Not a technician but id say Tesla?

11.08.2025 17:35 — 👍 1 🔁 0 💬 0 📌 0Ammar

@ammar814.bsky.social

Markets & Economy

@ammar814.bsky.social

Markets & Economy

Not a technician but id say Tesla?

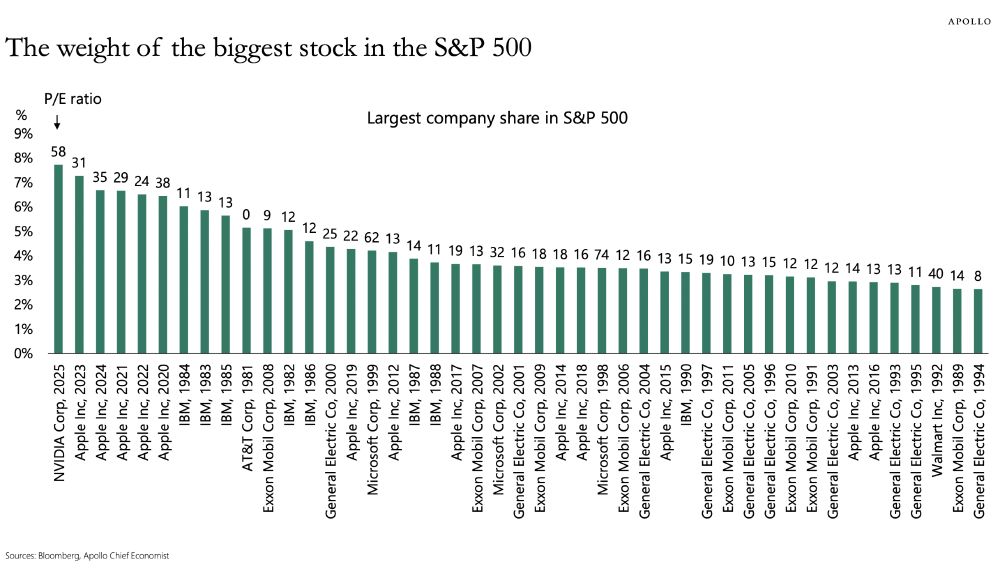

11.08.2025 17:35 — 👍 1 🔁 0 💬 0 📌 0I think one reason Buffett has been selling so much of his Apple stake is the company’s buybacks at these stretched valuations. With a free cash flow yield under 2.5% and a P/E over 30, it’s hard to argue this is the best use of capital

