29.10.2025 22:03 — 👍 0 🔁 0 💬 0 📌 0

29.10.2025 22:03 — 👍 0 🔁 0 💬 0 📌 0

Andy Lloyd

@andyjlloyd.bsky.social

Funny how comforting it is that, in the long run, we’re all dead. In the meantime, walking the Malvern hills with Pablo.

@andyjlloyd.bsky.social

Funny how comforting it is that, in the long run, we’re all dead. In the meantime, walking the Malvern hills with Pablo.

29.10.2025 22:03 — 👍 0 🔁 0 💬 0 📌 0

29.10.2025 22:03 — 👍 0 🔁 0 💬 0 📌 0

27.10.2025 20:39 — 👍 0 🔁 0 💬 0 📌 0

27.10.2025 20:39 — 👍 0 🔁 0 💬 0 📌 0

24.10.2025 19:20 — 👍 0 🔁 0 💬 0 📌 0

24.10.2025 19:20 — 👍 0 🔁 0 💬 0 📌 0

24.10.2025 19:19 — 👍 0 🔁 0 💬 0 📌 0

24.10.2025 19:19 — 👍 0 🔁 0 💬 0 📌 0

"We’re told tax is a curse and even “theft.” That’s wrong"

24.10.2025 08:53 — 👍 2 🔁 1 💬 0 📌 0 22.10.2025 20:42 — 👍 0 🔁 0 💬 0 📌 0

22.10.2025 20:42 — 👍 0 🔁 0 💬 0 📌 0

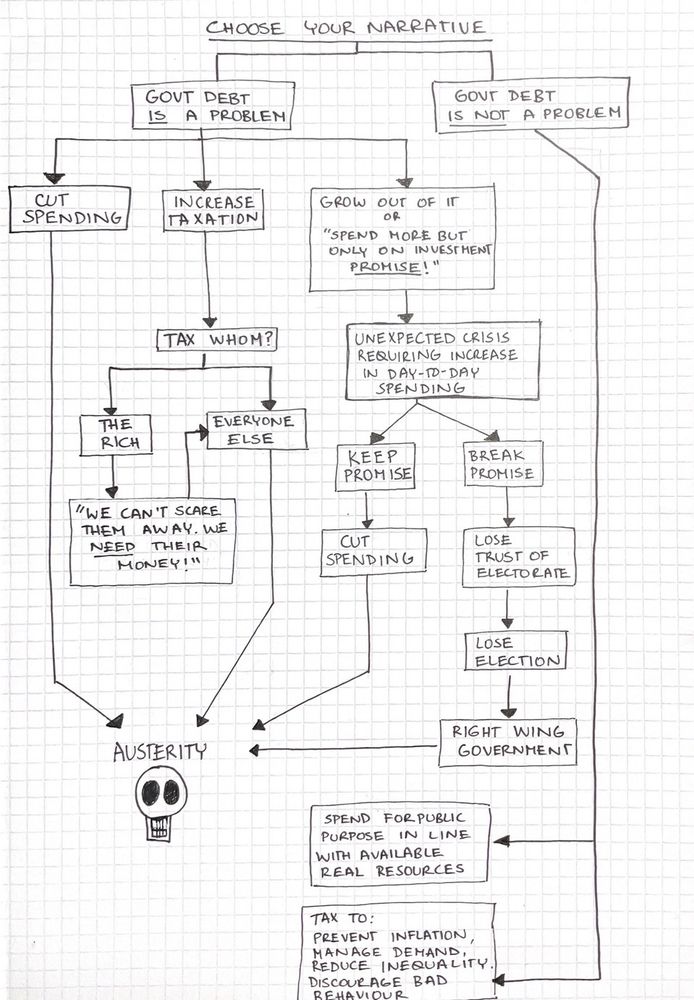

I’ll just leave my Austerity narrative flowchart here in case anyone needs to persuade a Lefty pundit/politician not to try to compete with the Right on debt hawkishness. Remember, all routes down that path lead to austerity.

15.11.2024 03:31 — 👍 158 🔁 76 💬 5 📌 13Brilliant, love this

21.10.2025 18:05 — 👍 0 🔁 0 💬 0 📌 07. Real resources matter.

