NEW from me:

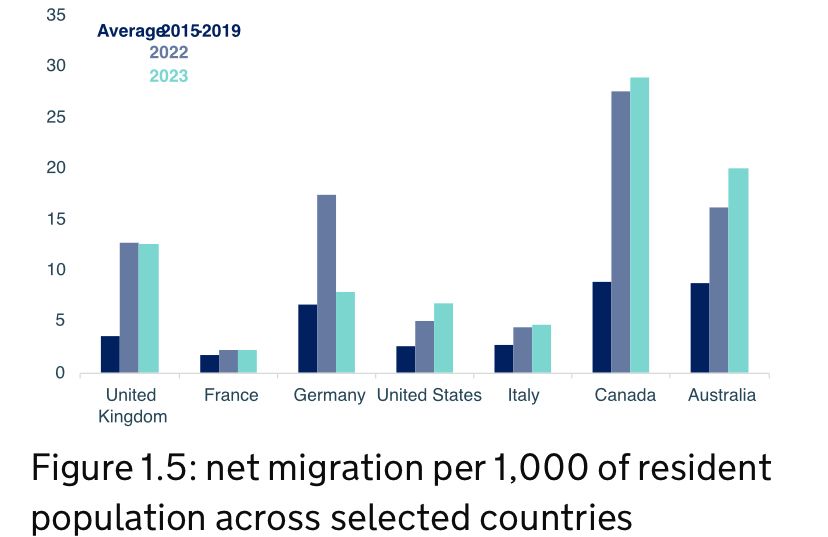

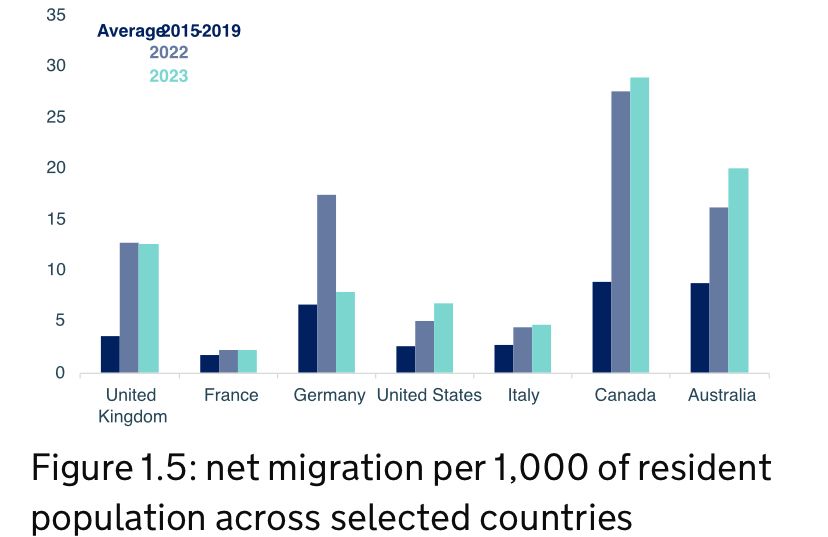

Political hostility, high visa fees and (in the case of the UK) stagnant incomes are making the UK and US less attractive destinations for top international talent.

That steep decline in the appeal of moving to the US after 2016 is 👀

31.10.2025 14:32 — 👍 1002 🔁 408 💬 32 📌 93

...I agree with JBM that UK is making itself relatively less attractive to high-skill migrants through combination of hostile rhetoric, excessive fees & stupid/unnecessary rules that will disproportionately deter those with options elsewhere. But this just gets current system wrong.

31.10.2025 08:00 — 👍 63 🔁 6 💬 2 📌 1

This is unusually sloppy for @jburnmurdoch.ft.com - uncharacteristically, he doesn't cite *any* data to back up his claims about the outcomes of the UK system.

But we have Home Office/HMRC data on this! Those on skilled work visas earn about 2x UK average..

www.ft.com/content/d70c...

31.10.2025 07:40 — 👍 147 🔁 41 💬 6 📌 2

Top incomes in the UK are no longer among the highest in the rich world

Rank among developed countries for average post-tax income of top 10%

On the one hand: Interesting just how long post-imperial Britain could cling on to its relative economic position. On the other hand: Yikes.

www.ft.com/content/d70c...

