Figure 8 shows one standard measure of dynamism known as job churn, which sums up

employment growth in new and growing firms and employment losses in shrinking or

closing firms. When churn is high, firms are growing and shrinking rapidly. Churn mostly

fell in the UK in the two decades before the pandemic, as it did around the world.

Churn has been broadly flat over the past decade, having fallen markedly in the decade

before that. But a close look at Figure 8 reveals that job destruction among exiting firms

picked up in 2024 to its fastest rate since 2011. This is not a turnaround by any means,

and is offset by lower destruction among incumbent firms, but it is a ‘green shoot’ of

improvement to the supply side of the economy.

Slowing dynamism is a key culprit in slowing productivity growth.

One standard measure of dynamism is job churn - this mostly fell in the UK in the two decades before the pandemic.

Jobs lost to exiting firms in 2024 were the highest since 2011, but other components of job reallocation remain weak.

09.02.2026 13:30 — 👍 2 🔁 3 💬 1 📌 0

Love the Wernham Hogg "Swindon lot" sponsor in the background 😂

03.02.2026 12:53 — 👍 4 🔁 0 💬 0 📌 0

Fascinating new analysis by the ONS on UK #business #dynamism and #productivity. Firms employing a third of workers in the non-financial business economy contributed negatively, and the next third only marginally, to productivity #growth.

Full ONS analysis: bit.ly/48Yhqqn

08.12.2025 13:12 — 👍 4 🔁 3 💬 0 📌 0

In 2023 and 2024, net job creation was entirely due to incumbent firms expanding their workforces. This contrasts with most of the period since the global financial crisis, where the majority of net job creation came from entering firms creating more jobs than exiting firms destroyed.

08.12.2025 11:01 — 👍 1 🔁 1 💬 1 📌 0

This year we have introduced analysis of business dynamism by industry, showing that although dynamism is lower in every industry than in 2001, there is variation in the levels and recent trends.

08.12.2025 11:01 — 👍 2 🔁 0 💬 1 📌 0

The latest year's statistics continue the longer term trends:

- business dynamism that is lower than 20 years ago

- productivity growing faster for the most productive firms than the median

- average markups the joint highest since our series began.

08.12.2025 11:01 — 👍 1 🔁 0 💬 1 📌 0

Today we published our annual bulletin Trends in UK business dynamism and productivity: www.ons.gov.uk/economy/econ...

To help users explore the rich detail in the business dynamism statistics, we are also piloting an interactive dashboard: ons-dynamism.shinyapps.io/lbd_dashboar...

08.12.2025 11:01 — 👍 1 🔁 1 💬 1 📌 0

It's well-established that UK firms engaged in international trade are more productive, but why?

New analysis from @christinavpalmou.bsky.social and Kyle Jones (ONS) offers new evidence: tinyurl.com/5c9mazpa

14.08.2025 08:31 — 👍 3 🔁 5 💬 0 📌 1

Exactly!

03.07.2025 13:50 — 👍 1 🔁 0 💬 0 📌 0

The ones that always annoy me are along the lines of "£70 a year...that's only 20p a day!" That always sounds more significant to me than the annual cost, not less!

03.07.2025 10:30 — 👍 0 🔁 0 💬 1 📌 0

We will deposit these surveys on the Secure Research Service, and hope that researchers will link the microdata more widely and uncover further insights. PSMPS was funded by the Public Services Productivity Review. Many thanks to my team and previous work by collaborators at @escoeorg.bsky.social

27.05.2025 10:40 — 👍 0 🔁 0 💬 0 📌 0

For example, researchers could apply their own judgement to whether limited financial incentives in the public sector reflect weaker management practices, or are appropriate to the nature of the work in that sector. Differences in characteristics, such as size, might also affect comparisons.

27.05.2025 10:38 — 👍 0 🔁 0 💬 1 📌 0

It is worth reflecting on the trade-offs of applying the same management practices standards to public and private sectors. It is helpful to be able to compare results directly, but different organisational characteristics and cultures might affect how questions are interpreted.

27.05.2025 10:38 — 👍 0 🔁 0 💬 1 📌 0

We also asked about average days worked from home by managers and non-managers. In all subsectors, managers were at least as likely as non-managers to use hybrid work, and in most cases were more likely. Average management practice scores were usually higher in organisations that use hybrid working.

27.05.2025 10:37 — 👍 0 🔁 0 💬 1 📌 0

Scores on underperformance were strongly influenced by the proportion of organisations that reported having no underperformance. These scored zero under our scoring metric, because we assume that all organisations must have some examples of underperforming staff.

