NEW: Societe Generale gains ground in fixed income trading push

SocGen's drive to expand in fixed income starting to bear fruit: spot FX volumes up 70-80% this year

Part of broader push to diversify its trading division beyond structured equity derivatives

www.ifre.com/people-and-m...

07.07.2025 13:38 — 👍 1 🔁 2 💬 1 📌 0

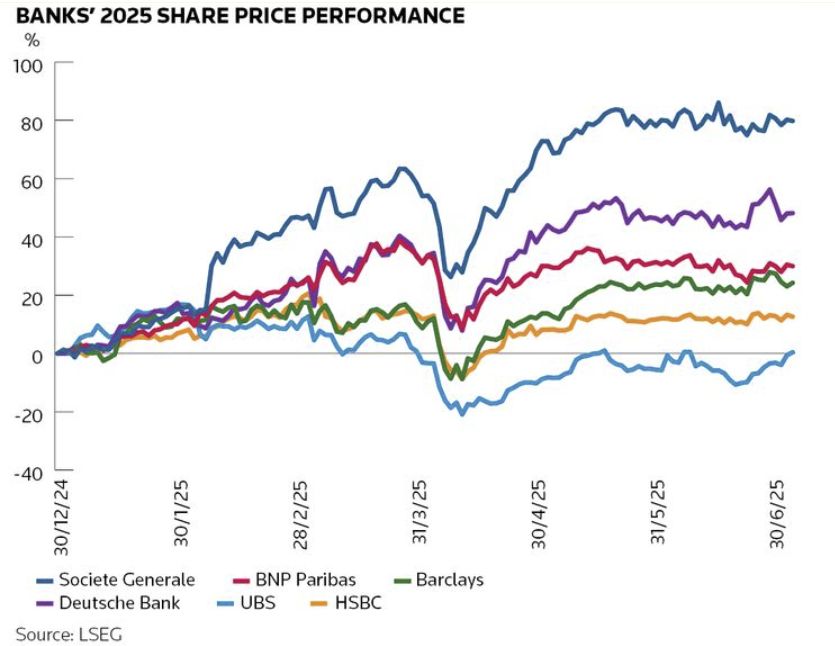

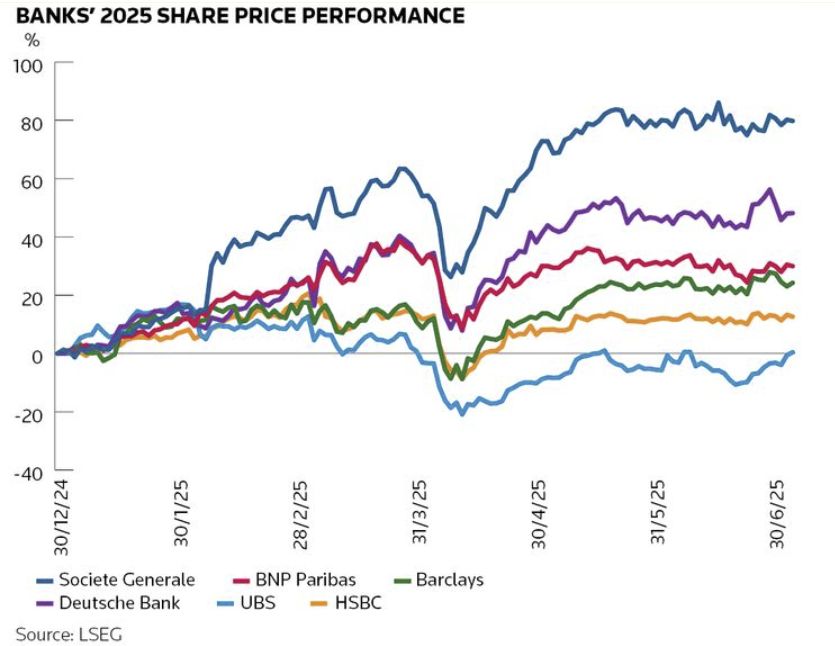

Investors seem to approve

SocGen shares are up ~80% this year, comfortably the best performer of major investment banks