31.10.2025 08:23 — 👍 64 🔁 18 💬 10 📌 5

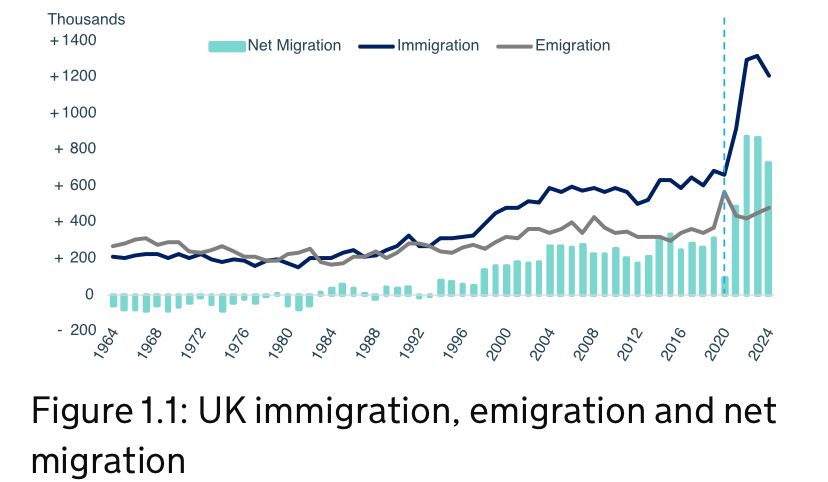

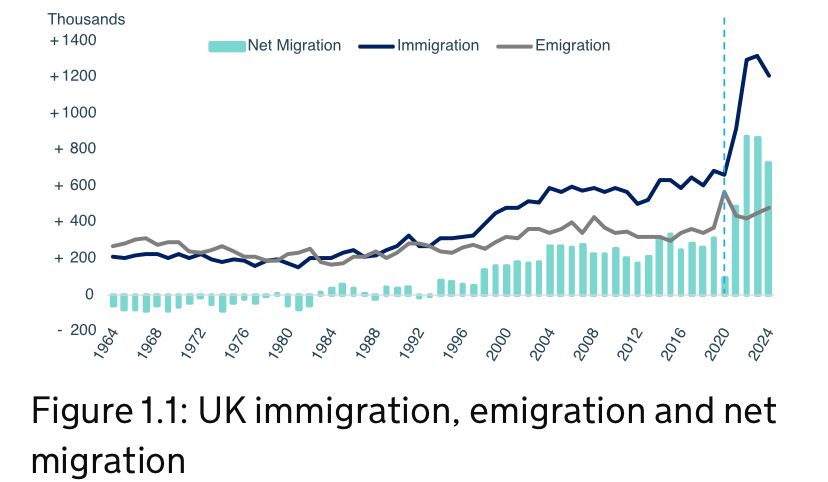

Net migration to the UK is falling rapidly. But how far will it fall? A new, detailed estimate by @jamesbowes01.bsky.social projects net migration in 2026 will be 70K to 170K.

This will have significant consequences, both economic and political.

ukandeu.ac.uk/the-coming-c...

29.10.2025 13:29 — 👍 229 🔁 107 💬 26 📌 34

Fed cuts rates by a quarter point.

For the first time in forever, there's a dissent on either side. Miran wants more (sigh, it's Miran). Schmid surprises and says he wanted no change.

Quantitative tightening ended.

29.10.2025 18:06 — 👍 198 🔁 45 💬 9 📌 4

Ed Luce watching democracy die in the United States of America

24.10.2025 06:53 — 👍 8792 🔁 3304 💬 367 📌 406

it's important to call things what they are

"mass deportations of legal residents for cultural homogeneity" is an ethnic cleansing policy

22.10.2025 08:21 — 👍 218 🔁 72 💬 2 📌 2

FT graph showing massive UK public support for the opinion that it was wrong to vote to leave the EU.

