How some geopolitically relevant economies are doing relative to their pre-COVID trends.

21.11.2025 16:43 — 👍 32 🔁 4 💬 0 📌 0@jasonfurman.bsky.social

Professor at Harvard. Teaches Ec 10, some posts might be educational. Also Senior Fellow @PIIE.com & contributor @nytopinion.nytimes.com. Was Chair of President Obama's CEA.

How some geopolitically relevant economies are doing relative to their pre-COVID trends.

21.11.2025 16:43 — 👍 32 🔁 4 💬 0 📌 0My bottom line: I would not cut rates at the Dec meeting. Unemployment rate only 0.2pp above Fed's long-run estimate (i.e., natural rate) with bigger problem being supply. GDP growth likely high. Inflation 1pp above target. Asset prices high. Fiscal impulse likely positive. Etc.

20.11.2025 14:53 — 👍 21 🔁 1 💬 1 📌 1

Hours flat.

20.11.2025 14:53 — 👍 12 🔁 0 💬 1 📌 0

3-month moving average of average hourly earnings growth mostly flat and more like what one would expect in a 3% inflation world than a 2% inflation world.

20.11.2025 14:53 — 👍 4 🔁 0 💬 1 📌 0

But prime age employment-population ratio has been stable. And higher than pre-COVID.

20.11.2025 14:53 — 👍 5 🔁 1 💬 1 📌 0

The unemployment rate had been increasing about 0.03pp/month, the increase in September was much larger than that.

20.11.2025 14:53 — 👍 3 🔁 0 💬 1 📌 0

A small decrease in Federal jobs in September. Even absent shutdown would have expected the larger decline in October for the people that took the fork.

20.11.2025 14:53 — 👍 5 🔁 0 💬 2 📌 0

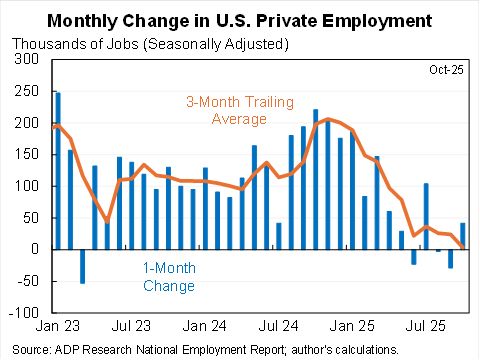

A weakish jobs report but, as usual, not completely clear.

Surprisingly strong 119K jobs added but 3-month average is only 62K.

Unemployment rate up 0.12pp to 4.4% but LFPR and employment rate up and U-6 (broadest measure) down.

Average hours flat.

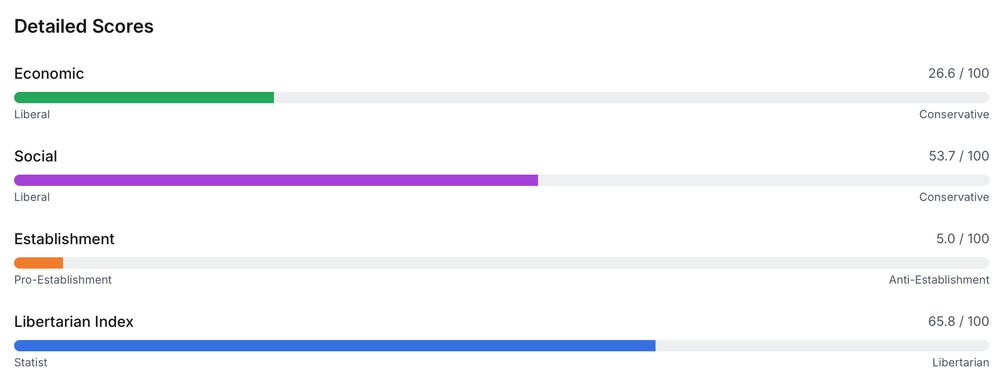

Not sure if I misunderstand myself. Or the Political Tribes quiz misunderstands me (and possibly the world). yourpoliticaltribe.com

14.11.2025 22:10 — 👍 11 🔁 1 💬 7 📌 0

Also now how I would describe myself.

14.11.2025 22:10 — 👍 6 🔁 0 💬 1 📌 0

This is not how I would describe myself.

14.11.2025 22:10 — 👍 14 🔁 0 💬 2 📌 1

Jobs numbers, per ADP. Back in the black but not by much--and 3-month moving average basically zero.

