There is an increasing sense that the UK's approach towards fiscal policymaking, and in particular the excessive focus on "headroom", isn't delivering good outcomes.

Come along on 19 February to hear me make the case for how we could do things differently, and to hear from our terrific panel.

03.02.2026 11:50 — 👍 7 🔁 2 💬 1 📌 0

Breaking revenues down, taxes we might expect to respond more quickly to inflation or wage growth, such as VAT and PAYE Income Tax, haven't come in above either forecast.

If inflation had started to come through, we'd expect to see movement here first, and we haven't. (4/4)

22.01.2026 13:43 — 👍 0 🔁 0 💬 0 📌 0

Revenues from March to December are over £3bn below that expected in March, and over £2bn below that forecast at the end of November - a sign that even when incorporating data from the summer, the OBR's forecast still looks optimistic. (3/4)

22.01.2026 13:42 — 👍 1 🔁 2 💬 1 📌 0

In November, the OBR forecast higher short-term revenues from inflation and wage growth than previously expected - this was what made the forecast better news for Rachel Reeves than expected.

However, there is still little sign of these higher tax receipts, despite persistent inflation: (2/4)

22.01.2026 13:42 — 👍 1 🔁 0 💬 1 📌 0

New ONS public finance figures for December show borrowing from April to December was below 2024, in line with forecasts.

This is good news, but under the hood there's little sign of a pickup in revenues from inflation - an important thing to watch out for going forward. (1/4)

22.01.2026 13:41 — 👍 3 🔁 3 💬 1 📌 0

This is important as last month's OBR forecast (no monthly breakdown of this yet) expects a big increase in receipts by 2029/30 from higher inflation, boosting the public finances.

That may materialise, but it’s concerning that it hasn’t yet - one watch out for in the new year

19.12.2025 14:39 — 👍 1 🔁 1 💬 0 📌 0

New ONS public finance data today shows central government revenues are still lagging significantly below March expectations.

Given inflation has been higher than forecast, this is surprising - even VAT receipts, which one might expect to rise with inflation, are below forecast

19.12.2025 14:39 — 👍 3 🔁 4 💬 1 📌 0

Key thing about the OBR's downgrade then upgrade to revenues: much of it is from inflation and wage growth this year boosting tax take.

While inflation and wage growth are up, we're yet to see any increase in tax revenue in recent public finance data. The government will hope it materialises soon.

27.11.2025 13:28 — 👍 1 🔁 1 💬 0 📌 0

Underrated part of yesterday's Budget was what's happening to public service spending in 2028-29. Spending Review settlements reopened just 5 months after the SR to account for loosely-specified 'efficiency savings' of £1.4bn in 28-29 (rising to 4bn in 29-30)

27.11.2025 11:58 — 👍 16 🔁 7 💬 2 📌 1

Some early takeaways on the public finances from us @theifs.bsky.social. Really interesting thing to me is that the much-anticipated productivity downgrade didn't end up creating that big an increase in forecast borrowing. This means the policies we've seen today have grown headroom substantially.

26.11.2025 16:22 — 👍 4 🔁 1 💬 0 📌 0

One reading of this remark is that the fiscal rule requiring debt to be falling as a share of GDP in 2029/30 is now the one that binds (as cuts to capital spending wouldn't help to meet her borrowing rule). That's entirely possible - and was what we predicted in the IFS Green Budget, as it happens.

10.11.2025 16:24 — 👍 6 🔁 3 💬 1 📌 0

If there's one key message for the Chancellor from our analysis published today, it's this:

Doing a bigger package to increase ‘headroom’ wouldn’t be costless – but nor is limping from one forecast to the next under constant speculation that policy will be tightened again.

16.10.2025 12:12 — 👍 6 🔁 5 💬 0 📌 0

Frequent policy changes lead to overly frequent and overly rushed policy adjustments. Other measures like a range could help, but if the Chancellor wants to stave off the speculation and uncertainty like we’ve seen recently for more than a few months, more headroom is likely to be needed.

