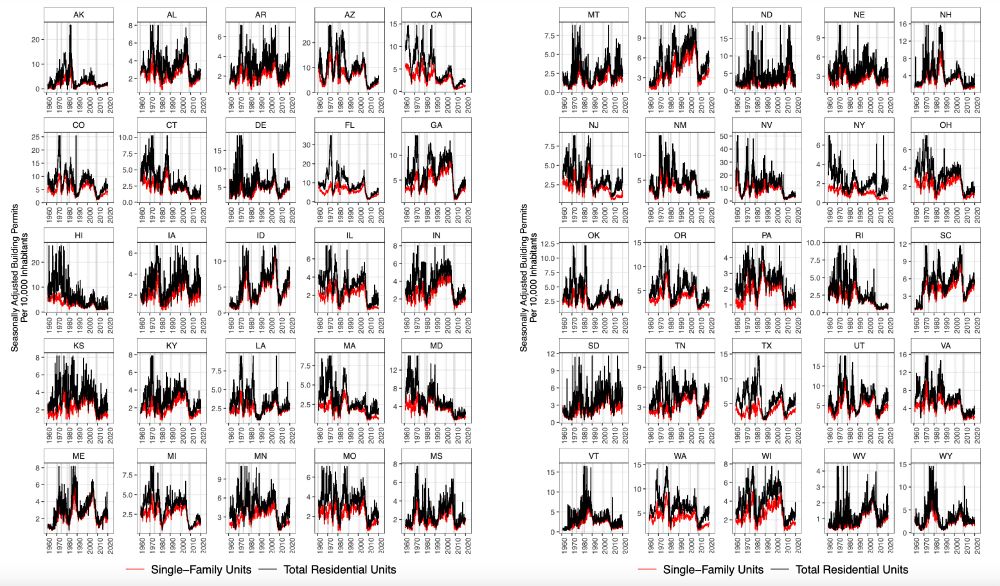

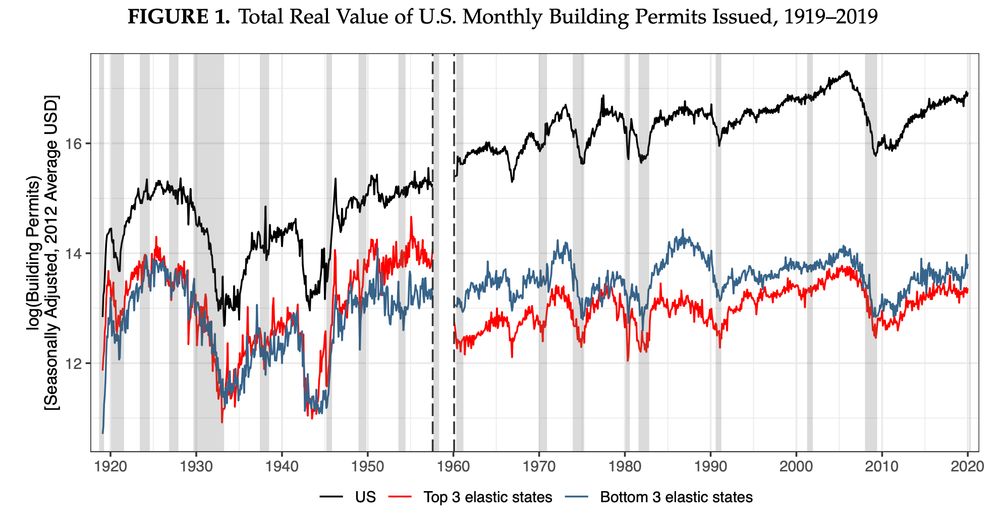

California's lackluster permitting (+ New England's) is even more stark if you look at permits per capita in a longer-run context. From our paper on 100 years of building permits in the US: papers.ssrn.com/abstract=485...

