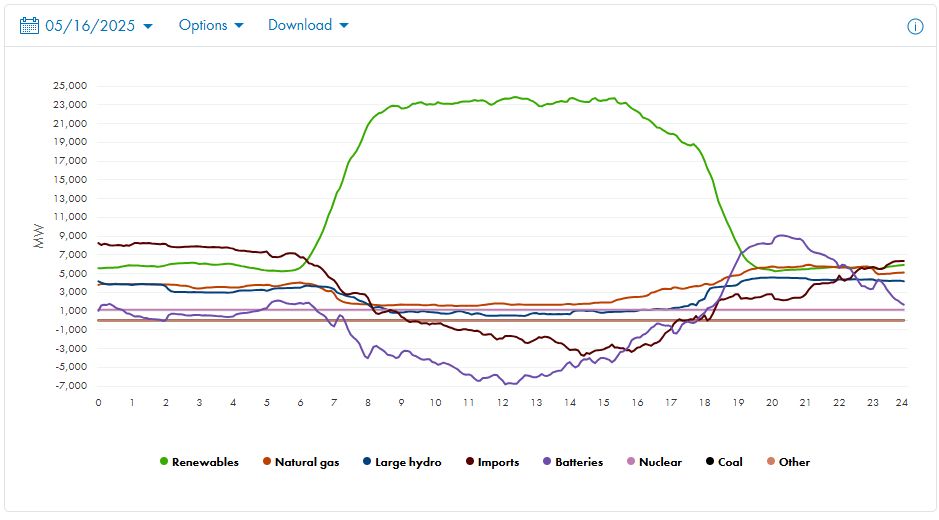

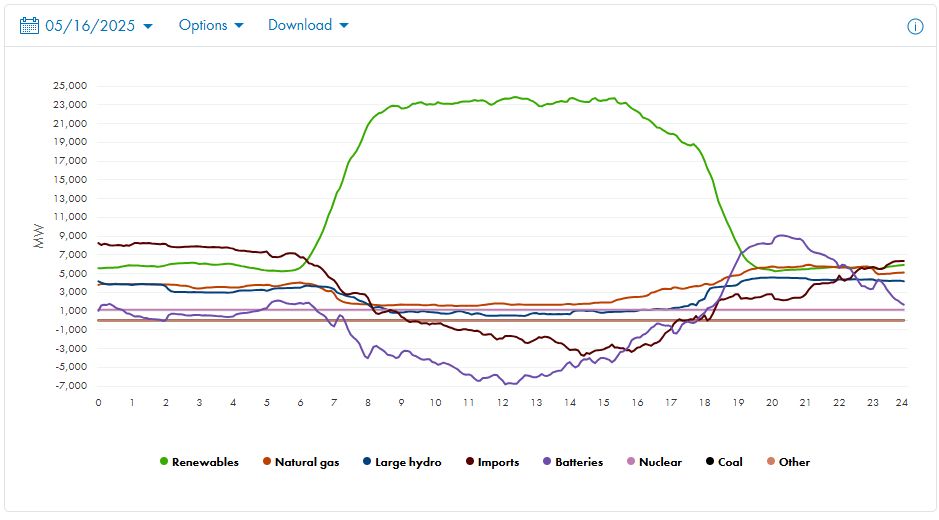

Natural gas is pretty much disappearing from the electricity mix in California.

19.05.2025 05:38 — 👍 9 🔁 0 💬 0 📌 0@jonsteinsson.bsky.social

Economics professor at UC Berkeley. https://eml.berkeley.edu/~jsteinsson/

Natural gas is pretty much disappearing from the electricity mix in California.

19.05.2025 05:38 — 👍 9 🔁 0 💬 0 📌 0Second that!!

11.05.2025 19:54 — 👍 1 🔁 0 💬 0 📌 0Good to hear from you! But unfortunately I won't be going. Sorry to miss you. Would have been great to catch up.

08.05.2025 14:43 — 👍 1 🔁 0 💬 0 📌 0

Congratulations @s-stantcheva.bsky.social !!!

Wonderful choice!