16.10.2025 06:57 — 👍 0 🔁 0 💬 1 📌 0

The government has a second fiscal rule, the debt rule, which is more volatile, with no plans for a range. Here, the chances of surviving are even slimmer – the £15bn the government had in Spring would be v unlikely to survive for three years.

16.10.2025 06:56 — 👍 0 🔁 0 💬 1 📌 0

To hold up over a longer timeframe, such as 3 years, the Chancellor would need far more headroom: £9.9bn would only give a 1 in 4 chance of avoiding further changes. To get above 50%, she’d need around £50bn, around the levels maintained in 2013 & 2014.

16.10.2025 06:56 — 👍 0 🔁 0 💬 1 📌 0

Now, from 2027, there will be a range of 0.5% of GDP on the borrowing rule in the Spring, so it binds less tightly. If this were brought forward, it would improve the Chancellor’s chances of not needing further changes to over 80%. But we might want to avoid volatility for longer than six months…

16.10.2025 06:55 — 👍 0 🔁 0 💬 1 📌 0

We looked at past revisions to the OBR forecast, and what proportion of them the Chancellor would survive without being bounced into further changes – we find that to withstand 80% of past shocks, she would need around £26 billion of headroom.

16.10.2025 06:54 — 👍 0 🔁 0 💬 1 📌 0

With a fiscal “groundhog day” of discussions about how the Chancellor could keep meeting her fiscal rules for the second time this year, we were wondering: what are the chances we could be doing all this again in Spring? The answer: pretty high. Particularly nerdy thread:

