In my column for Herald Insight Collection, I explore how swap lines could evolve into geopolitical instruments of strategy and power.

www.linkedin.com/feed/update/...

@gianlucabenigno.bsky.social

Professor of Economics at the University of Lausanne. Former Head of the International Studies Department at the NYFed and a tenured Professor at the LSE. https://gianlucabenigno.substack.com/ https://sites.google.com/view/gianlucabenigno/home;

In my column for Herald Insight Collection, I explore how swap lines could evolve into geopolitical instruments of strategy and power.

www.linkedin.com/feed/update/...

Hi, apologies for the delayed reply. Since June, perceptions of the labor market have shifted, and it now seems likely that we’ll see at least two rate cuts by the end of 2025, possibly three. The next SEP is out next week, so we’ll have a clearer view of the new median then.

12.09.2025 16:42 — 👍 0 🔁 0 💬 0 📌 0Committee Dynamics:

Potential split: There may be a growing divide between the voting members (12 FOMC) and the full committee (19 participants) about the pace and direction of policy.

Future decisions, especially from September on, are likely to hinge on the inflation outlook.

Stagflation risks noted:

End of 2025-GDP growth (2025 median) drops from 1.7% to 1.4% (central tendency narrows from 1.5–1.9% to 1.2–1.5%)

End of 2025-PCE inflation (2025 median) rises from 2.7% to 3.0% (central tendency shifts from 2.6–2.9% to 2.9–3.4%)

Quick Fed Update: 2025 rate cuts: The median projection still sees 2 rate cuts by end-2025.

Rising support for “no cuts”: In March 2025, 4 FOMC participants saw no cuts in 2025. In June, that number has increased to 7, showing increased caution within the committee on easing policy further.

Japan Inflation (Apr): CPI steady at 3.6% YoY; core CPI up to 3.5%. Food eased, but rice +98.4% YoY. Goods—not services—drive inflation. BoJ likely to stay cautious amid external risks.

#Japan #CPI #BoJ #inflation #economy #Yen

UK data: CPI rose to 3.5% YoY (vs. 3.3% expected), led by services inflation at 5.4% YoY, up from 4.7%. With wage growth sticky at 5.4% YoY, the current release might lead to a further cautious approach by the #BoE.

#UKinflation #CPI #wages #BoE #interestrates #monetarypolicy

Decline in interest rates would mitigate the cash-flow channel (associated with higher mortgage payments) and support aggregate demand, but overall, it is hard to see how all this would lead to inflation in a low-growth context with lack of fiscal support

20.05.2025 08:36 — 👍 2 🔁 0 💬 0 📌 0Thanks for your comment, I agree that there are structural factors in explaining pressures in the rental market, but what is striking about the UK and also Canada is how rent inflation started rising as interest rates increased and now has recently declined in Canada as they cut interest rates more.

20.05.2025 08:31 — 👍 1 🔁 0 💬 0 📌 0

From a monetary policy perspective, these factors suggest that more decisive easing by the Bank of England could be appropriate, with relatively limited side effects in the current context. #Inflation #Interestrates #MonetaryPolicy 3/3. open.substack.com/pub/gianluca...

20.05.2025 04:56 — 👍 0 🔁 0 💬 0 📌 0I made 3 key points: a)The role of rent inflation in accounting for UK inflation and its persistence b)The rapid and sizeable increase in the policy rate as a driver of UK inflation through higher rent c)The role of wage growth as demand support rather than just an input cost 2/3

20.05.2025 04:56 — 👍 0 🔁 0 💬 1 📌 0I presented "The Flip Side of UK Monetary Policy" last week at the BoE's Watchers Conference. The main message is that the transmission mechanism of monetary policy is not mechanical, but depends on state-contingent and institutional country-specific factors. #BankofEngland 1/3

20.05.2025 04:56 — 👍 5 🔁 0 💬 1 📌 1

No signs of tariffs-induced price increases yet for the U.S. economy.

open.substack.com/pub/gianluca...

Finally, in my own paper with @gianlucabenigno.bsky.social and @lucafornaro.bsky.social, we show that the Financial Resource Curse is not merely a theoretical possibility by presenting careful empirical evidence that it is a general phenomenon www.sciencedirect.com/science/arti... 4/n

19.04.2025 13:53 — 👍 6 🔁 2 💬 0 📌 0In an AER paper w Martin Wolf (of U.St.Gallen) @gianlucabenigno.bsky.social and @lucafornaro.bsky.social show that the Financial Resource Curse has even larger negative implications when flows go to the world technological leader, I.e. the US (ungated here: www.newyorkfed.org/research/sta...) 3/n

19.04.2025 10:49 — 👍 5 🔁 2 💬 1 📌 0I like that Brunnermeier and Merkel at least nod (without citation for some reason) at @gianlucabenigno.bsky.social and @lucafornaro.bsky.social ‘s work on the Financial Resource Curse (e.g crei.cat/wp-content/u...) 3/n

