Great article from @dsmitheconomics.bsky.social who

kindly quoted my research on funding & financing infrastructure without negatively impacting the public finances. The Chancellor can pursue an alternative path.. @greenmirandahere.bsky.social @tonytassell.bsky.social @pmdfoster.bsky.social

08.10.2025 06:52 — 👍 6 🔁 1 💬 0 📌 1

Pimco and BlackRock tell Reeves to build bigger fiscal buffer

Big bond investors say chancellor needs to go beyond slim £9.9bn of margin left against key borrowing rule

www.ft.com/content/7345... Highlights the flaw at the heart of the Chancellor's strategy in centralising financing in the hope that future productivity growth increases. But there are other alternatives. www.bennettschool.cam.ac.uk/blog/financing-infrastructure-without-unnerving-the-bond-market/

08.10.2025 06:35 — 👍 0 🔁 0 💬 0 📌 0

It’s time to go Dutch to solve Britain’s housing crisis

Using public corporations to finance infrastructure promises to revolutionise the nation’s prospects

My Times piece: We can learn from the Netherlands on how better to finance infrastructure spending and more house building, without spooking the markets:

It’s time to go Dutch to solve Britain’s housing crisis

www.thetimes.com/article/ce46...

07.10.2025 17:29 — 👍 4 🔁 3 💬 1 📌 2

YouTube video by Center for Strategic & International Studies

China’s Influence in Pharmaceutical Supply Chains: A Conversation with Dr. Yanzhong Huang

Great podcast on the vertical integration between the chemicals and pharma sector in China and how it became dominant globally www.youtube.com/watch?v=8g4l...

04.10.2025 11:23 — 👍 2 🔁 0 💬 0 📌 0

The conservative hardliner who could become Japan’s first female PM

Veteran politician Sanae Takaichi has called for a return to ‘Abenomics’ to rejuvenate ailing ruling party

Sanae Takaichi has been elected lesder of the LDP party in Japan and is set to become the country’s first female prime minister. Profile here by @urbandirt.bsky.social of the conservative who has dreamed of becoming the Margaret Thatcher of Japan www.ft.com/content/18d7...

04.10.2025 06:06 — 👍 20 🔁 7 💬 4 📌 1

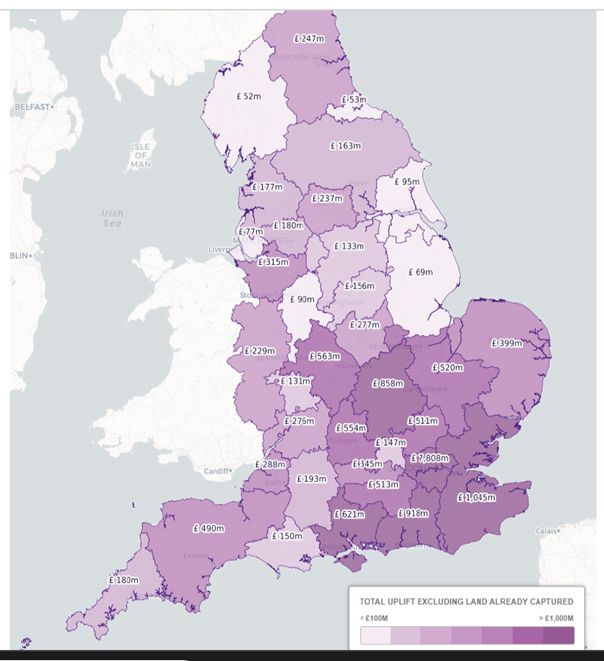

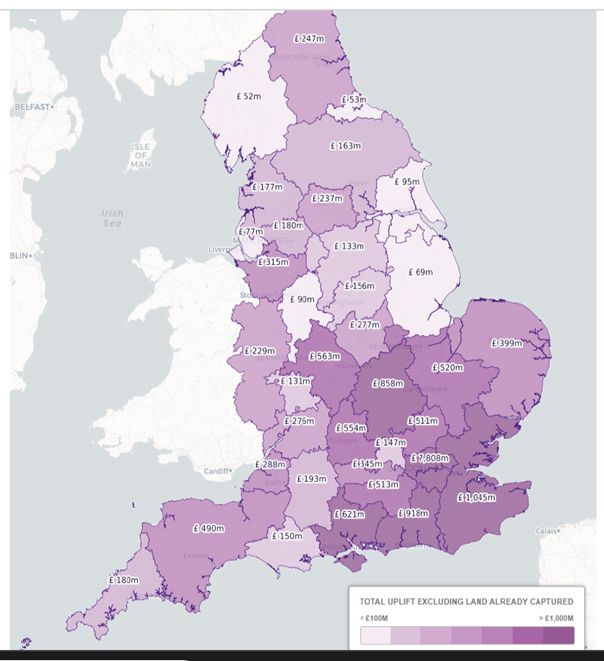

@jenwilliamsft.bsky.social These are annual amounts so multiply by 20 to give you infrastructure funding £££