18.01.2025 19:26 — 👍 9 🔁 0 💬 1 📌 0

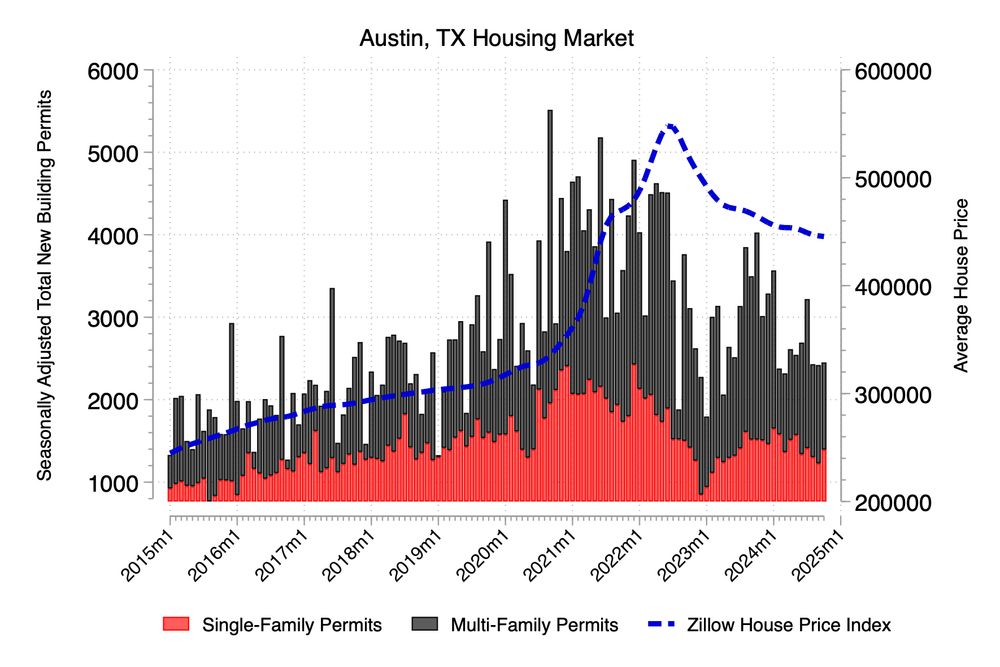

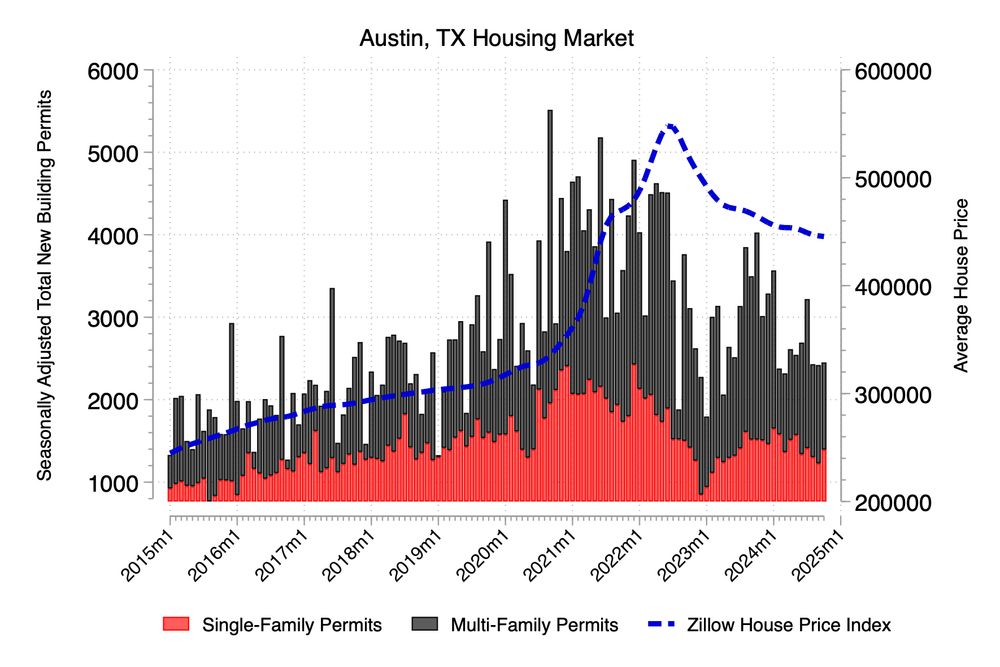

11/ Armed with permits in particular areas as a leading indicator, policymakers might be able to prevent runaway housing market booms by restricting credit access in markets headed towards “overbuilding” risk, such as Austin, TX and other reservoirs for “digital nomads” over the past two years.