11.08.2025 13:07 — 👍 0 🔁 0 💬 0 📌 0

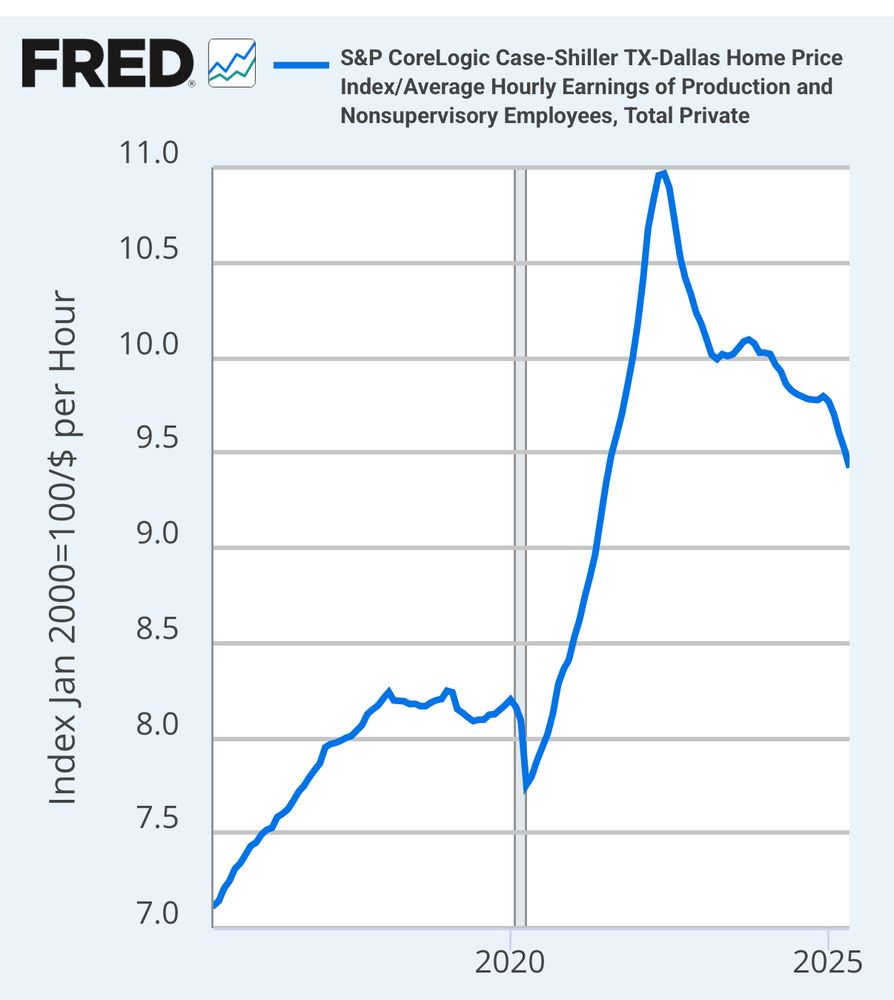

What is the best explanation for this chart? @conorsen.bsky.social @peark.es @econberger.bsky.social

10.08.2025 23:53 — 👍 0 🔁 0 💬 0 📌 0Waller is the best choice. He was right about inflation not being transitory + has had good calls in the past.

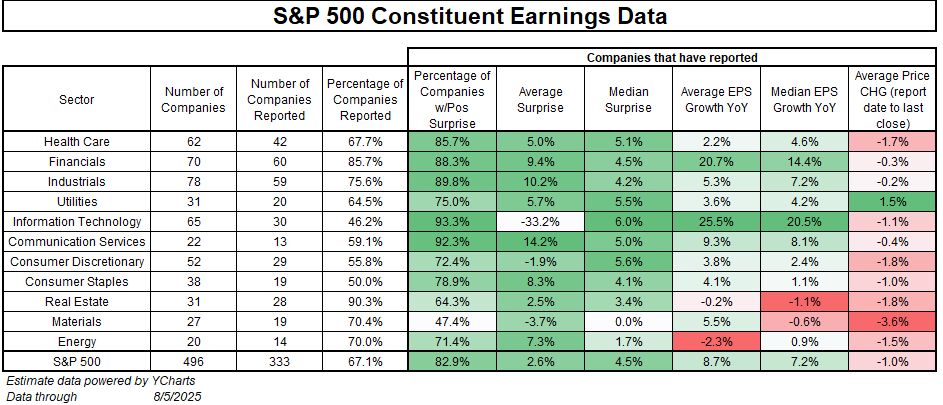

08.08.2025 19:56 — 👍 1 🔁 0 💬 0 📌 0Brutal earnings season for stock pickers

08.08.2025 17:51 — 👍 0 🔁 0 💬 0 📌 0Not really. Online gambling + 0dte are replacing physical gambling. Not really a macro indicator here

08.08.2025 15:22 — 👍 1 🔁 0 💬 1 📌 0I don't think anything is pricing in a recession. Spreads are tight, yields are elevated, valuations are higher for large cap, mainly because margins are higher, debt/ebitda is much lower & then AI boom/bubble. Smalls are not trading cheaply, they are trading accordingly to their fundamentals.

08.08.2025 14:30 — 👍 1 🔁 0 💬 0 📌 0Is it fair to say this was one of the worst calls by any economist ever?

08.08.2025 12:49 — 👍 0 🔁 0 💬 1 📌 0

Nvidia is dominating the S&P 500 more than any company in at least 44 years

sherwood.news/markets/nvid...

