Corporate quality spread (Baa – Aaa) just hit its narrowest level in 60 years.

Credit markets are pricing very little stress.

@markdodson.bsky.social

Founder of Cypress Capital - www.cypresscapital.com

Corporate quality spread (Baa – Aaa) just hit its narrowest level in 60 years.

Credit markets are pricing very little stress.

“This has pushed buybacks and dividends from the group to the lowest level since the tech bubble.” www.dailychartbook.com/p/852

11.02.2026 14:46 — 👍 11 🔁 1 💬 0 📌 0

‘The era of tech buybacks has ended.’ www.dailychartbook.com/p/850 via @dailychartbook.bsky.social

07.02.2026 15:27 — 👍 13 🔁 5 💬 0 📌 1

Precious metals: average daily retail volume in precious metals options on our platform is running at nearly 7x the 2023 baseline. $GLD $SLV $GDX

Citadel Rubner

Speaking as a Southerner, my respect for Minneapolis has rocketed higher over the last couple of months. I didn’t know what that place was built like. This is an important moment in American history, and they’ve met it. Nice doesn’t mean soft.

04.02.2026 02:06 — 👍 3 🔁 0 💬 1 📌 0

UBS: The Adobe Digital Price Index, which covers prices of items sold online, rose in January by the most in its 12-year history.

(via @nicktimiraos.bsky.social)

Edit: It isn't futures speculation.

29.01.2026 17:25 — 👍 1 🔁 1 💬 0 📌 1

CRB Raw Industrials are running hot (>12% YoY).

When raw-material inflation hits double digits, stock returns tend to suffer & CPI/PPI often follow.

It futures speculation; it’s real-world inputs like burlap, tallow, & scrap metals.

Hard to square with hopes for a 90s-style, AI-driven disinflation.

‘Dealers have been rapidly extending leverage in the equity market, as inferred by the rise in equity inventory on their balance sheets.’ blinks.bloomberg.com/news/stories...

27.01.2026 19:49 — 👍 10 🔁 2 💬 0 📌 0Sad to hear of Doug Ramsey’s passing. He was one of my favorite strategists – clear thinking, independent, and consistently worth reading. He’ll be missed.

27.01.2026 00:44 — 👍 2 🔁 0 💬 0 📌 0

'Investors just made a mammoth $133 billion flip from cash to stocks, per Goldman Sachs - It’s a dash from cash, with investors taking billions in dry powder and pouring that money into the stock market....this is the 3rd largest level in our dataset'

sherwood.news/markets/inve...

‘Servicemembers are making fortunes in tech stocks and bitcoin. They’re trading tips on obscure cryptocurrencies from the decks of aircraft carriers. Base parking lots are peppered with new Porsches and Humvees as the market hits new highs.’ www.wsj.com/finance/stoc...

01.12.2025 15:30 — 👍 9 🔁 1 💬 0 📌 2

‘Failing the OC test is unusual for the higher-rated tranches of CLOs. The performance of the portfolio raises questions about the outlook for the broader private credit market, which has mushroomed in recent years but is now showing signs of weakness.‘ www.bloomberg.com/news/article...

20.11.2025 16:08 — 👍 6 🔁 2 💬 0 📌 0

GOOGLE DEEPMIND CEO: “.. It feels like there’s obviously a bubble in the private market. You look at seed rounds with just nothing, really, being tens of billions of dollars. That seems a little unsustainable. It’s not quite logical to me.”

$GOOGL

sources.news/p/demis-hass...

Fund managers: “Companies are over-investing.”

Also fund managers: near record-low cash and nearly max-long equities… otherwise known as over-invested.

sherwood.news/markets/fund...

BofA FMS: FMS cash level drops to 3.7% from 3.8%

Lowest in 15 years

“There is no point in subjecting our investors to risk in a market which I frankly do not understand.” - Julian Robertson, March 2000

14.11.2025 03:48 — 👍 3 🔁 0 💬 0 📌 0

This chart shows the explosion in the percentage of exchange-traded equity funds that use leverage, which recently soared to 33%, three times the prior peak in 2022.