16.10.2025 06:54 — 👍 4 🔁 3 💬 1 📌 0

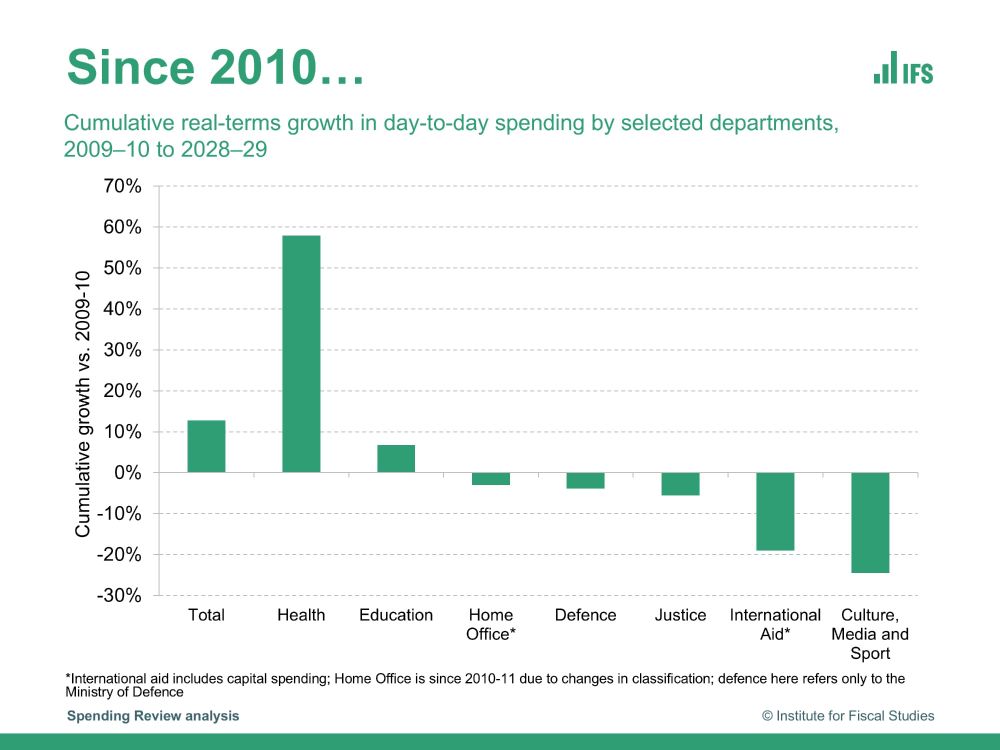

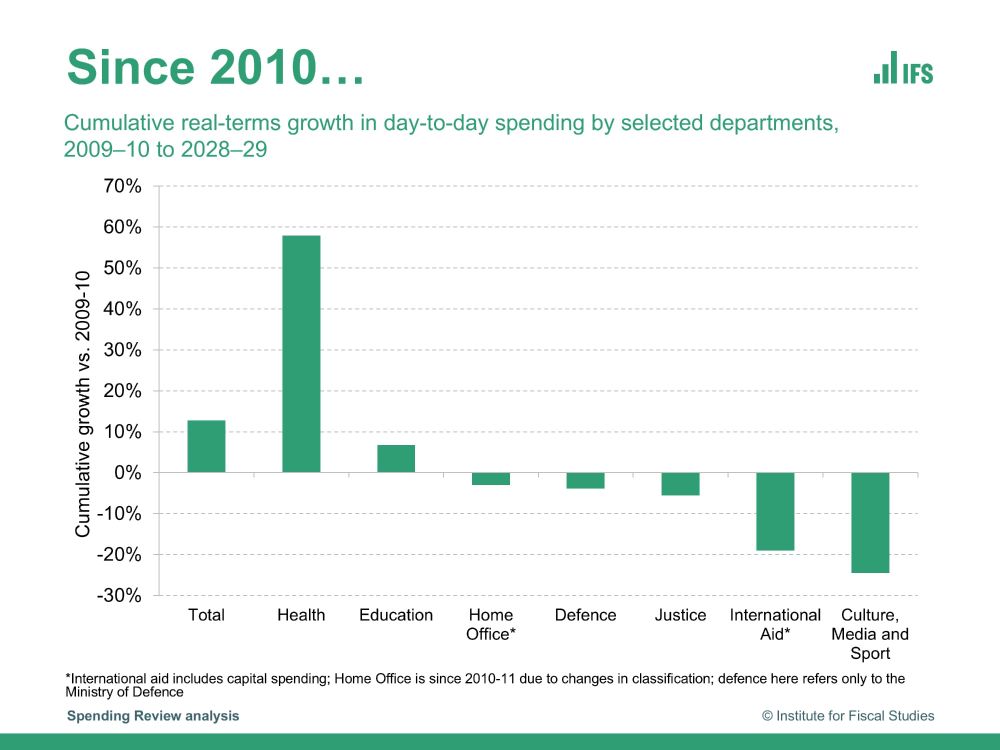

At the end of parliament, health funding will be more than 50% higher than in 2010.

Spending on justice, in contrast, will be lower in 2028–29 than two decades earlier despite recent increases. Spending on overseas aid and culture, media & sport will also be lower than in 2010.