(h/t Torsten Slok)

Add TTD, FTNT, NVO

08.08.2025 12:23 — 👍 1 🔁 0 💬 0 📌 0Doomsday spending?

07.08.2025 20:55 — 👍 0 🔁 0 💬 0 📌 0A question I’ve been getting more and more lately is:

“If the S&P 500 goes up in the long run, why not just invest in a leveraged S&P fund like SSO..

Meaning it wont happen

06.08.2025 18:31 — 👍 3 🔁 0 💬 0 📌 0ARKK under Trump 1.0 up 640%, down 60% under Biden & up 23% under Trump 2.0

05.08.2025 19:12 — 👍 1 🔁 0 💬 0 📌 0One thing common among these countries is that they are major commodity producers (not all of them ofc)

05.08.2025 17:18 — 👍 0 🔁 0 💬 0 📌 0

Despite positive earnings, the average price change from the report date to the last close is -1.0%. for the S&P500

05.08.2025 16:41 — 👍 1 🔁 0 💬 0 📌 0Dragflation?

05.08.2025 16:09 — 👍 2 🔁 0 💬 0 📌 0Do cycles even exist anymore

04.08.2025 21:41 — 👍 1 🔁 0 💬 2 📌 0They claim countries that are being tariffed are paying for it

04.08.2025 19:30 — 👍 0 🔁 0 💬 0 📌 0Sorry for the messy earlier question!

Basically, why do you think guidance are getting stronger at the same time when overall GDP growth estimates are coming down? Goldman today said they expect around 1.1% GDP growth for 2025

@peark.es why do you think that is when GDP likely to come in below 1.5% in 2025?

04.08.2025 14:38 — 👍 1 🔁 0 💬 1 📌 0Kevin thinks that by changing the subject or avoiding questions, he’s doing a great job. What he doesn’t realize is that he’s becoming increasingly irrelevant. From an investor’s perspective, whatever he says just doesn’t matter anymore.

03.08.2025 14:47 — 👍 1 🔁 0 💬 1 📌 0

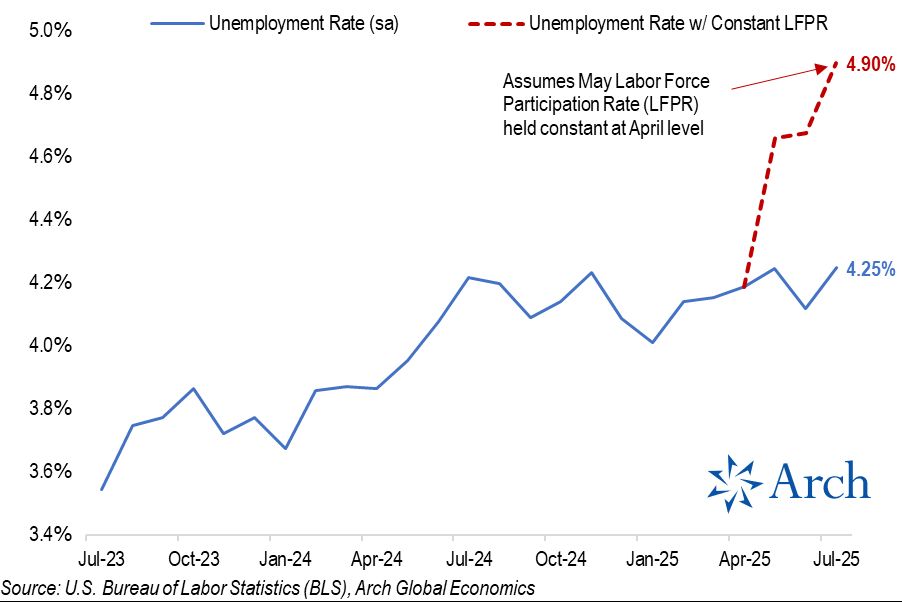

Not a pretty jobs report today...