The government is constrained by the availability of real resources and its ability to mobilise them. “Anything we can do, we can afford.” JM Keynes. #MMT

6. The effect: depoliticising economics.

By framing the state as a household, questions about distribution, power, and ownership sound like questions about accounting. Instead of “what kind of economy do we want?” people are encouraged to ask “how can we afford it?” #MMT

5. It separated monetary and fiscal power.

The 1970s inflation crisis was used to justify giving central banks “independence.” Entrenching the idea that the BoE must be neutral and technocratic, while politicians must “find the money” through taxes or borrowing. #MMT

4. And prioritises the interests of financial markets.

From the ‘80s onward, the Treasury and BoE were reorganised to make bond markets the apparent source of public finance.

In reality, markets depend on the government’s money creation. The illusion of dependence shifts power toward finance. #MMT

3. It legitimises austerity and privatisation.

Once the state is said to be financially constrained it justifies cutting services and welfare, paving the way for private capital to take over state functions and allowing politicians to claim prudence for shrinking the state. #MMT

2. It imposes artificial scarcity on the public sector.

By insisting that the government must first collect taxes or borrow before it can spend, policymakers created a narrative of constraint. That narrative limits public spending. #MMT

1. UK borrowing reaches five-year high for September at £20.2bn www.theguardian.com/business/202...

The purpose of making the government behave like a household is political and ideological, not technical and neutral. #MMT @theguardian.com

04.10.2025 20:45 — 👍 0 🔁 0 💬 0 📌 0

04.10.2025 20:45 — 👍 0 🔁 0 💬 0 📌 0

View from the Malvern hills towards the Wych cutting.

Views from the Malvern hills towards British Camp

04.10.2025 08:43 — 👍 0 🔁 0 💬 0 📌 0 30.09.2025 18:27 — 👍 0 🔁 0 💬 0 📌 0

30.09.2025 18:27 — 👍 0 🔁 0 💬 0 📌 0

3.Scare stories keep rentier monopolies safe. The lesson from Truss isn’t “never upset markets,” it’s: design policy coherently, anchor it in real resources, and stop giving finance a veto over democracy.

www.cliffordchance.com/content/dam/...

2.She also waves the Truss fiasco like a ghost story: “don’t upset the markets.” This is how the soft left narrows debate — markets as weather, government as powerless. In truth, the state creates & backstops markets.

30.09.2025 06:23 — 👍 1 🔁 0 💬 1 📌 0

1.Polly Toynbee says there’s “no cash” to renationalise water or rail. But you don’t need piles of cash — the state issues securities. Nationalisation is a balance-sheet swap, not a cash-dump.

🔗 www.theguardian.com/commentisfre...

@theguardian.com

@andyburnham.bsky.social

@zackpolanski.bsky.social

Oddly @theguardian.com seems to think the coincidence excusable. Odd for such a liberal minded paper.

12.05.2025 15:12 — 👍 4 🔁 0 💬 2 📌 0Labour MP says Starmer’s ‘island of strangers’ warning over immigration mimics scaremongering of far right – UK politics live

@theguardian.com suggests similarities to Enoch Powell’s language is a coincidence but the effect is much the same.

27.04.2025 21:29 — 👍 2 🔁 0 💬 0 📌 0

27.04.2025 21:29 — 👍 2 🔁 0 💬 0 📌 0

Stand up for trans rights 🏳️⚧️

Join me and @GoodLawProject and help us fight the Supreme Court’s harmful decision:https://goodlawproject.org/s/c41bb8

The real problem is ideology.

Mainstream economics treats money as scarce and “market discipline” as sacred—even in a country with a permanent trade deficit.

Our pockets are finite. The government’s aren’t. The real constraint isn’t money. It’s the people in charge.

#Austerity #PublicSpending

The Chancellor could stop paying interest on bank reserves—a tweak that could save £30 billion over two years, says the IFS:

theguardian.com/p/z4j3p

The ECB already uses tiered rates. We’re handing billions to banks while pretending we can’t afford warm homes or decent care. #Economics

25.01.2025 08:42 — 👍 1 🔁 0 💬 0 📌 0

25.01.2025 08:42 — 👍 1 🔁 0 💬 0 📌 0

Spot on. The blind pursuit of GDP growth is a death spiral for the planet. Converting nature into profit might boost short-term numbers, but it accelerates ecological collapse.

23.01.2025 09:26 — 👍 4 🔁 0 💬 0 📌 0