27.05.2025 10:37 — 👍 0 🔁 0 💬 1 📌 0

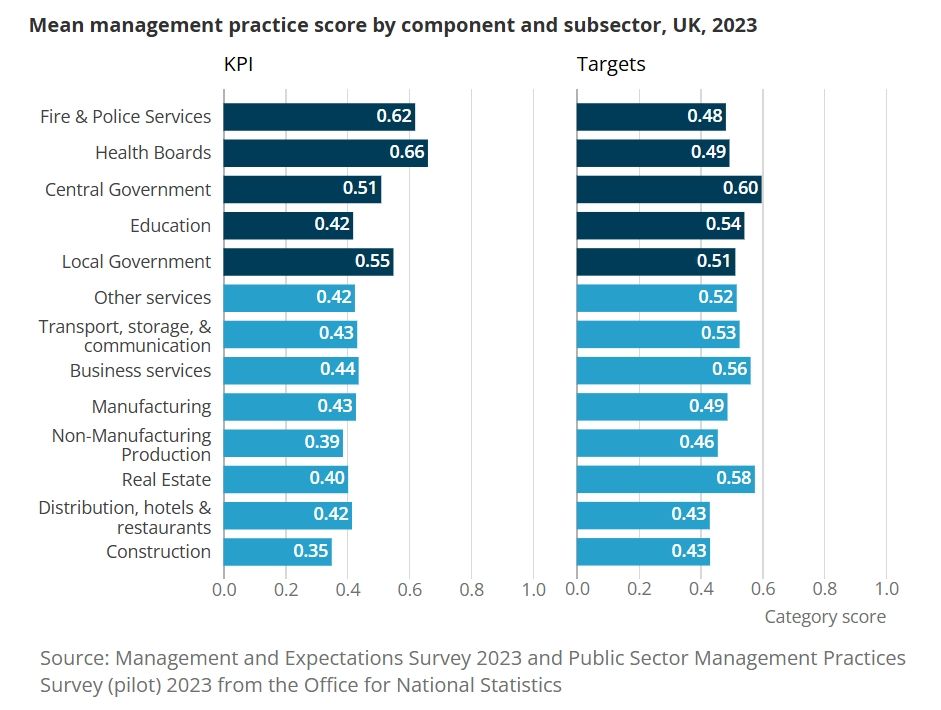

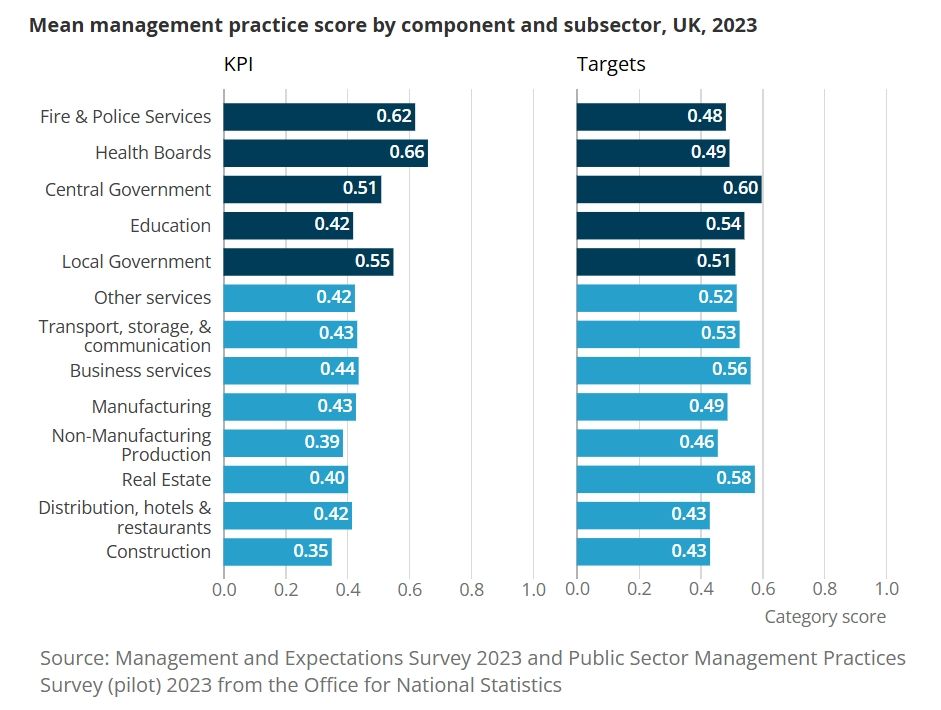

While the public sector generally scored well on KPIs, Targets scored similarly to the private sector, with the lack of financial incentives for achieving targets reducing public sector scores. Despite prior question testing, the concept of KPIs was not consistently understood across subsectors.

27.05.2025 10:36 — 👍 0 🔁 0 💬 1 📌 0

Given the pilot nature of the PSMPS and the diversity of subsectors, it is worthwhile looking at the responses in more detail. Responses on Employment Practices were more likely to score highly across most of the public sector, but in Education the lack of promotions lowered the score.

