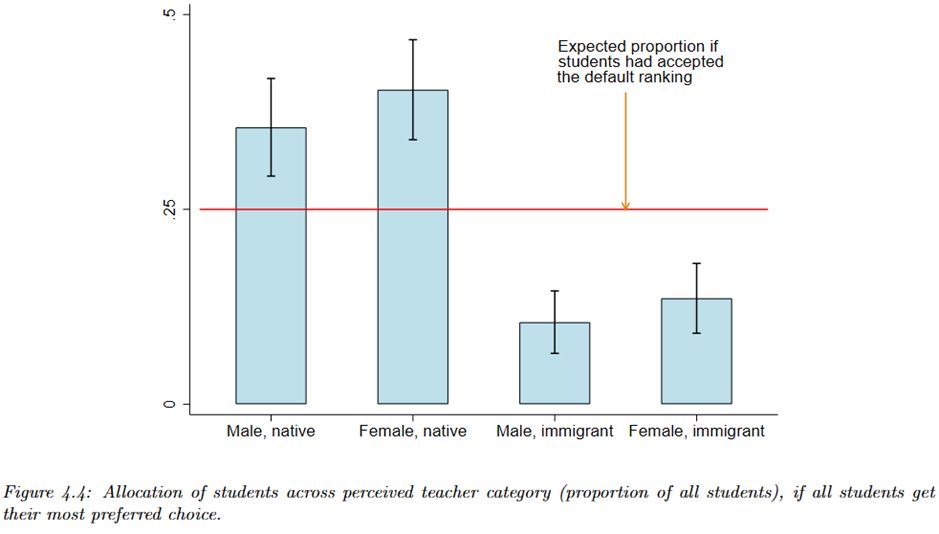

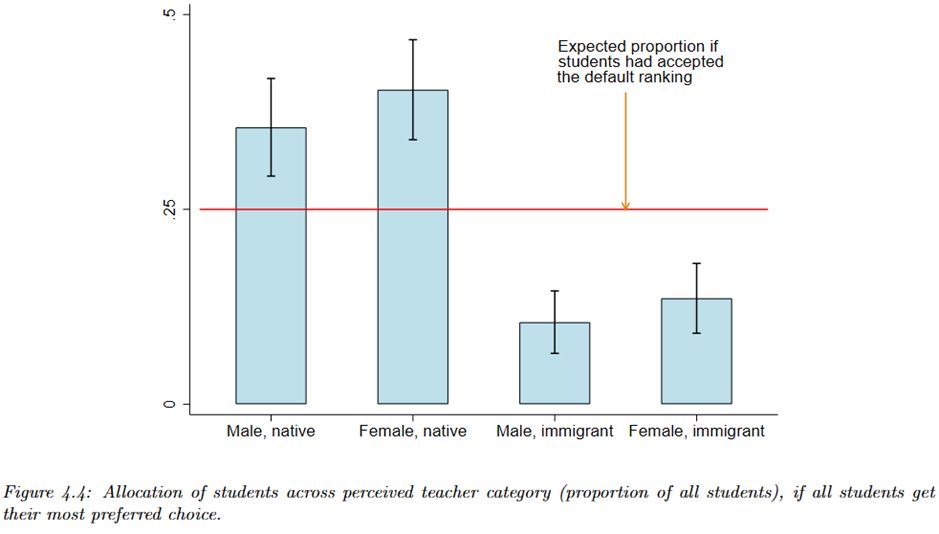

1/12 New working paper! The pioneer penalty in higher education seems to be real. Our new study examines how student biases influence course selection and provides cautionary lessons for role model advertising.

Paper: osf.io/preprints/so...

@olalandersson.bsky.social

Professor of Economics with an interest in Game Theory, Behavioral Economics and Experimental Economics. Located at Uppsala University, Sweden

1/12 New working paper! The pioneer penalty in higher education seems to be real. Our new study examines how student biases influence course selection and provides cautionary lessons for role model advertising.

Paper: osf.io/preprints/so...

Amin Hussain’s work shows how to carefully balance incentives for innovation while protecting consumer welfare.

Reach out ur you have futher Q’s

Although framed in health economics, Amin’s results are highly generalizable.

The paper could easily evolve into a pure theory paper with broad applications. It’s a step forward in understanding pricing and incentives in dynamic markets.

Amin doesn’t just propose a mechanism—he provides an algorithm to find solutions that:

• Minimize price variance

• Minimize variance in consumer surplus

• Minimize the number of market segments

Practical and flexible. 💡

But there’s more: Amin extends the model to the post-patent market.

His framework allows regulators to leverage future consumer surplus to incentivize trials for drugs with long-term social value—key for conditions neglected by pure market forces.

The result?

🎯 Manufacturers are incentivized to run trials for all socially profitable indications.

🎯 Consumer surplus is maximized.

🎯 Rare diseases and orphan drug trials—often ignored under IBP—become feasible, improving overall welfare.

Amin builds on Bergemann et al. (2015, AER) to model a dynamic setting:

1️⃣ Manufacturers first decide whether to run trials (at a cost) for new indications.

2️⃣ A regulator smartly segments the market for profit-maximizing pricing—balancing incentives and surplus.

Enter Amin Hussain’s job-market paper. 🚨

Amin proposes a regulatory mechanism that goes beyond IBP. It:

✅ Incentivizes trials for socially valuable indications.

✅ Protects consumer surplus.

✅ Ensures access for patients.

Here’s how it works 👇

Indication-based pricing sets prices based on the condition treated, aligning cost with value.

Sounds ideal, right? Not quite.

IBP risks letting manufacturers capture too much surplus, leaving patients and payers worse off. A balancing act is needed. ⚖️

One key issue: uniform pricing for multi-indication drugs.

👉 Patients with less profitable conditions face limited access.

👉 Manufacturers lose incentives to run trials for rare or low-margin diseases.

A better approach? Indication-based pricing (IBP). But there’s a catch…

💊 The pharmaceutical market reached $1.48T in 2022, but skyrocketing drug development costs are shifting focus to multi-indication drugs—existing drugs repurposed for new conditions. While promising, they bring new challenges for pricing and access.

Let’s dive in! 🧵

Here’s a suggested Twitter thread to summarize Amin Hussain’s job-market paper:

29.11.2024 06:31 — 👍 0 🔁 0 💬 1 📌 0

Amin Hussain is on the market this year. His JMP makes important contributions to the pricing of multi-use drugs. Let me explain why

sites.google.com/view/aminhus...

We are hiring a a Senior Lecturer/Associate Professor in economics with a focus on environmental and natural resource economics – come join us!

13.10.2023 07:01 — 👍 8 🔁 11 💬 0 📌 0at least it was a Norwegian...

05.10.2023 11:06 — 👍 1 🔁 0 💬 0 📌 0