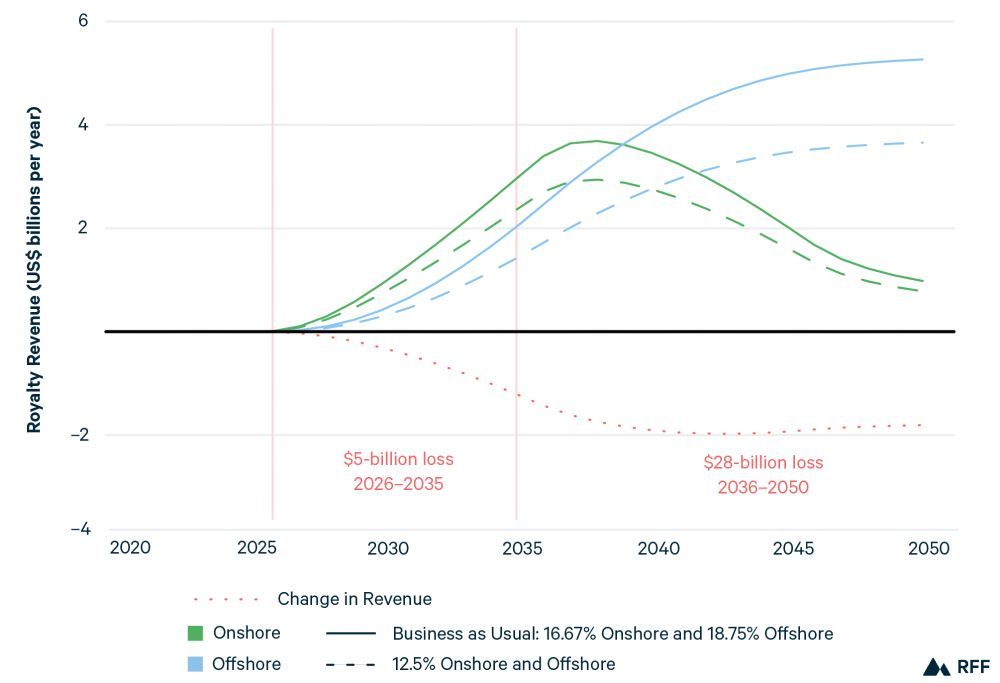

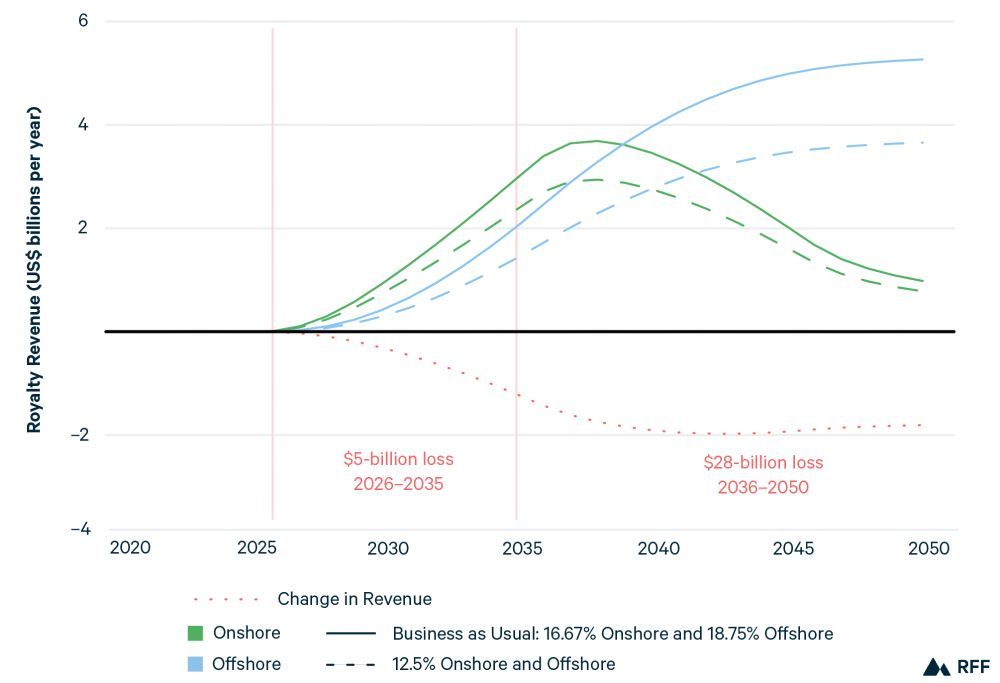

The reduced royalty rates do encourage additional production, which DOGMA accounts for, but not nearly enough to overcome the substantial reduction in federal revenue.

I’ll be posting additional details of this analysis on RFF’s web site later this week--stay tuned!

