The Australians getting hit with up to 122 per cent tax

Some Australians who are eager to take on more work are being held back by the prospect of giving up most of their additional income – and in some cases, even paying to work.

For decades Aus has cut marginal tax rates, largely on high earners, based on exaggerated claims about work disincentives.

Meanwhile, over the same period, we've set up *genuinely* punitive (at times > 100%) effective marginal tax rates on low-middle income earners.

www.smh.com.au/politics/fed...

11.09.2025 10:44 — 👍 55 🔁 20 💬 4 📌 0

reminds me of that quadratic someone used to project covid cases. incredible

12.08.2025 00:34 — 👍 0 🔁 0 💬 0 📌 0

It also complements this finding from Grattan that households pay different rates of tax on the same income based on age (for the same reasons)

12.08.2025 00:29 — 👍 0 🔁 0 💬 1 📌 0

This result is per-person and thus not driven by ageing—the generosity of the tax and transfer system really has tilted towards older people over time—but the ageing trend will amplify its budgetary implications

12.08.2025 00:29 — 👍 0 🔁 0 💬 1 📌 0

people on the other site are doing "is living in denmark better than living in the us" discourse based on that one paper about wealth and mortality and all reasonable interpretations aside, if your metric of wellbeing says that living in mississippi is better than denmark then it's a stupid metric

11.04.2025 00:18 — 👍 204 🔁 14 💬 6 📌 2

treating data as a plural is almost as quaint and kooky as ‘fora’ and ‘stadia’

27.03.2025 23:15 — 👍 5 🔁 1 💬 3 📌 0

fun quirk of the discourse:

giving $x to everyone *except the poorest* via the tax system is called "targeted" and "progressive"

giving $x to everyone *including the poorest* via the payments system is called "untargeted", "regressive" and "middle class welfare"

26.03.2025 06:06 — 👍 36 🔁 10 💬 1 📌 1

Germany’s ‘whatever-it-takes’ spending push to end years of stagnation

Europe’s largest economy could return to pre-pandemic growth trend

Germany’s ‘whatever-it-takes’ spending push to end years of stagnation - on.ft.com/3R7j4fX

Can't help wondering if doing this a few years ago might have been clever

06.03.2025 06:38 — 👍 33 🔁 4 💬 1 📌 0

But my "favourite" chart is this one - incomes boomed across the distribution in the years leading up to the Financial Crisis and inequality rose to a higher level. But between 2013 and 2019 income growth has been at historically low levels.

05.03.2025 23:57 — 👍 3 🔁 2 💬 0 📌 0

When you finance redistribution through a phase-out, you concentrate the burden of taxation on middle income families with children

A tax-financed universal system allows you to reduce the burdens associated with taxation by spreading it out vertically *and* horizontally!

15.02.2025 02:39 — 👍 0 🔁 0 💬 1 📌 0

The Accepted Manuscript version of my review of Spies-Butcher's new work 'Politics, Inequality and the Australian Welfare State After Liberalisation' is now on my blog if anyone's interested the complex process of liberalisation reforms.

www.bevansadvocate.com/p/politics-i...

12.02.2025 10:33 — 👍 4 🔁 3 💬 0 📌 0

New analysis of asteroid dust reveals evidence of salty water in the early Solar System

Two new studies show a briny, carbon-rich environment on the parent body of the Bennu asteroid was suitable for assembling the building blocks of life.

29.01.2025 19:44 — 👍 2 🔁 3 💬 0 📌 0

"This tax-and-transfer insurance effect—or the role of the state in reducing adult disadvantages that stem from childhood poverty—matters more than other oft-studied characteristics, such as parental education or marital status, in shaping the U.S. disadvantage compared with peer nations."

09.01.2025 05:01 — 👍 21 🔁 16 💬 0 📌 2

2024 tax expenditure statement showing super concessions estimated to reach an eye-watering $55 billion in 2024-25, billions higher than the previous estimate

Even bigger difference for the forwards too - $63 billion by 2026-27!

03.01.2025 01:55 — 👍 1 🔁 0 💬 0 📌 0

Seems highly contradictory that (a) huge tax concessions for super are often justified on compensatory grounds because being forced to save is welfare detracting and (b) a frequent justification of forced savings is that it's welfare enhancing

Am I missing something?

01.01.2025 11:09 — 👍 0 🔁 0 💬 0 📌 0

WA GST situation is crazy

29.12.2024 11:19 — 👍 0 🔁 0 💬 0 📌 0

Limitations of markets due to public goods and market failures are well-known, but I really like this framing by Amartya Sen that many of the most significant things in life are not suitable for marketisation

15.12.2024 01:51 — 👍 1 🔁 0 💬 0 📌 0

Happy 400th birthday to the world’s oldest bond

🎂

Happy 400th birthday to the world's old living bond! 🎂🎉🎊

www.ft.com/content/5122...