27.11.2024 13:52 — 👍 2 🔁 0 💬 1 📌 0

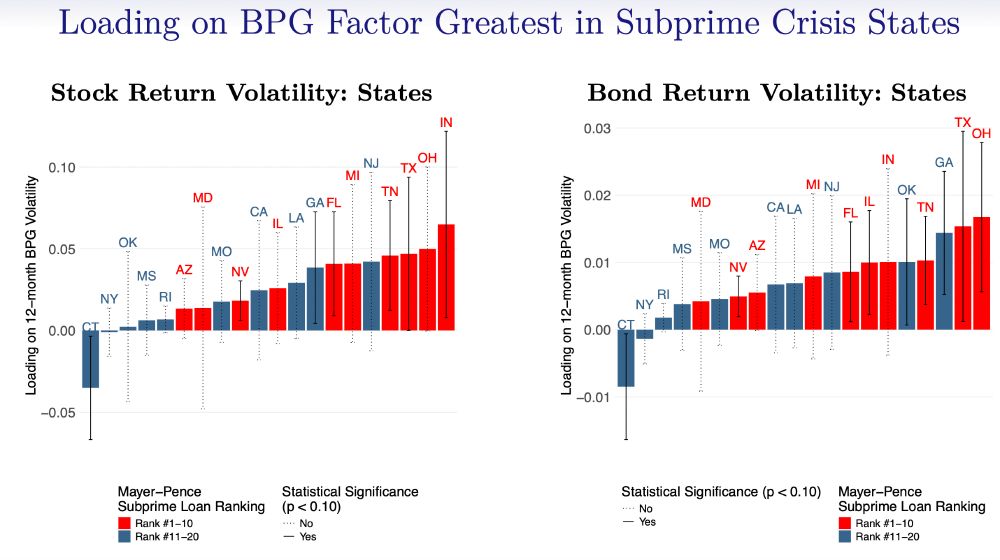

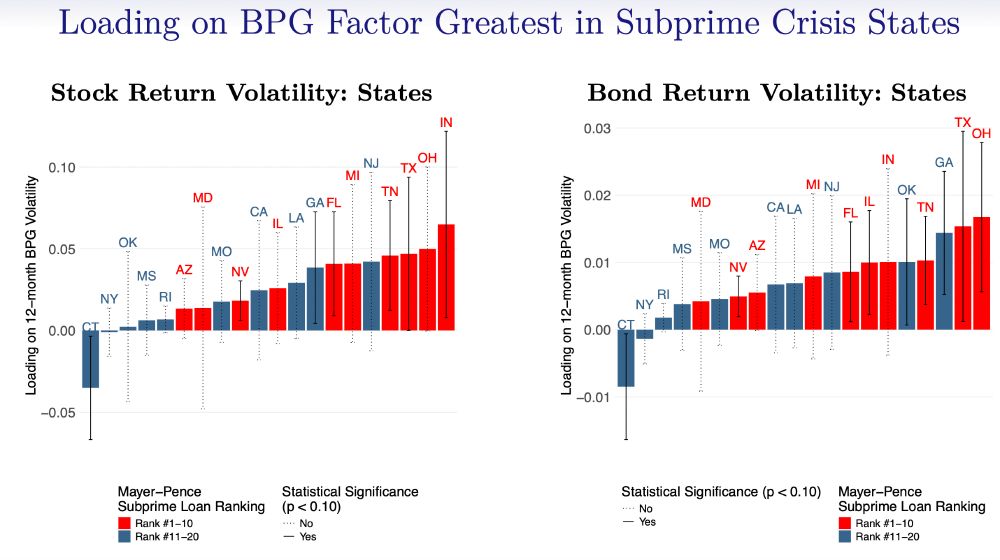

10/ One stark example of the soft info permits contain comes from the 2000s subprime mortgage crisis. Areas which had the largest concentration of subprime MBS loans as of 2005 are the same states where swings in permits predict asset market movements a year later.

27.11.2024 13:51 — 👍 2 🔁 0 💬 1 📌 0

9/ Our findings agree with textbook macro-finance models. Building permits act as signals to savvy investors about future dividends. Because permits are a necessary first step in property development, they capture builders’ beliefs about local economic prospects — linking Main Street to Wall Street.

27.11.2024 13:51 — 👍 4 🔁 0 💬 1 📌 0

8/ Why might one want to use permits rather than other economic indicators commonly cited in the media? Permits are continuously available at monthly frequency, unlike other indicators like labor market statistics (e.g. BEA/QCEW) which are released with long lags and subject to revisions.

27.11.2024 13:51 — 👍 5 🔁 0 💬 1 📌 0

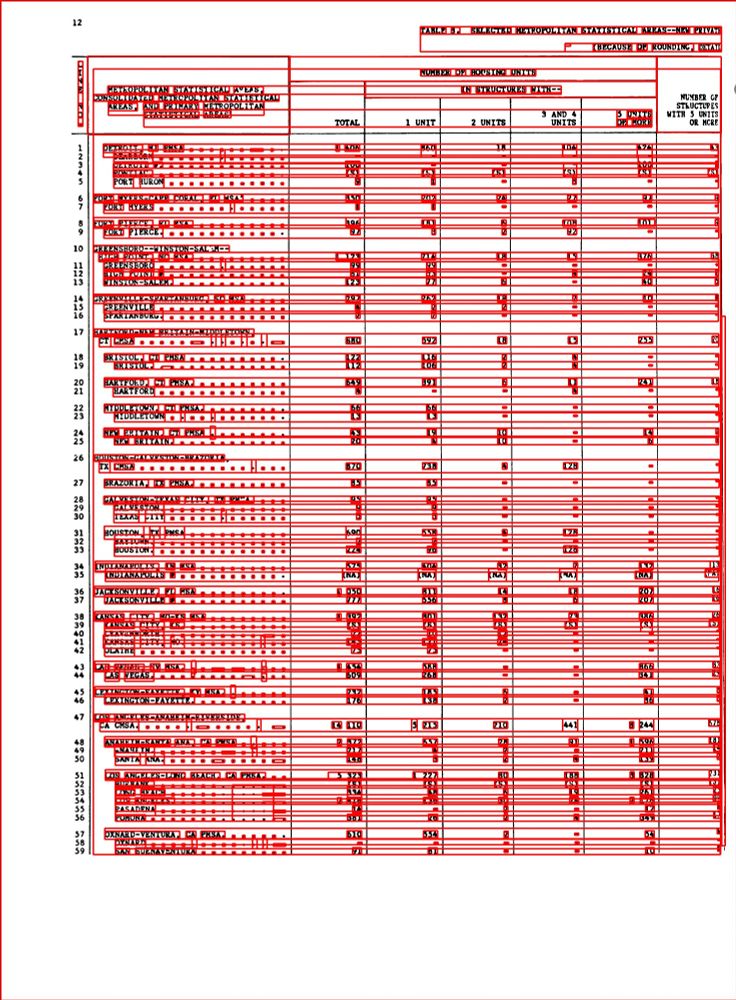

7/ This was a massive data effort, which took us and a team of RAs nearly 3 years. We used advanced OCR and deep learning techniques to digitize historical records, allowing us to cover all 50 states and the largest 60 MSAs (with an extension to all 3,000+ counties in the coming months!)

27.11.2024 13:50 — 👍 5 🔁 0 💬 1 📌 0

6/ In most states, new housing permits per capita peaked in the 1970s. After the Great Recession, permits collapsed, recovering somewhat in the sunbelt states which have experienced large net migration over the last 30 years. New housing supply appears unable to accommodate demand from residents.