Ah! Good morning, reality. And welcome. We’ve been expecting you…

20.10.2025 06:43 — 👍 10699 🔁 2802 💬 611 📌 266

The authors of the book write: “Even Sir Tony Blair, a Labour prime minister, argued that if you look at the levels of direct taxation for people, they’re really high, and in historical terms, they’d be considered extremely high, and people feel they’re getting taxed highly

Just ignorant, ahistorical rubbish from Blair.

The average burden of direct taxes (income tax and employee NICs) has barely shifted in two decades. Was 21% of gross incomes in 2004, was 21% last year.

archive.ph/MVNMw

19.10.2025 11:31 — 👍 363 🔁 132 💬 22 📌 3

This is, in fact, apropos of Reform and *Conservative* proposals to do exactly that for hundreds of thousands of legal migrants with permanent status.

19.10.2025 11:39 — 👍 89 🔁 30 💬 2 📌 1

Infusing economically motivated structure into machine learning methods

Staff working papers set out research in progress by our staff, with the aim of encouraging comments and debate.

Staff Working Paper 1144 by M Buckmann (BoE) & G Potjagailo (BoE) discusses how economic theory can be integrated into machine learning methods to address “black box” concerns and still harness their predictive power in forecasting & policy analysis.

🔗 www.bankofengland.co.uk/working-pape...

17.10.2025 13:46 — 👍 4 🔁 1 💬 0 📌 0

Agree with Dom. And.. There's anyway room for the MPC to set lower policy rates to compensate for QT. The proof of whether policy has been too tight or not is in the inflation outcomes relative to target. On that metric it's much easier to argue that policy has been too loose, not too tight.

07.10.2025 08:43 — 👍 10 🔁 2 💬 2 📌 0

Immigration is down, should the government be happy? - UK in a changing Europe

Jonathan Portes analyses the latest ONS immigration statistics. He argues that net migration has dropped significantly, but that this will expose the...

The unravelling of Reform's xenophobic and half-baked proposals on ILR would be ideal time for Govt to say its own proposals, which I described as "not just unfair and vindictive, but economically irrational" will *not* apply retrospectively to migrants already here.

ukandeu.ac.uk/immigration_...

22.09.2025 18:50 — 👍 113 🔁 34 💬 2 📌 2

A graph showing that in a survey of British people, immigration is rated as the most important for the country, but among the lowest for importance to them personally.

Is hostility to immigration something that people develop spontaneously based on their own experiences, or is it deliberately cultivated by politicians and the press?

The authors of this FT don’t say so, but it’s hard not to see this figure as evidence for the latter. www.ft.com/content/43da...

20.09.2025 14:11 — 👍 293 🔁 95 💬 11 📌 2

And so my advice to the government is:

DO NOT EXTEND ILR WAITING TIME TO TEN YEARS.

DEFINITELY DO NOT CHANGE THE RULES ON PEOPLE WHO ARE ALREADY HERE, YOU TOTAL LUNATICS

I think that is suitably clear

25/n

12.09.2025 08:40 — 👍 60 🔁 7 💬 1 📌 0

The deeper problem - perhaps the fundamental problem in this area - is that we have organized housing so that provision of a basic service is completely intertwined with a speculative asset market. The long run goal should be to disentangle them.

07.08.2025 12:58 — 👍 260 🔁 52 💬 3 📌 8

A game-theoretic foundation for the fiscal theory of the price level

Staff working papers set out research in progress by our staff, with the aim of encouraging comments and debate.

Staff Working Paper 1137 by Tim Willems (BoE) and Thomas Norman (Oxford) examines the importance of fiscal-monetary interactions for inflation outcomes via a game-theoretic approach. 🔗 Read the paper here: www.bankofengland.co.uk/working-pape...