Many analysts are pencilling in further gains following years of lacklustre performance

07.07.2025 14:37 — 👍 0 🔁 0 💬 0 📌 0

SocGen is determined to reduce the volatility of its trading revenues through diversification and cutting back risk

Growing fixed income is an important part of that, as is expanding in cash equities and prime brokerage

Here's SocGen's co-head of markets on the strategy:

07.07.2025 14:05 — 👍 0 🔁 0 💬 1 📌 0

NEW: Societe Generale gains ground in fixed income trading push

SocGen's drive to expand in fixed income starting to bear fruit: spot FX volumes up 70-80% this year

Part of broader push to diversify its trading division beyond structured equity derivatives

www.ifre.com/people-and-m...

07.07.2025 13:38 — 👍 1 🔁 2 💬 1 📌 0

Bank trading bonanza continues in second quarter | IFR

People & Markets

Equities trading powers markets divisions

NEW: Bank trading bonanza continues in second quarter

Banks' trading revenues set to rise 10-15% in Q2, Coalition Greenwich says

Equities trading leading the way again - up 20-25%

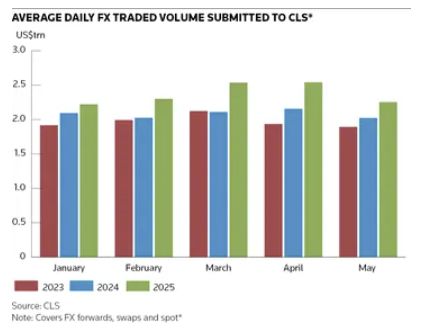

Fixed income up 5-10% on the back of strong FX trading results

www.ifre.com/topic-codes/...

07.07.2025 13:24 — 👍 1 🔁 1 💬 0 📌 0

Bank trading bonanza continues in second quarter | IFR

People & Markets

Equities trading powers markets divisions

NEW: Bank trading bonanza continues in second quarter

Banks' trading revenues set to rise 10-15% in Q2, Coalition Greenwich says

Equities trading leading the way again - up 20-25%

Fixed income up 5-10% on the back of strong FX trading results

www.ifre.com/topic-codes/...