11.12.2024 10:20 — 👍 173 🔁 48 💬 11 📌 18

it's meant to be a graph but it looks like an AI tried to make an origami concertina

A thread of mystifying and hilarious data visualisations from the "Australians" books, published in 1987 by the Australian Government. (originally brought to my attention by @mikejbeggs.bsky.social )

#ausecon #chartcrimes #dataviz

1. Spikes

04.12.2024 23:58 — 👍 101 🔁 37 💬 12 📌 11

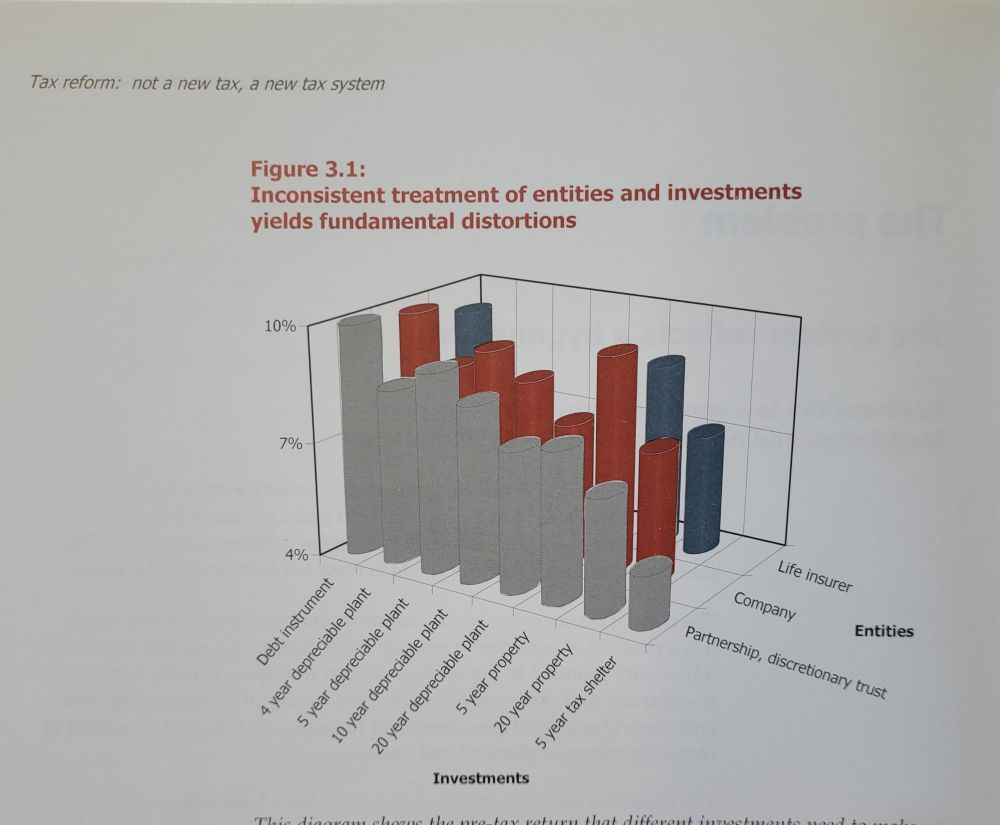

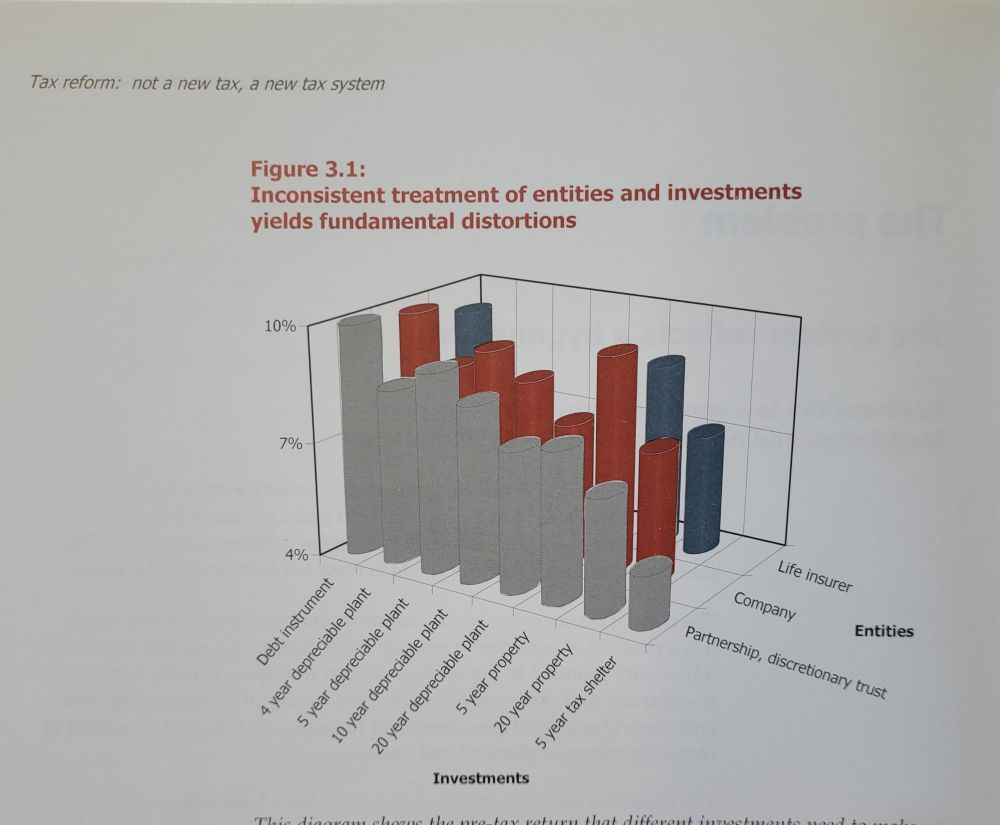

A few months ago I came across this 3 dimensional cylindrical bar column chart in a howard era tax paper 😬

05.12.2024 01:50 — 👍 6 🔁 0 💬 3 📌 0

Mean Charts

On Wednesdays we calculate the median wage statistics

There have been two economic charts going semi-viral— or at least what counts as viral for ABS statistics—in the past couple of weeks.

Both claim to show a dramatic fall in living standards in Victoria and Australia. Both are wrong.

gross.substack.com/p/mean-charts

02.12.2024 02:13 — 👍 15 🔁 7 💬 0 📌 3

one of the best type of guys

26.11.2024 07:18 — 👍 1 🔁 0 💬 0 📌 0

Really interesting bit of research on actual vs publicly preferred tax rates in Norway. The gap is mainly driven by changing composition of (differentially taxed) income across the earnings distribution

www.cambridge.org/core/journal...

23.11.2024 01:05 — 👍 0 🔁 0 💬 0 📌 0

Incredible chart showing how age influences the amount of tax you pay for a given level of income. Difference driven in large part by super concessions/investment earnings

Regressive, expensive and without any compelling equity justification

22.11.2024 07:32 — 👍 9 🔁 7 💬 1 📌 1

Good to see one of the classics getting reposted

21.11.2024 22:53 — 👍 1 🔁 0 💬 0 📌 0

Excellent Amartya Sen passage on the key question of equality, 'Equality of What?' Almost all normative theories are based on a form of egalitarianism, they just differ on what they focus on providing equal an entitlement of

21.11.2024 11:07 — 👍 31 🔁 8 💬 2 📌 2

Convenor of @greatercanberra.org.au- Lawyer, general purpose nerd. Building better cities requires actually building. Views my own.