05.08.2025 13:01 — 👍 4 🔁 3 💬 0 📌 0

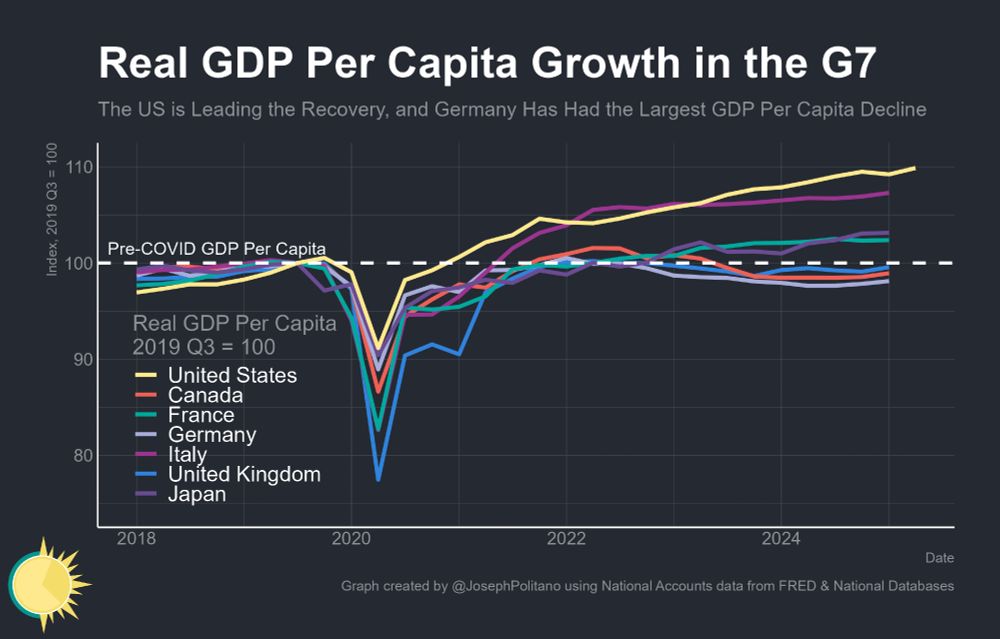

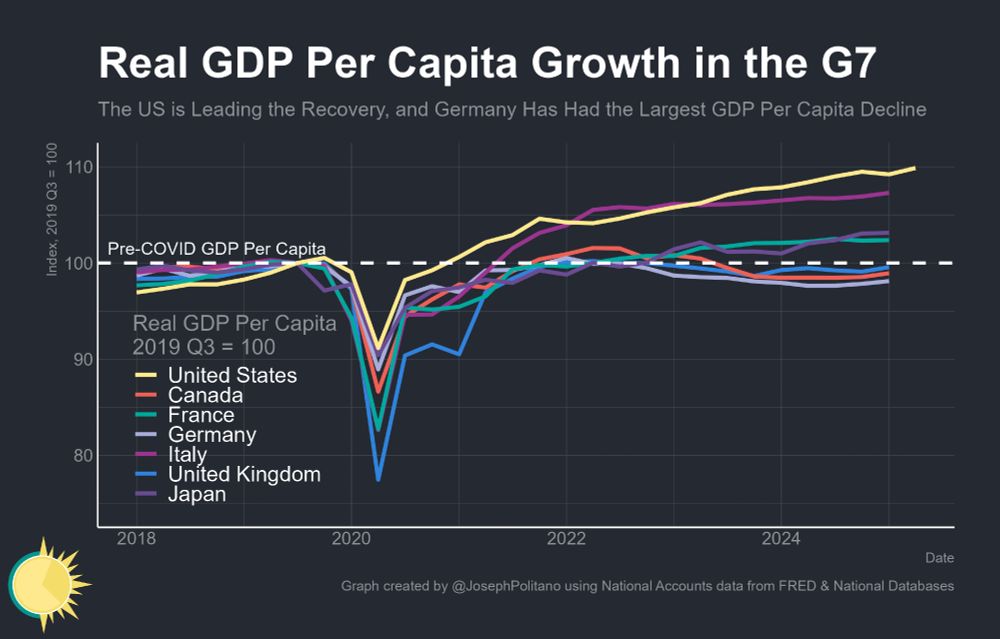

A graph of GDP per capita growth in the G7

Here's each G7 country's cumulative increase in real GDP per capita, since just before the pandemic:

🇺🇸 +9.9%

🇮🇹 +7.3% (thru Q1)

🇯🇵 +3.1% (thru Q1)