12.06.2025 09:54 — 👍 1 🔁 3 💬 1 📌 0

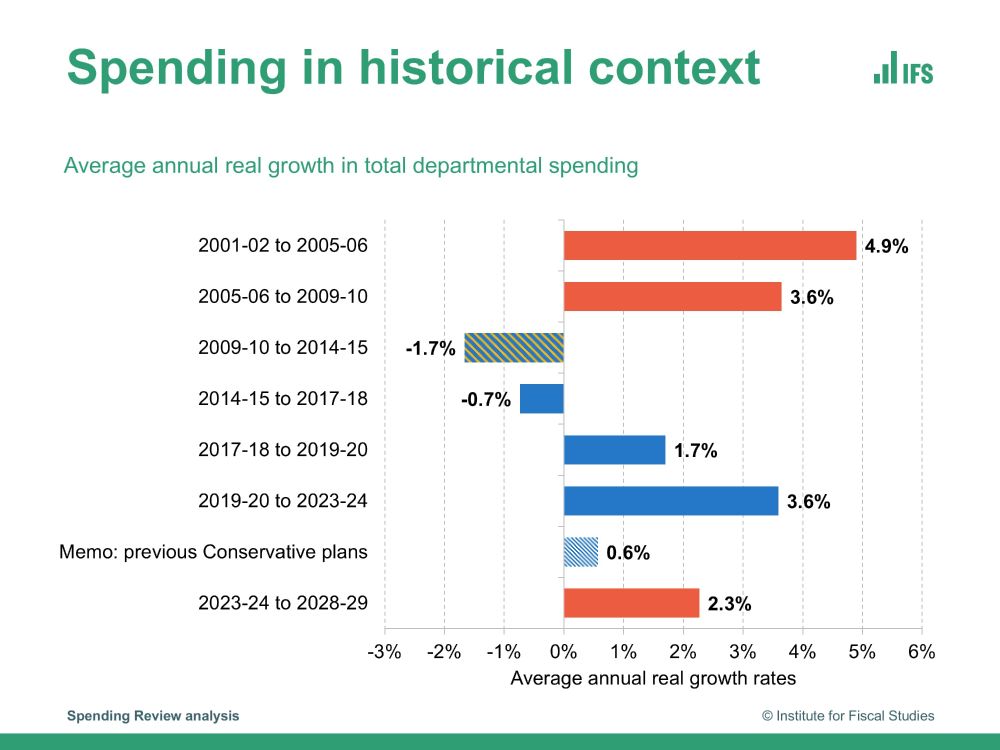

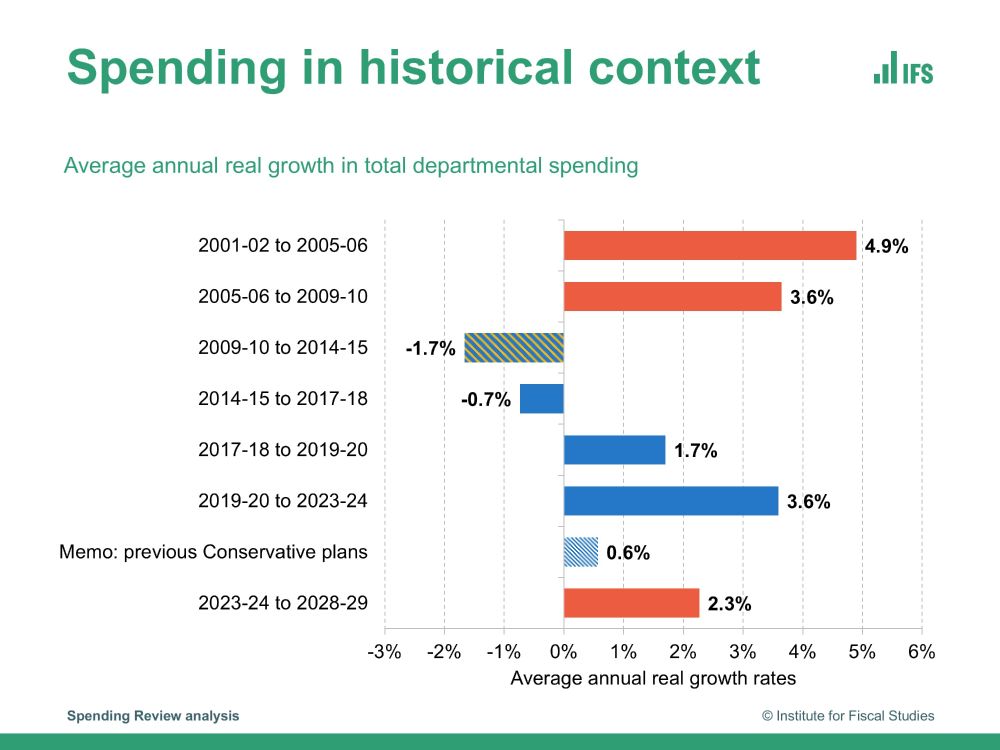

Average annual real growth in total departmental spending over this parliament is set to be 2.3%.

