Feedback Machines: Writing and editing research papers with generative AI

Claude Code and Cursor are changing the way we can get feedback on research

Done well, AI is a feedback machine. In the post, I go through how my workflow has changed, and what kind of prmopts have proven useful for ,e.

Please let me know if you have some comments or thoughts. It's fast moving field,

claesbackman.substack.com/p/feedback-m...

22.01.2026 08:41 —

👍 1

🔁 0

💬 0

📌 0

It used to be difficult to get feedback on your research. The classic way was to ask someone to read it, hoping they would give you a few notes.

That is changing. In the post below, I outline some ways I use Cursor and Claude Code to get feedback on my own work directly

22.01.2026 08:41 —

👍 2

🔁 0

💬 1

📌 0

If you are looking for more research-related guides, I have plenty collected on my website: sites.google.com/view/claesba... Take a look!

10.12.2025 20:34 —

👍 0

🔁 0

💬 0

📌 0

Other highlights include the importance of having one contribution and how you should learn to ignore (some) feedback, as well as some writing tips.

10.12.2025 20:34 —

👍 0

🔁 0

💬 1

📌 0

I'm continuing my Substack blogging career by sharing some tips for doing research. Most important point: try to be hard on writing and ideas, not on yourself.

10.12.2025 20:34 —

👍 1

🔁 0

💬 1

📌 0

That was a much better answer than mine!

18.11.2025 19:50 —

👍 1

🔁 0

💬 0

📌 0

That’s a good question, I asked that of @alemartinello.com too. I wouldn’t expect much impact on house prices in Denmark from 40-year mortgages, because IO mortgages are available.

18.11.2025 17:01 —

👍 0

🔁 0

💬 1

📌 0

@alemartinello.com also wrote well about this question!

18.11.2025 14:34 —

👍 0

🔁 0

💬 1

📌 0

But, longer maturities will likely not benefit first-time buyers

-- If the benefit of longer maturities is capitalized into house prices, first-time buyers will not have increased access to the housing market

18.11.2025 14:34 —

👍 0

🔁 0

💬 1

📌 0

The concern with longer maturities is that borrowers may not make informed decisions and may be enticed by lower monthly payments.

18.11.2025 14:34 —

👍 0

🔁 0

💬 1

📌 0

Second benefit: higher consumption at points in life when you want to save less

— with lower monthly payments you can consume more and save less, which you may want to do if you are either retired or expect to earn a lot in the future

18.11.2025 14:34 —

👍 0

🔁 0

💬 1

📌 0

First benefits to longer maturities: more portfolio diversification

— If you don't amortize, you can save in stocks or more liquid assets.

— Maybe all savings shouldn't be concentrated in a single, illiquid asset.

18.11.2025 14:34 —

👍 0

🔁 0

💬 1

📌 0

Brief summary:

1️⃣ Longer maturities reduce monthly payments.

With a 30-year mortgage and a 6 percent interest rate, the borrower has amortized about 16% of the loan amount after 10 years. With a 50-year mortgage, the borrower has amortized about 4 percent.

18.11.2025 14:34 —

👍 0

🔁 0

💬 1

📌 0

Longer maturities for mortgages are back in the news.

I wrote a Substack post about the benefits of longer maturities, potential concerns of households making mistakes, and what longer maturity mortgages might do for young households and first-time buyers (not much?)

18.11.2025 14:34 —

👍 4

🔁 3

💬 1

📌 1

Link to paper: claesbackman.github.io/Papers/Perso...

Link to blog post: safe-frankfurt.de/news-latest/...

12.11.2025 10:55 —

👍 1

🔁 0

💬 0

📌 0

💡 Key takeaway: Personal financial advice from close connections improves investment outcomes, highlighting an important distinction from online peer effects in finance.

12.11.2025 10:55 —

👍 0

🔁 0

💬 1

📌 0

A personal relationship means that you probably feel responsible if a risky recommendation goes wrong. This aligns perfectly with what we find in the data: advice-givers emphasize expertise and trustworthiness, and their recommendations lead to better portfolio outcomes.

12.11.2025 10:55 —

👍 0

🔁 0

💬 1

📌 0

Our results resonate with me personally, because it's the type of financial advice I would always give when my friends ask. When someone you care about asks for investment advice, you're motivated to recommend sound, diversified strategies.

12.11.2025 10:55 —

👍 0

🔁 0

💬 1

📌 0

🔍 Unlike advice shared on anonymous social media platforms, personal financial advice is based on trust and expertise rather than past returns. Those who provide advice are positively selected on experience and financial knowledge, and they internalize the outcomes of their recommendations.

12.11.2025 10:55 —

👍 0

🔁 0

💬 1

📌 0

📊 We study how financial advice from family and friends affects portfolio outcomes. Using unique brokerage data and survey evidence, we find that personal financial advice is widespread and leads to better portfolio quality—more diversification and a preference for funds over single stocks.

12.11.2025 10:55 —

👍 0

🔁 0

💬 1

📌 0

🎉 Excited to share that our paper "Personal Financial Advice and Portfolio Quality" has been conditionally accepted at the Review of Finance! Many thanks to my co-authors, Olga Balakina, Tobin Hanspal, Andreas Hackethal and Dr. Dominique Lammer!