🇫🇷 +2.4% (thru Q1)

🇬🇧 -0.1% (thru Q1)

🇨🇦 -1.1% (thru Q1)

🇩🇪 -1.9% (thru Q1)

04.08.2025 16:56 — 👍 86 🔁 8 💬 5 📌 3

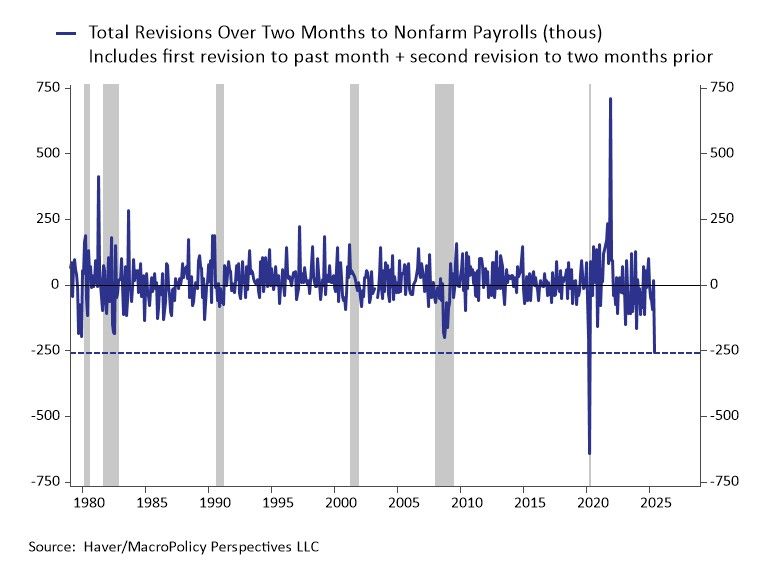

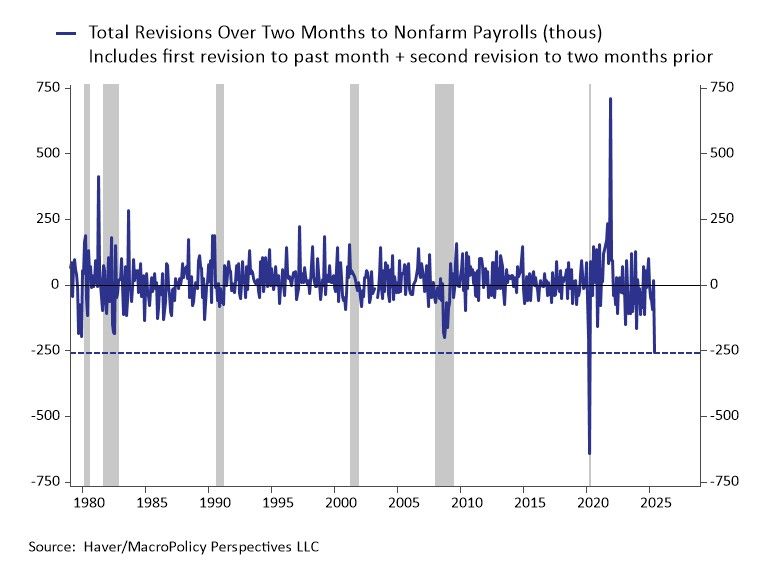

This is the second largest 2m revision on record. In general they get larger at cyclical turning points. We take more signal that we are at a cyclical turning point than that there is some data collection conspiracy

01.08.2025 15:46 — 👍 66 🔁 27 💬 3 📌 4

There's a science reason! A bunch, actually. Air conditioners are heat pumps, they move heat around rather than needing to create something from scratch, which is more efficient.