Get investing and trading insights inside the #1 newsletter for Elliott wave: tinyurl.com/454j3h75

Warren Buffett now owns a staggering 5.6% of the entire U.S. Treasury Bill Market 🚨🚨🚨

10.11.2025 23:27 — 👍 60 🔁 14 💬 2 📌 2

'US tech capital expenditure grew more over the past five years than between 1999 and 2002, and almost as rapidly as the entire technology, media, and telecommunications sector at the height of the dot-com boom'

www.bloomberg.com/opinion/news...

This chart is going around and purports to show that EM central banks are behind rising gold prices. This chart is bogus. The rise in gold prices is driving up the gold share in central bank holdings. So this plots price against price. Volumes are stable.

robinjbrooks.substack.com/p/debunking-...

Missed this one in the last post... 'Retail participation in the equity market (~22%) now stands at its strongest since February 2021.'

www.citadelsecurities.com/news-and-ins...

'Retail Call Option Frenzy: Retail call buying is hitting new record levels — a clear sign of renewed confidence.'

www.citadelsecurities.com/news-and-ins...

Retail speculation isn’t just a U.S. story…

22.10.2025 02:34 — 👍 1 🔁 0 💬 0 📌 0

Greed is in the driver’s seat – the ratio of margin debt to money supply is higher than at any time except February and March 2000.

20.10.2025 20:05 — 👍 25 🔁 6 💬 0 📌 2

‘Today, working-class investors are flocking to all these markets: stocks, betting and crypto. They are beneficiaries of a new age of democratic finance. Or the last invitees to a party that’s going to end.’ www.wsj.com/finance/inve...

16.10.2025 17:53 — 👍 11 🔁 2 💬 0 📌 2

Every dip is bought. "Friday, October 10th – marked the largest options trading day in market history...surge epitomized the “buy-the-dip” mentality. Retail flow skewed 11% better to buy...marking the largest single-day call buying ever on our platform."

www.citadelsecurities.com/news-and-ins...

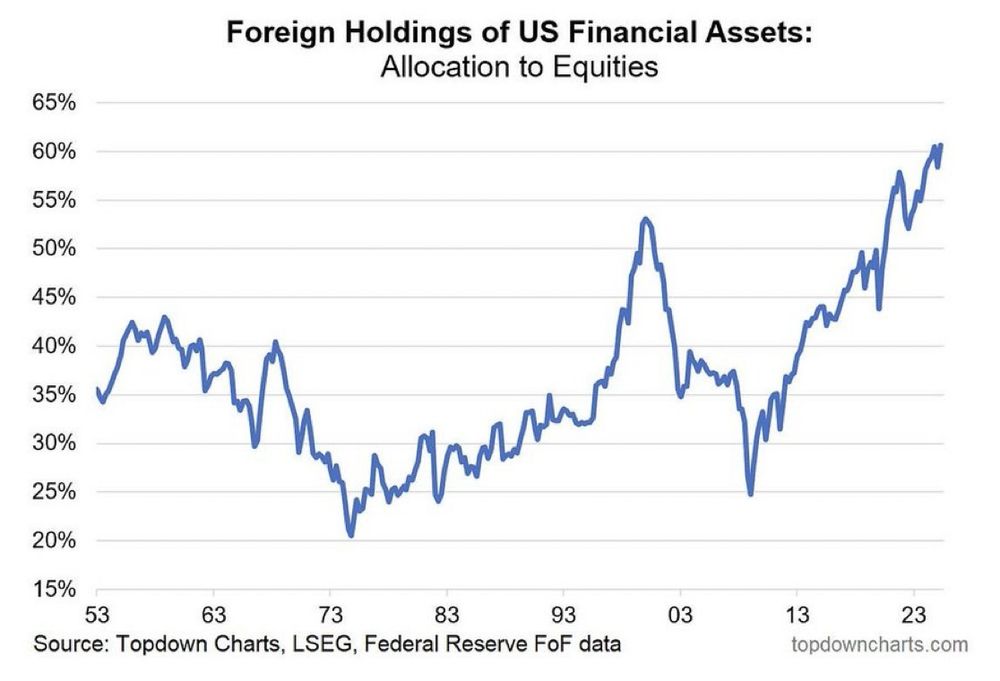

Foreigners now have the highest allocation to U.S. Stocks in history 🇺🇸🚨

16.10.2025 11:23 — 👍 23 🔁 6 💬 1 📌 2