06.05.2025 14:23 — 👍 0 🔁 0 💬 0 📌 0

These values represent only the approximately 50% share of royalties retained by the federal government, so the cuts would lead to similarly large revenue losses to the states where the oil and gas is being produced.

06.05.2025 14:23 — 👍 0 🔁 0 💬 1 📌 0

Using the Dynamic Oil and Gas Market Analysis model, I estimate that these royalty cuts will lead to nearly $5 billion in losses to the federal government between 2026 and 2035, with growing annual losses averaging nearly $2 billion per year over 2036 to 2050 (see figure).

06.05.2025 14:23 — 👍 0 🔁 0 💬 1 📌 0

These changes in royalty rates are not the only proposed ones, but because royalties represent 95% of the federal government’s share of the revenues from the sale of its oil and gas, the proposed royalty rate cuts are expected to be a key driver of the bill’s overall impacts on the federal deficit.

06.05.2025 14:23 — 👍 0 🔁 0 💬 1 📌 0

The proposal would make major process changes to federal leasing of public lands for oil and gas production, including cutting royalty rates paid by oil and gas companies operating on federal land by about 25% to 33%.

06.05.2025 14:23 — 👍 0 🔁 0 💬 1 📌 0

The House Natural Resources Committee today is marking up its piece of the reconciliation bill currently making its way through Congress.

06.05.2025 14:23 — 👍 0 🔁 0 💬 1 📌 1

Office of Fossil Energy and Carbon Management

Homepage - Office of Fossil Energy and Carbon Management

DOE is taking public comment on their study until March 20th for anyone interested in submitting their opinions (we did).

In the meantime, I'm looking forward to presenting this work at this summer's @aereorg.bsky.social conference! See you in New Mexico!

end/11

11.03.2025 19:37 — 👍 2 🔁 0 💬 0 📌 0

Comparing these results to DOE's own analysis from December 2024 suggests that the DOE analysis is likely understating both the potential impacts of LNG exports both on US gas prices and the methane intensity of gas supplies expected to meet LNG demand.

10/11

11.03.2025 19:37 — 👍 2 🔁 0 💬 1 📌 0

Finally, I estimate the impacts on US oil and gas prices, as export constraints have historically limited US gas prices from aligning with much higher prices in Europe and Asia.

I estimate each +1 Bcf/d of gas exports is likely to increase US natural gas prices by about 2.5%.

9/11

11.03.2025 19:37 — 👍 2 🔁 1 💬 1 📌 0

So oil exports induce oil & gas production with *much* higher methane intensity (effectively 9%) than do gas exports (less than 2%).

This suggests that past US crude oil exports have induced larger annual US methane emissions than what would be expected from 20 Bcf/d of additional gas exports!

8/11

11.03.2025 19:37 — 👍 2 🔁 0 💬 1 📌 0

But don't forget that we have become a big crude oil exporter over the past decade. There, the results are flipped: crude oil exports are met mainly by high-leak Permian oil that produces pretty leaky associated gas. This add'l gas coproduction could even "back out" low-leak Appalachian gas.

7/11

11.03.2025 19:37 — 👍 2 🔁 0 💬 1 📌 0

So gas exports will be met by gas supply that leaks at lower rates (<2% average) than the US average (~3%). This is good news!