13.07.2025 19:28 — 👍 396 🔁 9 💬 7 📌 3

A feature not a bug − speech by Megan Greene

Speech given at the National Institute of Economic and Social Research

I gave a speech today at @NIESRorg looking at how the BoE, ECB and Fed manage their balance sheets, whether the differences bw them create trading opportunities for banks to book profits and whether I need to worry about this as an MPC member.👇

b-o-e.uk/44dbxCb

24.06.2025 14:57 — 👍 6 🔁 3 💬 0 📌 1

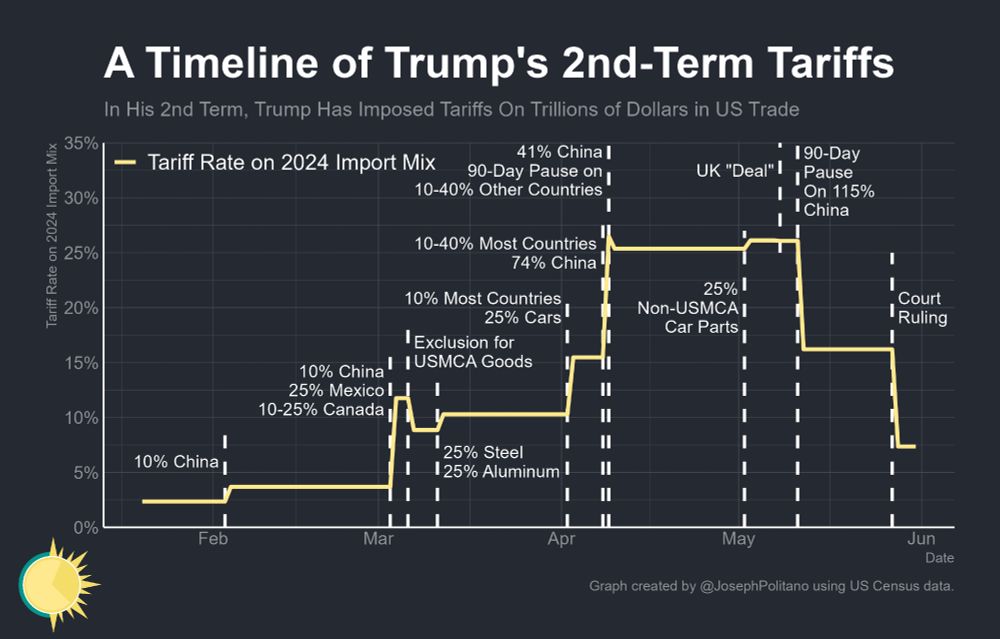

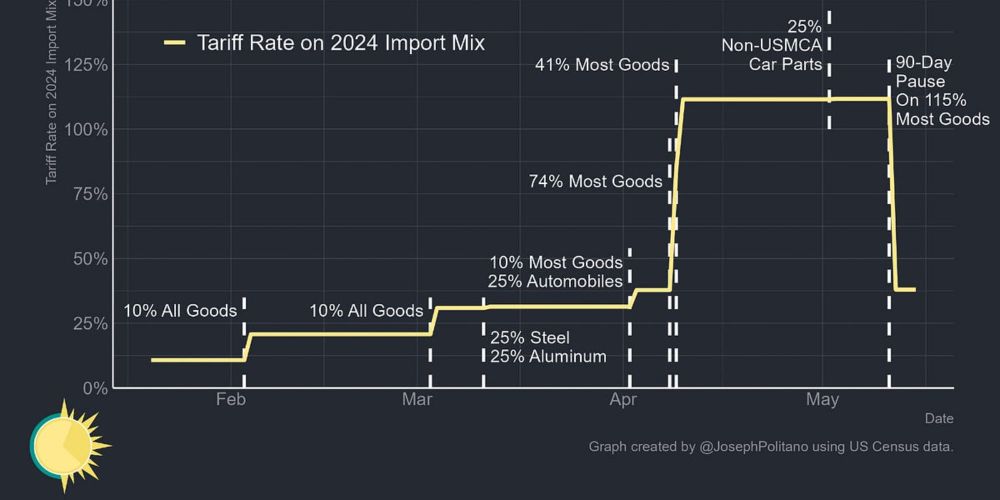

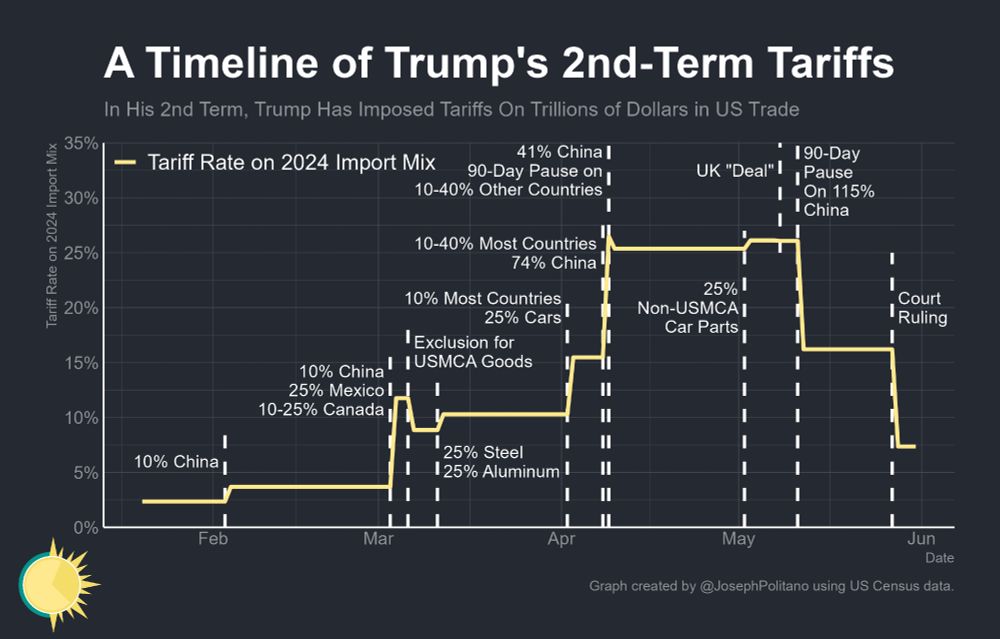

a timeline graph of Trump's 2nd-Term tariffs

The court ruling against many of Trump's tariffs today would lower US overall tariff rates by roughly 10%, only leaving the tariffs on cars, steel, & aluminum