27.05.2025 10:34 — 👍 0 🔁 0 💬 1 📌 0

There are similarities and differences between and with the sectors. The mean management practice scores were close: 0.56 for the public sector and 0.55 for the private sector. But the spread was wider in the private sector, where firms were more likely to receive the highest or lowest scores.

27.05.2025 10:34 — 👍 0 🔁 0 💬 1 📌 0

Management practices in the UK QMI - Office for National Statistics

Quality and methodology information for the Management and Expectations Survey (MES), including strengths and limitations of the data, recent corrections, methods, and data uses and users.

We combined the 2023 Management and Expectations Survey (MES) with our pilot 2023 Public Sector Management Practices Survey (PSMPS). We kept scoring management practices questions in the PSMPS identical to MES to allow direct comparison. More info on MES methods here: www.ons.gov.uk/economy/econ...

27.05.2025 10:33 — 👍 0 🔁 0 💬 1 📌 0

Another busy room for this panel on trade and productivity in British firms with @grantfitzner.bsky.social, @christinavpalmou.bsky.social, Swati Dhingra, Gregory Thwaites, Mairi Spowage and @sophie-piton.bsky.social. #EconStats2025

22.05.2025 11:47 — 👍 4 🔁 1 💬 0 📌 1

The UK will soon have a new industrial strategy. What can we learn from past policies, and from examining the sectors in the government's recent green paper?

Our new CMA report looks at the data.

https://www.gov.uk/government/publications/industrial-policies-new-evidence-for-the-uk

1/

09.04.2025 12:24 — 👍 20 🔁 16 💬 2 📌 3

Management practices and the adoption of technology and artificial intelligence in UK firms - Office for National Statistics

Investigating how technology adoption and use of artificial intelligence by businesses vary with management practices.

The article and data pack contain more results on uses of AI, barriers to adoption, and the relationship with productivity. Please let us know if you have feedback on the analysis. The dataset will be available to accredited researchers in the Secure Research Service. www.ons.gov.uk/economy/econ...

24.03.2025 10:05 — 👍 0 🔁 0 💬 0 📌 0

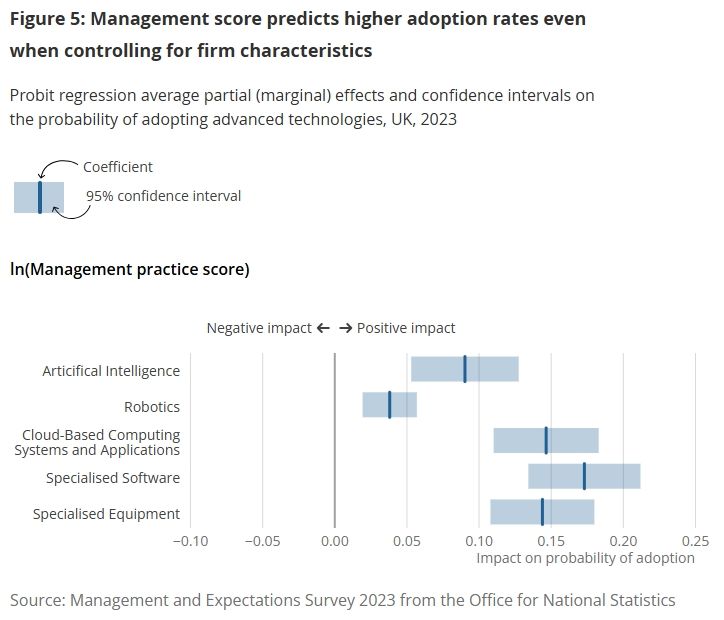

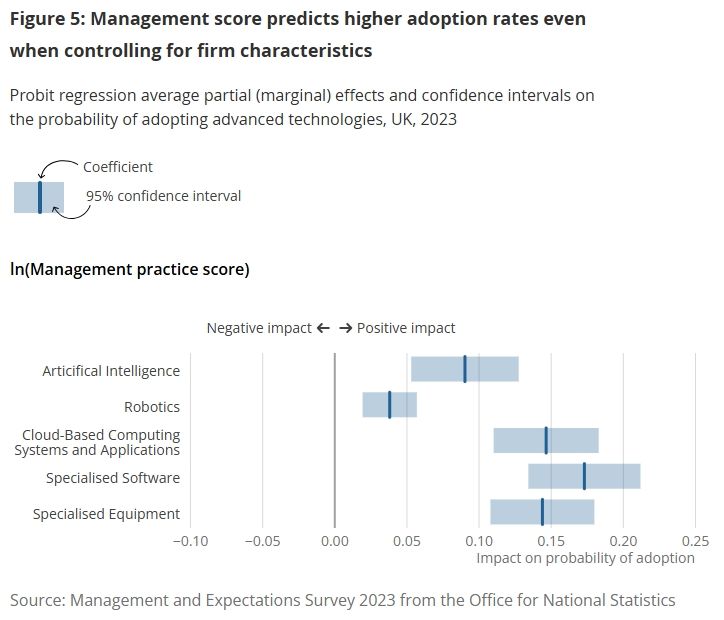

By linking waves of the Business Insights and Conditions Survey in 2024 onto MES 2023, we also found that among firms who hadn't adopted AI in 2023 but said they planned to in 2024, the firms with stronger management practices were more likely to follow through on those plans.