29.09.2025 11:48 — 👍 0 🔁 0 💬 0 📌 0

A land value tax is complex to implement but a proportional council tax gets you most of the way there. For infrastructure you would need land value capture (see £ by region) & business rates needs to remove plant & machinery from valuation centreforprogressivecapitalism-archive.net/wp-content/u...

29.09.2025 11:28 — 👍 1 🔁 0 💬 1 📌 0

New Towns 🧵@pickardje.bsky.social @jenwilliamsft.bsky.social @chriscurtis94.bsky.social

29.09.2025 08:39 — 👍 0 🔁 0 💬 0 📌 0

speculative housing model which will likely worsen the public finances driving gilt yields higher.

29.09.2025 08:15 — 👍 0 🔁 0 💬 0 📌 0

generate the level of housing delivery that are needed. Nor will they be of much use for the delivery of New Towns. In conclusion we can either go down the self-funding route using public corporation debt that is paid back by hypothecated cash flows and lower gilt yields OR use PPP to boost the

29.09.2025 08:15 — 👍 1 🔁 0 💬 1 📌 0

failure. Hence the Housing Bank is largely about trying to get speculative housing projects off the ground where they don't meet the developer profit thresholds hence the taxpayer will be subsidising these projects. While there is some rationale for provision at the margin, this will not be able to

29.09.2025 08:15 — 👍 0 🔁 0 💬 1 📌 0

Transactions (FTs) will come on to the government's balance sheet net of its liabilities, thereby placing less pressure on the fiscal rule. But this looks a lot like financial engineering that is merely creating a fiscal illusion. Moreover, these FTs are ONLY to be permitted in the event of market

29.09.2025 08:15 — 👍 0 🔁 0 💬 1 📌 0

can make a difference but given the infrastructure deficit of some £700bn there is a limit to what this can do. Finally the National Housing Bank which has the capacity based on HCLG CDEL limits to provide £5.5bn of guarantees and £10.5bn of loans/equity (assume most will be loans) These Financial

29.09.2025 08:15 — 👍 0 🔁 0 💬 1 📌 0

England’s social housing funds ‘less generous’ than £39bn settlement suggests

Analysis indicates spending of about £3bn a year until 2029, similar to AHP’s money for current financial year

National Housing Delivery Fund (£5bn) and the £39bn commitment to social housing investment. The £39bn is genuinely new money BUT a large chunk is backloaded www.ft.com/content/92a1... and given the state of the public finances could be chopped by the next government. The £5bn in grants from NHDF

29.09.2025 08:15 — 👍 0 🔁 0 💬 1 📌 0

development and the direction is justified in the public interest." This clarification is hugely important and highlights the opportunity that all areas have to help fund large scale projects NOW. 7) The department in its response notes the National Housing Bank (£16bn), Capital grant for the

29.09.2025 08:15 — 👍 0 🔁 0 💬 1 📌 0

stating: "The government expects delivery bodies to use the power introduced by the Levelling-up and Regeneration Act 2023 to acquire land for new towns development by compulsory purchase with a direction removing ‘hope value’ compensation, where affordable housing is to be provided by the

29.09.2025 08:15 — 👍 0 🔁 0 💬 1 📌 0

budgeting frameworks and the cycle of spending reviews. 6) One oversight in the report is that no mention was made of the Levelling Up & Regeneration Act provisions to ignore hope value under certain circumstances (Section 190). However, the government in their response to the Report DID mention it

29.09.2025 08:15 — 👍 0 🔁 0 💬 1 📌 0

planning permission and building infrastructure, and selling this in ‘serviced parcels’ to residential and commercial developers. 5) Crucially the report notes that publicly issued long term loans should empower development corporations to manage their budgets outside of the government’s annual

29.09.2025 08:15 — 👍 0 🔁 0 💬 1 📌 0

long run tax revenues might increase – BUT this is a strategy of HOPE not prudence. Gilt investors will therefore seek higher yields. 3) The report is aware that “Infrastructure delivery could prove a binding constraint on new town delivery” including transport, utilities & social infrastructure.