19.04.2025 10:43 — 👍 2 🔁 2 💬 1 📌 0

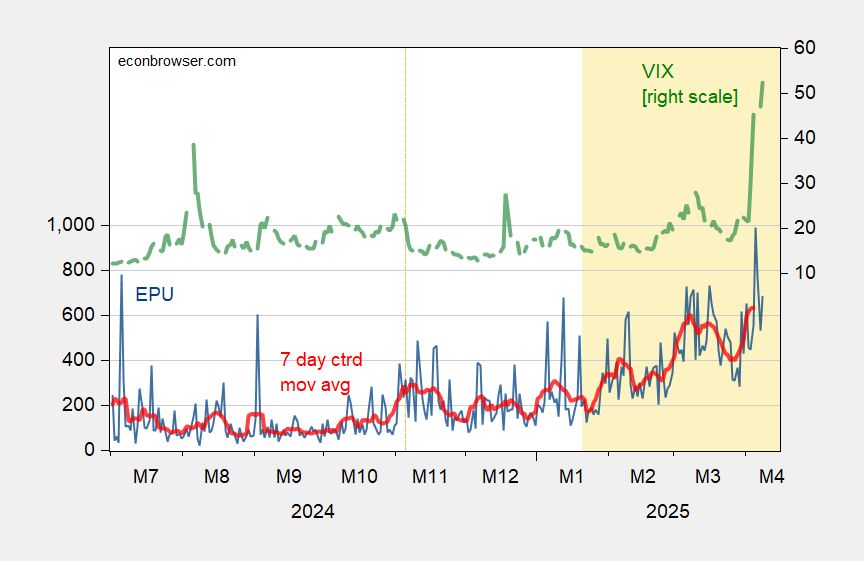

When tariffs become a financial shock inducing feedback loop in asset prices @gianlucabenigno.bsky.social #econsky

econbrowser.com/archives/202...

My teaching notes on the new U.S. Trade regime. What are tariffs? Who pays for it? Do they increase prices? what policy actions have been adopted, their implementation and possible legal challenges.

open.substack.com/pub/gianluca...

January CPI inflation release surprised on the upside. Core inflation seems to be stuck above 3% showing little progress. As trade tensions increase, goods prices will likely add to inflationary pressures rather than contribute to disinflation as in 2024.

gianlucabenigno.substack.com/p/us-january...

Interest Rates Politics: can Trump Pressure the Fed?

open.substack.com/pub/gianluca...

This is the link of @martinsandbu.bsky.social on.ft.com/4gqJKmz

20.12.2024 19:35 — 👍 1 🔁 0 💬 0 📌 0

Nice article by @martinsandbu.bsky.social on Draghi's proposal. "Demand creates its own supply" this is what happens in the Keynesian growth framework (libertystreeteconomics.newyorkfed.org/2019/04/the-...)

20.12.2024 19:35 — 👍 2 🔁 1 💬 1 📌 0

How can Central Banks manage the post-pandemic world with increased macro variability, geopolitical tensions, and shifting interest rate dynamics? Building on the BoE, I explore how scenario analysis could emerge as a new communication device for CBs. gianlucabenigno.substack.com/p/scenario-a...

10.12.2024 09:18 — 👍 4 🔁 0 💬 0 📌 0@andreasbeerli.bsky.social @gianlucabenigno.bsky.social @kenzabenhima.bsky.social @fuster.bsky.social @eyquem2.bsky.social @dominic-rohner.bsky.social @marcbruetsch.bsky.social @karstenjunius.bsky.social

27.11.2024 09:08 — 👍 3 🔁 1 💬 0 📌 0This reflects the guidance provided by Powell at the November press conference where he stated “..we are on a path to a more neutral stance.. that has not changed at all since September..”. There is one more CPI inflation report before the next FOMC policy meeting.

14.11.2024 12:34 — 👍 2 🔁 0 💬 0 📌 0This would mark a decisive shift relative to the pre-pandemic period in which both measures were gravitating around 2%. Financial markets have reacted by pricing more aggressively the likelihood that the Federal Reserve will cut the Fed Fund rate again by 25 bps in December.

14.11.2024 12:34 — 👍 2 🔁 0 💬 1 📌 0

Today’s CPI inflation report suggests that progress towards the 2% target is slow. My interpretation is that inflation has reached a plateau, gravitating around 2.5% at the headline level and around 3% at the core CPI level. (gianlucabenigno.substack.com/p/october-24...)

14.11.2024 12:34 — 👍 6 🔁 0 💬 1 📌 1

In my substack, I describe the intellectual background behind this research agenda along with the suggested policy implications that we analyze in the paper. (open.substack.com/pub/gianluca...)

23.10.2024 12:32 — 👍 1 🔁 0 💬 0 📌 0