This is below the previous parliament’s average of 3.6%, but higher than the last government had outlined.

@beeboileau.bsky.social on the big picture choices in the Spending Review:

12.06.2025 09:48 — 👍 6 🔁 5 💬 1 📌 3

Our new Sure Start overview report out today includes a cost-benefit analysis.

These estimates are uncertain (many of the likely benefits haven’t happened yet!) but suggest Sure Start may go 90% of the way to ‘paying for itself’, with additional long-run benefits for children as they grow up

22.05.2025 11:46 — 👍 14 🔁 8 💬 1 📌 1

We've built a new IFS tool which can be used to explore what the government spends money on, and where in the UK benefits from that spending. Here it is: ifs.org.uk/calculators/.... Short thread on what you can do with the tool:

10.04.2025 08:42 — 👍 13 🔁 8 💬 1 📌 1

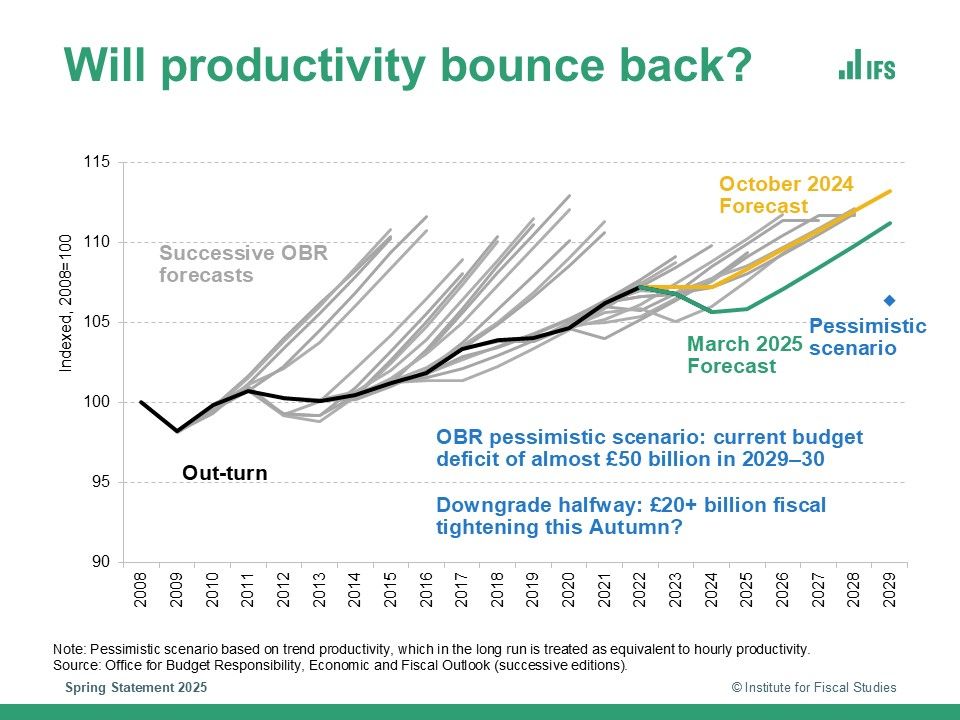

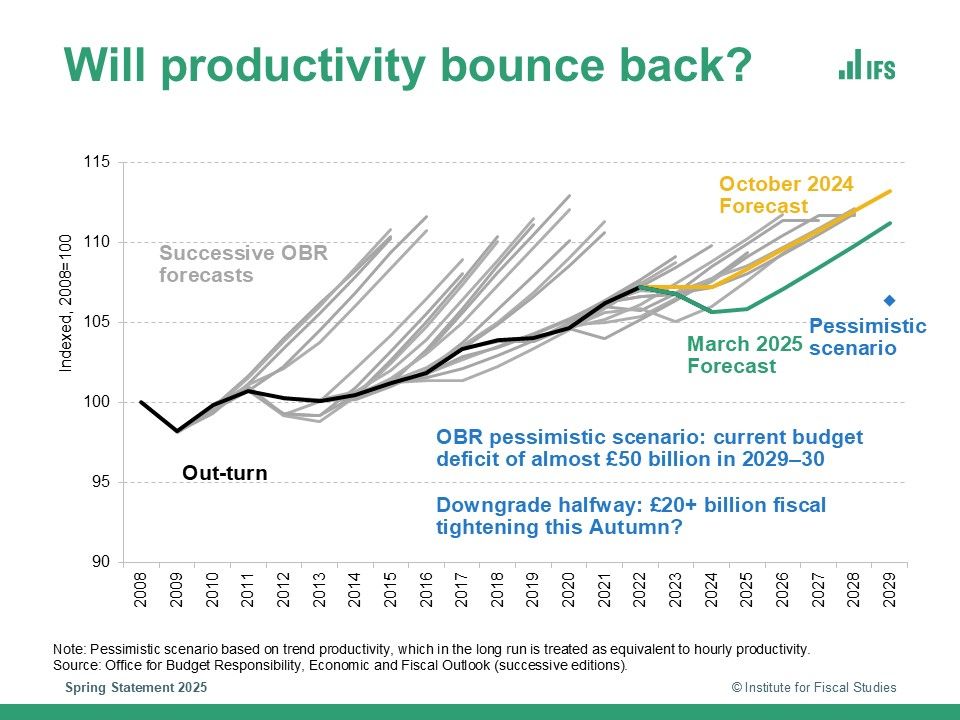

OBR productivity growth forecasts have historically been over-optimistic.

They remain above the productivity growth rates seen since 2008 – a downgrade to the OBR's forecast could cause a real fiscal headache for the Chancellor.

27.03.2025 11:00 — 👍 0 🔁 1 💬 0 📌 0

NEW: It has been widely reported that the government is looking to make significant savings from the working-age disability and incapacity benefits budget.

How might they do this and what kind of scale of changes would be required?

[THREAD]

17.03.2025 16:00 — 👍 5 🔁 7 💬 1 📌 1

New evidence out on the EMA today.

We find that while it did keep more students in full-time education, this didn't pass through to better quals or earnings later in life - in fact, reduced links to the labour market may have even reduced earnings.