🇦🇺25, hobbyist computer toucher, regrettably literate

politics/technology/capitalism. prof somewhere.

enthusiastic guitar guy. book on why vc was a bad idea the whole time coming from UChicago Press

writing - https://oddletters.com/

stickers+noise - https://duopoly.bandcamp.com/merch

i curse a lot

he/they

Economist at the IFS working on health and social care, public spending and public sector productivity https://ifs.org.uk/people/max-warner

Founder of Tax Policy Associates Ltd. Tax realist. @danneidle on Twitter

Economist, formerly a physicist. Head of UK Economic Policy & Modelling at Cambridge Econometrics. Visiting Researcher at Oxford Brookes Business School. Also interested in cricket, baseball and metal. Displaced Salopian. Vmo

Econ prof at Harvard. (Mechanism design, market design, behavioral theory.) www.shengwu.li

Emeritus professor of astronomy at the University of Nottingham. Too frequent appearances on YouTube. All my own views.

Journalist. Author. Podcaster. Liberal extremist.

Illuminating the debate through data-driven research #inequalitydata✨

Hosting the World Inequality Database🌐 https://wid.world/

https://inequalitylab.world/en/

Vienna Institute for International Economic Studies (wiiw); macroeconomics, economic policy, public finance, political economy, meta-science.

#Development #inequality & #economic issues

Research Coordinator @ Oxfam Intermón

Psephologist, polling analyst and poll transparency advocate, political commentator, ecologist, chess player/admin. No party loyalties. Not-A-Pollster.

Contributing Editor at Prospect Magazine; Principal Editor at Resolution Foundation

Researcher at CREi, working on international macroeconomics.

https://crei.cat/people/fornaro/

Editorial Director and Senior Policy Fellow, European Council on Foreign Relations (@ecfr.eu)

https://ecfr.eu/profile/jeremy-cliffe/

Economic Security Project is an ideas advocacy organization that builds economic power for all Americans.

Economics and Ethics, UMass Amherst

Do investigations for the FT, into dubious accounting and dodgy characters mainly. Wrote a book called Money Men about a spectacular fraud