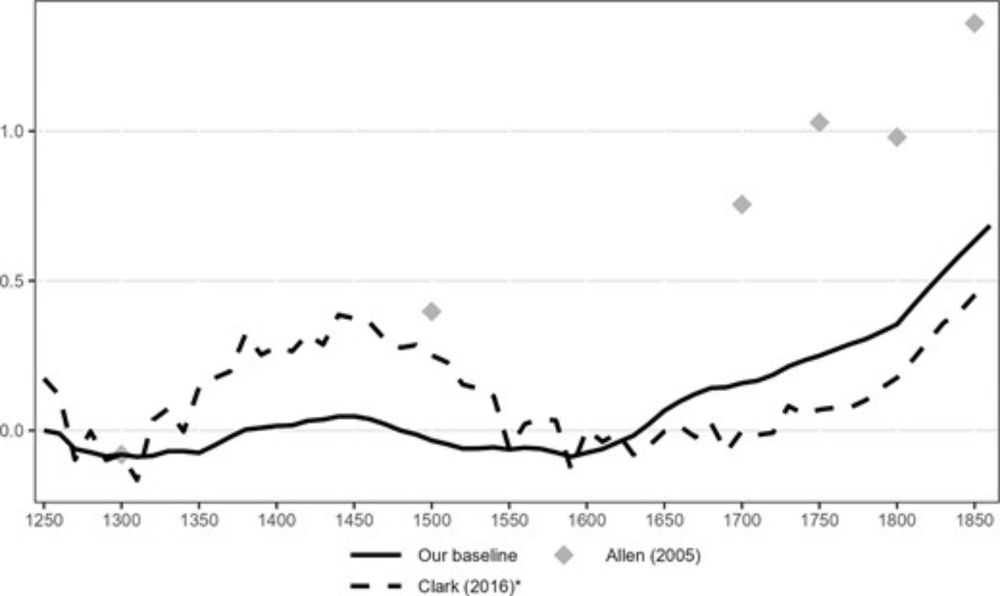

#QJE May 2025, #1, “When Did Growth Begin? New Estimates of Productivity Growth in England from 1250 to 1870,” by Bouscasse (@paulbouscasse.bsky.social), Nakamura, and Steinsson (@jonsteinsson.bsky.social): doi.org/10.1093/qje/...

16.04.2025 18:53 — 👍 10 🔁 3 💬 1 📌 0The Fed spent down a lot of credibility when it looked through the temporary post-Covid inflation and managed to engineer a rare soft landing. But this probably means it has less of an ability to do so again now (less credibility). That means a more aggressive approach is probably optimal this time

05.04.2025 00:40 — 👍 17 🔁 1 💬 3 📌 0I guess Trump is going for import substitution policy. That sure made lots of countries rich in the past.

11.03.2025 18:37 — 👍 7 🔁 2 💬 1 📌 0Welcome!

06.03.2025 03:51 — 👍 2 🔁 0 💬 0 📌 0I finally made the transition from X to here, looking forward to interacting with the econ community here @tedmiguel.bsky.social @evavivalt.bsky.social @rthaler.bsky.social @cega-uc.bsky.social @socscipredict.bsky.social

05.03.2025 18:51 — 👍 102 🔁 13 💬 9 📌 3

CDU/CSU &SPD have just proposed a sea change in German fiscal policy:

- defence spending above 1% of GDP exempt from debt brake

- 10-year €500bn special fund for infrastructure

- looser debt rules for states

- further debt-brake reform in new Bundestag

We speak today on behalf of the legal profession and its members who seek to live by the oath each took upon admission to the bar. We reject efforts to undermine the courts and the profession. We will not stay silent in the face of efforts to remake the legal profession into something that rewards those who agree with the government and punishes those who do not. Words and actions matter. And the intimidating words and actions we have heard must end. They are designed to cow our country’s judges, our country’s courts and our legal profession. These efforts cannot be sanctioned or normalized. There are clear choices facing our profession. We can choose to remain silent and allow these acts to continue or we can stand for the rule of law and the values we hold dear. We call upon the entire profession, including lawyers who serve in elected positions, to speak out against intimidation. We acknowledge that there are risks to standing up and addressing these important issues. But if the ABA and lawyers do not speak, who will speak for the organized bar? Who will speak for the judiciary? Who will protect our system of justice? If we don’t speak now, when will we speak? The American Bar Association has chosen to stand and speak. Now is the time for all of us to speak with one voice. We invite you to stand with us.

The ABA rejects efforts to undermine the courts and the legal profession. Read full message: www.americanbar.org/news/abanews...

03.03.2025 19:50 — 👍 943 🔁 394 💬 51 📌 58For the record, as of the start of Trump's second term, the US economy is on a tear.

18.02.2025 06:07 — 👍 4 🔁 1 💬 1 📌 0These DOGE guys are so smart!!!

"Not realizing they oversee the country's weapons stockpile"

Hard to tell. But more and more feasible.