27.11.2024 13:50 — 👍 3 🔁 0 💬 1 📌 0

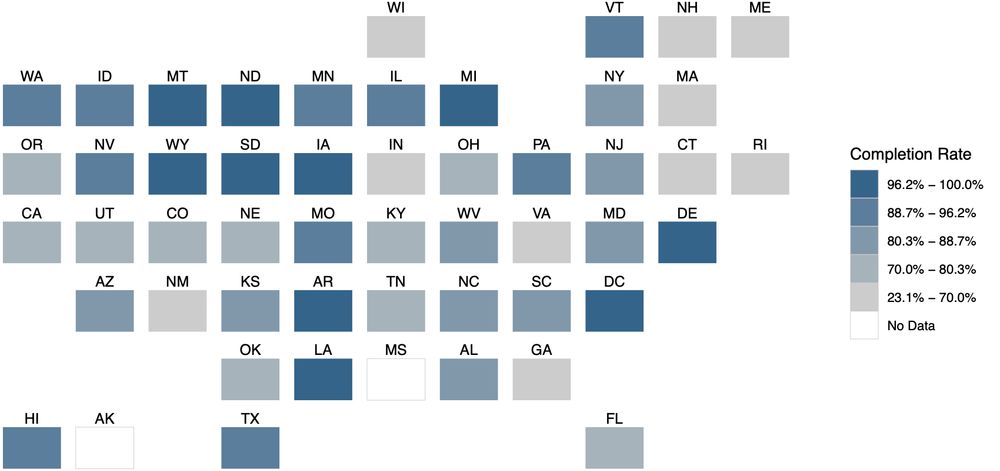

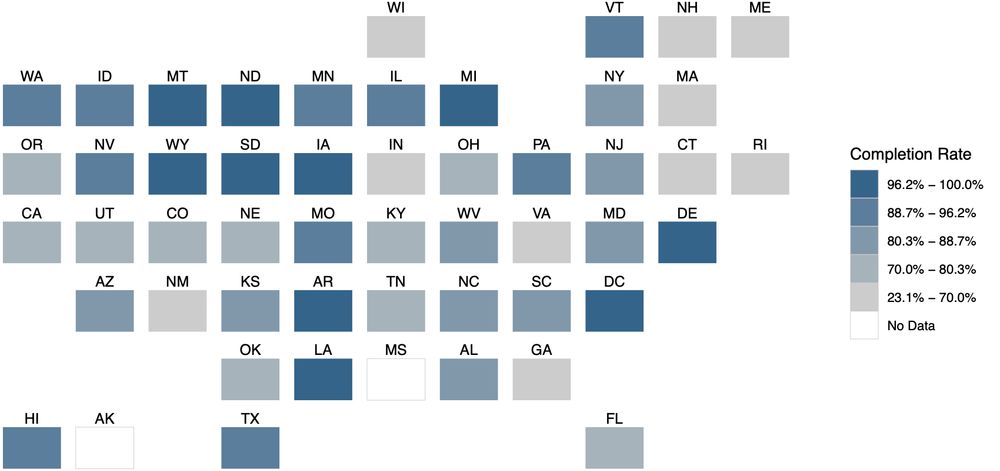

5/ Beyond predicting financial downturns, we use our data to establish new facts about long-run housing supply. > 80% permits for single-family homes are completed, meaning permits often translate to new housing units. Avg. completion rates are much lower in high-regulation regions like New England.