If it holds (a very big if) tariffs would drop to the lowest rate since March & importers would get retroactive relief

29.05.2025 01:48 — 👍 648 🔁 123 💬 20 📌 19

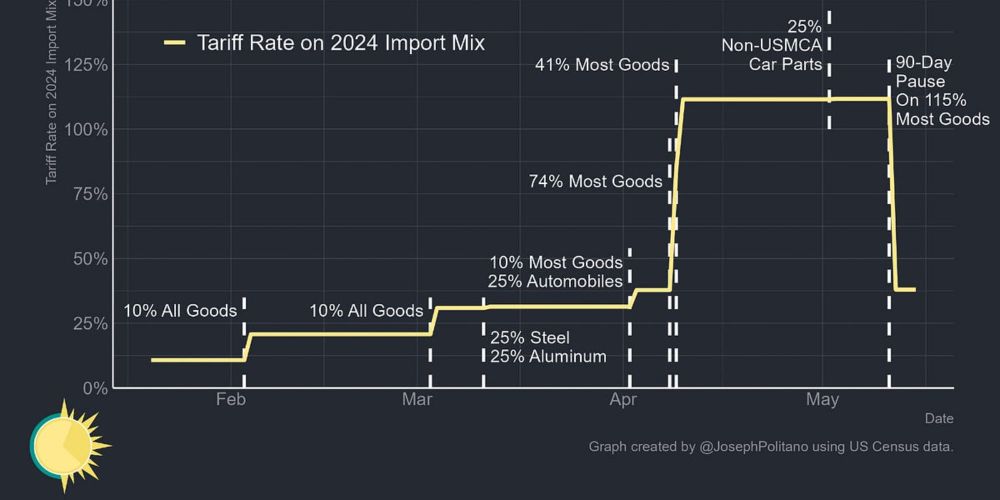

Trump's Retreat Still Leaves Tariffs at 90-Year Highs

China Tariffs Are Now Below "Embargo" Levels, but Overall Tariffs are at the Highest Rate Since the Great Depression

NEW from me:

Trump's 90-day pause on the China trade war still leaves tariffs at the highest level since the Great Depression—and that's before upcoming sector-specific tariffs or possible un-pausing

Trump may be easing his trade war, but he's far from ending it🧵

www.apricitas.io/p/trumps-ret...