12.11.2025 10:55 —

👍 2

🔁 0

💬 1

📌 0

Cover of SAFE Working Paper No. 459 "Macroprudential Policies and Homeownership" by Claes Bäckman from October 2025

📝New SAFE Working Paper No. 459 "Macroprudential Policies and Homeownership" by @claesbackman.bsky.social

👉Find it via papers.ssrn.com/sol3/papers.... #EconSky #Homeownership #YoHo

03.11.2025 10:00 —

👍 1

🔁 1

💬 0

📌 0

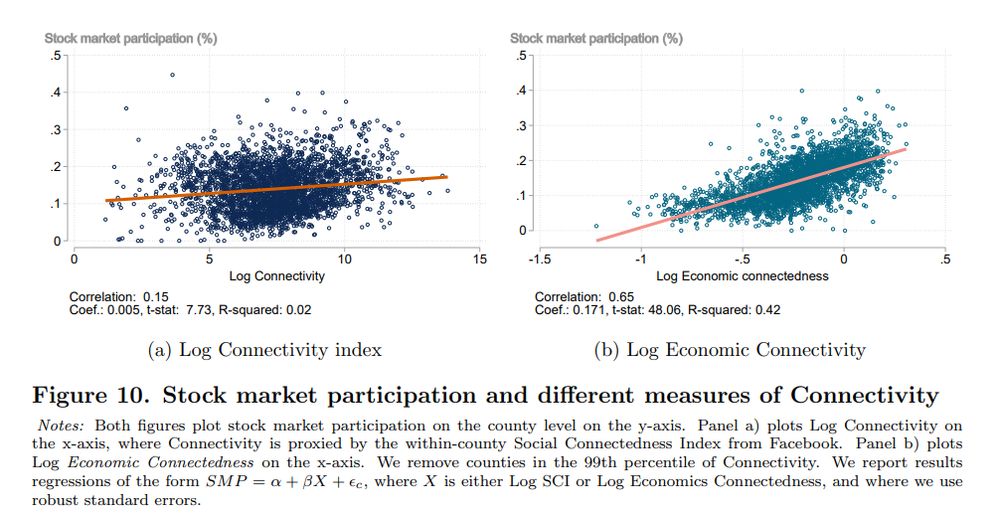

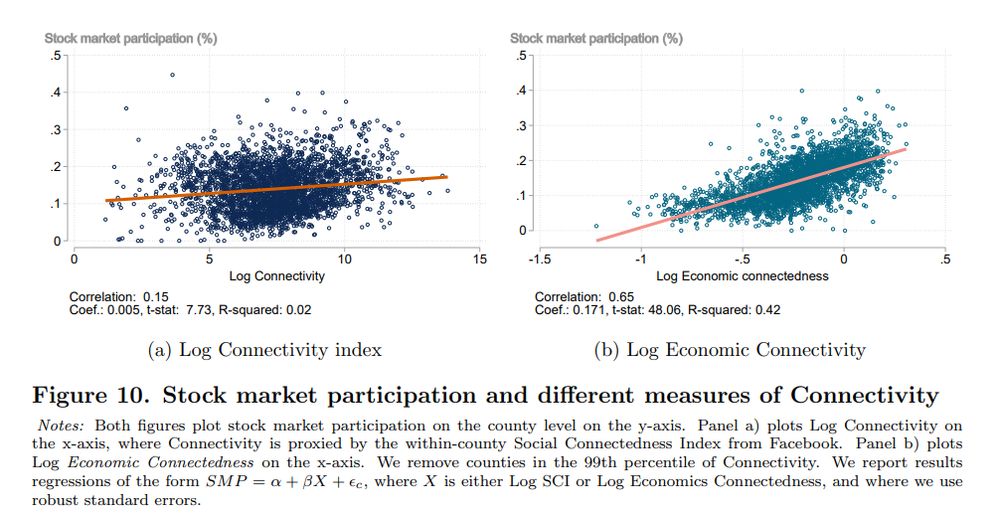

This paper shows that homophily in #socialnetwork affects stock market participation. Denser, homogenous networks boost participation, especially among wealthier individuals, while social influence is more significant for lower-income groups.

Read: papers.ssrn.com/sol3/papers....

13.06.2025 15:55 —

👍 2

🔁 1

💬 1

📌 0

Eller hur!

04.06.2025 18:37 —

👍 0

🔁 0

💬 0

📌 0

Tack!

04.06.2025 18:37 —

👍 0

🔁 0

💬 0

📌 0

These two mechanisms have different implications for regulation, and we are hoping to explore the exact mechanism more in detail in some follow-up work.

04.06.2025 06:48 —

👍 0

🔁 0

💬 0

📌 0

Two broad mechanism for why amortization payments are costly are i) monthly payment targeting, where households focus on a specific monthly mortgage payment rather than minimizing the lifetime cost of the loan and ii) a desire to save in other assets.

04.06.2025 06:48 —

👍 0

🔁 0

💬 1

📌 0

Second, we show in the model that the amortization requirement will have a significant impact on household wealth accumulation, matching some recent empirical evidence from the Netherlands.

04.06.2025 06:48 —

👍 0

🔁 0

💬 1

📌 0