27.11.2024 13:49 — 👍 4 🔁 0 💬 1 📌 0

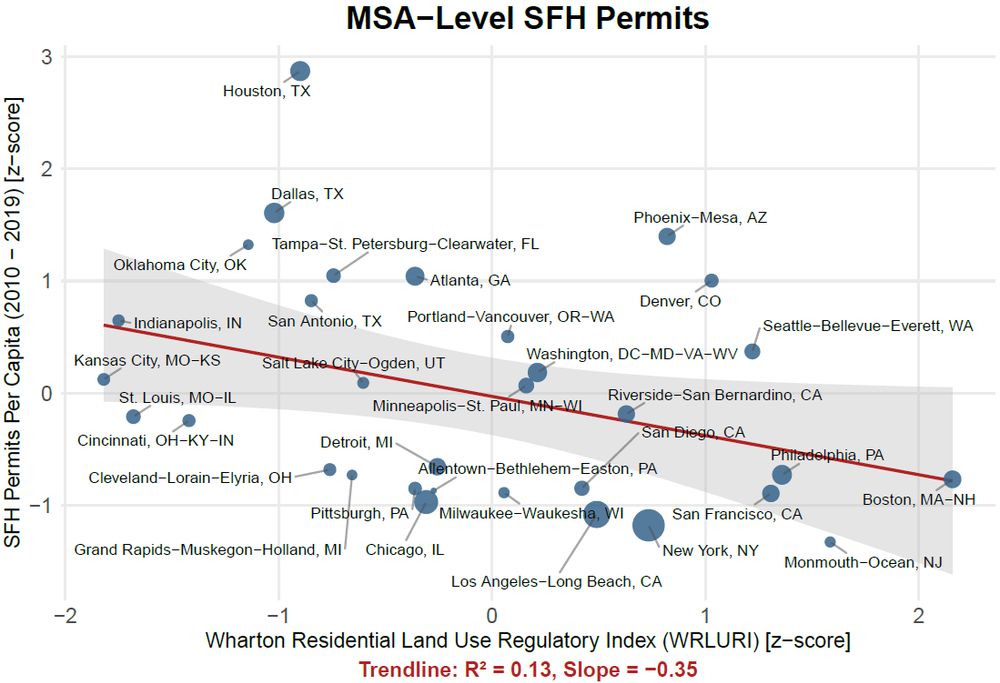

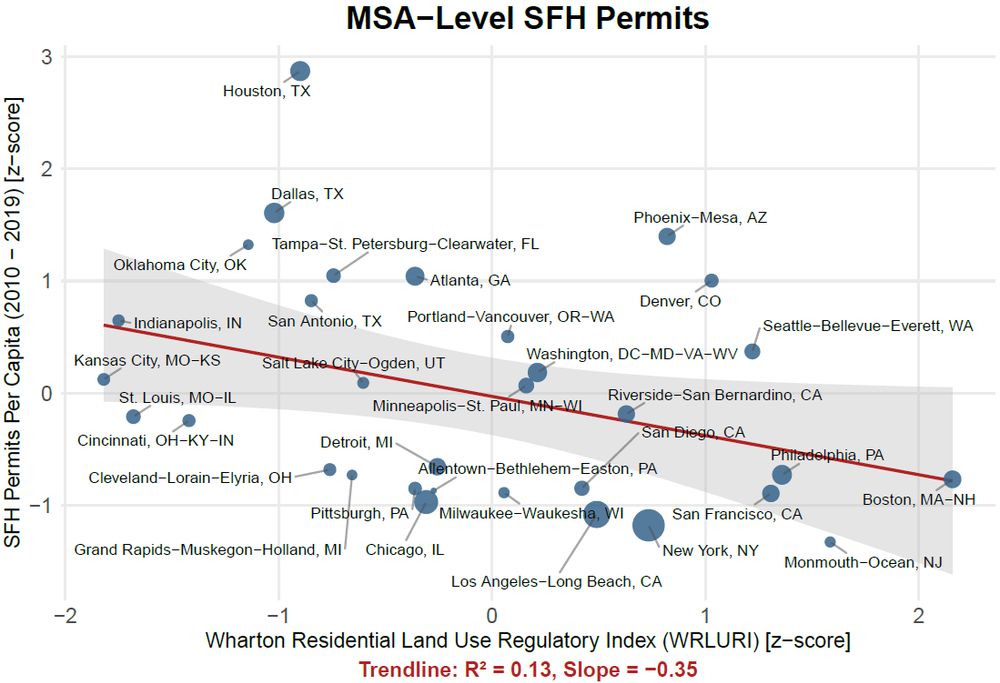

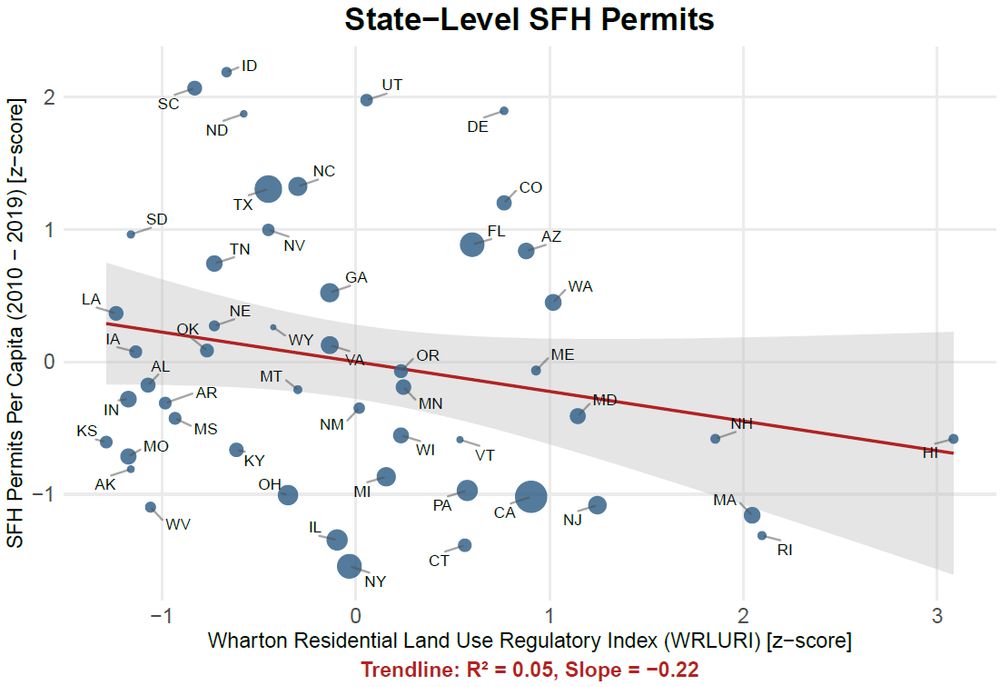

Regulations increase construction costs, reducing permits, and creating longer, more variable lags between permit applications and new housing units completed. This can be seen in the strong negative correlation between permits and measures of regulatory stringency, such as the "Wharton Index."