Have a read of the thread below and the report 👇

26.02.2025 09:14 — 👍 6 🔁 3 💬 0 📌 2

Policy and analysis correspondent, BBC Verify.

https://www.benchu.co.uk/

Author of "Exile Economics: What Happens if Globalisation Fails", published May 2025

https://linktr.ee/exileeconomics

Rates and bikes. Wholly unable to deal with Thibaut Pinot’s retirement. “Gilt guru” and “ethereal bond vigilante” by day, elite level idiot with Bengali Dad energy at all other times. Baked goods and fried chicken enthusiast.

this is a low flying panic attack

it’s too late I’ve ruined it

love is the plan the plan is death

Strategy & Asset Allocation. Queasy metropolitan liberal. “Economist” -

@t0nyyates

The bread is mouldy and the circus has low attendance - justice reform - she/her

Journalist at the Economist, writing about life in Britain. Author of "Underdogs".

having fun with concepts online

American writer for the Observer / TELL ME ABOUT MYSELF on the rise and impact of psychotherapy is out with HarperCollins (UK) and Simon & Schuster (US) in 2027

sarahmanavis.com / she/her

Economist at the IFS working on health and social care, public spending and public sector productivity https://ifs.org.uk/people/max-warner

Economist at Queen Mary’s University of London, working in Empirical IO and Market Design. I did not found Open AI. (he/him) https://www.samaltmann.com

dottore, ingegnere, avvocato

When the Clock Broke: Con Men, Conspiracists, and How America Cracked Up in the Early 1990s — out now from

@fsgbooks

https://www.unpopularfront.news/

Cycling enthusiast with useless stats/memes/opinions

Number 1 Gleb Syritsa fan

Economist at IFS | PhD student in Economics at UCL

Postingg about politics and computers mostly