07.07.2025 13:22 — 👍 1 🔁 0 💬 0 📌 0

Ofc, chart looks very different if you adjust for currency

Yellow line is S&P performance this year in euros

03.07.2025 14:12 — 👍 1 🔁 0 💬 0 📌 0

S&P 500 nearly now caught up with European stocks year to date

03.07.2025 14:10 — 👍 1 🔁 0 💬 1 📌 0

Worst H1 performance for the dollar index since 1973 - Deutsche Bank

01.07.2025 08:49 — 👍 1 🔁 0 💬 0 📌 0

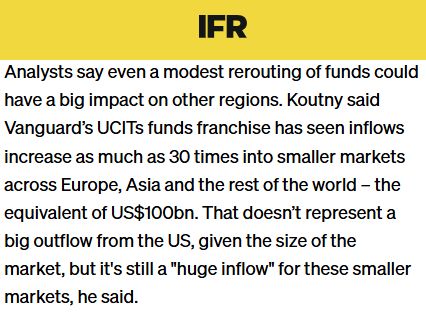

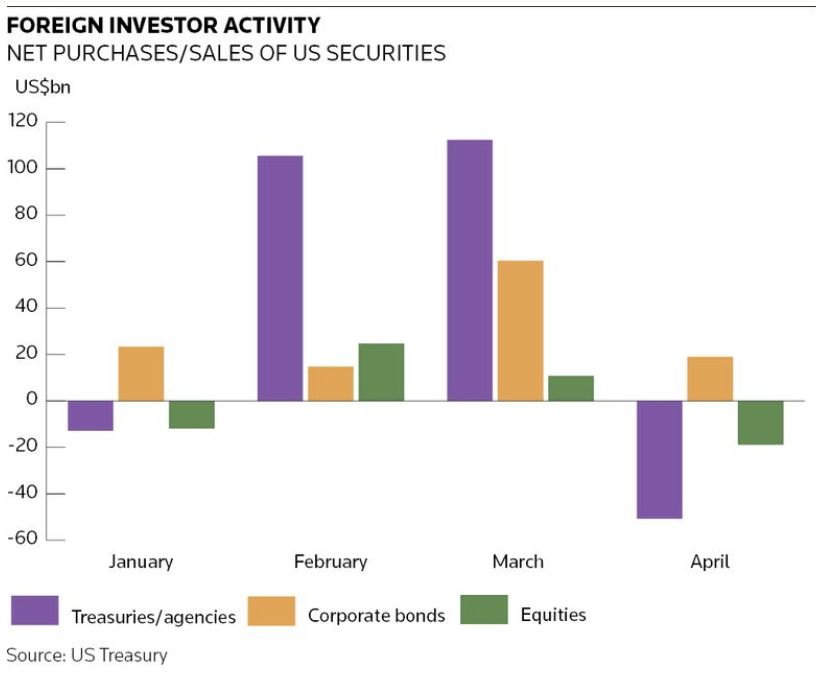

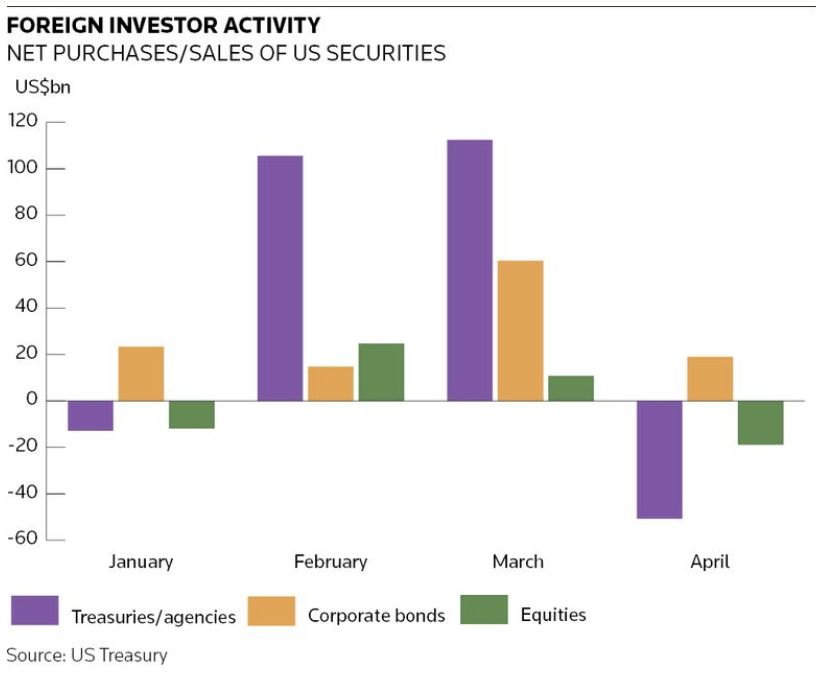

But this backs up anecdotal evidence that investors are starting to rebalance after years of overallocation to the US

That could be simply currency hedging dollar assets, or putting new money to work elsewhere- potentially having a bit impact on smaller markets ///

23.06.2025 08:52 — 👍 1 🔁 0 💬 0 📌 0

Obviously this is just one month of data

It's also a drop in the ocean compared with the $3.5trn of US securities foreigners have bought since the start of 2022

And, after underperforming at the start of the year, US stock markets have rebounded sharply

bsky.app/profile/chri...