27.11.2024 13:48 — 👍 2 🔁 0 💬 1 📌 0

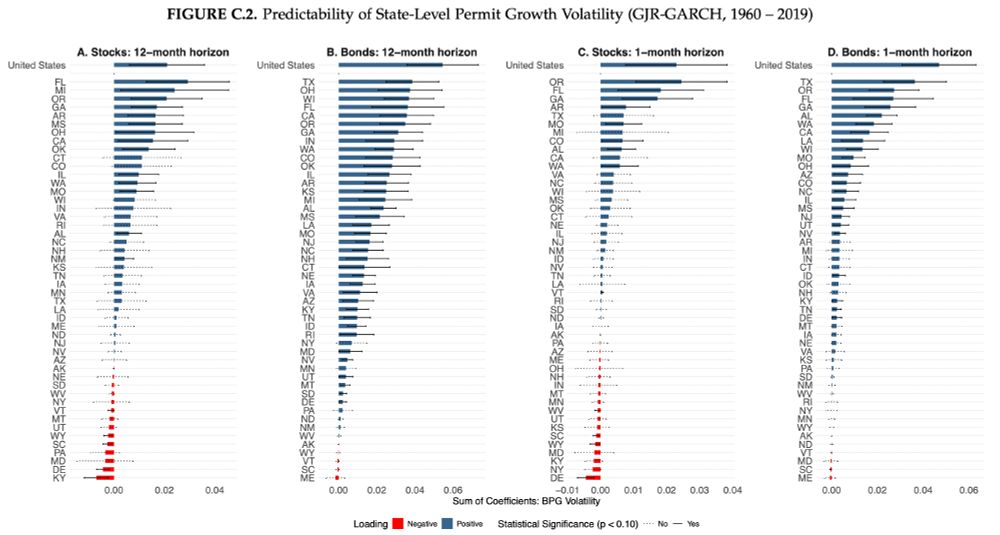

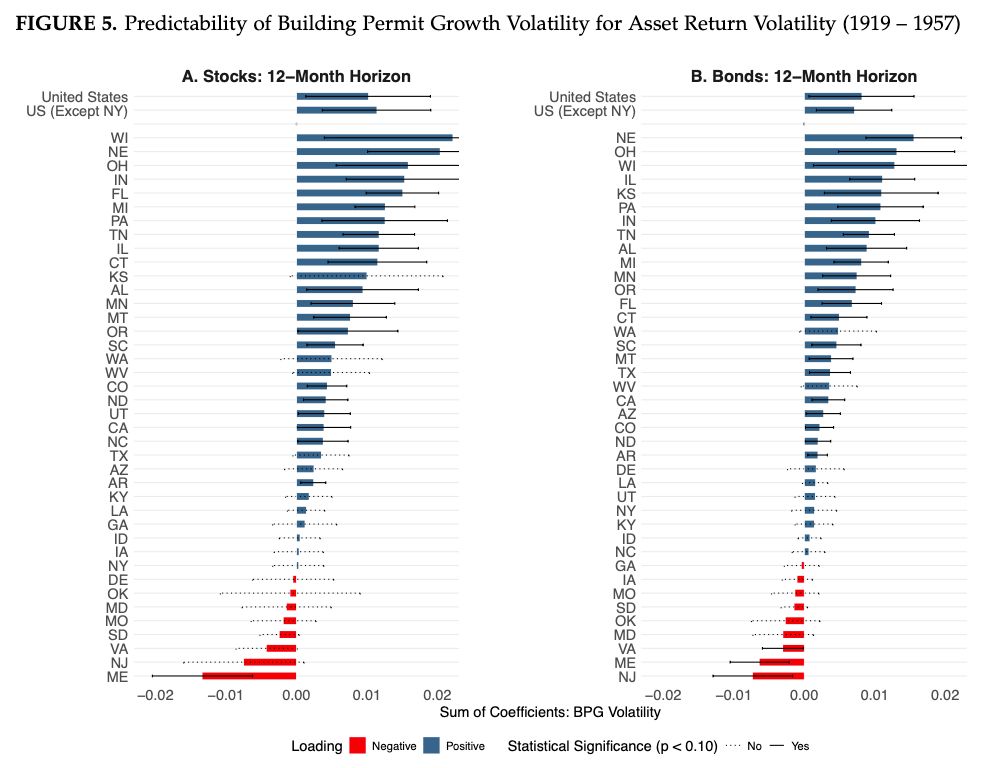

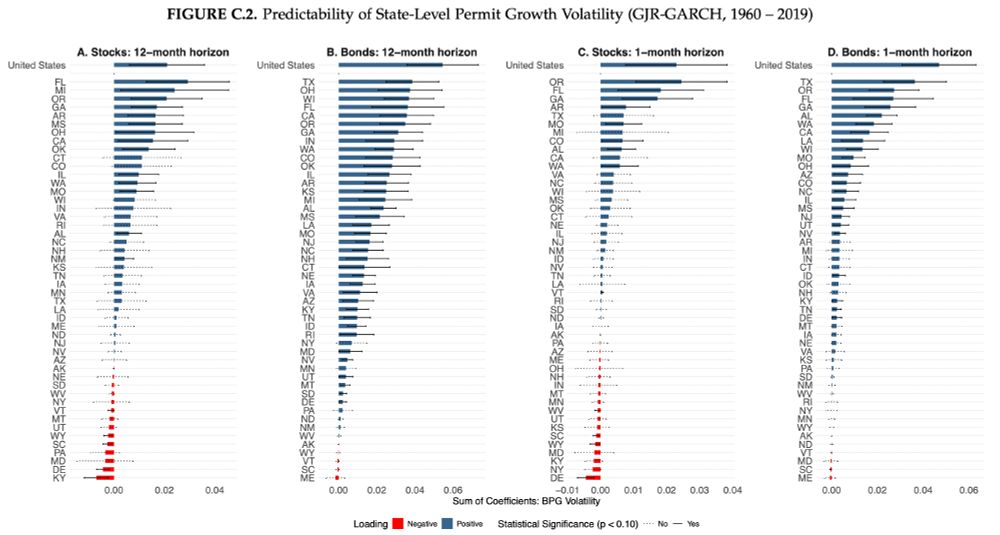

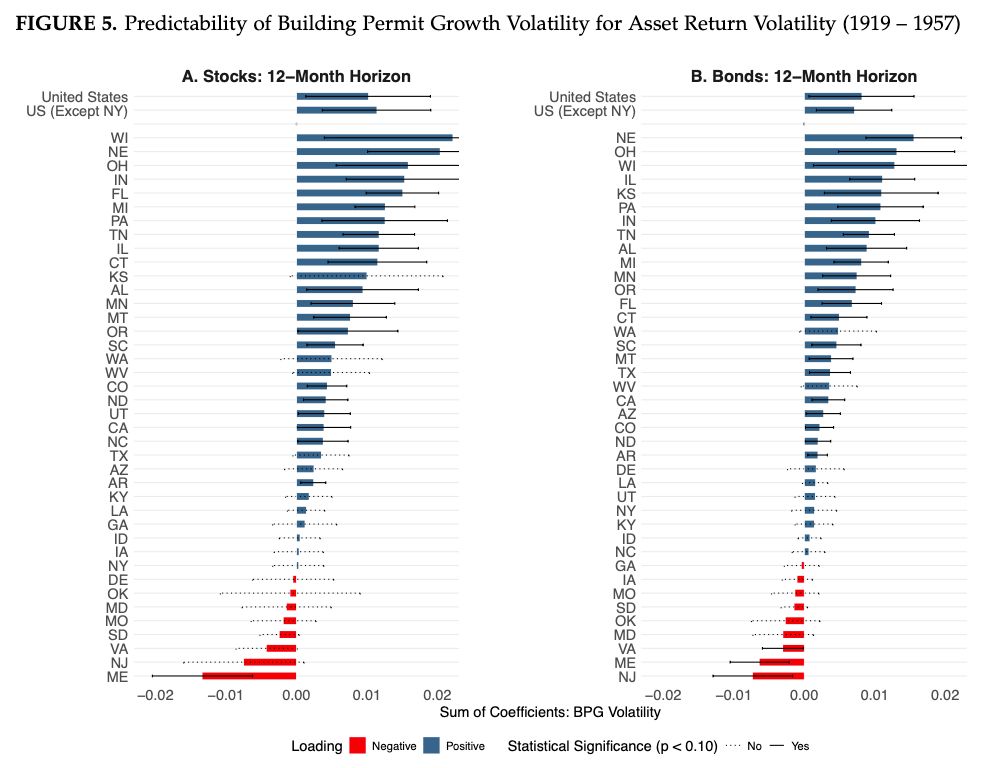

3/ Geographic variation matters a lot. Housing supply-elastic states like Florida, where land use regulations are lax, are bellwethers. In contrast, states like Connecticut, where policies render it difficult to build, have very little ability to predict downturns.