6/11

11.03.2025 19:37 — 👍 2 🔁 0 💬 1 📌 0

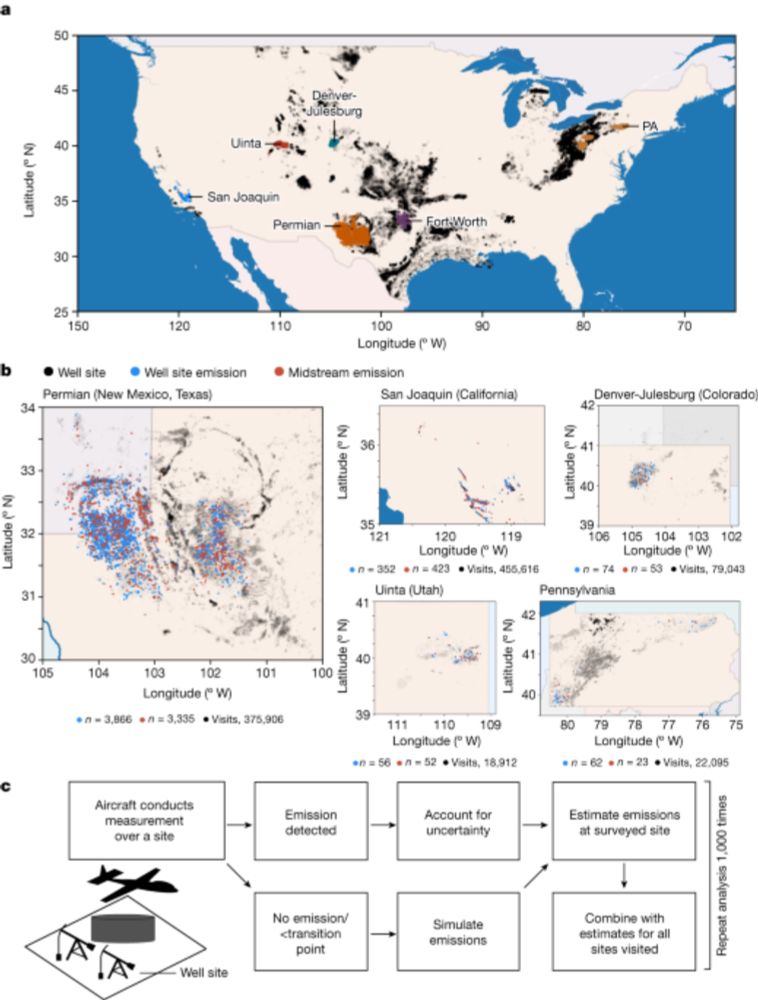

So which basins feed marginal supply matters tremendously.

I find that each +1 billion cubic feet per day (Bcf/d) of additional gas exports (~1% of today's US production) comes disproportionately from the low-leak Appalachia, where drilling is more sensitive to gas prices than oil prices.

5/11

11.03.2025 19:37 — 👍 2 🔁 0 💬 1 📌 0

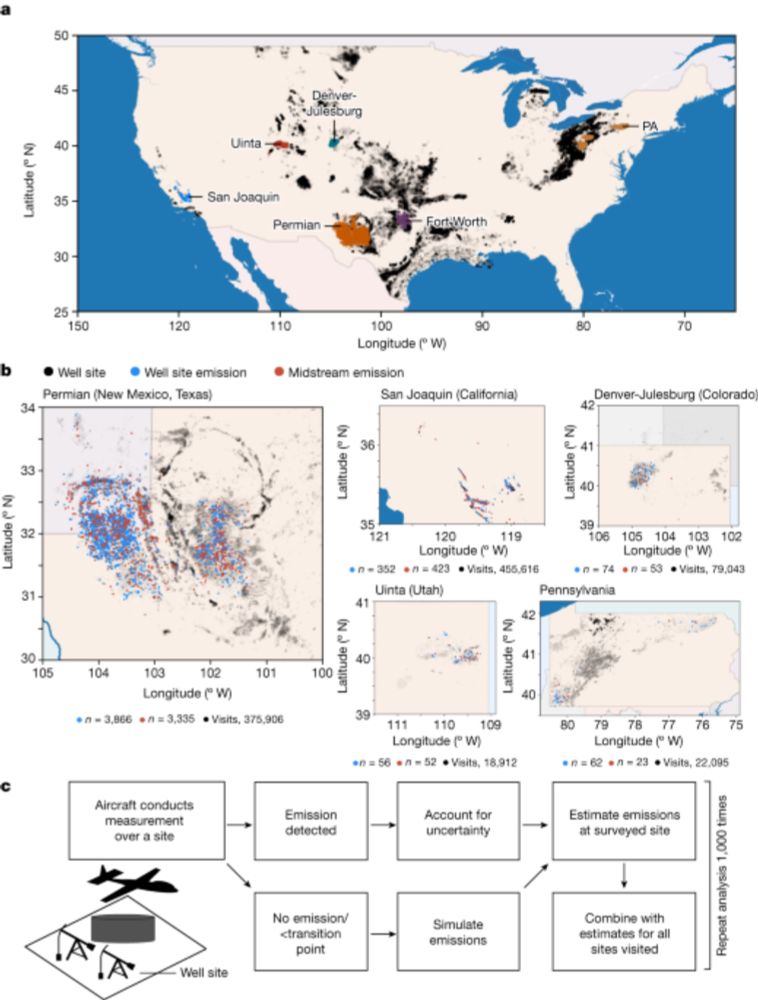

Half of US gas comes from two sources:

1) Appalachia, where methane leak rates are low (<1%) since companies drill for the gas,

and

2) the Permian basin, where gas is largely a byproduct of oil production, and leak rates are high (>5% average per Sherwin) amid less incentive to capture it.

4/11

11.03.2025 19:37 — 👍 3 🔁 0 💬 1 📌 0

US oil and gas system emissions from nearly one million aerial site measurements - Nature

We integrate approximately one million aerial site measurements into regional emissions inventories for six regions in the USA, finding methane emission intensities that vary by more than a factor of ...