13.02.2025 23:25 — 👍 0 🔁 0 💬 0 📌 0We are trending towards less and less cash. So, the fiscal costs of the penny are not likely to balloon fast. So, overall, not a big deal. But on balance I support getting rid of the penny. 9/

13.02.2025 06:20 — 👍 1 🔁 0 💬 2 📌 0The attachment argument is the only reasonable argument I can think of in favor of the penny. The economic argument for the penny is super weak (IMHO). But then the argument against the penny is not that strong. $40 million is not a lot of money for a big country. 8/

13.02.2025 06:20 — 👍 0 🔁 0 💬 1 📌 0Now, some people are attached to the penny. Just like others are attached to national parks (which the government spends money on). So, perhaps that attachment is worth $40 million a year. Totally reasonable debate. I am not attached to the penny. So, I support getting rid of it. 7/

13.02.2025 06:20 — 👍 0 🔁 0 💬 1 📌 0The rounding issue would be a bigger deal for the nickel. So, it is worth a bit more to keep the nickel. 6/

13.02.2025 06:20 — 👍 0 🔁 0 💬 1 📌 0Firms would continue to want to price at $9.99 etc. for psychological reasons. But then taxes are added and you buy several items at a time. The final digit of the total price of your purchase (with taxes) quickly becomes random. So, rounding would be symmetric. 5/

13.02.2025 06:20 — 👍 0 🔁 0 💬 1 📌 0Getting rid of the penny would entail rounding of prices. But that is not a big deal. Rounding is symmetric. So, prices need not rise on average and probably wouldn't. 4/

13.02.2025 06:20 — 👍 0 🔁 0 💬 1 📌 0The fiscal cost of the penny is small. About $40 million per year on average. (The cost of the nickel is larger. More like $80 million.) So, modest fiscal savings. 3/

13.02.2025 06:20 — 👍 0 🔁 0 💬 1 📌 0It costs 3.7 cents to produce a penny (and rising). So, the government is losing money on the penny. But the government spends money on lots of things. Is it worth it? 2/

13.02.2025 06:20 — 👍 0 🔁 0 💬 1 📌 0Getting rid of the penny seems sensible to me. But there are arguments on both sides. Here are a few. 1/

13.02.2025 06:20 — 👍 8 🔁 1 💬 2 📌 0Next chapter will be about interest rates.

11.02.2025 19:10 — 👍 0 🔁 0 💬 0 📌 0

This is a useful example of how economists’ mental model of climate change leads us astray.

The idea is that optimal climate policy is a carbon tax of ~$200/ton, and IRA is equivalent to a carbon tax around $10/ton, so we need 20x stronger policy.

That's wrong 🧵

🚨 Oprea (2024 AER) argued that prospect theory choice anomalies were not due to risk, but due to complexity-driven mistakes.

But this new analysis convinces me that Oprea (2024) is substantially wrong. In my opinion, the paper should be retracted.

A Bayesian Assessment of the Origins of COVID-19 using Spatiotemporal and Zoonotic Data Andrew T. Levin #33428 Abstract: This paper uses Bayesian methods in conjunction with spatiotemporal and zoonotic data to evaluate the odds ratio for two hypotheses regarding the origin of the COVID-19 pandemic, namely, an accidental laboratory leak of a chimera virus or the transmission of a natural virus from an infected wildlife mammal. The overall Bayes factor is decomposed into 4 components: (1) the odds that the outbreak would occur in the People’s Republic of China (PRC); (2) the odds that the outbreak would occur in Wuhan, conditional on its location in PRC; (3) the odds of observing the spatiotemporal pattern of confirmed COVID-19 cases with no known link to the specific wholesale market where wildlife mammals were being sold, conditional on the outbreak taking place in Wuhan; and (4) the odds of observing the spatiotemporal pattern of confirmed vendor cases at that market, conditional on the outbreak taking place in Wuhan. These four conditional Bayes factors are estimated as 2.3:1, 20:1, 27:1, ! and 12:1, respectively, and hence the overall odds ratio is 14,900:1, indicating overwhelming evidence in favor of the hypothesis that the pandemic resulted from an accidental lab leak. This conclusion is robust to alternative specifications of the detailed statistical analysis.

Interesting!

03.02.2025 07:01 — 👍 10 🔁 2 💬 1 📌 0Private money? Should the government be so heavily involved in our monetary system? Do we even need a central bank? These are questions discussed in section 9 of my new “Money and Banking” chapter:

eml.berkeley.edu/~jsteinsson/...

Take a look at the Wallis (2006) paper I cite in the chapter. It is about how the US conquered related corruption in the 19th century. A hard nut to crack for sure. (Paper should be available on the NBER's website.)

23.01.2025 19:42 — 👍 1 🔁 0 💬 1 📌 0Not any more? 😕

23.01.2025 18:19 — 👍 0 🔁 0 💬 1 📌 0