27.11.2024 13:48 — 👍 7 🔁 0 💬 1 📌 0

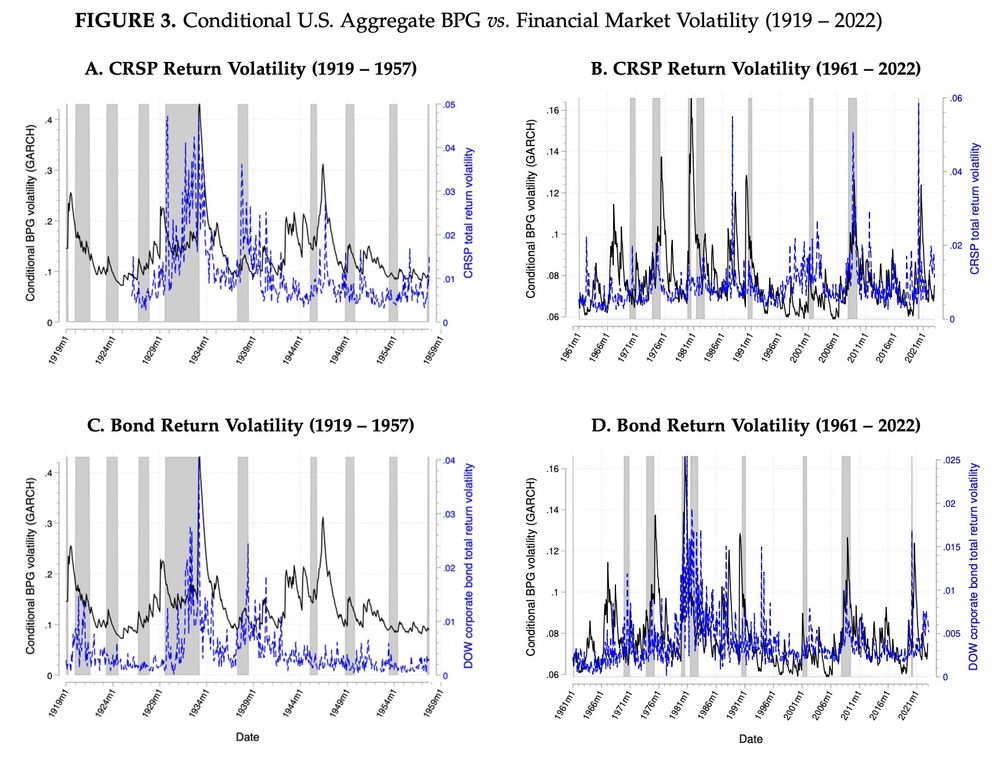

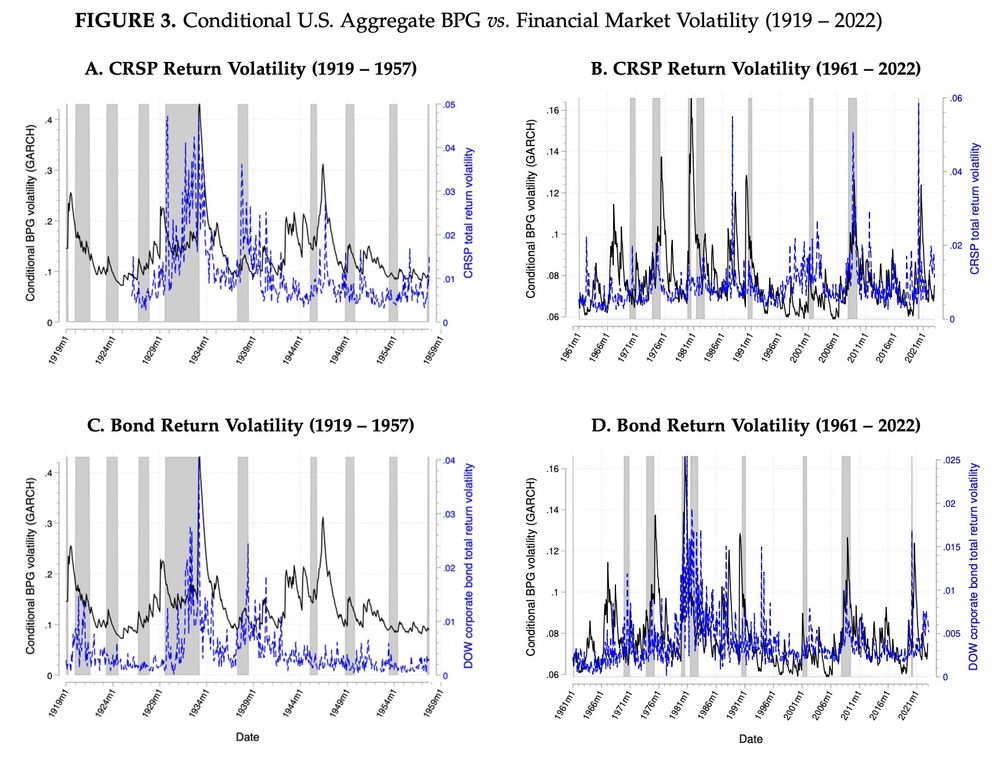

2/ Key finding: Boom-bust cycles in residential building permits, as captured by building permit growth (BPG) volatility, are a harbinger for future stock and bond market fluctuations across most recessions over the last century.

27.11.2024 13:47 — 👍 5 🔁 1 💬 1 📌 0

Excited to debut my new paper, "Housing Is the Financial Cycle: Evidence from 100 Years of Local Building Permits,” joint with @cortesgustavos.bsky.social. We document that building permits predict financial market volatility across a century of U.S. economic history.

papers.ssrn.com/abstract=485...

27.11.2024 13:46 — 👍 82 🔁 24 💬 5 📌 11

Property Assessed Clean Energy (PACE) loans are a new low-screening contract which allow homeowners to borrow through their property taxes to fund climate-resiliency and energy efficiency home improvements. This is a timely topic given continued rebuilding efforts from Hurricane Helene and Milton.

05.11.2024 15:51 — 👍 1 🔁 0 💬 0 📌 0

CEPR, established in 1983, is an independent, non‐partisan, pan‐European non‐profit organization. Its mission is to enhance the quality of policy decisions through providing policy‐relevant research, based soundly in economic theory.

Ph.D. Student at NYU Stern

Professor of Finance, Economics, and Real Estate

University of Oxford @ox.ac.uk

PhD student in Economic History, LSE.

nicholasfitzhenry.co.uk

Research: death, disease & doctors during Apartheid

Methods: Applied econometrics and historical demography.

Teaching: Industrial Rev., History of Middle East

Connaughton Professor of Alternative Investments at the University of Virginia - McIntire, CEPR, ECGI; Wharton PhD www.NickolayGantchev.com

Founded in 1907, the National Tax Association serves as the leading association of scholars and professionals dedicated to advancing the theory and practice of public finance, including public taxing, spending and borrowing.

Green Central Banking publishes the latest news, research and policy proposals on central banking and climate change.

Owned by Global 2050.

www.greencentralbanking.com

Professor @sciencespo @ScPoEcon #econometrics #education