23.06.2025 08:52 — 👍 1 🔁 0 💬 1 📌 0

Treasuries were the biggest casualty with a net $40.6bn of sales in April from foreigners

Canadian institutions (!) were the biggest sellers - their holdings of Treasuries fell $57.8bn in April to $368.4bn

This followed (much bigger) Treasury inflows in Q1

23.06.2025 08:46 — 👍 0 🔁 1 💬 1 📌 0

NEW: 'Sell America' trade emerges in April

Foreign investors sold a net $50.6bn of US stocks and bonds - highest monthly total since the pandemic in early 2020

First concrete sign foreign investors could be reconsidering US exposures after years of heavy investing

www.ifre.com/people-and-m...

23.06.2025 08:36 — 👍 4 🔁 0 💬 1 📌 0

*percentage points

18.06.2025 14:30 — 👍 2 🔁 0 💬 0 📌 0

S&P 500 outperforming Stoxx Europe 600 by ~8 percentage over the last three months

18.06.2025 14:25 — 👍 0 🔁 0 💬 1 📌 1

Speaking of $$$, here's a fun story about the steep price tag attached to THE consensus trade in the market right now

Shorting the dollar is expensive b/c of the negative carry (US rates much > Japan, Swiss, eurozone)

"There’s only so long you can hold that trade"

www.ifre.com/topic-codes/...

16.06.2025 13:09 — 👍 5 🔁 2 💬 1 📌 0

Dollar upheaval sparks FX trading boom | IFR

P&M

Traders expect more dollar hedging to come

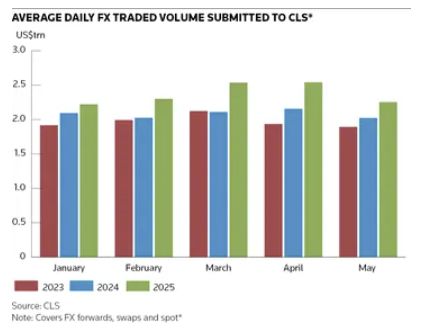

NEW: Dollar upheaval sparks FX trading boom

Banks' off to their best start to a year since 2022 w/ >$6.5bn of FX revenues in Q1

Investors hedging dollar exposure a huge driver of flows

"The surge in client activity... was very profitable for banks"

www.ifre.com/topic-codes/...

16.06.2025 12:43 — 👍 9 🔁 2 💬 1 📌 0

Eg shorting the dollar against the yen costs 4% of yield a year, Barclays says

So you need a big move lower in the buck to make it worthwhile

May explain why dollar shorts have reduced somewhat recently

Here's Amundi on the conundrum:

16.06.2025 13:14 — 👍 1 🔁 0 💬 0 📌 0

Speaking of $$$, here's a fun story about the steep price tag attached to THE consensus trade in the market right now

Shorting the dollar is expensive b/c of the negative carry (US rates much > Japan, Swiss, eurozone)

"There’s only so long you can hold that trade"

www.ifre.com/topic-codes/...

16.06.2025 13:09 — 👍 5 🔁 2 💬 1 📌 0

BNP Paribas estimates Danish pension funds reduced their unhedged dollar exposure ~$38bn in March/April; Dutch funds reduced theirs $53bn in Q1

Here's Morgan Stanley's FX/EM head on expectations of more to come //

16.06.2025 12:50 — 👍 1 🔁 0 💬 0 📌 0

FX trading volumes submitted to CLS are much higher this year and hit records in April after US tariff announcements

Dealers report a step-change in activity post April 2 w/ "real" FX users (pensions, insurance etc) increasing $ hedging ratios for the first time in years

16.06.2025 12:50 — 👍 1 🔁 0 💬 1 📌 0

Dollar upheaval sparks FX trading boom | IFR

P&M

Traders expect more dollar hedging to come

NEW: Dollar upheaval sparks FX trading boom

Banks' off to their best start to a year since 2022 w/ >$6.5bn of FX revenues in Q1

Investors hedging dollar exposure a huge driver of flows

"The surge in client activity... was very profitable for banks"

www.ifre.com/topic-codes/...