29.09.2025 08:15 — 👍 0 🔁 0 💬 1 📌 0

Chancellor’s focus on public-private partnerships is wrong headed & largely financial engineering to get around her own fiscal rules. www.longfinance.net/news/pamphle... Government investment will be needed for the upfront infrastructure enabling the private body to meet profit thresholds. In the

29.09.2025 08:15 — 👍 0 🔁 0 💬 1 📌 0

the public finances and fewer of these New Towns will ever get built. A few comments on the report: 1) Crucial stat: buildout rates for New Towns are 4X faster than the speculative housing model 2) Private sector partners and investors WILL play a key role in the delivery of new towns. BUT the

29.09.2025 08:15 — 👍 0 🔁 0 💬 1 📌 0

The New Towns Taskforce has done a superb job in making the case for New Towns in terms of rationale and location. However, the funding & financing of these bodies is still up from grabs. If the Chancellor’s public private partnership is used this will continue to worsen www.gov.uk/government/p...

29.09.2025 08:15 — 👍 0 🔁 0 💬 1 📌 1

Rachel Reeves will struggle to sell growth case to UK fiscal watchdog, economists warn

Chancellor wants the OBR to give her credit for trade deals and proposed EU mobility scheme

This piece suggests the Chancellor is increasingly desperate in her search for growth www.ft.com/content/2865... The reality is that most "Whitehall ideas" will not add to growth and hence the importance of the OBR. But there are many options to drive growth without negatively impacting the public

29.09.2025 06:27 — 👍 0 🔁 0 💬 1 📌 0

It generates a very high return on capital for the current volume housebuilders. You would need to shift to a plan-led model & away from a speculative model. A fall in the ROC would stimulate more modular construction as in C. Europe. But until that happens there isn't much incentive!

27.09.2025 13:24 — 👍 1 🔁 0 💬 1 📌 0

Economics Editor, The Sunday Times.

Erstwhile economist, Stoke City supporter. #madeinstoke

Write Bagehot column for the Economist. Comment writer of the year at British Journalism Awards 2024

Assoc. Prof. at the European Institute, LSE. Research and teach the political economy of the state. Optimist. Alarmed by people who lack self-doubt...

Economist, formerly a physicist. Head of UK Economic Policy & Modelling at Cambridge Econometrics. Visiting Researcher at Oxford Brookes Business School. Also interested in cricket, baseball and metal. Displaced Salopian. Vmo

Director of Devolution Policy, Labour Together. Economist. Author at Future North writing about the North of England (link below).

Posts about policy, politics and the Pennines (and beyond).

📍 West Yorkshire.

🧭 futurenorth.substack.com

The Economic Statistics Centre of Excellence (ESCoE) is a research centre hosted at King's College London and supported by the ONS.

We provide research on economic statistics for the modern economy. 📈

Public policy research, teaching and engagement, enabling the right kind of growth, fairly shared. bennettschool.cam.ac.uk

Emeritus Professor · Problem Structuring · Problem Formulation · Soft Systems Methodology · Practice of Operational Research · Process Thinking · Facilitation · Group Support Systems · Co-Editor-in-Chief European Journal of Operational Research · CEng

Chief economist at Absolute Strategy Research in London. But all of the nonsense I spout on here is mine and mine alone. RTs are not endorsements unless they are.

Former politico, comment writer, spread betting dealer, editor, now think tanker, consultant, former baker of overly dense loaves.

The Centre for Cities is an independent think tank dedicated to improving the economies of the UK's largest cities and towns

Yakking. Tippy tappy typing. More yakking. Politics. Education. FT columns, Political Fix podcast and videos here https://www.ft.com/miranda-green - please check out Not Another One https://open.spotify.com/show/7u4nlhVNmzzZrLjmB7z137?si=dcf00d7580444ccb

Proud Milton Keynesian and Labour MP for MK North. Can't spell, views my own.

Former economist and civil servant. Former (age related) national cycling champion. Still a music fan. Sewn up member of the Zipper Club.

Bennett Professor of Public Policy, University of Cambridge; economist

Deputy political editor, Financial Times. Also amateur iphone photographer and some-time musician.

Pensions correspondent @FT. Tips to mary.mcdougall@ft.com

Northern correspondent, Financial Times

📍Manchester

Defence Editor at The Economist.

Visiting Fellow at Department of War Studies, KCL. For speaking engagements: https://chartwellspeakers.com/speaker/shashank-joshi