https://sites.google.com/site/clementdechaisemartin/

Research papers, #bankunderground posts, publications and news from Bank of England researchers. Staff opinion and analysis, not necessarily official BoE views. https://linktr.ee/boeresearch

Professor, Yale Law School & Yale School of Management; President @budgetlab.bsky.social; Contributing columnist @postopinions.bsky.social

Former Counselor at Treasury, Professor Penn Law & Wharton

https://www.natashasarin.com/

Economic sociologist, professor, University of California, Merced.

Research: Wall Street, Big Tech, oligarchs, elites, universities.

Book: Bankers in the Ivory Tower. Bylines: NYT, WaPo, LAT.

Newsletter: https://charlieeatonphd.substack.com

Kirkland & Ellis Professor of Law, Harvard Law School. Aligning Election Law: https://global.oup.com/academic/product/aligning-election-law-9780197662151.

🇬🇧 in 🇺🇸 | Assistant Professor of Finance at Rice University Jones Graduate School of Business | Tweets #HouseholdFinance + 🏏 | Chicago Booth PhD | Kent & England Cricket, Man Utd & England Soccer Fan www.benedictgk.com

EBRD’s Director of Research, CEPR Research Fellow, part-time Professor of Finance at KU Leuven. 🇳🇱🏳️🌈🇪🇺. Views are my own.

The Panel Study for Income Dynamics (PSID) at the University of Michigan's Institute for Social Research is the longest running nationally representative household panel survey in the world. Learn more about America's Family Tree: psidonline.isr.umich.edu.

Where research meets practice; a platform for development enthusiasts to discuss key policy issues. Powered by CEPR, IGC & PEDL.

Board: Martina Björkman-Nyqvist, Michael Callen, Cesi Cruz, David Lagakos, Joana Naritomi, Oliver Hanney & Emaan Siddique

the once and future city planner // YIMBY // AICP // kentuckian in california // #BBN // author of hit broadway musical arbitrary lines

Economist AP at Aalto University and Helsinki GSE studying urban mobility, public transit, congestion, segregation; he/him

https://www.prottoyamanakbar.com/

Professor UC Irvine Economics; Editor-in-Chief ITAX; Research on tax, fiscal competition, local policy, RST/VAT, inequality & mobility

https://sites.socsci.uci.edu/~dagrawa4/