19.05.2025 12:28 — 👍 375 🔁 105 💬 7 📌 7

Finally, while this particular channel might imply MP fueled inflation (still not convinced about this), wouldn’t we still expect that an activist easing policy to boost demand and inflation even more? Or is the implicit assumption that rental prices would fall leading to deflationary effects? 🤔

20.05.2025 06:26 — 👍 0 🔁 0 💬 1 📌 0

Also, migration as driver of higher rental inflation is consistent with Canada similar profile. (See www.gov.uk/government/p...)

20.05.2025 06:24 — 👍 1 🔁 0 💬 1 📌 0

Interesting blog, but I wouldn’t attribute too much of the rental inflation to MP (haven’t read the paper but seems that MP shocks are not identified,no?). Especially as Brexit and migration over the past years are probably more relevant structural drivers of the increase in rental demand, no?

20.05.2025 06:12 — 👍 1 🔁 0 💬 2 📌 0

Benchmarks editor at Central Banking - covering economics, data and the BIS. Short stories published by Liars' League and Every Day Fiction

📚📰🚲🍲🏃🥾

Signal: @danhinge.89

https://www.centralbanking.com/author/daniel-hinge

The official Bluesky channel of the Board of Governors of the Federal Reserve System.

Privacy Policy: http://federalreserve.gov/privacy.htm

https://www.federalreserve.gov/

Associate professor of economics, John Jay College-CUNY, senior fellow at the Groundwork Collaborative. Blog and other writing: jwmason.org. Study economics with me: https://johnjayeconomics.org. Anti-war Keynesian, liberal socialist, Brooklyn dad.

Economist & Prof at Harvard | 1st-gen college grad | Education, inequality | Shitposts are in a Boston accent | Former union organizer | Native Somervillen

NYT Columns https://bit.ly/3TbaxXV

https://linktr.ee/susan.dynarski

www.susandynarski.com

Author of "Slouching Towards Utopia: An Economic History of the 20th Century". Too online since 1995. Sometime Deputy Assistant Secretary of the U.S. Treasury. UC Berkeley Professor.

Economist, tax policy/inequality. Professional skeptic. Anti-illiberal.

http://www.columbia.edu/~wk2110/index.html

@wwwojtekk at various other websites

Founder MPP (yeah you know me), UT Austin Prof, former chief economist various financial firms, Fed economist, Prez NABE. Passionate about family, macro, cats and freedom

More good things for everyone. Public sector appreciator. Tax and welfare policy knower. Hyperinflation doubter.

Applied economic theorist: competition and information. Chief Economist @LawEconCenter Price Theory Newsletter http://pricetheory.substack.com.

Yale SOM professor & Bulls fan. I study consumer finance, and econometrics is a big part of my research identity. He/him/his

· Economist @univlorraine.bsky.social, en français and in English

· I use computers, network theory, and data to study how humans behave at work, in organizations and communities #Rstats

· He/Him 🏳️🌈

🌐 https://o.simardcasanova.net

📍 Nancy, Lorraine, France 🇪🇺

Historian of applied economics

(macro, public, urban, ag, env, design, tractability, computational econ & more)

CNRS & CREST, Ecole Polytechnique

Visiting Associate Professor at Stanford University

Writing "The Great Gender Divergence"

Substack: www.ggd.world

Prof at Harvard Kennedy School. Associate at NBER.

Past: Prof at UCB Econ & Member of President's CEA.

Author of the NYT bestseller The Deficit Myth. Professor of Economics and Public Policy at Stony Brook University. Writer of newsletter https://stephaniekelton.substack.com/

Professor of Economics London Business School

Vice President CEPR

President European Economic Association. Views are my own.

FT Alphaville reporter. Ex-“veteran” fund manager. Resolution Foundation Assoc. Baring Foundation Trustee.

Senior Fellow at @brookings.edu. Previously Chief Economist at IIF and Chief FX Strategist at Goldman Sachs.