16.06.2025 12:43 — 👍 9 🔁 2 💬 1 📌 0

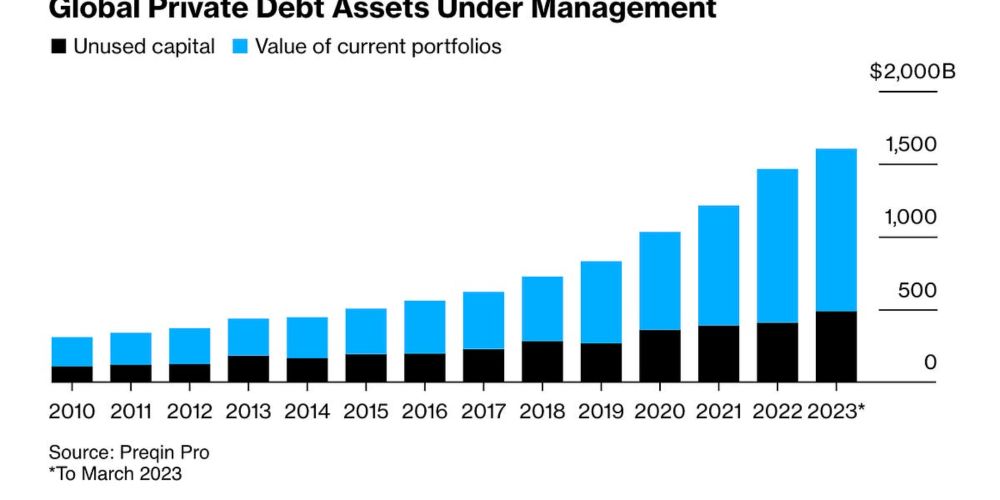

How Goldman Sachs turned financing into a US$9bn powerhouse | IFR

People & Markets

Heady growth means financing now generates more revenue than investment banking

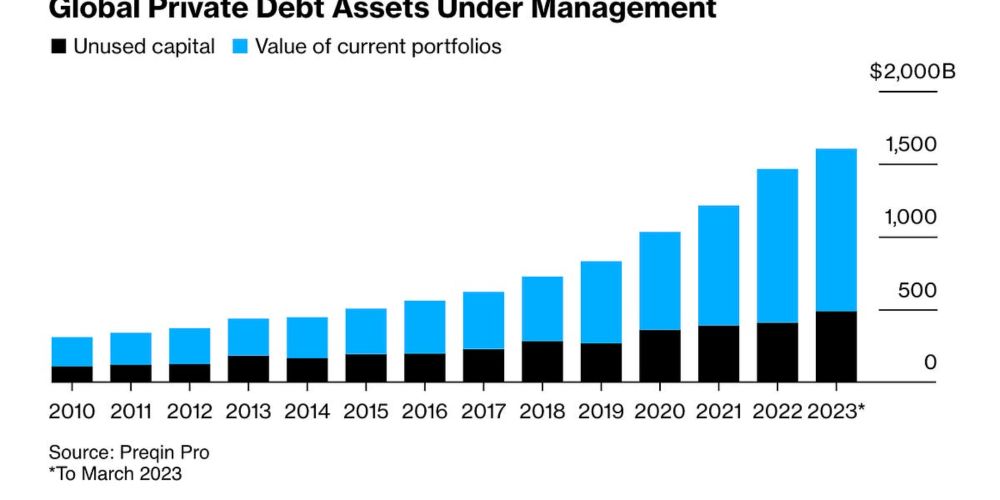

NEW: How Goldman Sachs turned financing into a $9bn powerhouse

Goldman's financing revenues now outstrip investment banking fees after >doubling since 2020

Profile of how the age-old business of lending money is transforming the investment bank 🧵

www.ifre.com/topic-codes/...