A key piece of the carbon intensity of supply is how much methane (a potent greenhouse gas and the chief component of natural gas) leaks into the atmosphere during the supply chain.

Sherwin (2024, Nature) found huge variation across the US in this leak rate, ranging from under 1% to above 9%!

3/11

11.03.2025 19:37 — 👍 2 🔁 0 💬 1 📌 0

Where Does the Marginal Methane Molecule Come From? Implications of LNG Exports for US Natural Gas Supply and Methane Emissions

This paper examines whether liquefied natural gas is more carbon intensive than coal by expanding a mathematical model to assess the effects of increased US oil and gas exports on gas supply, methane ...

First, over the past ten years, US exports of both oil and natural gas have surged to 4 million barrels and 12 billion cubic feet of LNG each day in 2024, when the Biden admin temporarily paused new LNG facility approvals to study the potential impacts on US gas prices and carbon emissions.

2/11

11.03.2025 19:37 — 👍 2 🔁 0 💬 1 📌 0

Economic and Environmental Effects of Natural Gas Exports, with Brian C. Prest

Brian C. Prest discusses liquefied natural gas exports from the United States, including the effects of increasing exports on domestic energy prices and methane emissions and the ability of the federa...

New @rff.org paper & podcast episode alert!

I model the regionally varying response of US oil and gas supply to export demand--both for liquefied natural gas (LNG) & crude oil. I focus on the impacts on methane emissions & US energy prices.

[Podcast link below, paper link in the next post]

1/11

11.03.2025 19:37 — 👍 6 🔁 2 💬 1 📌 0

Economist interested in energy, environment, and climate

EBS19 (E4 B3 S12), H125

ORCID https://orcid.org/my-orcid?orcid=0000-0002-8012-3988

Environmental economist, Professor @Cornell Brooks Public Policy, Fellow @Cornell Atkinson Center for Sustainability, President @aereorg.bsky.social. Views are my own.

https://sites.google.com/view/sheilaolmstead/

I am an Economist leveraging the assignment mechanism in the field to test theory and help non-profits, govts, and anyone who will listen! My goal is to (hopefully!) change the world for the better. My picture is with my son who makes me so proud daily.

Environmental economist working on climate change and water pollution.

Principal Economist, US Census Bureau

I study people, places, businesses and the environment

Opinions are not my employer's, my coauthors nor mine (in expectation)

An independent, nonprofit research institution dedicated to advancing a healthy environment 🌎 and thriving economy 📈 through impartial economic research and policy engagement.

https://www.rff.org/

Consulting on climate change & the energy transition for NGOs & foundations at Kostyack Strategies. Senior Contributor at Forbes.com & Senior Fellow at ceea.us. I prioritize offering hot takes over cleaning up typos.

Energy systems and climate policy person with lots of opinions, few of which are wise to share. Total sucker for novel decarb pathways. Fanboy of functional democracies and a bit of grace.

FT's US columnist/commentator. Author of several books including NYT best selling biography of Zbigniew Brzezinski (Simon & Schuster 2025). People lacking a sense of humour might get muted.

Assistant Professor, Environmental Economics, UCD.

https://sites.google.com/view/marta-talevi/

Senior Lecturer in Energy Policy at the University of Exeter, UK. Researching change, inertia and public engagement in energy transitions.

https://experts.exeter.ac.uk/19656-iain-soutar

CEO Energy UK - and also on the Board of Green Alliance & EVA England. Came here for the energy chat....

Associate Professor at University of Exeter researching societal transitions for equitable, resilient, environmentally sustainable futures

Energy policy, energy justice. People are the centre of the clean energy transition.

Managing Principal, Regulatory Assistance Project. Member, South East London Community Energy.

Views my own.

@sunderlandlouis

/in/louise-sunderland-5474b848

Energy modelling | Wikipedian | Solar energy, energy storage and sector coupling | Long COVID | Senior Lecturer at ExeterUni

Senior Researcher, Environmental Change Institute, University of Oxford. Convenor Oxford Energy Network. Environmental Change Fellow, Reuben College. Interested in energy demand, energy policy, climate hope & a just transition.

Sen. Researcher in Transf. Innovation @ZSI - Centre for Social Innovation in Vienna 🇦🇹 - agri / waste / energy x sustainable development. Horizon 🇪🇺 projects: CircSyst - Circular Systemic Solutions, MountResilience - Climate Adaptation in mountain regions

Energy & Sustainability Engineer.

Working in decarbonisation & sustainable infrastructure. Climate, energy, net zero.

She / her.

Founder + CEO of Ripple Energy - reinventing community energy and enabling everyone to own their own source of green, low cost energy. www.rippleenergy.com

Sustainable homes, resilient communities, strategic #retrofit, data geekery, policy wonkery and the good life. #ukhousing #energyefficiency #proptech