24.03.2025 10:04 — 👍 0 🔁 0 💬 1 📌 0

The positive relationship between management practices quality and technology adoption remained after controlling for other business characteristics such as size and industry.

24.03.2025 10:03 — 👍 0 🔁 0 💬 1 📌 0

Firms with higher management practice scores were more likely to adopt advanced technologies. 20% of firms in the top tenth of firms by management practices quality used AI in their methods or processes in 2023, compared to 2% of firms in the lowest tenth.

24.03.2025 10:02 — 👍 0 🔁 0 💬 1 📌 0

Conditional adoption rates give clues about which advanced technologies might be required or complementary to adopting others. 91% of the firms using AI in 2023 also used cloud-based computing systems and applications, and 83% of the firms using AI also used specialised equipment.

24.03.2025 10:01 — 👍 0 🔁 0 💬 1 📌 0

This looks into what supporting investments are needed for businesses to adopt AI, including good quality structured management practices, and complementary technologies. This is important for understanding potential barriers to diffusion of AI to firms throughout the productivity distribution.

24.03.2025 10:01 — 👍 0 🔁 0 💬 1 📌 0

Journalist, broadcaster, Mum of 2 boys, owner of 2 cocker spaniels

Unbelievable Britain - YouTube

BBC Newsnight 🎥 📱

And Then Came Breast Cancer 🎧

BAFTA RTS Sony Pink News AIB British Podcast Award winner

L'avenir est ce que nous allons faire.

🧰 Economist OECD.

🎓 Board lavoceinfo, scuolapolitiche & Labor Chair PSE.

⚠️ Opinions mine.

AI correspondent at the Economist. I write about it, that is. I’m still human. One of literally dozens of people online who is not American.

When you absolutely, positively got to know every "On This Day" in movie history, accept no substitutes.

10+ years & 50,000 followers on Twitter, making a new home for ourselves here.

Worker-owned media. We make lots of video essays, podcasts and livestreams about video games, movies and TV shows. https://youtube.com/@secondwindgroup

From the former team of The Escapist.

Support us on Patreon. https://patreon.com/SecondWindGroup

Creator/voice of Zero Punctuation and the entirely legally distinct Fully Ramblomatic. Critic. Novelist. Game designer. Wears slippers. https://fullyramblomatic-yahtzee.blogspot.com/

@greenpeaceuk.bsky.social chief scientist, policy director

View are all my own, except those I've borrowed

🌹 Labour MP for Earley and Woodley, covering Shinfield & Whitley

📈 Member of the Treasury Select Committee

📚 Chair of the APPG for Social Science and Policy

✉️ Please email if you'd like a reply: yuan.yang.mp@parliament.uk

Waitress turned Congresswoman for the Bronx and Queens. Grassroots elected, small-dollar supported. A better world is possible.

ocasiocortez.com

Official account of Saturday Morning Breakfast Cereal created by

@zachweinersmith.bsky.social.

Home of the ongoing webcomic SMBC, A City on Mars, and of little books featuring large concepts abridged beyond the point of usefulness.

Economics Editor, The Sunday Times.

Writer Diver Econometrician Rum enthusiast

Member of Parliament for Chipping Barnet & Exchequer Secretary to HM Treasury.

Professor of Productivity Studies, Alliance Manchester Business School; Managing Director, The Productivity Institute;

Multi-award winning journalist and author based in Cardiff.

I conduct investigative journalism and help people better understand Wales/Cymru.

You sign up to my newsletter here: willhaywardwales.substack.com

Columnist at The Guardian.

I'm Stuart Humphryes (known online as BabelColour). I clean, repair, enhance and transform early colour photography.

Sustainability | Governance

Trust is built in complexity

Engagement ≠ Alignment

Comedian and maker of nonsense.

Artist, animator, utter nonsense. Don't believe a word except when I'm being serious. Did that gif once, those noseflags and other stuff.

HappyToast.co.uk

patreon.com/HappyToast

redbubble.com/people/HappyToast/explore

https://ko-fi.com/happytoast

TV Critic and Broadcaster. Must Watch and The Bachelor of Buckingham Palace podcasts on @BBCSounds.