09.06.2025 10:47 — 👍 7 🔁 3 💬 1 📌 1

News Sites Are Getting Crushed by Google’s New AI Tools

Chatbots are replacing Google’s traditional search, devastating traffic for some publishers.

"Nicholas Thompson, chief executive of the Atlantic, said the publication should assume traffic from Google would drop toward zero and the company needed to evolve its business model.

'Google is shifting from being a search engine to an answer engine' "

www.wsj.com/tech/ai/goog...

10.06.2025 13:01 — 👍 0 🔁 0 💬 0 📌 0

Does Private Credit Really Reduce Systemic Risk?

If you squint

Also includes links to other pieces that have talked about this concept of the re-tranching of the banking system for some time now

eg these posts from @stevenkelly49.bsky.social and Huw van Steenis last year

www.withoutwarningresearch.com/p/does-priva...

www.oliverwyman.com/our-expertis...

10.06.2025 11:53 — 👍 3 🔁 0 💬 0 📌 0

Link to our story and thread on Goldman's financing push

bsky.app/profile/chri...

10.06.2025 11:44 — 👍 3 🔁 0 💬 1 📌 0

The Banks Are Re-Tranching

Also private equity recruiting, a Ferretti buyback, a different Goldman and is Musk v. Trump securities fraud?

"There is something culturally interesting about this moment... banks are moving up the capital structure, doing less risky stuff and more lending of money to the people doing the risky stuff. The post-crisis push to make banks more boring is essentially working."

www.bloomberg.com/opinion/news...

10.06.2025 11:41 — 👍 33 🔁 4 💬 1 📌 0

Public Policy Executive Representing Securities Regulators | Adjunct Associate Professor | Focused on AI, Crypto, and Financial Regulation | Grateful American | Personal Account

General Director, European Trade Union Institute

@etui.bsky.social

Formerly www.imk-boeckler.de

EU economic governance, comparative political economy, European integration, socio-ecological transition, wage bargaining

Deutschland-Versteher

Vietnam

I’m the Michael Klein Senior Research Fellow in the Global Economy and Finance Programme at Chatham House. Formerly I was head of emerging markets economics research at Citi.

FT asset management/investment writer based in London. Formerly at Lex. Chelsea fan, wine lover and a great admirer of butterflies. Opinions are all my own.

Markets correspondent, Thomson Reuters. Free school meals kid, FT diaspora, SEND parent.

Purveyor of fine Interest rate derivatives to the discerning.

Business editor, New Statesman

Author of OPUS

"A damning account" – WASHINGTON POST

“Vividly told and excellently researched" – FINANCIAL TIMES

"A deeply disturbing and important book" – IRISH TIMES

Journalist at @financialtimes.com Formerly @thetimes.com and The Sunday Times | Editor, writer and occasional coder | Markets and tech | Views my own

🌐 http://raydouglas.co.uk

Markets, finance, crypto. London via Pittsburgh.

‘The view from the column is ever distant’

(Anon, early 21st century)

Befuddling mix of politics, art, literary theory, philosophy, financial markets, international relations, cooking, and…dog photos…

‘Wow just wow what a skeeter’

‘Such a cute dog’

Just sharing interesting charts, seeking to learn more, and better understand this world of economics/finance and their impacts on the real economy.

Energy (macro)economist, cycling know it all.

The tweeter formerly known as @jxb101 at the previous place

Brexit is shite

🇨🇦🇬🇧🇿🇦🇨🇿☸️🔸

Deputy managing editor for business at Axios

Brighton-dwelling World Trade Editor at the Financial Times

https://www.ft.com/peter-foster

Sometime Brexit nerd & author of 'What Went Wrong with Brexit' https://t.co/VsIipD7JBr

Former buy-side gone corporate. Still know a thing or three. Interests include: finance, economics, sports, gambling, dad life, etc #FCOTY

Bonds Books Bikes Beaches…