I think this one chart sums up what's wrong with anyone pointing to unemployment as a sign the labor market is "solid."

A lot to unpack in the 🧵

#EconSky

Payrolls rose by 73K in July 2025, well below expectations of 110K. The June figure was sharply revised down from an initial 147K to just 14K, while May's reading was also cut by 125K. Taken together, these revisions show that employment in May and June was 258K lower than previously reported WOW!

01.08.2025 13:04 — 👍 0 🔁 0 💬 0 📌 0Price discovery when happens will be ugly.. buy the dip is the most consensus trade.

31.07.2025 18:37 — 👍 1 🔁 0 💬 0 📌 0With AMD AI 8?

31.07.2025 17:35 — 👍 1 🔁 0 💬 0 📌 0In today’s mkt, valuations have become the most uncomfortable word in the room

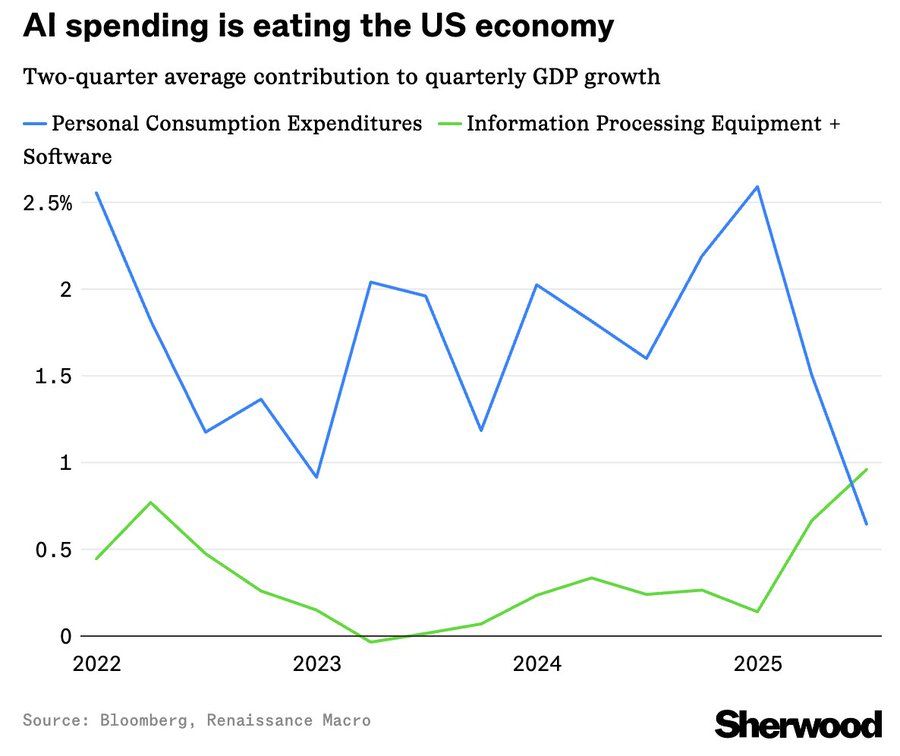

31.07.2025 17:31 — 👍 3 🔁 0 💬 0 📌 0Still think this is an extremely slept-on story.

Microsoft’s FCF surprised to the upside by 21% this quarter!

Meta’s FCF surprised by 33%!

This was an <amazing> call by Morgan Stanley.

AI SPENDING IS EATING THE US ECONOMY

Per @renmacllc.bsky.social’s Dutta

“So far this year, AI capex, which we define as information processing equipment plus software has added more to GDP growth than consumers’ spending”

sherwood.news/markets/the-...

Dallas home prices have been dropping around 0.6-0.7% per month while wage growth has been 0.3-0.4% per month, so that’s like a 1% improvement in affordability every month. On just a home price to average hourly earnings basis it could be back at pre-pandemic affordability by the end of 2026:

29.07.2025 13:19 — 👍 15 🔁 1 💬 1 📌 0