05.11.2025 14:57 — 👍 34 🔁 15 💬 3 📌 2If average work hours per person fall dramatically in the future due to AI is that more likely to be because:

1. AI substitutes for labor, market-clearing wage falls below zero, people not hired.

2. AI complements labor, wages rise, income effects so people don't work as much.

I am also ranking Burhan Azeem as my #1 choice. I agree with everything Josh says. And I've also personally been really impressed with Burhan's amazing combination of commitment to Cambridge, deep thoughtfulness about the issues it faces and pragmatism and inclusiveness in his approach to them.

03.11.2025 18:19 — 👍 29 🔁 9 💬 1 📌 1

My other top choices will be largely drawn from the "A Better Cambridge" coalition. www.abettercambridge.org

03.11.2025 18:22 — 👍 11 🔁 1 💬 1 📌 0I am also ranking Burhan Azeem as my #1 choice. I agree with everything Josh says. And I've also personally been really impressed with Burhan's amazing combination of commitment to Cambridge, deep thoughtfulness about the issues it faces and pragmatism and inclusiveness in his approach to them.

03.11.2025 18:19 — 👍 29 🔁 9 💬 1 📌 1Fantastic! I think about it a lot. Reading Streets of Laredo now, not nearly as good.

29.10.2025 01:05 — 👍 1 🔁 0 💬 0 📌 0Definitely depend on the horizon. I usually show the full horizon. But the last quarter century good too.

People used to talk about wage stagnation from, say, 1975-2000 and the defense that wages grew if you started in 1950 was never considered compelling.

People post too many memes.

28.10.2025 22:33 — 👍 42 🔁 0 💬 4 📌 1Including stock options granted shows a more pronounced downward trend since 2000.

Both series jumped way up prior to 2000.

All these measures are imperfect, not sure any of them "indefensible."

And the probability Musk passes the hurdles to get that $1T is quite low.

Being an Anglo-Saxon country not great for borrowing costs right now.

27.10.2025 19:15 — 👍 57 🔁 15 💬 7 📌 10

This graph may or may not say a lot about the world over the last decade.

27.10.2025 12:58 — 👍 29 🔁 8 💬 6 📌 0

CEO pay has stagnated for the last quarter century.

26.10.2025 17:41 — 👍 24 🔁 0 💬 11 📌 6

Fixed by John Cambpell & Tarun Ramadorai is an important book--drawing on up-to-date research, grounded in experience in the US, UK and India, argues persuasively for more consumer finance regulation--an issue that has almost entirely faded from the debate. www.goodreads.com/review/show/...

26.10.2025 15:06 — 👍 29 🔁 4 💬 1 📌 0

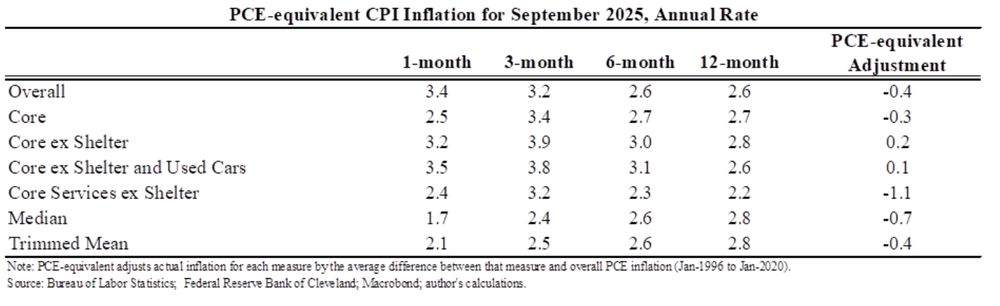

Median and trimmed mean looked fine in September suggesting outliers were driving the overall increase.

26.10.2025 14:45 — 👍 7 🔁 0 💬 2 📌 0

The CPI-based ecumenical underlying inflation measure was 2.7% in September, up 0.1pp from August (and the same as the PCE-based measure for August).

This is the median 7 concepts over 3, 6 and 12 months.

My own judgment is closer to 2.5%, maybe a tiny bit below.

In Ec10 we discuss some of the theory and evidence on the effect of the minimum wage on employment. And also talk about how the employment effect is not the only factor in evaluating ones view on it. That slide is attached.

26.10.2025 14:29 — 👍 15 🔁 1 💬 2 📌 0You might view the above as a good thing or as a bad thing. But either way it is remarkable that after regular bipartisan increases the federal minimum wage has disappeared and state-level ones have grown enormously.

26.10.2025 14:29 — 👍 17 🔁 0 💬 1 📌 0

And this is compares minimum wages to median wages by country.

26.10.2025 14:29 — 👍 16 🔁 1 💬 2 📌 0

This is how U.S. minimum wages compare to other countries in US dollars. Note Massachusetts is $15/hour, which is about in the middle of states that have set rates higher than the Federal government.

26.10.2025 14:29 — 👍 20 🔁 5 💬 1 📌 0